I thought that you’d appreciate a quick update given today’s volatility.

As I warned yesterday and earlier today, we’re seeing significant intraday volatility around the Fed interest rate decision. As I expected, we saw a 0.25% hike.

The initial reaction in the markets is quite interesting. Let’s take a look.

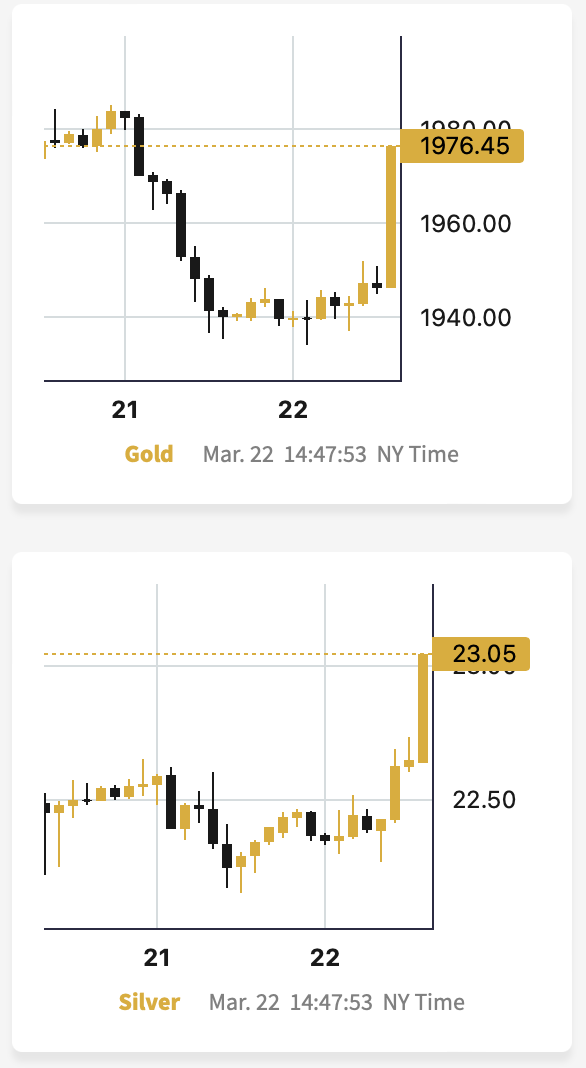

Gold moved higher, but not above the most recent intraday highs.

Silver soared above recent highs in a meaningful way.

I know that I repeated this hundreds of times, but here we go again – silver’s very short-term outperformance of gold is a sell signal. It worked in tens, hundreds, and perhaps even thousands of cases.

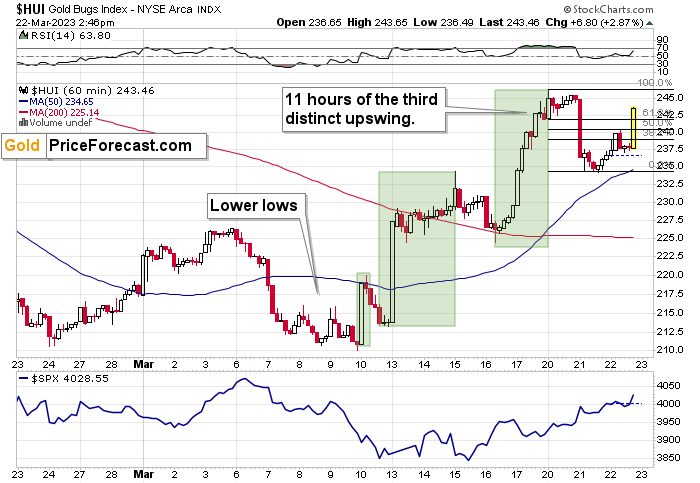

Meantime gold stocks are moving higher as well, but… They are moving higher pretty much like they did in 2008.

Right now, the HUI Index moved a bit above the 61.8% Fibonacci retracement based on the initial downswing.

Back in 2008, the HUI Index corrected 61.8% of the initial decline.

This time the moves were quicker, so it’s no wonder that they were bigger – quicker moves are more emotional.

So, while this volatility might appear to be a game-changer, it most likely isn’t. It didn’t invalidate the bearish link with 2008.

The extremely favorable bearish potential of the current situation in junior mining stocks remains intact.

As always, we’ll keep you - our subscribers - informed.

Thank you.

Sincerely,

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief