Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

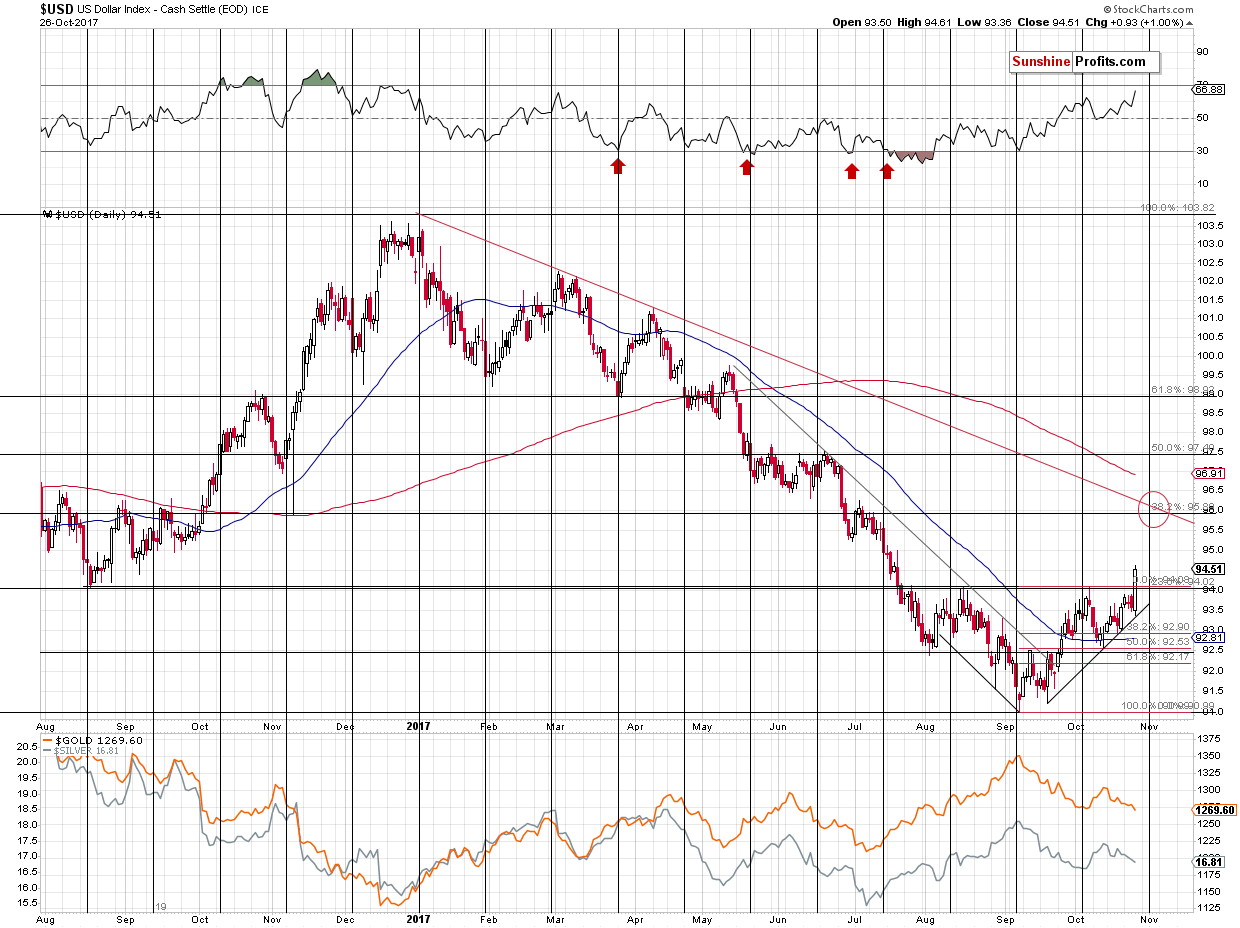

The USD Index soared, just like it was likely to based not only on the technical grounds, but also on the analogy in the interest rate hikes. It completed the reverse head and shoulders formation and things appear very bullish for the short term. Miners plunged exactly as we had expected them to, so things should be clearly bearish for the precious metals sector… But gold and silver declined only a little yesterday and this strength should raise one’s eyebrow. Based on the size of the rally in the USD Index (almost a full index point), one would expect gold to slide by at least $20. Instead, we saw a decline smaller than $10 and no new intraday October low. Has the decline just ended?

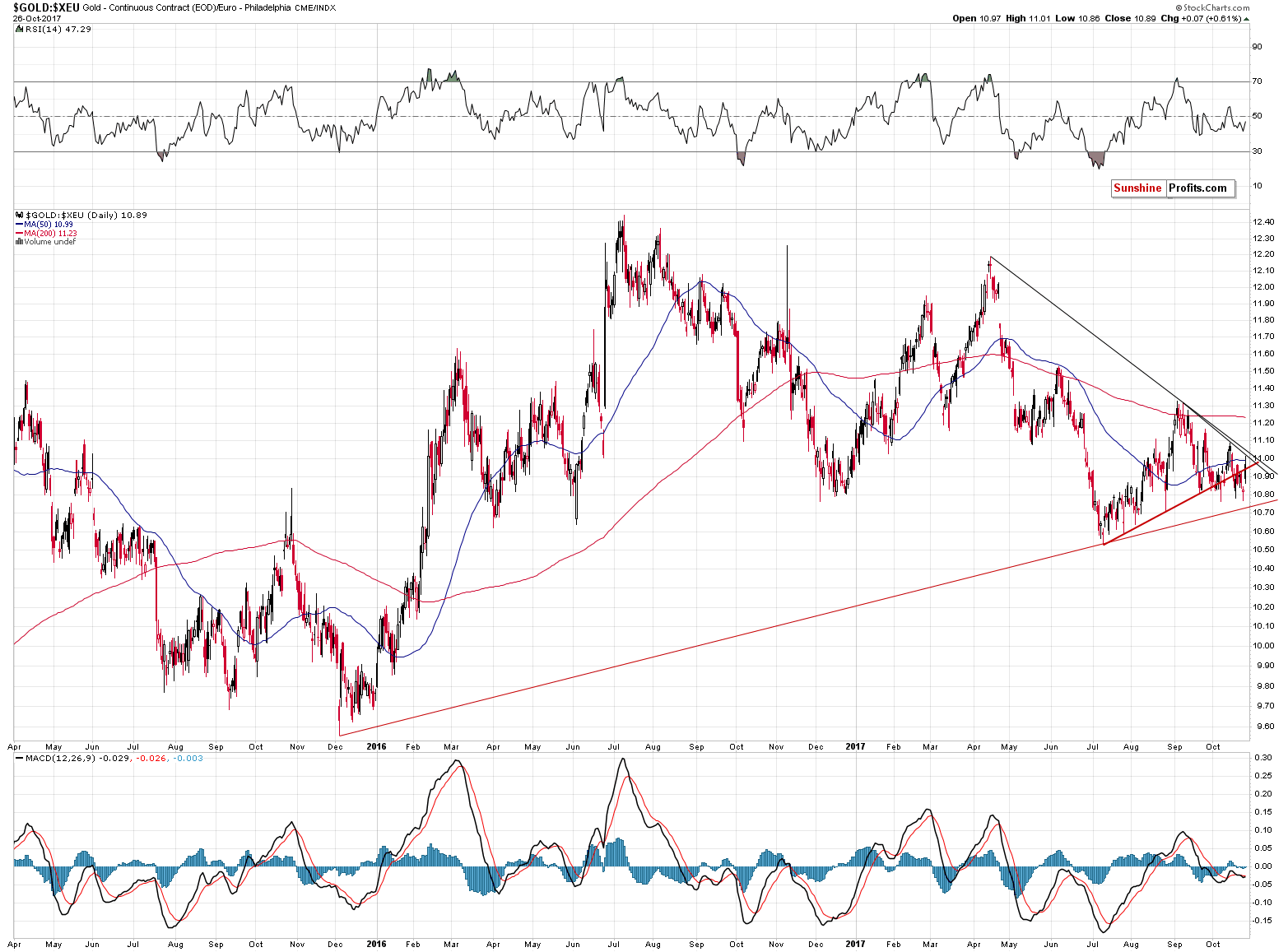

While the above seems to be a real concern, after taking a closer look at gold’s reactions, it seems that the strength was not significant enough to change anything. In order to illustrate it, let’s look at gold’s performance in terms of the euro – the biggest component of the USD Index (chart courtesy of http://stockcharts.com).

As you can see above, gold actually moved higher in terms of the euro yesterday – gold’s move lower was much smaller than the decline in the EUR/USD currency pair (by the way, we were shorting this pair in our Forex Trading Alerts) and overall gold became a bit more expensive for euro holders. Now, the key question is if this strength changes anything going forward.

In short, it does not and the above chart illustrates it. Gold moved indeed higher, but not above the declining resistance lines based on the April and September highs (it didn’t move above the short-term resistance line based on the September and October highs either). Consequently, there was no breakout and no change in the technical picture.

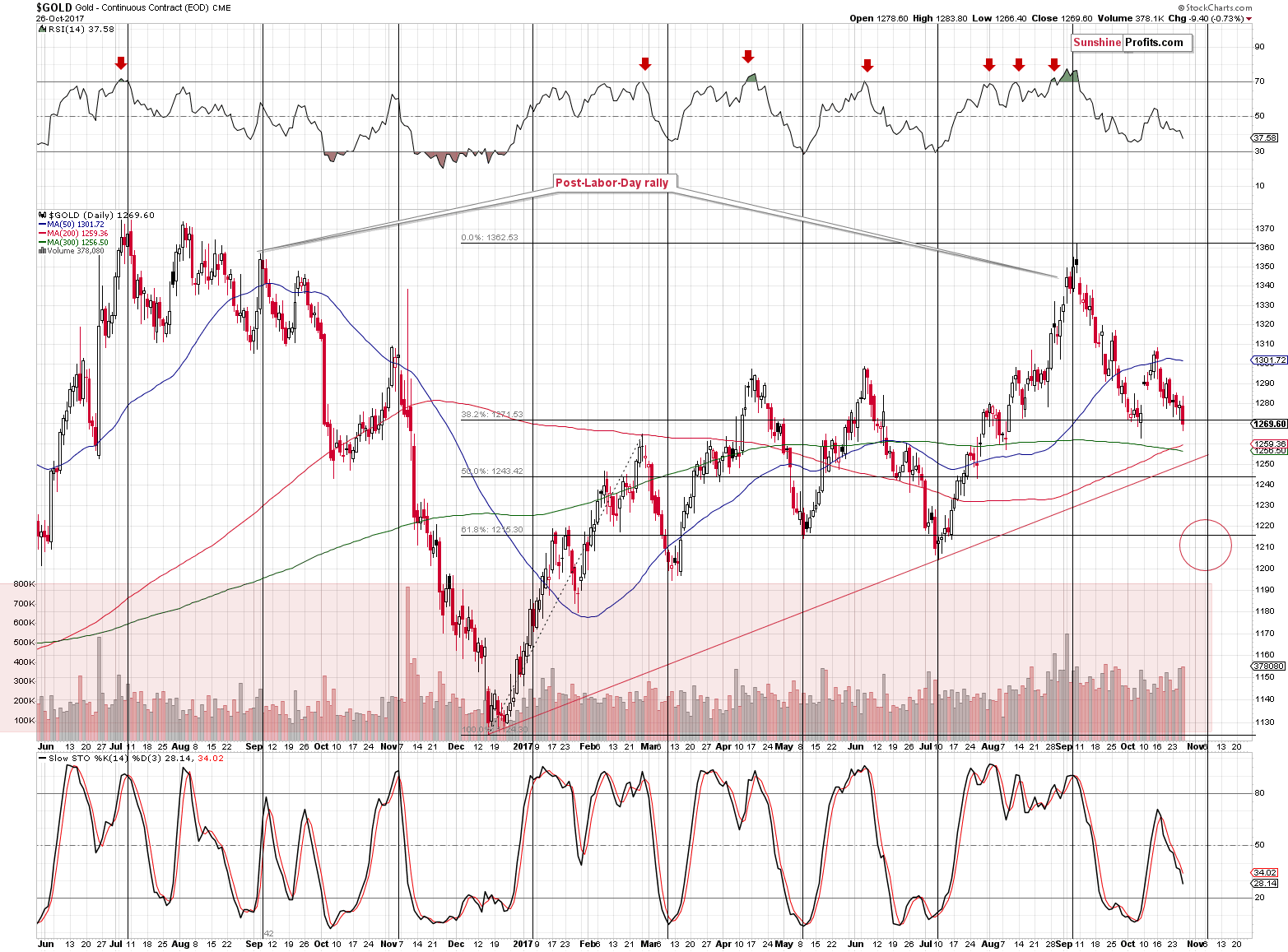

The above chart shows that gold’s big slide has yet to begin – gold has been moving lower since September, but the decline has been rather small so far. There are support levels at the December 2016 and July 2017 lows and once these are broken, then there is no strong support all the way until gold reaches its December 2015 lows. The above information is useful, because we know that once the breakdown is confirmed, it will not be a good idea to bet on any temporary corrective upswings until much lower prices are reached.

Consequently, metals’ yesterday’s reluctance to decline more visibly is not a game-changer and lower prices still appear to be on the horizon, especially that the volume that accompanied yesterday’s downswing was sizable.

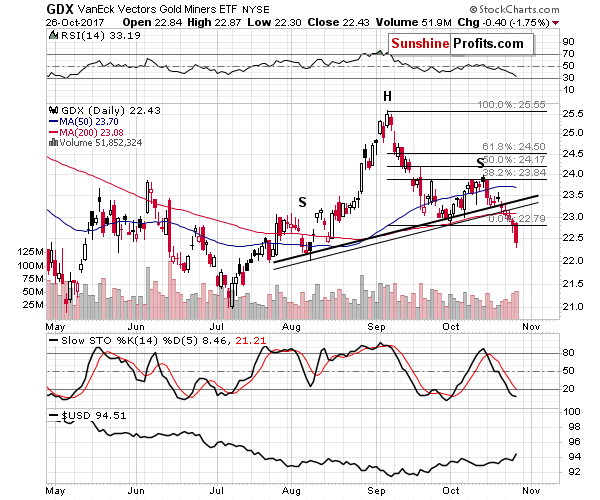

Speaking of sizable volume, please note that we also saw big volume readings in the case of the GDX ETF, so the decline continues to be confirmed. Low volume might indicate a looming correction, just like it did at the end of September, but we haven’t seen anything like that yesterday.

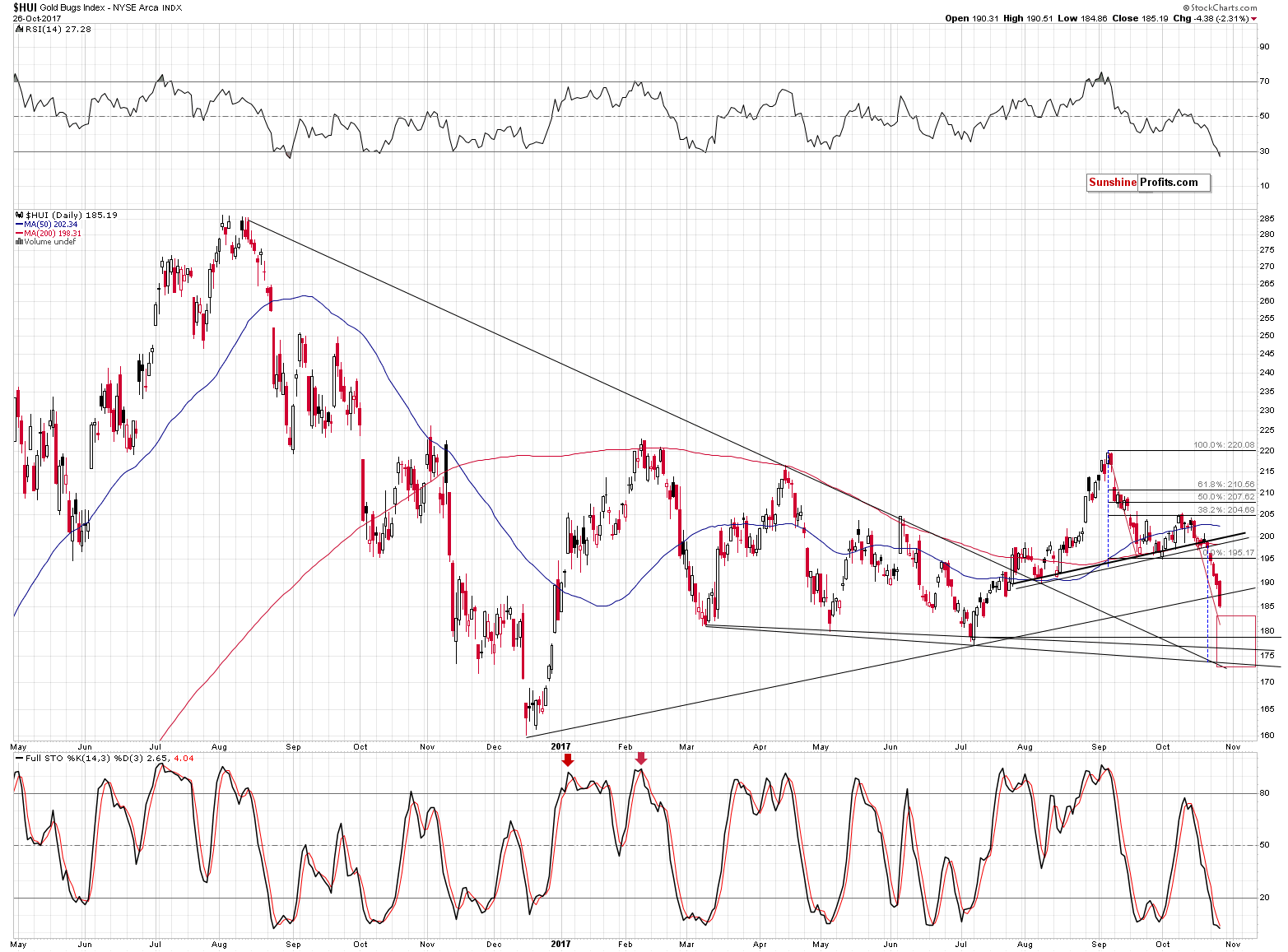

Conversely, gold stocks plunged significantly and even managed to break below the rising support line based on the 2016 and 2017 lows. It seems that we can once again report the same thing as we did yesterday:

Gold was relatively unchanged and gold stocks declined once again. The extraordinary weakness in mining stocks continues and the bearish implications remain in place – based on yesterday’s session, the current situation is even more similar to the pre-2013-plunge trading.

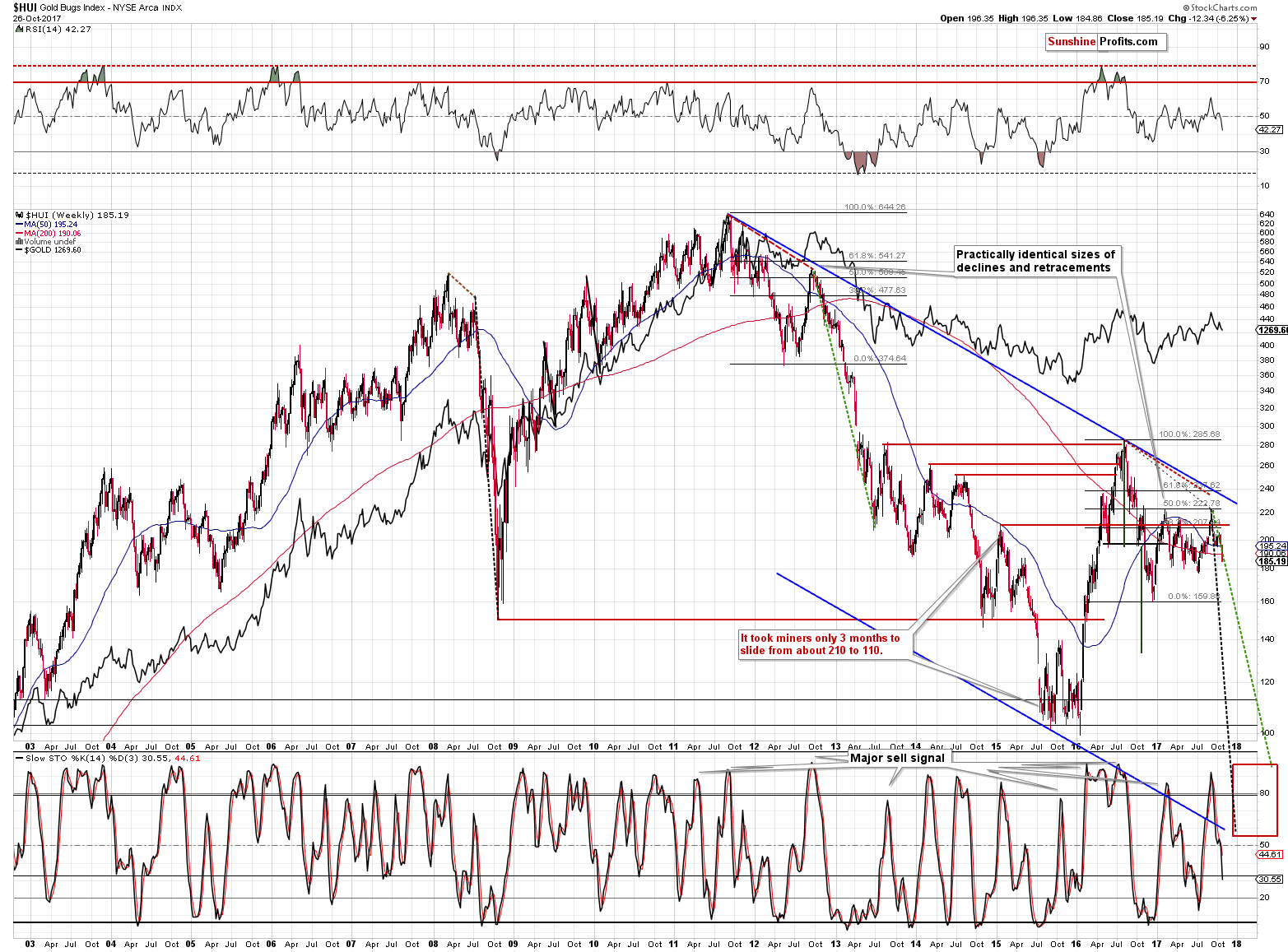

Speaking of the pre-2013 plunge, the long-term HUI Index chart shows that the HUI Index is currently declining almost perfectly in tune with the way it declined in late 2012 and early 2013. There were a few corrections along the way and we are just after the first of them.

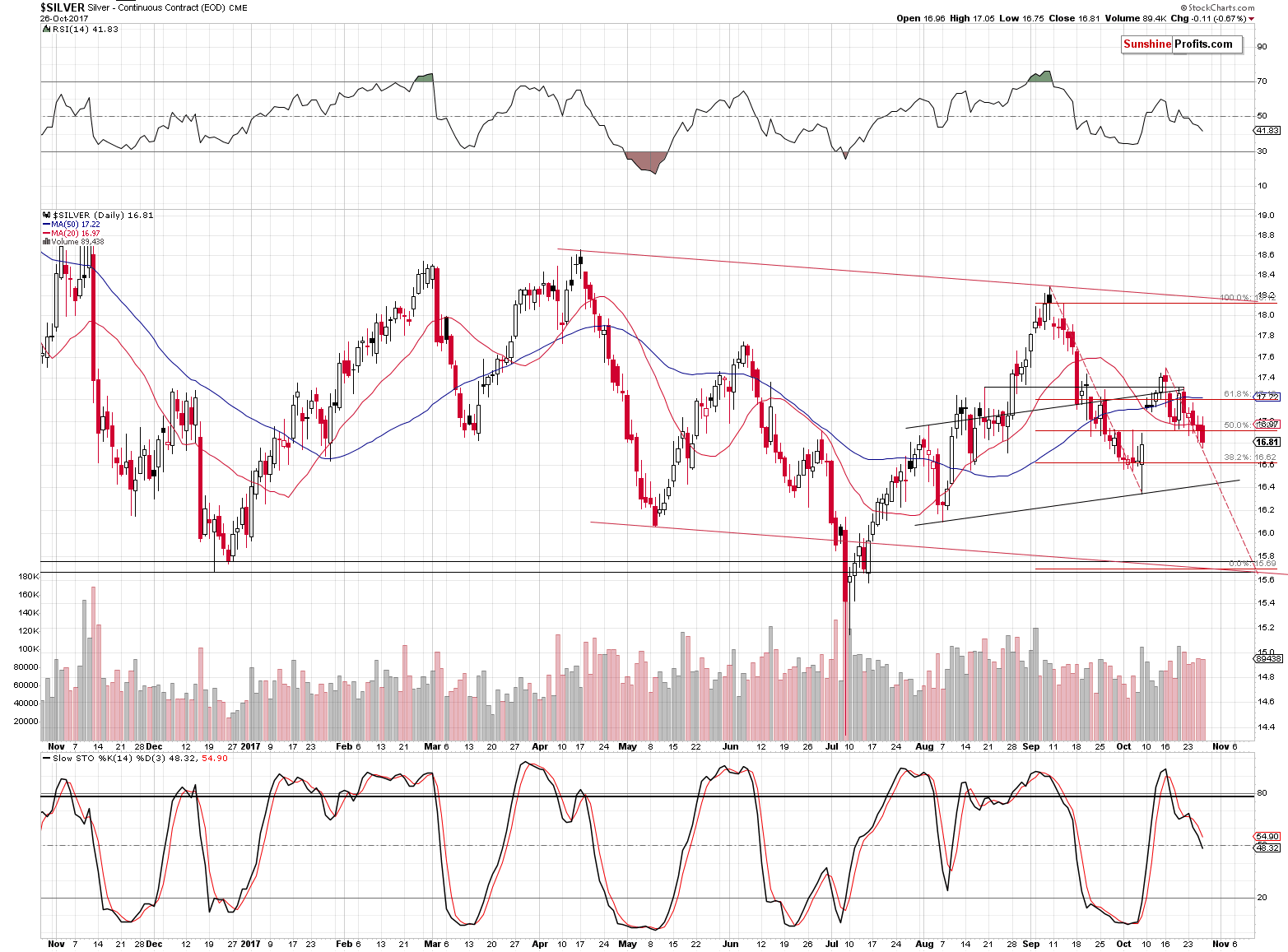

Now, with the decline in mining stocks being much more visible than the one in gold, one could be wondering if all our targets (for gold, silver and mining stocks) will really be reached at the same time or at least close to each other. In our view, that’s still likely. Let’s keep in mind that miners are usually the first to rally and silver is the one that catches up. Consequently, it’s no wonder that miners are leading the way lower. At even lower price levels, miners could start to show strength by declining less than gold and silver. Finally, silver could plunge sharply lower confirming the temporary (not final) bottom.

We’ll monitor the situation and report to you accordingly.

Moving on to the star of yesterday’s session, we see that the reverse head and shoulders formation was clearly completed and the implications are very bullish. Still, let’s keep in mind that the formation could still become invalidated and if that happens, the USD would be likely to move to 92.5 or lower – maybe even to the 91 bottom. This is not likely, but we want to prepare you for this possibility. At the moment of writing these words, the USD Index is trading at 94.86, so it has a long way down to invalidate the breakout above 94 and – again – the invalidation of the breakout doesn’t appear likely, but it should be kept in mind nonetheless.

What is likely is the scenario that we had outlined previously – a quick run to the 95.5 – 96.5 area (96 being the most likely target) followed by a local (not the final one) top in early November.

The RSI indicator is moving close to the 70 level, but that doesn’t concern us as in the recent past there were only 2 similar cases - about a year ago. In both of them, the USD Index continued to rally to much higher levels before the top was in (PMs continued to decline).

Summing up, it seems that another wave higher in the USD has just started and while gold and silver reacted modestly yesterday, it doesn’t seem that this is a reason to be concerned. Mining stocks continued to decline significantly and – as it is usually the case – gold and (especially) silver are likely to catch up in the following days. As far as the medium-term outlook is concerned, the outlook remains bearish and multiple bearish signs continue to confirm it: gold’s huge monthly volume, the analogy in the HUI Index, the analogy between the two most recent series of interest rate hikes, the breakout in Nikkei and the RSI signal from gold priced in the Japanese yen.

As far as the following weeks are concerned, it seems that we could see another rebound during the decline, but not likely until gold moves to the $1,200 - $1,220 range, which is likely to take place in the first half of November. The analogous range for the USD Index is 95.5 – 96.5 with the 96 level being the most likely target.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit price levels / profit-take orders:

- Gold: exit price: $1,218; stop-loss: $1,366; exit price for the DGLD ETN: $51.98; stop-loss for the DGLD ETN $38.74

- Silver: exit price: $15.82; stop-loss: $19.22; exit price for the DSLV ETN: $28.88; stop-loss for the DSLV ETN $17.93

- Mining stocks (price levels for the GDX ETF): exit price: $21.23; stop-loss: $26.34; exit price for the DUST ETF: $29.97; stop-loss for the DUST ETF $21.37

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and exit prices:

- GDXJ ETF: exit price: $30.28; stop-loss: $45.31

- JDST ETF: exit price: $66.27; stop-loss: $43.12

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

On Thursday, the European Central Bank released its most recent monetary policy statement. What does it say about the ECB’s stance and what does it imply for the gold market?

ECB Meeting in October 2017 and Gold

There are many myths about the China’s role in the shaping of the price of the yellow metal. We invite you to read our today’s article about the country’s importance in the gold market and find out whether the yuan is going to replace the U.S. dollar as the world’s reserve currency.

China’s Importance in the Gold Market

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold slips as dollar benefits from ECB bond-buying extension

Germany's Degussa to shut Singapore gold store after two years

Chinese Millennials Are No Longer Interested in Pure Gold Jewelry

Barrick shares crater as Tanzania troubles grow

=====

In other news:

U.S. economy likely slowed by hurricanes in third quarter

It’s Going to Stay a Yellen Fed No Matter Who Gets the Job

Catalans Are Said to Send Emissary to Madrid to Plead for a Deal

Alarm sounds over state of UK high street as sales crash

Bitcoin Is Leaving Other Digital Coins in the Dust

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts