Briefly: In our opinion, long (full) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

Gold declined yesterday in a quite significant way, but does it really change the short-term outlook? The volume might be the thing that one should focus on – but not the only thing.

Let’s jump right into the charts (charts courtesy of http://stockcharts.com).

In Monday’s alert we wrote the following:

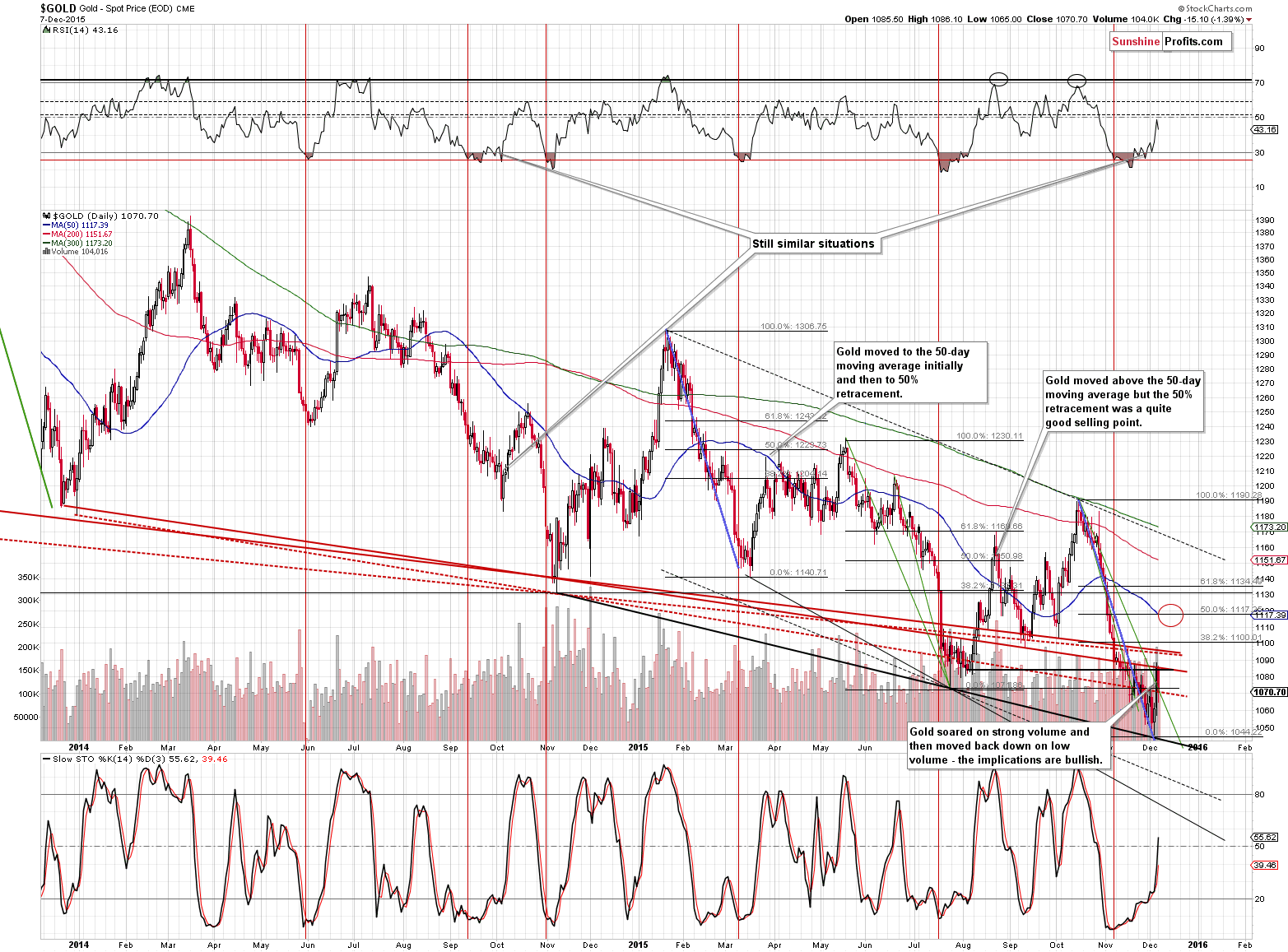

Similar patterns usually breed similar results and the previous similar patterns (note the blue and green lines on the above chart) resulted in a move to the 50% and 61.8% Fibonacci retracement levels and moves to / a bit above the 50-day moving average. Applying the above to the current situation provides us with a target at about $1,117 – higher than we initially expected this rally to take gold.

The above remains up-to-date since gold moved lower on much lower volume. Gold had rallied sharply on Friday, so it’s not unexpected that it took a breather yesterday. There are no bearish implications of yesterday’s decline, in our opinion.

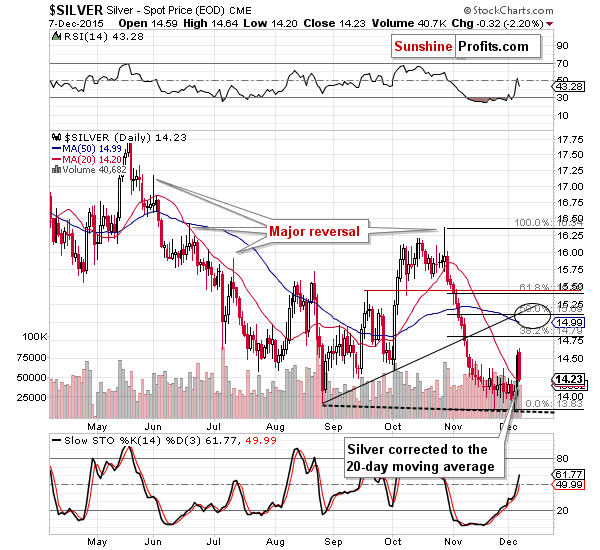

Silver moved back to its 20-day moving average (which served as support and resistance on numerous occasions), after breaking visibly above it. Yesterday’s move was big, but ultimately it didn’t invalidate the breakout. Consequently, not much changed and the short-term outlook remains bullish, while the medium-term one remains bearish.

In yesterday’s alert we wrote the following:

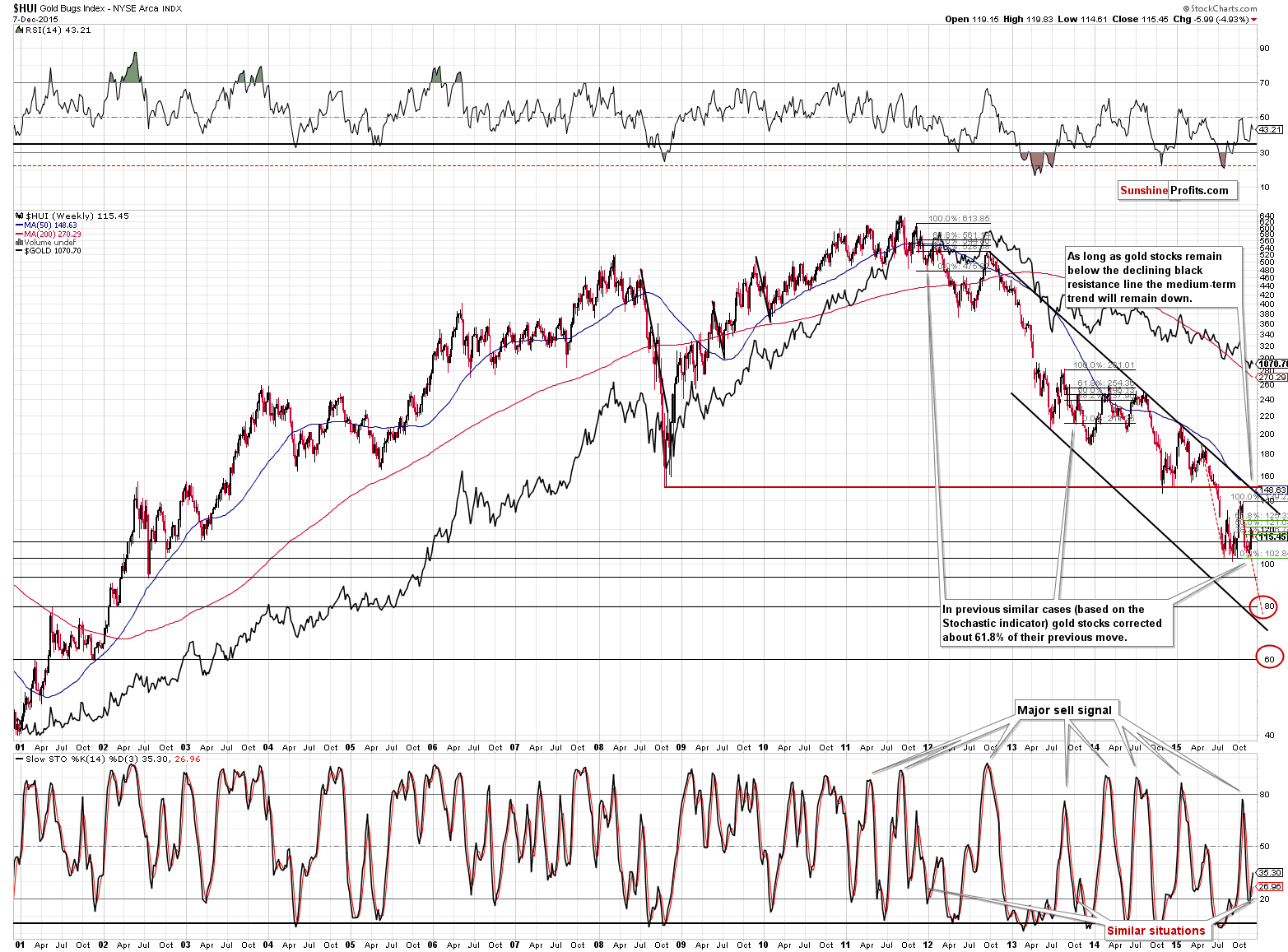

The situation in gold stocks is currently analogous to 2 situations from the past, at least based on the short-term decline and bounce and as described by the Stochastic indicator (which has been quite effective). In the past cases, gold stocks moved higher than what we’ve seen so far during this rally (on a relative basis), but the moves weren’t very big. In past cases gold miners moved close to the 61.8% Fibonacci retracement level, which is currently at 125. If the history is any guide here, then we can expect the HUI Index not to exceed the 130 level (at least not in a meaningful way).

The above remains up-to-date. The Stochastic indicator continues to provide us with a buy signal despite yesterday’s move lower in the HUI, so the implications for the short term remain bullish.

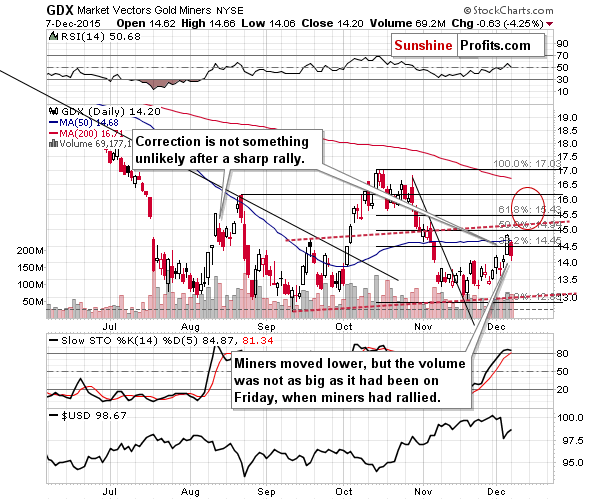

The GDX ETF, another proxy for the mining stocks, moved lower as well and the volume was not low – should we be concerned? Not really, because the volume was smaller than what we had seen on the previous trading day when miners rallied.

Moreover, please note that the most recent rally is somewhat similar to what we saw in August. Back then miners were after an even bigger decline and were correcting in a sharp fashion. Actually, the rally was more volatile back then, but so was the preceding slide. The rally didn’t take form of a straight line – there was a correction after which miners moved even higher. Consequently, yesterday’s decline is something quite natural to take place at this stage of the move higher and we don’t think it is a bearish phenomenon.

Summing up, the situation in the precious metals market didn’t deteriorate based on yesterday’s move lower and the short-term outlook remains bullish. The medium-term outlook remains bearish, though.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Long position (full) position in gold, silver and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and initial (! – this means that reaching them doesn’t automatically close the position) target prices:

- Gold: initial target price: $1,114; stop-loss: $1,028, initial target price for the UGLD ETN: $8.59; stop-loss for the UGLD ETN $6.70

- Silver: initial target price: $14.96; stop-loss: $13.26, initial target price for the USLV ETN: $12.62; stop-loss for USLV ETN $8.54

- Mining stocks (price levels for the GDX ETF): initial target price: $15.37; stop-loss: $12.57, initial target price for the NUGT ETF: $34.59; stop-loss for the NUGT ETF $18.91

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $20.68; stop-loss: $17.76

- JNUG ETF: initial target price: $38.97; stop-loss: $24.83

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

On Thursday, Janet Yellen testified before the Joint Economic Committee. What can we learn from her testimony?

On Friday, crude oil reversed and declined sharply after the Organization of the Petroleum Exporting Countries' decision to keep production high weighed on investors’ sentiment. Thanks to these circumstances, light crude lost 2.74% and slipped under the barrier of $40 once again. What’s next?

Oil Trading Alert: Crude Oil under $40!

=====

Hand-picked precious-metals-related links:

Gold traders raise bets prices will soon drop to $1,000

HSBC cuts 2016, 2017 silver price forecasts

Merk 2016 Outlook: Markets, Dollar, Gold

Anglo American Platinum Sees Earnings 20% Lower on Restructuring

=====

In other news:

EU is in danger and can be reversed: European Parliament's Schulz

China Exports Decline for Fifth Month, Import Slump Moderates

Japan GDP revised from recession to growth in Q3

OPEC's Oil Market Disarray Looks Like 1990s Slump All Over Again

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Sunshine Profits - Founder, Editor-in-chief

Sunshine Capital Management, LLC

Sunshine Gold Investment Fund, LP

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts