In short: In our opinion short positions (half): gold, silver, and mining stocks are justified from the risk/reward perspective.

Gold, silver and mining stocks moved back up yesterday, so the key question is whether or not the situation improved (or deteriorated). Let’s take a closer look (charts courtesy of http://stockcharts.com.)

There was a correction after the local top in August 2013 as well, so what we saw yesterday might be simply a repeat of that pattern. However, that was also a correction to the 200-day moving average – which was a successful one – gold didn’t move back below it. In Dec 2012 – Feb 2013 it took 4 attempts for gold to finally decline below this moving average and it was not seen above it until this week.

The volume was not that significant yesterday, though, and both indicators that we plotted on the above chart still suggest a move lower. Please note that the August 2013 – today similarity is present if you take a look at RSI and Stochastic as well. Back then the small post-top move higher was reflected by a small upswing in the RSI but there was no reaction in Stochastic and the same is the case today.

Overall, it seems that the situation didn’t change based on yesterday’s move higher.

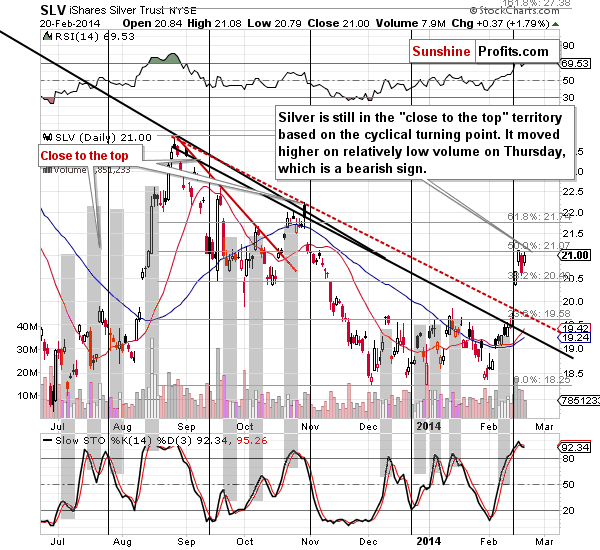

We discussed the long-term resistance present in the silver market yesterday, so today we’ll focus on the short-term picture.

Silver is still close to the turning point and likely to decline based on it. Yesterday’s move higher was accompanied by relatively low volume, which is a bearish sign.

We previously discussed the similarity between August 2013 and today. Please note that back then we saw a huge catch-up in case of silver – an even bigger one than we saw this month. It was very encouraging but was followed by disappointment and declines. Let’s keep in mind that major declines in the precious metals sector are usually accompanied by silver’s sharp underperformance at the bottom. We haven’t seen that this time – at least not yet.

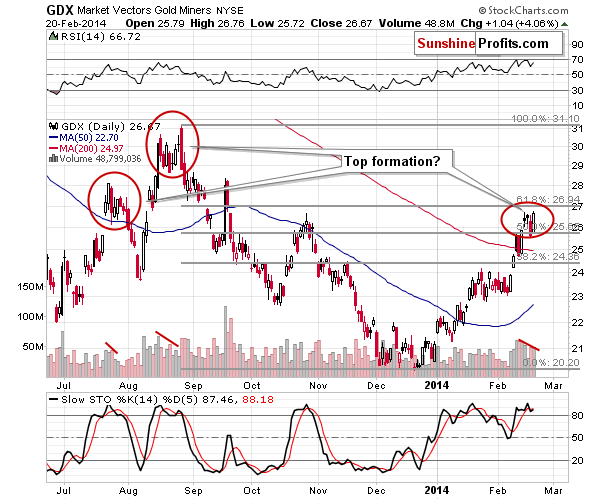

Now, as far as mining stocks are concerned, we didn’t see very low volume, but we see that it’s been declining. This + the RSI close to the 70 level + the analogy to the August 2013 in gold and silver suggest that we might indeed be looking at the top formation right now. Please note that miners have not corrected more than 61.8% of the August 2013 – December 2013 decline, so technically, the recent move higher was just a correction and the decline is likely to continue.

Meanwhile, the USD Index moved slightly higher in the initial part of the session yesterday, but then declined and overall we saw only a little change. It seems that the traders viewed this action as a confirmation of the breakdown below the June 2013 or January 2014 lows and acted as if it was a bearish piece of information (we saw a move higher in the precious metals sector). However, based on the medium-term support line and the long-term breakout we think that the situation hasn’t changed and the outlook remains positive.

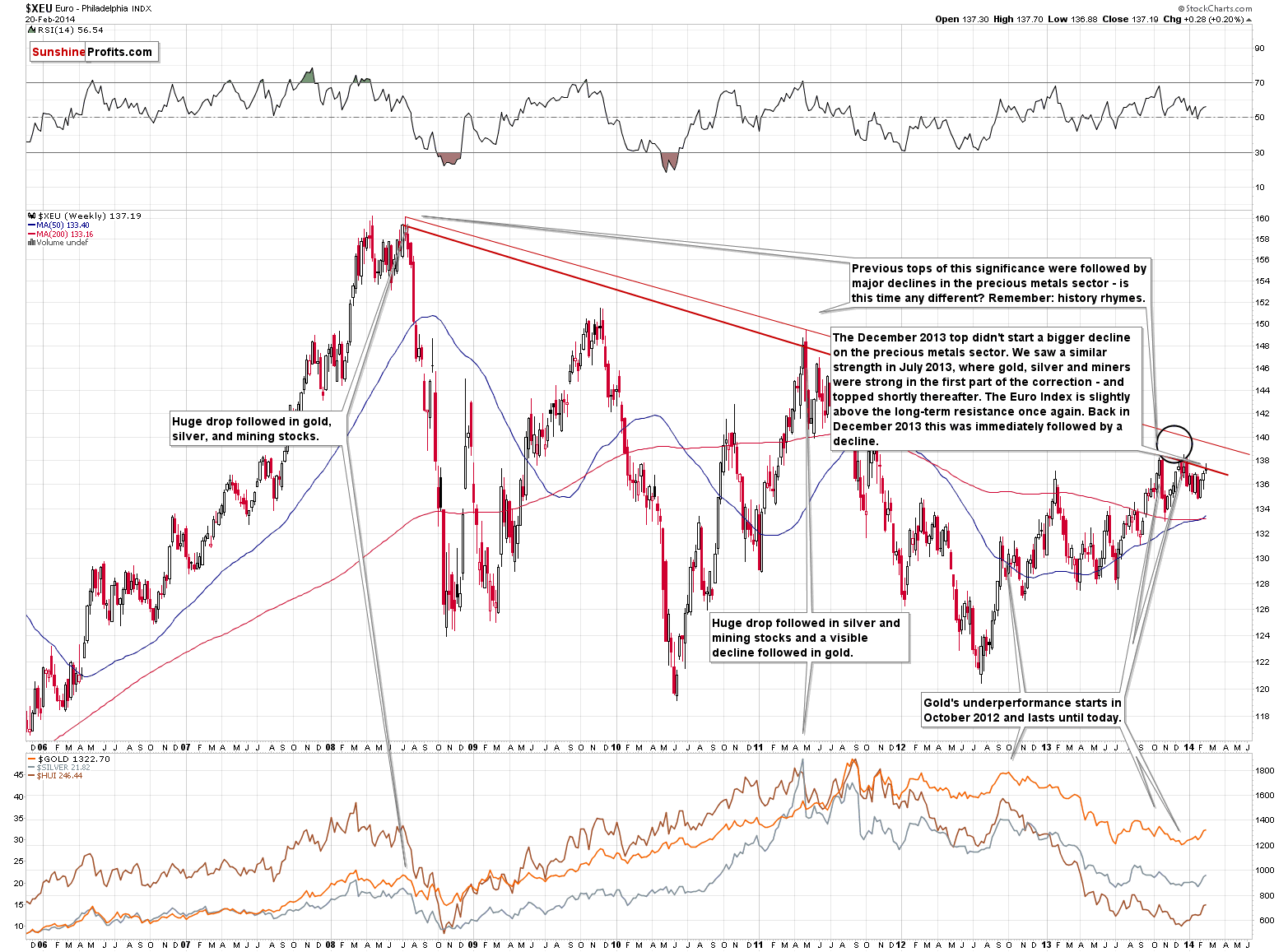

Especially that the Euro Index has just invalidated its small breakout above the long-term resistance line.

Yesterday, we wrote that the Euro Index [was] now even slightly above its long-term resistance line. This line kept rallies in check and the situation now is similar to what we saw in December 2013.

This further supports the bearish outlook for the precious metals market, at least for the short term as in the recent weeks short-term moves in the Euro Index and in gold, silver and mining stocks have been quite in tune with each other.

At this time precious metals are amplifying euro’s gains but if the decline in the euro is huge, the above strength will likely not be enough to prevent a decline in metals and miners. The point is that the resistance is significant enough to generate a big downswing.

The Euro Index moved lower yesterday (once again) and it invalidated the previous small breakout, which is a bearish sign. That’s bullish for the USD Index and bearish for the precious metals market.

Overall, what we wrote about the current situation in the previous alert remains up-to-date:

The “problem” with gold’s rally is that it is very unlikely to continue unless the USD Index gives in and declines below the medium-term line. We already saw a move very close to it yesterday and in today’s pre-market action. The USD is after a long-term breakout, and at medium-term support, which is a powerful bullish combination for the coming weeks.

If the USD Index breaks lower or it rallies strongly (not a daily rally, but at least a weekly one) and gold refuses to decline, then we will have a good indication that it’s safe to jump back into the precious metals market. At this time, we have an encouraging rally, but we also see a major threat (the USD is likely to start a significant rally) that is just waiting to impact the market.

If the USD rallies – and it seems likely that it will relatively soon – we will quite likely see invalidations of breakouts and subsequent plunges. This will be likely until either the USD breaks below the medium-term support or precious metals prove that the dollar’s substantial rally is not a major threat.

Even if the next big upswing in the precious metals market is underway, we are still likely to see a decline shortly as the situation in gold is now overbought on a short-term basis (...)

To summarize:

Trading capital (our opinion): Short position (half): gold, silver, and mining stocks (we moved stop loss orders slightly higher for silver and GDX).

Stop-loss details:

- Gold: $1,346

- Silver: $22.36

- GDX ETF: $27.9

Long-term capital: No positions.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief.

Gold & Silver Trading Alerts