Briefly: In our opinion, no speculative positions are justified from the risk/reward point of view.

Last week gold broke above the declining resistance line and managed to close the week without invalidating the breakout. Will gold continue to rally for much longer?

In our opinion, it’s rather unlikely. The implications of the short-term breakout are bullish, but they are of a short-term nature. Let’s take a closer look at what happened in gold (charts courtesy of http://stockcharts.com).

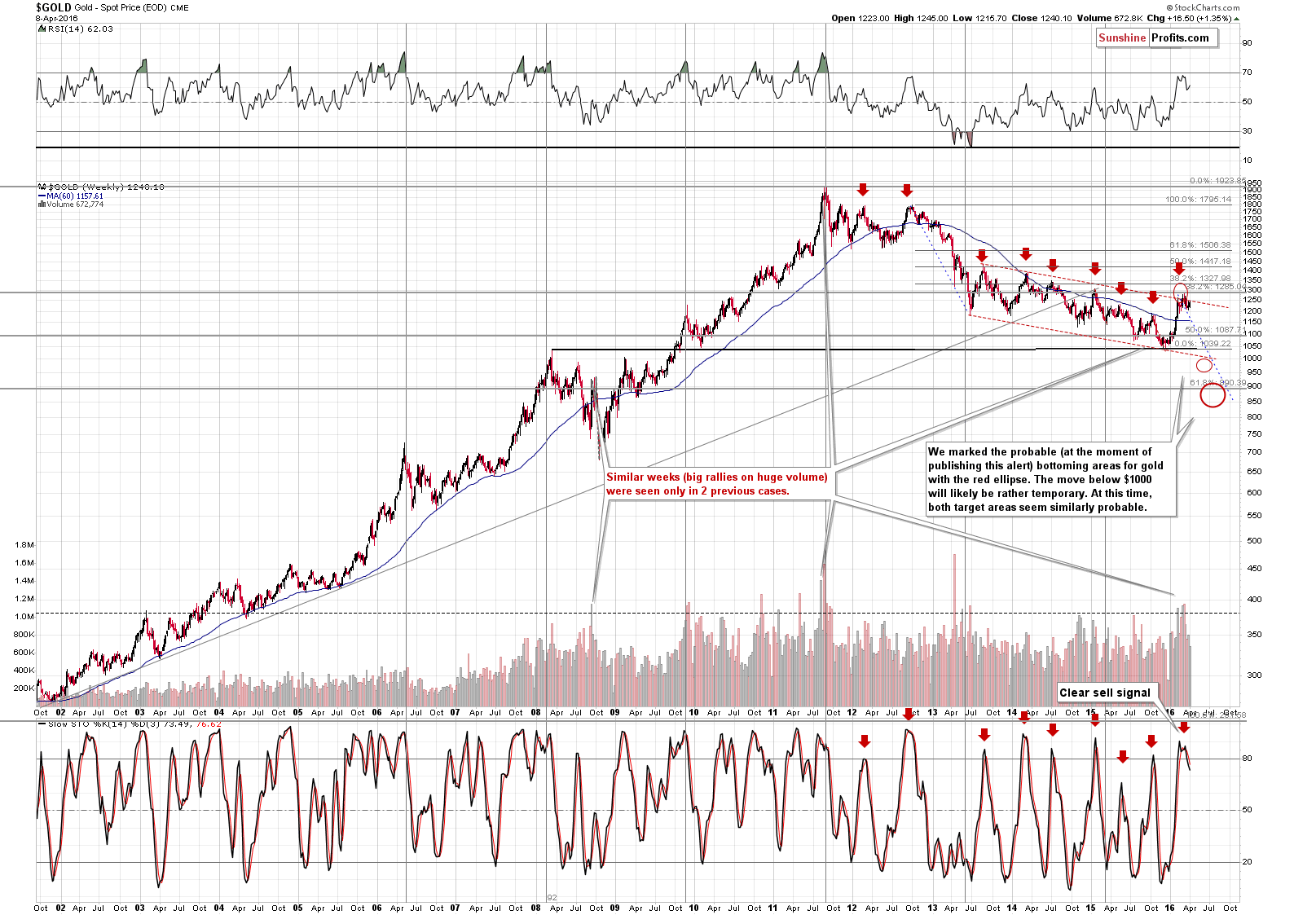

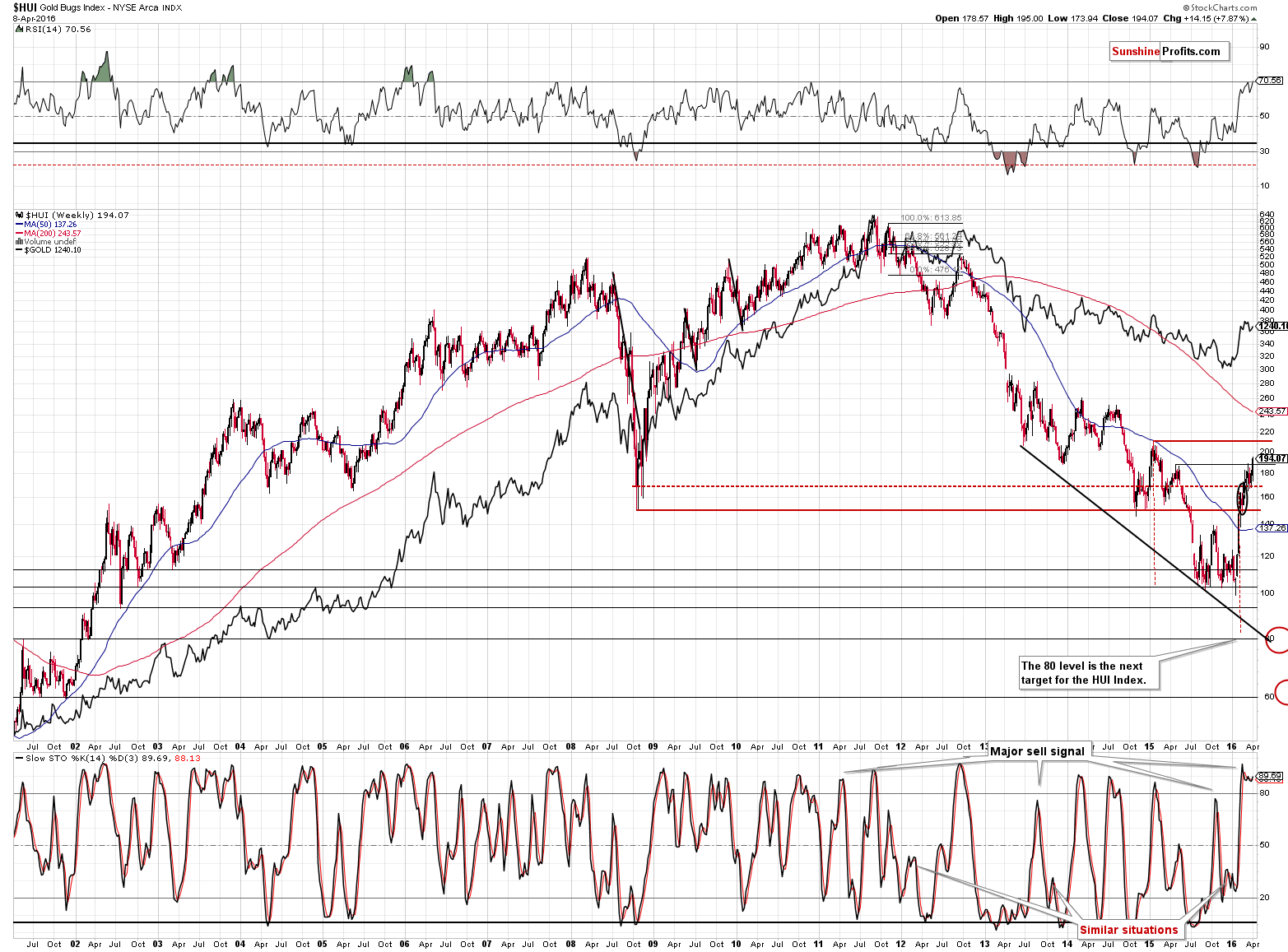

Let’s start by saying that once again nothing changed on the long-term chart. The outlook was bearish and this remains to be the case also based on the last week’s closing price. The major sell signal from the Stochastic indicator remains in place and the medium-term trend remains down.

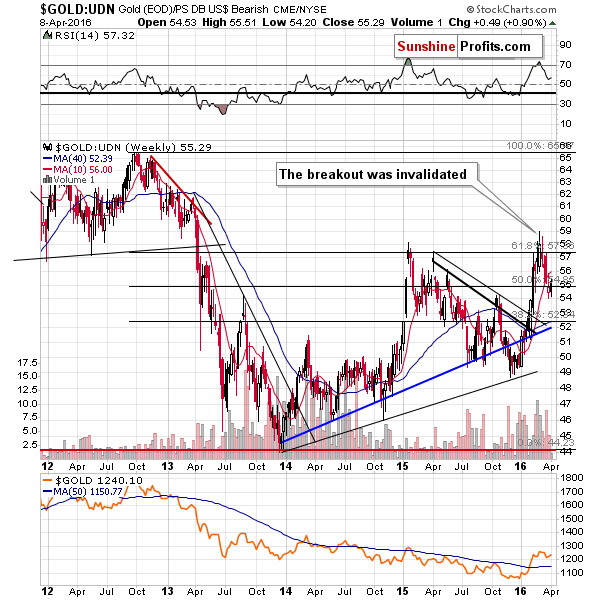

From the non-USD perspective, nothing really changed. The outlook continues to be bearish based on the invalidation of the breakout above the 2015 high.

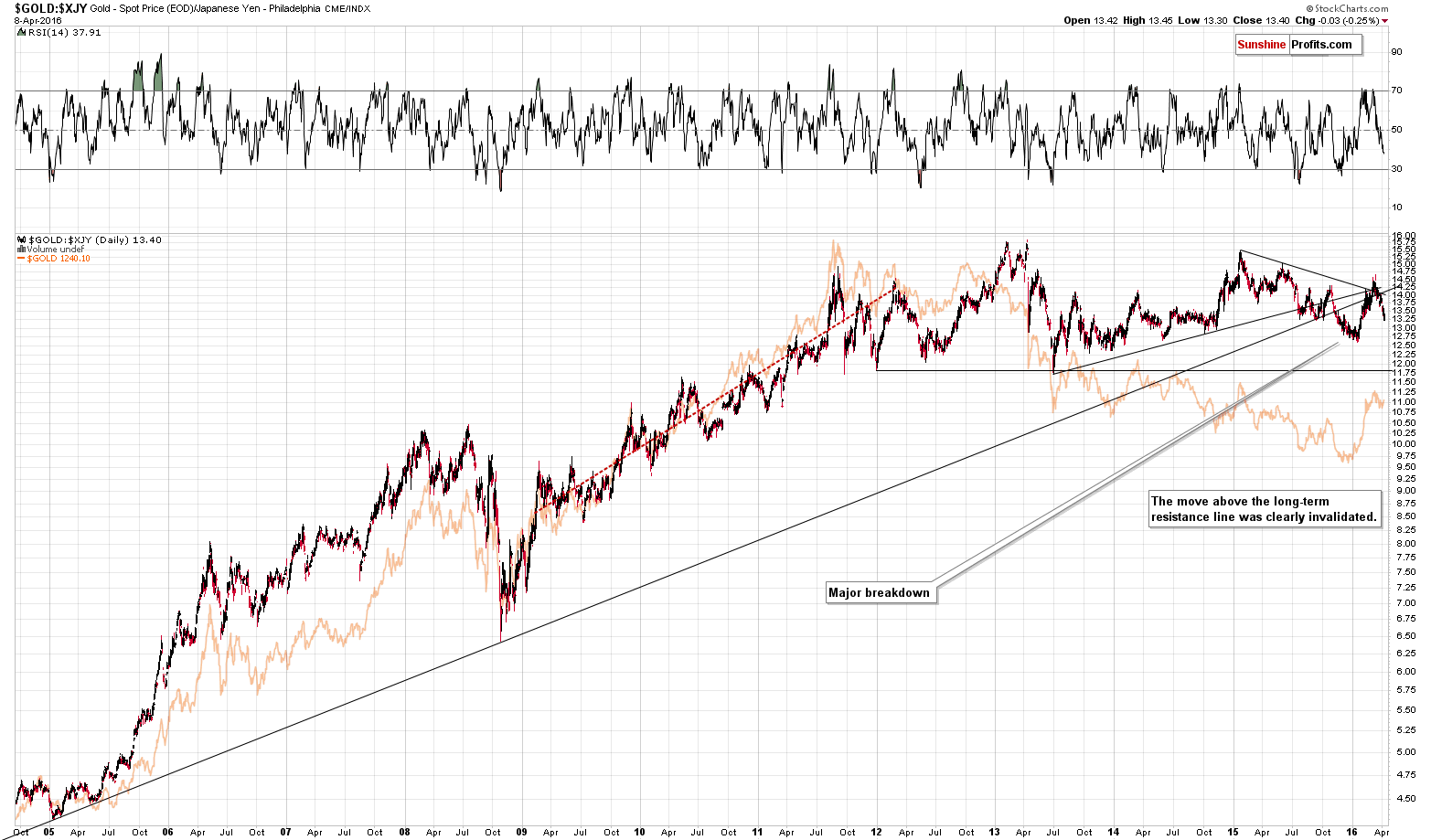

We can say the same in the case of the price of gold viewed from the Japanese yen perspective – the outlook remains bearish and last week’s move higher didn’t change anything.

So, all in all, nothing changed as far the long-term and medium-term outlooks are concerned.

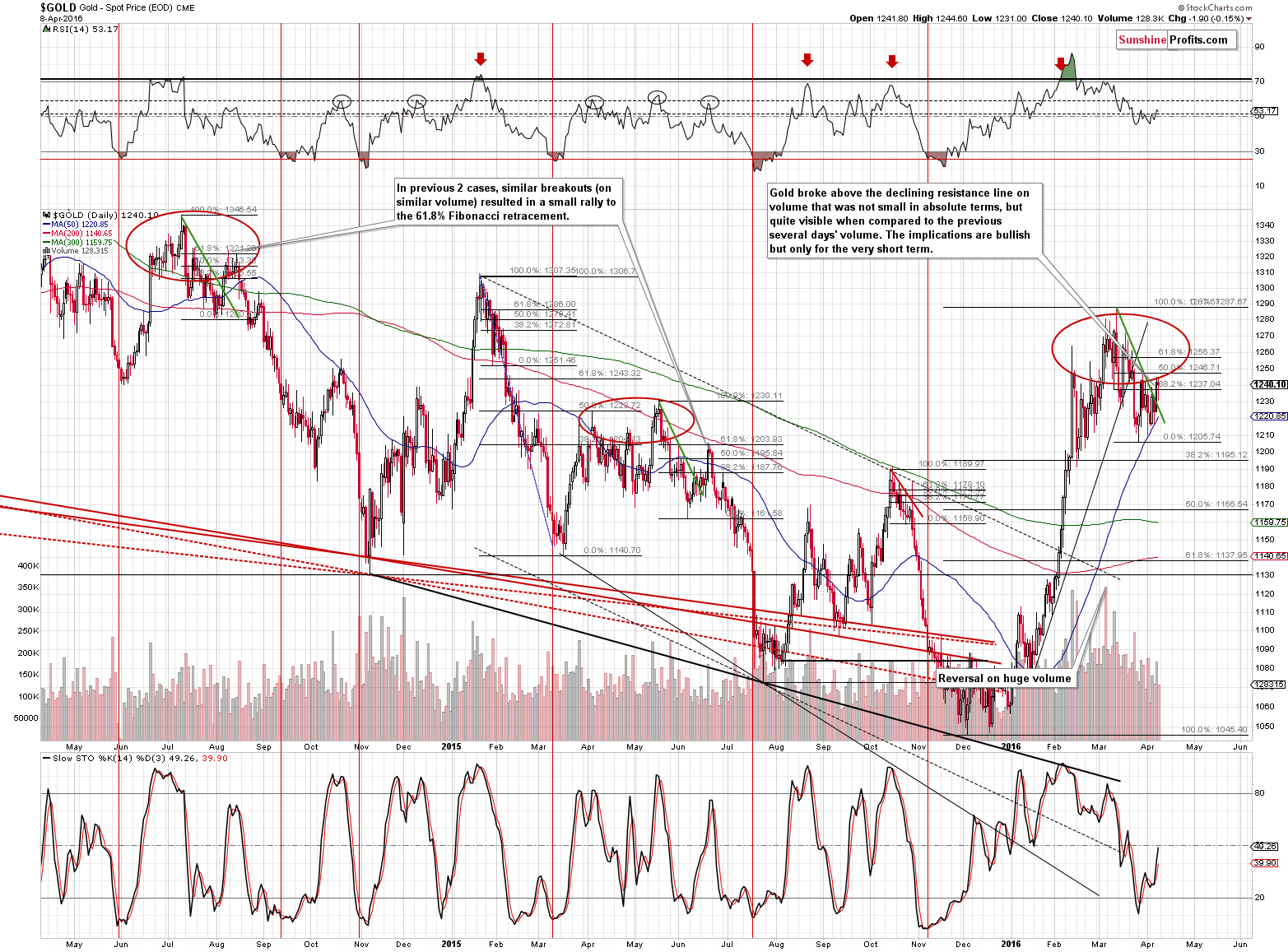

On the short-term chart, we see that gold didn’t invalidate the breakout above the declining short-term resistance line and the 38.2% Fibonacci retracement level. Is the breakout confirmed? We usually wait for 3 consecutive closes above a certain level before saying this is the case, but it seems that since gold closed the week above the previously broken levels, we can view the breakout as confirmed.

In Friday’s alert, we wrote the following:

The question is if this is significant. As far as short-term is concerned, it seems that it is.

There are 3 similar situations visible on the above chart. We marked 2 of them with green lines and one of them (October 2015) with a red line. These 2 cases are more similar because gold broke out in terms of closing prices in both cases, and there was only an intra-day breakout in the third case.

So, what happened in these cases? In all cases gold moved higher and declined only after moving to the 61.8% Fibonacci retracement level. That was in fact the final chance to enter a short position, before the decline’s pace greatly increased.

What about the volume? It pretty much confirms the above. In cases when the breakouts caused small rallies, the volume on which the breakouts were seen were quite similar to what we saw yesterday – the volume was not huge, but decent.

The above remains up-to-date. Gold moved higher in today’s pre-market trading (to $1,255) so the rally could already be over.

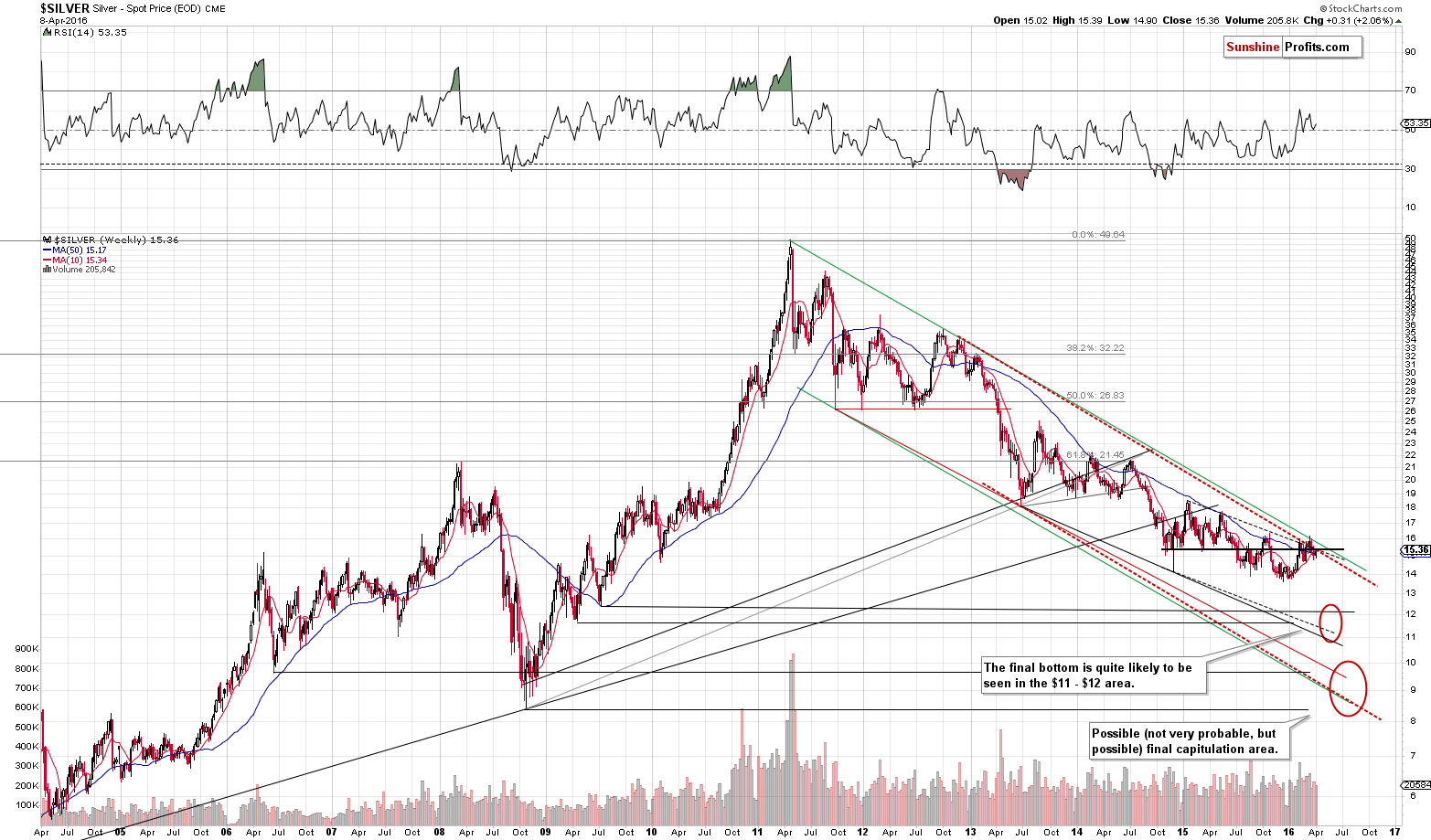

Just like it was the case with gold, there are no changes on the long-term silver chart. The trend remains down and the potential for any additional rally is very limited as there is very strong resistance (marked in green) relatively close to where silver is currently trading.

In Friday’s alert we wrote the following:

Silver has underperformed recently on a short-term basis, but let’s not forget that silver tends to outperform very temporarily right before local tops, so we could see a more visible move higher in silver shortly.

The above remains up-to-date. Silver could move higher on a very temporary basis and it could serve as a bearish confirmation.

Gold stocks broke above the April 2015 high and this is a somewhat bullish event – somewhat, because this breakout was not confirmed. Still, based on this breakout, it could be the case that the HUI will move to the next resistance at about 211 before turning south again.

It is mainly due to this sign that we are not re-opening the short position at this time, despite gold moved almost to its 61.8% Fibonacci retracement in today’s pre-market trading. Given this bullish sign from the HUI Index, it seems best to wait for an additional sell signal before re-entering short positions.

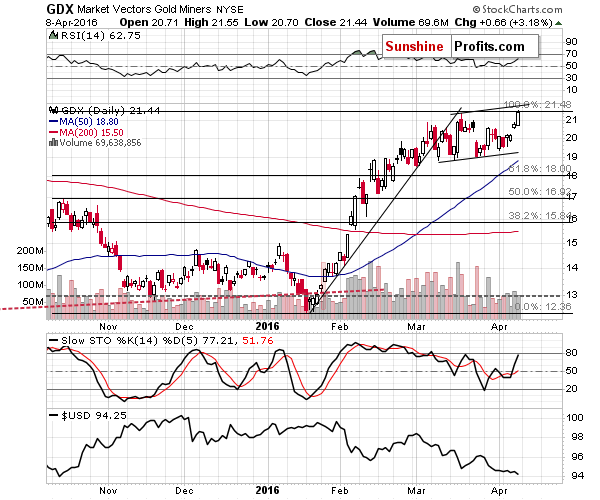

Silver stocks didn’t move as high as gold stocks, and GDX (which includes both) didn’t move as high as the HUI Index. There was a breakout, but it was not as visible as the one in the HUI Index. On the above chart we see that volume was not particularly big, which suggests that this breakout and the following rally should not be trusted – at least not until it is confirmed.

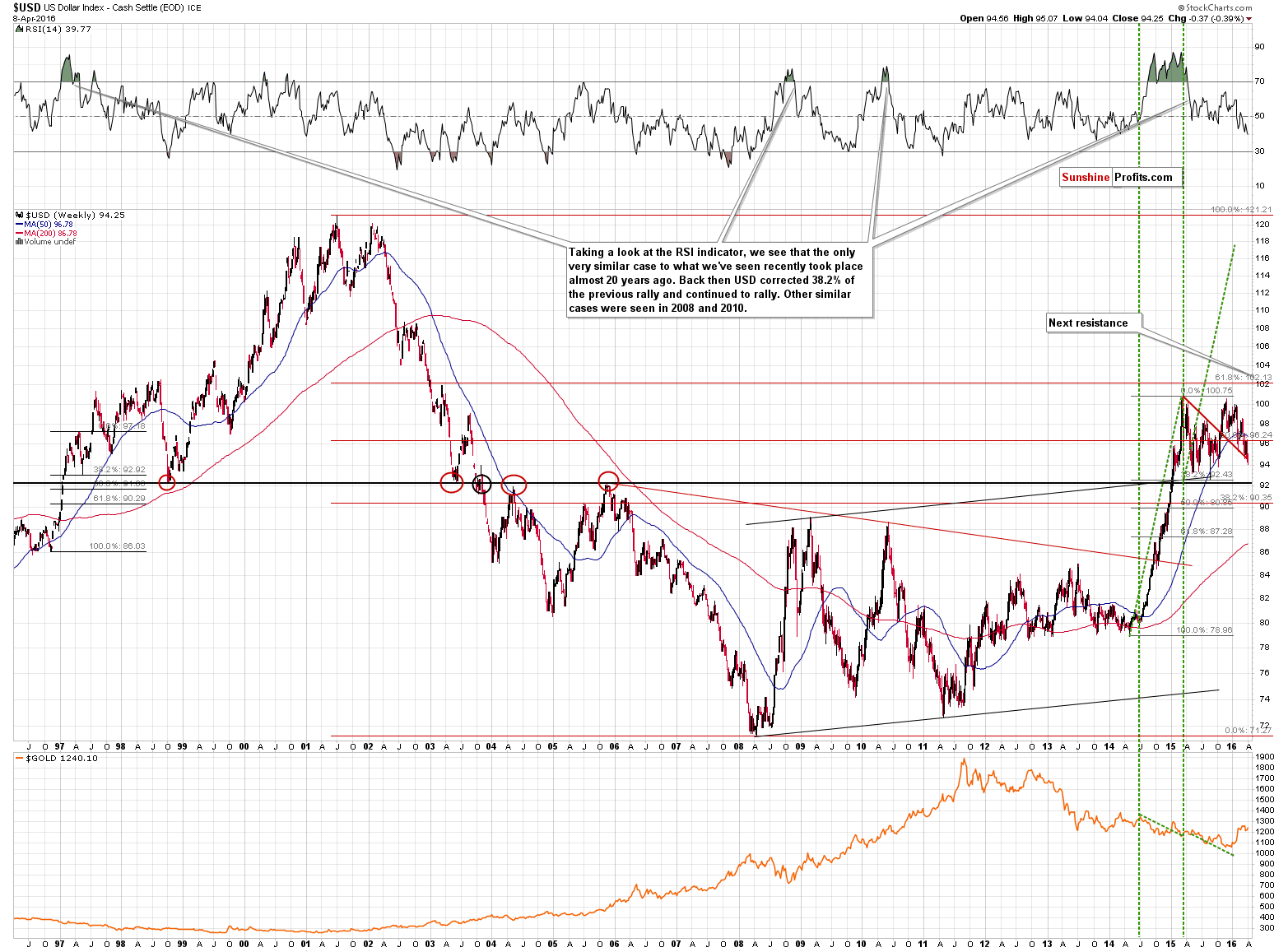

What about the USD Index? It declined but not below the declining red support line. Consequently, the decline in the USD Index could already be over or very close to being over. The implications are bearish for the precious metals sector, but it doesn’t rule out another daily move higher in the latter – the implications of the situation in the USD Index are of medium-term nature.

Summing up, we saw a temporary move higher in the precious metals sector, but it appears that the rally is just a corrective upswing within a bigger decline. Still, based on the rally in gold stocks and the breakout in the HUI Index, we are not re-entering short positions just yet – we plan to re-enter them after seeing additional bearish confirmations.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Last week, we covered three important reports about the gold market. Today, we would like to discuss yet another publication. On March 31, the World Gold Council (WGC) released a market update entitled “Gold in a world of negative interest rates”. What are the main conclusions of the report?

Gold in a World of Negative Interest Rates

On Friday, crude oil extended gains as renewed hopes for output freeze in combination with the closure of the Keystone pipeline and Baker Hughes report supported the price. In this environment, light crude climbed to the barrier of $40, invalidating earlier breakdown under medium-term support/resistance line. What’s next for the commodity?

Oil Trading Alert: Will Barrier of $40 Stop Oil Bulls?

S&P 500 index extended its short-term fluctuations on Friday, as it remained close to the level of 2,050. Is this just a flat correction within two-month long uptrend or some topping pattern before downward reversal?

=====

Hand-picked precious-metals-related links:

Gold Advances to Highest in Three Weeks on Interest Rate Outlook

China Buys Gold Whenever Price Slumps: BI's Hoffman

Amcu accepts Sibanye Gold new wage offer

Gold and Silver Ratio Near 2008 Crisis Level

Gold Standard in Islamic Finance ‘Almost There’ for Submission

=====

In other news:

ECB seeks to mollify Germany after uproar over 'helicopter money'

Wall Street Wages Double in 25 Years as Everyone Else's Languish

Is being Fed chair like 'being God'?

Will OPEC deliver oil deal in Doha?

U.S. shale oil firms feel credit squeeze as banks grow cautious

18 Warren Buffett quotes that tell you all you need to know about personal finance

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts