Briefly: In our opinion, short (full) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

The precious metals once again moved significantly lower yesterday and once again we profited on these moves. However, there is one thing that indicates that we might be at a major bottom - mining stocks are not really moving much lower despite gold’s plunge. Are we likely to see the final bottom soon or have we already seen it?

In short, in our opinion, it’s very unlikely. It’s true that mining stocks didn’t move much lower recently, but it seems that: 1. they had a good reason for it, and 2. this reason is likely to disappear relatively soon.

Let’s take a closer look at the charts (charts courtesy of http://stockcharts.com).

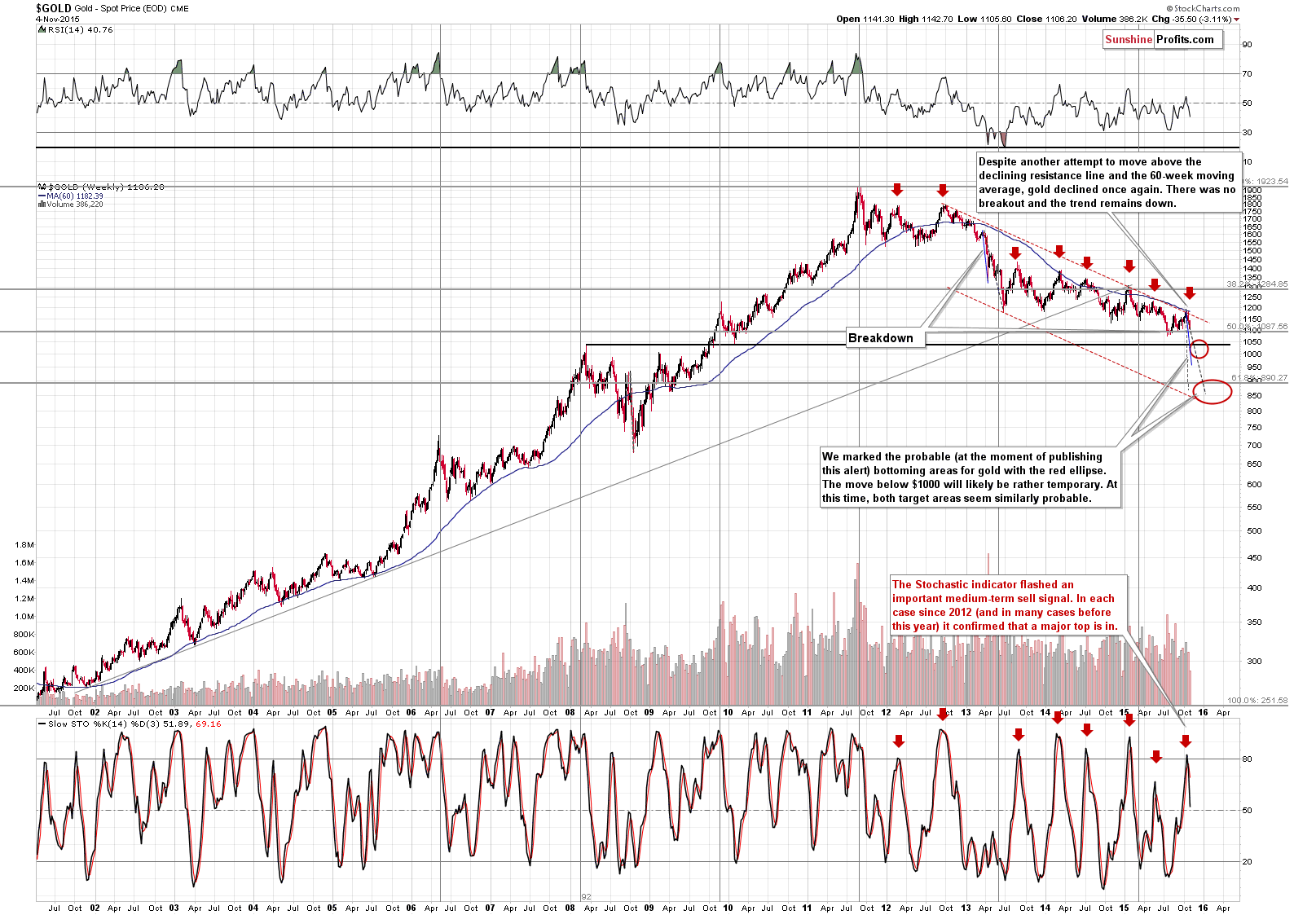

The long-term gold chart shows that gold topped at the declining resistance line and the 60-week moving average. However, we would like you to focus on the lower part of the declining trend channel – this shows just how far gold could slide before the decline is over. The next target area is between $1,000 and $1,050 and we’ll be monitoring the gold market for signs of strength once it moves closer to these levels.

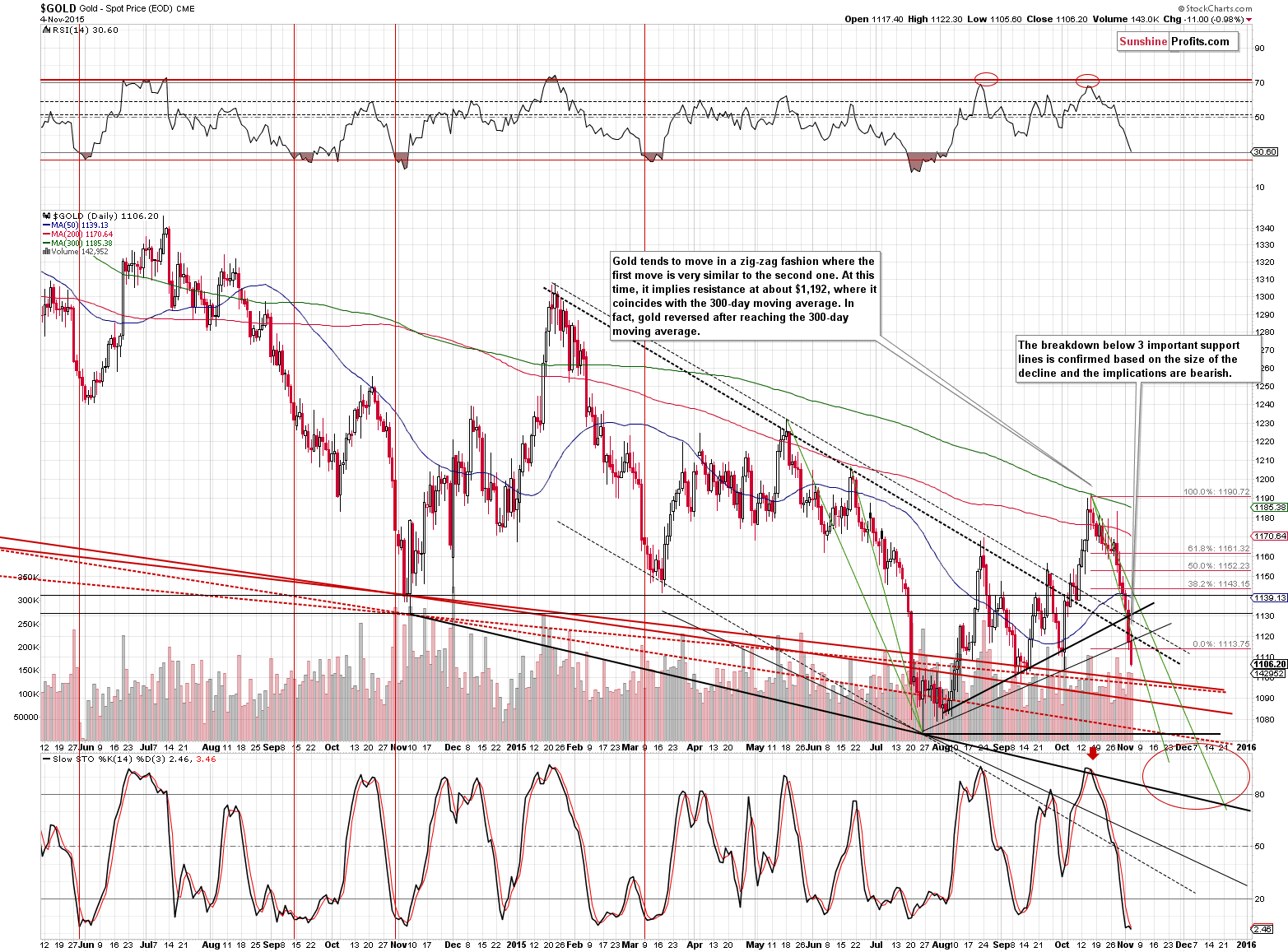

Gold has just declined below the October intra-day low, which means that it has more than erased the entire October rally (that got many gold investors way too excited). Gold broke and declined significantly below most of the support lines and the volume was not low.

The outlook remains bearish, but let’s keep in mind that no market can move up or down in a straight line, so we will eventually see a corrective upswing, likely before gold moves close to the $1,050 level. As you can see on the above chart, there are quite a few additional support levels that could trigger the corrective upswing (and it’s unclear which of them will manage to do so). When that happens, however, it doesn’t seem to be worth exiting the current short positions as the move will likely not take gold much higher and will likely not take long.

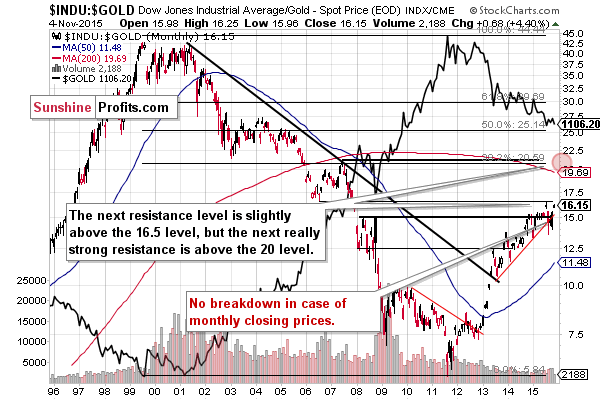

The Dow to gold ratio moved sharply higher, proving that the recent move back above the rising support/resistance line was no coincidence. We could see a pause when the ratio moves to the previous 2015 high (at about 16.5), but it’s not certain. The upside target of about 20 remains up-to-date.

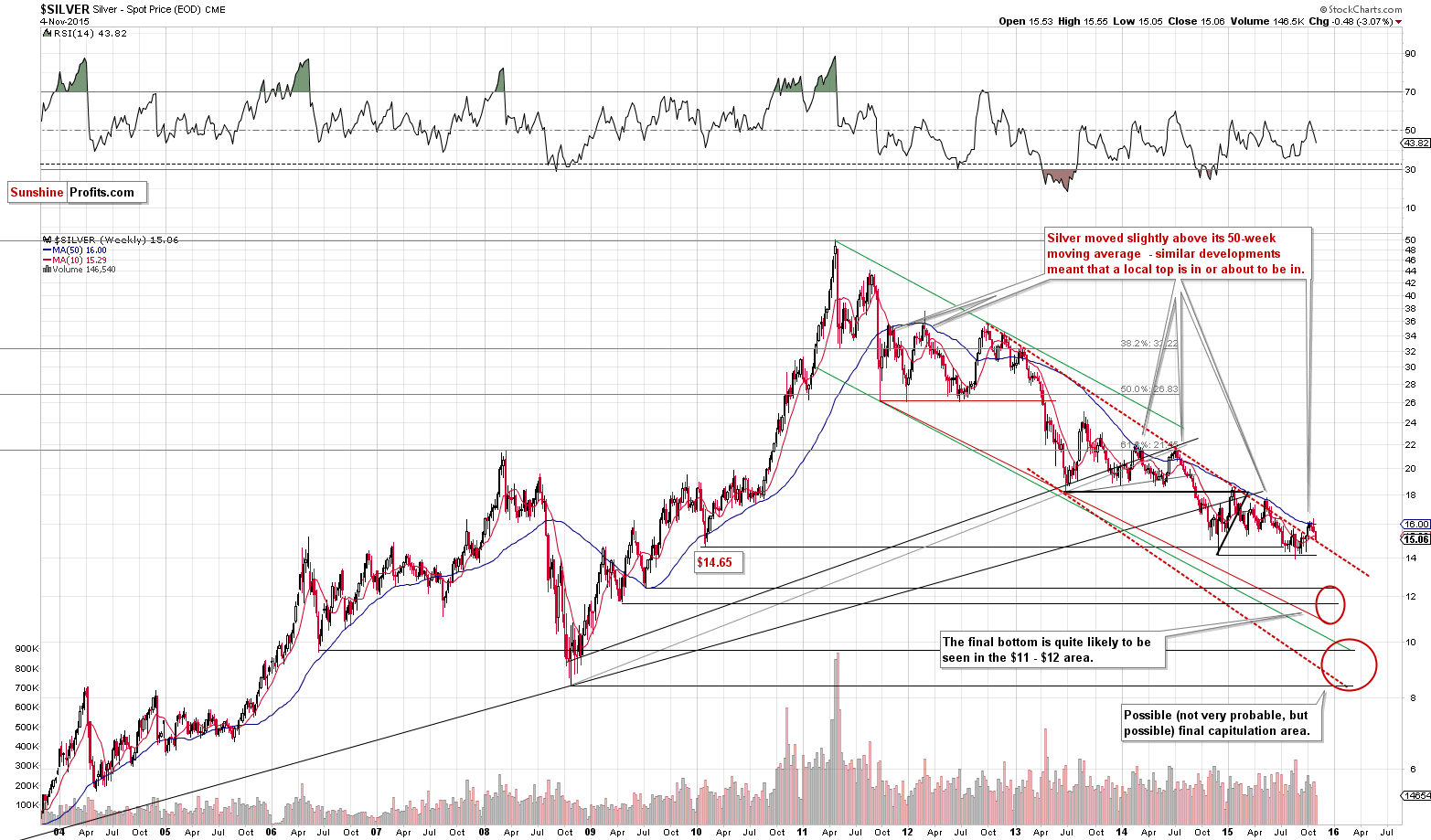

Silver declined back to the declining red resistance/support line. The last time it did so, it didn’t rally back up (at least not significantly) – instead, silver moved even lower and traded sideways for several days only to continue the slide shortly thereafter. This seems like a likely scenario for the following days and weeks.

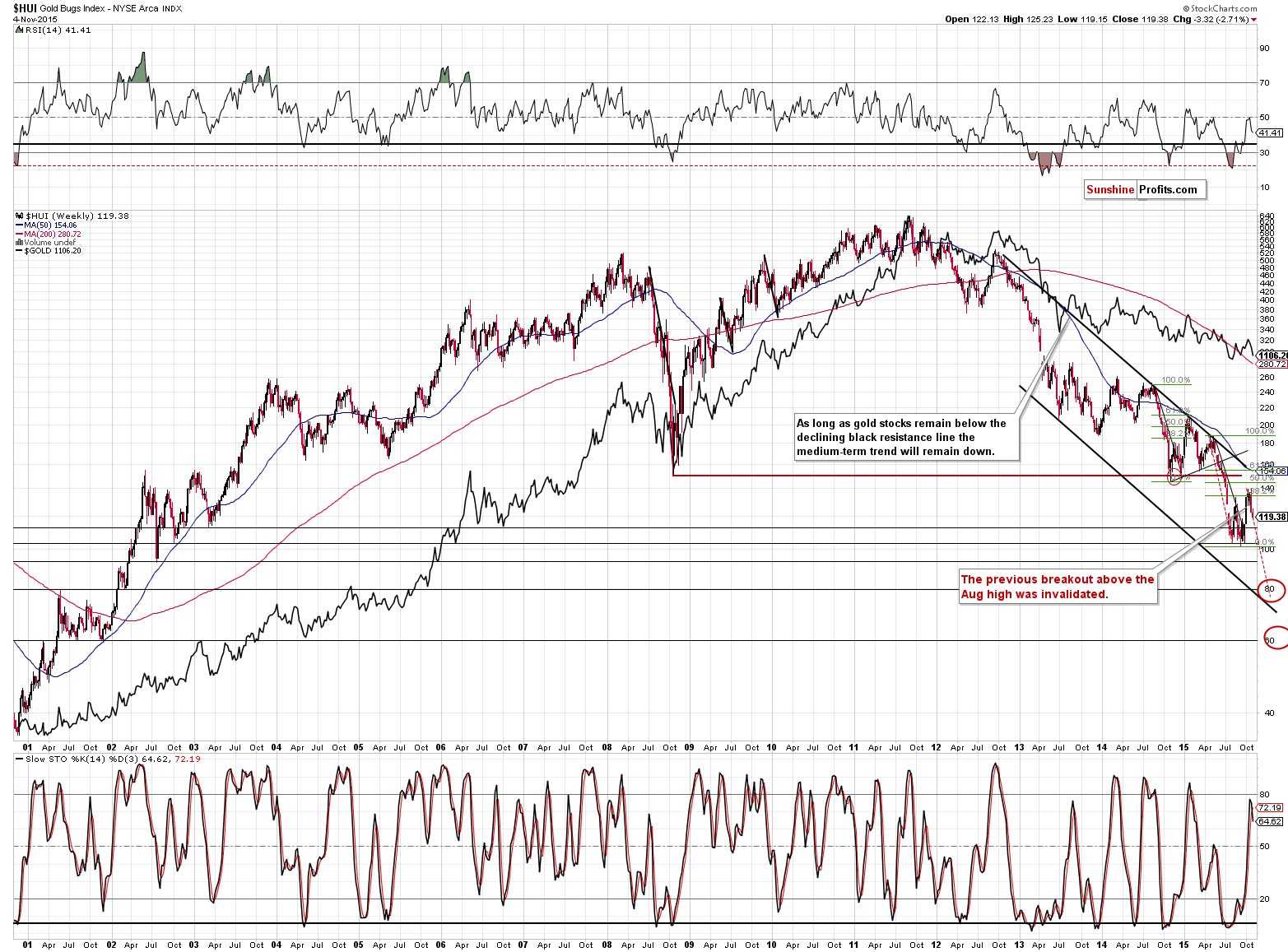

The gold stocks’ performance can be viewed as strength, but the above chart clearly shows that the current pace at which miners decline is actually in tune with what we saw at the previous decline, so it’s not really alarming or particularly bullish.

In yesterday’s alert, we wrote the following regarding mining stocks:

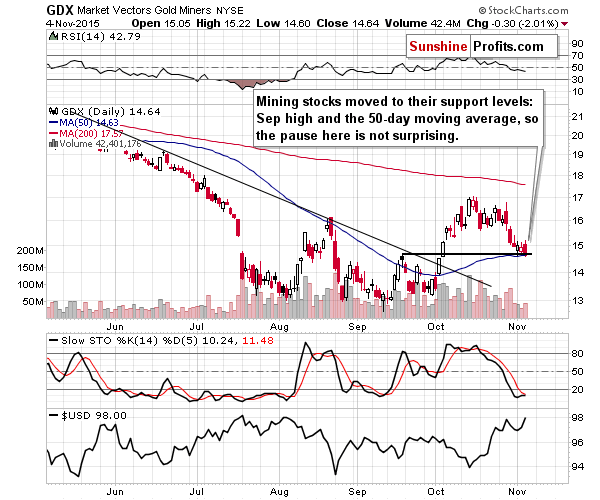

Miners moved higher by only a few cents and the fact that they formed a reversal candlestick is not really relevant, because the accompanying volume was low (in both absolute and relative terms). It seems that the miners’ pause was a reaction to the general stock market’s rally – not a show of true strength of the precious metals sector.

We can say the same once again today, as we saw more or less a repeat of what had happened previously. Today, we would like to add that there were 2 additional reasons for miners not to decline significantly: the September high and the 50-day moving average. Both levels helped to keep the miners’ declines in check, especially in light of a rising stock market.

The above remains up-to-date. What’s the other reason for the possible miners’ strength other than the mentioned technical factors? The rally in the general stock market. The rally in the main stock indices is likely to end relatively soon and once that happens, miners are likely to catch up with gold by declining quite sharply.

We covered multiple bearish signs on Monday, but let’s take a look at one additional – a very important one.

In yesterday’s alert, we wrote the following:

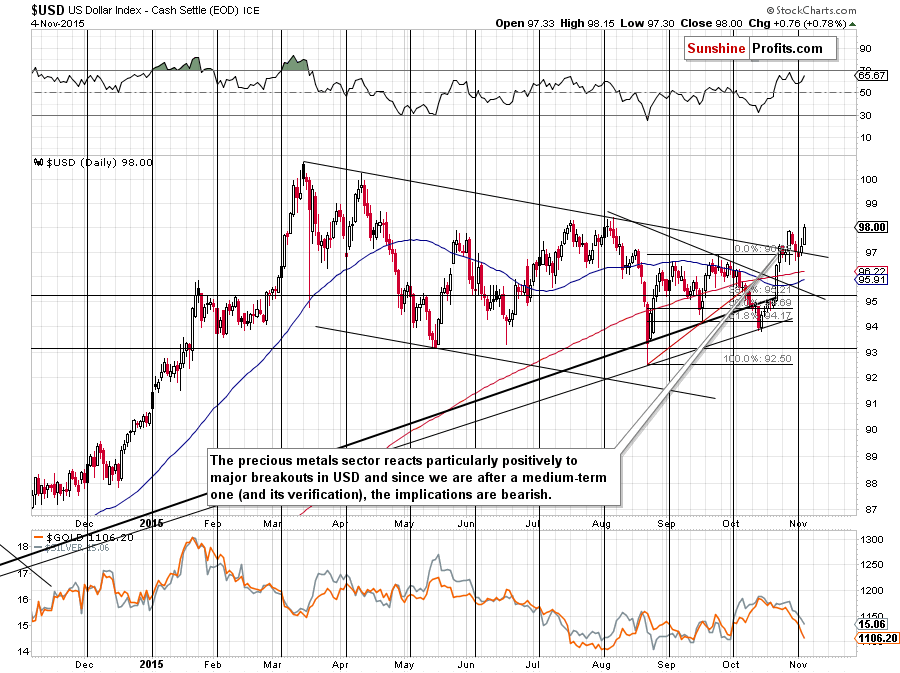

The outlook for the USD Index is bullish (and our short positions in EUR/USD are likely to become even more profitable in the coming weeks) and this has important bearish implications for the precious metals market. We previously wrote that metals and miners reacted mostly to breakouts and breakdowns in the USD Index and it was true also this time – the precious metals sector hesitated while the USD was rallying (but not breaking higher) only to decline when the USD indeed declined and verified the breakout. The USD Index is now right after a cyclical turning point and the small, short-term move preceding it was down, so the implications are bullish for the USD – and bearish for metals and miners.

The resistance line that was just broken is significant and the USD Index can now rally at least to the previous 2015 high. If that happens, metals and miners will be likely affected very negatively. Even without considering multiple bearish signs covered on Monday, this factor alone is something that makes us stick to our short positions despite the risk of a temporary upswing.

The USD Index rallied visibly yesterday and the above comments remain up-to-date. The implications remain bearish for the precious metals sector.

All in all, not much changed yesterday (as far as the outlook is concerned) even though miners and – especially – metals declined visibly. Consequently, we will summarize today’s alert just as we summarized yesterday’s issue:

Summing up, the medium-term decline in the precious metals sector continues and there are multiple signs that confirm this bearish outlook. This week we saw some signs that could indicate a possible temporary upswing in the coming days, but – even if it materializes – it doesn’t seem that this move would be significant or worth betting on. In our opinion, the current short position continues to be justified from the risk to reward point of view and it seems likely that it will further increase our profitability.

Since gold moved much lower, and so did the resistance lines and moving averages, we are adjusting the stop-loss level for gold by moving it lower as well. We are not adjusting anything regarding the position in silver and mining stocks.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short position (full) position in gold, silver and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and initial (! – this means that reaching them doesn’t automatically close the position) target prices:

- Gold: initial target price: $1,050; stop-loss: $1,167, initial target price for the DGLD ETN: $98.37; stop-loss for the DGLD ETN $71.04

- Silver: initial target price: $12.60; stop-loss: $16.73, initial target price for the DSLV ETN: $96.67; stop-loss for DSLV ETN $40.28

- Mining stocks (price levels for the GDX ETF): initial target price: $11.57; stop-loss: $18.13, initial target price for the DUST ETF: $26.61; stop-loss for the DUST ETF $9.22

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $16.27; stop-loss: $25.23

- JDST ETF: initial target price: $46.47; stop-loss: $15.58

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The European Central Bank said that four major Greek banks must find up to €14.4 billion to survive potential negative shocks. What does it mean for the global economy and the gold market?

Greek Banks Must Raise €14.4 Billion for ECB Stress Tests

=====

Hand-picked precious-metals-related links:

PM Modi launches India Gold Coin, Gold Monetisation & Gold Sovereign Bond schemes

Fed inflicts more damage on gold price

=====

In other news:

Dollar jumps as markets fix on December rate expectations

Auto loans reach an all-time high

Details of controversial Pacific trade deal are released

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts