Briefly: In our opinion, no speculative position in gold, silver and mining stocks is justified from the risk/reward point of view.

The precious metals market moved higher yesterday and the million-dollar question is how much changed because of this rally. Did gold’s $20+ move higher change anything? Let’s take a look at the charts (charts courtesy of http://stockcharts.com).

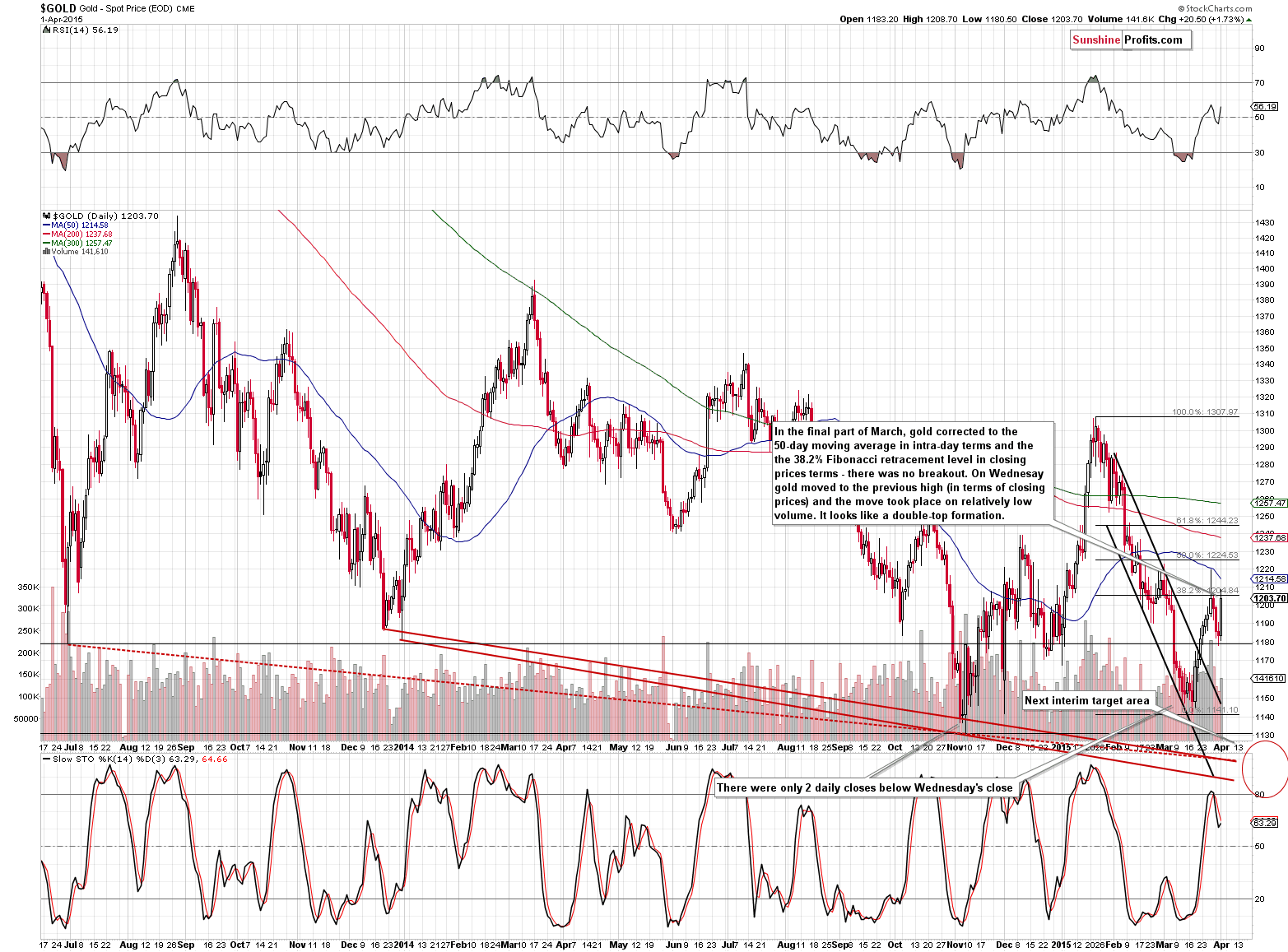

Gold moved higher yesterday and closed at the previous local high (in terms of closing prices). This time the volume that accompanied the move was lower than when it had previously rallied to this level, so the entire formation could become a double top. The implications of the above chart remain bearish.

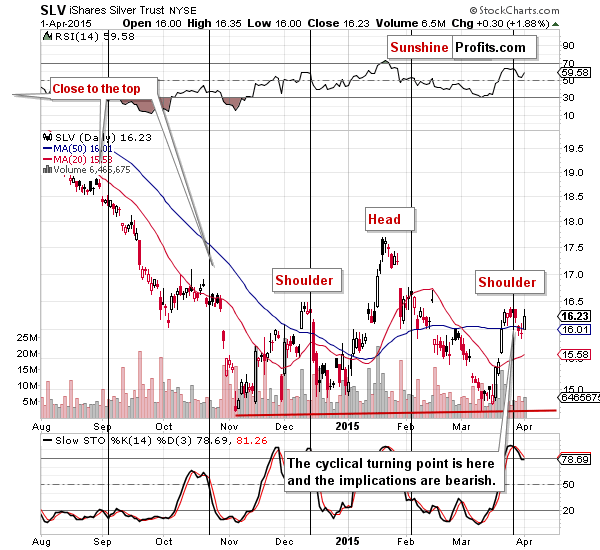

Silver moved higher as well and just like it was the case with gold, it didn’t move above the previous local high. Not much changed on the above chart.

Another thing that’s worth keeping in mind at this time is the head and shoulders formation that is probably being formed (we will know for certain only after it is completed). The pattern is big and its implications are very bearish, however not for the very short term. If silver moves higher $0.50 or so, the pattern will not be invalidated and the bearish implications for the following weeks will remain in place. It does not rule out such a very short-term move by itself.

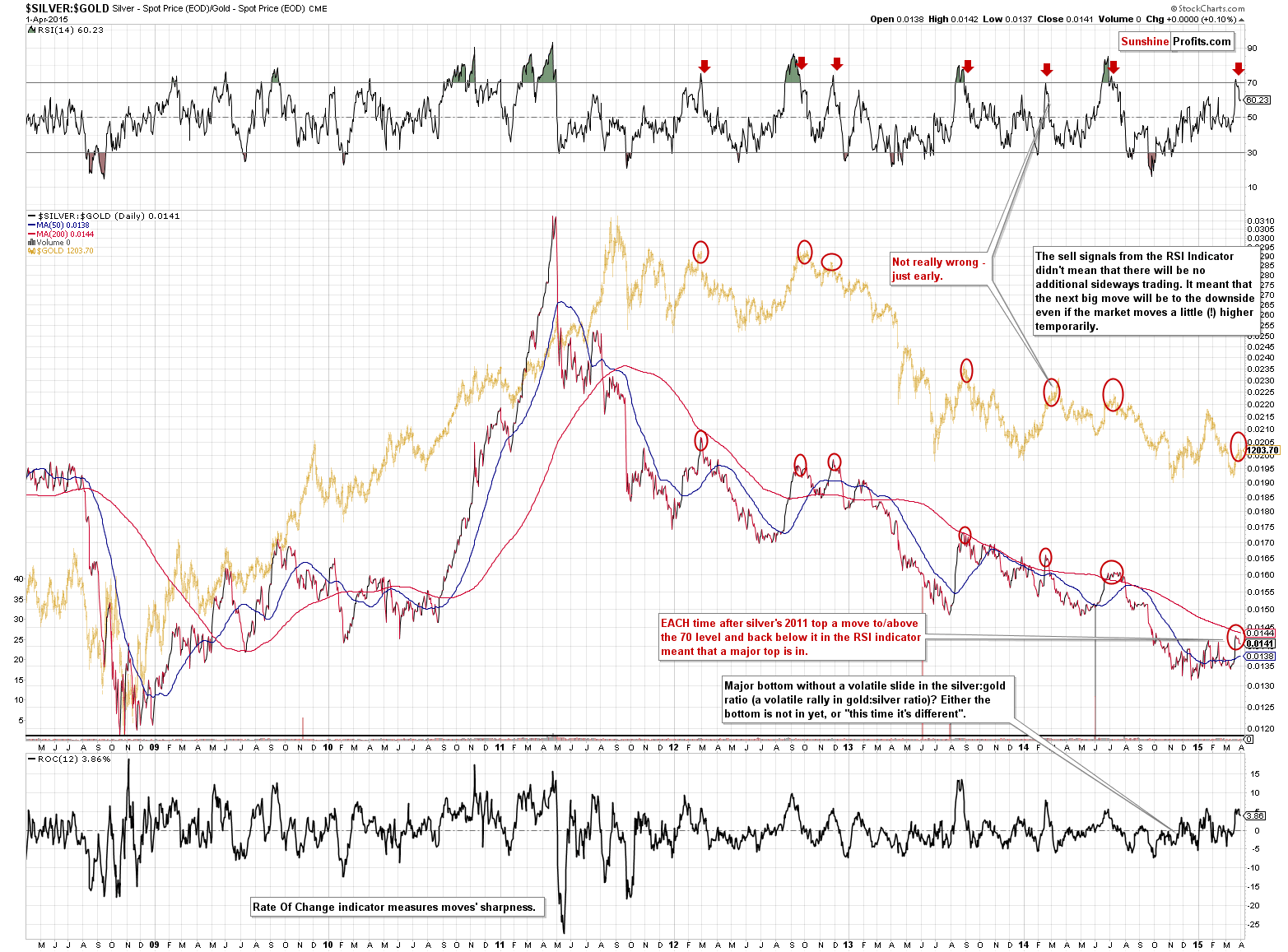

We can say the same about the very important and very bearish signal from the silver to gold ratio and more precisely from the RSI indicator based on it. The implications are strongly bearish, but not necessarily for the very short term.

Our previous comments on the above chart remain up-to-date, though:

Note the red arrows that mark the sell signals and what happened with the silver to gold ratio and gold in the past years.

Some would say that silver is leading gold higher. Others would say that “whites lead yellow” suggesting that silver’s (or platinum’s) outperformance is a very bullish sign. Here’s our take:

Wrong.

Very wrong.

OK, there are no sure bets in any market, but the odds are that the most recent outperformance of silver is just a sign preceding a major top. Just take a look what happened in the past YEARS. EACH TIME (yes, each time) the RSI indicator based on the silver to gold ratio moved above 70 and then moved back below it (the times when silver outperformed gold for some time, but then it moved back down again), a major top was formed. That’s a signal that’s been 100% effective for 4 years. If this was the case for a year and there were 3 such cases, we would not be that excited, but it’s a signal that has been in place for 4 years and we saw 6 signals that were followed by 6 declines, which makes this signal something that should definitely not be ignored. The implications, of course, are bearish.

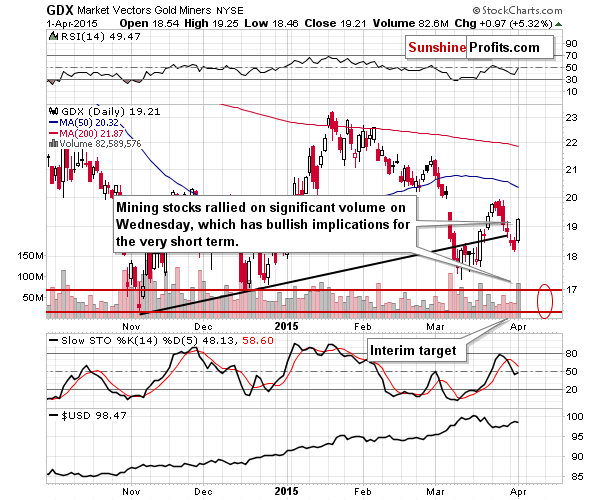

The situation in mining stocks, however, has clearly improved for the very short term. Yesterday’s rally was quite big and it was accompanied by big volume. While it doesn’t have meaningful implications for the medium term, this is a bullish sign for the very short term. We saw similar daily action in mid-March and it was followed by a $1 rally.

In yesterday’s second alert we wrote that the volume in mining stocks was small at that moment and that the prices of mining stocks were not moving much higher. Their prices and volume caught up and ended the day at much higher levels. Consequently, the situation changed and improved for the very short term.

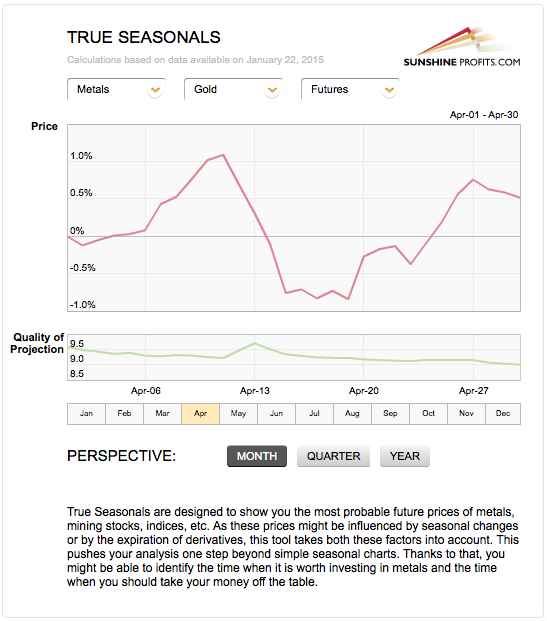

Before yesterday’s session (and in the first half thereof) it seemed that the combination of bearish factors and lack of bullish ones was something that made the True Seasonal patterns less important. At this time, however, we think that they could be very useful.

Gold tends to move higher in the first part of part of April only to disappoint close to the middle of the month. Consequently, a very short-term rally should not surprise us, but we should not expect it to be anything more than that. This is in tune with other signals.

Summing up, while the outlook for the precious metals market remains bearish for the medium term (the following weeks) it has just improved for the very short term (the following days). Since the gold and silver charts don’t point to higher prices on their own and only the miners chart and True Seasonals do, it doesn’t seem that the situation is bullish enough to justify opening long positions. It does seem, however, that keeping even small short positions at this time is too risky as the odds for a quick (but temporary) move higher that would trigger the stop-loss orders are too high.

Please note that gold could move to $1,250 or so (and this could actually take place in the following days, but a move to $1,235 seems more probable) and it would still not invalidate the bearish outlook for the medium term (unless it was accompanied by other important developments, of course).

It seems that we will have an opportunity to re-enter the short positions in just several days (and perhaps at more favorable prices) – we will keep you – our subscribers – updated. Due to the upcoming Holidays and your Editor travel plans, the next alert will be posted on Tuesday, April 7, 2015.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

S&P 500 index extended its short-term consolidation, as investors remained uncertain following recent fluctuations. Which direction is next?

Stock Trading Alert: More Short-Term Uncertainty As Investors Await Quarterly Earnings Releases

Consumer spending rose merely by 0.1 percent in February, according to the report on the U.S. February Personal Income and Outlays. What does it mean for the U.S. economy and the gold market?

Gold News Monitor: U.S. February Personal Income and Outlays

On Tuesday, crude oil lost 2.52% as negotiations with Iran on its nuclear program continued o weigh on investors’ sentiment. As a result, light crude dropped below the resistance area and reached the 50% Fibonacci retracement. Will we see further deterioration in the coming days?

Oil Trading Alert: Oil Bears in Charge

=====

Hand-picked precious-metals-related links:

JP Morgan lowers gold, silver price forecast for 2015

Report: 2016 is start of new gold bull cycle

Gold imports up by 67%, silver down by 56%

Impala to build power plant fired by fuel cells

=====

In other news:

Samaras Says He’d Join Alliance to Keep Greece in Euro

Doubts over U.S. growth cool dollar rally

Iran talks stretch into another day; deal seen close but elusive

In the Iran Talks, Does a Missed Deadline Matter?

These G-10 currencies are in for a bumpy ride

Janus Capital's Bill Gross: Markets 'hostile' to investors

Goldman Sachs on oil: US needs to cut, not OPEC

Public trading could begin next week for bitcoin fund

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts