Briefly: In our opinion, short (full) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

Gold and silver declined on Friday but mining stocks showed some strength and refused to move lower despite gold’s and the general stock market’s decline. How much did this action change?

In our opinion, not much. Miners moved a bit higher – that’s true – but the volume on which they rallied was low and it’s actually no wonder that they paused as the are already at their previous 2015 lows, while gold and silver are not (yet) so low. No market can move up or down in a straight line and just because miners paused, it doesn’t make the outlook bullish. Let’s take a look at the details (charts courtesy of http://stockcharts.com).

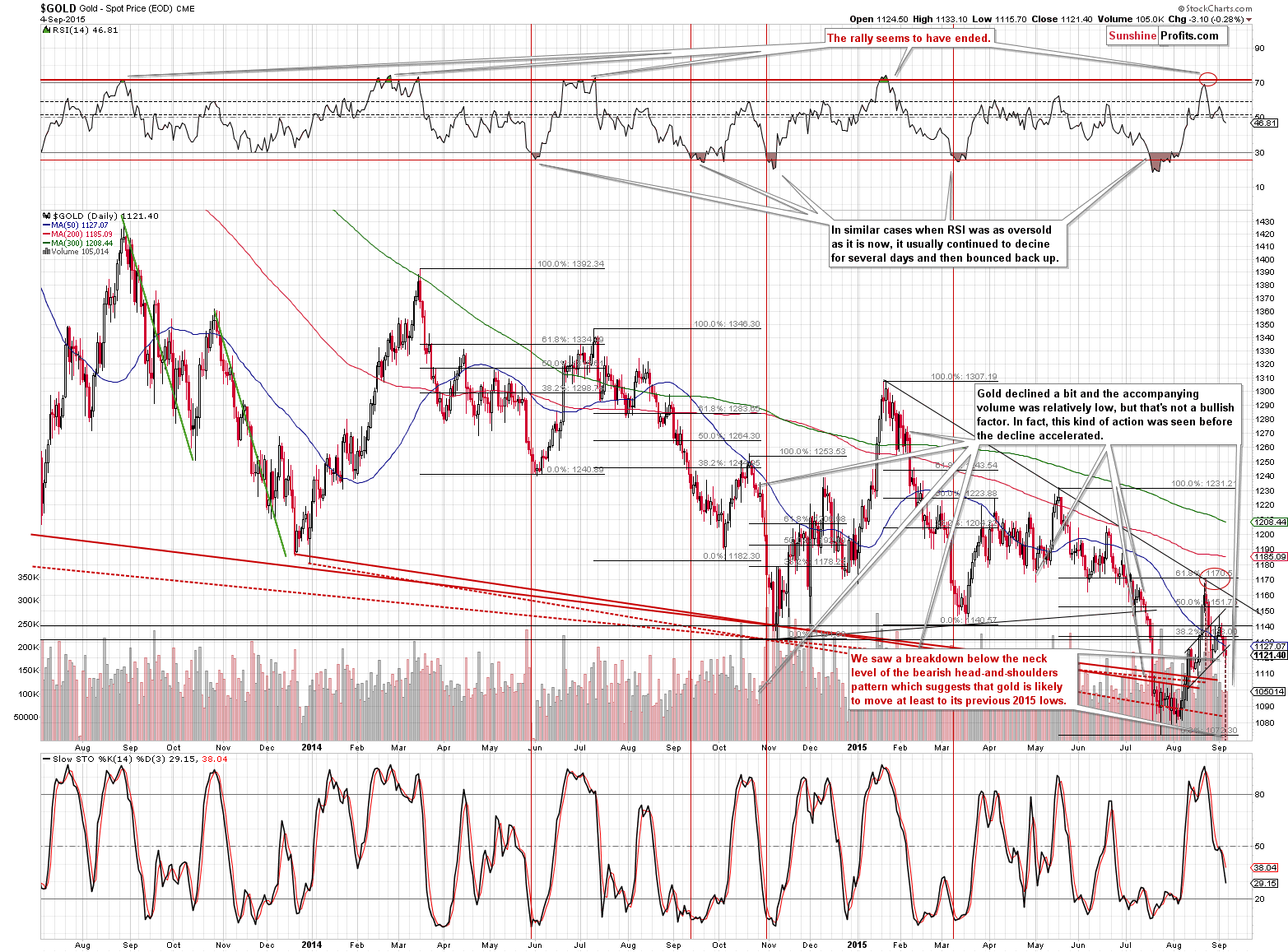

To a large extent, our previous comments on the above chart remain up-to-date:

The volume was indeed low, but in several previous similar cases low-volume declines were in fact the final step before a sharp decline in gold. History tends to repeat itself to a considerable extent, so it’s hard to view the low volume during gold’s decline as a bullish sign.

Moreover, please note that gold’s performance since mid-August can be viewed as a bearish head-and-shoulders pattern. Gold moved to the line that is parallel to the neck level, which means that the 2 shoulders of the pattern are similarly big. This makes the formation more believable. Of course, it will have very bearish implications only after it is completed, but it seems that this it’s completion is quite likely possible.

The new development is that gold just broke and close the week below the neck level of the mentioned head-and-shoulders pattern. Consequently, the situation deteriorated once again and we can expect lower prices in the coming days. It’s usually not enough for just one daily close to confirm a breakdown, but in this case it was also a weekly breakdown, which makes it more significant and meaningful.

The mentioned head-and-shoulders pattern suggests that gold will move at least (!) to its previous 2015 lows. The size of the decline after the breakdown below the “neck level” is likely to be at least equal to the size of the “head”.

The interesting fact is that since miners are already at their 2015 lows, then if gold moves much lower, they are likely to move substantially lower as well. Consequently, our short positions are likely to become much more profitable in the coming days and weeks.

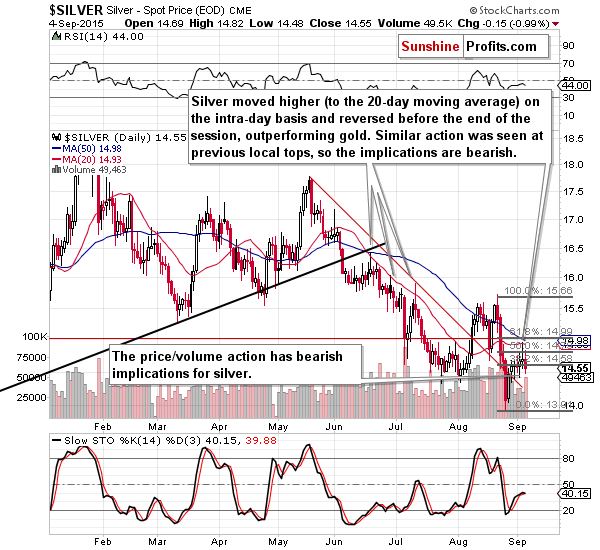

We previously commented on the above chart in the following way:

Silver moved higher, especially on an intra-day basis, and for those who are new to the precious metals realm it might have seemed bullish. The tendency, however, is for silver to perform like that right before sharp declines. The intra-day rally and reversal to the 20-day moving average meant local tops several times in the recent months and it seems that this will be the case also this time.

Moreover, please note that yesterday’s intra-day high is practically the same as the late-July high, which means that we might be looking at a bearish head-and-shoulders pattern in silver, just like we are likely looking at one in gold. Again, the implications are bearish.

Silver moved lower, so it could have been the case that the local top had been just formed. More importantly, silver declined on high volume, which confirms the bearish outlook.

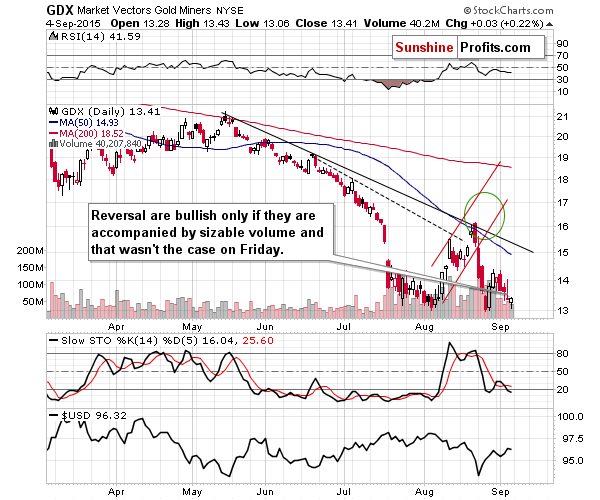

Miners moved 3 cents higher on Friday, invalidating the intra-day decline, which might seem like a bullish event, but we think that it isn’t one. In light of the fact that miners are already at the previous 2015 lows, it’s not surprising that we saw a small rebound. It’s natural, not necessarily a sign of strength.

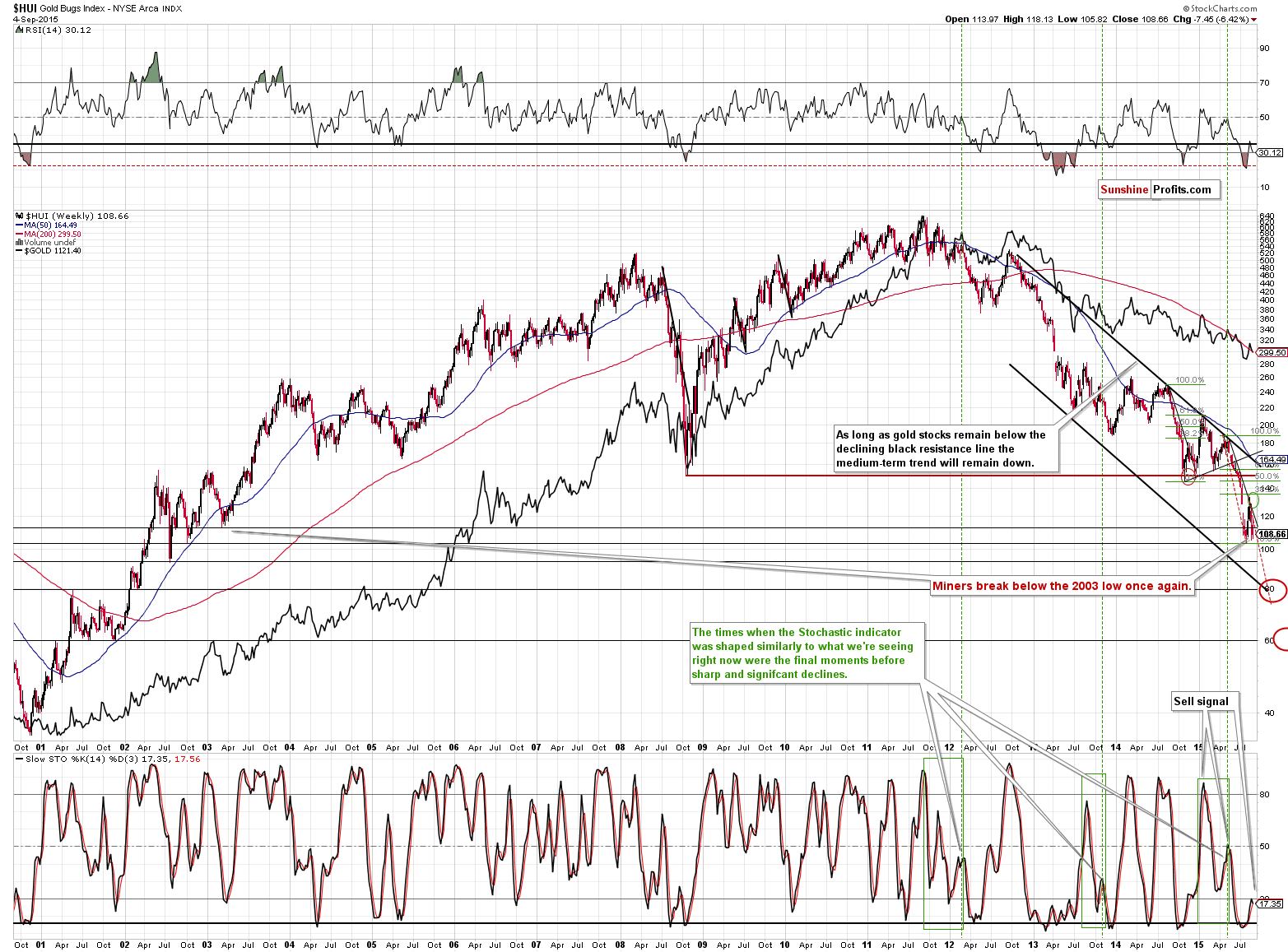

From the long-term perspective, we see that the daily turnaround didn’t change anything. Miners are already at their 2015 lows and metals aren’t, which means that miners are underperforming, which is a bearish sign.

Moreover, the Stochastic indicator based on weekly closes of the HUI Index just flashed a sell signal, which is a major bearish sign. We feel quite good having short positions that were opened at higher price levels.

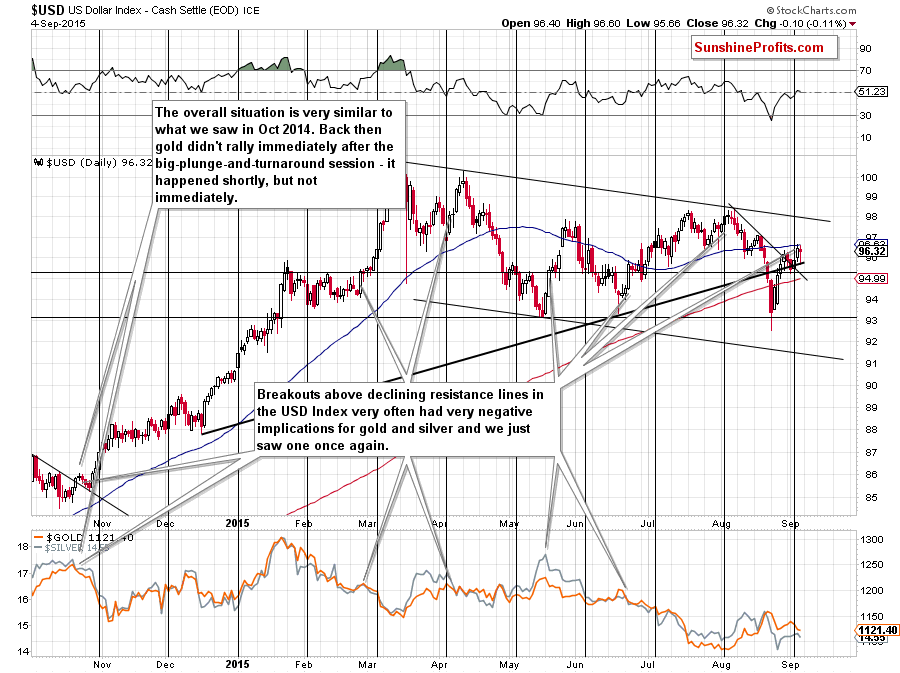

Finally, the USD Index continues to have bearish implications for the precious metals market.

In Friday’s alert we wrote the following:

The USD Index broke above the declining support line (thus increasing the profits on our short EUR/USD position) and breakouts in USD very often have very bearish consequences for the precious metals sector. The breakdown above the declining medium-term resistance line will be even more profound, but what we saw yesterday is already bearish for PMs and miners.

The above remains up-to-date. The USD declined a bit, but not below the previously broken medium-term support/resistance line. Consequently, the outlook for the USD remains bullish and it is bearish for the precious metals sector.

Before summarizing, we would like to draw your attention to our previous articles. If you’ve been following our alerts for some time, you can ignore that, but if you subscribed recently, we encourage you to go though our alerts that include details on the following topics:

- Gold Price Targets

- Silver Price Targets

- Bottom’s Confirmations (most important out of these 3)

Overall, since the situation in the precious metals market once again deteriorated (the short-term outperformance of silver actually has bearish implications and gold just broke below the neck level of the head-and-shoulders formation). We can summarize today’s alert in the same way as we summarized the previous issue:

Summing up, the situation and outlook didn’t change based on yesterday’s price move and the outlook remains bearish.

The analogy to the similar session (Oct. 15, 2014), gold’s underperformance relative to the USD Index, and other technical signs make us think (our opinion) that much lower prices are in the cards and that the short positions will become much more profitable than they already are (despite natural corrections along the way).

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short position (full) position in gold, silver and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and initial (! – this means that reaching them doesn’t automatically close the position) target prices:

- Gold: initial target price: $1,050; stop-loss: $1,213, initial target price for the DGLD ETN: $98.37; stop loss for the DGLD ETN $65.60

- Silver: initial target price: $12.60; stop-loss: $16.73, initial target price for the DSLV ETN: $96.67; stop loss for DSLV ETN $40.28

- Mining stocks (price levels for the GDX ETN): initial target price: $11.57; stop-loss: $17.33, initial target price for the DUST ETN: $41.10; stop loss for the DUST ETN $8.54

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ: initial target price: $16.27; stop-loss: $24.33

- JDST: initial target price: $16.98; stop-loss: $3.42

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The price of gold did not react significantly after the last Black Monday. Did gold fail as a safe-haven asset?

Is Black Monday Bad News for Gold?

Many analysts claim that the changes in the money supply drive the price of gold. In today’s article we examine whether they are right. We invite you to read it and learn what is the real link between the money supply and the price of gold.

Does Money Supply Drive the Gold Price?

On Thursday, the ECB’s held its monetary policy meeting and the press conference. How the ECB’s last decisions may impact the global economy and the gold market?

=====

Hand-picked precious-metals-related links:

Gold may fall below $1,000 an ounce in 2016: BofA Merrill Lynch

Platinum upgrade to golden reserve status seen as monetary alchemy

Platinum supply deficit shrinks

=====

In other news:

China Debt Crisis? The Other Side of the Ledger Suggests Not

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts