Gold mining stocks moved higher today, and they moved above their December highs, so I thought that you would appreciate an intraday update from me.

I know that this will sound like a broken record on a repeat, but this is not a game-changer. Nothing really changed.

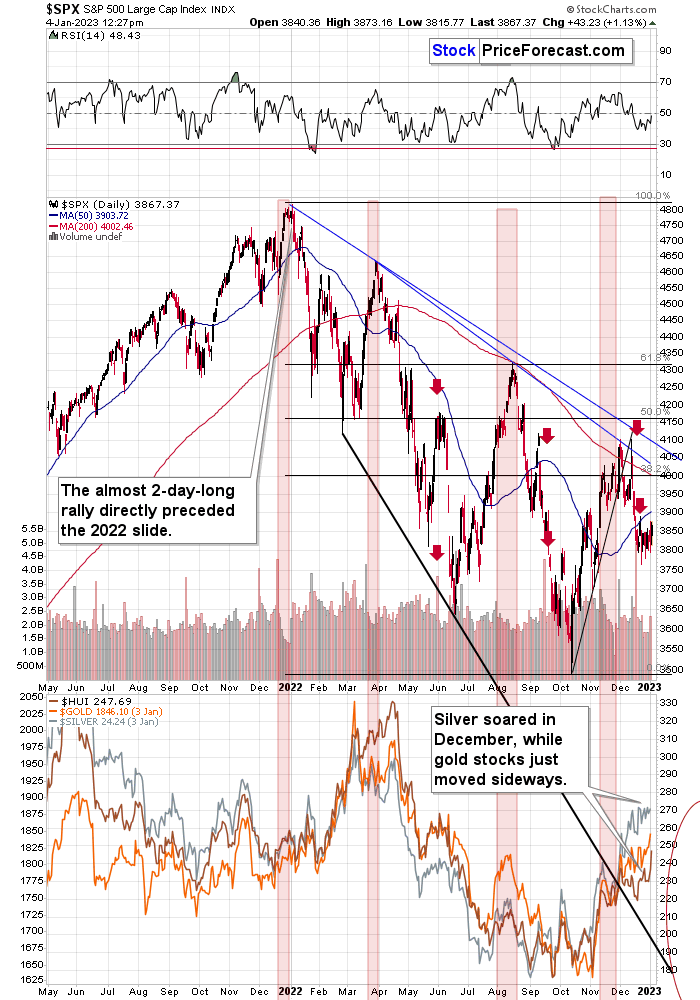

As you may recall, earlier today and yesterday, I emphasized that last year stocks made an intraday high on the second trading session of the year and then they declined substantially. Well, today is the second session of the year – it could be the case that the history is rhyming, and the current rally is practically ending now or it’s about to end.

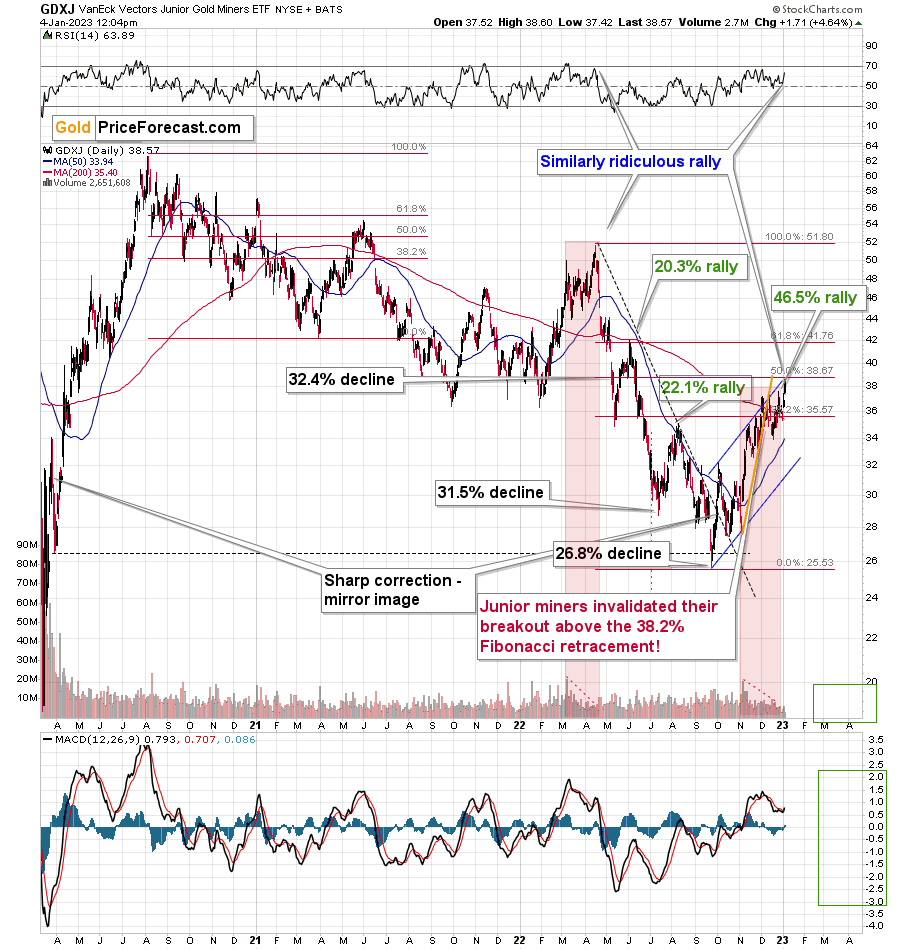

Technically, the GDXJ moved to the 50% Fibonacci retracement based on the entire 2022 decline and it then started to reverse. This is pretty much what the GLD ETF did as well, with the exception that the relative performance of the GDXJ is a bit worse than that of the GLD (the latter moved a bit above the 50% retracement).

The 61.8% retracement is still far, and the move to the 50% retracement didn’t result in a breakout. At the same time, the GDXJ moved to its upper border of the rising trend channel without breaking above it. This is yet another reason to expect it to turn south and decline.

Finally, please note how similar the current situation is to what happened in mid-2022. I previously mentioned this similarity, but now, based on the second rally in the RSI it seems that it’s even clearer. Just as the fake breakout in mid-2022 started a huge and rather quick decline, the same is likely to happen this time. In other words, in my view, this breakout is going to become a “fakeout” shortly.

Why are juniors so strong today?

Probably because the general stock market moved higher by over 1%. This rally might be somewhat exciting for those who really wish (!) to believe that stocks are going higher, but it’s no big deal – in fact no deal at all – when one focuses on the medium-term trend, and the fact that real interest rates are going higher, which is bad for stocks (as it’s generally bad for business).

Consequently, bearish outlook for the precious metals sector, especially for the junior mining stocks remains up-to-date.

I know that these are really trying times, especially for those that haven’t participated in all trades that we closed in 2022 (which were all profitable), and especially for those that entered the short position around Sep. 2022. It’s difficult, it’s not pleasant, and it’s either stressful or boring. That’s why trading/investing is said to be simple but not easy. It’s easy to buy and sell, but it’s difficult to stay calm when everyone else is super-excited about a particular move, even though in theory everyone knows that this is what happens at price extremes (right now, we’re probably very close to a top or right at it). If I could make the markets move lower sooner – I would, trust me.

The only thing that I can do, however, is to analyze the situation, as objectively as I can, and report to you (while emphasizing the importance of keeping the position sizes in check – feel free to click any link in the “Summary” part of the regular Alerts).

And right now, I see a great opportunity in being on the short side of the junior mining stocks. I can’t tell you what to do with your capital, but I can tell you that I’m keeping my short position in junior miners fully intact.

As always, we’ll keep you - our subscribers - informed.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief