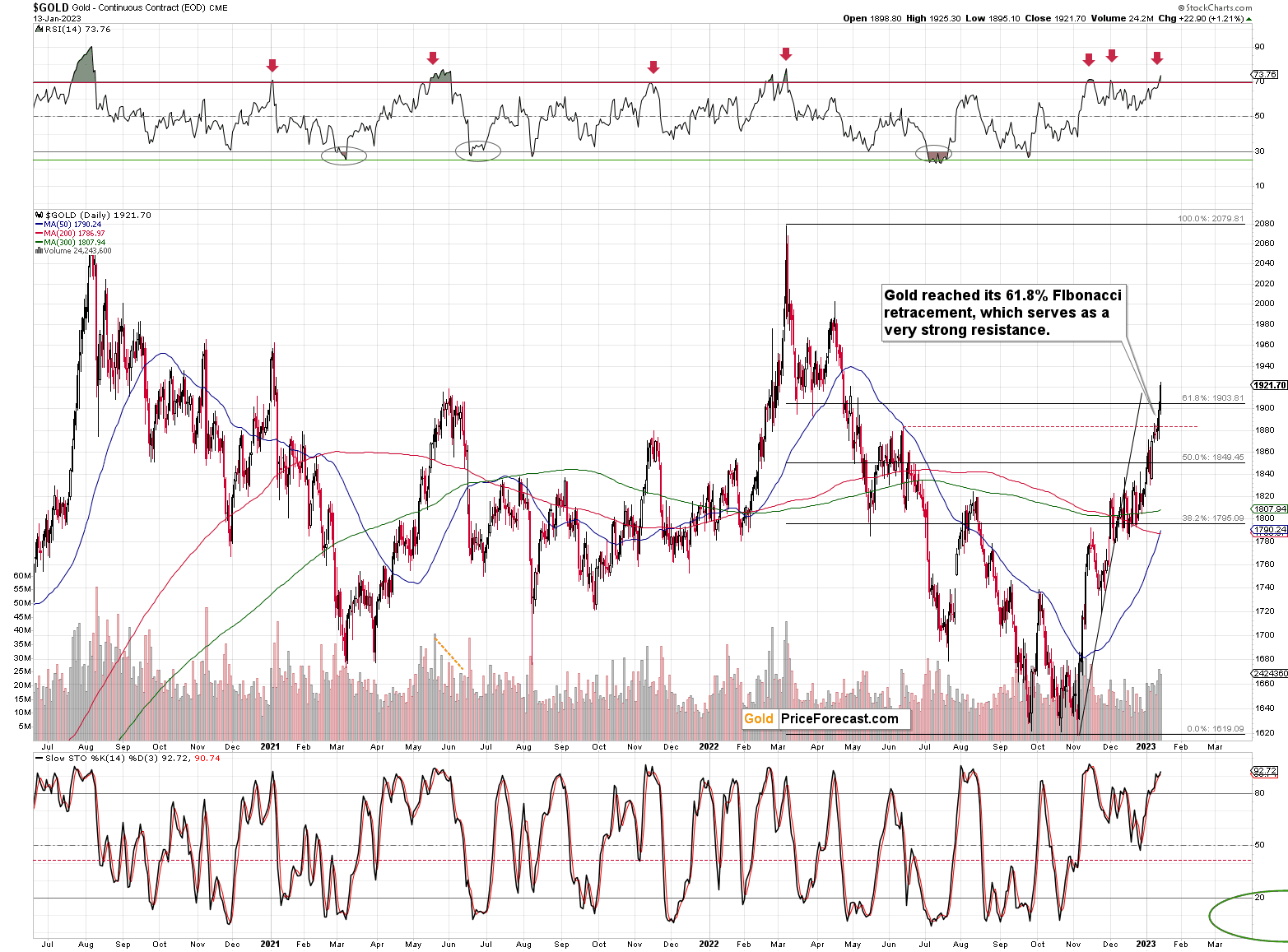

The U.S. markets are closed today, so there was no Gold Trading Alert scheduled for today. However, given gold’s move above its 61.8% Fibonacci retracement level, I thought that you’d appreciate my technical comments even before the regular schedule.

Gold has indeed closed above the 61.8% Fibonacci retracement level – the highest of the classic Fibonacci retracement levels. That’s a fact.

This breakout has not been confirmed – we just saw a single daily close above this important level. That’s also a fact. The most important fact at this point, because it’s not a game-change right now.

The RSI just moved above 70, flashing a sell signal that triggered many short- and medium-term declines in the past. That’s also a fact.

The above means that it’s likely that the breakout will be invalidated shortly. Here’s what we saw very recently on an intraday basis.

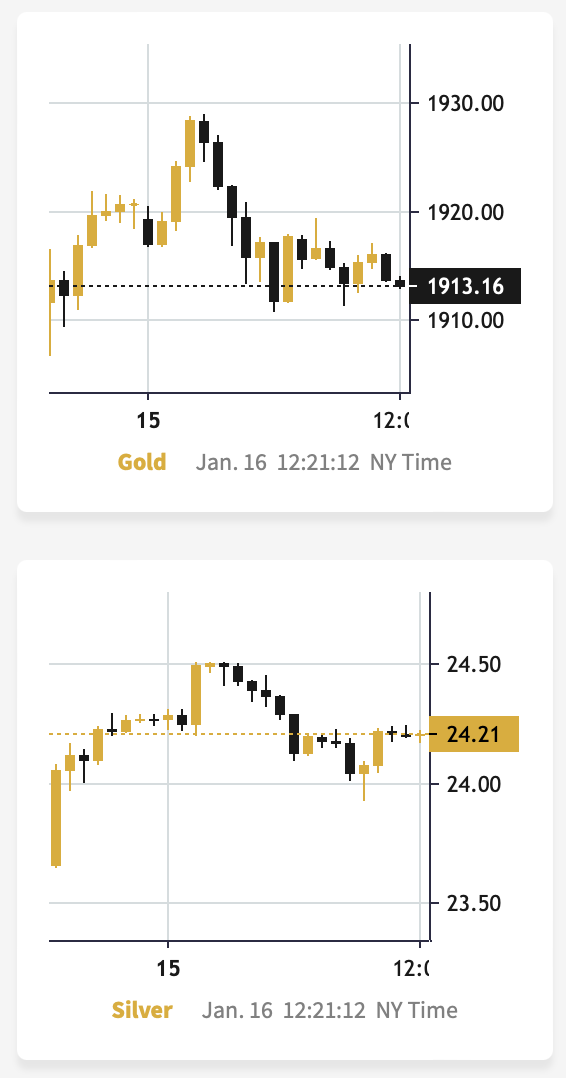

Silver just moved back below $24 and then it moved back up, and both precious metals reversed the most recent part of the rally. Gold remains above $1,900, but just doubling the most recent immediate-term decline would take it back below $1,900 and below the above-mentioned 61.8% Fibonacci retracement level.

It doesn’t look like the breakout above the retracement would get verified.

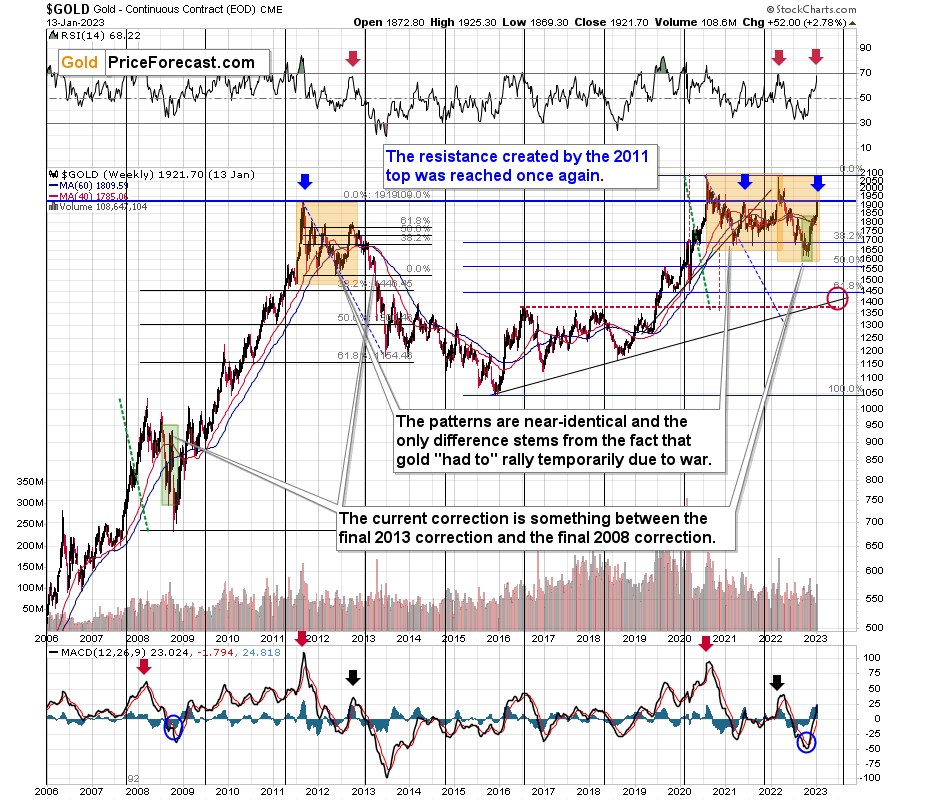

There’s another, much more important indication that it’s unlikely, and it’s visible once one zooms out and looks at the situation from a broader point of view.

Do you know what levels gold reached recently? Hint: those are very, very, very important price levels…

Gold just once again reached its 2011 high. The one that triggered reversals either immediately or after additional rally (but it took a war outbreak in Europe to push gold temporarily (!) above this level). Therefore, the importance of this long-term resistance can’t be overstated.

That’s one thing. Another thing is that given the major fundamental event that I already mentioned above (war outbreak), it’s possible for the technical patterns to be prolonged, and perhaps actually repeated, before the key consequence materialized. Similarly to the head-and-shoulders pattern that can have more than one right head, before the breakdown and slide happen.

In gold’s case, this could mean that due to the post-invasion top, the entire 2011-2013-like pattern got two major highs instead of one. And thus, the initial decline and the subsequent correction is pretty much a repeat of what we saw in 2020 and early 2021, as well as what we saw 2011 and 2012.

The particularly interesting fact (!) about the correction that we saw after the 2011-2012 decline (the one that was followed by the huge 2012-2013 decline) is that during it, gold corrected slightly more than 61.8% of the preceding medium-term decline. Consequently, the current situation is just like what happened back then.

And if all the above wasn’t bearish enough, please take a look at the reading of the RSI indicator based on the weekly price changes. It’s now just below 70, and guess where it was at the final top before the 2012-2013 slide? Yes, it was exactly there, too.

That’s also approximately, where the RSI was at last year’s top.

Taking all the above into account clarifies that despite Friday’s – and last few weeks’ – rally, the medium-term outlook remains very bearish. Of course, that’s just my opinion, and please feel free to do with your capital what you see fit, but I’m keeping my money where my mouth is and I’m keeping my short position in junior mining stocks intact. All last year’s trades were profitable, and, while I can’t promise any kind of performance, in my opinion the current one will become profitable (very profitable, actually) as well.

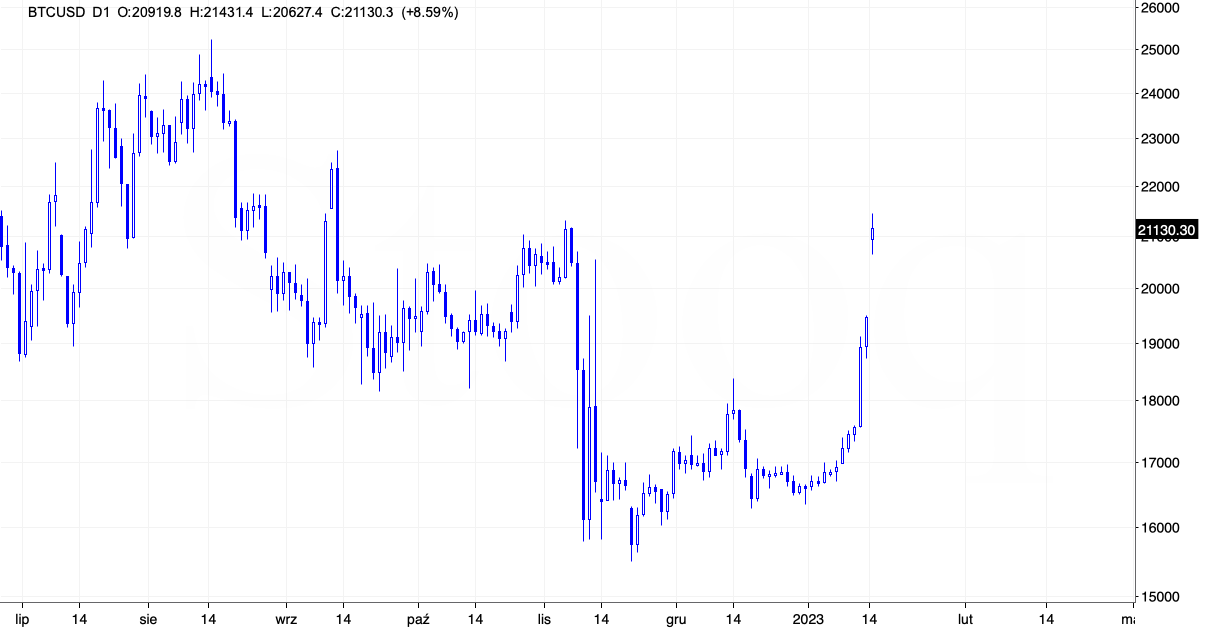

By the way, do you recall when in late 2022 I wrote that Bitcoin was likely forming a bottom? And that it was a bearish sign for the junior miners?

On Nov. 23, 2022, I wrote the following:

“

Remember when I previously commented on the link between juniors and cryptocurrencies? What I wrote back then was particularly important with regard to the less known (obscure?) ones with a shady background. In fact, some even call them “shitcoins.”

I wrote that for many individual investors, cryptocurrencies became the “new precious metals market.”

Alternative payment system? Just like gold, right?

There’s a flagship asset (gold, Bitcoin).

There’s a less expensive but obviously more useful asset (silver, Ethereum).

There are a number of little-known assets that are risky but have the potential to provide massive returns (high-quality mining stocks, low-quality mining stocks, especially low-quality junior mining stocks, altcoins, "shitcoins").While gold was not doing much, the wild rallies in cryptos got much more attention. That was finally exciting!

So, individual investors flocked from the precious metals market to cryptos. Not all investors, of course, but many.

While cryptos were on the rise and the overall sentiment was positive, investors dropped their PM holdings to buy cryptos as they forecasted that the latter would continue to rally “to the moon.” And while it didn’t matter that much for gold, as the yellow metal has powerful buyers and sellers that are not interested in cryptos, it mattered a lot to the junior mining stock sector as the buying power waned.

Fast-forward to the current situation, every other day we hear or read about yet another crypto scandal, while prices of cryptocurrencies are declining sharply.

This means that the above-mentioned effect could have been reversed. The investors who moved out of the junior mining stock sector in order to get into cryptos (in particular altcoins) could now be aiming to get out of that market (people tend to sell on declines, in fact, that’s why declines happen in the first place) and get back to what they “had liked” before – junior miners.

This specific phenomenon can be seen from a broader point of view when one compares the prices of gold and bitcoin.

(…)

As I wrote, the link is likely stronger in the case of altcoins and juniors, but gold and bitcoin have price data that’s more comparable, so that’s what I’m going to analyze.

Even though both gold and bitcoin moved higher between 2014 and now, they quite often moved in opposite directions in the short run. Short-term bottoms in gold, in particular, were usually followed by (larger or smaller) declines in bitcoin.

Interestingly, I originally featured the above chart many months ago, and please note that this tendency worked like a charm recently.

Gold formed a short-term bottom, rallied, and now Bitcoin slides. Why? Probably because people were fed up with Bitcoin’s inability to hold its ground, while gold soared. So they flocked to gold, silver, and - probably most intensely so - to junior mining stocks.

All right, so does this mean that as Bitcoin slides into the abyss, junior miners are now going to soar?

No.

No market moves up or down in a straight line, right? Well, neither does Bitcoin. How low is too low, then? That’s where technicals come in.

(…)

Remember when I wrote that Bitcoin was topping at about $50,000? Well, it did move a bit above that, but it didn’t trade there for long.

The flagship crypto fell like a stone in water, and it did so in tune with the technical principles. Bitcoin formed a bearish head and shoulders top pattern, and after breaking below the neck level earlier this year, it then corrected a bit, and then it plunged below $20,000.

All this is a textbook-example of how a head and shoulders pattern should work.

Now, the size of the decline based on this pattern is likely to be equal to the size of its head. I marked that with dashed lines.

Guess what – Bitcoin just moved to this target level (marked with green) recently. That is a strong indication that the bottom has been reached. The second indication comes from the huge volume that just accompanied the decline and the fact that the decline was quite sharp. The ROC (rate of change) indicator at the top of the above chart is close to -25 and when this happened and bitcoin was after a huge-volume decline, it then rallied.

What is even more interesting is that those were also the times when gold declined.

The sentiment itself is the final indicator that a short-term (!) bottom for bitcoin is in or near. Just go to any news website and look at what is being written about Bitcoin – it’s all scary and bearish. Or at least the majority of news/articles. That's what happens when prices fall to their lowest point. Remember what was written on those same pages when bitcoin was trading above $50,000? It was all sunshine and rainbows. All this time, I warned about the incoming slide. Very few listened then, just as very few want to hear about the upcoming slide in junior mining stocks.

“

Well, Bitcoin truly soared in a last couple of days, this means that small investors and traders will likely once again view cryptos as an interesting place for their capital, and they would be happy to dump their junior miner holdings when gold slides.

As always, we’ll keep you - our subscribers - informed.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief