Briefly: In our opinion, speculative short positions (half) in gold, silver and mining stocks are justified from the risk/reward point of view.

We summarized yesterday’s alert by saying that we were waiting for a specific confirmation – yesterday’s session was quite specific as silver rallied, while the rest of the precious metals sector didn’t do much. Did we see the signal?

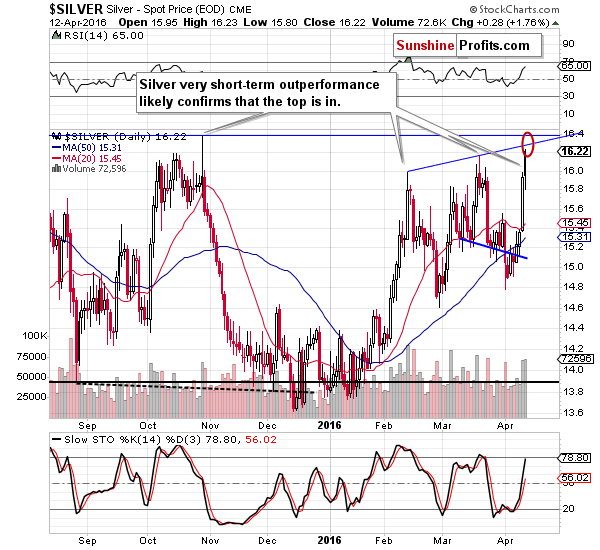

In our opinion, this could be the case, but there is still a chance that it wasn’t it. We saw another bearish sign from the silver market – as mentioned many times before, the short-term outperformance of silver is usually a sign that a top is at hand. However, we didn’t see a clearly bearish confirmation from the mining stocks – only a somewhat bearish sign.

Let’s take a closer look at the charts (charts courtesy of http://stockcharts.com). Since there were no changes on the long-term charts, we’ll focus on the short-term ones.

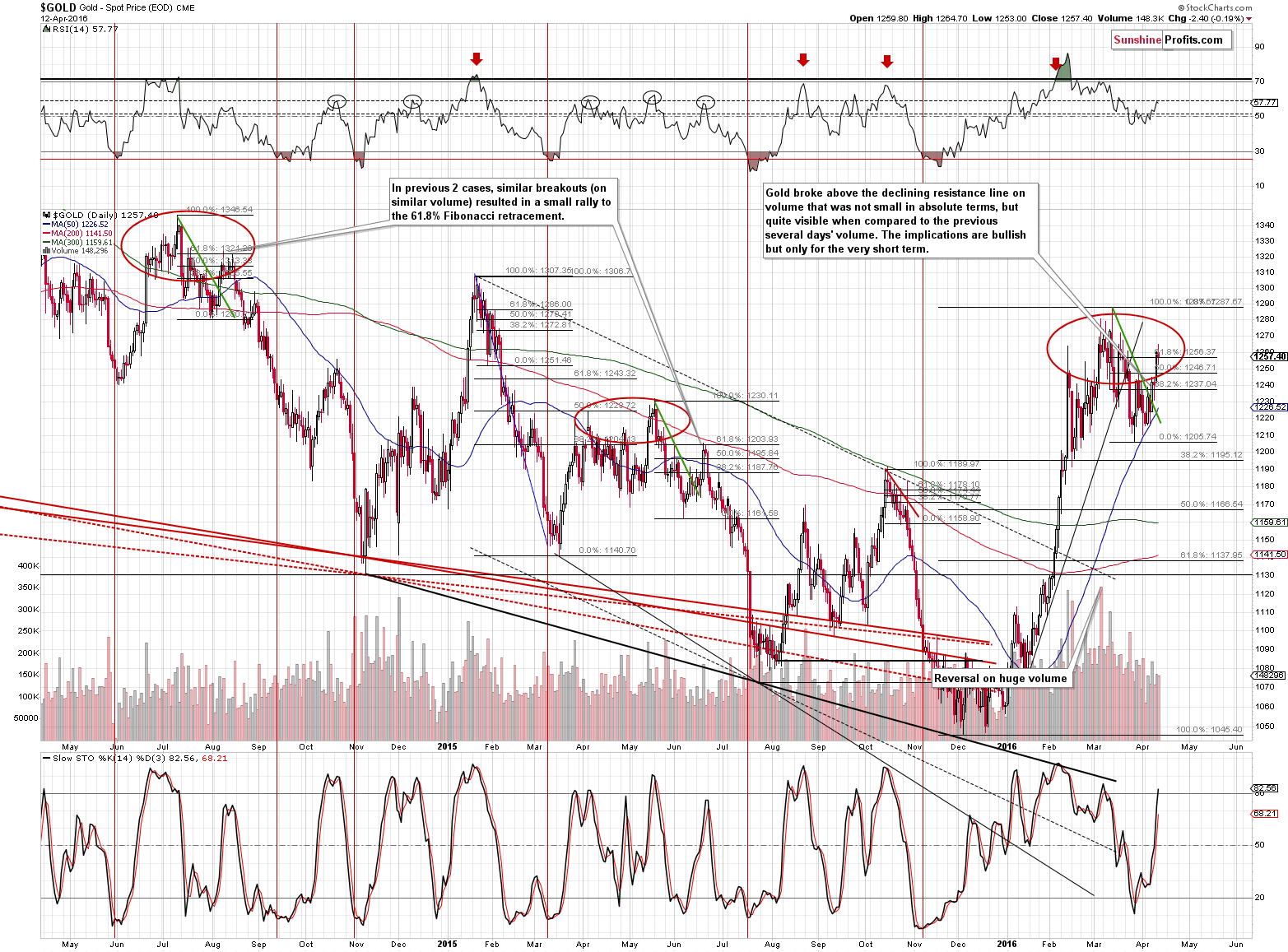

Gold didn’t do anything unexpected – it moved a bit above the 61.8% Fibonacci retracement level and decline back below it (in today’s pre-market trading). Gold closed the day very close to this level, so the breakout was definitely not confirmed, and since it was already invalidated today (with gold at $1,244), we can say that the situation has just deteriorated.

In the case of silver, the situation has also deteriorated based on the short-term outperformance. Is the top in? It could be the case as silver just invalidated the breakout above the March high (being at $16.00 at the moment of writing these words). It may not be the case just yet because the rising resistance line and the October 2015 top are just above yesterday’s high and either of them may need to be reached to trigger the true decline.

Still, based on today’s move lower, the outlook deteriorated.

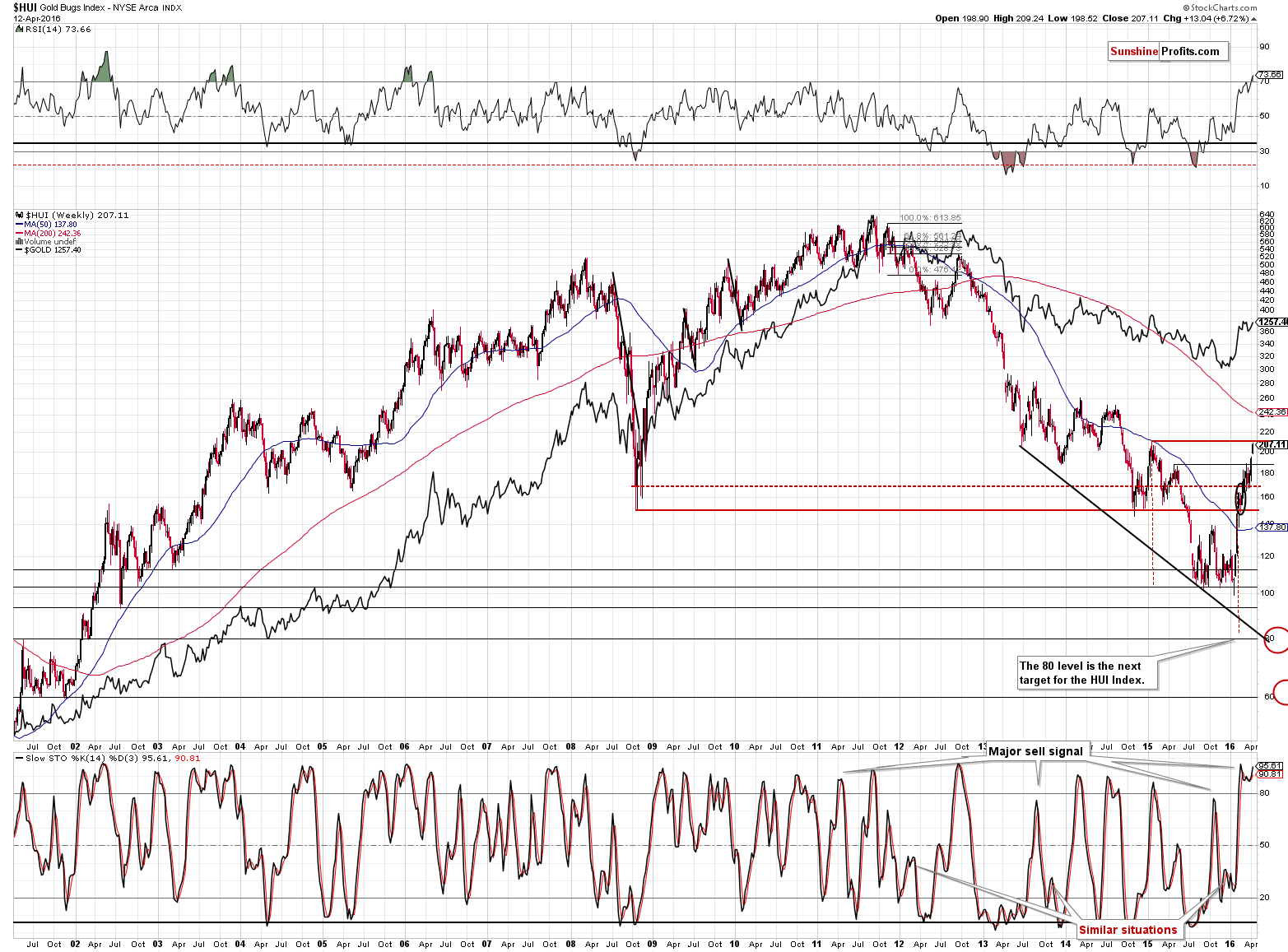

Gold stocks broke above the April 2015 high and this is a somewhat bullish event – somewhat, because this breakout was not confirmed. Still, based on this breakout, it could be the case that the HUI will move to the next resistance at about 211 before turning south again.

It is mainly due to this sign that we are not re-opening the short position at this time, despite gold moved almost to its 61.8% Fibonacci retracement in today’s pre-market trading. Given this bullish sign from the HUI Index, it seems best to wait for an additional sell signal before re-entering short positions.

The HUI Index indeed moved higher yesterday, but the 211 level wasn’t reached. This doesn’t mean that miners can’t decline before reaching this level. They can, for instance based on the 2015 high in terms of daily closing prices, which is at about 207 – very close to yesterday’s close.

The HUI Index finally closed at 207, so the top may be in. Ideally, we would prefer to see a reversal on huge volume – and we didn’t – but a very important resistance was reached and the next one is very close, so even if the top is not in yet, it’s likely not far from yesterday’s close.

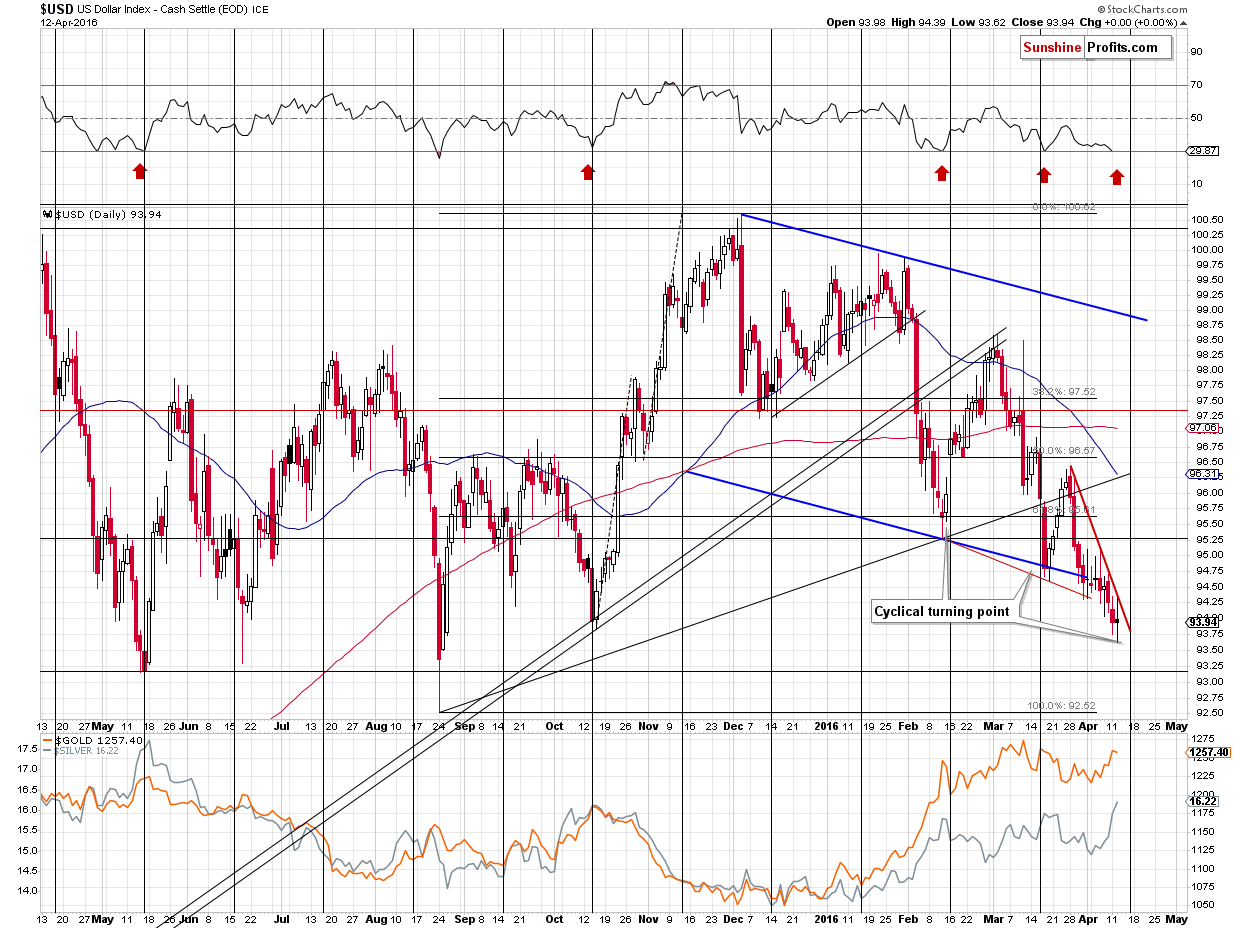

Most importantly, we have just seen a breakout in the USD Index. It moved visibly above (being at 94.53 at the moment of writing these words) the declining red resistance line and since the USD Index is very close to its turning point, it seems that the bottom may already be in. Let’s keep in mind that the turning points work on a near-to basis, so it could be the case that the turnaround that was going to happen based on the turning point, has already happened.

Moreover, based on yesterday’s session, the RSI indicator moved below the 30 level and this is not only a classic buy signal, but also a one that worked many times in the case of the USD Index.

Summing up, while we didn’t get a perfect set of circumstances that would confirm that the top is in, based on yesterday’s session the outlook for metals and miners deteriorated and today’s pre-market price action has even more bearish implications so far, mainly due to the USD’s breakout. Consequently, since we have a lot of sell signals in place but not as many as we had before the previous decline (when we decided to open a short position with 150% of our regular position), we are still opening a short position in gold, silver and mining stocks (naturally, you are free to use our opinions in any way you see fit, but please note that we’ve been writing about the position in all parts of the precious metals sector – not about mining stocks alone – in order to reap the benefits of diversification), but so far with half of the regular capital. If we get additional bearish confirmations, it’s likely that we will increase the size of the position, but for now, half of the regular position appears justified from the risk to reward perspective.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short positions (half) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $973; stop-loss: $1,304, initial target price for the DGLD ETN: $89.05; stop-loss for the DGLD ETN $47.15

- Silver: initial target price: $12.13; stop-loss: $16.62, initial target price for the DSLV ETN: $68.48; stop-loss for DSLV ETN $36.11

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $24.07, initial target price for the DUST ETF: $5.72; stop-loss for the DUST ETF $1.74

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $34.57

- JDST ETF: initial target price: $8.86; stop-loss: $2.75

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

On Friday, the GDPNow model forecast of real GDP growth for the first quarter of 2016 decreased to 0.1 percent from 0.4 percent. What does it mean for the gold market?

Zero Growth in Q1 2016 and Gold

Earlier today, official data showed that euro zone industrial production declined by 0.8% in Feb (month-on-month), missing analysts’ forecasts. Additionally, industrial production (year to year) rose less-than-expected in Feb, which pushed the euro lower against the greenback. As a result, EUR/USD declined under the Feb high, invalidating earlier breakout. How low could the exchange go in the coming days?

Forex Trading Alert: EUR/USD Is Sending Currency Bears Message

In the previous month, crude oil extended gains and climbed above the barrier of $40. Despite this improvement, the combination of resistance levels encouraged oil bears to act, which resulted in erasing 40% of the previous upward move. What happened at the same time with oil stocks? What’s next for the XOI?

Oil Stocks - For the Bulls or Bears?

=====

Hand-picked precious-metals-related links:

Indian Gold Buying Returning Post Jeweler Strike – HSBC

China Gold Fix to create greater price transparency

China's yuan gold benchmark to launch with 18 members -source

=====

In other news:

Lower Growth Expectations Cloud World Finance Leaders’ Forum

Dollar gains, eyes on G20, Bank of Canada

Funds shy from Europe, Japan amid fear of ‘quantitative failure’: Survey

Will oil rally have legs as JPMorgan reports?

Venezuela: the land of 500% inflation

IMF warns of another 14% drop in metal prices this year

China trade beats forecasts in March

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts