Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks is justified from the risk/reward point of view at the moment of publishing this Alert.

We have a lot to tell you today, and we plan to have a lot to tell you each Monday. In the previous weeks, we've been providing longer or shorter analyses of the precious metals market from various angles. We kept the "Key Factors to Keep in Mind" section at the end of each Alert to ensure that everyone has the chance to easily access the long-term context of a given day's analysis. However, based on the feedback received, it seems that it's not the optimal way of providing the context, as it's not clear if a link to something that we posted a few months ago is indeed still relevant today.

Consequently, instead of copy-pasting the same links in all Gold & Silver Trading Alerts, we will provide you with one huge analysis per week, and then we will simply keep you up-to-date with regard to changes from that analysis as the week progresses. Thanks to this approach, everyone will be absolutely sure that everything that they have read in the latest huge analysis (which will be usually posted each Monday) is up-to-date. The outlook and the reasons behind it should be clearer this way as reading just one big analysis would likely cover all the key points that - taken together - would paint a coherent picture for the precious metals sector. This approach would save you time as well - it's quicker to read one big analysis on Monday and then relatively short updates in the remaining days of the week, than it is to read through all the links to relevant analyses each day or even once per week.

Before we start, one more note. Today's analysis will be relatively big, but the future "main analyses of the week" will likely be even bigger and we might start them with bigger discussion of last week's and upcoming week's news that are relevant for the precious metals market. Also, we would appreciate if you sent us the questions that you might have about the precious metals market, be that from the technical, fundamental or news-related point of view. We usually reply to the quick questions directly, but in case of the more detailed ones, we would include our replies in the big Gold & Silver Trading Alerts so that other subscribers can benefit from them as well.

Having said that, let's move to today's analysis of the precious metals market. Let's start with the most important issue.

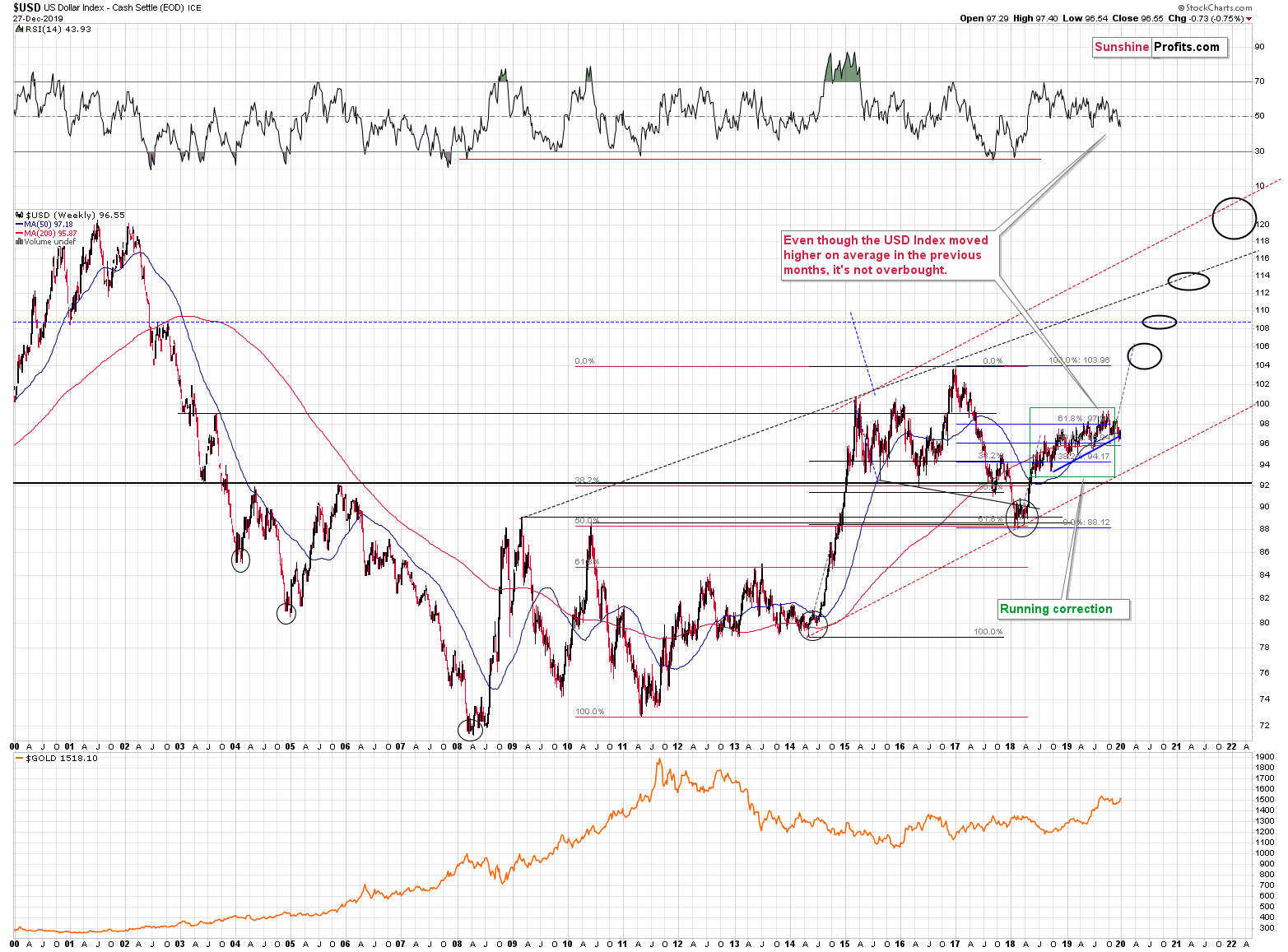

The most important point is that the USD Index is after a massive breakout that was already verified more than once.

The Big Picture View of the USD Index

(please click on the charts to enlarge them)

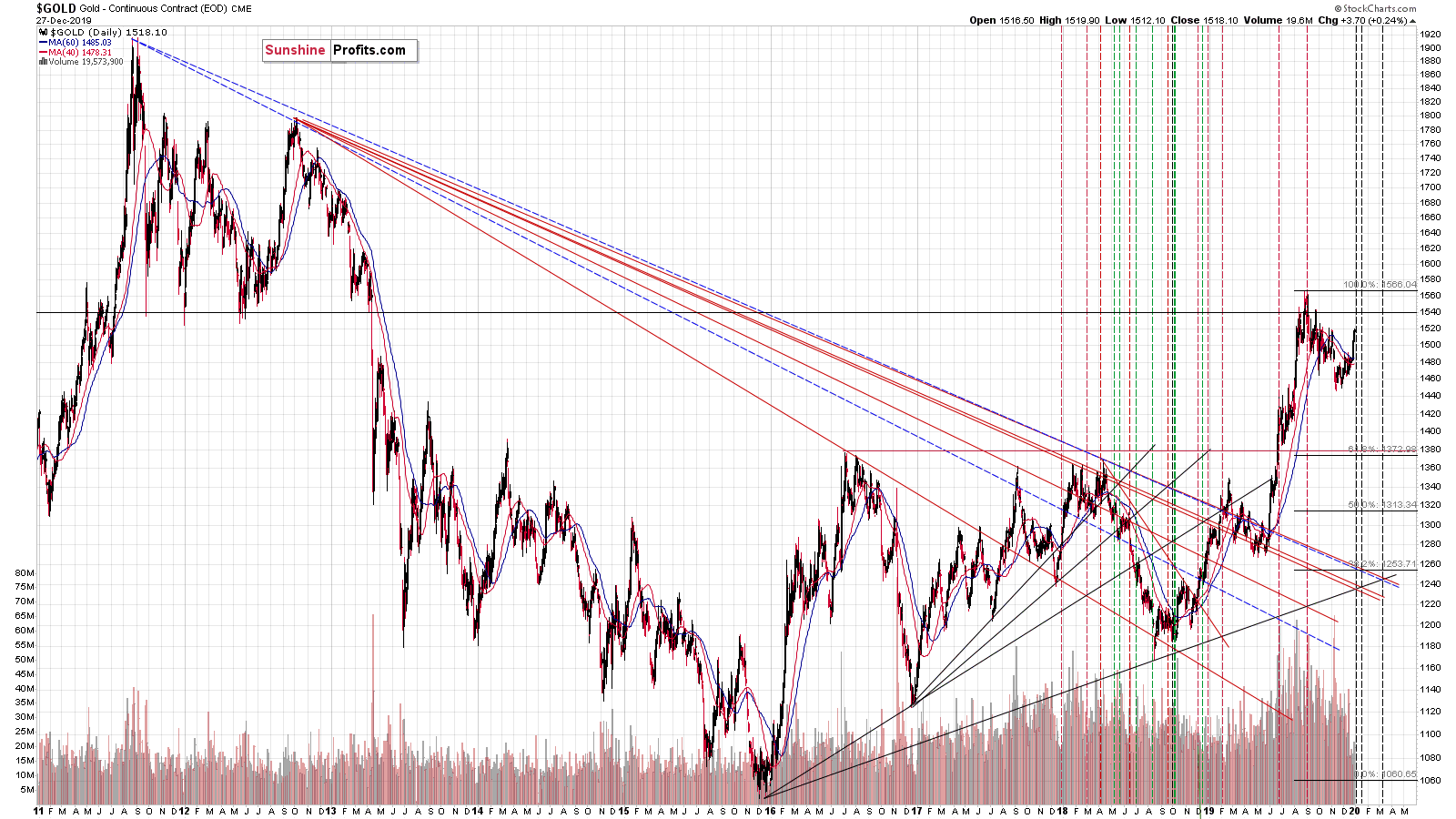

The 2014-2015 rally caused the USD Index to break above the declining very-long-term resistance line, which was verified as support three times. This is a textbook example of a breakout and we can't stress enough how important it is.

The most notable verification was the final one that we saw in 2018. Since the 2018 bottom, the USD Index is moving higher and the consolidation that it's been in for about a year now is just a pause after the very initial part of the likely massive rally that's coming.

If even the Fed and the U.S. President can't make the USD Index decline for long, just imagine how powerful the bulls really are here. The rally is likely to be huge and the short-term (here: several-month long) consolidation may already be over.

There are two cases on the above chart when the USD Index was just starting its massive rallies: in the early 1980s and in mid-90s. What happened in gold at that time?

Gold Performance When the USD Index Soars

These were the starting points of gold's most important declines of the past decades. The second example is much more in tune with the current situation as that's when gold was after years of prolonged consolidation. The early 1980s better compare to what happened after the 2011 top.

Please note that just as what we saw earlier this year, gold initially showed some strength - in February 1996 - by rallying a bit above the previous highs. The USD Index bottomed in April 1995, so there was almost a yearly delay in gold's reaction. But in the end, the USD - gold relationship worked as expected anyway.

The USD's most recent long-term bottom formed in February 2018 and gold seems to have topped right now. This time, it's a bit more than a year of delay, but it's unreasonable to expect just one situation to be repeated to the letter given different economic and geopolitical environments. The situations are not likely to be identical, but they are likely to be similar - and they indeed are.

What happened after the February 1995 top? Gold declined and kept on declining until reaching the final bottom. Only after this bottom was reached, a new powerful bull market started.

Please note that the pace at which gold declined initially after the top - in the first few months - was nothing to call home about. However, after the initial few months, gold's decline visibly accelerated.

Let's compare the sizes of the rallies in the USDX and declines in gold. In the early 80s, the USDX has almost doubled in value, while gold's value was divided by the factor of 3. In the mid-90s, the USDX rallied by about 50% from its lows, while gold's value was divided by almost 1.7. Gold magnified what happened in the USD Index in both cases, if we take into account the starting and ending points of the price moves.

However, one can't forget that the price moves in USD and in gold started at different times - especially in the mid-90s! The USDX bottomed sooner, which means that when gold was topping, the USDX was already after a part of its rally. Consequently, when gold actually declined, it declined based on only part of the slide in the USDX.

So, in order to estimate the real leverage, it would be more appropriate to calculate it in the following way:

- Gold's weekly close at the first week of February 1996: $417.70

- USDX's weekly close at the first week of February 1996: 86.97

- Gold's weekly close at the third week of July 1999: $254.50

- USDX's weekly close at the third week of July 1999: 103.88

The USD Index gained 19.44%

Gold lost 39.07% (which means that it would need to gain 64.13% to get back to the $417.70).

Depending on how one looks at it, gold actually multiplied USD's moves 2-3 times during the mid-90 decline.

And in the early 1980s?

- Gold's weekly close at the third week of January 1980: $845

- USDX's weekly close at the third week of January 1980: 85.45

- Gold's weekly close at the third week of June 1982: $308.50

- USDX's weekly close at the third week of June 1982: 119.01

The USD Index gained 39.27%

Gold lost 63.49% (which means that it would need to gain 173.91% to get back to $845).

Depending on how one looks at it, gold actually multiplied USD's moves by 1.6 - 4.4 times during the early-80 decline.

This means that just because one is not using U.S. dollars as their primary currency, it doesn't result in being safe from gold's declines that are accompanied by USD's big upswings.

In other words, the USD Index is likely to soar, but - during its decline - gold is likely to drop even more than the USD is going to rally, thus falling in terms of many currencies, not just the U.S. dollar.

Having covered the most important factor for the USD Index and gold, let's take a look at the other - also important - factors influencing both of these markets.

More On the USD Index and Gold

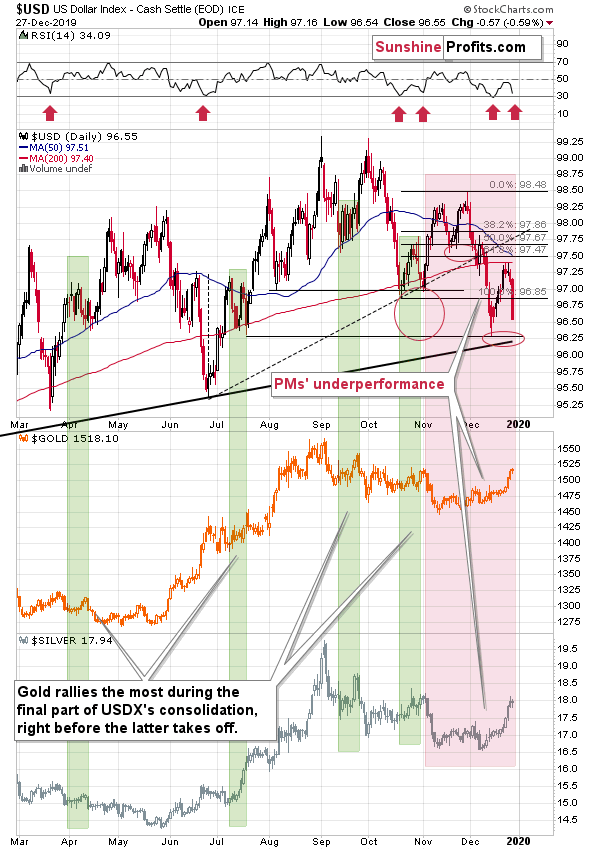

The USD Index is moving up in a rising trend channel that formed after the index ended a very sharp rally. This means that the price movement within the rising trend channel is actually a running correction, which is the most bullish type of correction there is. If a market declines a lot after rallying, it means that the bears are strong. If it declines a little, it means that bears are only moderately strong. If the price moves sideways instead of declining, it means that the bears are weak. And the USD Index didn't even manage to move sideways. The bears are so weak, and the bulls are so strong that the only thing that the USD Index managed to do despite Fed's very dovish turn and Trump's calls for lower USD, is to still rally, but at a slower pace.

The USD Index is at the lower border of its rising trend channel right now, which means that the downside is most likely very limited. Perhaps the bottom was formed just a few hours ago.

The USD Index declined about 0.25 in today's pre-market trading before moving slightly back up. This means that it's testing the previous lows and the rising support line. This also means the RSI Indicator has most likely moved to about 30, even though we don't yet see it on the above chart.

The USDX reaching its previous lows and an important medium-term support line when the RSI is moving to 30, is a very bullish combination.

Also, while we're discussing this chart, please note what the USD Index did since early November and what gold and silver did meanwhile. The USDX is almost a full index point lower than it was back then, while gold and silver are more or less at the same price levels. Both metals are underperforming the USDX on a medium-term basis.

As far as the very short-term is concerned, please note that gold tends to rally the most during the final part of USD's consolidation and from the medium-term point of view, the October - now decline is a consolidation. This means that gold's and silver's rally is not that surprising. Well, it was not the likely outcome, just as the additional decline in the USD Index was unlikely, but since the latter took place, the former is a relatively normal course of action.

At this point, you might be wondering why are we discussing the USD Index in such a great detail in the Alerts dedicated to the precious metals market (after all, we have separate Alerts for the forex market). There are two reasons: one general and one specific.

The general reason is that in the long run, the price of gold cannot be disconnected from the value of the currency it is priced in, especially if it's viewed as the key world currency and a safe haven (yes, people view both: gold and the U.S. dollar as safe havens). Moreover, as we showed previously, during big upswings in the USDX, gold can even multiply USD's movement.

The specific reason is because of the year that is about to end. In the previous several years, we saw a very specific seasonal gold price pattern. Namely, gold soared, which might be a reason for many people to think that gold will soar in January as well. The gold - U.S. dollar link should help to put this view into perspective.

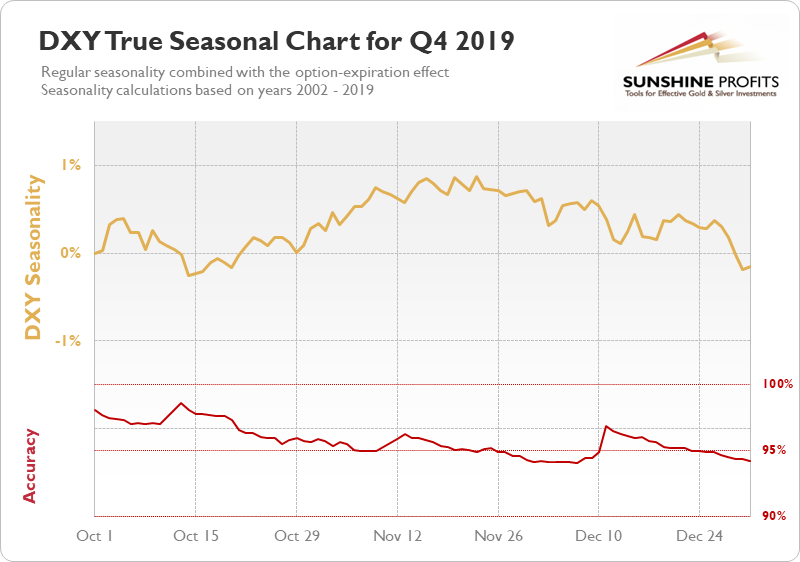

Let's take a look at the average True Seasonal price swings before we move to the individual price moves.

Gold and Seasonality

On average, gold tends to rally in the final part of the year, and the USD Index tends to decline. No surprises so far.

At the beginning of the year, gold tends to rally while the USD's performance varies. Let's keep in mind that the above charts are based on the 2002 - 2018 period and looking at the most recent years might provide us with even more accurate insights. Let's dig deeper.

Gold rallied in early 2019, early 2018, early 2017, early 2016, early 2015, early 2014, early 2012, early 2010, and early 2008.

Gold declined in early 2011, early 2009, and early 2007.

And do you know when the USD Index rallied? In early 2011, in early 2009, and in early 2007. It also rallied in early 2012, in early 2014, and in early 2015.

In other words, half of early January USD's rallies triggered declines in gold. If the USD Index is very likely to rally shortly - and this is the case - then the better comparison than just taking the previous years into account is to focus on cases when the USD Index rallied. This means that in half (3 out of 6) cases, gold rallied, and that it declined in the remaining cases. The 50/50 performance means that the outlook is not as bullish as the seasonality would have one believe.

The outlook for the USD Index nullifies the positive effect of the seasonality.

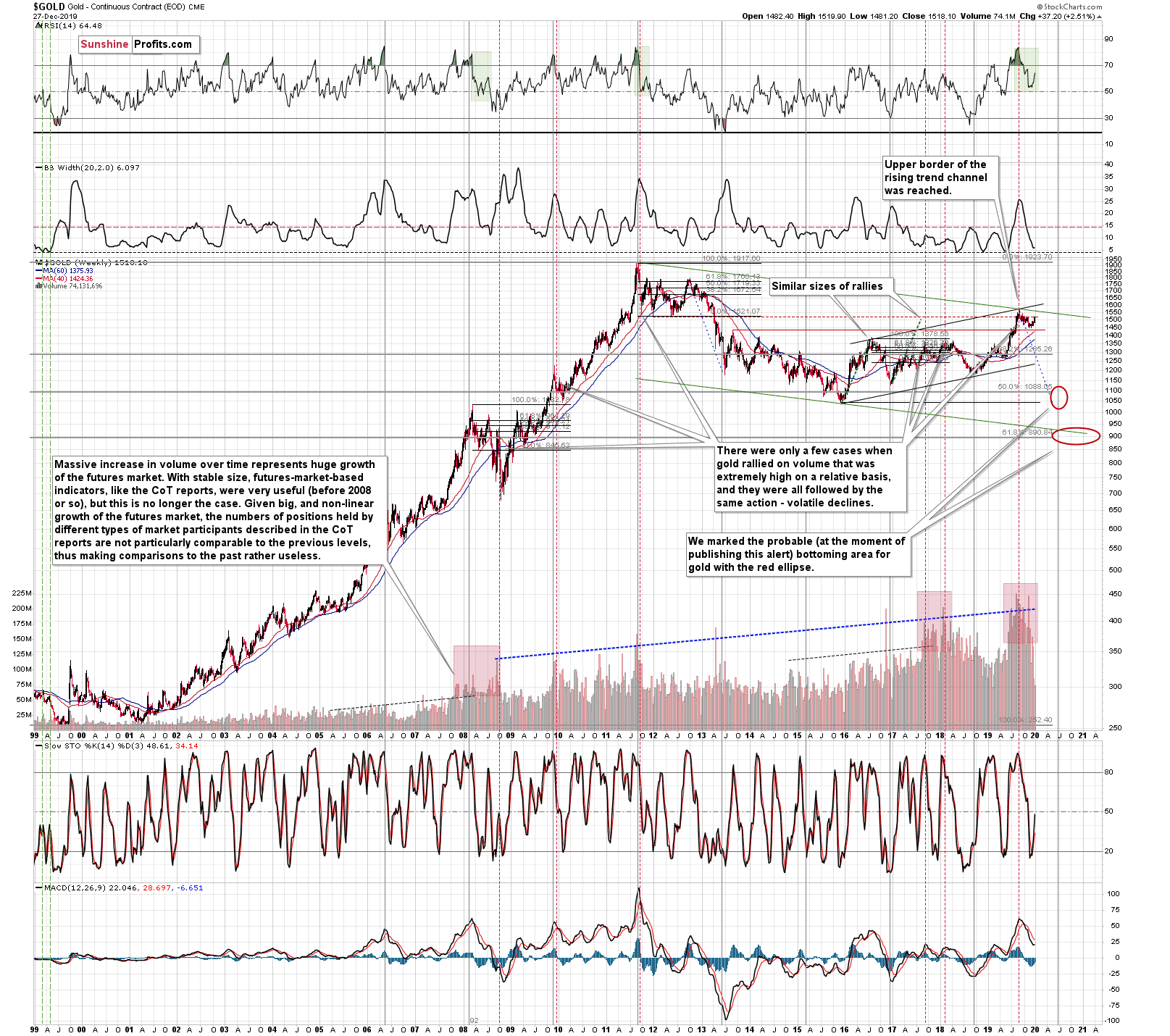

Naturally, there are many other things that need to be taken into account while analyzing the market other than just the USD Index and gold's seasonality. For instance, the analogy between the 2019, 2011, and 2008 tops.

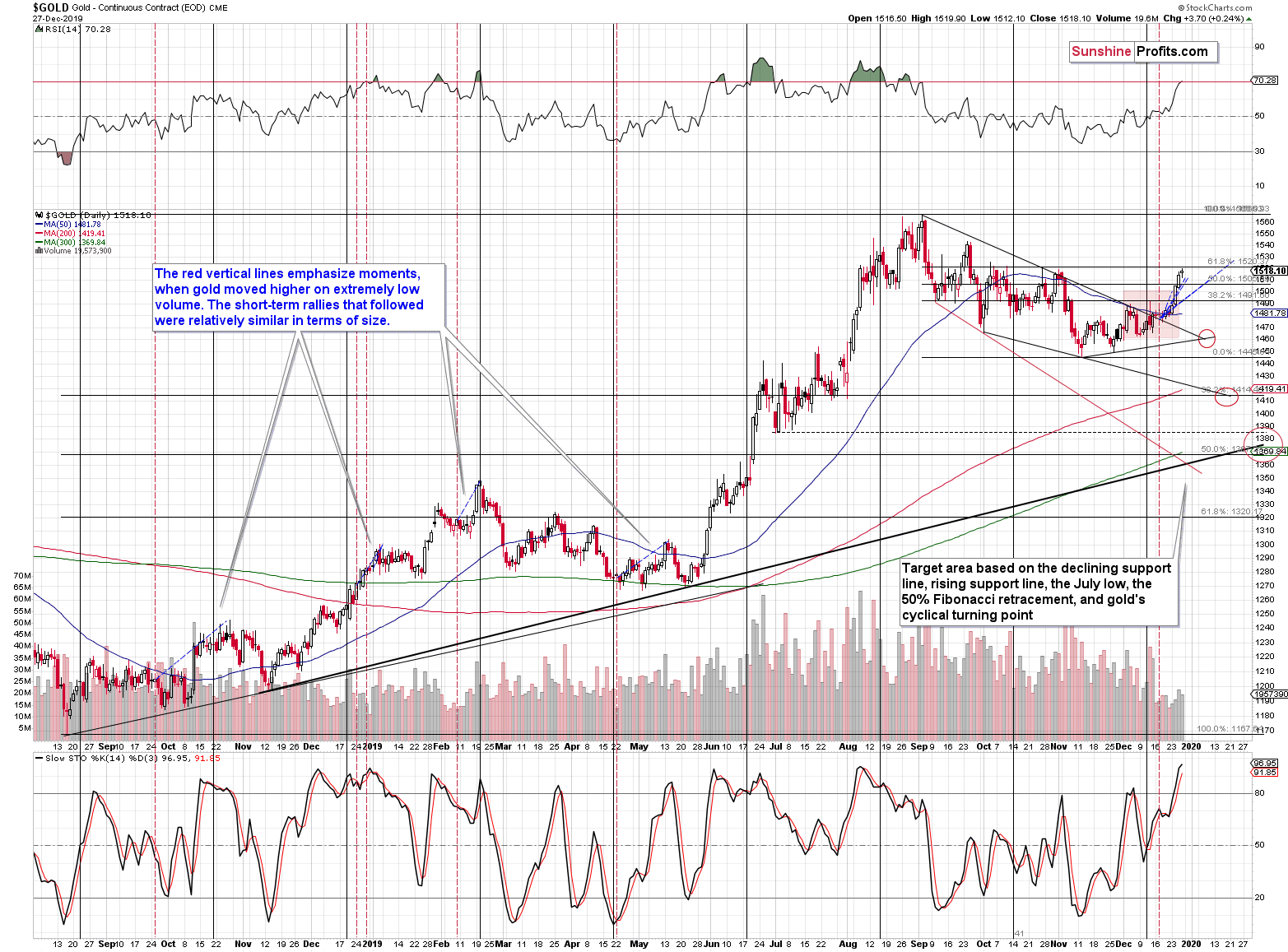

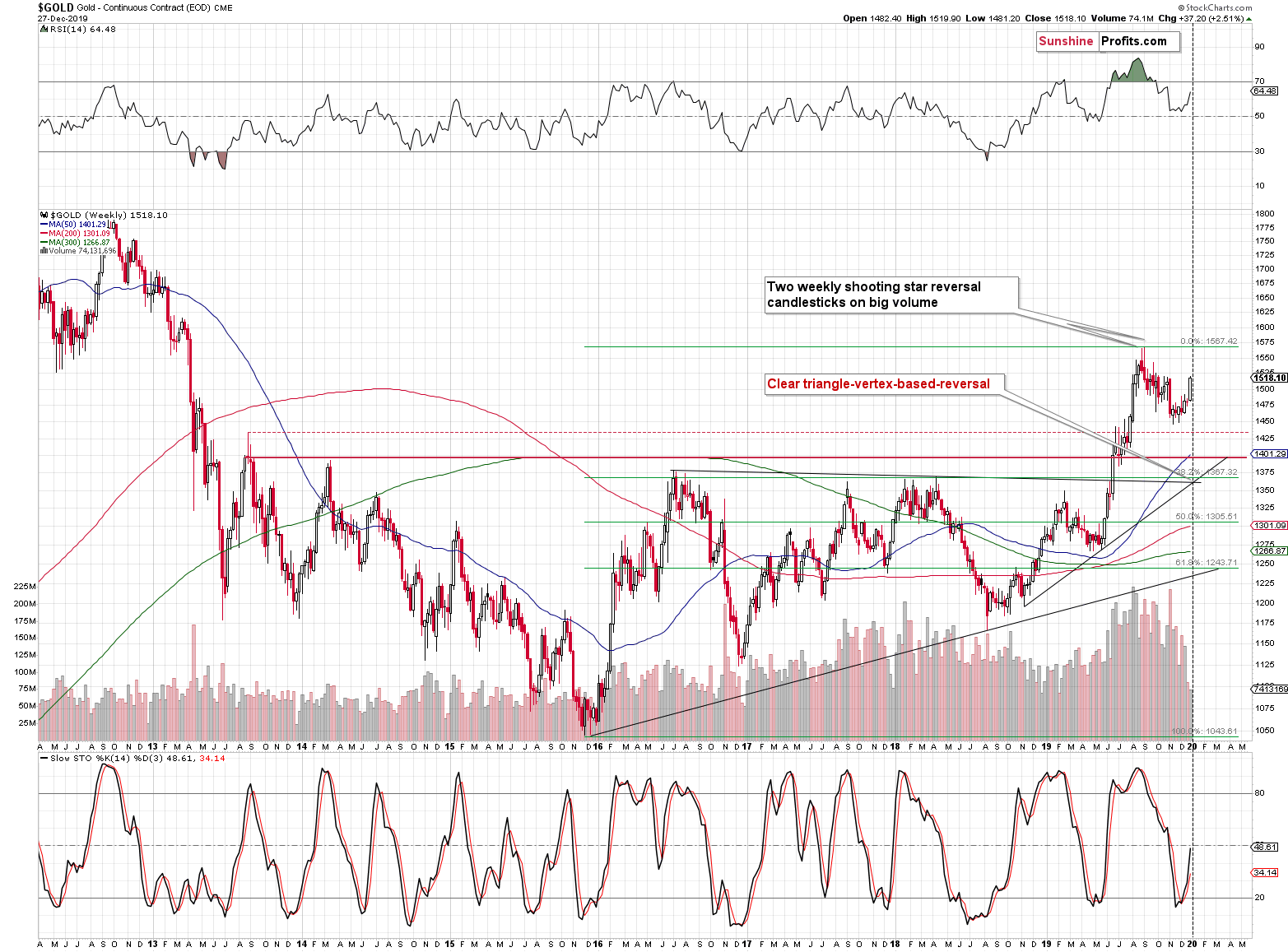

These were the only three tops that formed after gold rallied so sharply that RSI moved above 80, along with relatively huge volume.

In both previous cases (2011-2012 and 2008), gold declined initially after the top and then corrected a bit more than 61.8% of the decline before forming the final short-term top from which the biggest declines started. The 2016 decline was also preceded by a sharp rally and it was also characterized by a temporary move back up - slightly above the 61.8% Fibonacci retracement - before the main part of the slide.

Please note what the RSI indicator did when gold was correcting for the final time before the big slide (2008 and 2012). It moved slightly higher from about the middle of its trading range (50). Exactly the same thing can be said about what happened in gold recently. The RSI behaved just like it did in 2008 and 2012. And what did the gold price report?

Lessons from Topping Action in Gold

Gold touched the 61.8% Fibonacci retracement without breaking above it. In the previous cases (2008, 2012, and 2016), gold moved slightly above it but in this case, this level might hold. It's reinforced by the previous (October and November) highs as well as the 2011 and 2012 lows.

The situation is very similar to how gold "kissed the rally goodbye" in 2011, 2008, and also in 2016.

Plus, let's keep in mind the volume, which has been very low recently. When the volume became so low initially, we wrote that this is what often precedes bigger moves. The implications of very low volume turned out to be bullish instead of bearish (we managed to close the previous long position at a profit nonetheless), but... it seems that whatever bullish was likely to happen based on the low-volume situation, has already happened.

We marked the previous rallies that followed very-low-volume sessions with blue dashed lines and we copied them to the most recent low-volume session. The size of the rally that we saw in the last several days is in perfect tune with the previous cases. Consequently, gold is not likely to rally visibly more based on that factor. In fact, the odds are that the rally has already ran its course or is very close to doing so.

Speaking of gold's rally, it's also a bearish factor given the proximity of the two medium-term triangle-vertex-based reversals.

There's no doubt that the most recent move in gold was up. Therefore, there is no doubt that the only way in which gold could reverse right now is by forming a top and then declining.

Let's take a look at gold's sister metal - silver.

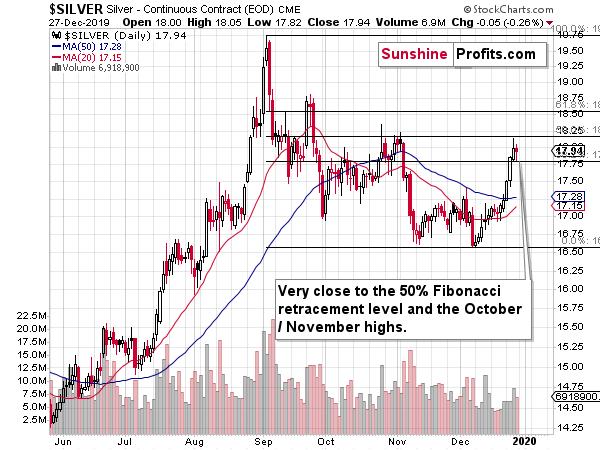

Silver Shares Its Two Cents

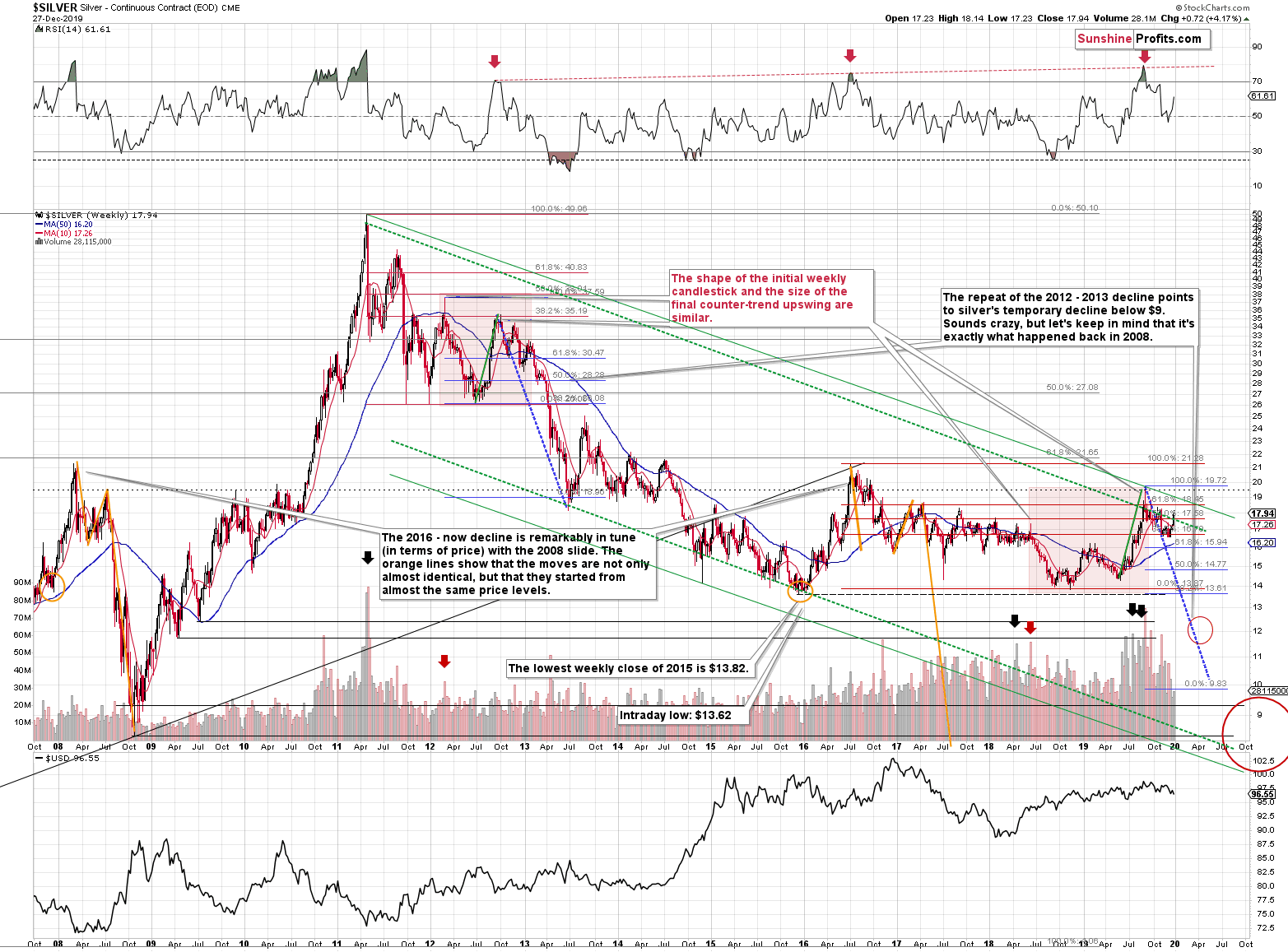

The key analogy in silver (in addition to the situation being similar to mid-90s) continues to be the one between 2008 and the 2016 - now periods.

There is no meaningful link in case of time, or shape of the price moves, but if we consider the starting and ending points of the price moves that we saw in both cases, the link becomes obvious and very important.

But first - why do we bother with detecting similarities in a given market? Do they have to repeat themselves? The times are very different, after all.

That's one of the boomerang questions that we get every few months or more frequently. The very foundation of the technical analysis is that the markets repeat their behavior. The times change. The presidents and monetary authorities change, the interest rate change and so on, but what doesn't change is that people are motivated by fear and greed (and we don't mean it in a negative way - striving to secure one's personal and family financial safety - making their dreams come true, is a very noble goal). And people will react to fear and greed in relatively similar ways. Of course, there is no single type of reaction, there are multiple ways in which people react, but they are together form the reaction that we see play out over and over again. Smaller parts of the price moves are often called "patterns" or "formations" while bigger ones are trends. Seeing that one of them just formed, allows one to check the follow-up action, which was also usually alike. This means that it's likely that the same (or similar) kind of movement will take place once again.

Of course, some formations tend to work on one given market and some on another one. The longer one analyzes a given market, the more proficient they become at discovering specific price moves that are applicable to it. For instance, in general, people view strong daily performance on big volume as bullish. But it is usually the other way around in case of silver, especially, if gold is weak on that day.

Different parts of trends are characterized by different price formations e.g. it is more common for something to appear at the beginning of an uptrend (e.g. gold stocks outperforming gold) than at its end. If one is able to detect what kind of price move from the past is being repeated (to a considerable extent), then it is much easier to forecast what's likely ahead. One will know what kind of signals should they be looking for, and what kind of signals are not likely to be seen (thus, if they are seen, they serve as a huge red flag).

For instance, the 90s - now perfectly fits the multiple medium-term bearish signals that we saw recently. Gold's strength in the previous months might appear very bullish, but this is no longer the case once one realizes that the same thing took place at a similar time right before the final top.

Having said that, let's take a look at what silver did in 2008 and what it's been doing since the 2016 top - the price similarities are uncanny.

The rallies that led to the 2008 and 2016 tops started at about $14 and we marked them both with orange ellipses. Then both rallies ended at about $21. Then they both declined to about $16. Then they both rallied by about $3. The 2008 top was a bit higher as it started from a bit higher level. And it was from these tops (the mid-2008 top and the early 2017 top) that silver started its final decline.

In 2008, silver kept on declining until it moved below $9. Right now, silver's medium-term downtrend is still underway. If it's not clear that silver remains in a downtrend, please note that the bottoms that are analogous to bottoms that gold recently reached, are the ones from late 2011 - at about $27. Silver topped close to $20.

The white metal hasn't completed the decline below $9 yet, and at the same time it didn't move above $19 - $21, which would invalidate the analogy. This means that the decline below $10, perhaps even below $9 is still underway.

Naturally, the implications for the following months are bearish.

Let's consider one more similarity in the case of silver. The 2012 and the 2018 - today performance are relatively similar, and we marked them with red rectangles. They both started with a clear reversal and a steady decline. Then silver bottomed in a multi-bottom fashion, and rallied. This time, silver moved above its initial high, but the size of the rally that took it to the local top (green line) was practically identical as the one that we saw in the second half of 2012.

The decline that silver started in late 2012 was the biggest decline in many years, but in its early part it was not clear that it's a decline at all. Similarly to what we see now, silver moved back and forth with lower highs and lower lows, but people were quite optimistic overall, especially that they had previously seen silver at much higher prices (at about $50 and at about $20, respectively).

The 2012 corrective upswings were actually the final chances to exit long positions and enter short ones. It wasn't easy to do it back then just as it's not easy to do so right now. But the size of the decline that follows speaks for itself. In investing and trading, what's pleasant and what's profitable is rarely the same thing.

On a short-term basis, we see that silver moved to the 50% Fibonacci retracement based on the most recent decline and relatively close to the previous highs, without breaking above them. In other words, silver reached its short-term resistance. Consequently, this might be the end of silver's rally.

Having covered the precious metals, let's take a look at the precious metals mining stocks.

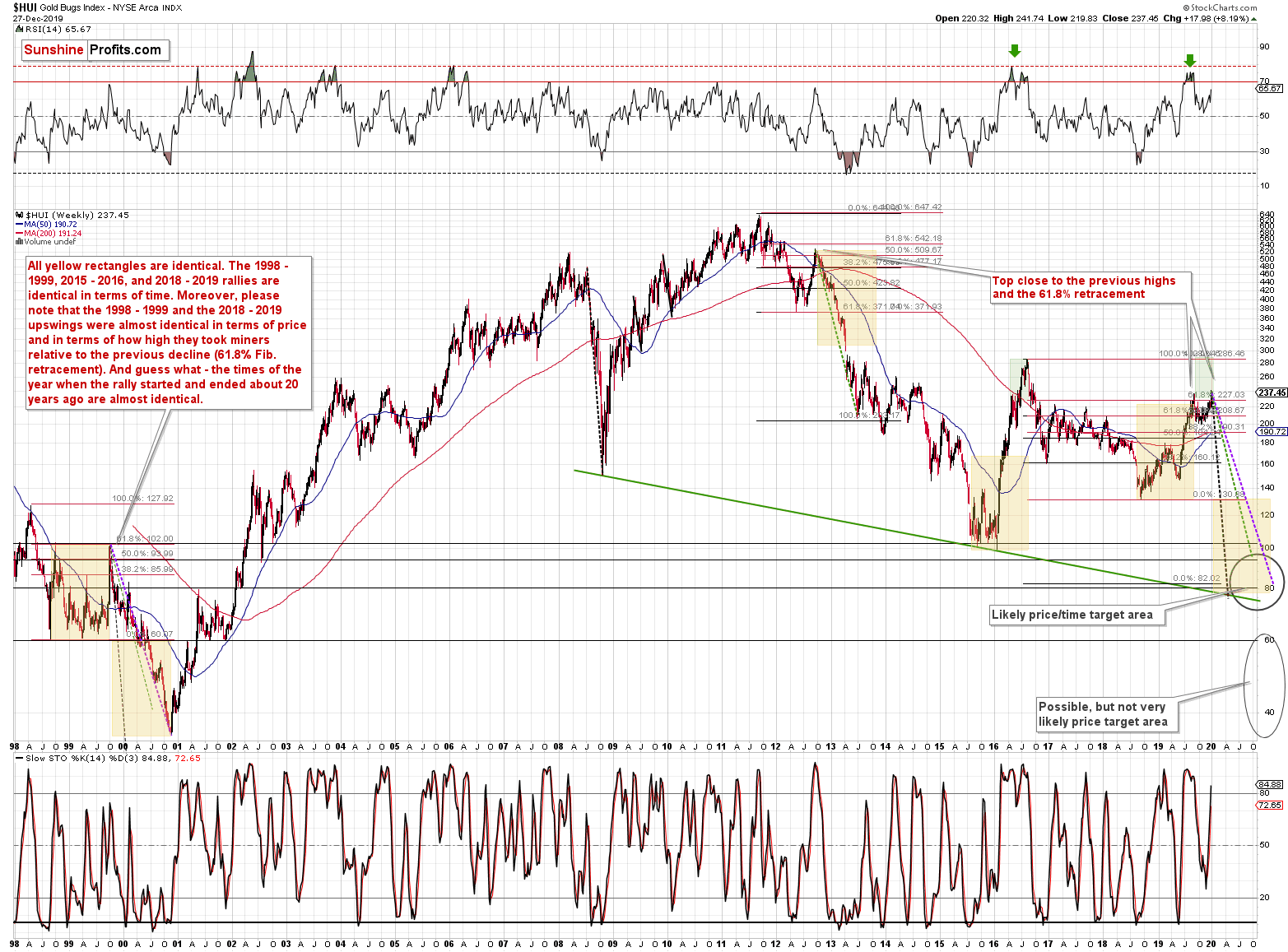

As with gold and silver, there's a flagship analogy present in the gold miners.

Turning to Gold Miners

In case of gold stocks, we see that the history is repeating with an almost exact 20-year delay. This might sound crazy... Until you see the chart that shows you how precise it is, and how well it fits to what happened now and what happened in 2012 as well.

(as a reminder, clicking on the chart will expand it)

Let's start with something relatively more familiar - the Fibonacci retracements. Back in 2012, the HUI Index retraced almost 61.8% of the preceding rally before the decline continued. That was one of the reasons that we thought that the 2019 rally won't get much above this retracement, if at all. Indeed, the August breakout above this retracement was very short-lived. The current move higher is just a little above the August high and the breakout is not yet confirmed. The important thing is that this is not the only time when this retracement stopped a sizable, yet counter-trend rally before a big decline.

The 1999 top formed almost exactly at the 61.8% Fibonacci retracement. That's one similarity between what happened recently and in 2012.

The second similarity is what's so exciting about this discovery. The length of the rally. All yellow rectangles on the above chart are identical. The 1998 - 1999, 2015 - 2016, and 2018 - 2019 rallies are identical in terms of time. Most importantly, the 1998 - 1999 and the 2018 - August 2019 upswings were almost identical in terms of both: time and price. And that's in addition to both rallies ending at the same Fibonacci retracement.

Let's re-state it again. Both rallies took practically the same amount of time, and the rallies were almost alike in terms of size - percentagewise.

The current move up is just a little above the August high and the breakout is not confirmed, which is why we don't yet view the current prices as the end of the rally. It's more of a double-top at this time. The rally seems to have ended in August and the only thing we see right now is a re-test of the same Fibonacci retracement.

The times of the year when the rally started and ended about 20 years ago are almost identical as well. The 1998 rally started right after the middle of the year and the same thing happened in 2018. The rally ended in the second part of 1999 and the same was / is the case right now. The month is not the same, but it's close nonetheless.

Based on the way in which the previous bear market in gold stocks ended, it seems that we have about a year of lower prices ahead of us and the HUI Index will decline at or a bit below the 80 level. That's in perfect tune with the upper one of the price target areas that we've been featuring on the above chart for some time now. The key of the additional trading techniques pointing to the 80 level or its proximity as the downside target are the early 1999, and 2011 tops as well as the early 2002 bottom, and the long-term declining support line based on the 2008 and 2016 lows.

The implications extend beyond just the final target - the analogy can tell us something important about the likely corrective upswings that we'll see along the way. Some of them will be relatively small, but there will also be those that are visible even from the long-term point of view, such as the one that we saw in early 2000.

How to detect them? Let's get back to the basics. When does a price rally, even though it remains in a downtrend? When it gets too low, too soon - at least in many cases. The key follow-up question is "too low compared to what?". And that's where the analogy to the 1999 - 2000 decline comes into play.

The purple line is the line that connects the start and the end of the 1999 - 2000 decline. The green line marks the start and the end of the 2012 - 2013 decline and the black one is based on the 2008 decline. There are two rules that we can detect based on these analogies.

First, the time after which we saw corrections during longer declines is similar to the times when the quicker decline ended. The end of the black line (early 2000) is also when we - approximately - saw the first big corrective upswing during the decline. Applying the same technique to the current top (of course, assuming that the top is being formed right now) provides us with early April 2020 as the likely bottoming target date. Naturally, it's likely to be just a short-term bottom that would be followed by a corrective upswing and then even lower prices.

Second, the chance of a corrective upswing and the chance that such upswing would be significant increases dramatically when price moves visibly below the dashed line. There are 3 dashed lines to choose from - each based on a different decline - so the question is which one should be used. It seems that the middle one is appropriate as it was most useful in 2000. The 2012-2013 decline took place mostly above the dashed line that connected its starting and ending point and it didn't have profound corrective upswings until it ended. What we saw 20 years ago, however, was very different. The price declined sharply initially, but then corrected a few times and the more price moved below the declining green dashed line, the bigger the corrective upswing was.

So, if the HUI moves visibly below the declining green dashed line, it will suggest that the miners got too low too fast and are likely to bounce back up sooner rather than later.

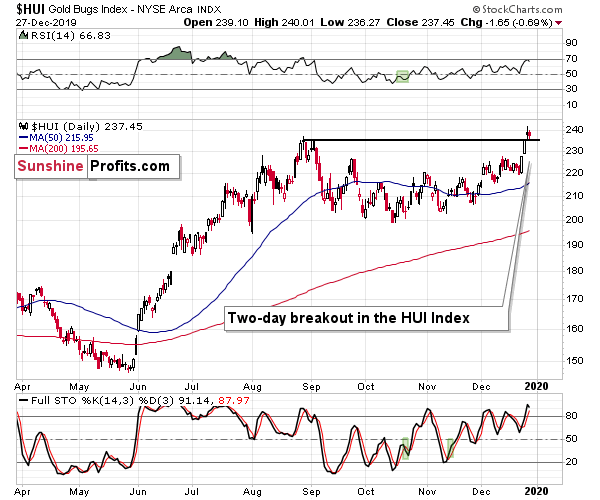

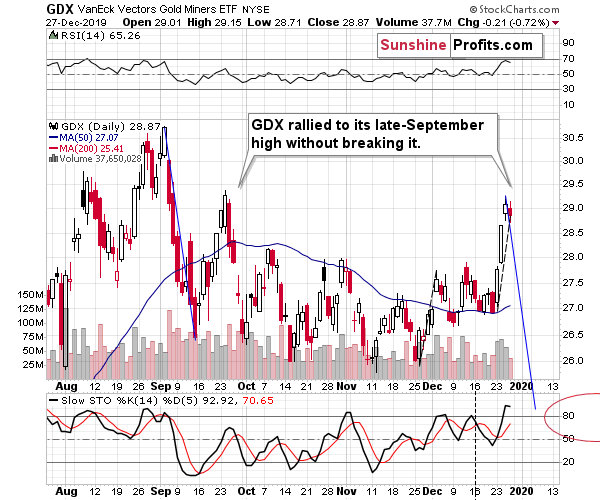

On a short-term basis, we see that the move above the August highs was not confirmed.

In case of the GDX ETF, a different proxy for the mining stock sector, we don't see a move above the August high at all. Conversely, GDX tried to break above the late-September high and failed to do so.

This divergence suggests that the breakout in the HUI Index is quite likely to be invalidated, especially that the RSI based on the GDX ETF is so close to the 70 level, which is the classic sell level.

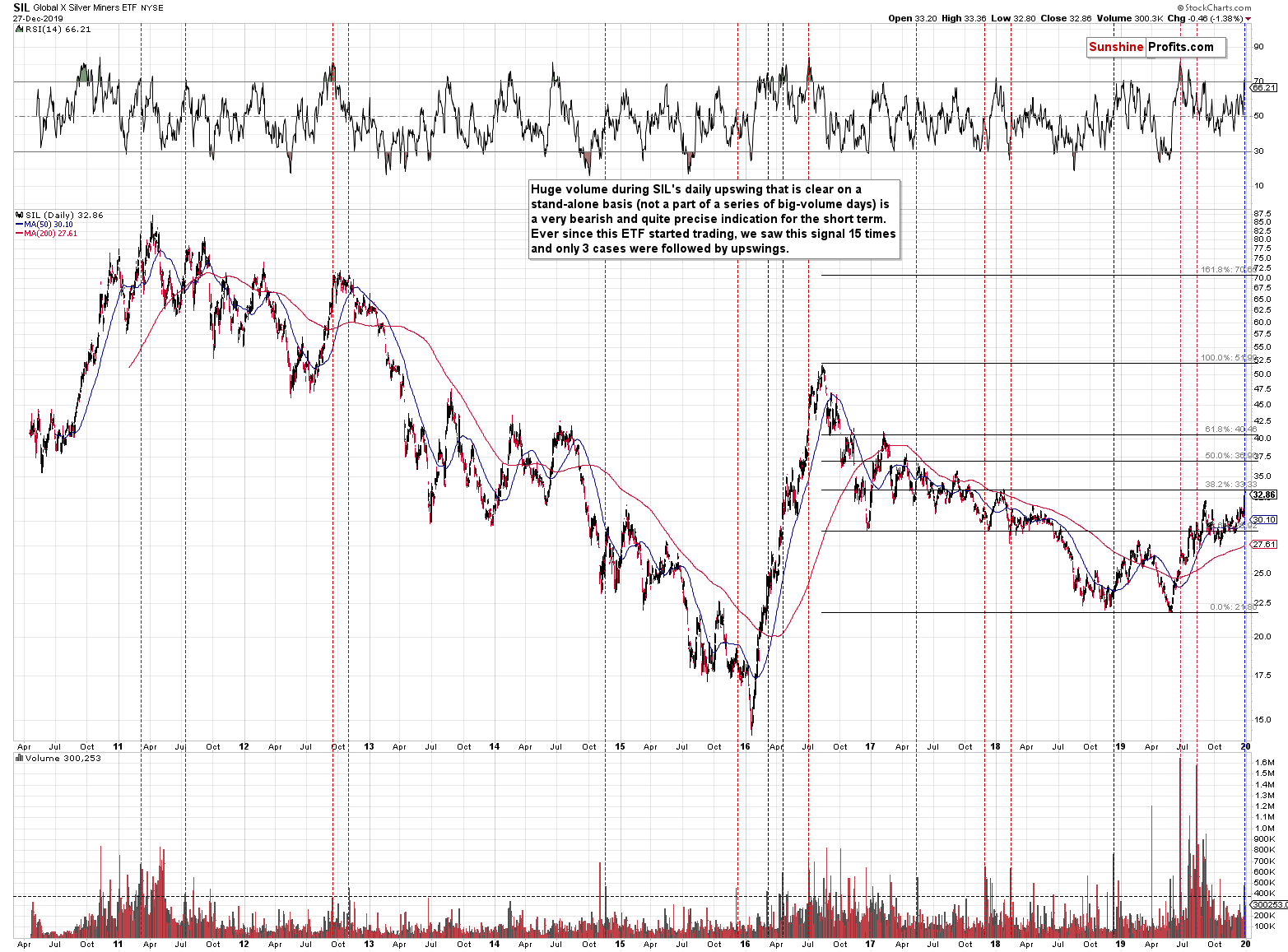

Finally, we would like to bring to your attention the fact that we just saw a spike in the volume of silver stocks.

Silver Stocks in Focus

"Silver stocks reached their new yearly high on relatively strong volume" sounds very bullish, doesn't it?

The problem is that reaching the new yearly high means that silver miners were barely able to correct 38.2% of the decline from the 2016 high. And that's compared to the decline alone. Comparing the recent rally to the one that we saw in 2016, we see that this year's upswing is barely one fifth of the previous upswing (about 50% vs about 250%). That's very weak performance - silver miners don't really want to move higher, they are forced to move higher as gold and silver are increasing, but the size of the move emphasizes that it's not the "true" direction in which the market is really moving.

The volume is also not as bullish as it seems to be at the first sight. Conversely, huge volume during SIL's (ETF for silver stocks) daily upswing that is clear on a stand-alone basis (not a part of a series of big-volume days) is a very bearish and quite precise indication for the short term. Ever since this ETF started trading, we saw this signal 15 times and only 3 cases were followed by upswings.

Yes, the silver stocks moved sharply higher on a very short-term basis, but please note that they had moved sharply lower on a very short-term basis in early 2016. The opposite of the recent price action was what preceded the biggest and most volatile rally of the recent years. If we see a reversal and invalidation of the breakout to new 2019 highs, we'll have almost exactly the opposite situation and the implications will be even more bearish.

Summary

Summing up, based on multiple similarities present in gold, silver, and mining stocks, as well as on the critical situation in the USD Index, the medium-term outlook for the precious metals market is very bearish. Given the proximity of the triangle-based reversals in gold, silver stocks' big volume spike, and the divergence between HUI and GDX, it seems that the short-term rally in gold, silver, and miners is now very close to being over. In other words, the profit potential of our trading positions remains intact.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short position (250% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and binding exit profit-take price levels:

- Gold futures: profit-take exit price: $1,391; stop-loss: $1,573; initial target price for the DGLD ETN: $36.37; stop-loss for the DGLD ETN: $25.44

- Silver futures: profit-take exit price: $15.11; stop-loss: $19.06; initial target price for the DSLV ETN: $24.88; stop-loss for the DSLV ETN: $14.07

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $23.21; stop-loss: $30.11; initial target price for the DUST ETF: $14.69; stop-loss for the DUST ETF $5.09

In case one wants to bet on junior mining stocks' prices, here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $30.32; stop-loss: $44.22

- JDST ETF: profit-take exit price: $35.88 stop-loss: $9.68

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager