Briefly: In our opinion, no speculative positions are justified from the risk/reward point of view.

Gold broke above the declining resistance line. Will the rally continue?

In our opinion, both yes and no. Yes, because based on yesterday’s closing prices a temporary (!) move higher became much more likely. No, because this move higher – if it materializes – is not likely to be significant and we don’t expect to see gold above this year’s high, before it reverses and starts to slide once again.

Let’s take a look at the charts (charts courtesy of http://stockcharts.com).

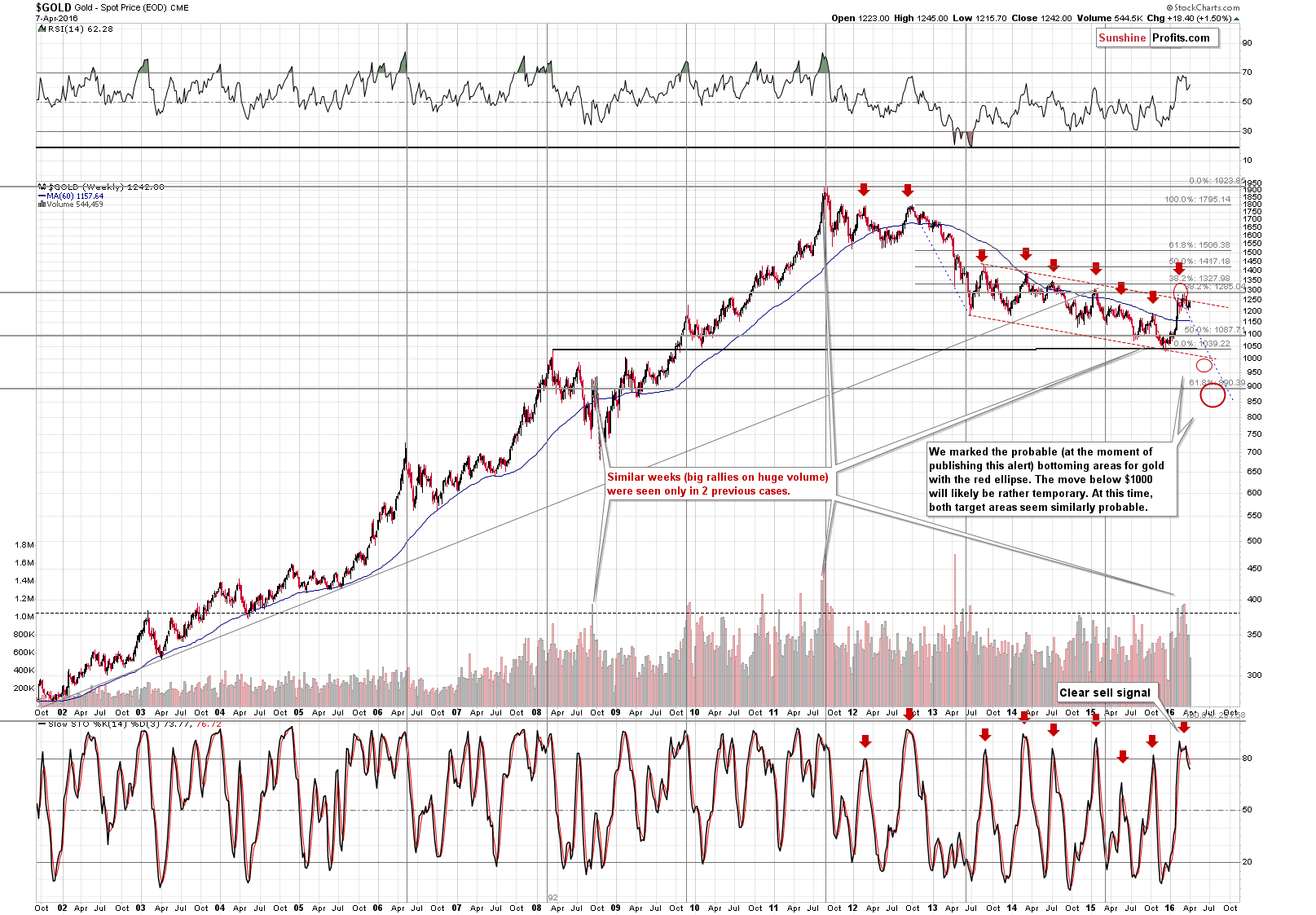

Let’s start by saying that nothing changed on the long-term chart. The outlook was bearish and this remains to be the case also based on yesterday’s closing prices. The major sell signal from the Stochastic indicator remains in place and the medium-term trend remains down.

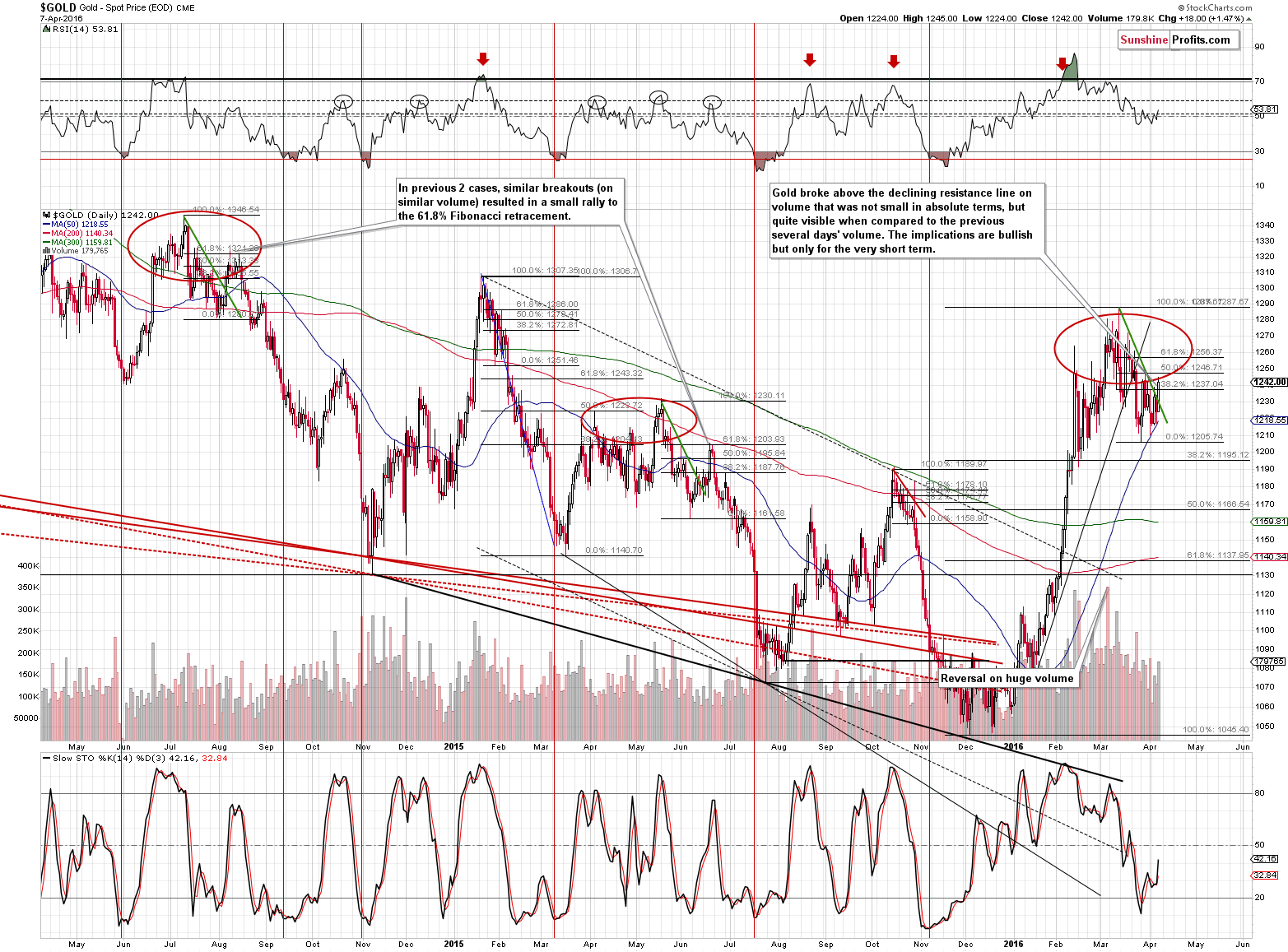

However, on the short-term chart, we saw a breakout above the declining short-term resistance line and the 38.2% Fibonacci retracement level. The question is if this is significant. As far as short-term is concerned, it seems that it is.

There are 3 similar situations visible on the above chart. We marked 2 of them with green lines and one of them (October 2015) with a red line. These 2 cases are more similar because gold broke out in terms of closing prices in both cases, and there was only an intra-day breakout in the third case.

So, what happened in these cases? In all cases gold moved higher and declined only after moving to the 61.8% Fibonacci retracement level. That was in fact the final chance to enter a short position, before the decline’s pace greatly increased.

What about the volume? It pretty much confirms the above. In cases when the breakouts caused small rallies, the volume on which the breakouts were seen were quite similar to what we saw yesterday – the volume was not huge, but decent.

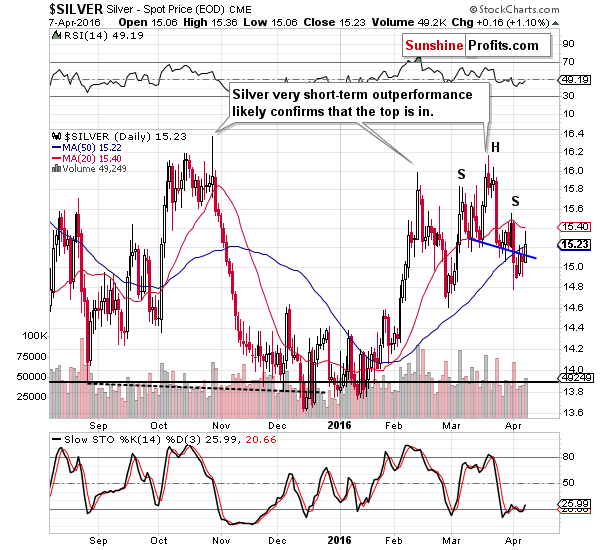

In the case of silver, the skewed head-and-shoulders pattern was invalidated, which is a bullish sign, but only for the short term. Silver has declined quite substantially since we wrote about opening short positions (it was trading at about $16), but it seems that we could see another short-term move higher, before the slide continues.

Silver has underperformed recently on a short-term basis, but let’s not forget that silver tends to outperform very temporarily right before local tops, so we could see a more visible move higher in silver shortly.

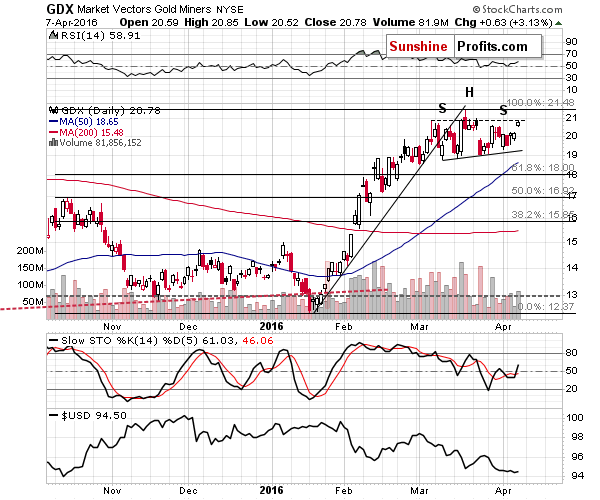

As far as mining stocks are concerned, the head-and-shoulders top pattern remains in place – miners didn’t move above the “head” or even the “left shoulder”. However, they moved higher on volume that was not very low which is a moderate-to-strong bullish sign. The outlook improved for the short term a little, but it didn’t improve for the medium term.

Summing up, the medium-term outlook remains bearish and we think that the big decline is already underway, but the risk of seeing a corrective upswing to the 61.8% Fibonacci retracement level in gold increased significantly based on yesterday’s closing prices. Consequently, we are closing the current short position and taking profits off the table (with gold at $1,233 and silver at $15.18 at the moment of writing these words). We plan to re-open the short position at higher prices (at about $1,255 in gold; the short-term price targets for silver and mining stocks are unclear at the moment).

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Yesterday, the WGC released its latest market update entitled “Gold outshines the market in Q1 2016”. What are the main conclusions of the report?

Gold Outshines Market in Q1 2016

One of the most crucial questions about the gold market is whether the ETFs’ inflows and outflows drive the price of gold or rather are they driven by the changes in gold prices? We invite you to read our today’s article presenting the overview of the gold ETFs and find out what is the relationship between the ETF flows and the gold price.

Do ETFs’ Flows Drive the Gold Price?

Earlier today, the yen moved sharply higher against the greenback on safe-haven buying and Bank of Japan Governor Haruhiko Kuroda comments (Kuroda said that easy monetary policies work and Japan is not headed for a recession). As a result, USD/JPY dropped under 109. How low could the pair go in the coming days?

Forex Trading Alert: USD/JPY – Declines Are Gaining Steam

=====

Hand-picked precious-metals-related links:

European Stocks Climb With Crude as Gold Declines; Yen Weakens

India’s physical gold industry strike could be set to end, alongside long lunches

Africa gold producers wary despite price rebound

What are the factors drive Platinum, Palladium? UBS

=====

In other news:

Yellen, alongside Fed alum, says rate hikes on track

Fed's Williams eyes two 2016 rate hikes: Fox Business Network

Yen stalls as finance minister warns on intervention

Yellen: US is 'not a bubble economy'

ECB's Mersch warns on competitive currency devaluation

Transaction Tax Poses Bigger Threat Than `Brexit' to Traders

World War Three may have already begun in Iraq and Syria

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts