Briefly: In our opinion, short (full) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

It seems that the markets were somewhat confused right after the interest rate hike, but once the dust had settled down, investors realized that, after all, increased rates are bearish for gold and that nothing really changed regarding the medium term – metals plunged. The question remains if there’s still some money to be made on the short side or should one already start to back up the truck on metals.

Let’s take a look at the charts (charts courtesy of http://stockcharts.com).

In yesterday’s alert we wrote the following:

Gold moved higher yesterday and the daily candlestick was not as bearish as in late October, but we didn’t see a breakout or a major upswing either. A move $11.10 higher is visible, but nothing to call home about. Without a major breakout, it appears that the medium-term trend will resume.

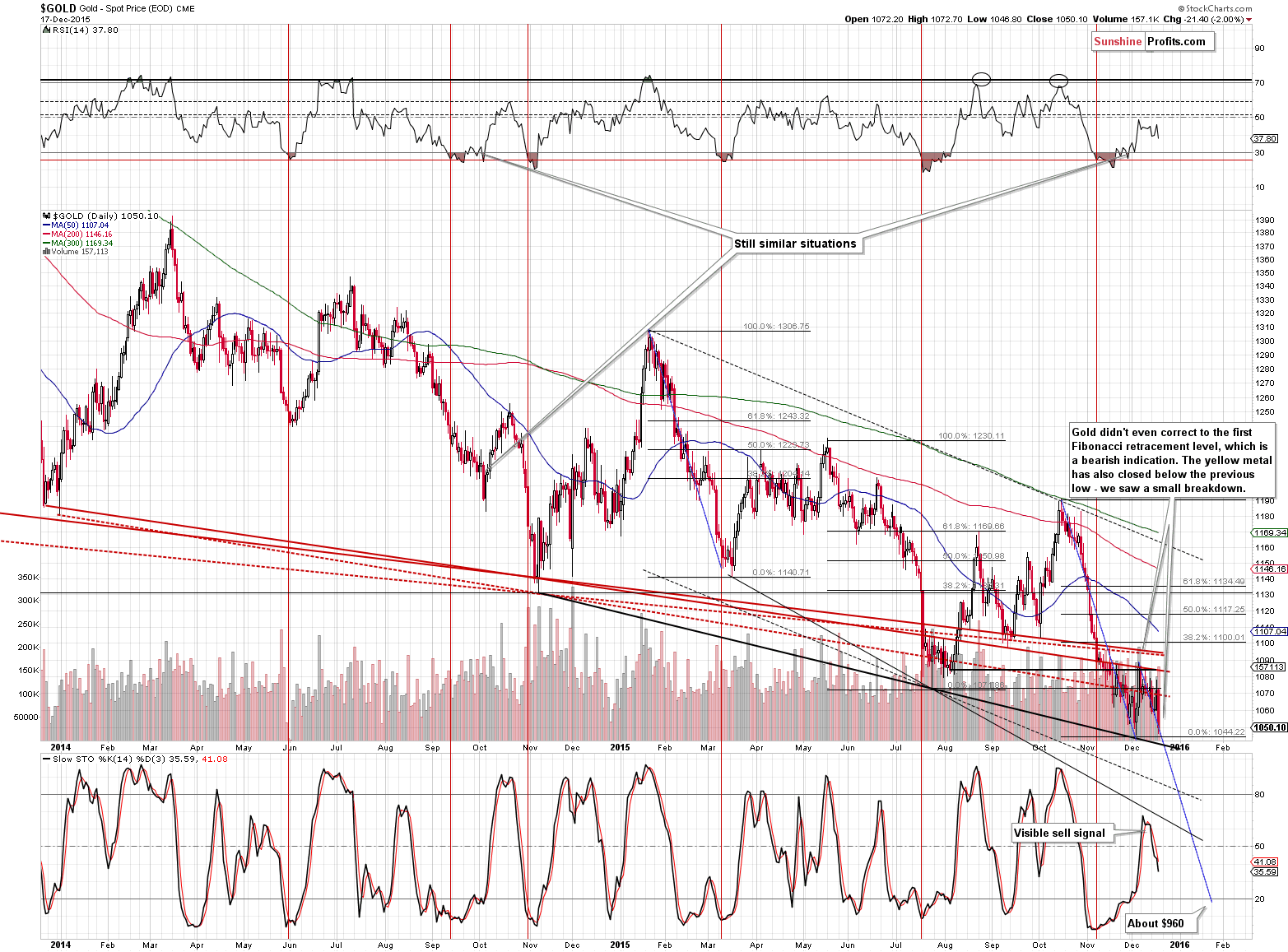

It seems that it has already resumed. Gold moved decisively lower and the move as accompanied by significant volume. The move was big enough to take gold to new lows – the yellow metal closed the day a few dollars below the previous low. The implications are bearish.

How low can gold go? As we described in Tuesday’s alert, the next target is at about $960:

(…) please note that gold often moves in a zigzag fashion and the first part of the decline is equal or very similar to the second part. If the corrective upswing is indeed over and gold is likely to decline by as much (percentagewise) as it did before the upswing, then we might see it decline to $960 or so before the next wave down is over. Would this be the final bottom? It’s possible, but it’s not certain – a lot depends on the number of confirmations that we see when gold moves that low.

If the current slide (the one that has just begun) is similar to the one that we saw in the first half of 2013, then $960 is justified also from this perspective – if the initial decline is currently as big as the initial decline in 2013, we should see gold at $960 and we are likely to see it there soon.

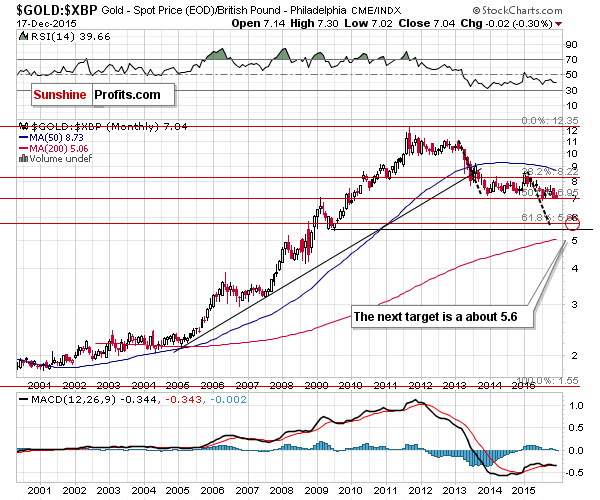

While we usually don’t include all the charts that we monitor on a daily basis (it’s not possible as there are about 100 of them, plus the majority of them doesn’t feature any changes on a daily basis), today we decided to include the chart featuring the price of gold in terms of the British pound. Why did we do so? Because it shows that gold is on a verge of breaking lower and once it does, the following slide is going to be significant – something like what we saw in the first half of 2013.

Gold is about to move below the 50% Fibonacci retracement level, which worked so well as support in the previous months and years. The next major support is created by the 2009 low and the 61.8% Fibonacci retracement.

Gold has been consolidating for many months and after the breakdown we can expect gold to decline in a way similar to the move that preceded the consolidation – the 2013 decline. This confirms the mentioned price targets and we can expect the above ratio to slide to 5.5 – 5.6 before the final bottom is in.

In yesterday’s alert we wrote the following regarding silver:

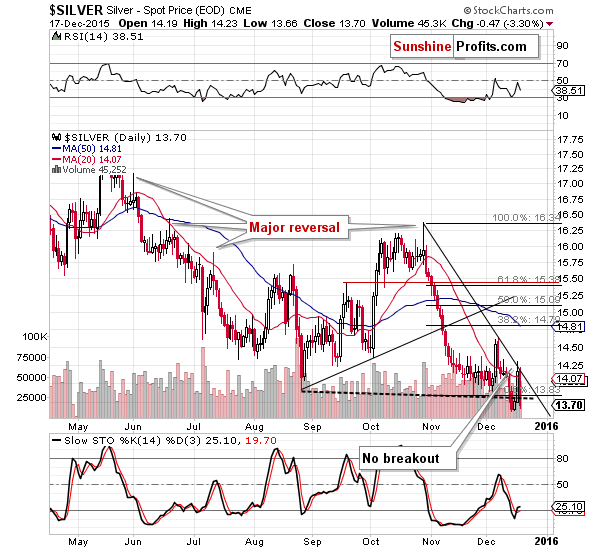

Silver moved sharply higher, which seems bullish, right? Not really – that’s the same thing that happened in late October – silver moved higher and declined before the end of the session. This time silver didn’t move all the way down before the session was over, but it declined somewhat and there was no breakout above the short-term rising resistance line. Putting lines aside and focusing on moving averages, on both occasions silver ended the session close to the 20-day moving average. Moreover, please note that the volume was high both during yesterday’s session and in the case of the late-October reversal.

Will silver slide shortly? It’s likely, but as it’s the case with all markets, there are no certainties.

The likely happened and silver declined sharply erasing the pre-Fed-announcement rally. The decline can now continue.

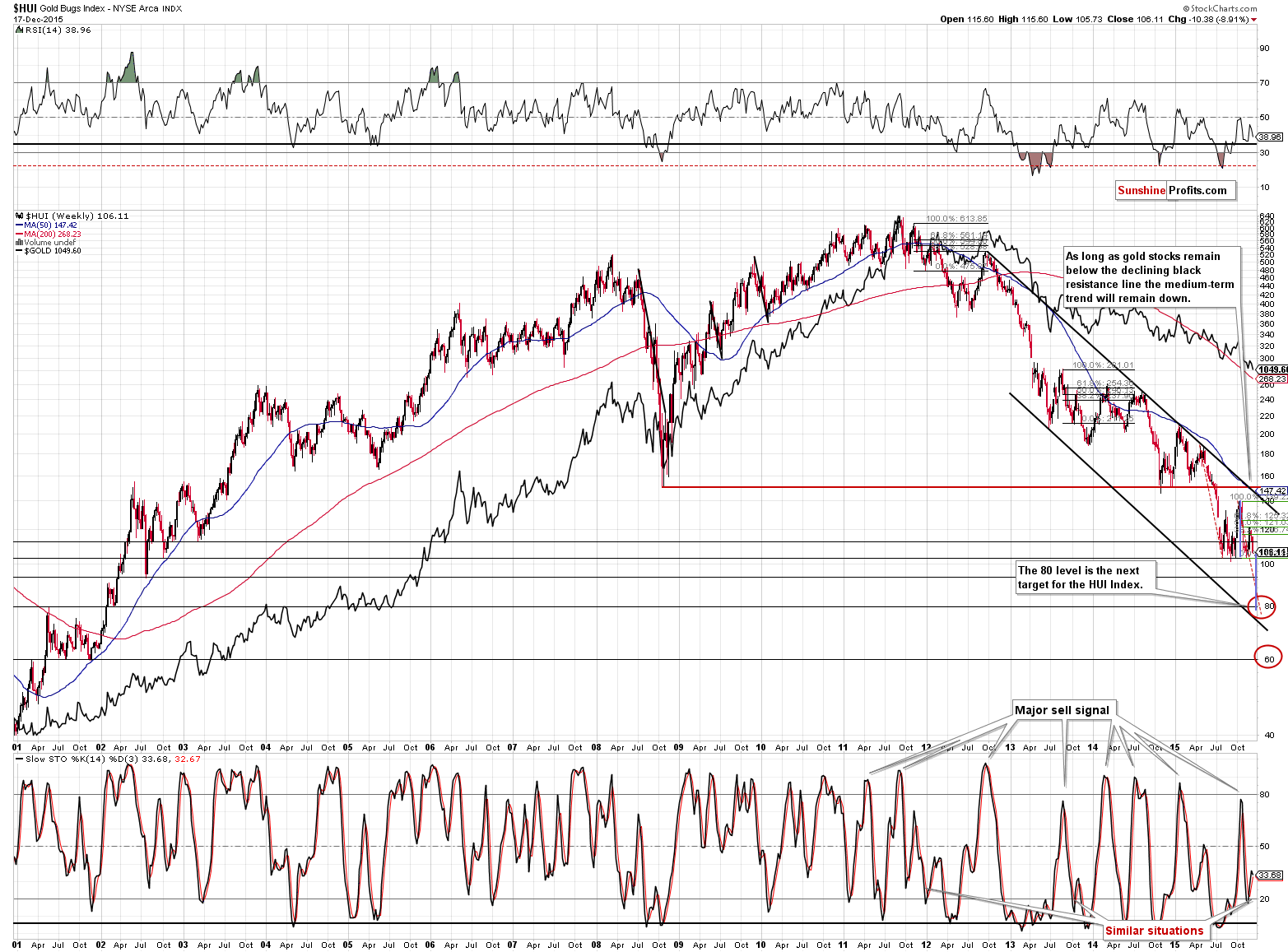

The HUI Index moved visibly lower and it’s about to create a bearish head-and-shoulders pattern. The target based on this formation is the 80 level, which was our next interim target anyway based on the early 2002 low and other calculations (the gold price target and the gold stocks to gold ratio analysis). Consequently, this target is even more likely to really hold the decline (at least for some time). Please note that there is also another level to which gold stocks could decline – the 60 level.

It seems unrealistic – we know – but did 106 seem realistic when the HUI was trading above 600 just a few years ago? The fundamental outlook for the precious metals market remains bullish in our view, but that doesn’t change anything (!) regarding the short term or even the medium term, given a strong downtrend. Markets are logical only in the long run, and emotional in the short run. Consequently, it is possible for the HUI Index to become even more oversold than it is right now before the final bottom is in.

Yesterday we wrote the following:

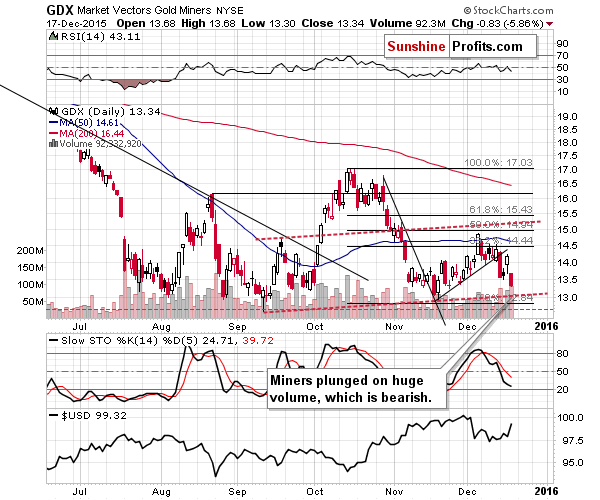

Gold miners moved higher on strong volume, which seems bullish until one considers that the GDX ETF didn’t even move above its most recent high. The volume was significant – that’s true – but given the uncertainty regarding the interest rates, it’s no wonder that many investors chose to take action yesterday – that’s not necessarily a bullish sign.

Miners didn’t move above their previous highs and they didn’t move above the rising resistance line. Consequently, the situation didn’t change much from the technical perspective.

The situation changed from the technical perspective based on yesterday’s development – it deteriorated. Yesterday’s decline was bigger than the previous day’s rally and the volume was bigger as well. The pre-Fed announcement rally seems to have been just a blip on the radar screen – a small corrective upswing within a bigger decline. The next target for the GDX ETF is at about the $10 level, which corresponds to 80 in the HUI Index.

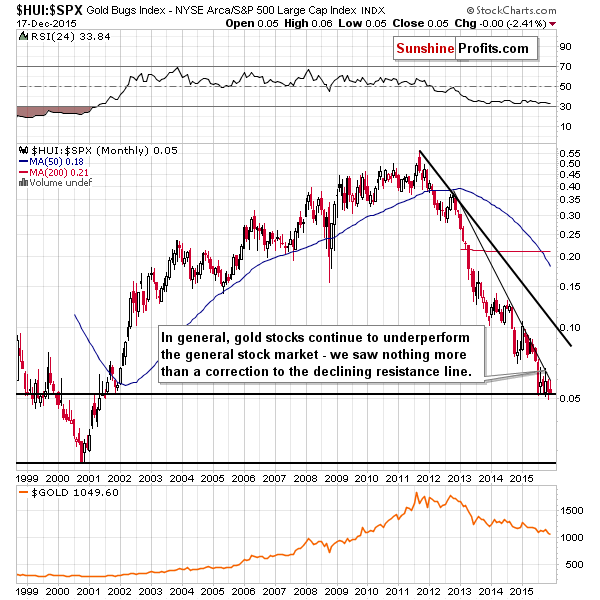

Comparing the performance of gold stocks with the general stock market we see a quite dramatic situation. The trend remains down and the ratio is on a verge of breaking below the previous lows – and it has a good chance to do so as it’s already after a visible consolidation. The implications are that the next downswing in the precious metals market is likely to be significant and that we can expect mining stocks to underperform.

Summing up, yesterday’s session confirmed that the “next” big slide is already underway and it seems that the profits on the current short position will become much bigger – after all our target of $960 in gold is well below the current market price.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $973; stop-loss: $1,107, initial target price for the DGLD ETN: $117.70; stop-loss for the DGLD ETN $81.84

- Silver: initial target price: $12.13; stop-loss: $14.37, initial target price for the DSLV ETN: $101.84; stop-loss for DSLV ETN $64.26

- Mining stocks (price levels for the GDX ETF): initial target price: $10.23; stop-loss: $15.47, initial target price for the DUST ETF: $31.90; stop-loss for the DUST ETF $10.61

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $15.23; stop-loss: $21.13

- JDST ETF: initial target price: $52.99; stop-loss: $21.59

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

We are going to write about gold in the new non-zero interest rates world in the upcoming edition of the Market Overview in greater detail, but let’s now sketch the possible consequences of the recent interest rate hike for the gold market.

Is There Life for Gold After Fed Hike?

The link between inflation and the gold market is very often studied, however, analysts focus practically only on the CPI. We invite you to read our today’s article on the relationship between the price of gold and other measures of inflation and learn how to take advantage of the short-term gold trading opportunities related to the releases of the Personal Consumption Expenditures Price Index and the Producer Price Index.

Do Inflation Indicators Drive the Prices of Gold?

Yesterday, the Federal Reserve decided to raise interest rates by 25 basis points for the first time in almost a decade, which fuelled optimism over the strength of the U.S. economy and pushed the USD Index to 99 earlier today. How did this move affect the technical picture of EUR/USD, GBP/USD and USD/CAD?

Forex Trading Alert: FED Decision and Its Impact on Currency Market

=====

Hand-picked precious-metals-related links:

BREAKING NEWS: U.S. Silver Production Plunges

Gold miners get crushed after the Fed raises rates

=====

In other news:

China Beige Book Shows ‘Disturbing’ Economic Deterioration

Ukraine Defaults on $3 Billion Bond to Russia

All of the world's money and markets in one giant visualization

Cameron faces tough negotiations over UK’s future in Europe

Goldman Sachs expects oil prices to fall further as OPEC stands pat

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts