Just a quick update as gold just declined by almost $20 even without waiting for Fed’s interest rate decision. Lack of action from the Bank of Canada was enough to trigger the decline.

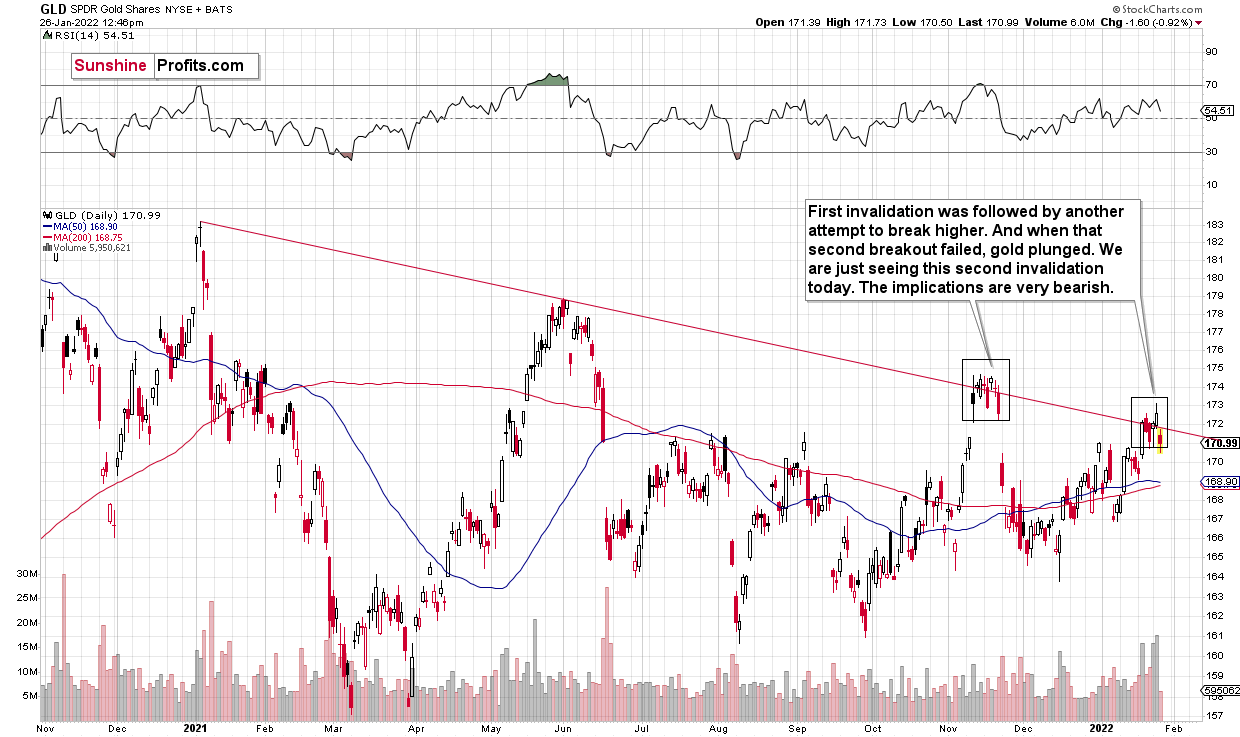

And as you can see on the below GLD ETF chart, the decline is much more important than it seems at the first sight.

That’s the second invalidation of the breakout above the declining red resistance line. The last time we saw the second invalidation, was right before the massive November declines.

The most interesting thing about this analogy is that back then gold also invalidated the breakout initially, then rallied back above the line, and then – after the second invalidation, we saw the powerful slide.

The session is not yet over, but that’s what we already saw today.

What does it tell us? It tells us that our short positions in junior mining stocks are more than justified from the risk to reward point of view. No adjustments in those positions are necessary, if one has them at their desired size, but if I didn’t have a short position in the junior mining stock sector today, I would have entered it now.

As always, we’ll keep you - our subscribers - informed.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief