Briefly: In our opinion, no speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view. We will likely have another trading opportunity shortly – likely this week.

The precious metals sector moved lower yesterday and mining stocks declined on big volume. Is the rally completely over?

In short, that’s quite likely, but it seems that we may get a better entry price tomorrow. Let’s first see why the former is the case and then we’ll move on to the latter. Let’s take a closer look at the charts, starting with gold (charts courtesy of http://stockcharts.com).

In the March 4 alert we wrote the following:

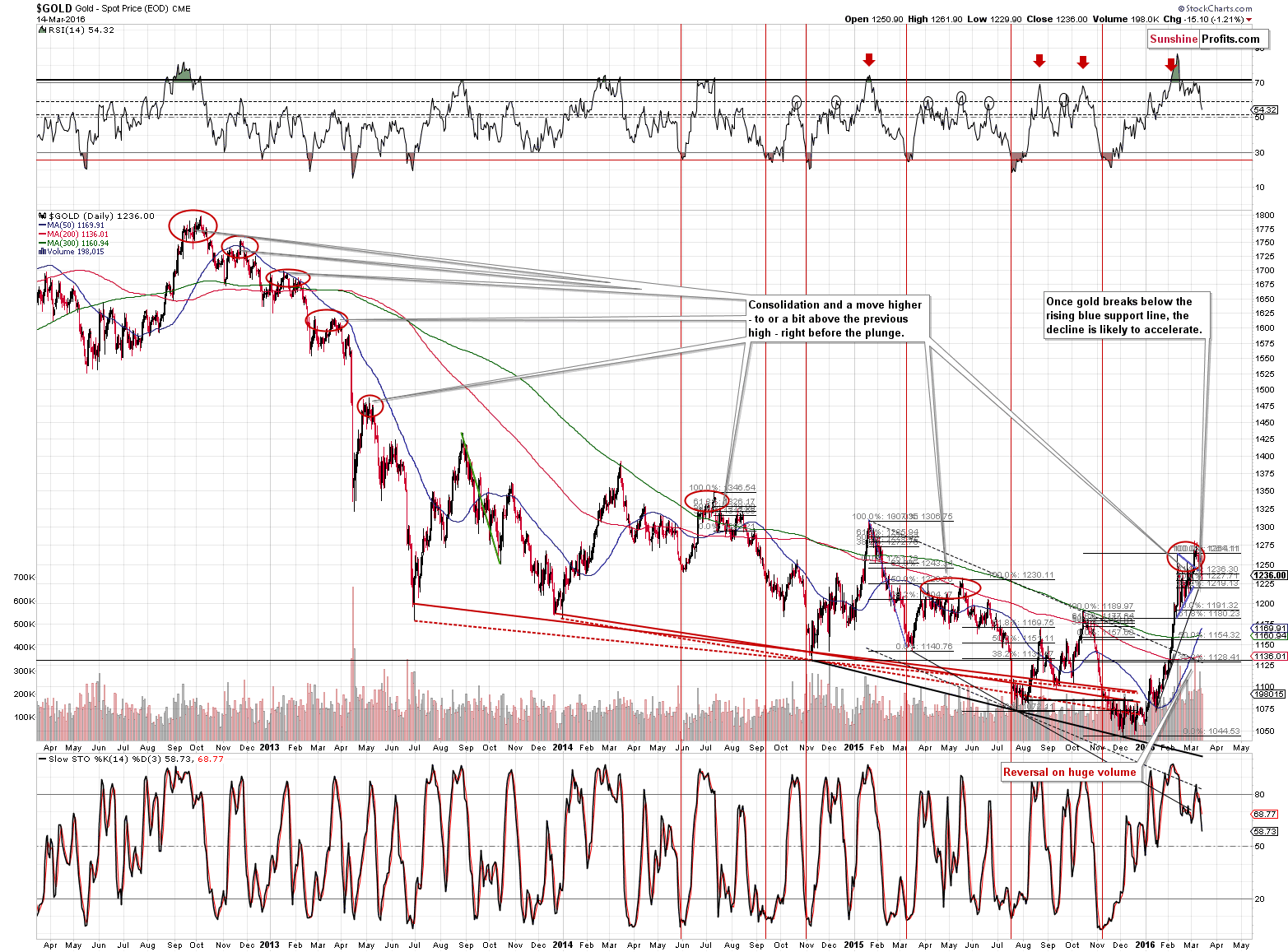

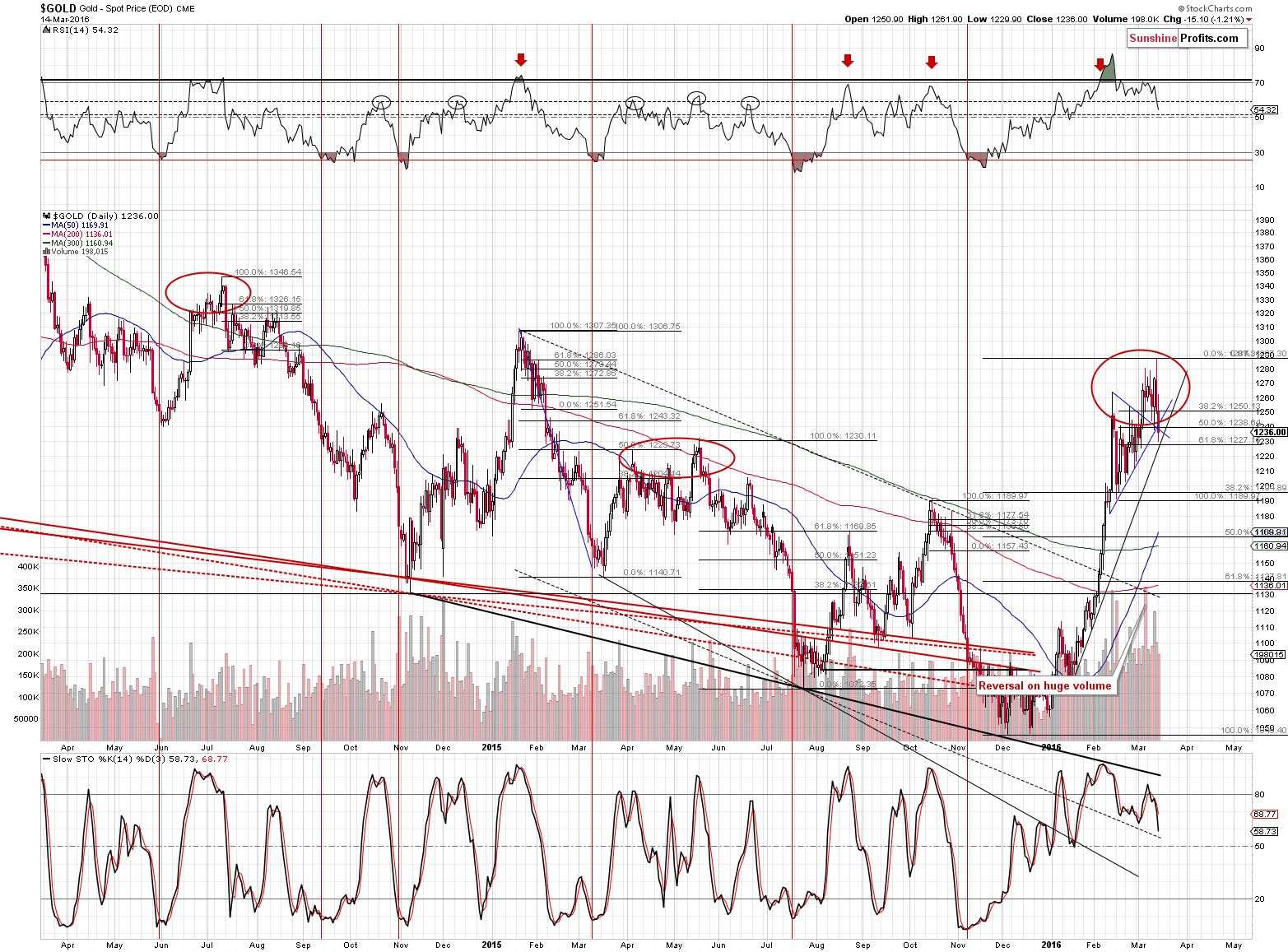

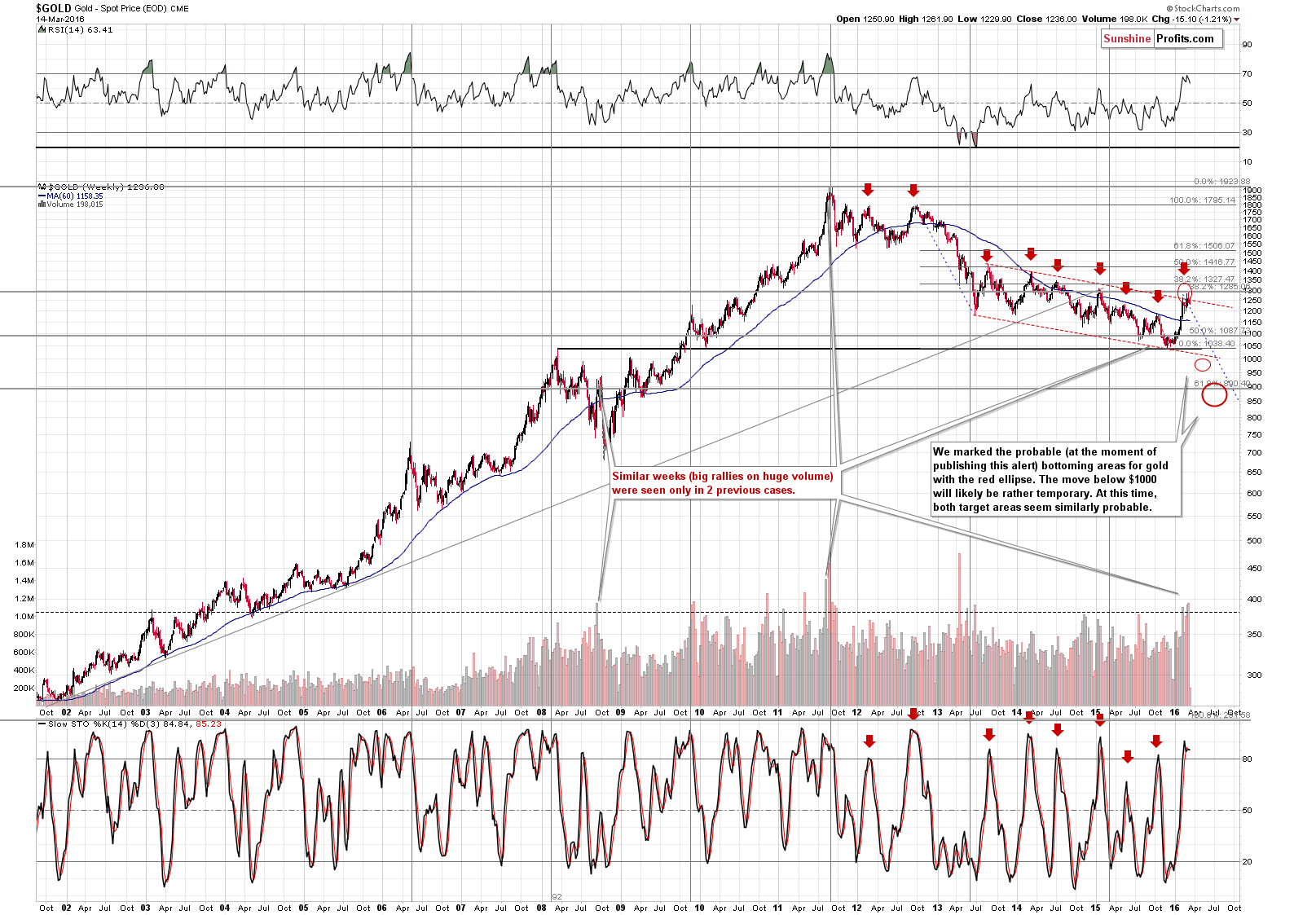

There were quite a few cases when gold moved to or a bit above its previous local high before sliding to new lows – we marked these cases with red ellipses on the above chart. So, gold’s breakout is not a “game changer” – it’s still something that was seen right after initial tops and before major plunges. Consequently, the next big move is still likely to be down.

It seems that the gold market is once again repeating the past pattern of a fake breakout. Naturally, there is still risk that gold will rally to $1,328 or so, but at this time it seems rather limited.

One thing that could make one concerned about yesterday’s decline and its reliability is the relatively low volume that accompanied it. Still, in case of the previous post-top declines (the beginnings thereof), the volume was also relatively low and this didn’t change much – the declines still continued. Consequently, the low volume that we saw yesterday is not bullish.

Did gold break below the key support levels yesterday? Through some – yes, through most of them including the rising support line – not yet. Consequently, the short-term outlook deteriorated only a little.

On the above long-term chart we see that gold briefly touched the 38.2% Fibonacci retracement level and then declined – sliding back below the upper border of the declining trend channel (marked with red dashed lines). The implications are very bearish for the medium term (invalidations of small breakouts above important resistance levels tend to be strong bearish signs).

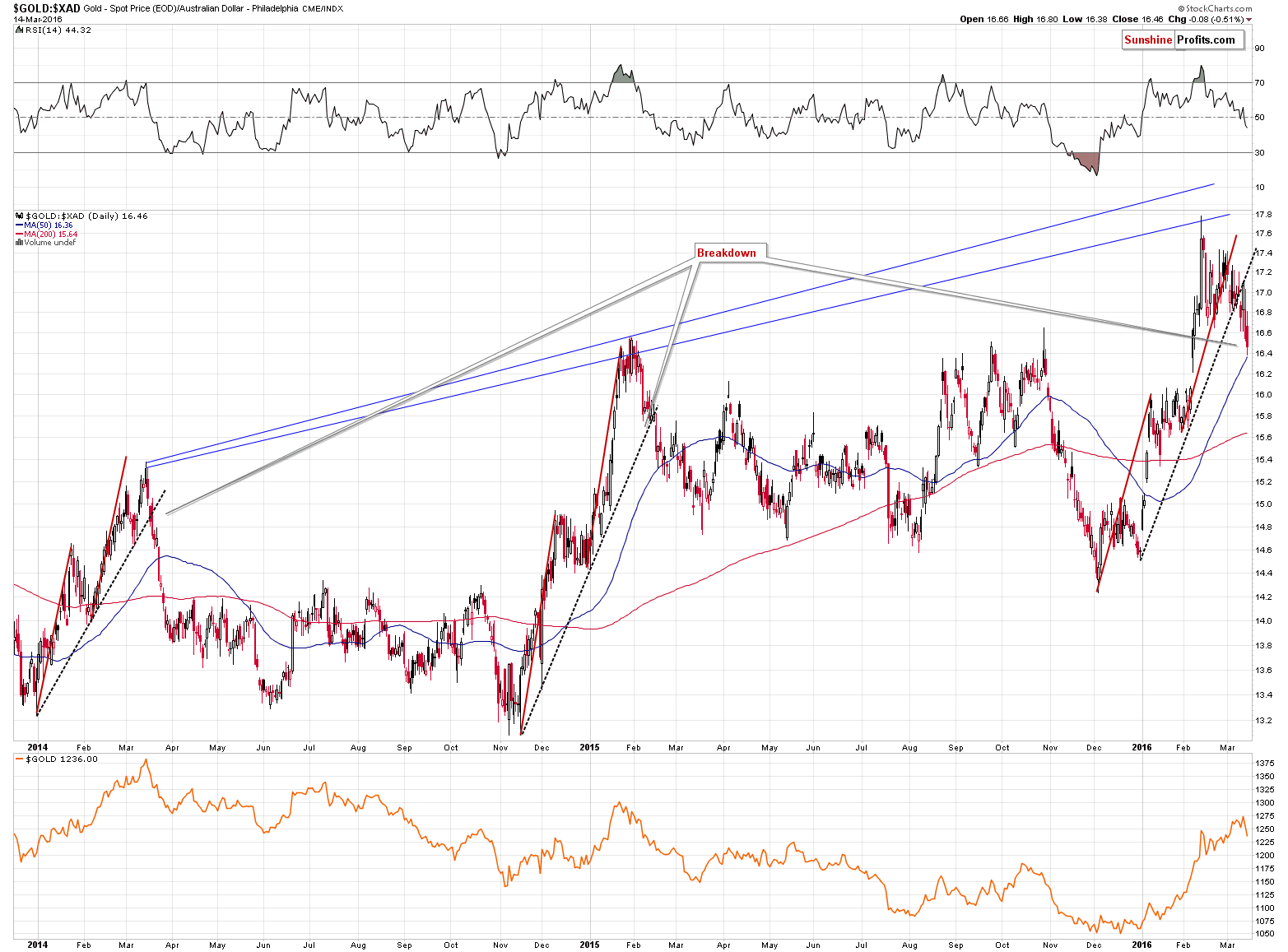

In addition to the factors discussed yesterday, there’s one more thing that points to lower gold prices in the coming weeks – a clear, confirmed breakdown below the rising support line in the case of gold priced in the Australian dollar. In the previous cases, such breakdowns confirmed that the major move to the downside had already begun.

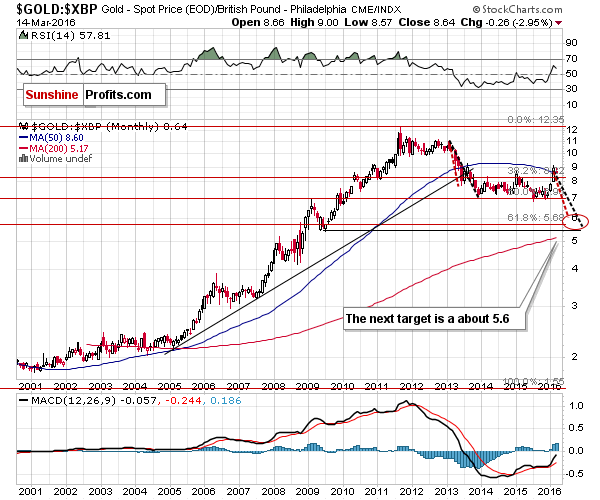

Speaking of gold priced in terms of currencies other than the US dollar, let’s keep in mind that the long-term chart of gold priced in the British pound continues to show that the size of the next big decline might indeed be sizable.

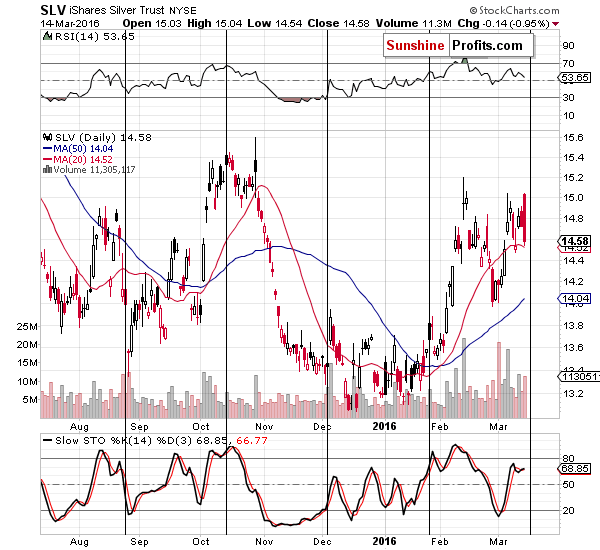

The implications of the long-term silver chart remain clearly bearish and there have been no changes recently, so let’s focus on the short-term point of view.

Silver declined a little yesterday, but it’s more important that it initially rallied higher only to plunge later during the session. This kind of reversal could be a confirmation that the top is already in, especially that silver is just before its cyclical turning point, but it could also be the case that silver gives us one more quick and sharp rally before the big turnaround. All in all, the situation in silver deteriorated yesterday, but only a little.

In yesterday’s alert we wrote the following:

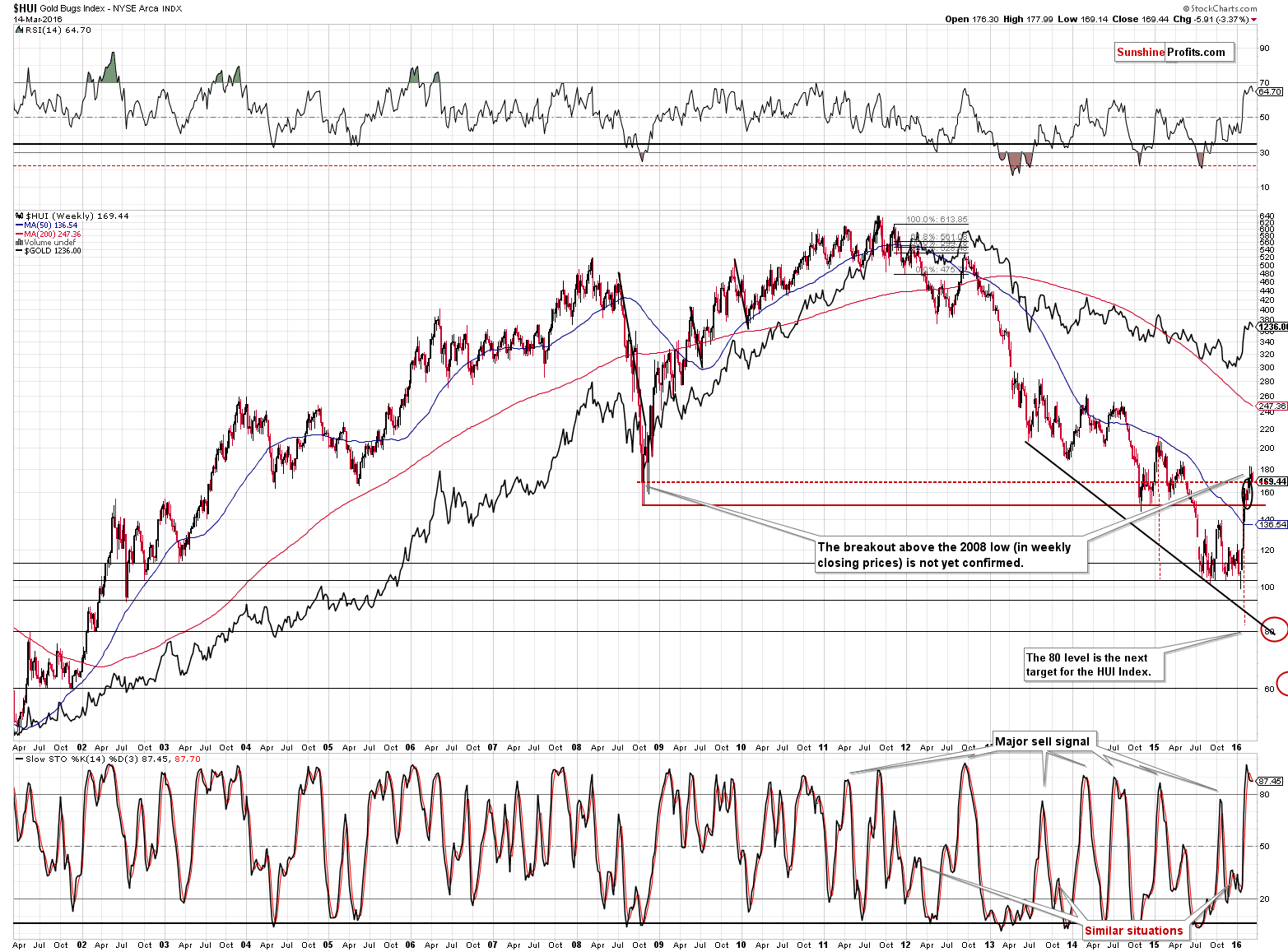

The most important thing visible on the above chart for the HUI Index (proxy for gold stocks) is the clear sell signal from the Stochastic indicator. This signal is something that confirmed tops multiple times in the previous years and the efficiency of these signals has been remarkable. The implications are of a medium-term nature, though.

The above remains up-to-date, but we would also like to point out that the HUI Index just invalidated a move above the 2008 low (in terms of weekly closing prices). That’s yet another bearish sign.

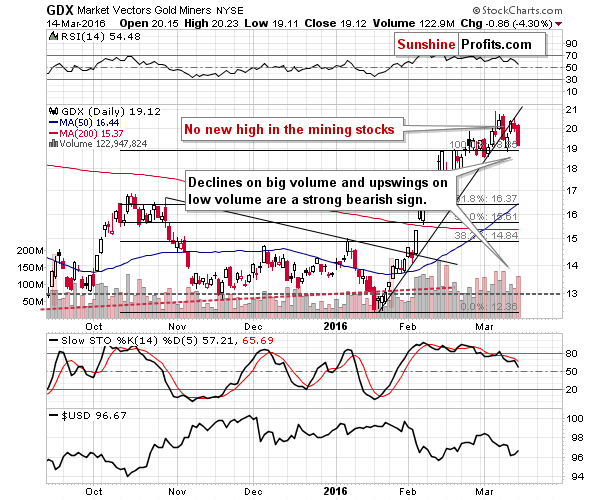

On a short-term basis, we see that mining stocks are not only clearly below the rising support line once again, but that they also declined after the breakdown and it took place on big volume (especially on a relative basis).

That’s a bearish sign for the short-term, however, let’s keep in mind that the bearish price-volume link (higher volume during daily downswings than during daily upswings) has been present in the mining stocks for a few weeks and it didn’t result in immediately lower prices, so it may not result in an immediate drop also this time. It simply tells us that the next big move is most likely to be to the downside and that it’s likely that miners won’t move much higher before reversing and sliding once again.

In a way, the January – March upswing is self-similar to the October 2015 rally (with the more recent rally being proportionally bigger). Back in October 2015 the time that it took for mining stocks to consolidate before erasing the previous gains was more or less equal to the time in which the rally unfolded (to the first top). If we apply the same also this time, it appears possible and likely that we will see more sideways trading before the next big slide is really seen.

The reason that we are mentioning this is not to say that the decline won’t start anytime soon – the reason that we are mentioning this is to say that it’s quite likely the case that we will get a better shorting opportunity than what we have right now.

This brings us to the second point that we mentioned in the third paragraph of this alert. Why could it be the case that we will get better prices tomorrow? Because tomorrow we’ll get the Fed’s latest comments and in the previous cases precious metals rallied ahead of such comments.

Tomorrow’s comments might be particularly interesting as this will be the chance for Janet Yellen to comment on the NIRP issue that the market likely overreacted to (Yellen only said that they can’t / don’t rule it out, which is inconsequential but the markets viewed it as meaningful – she couldn’t have said anything else regardless of the situation). If the effect of the NIRP comments was unplanned, it’s quite likely that tomorrow’s comments will aim to somehow reverse it. The previous comments turned out to be very bullish for gold (in fact, if it hadn’t been for these comments, we think the rally would have been over weeks ago), so tomorrow’s comments could be bearish.

Naturally, we can’t know what Janet Yellen will say, but the above appears to be the likely outcome. This fits very well into the technical picture described earlier in today’s alert. Gold, silver and miners could rally early tomorrow only to slide lower before the session is over. Of course we’ll have to wait and see how today’s session turns out and what happens in tomorrow’s pre-market trading in order to determine if the above is still likely to happen tomorrow, but at this time, it seems quite probable.

Please note that based on today’s closing prices it’s not possible to say exactly what the entry prices would be for tomorrow’s trade – if that is possible tomorrow morning, we’ll let you know. If not – we’ll send out another update intra-day (tomorrow).

Having said that, we would like to add one more chart before summarizing.

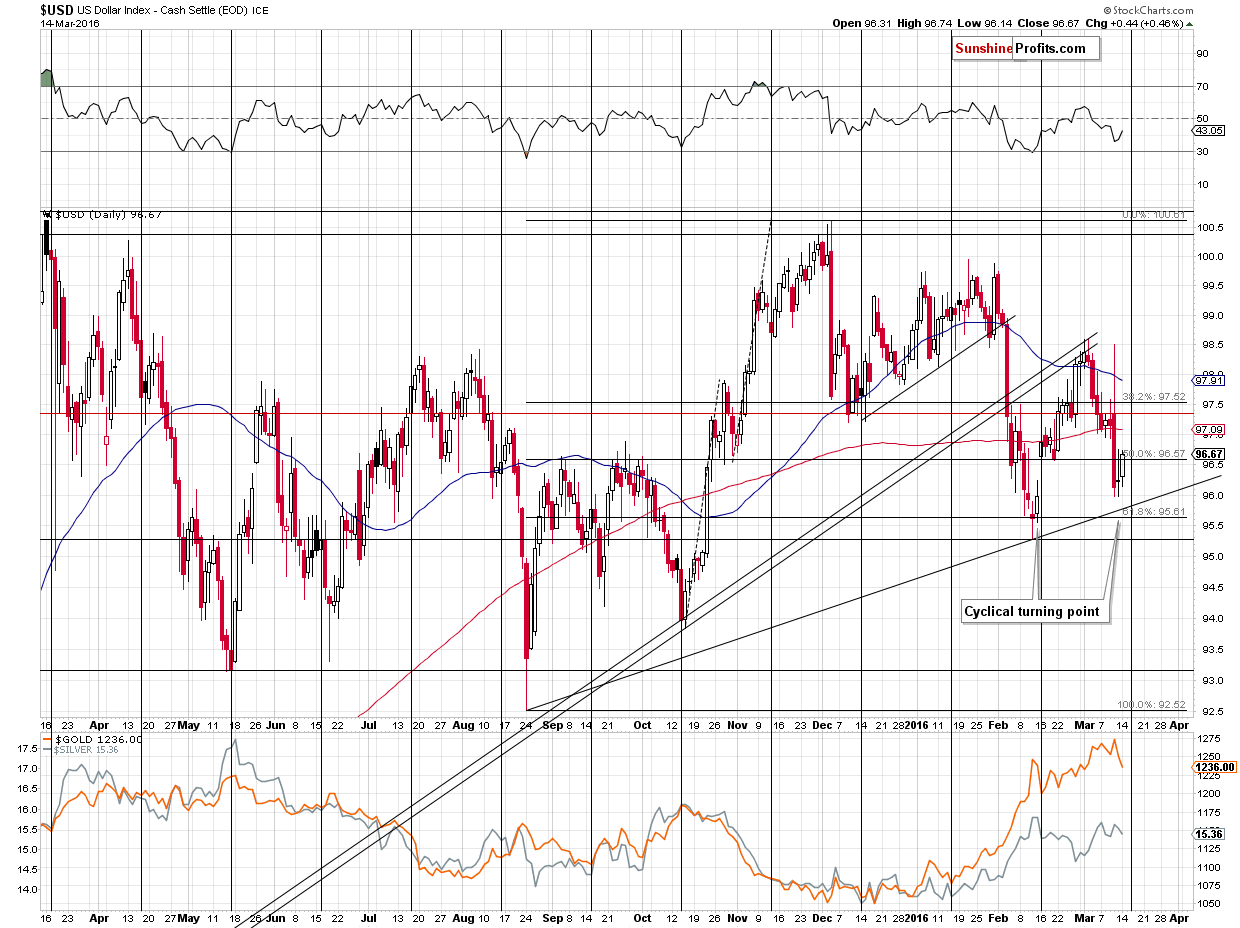

In short, our yesterday’s comments remain up-to-date:

The US dollar moved sharply lower last week and based on the above technical picture, we could see some additional small move to the downside (to the rising support line and the Fibonacci retracement at about 95.6 - 95.8) that would very likely – based on the cyclical turning point – be followed by a reversal and a rally.

The likely impact on the precious metals market is rather unclear (but more likely bullish) for the short term and bearish for the medium term.

The above fits nicely into the scenario in which gold rallies early tomorrow (the USD would decline, likely reaching the support line right at the turning point) and declines thereafter (the USD would rally).

Summing up, the outlook for the precious metals market deteriorated based on yesterday’s decline, but it appears that we might get a better entry point later this week, likely tomorrow, before the Fed’s comments. Consequently, it seems that we will be entering short positions in the precious metals and mining stocks shortly (likely tomorrow), but we are not doing this at this time.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

While waiting for the interest rate decisions of the world’s major central banks and important economic data on U.S. retail sales and inflation, let’s further investigate the ECB’s press conference held after its last monetary policy meeting. What can we conclude from Draghi’s answers?

On Friday, crude oil gained 1.24% as rig count declined to the lowest level ever. Thanks to this news, light crude hit a fresh March high, but will we see further rally in the coming week?

Oil Trading Alert: Crude Oil – Technical Juncture

=====

Hand-picked precious-metals-related links:

INDIAN FEBRUARY GOLD BAR IMPORTS AT 23 MT, LOWEST ON RECORD

Gold believers scoff at Goldman warning as wagers on rally rise

=====

In other news:

Fed to sit tight on rates at March meet, hint at hikes to come

Has Super Mario brokered a currency war ceasefire?

BOJ Keeps Policy Rates Unchanged Despite Lowering Economic Outlook

Mobius Sees Emerging Markets at Turning Point After Rout

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts