Briefly: In our opinion, long (half) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

The signals that the precious metals market currently provides are not easy to interpret – gold broke below the previous lows and didn’t invalidate its breakdown, silver invalidated the breakdown but just broke below the previous lows once again, and miners refused to break below their previous lows and are holding up strongly. What does the above provide us with? A trading opportunity.

Let’s take a look at the charts (charts courtesy of http://stockcharts.com).

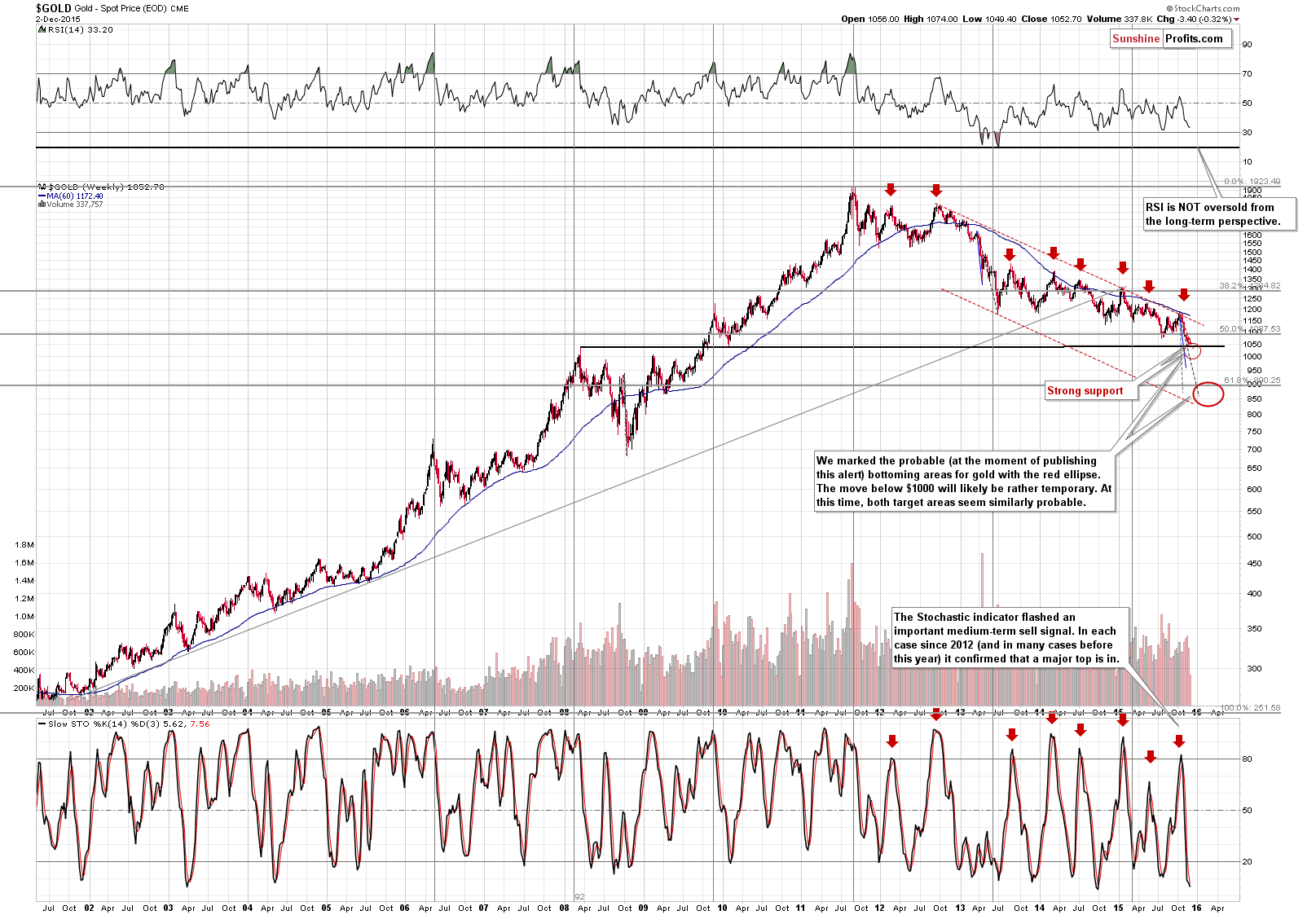

From the long-term point of view, gold moved close to the strong support provided by the 2010 intra-day low - $1,044.50, which on its own is not yet a strong bullish factor (moving to $1,000 would be one, though), but the fact that the important long-term support is very close is something worth keeping in mind.

If gold moves a bit higher then we might see a buy signal from the weekly Stochastic indicator, and – unlike its daily version – this indicator has been quite reliable in the past months.

The above has somewhat bullish implications for the short term, but the bearish implications for the medium term remain in place.

Gold declined significantly yesterday, which appears to be a bearish factor, but it seems that it’s not very bearish in light of the looming long-term support just a little lower (less than $10 lower).

Interestingly, there is also another support at $1,044 – the declining support line based on the November 2014 and July 2015 lows.

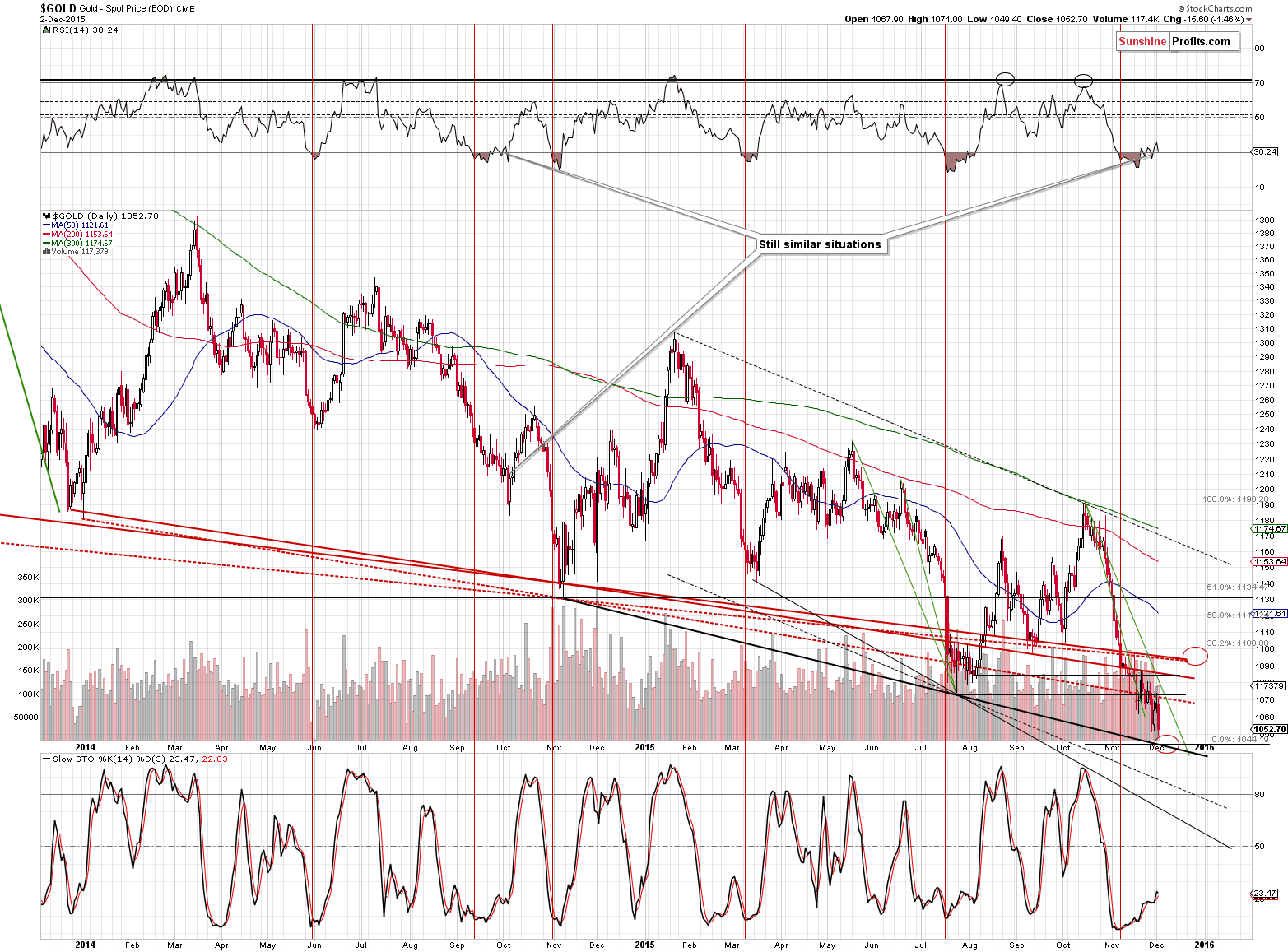

Another important thing is that gold’s decline is very similar to its previous declines in the recent months. The green lines show that its very similar to the May-July decline, and – while we didn’t mark it on the chart in order for it to remain clear – the size and pace of the current decline are practically identical to what we saw during the first decline of this year (January – March). Actually, moving to $1,044 would make these moves almost identical.

In the previous alerts, we commented on the RSI indicator and the similarity between now and what had happened in late September 2014 – early October 2014. Back then gold moved lower, albeit in a back-and-forth fashion, in the final days of the first part of the decline. Gold bottomed about 3 weeks after the initial breakdown below 30 in the RSI, which is where we are right now. There was a significant daily slide at the end of the decline (actually a day before the intra-day bottom) and this might be where we are right now, especially given the proximity of 2 important support levels at about $1,044.

Finally, we would like to discuss yesterday’s volume. It was low in the case of gold, but it was very high in the case of the GLD ETF. This is not something that we see often, so we investigated and found 2 situations in the recent and not-so-recent-but-not-very-distant past when this happened: December 29, 2014 and May 30, 2014. In both of these cases gold was right before a local bottom, but not yet at it. This serves as a very good confirmation of what we wrote earlier today.

How high can gold go, if it rallies? The $1,100 level is our best estimate at this time.

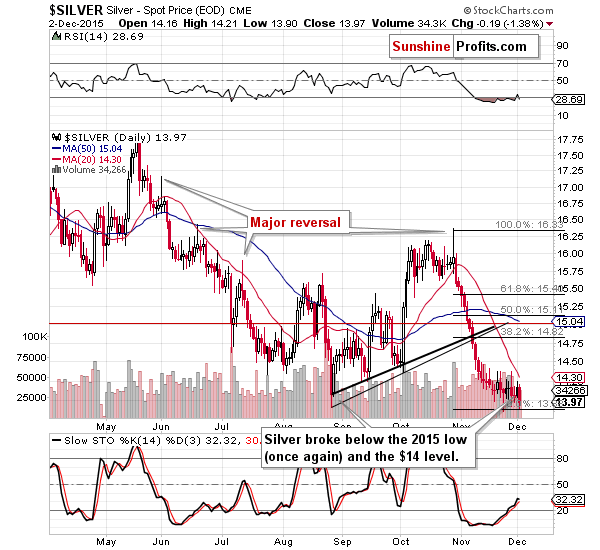

Silver broke below its previous 2014 low and this new breakdown is not yet confirmed. If gold declines and the moves back up, then we can expect big volatility in silver in both directions. Unfortunately, it’s not clear how low or how high silver will go, based on the above chart and given silver’s very volatile nature around turning points. A $0.50 decline would not surprise us and a subsequent $1+ rally wouldn’t either.

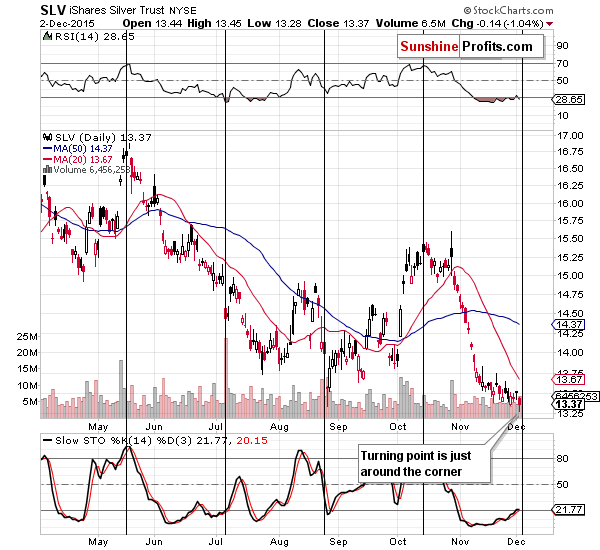

Speaking of turning points…

Silver is right at its turning point. This, plus the previous decline, suggests that a move higher is just around the corner. Please note, however, that the turning point does not exclude or make improbable a situation in which silver declines sharply for a day or two and then comes back up with vengeance – this kind of scenario would be just as much in tune with the previous patterns as would an immediate move higher.

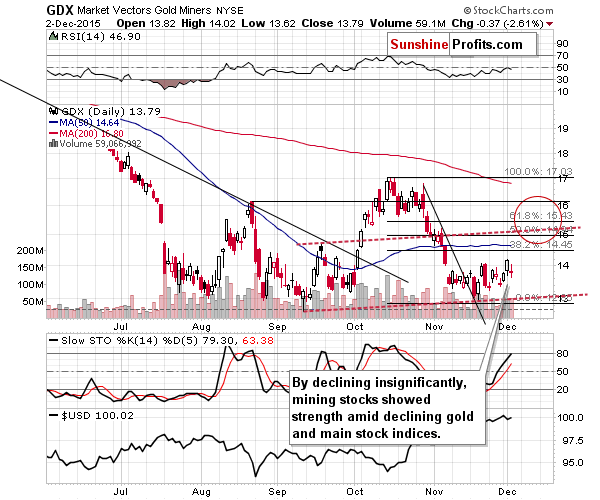

Mining stocks are not only not breaking below the previous lows – they are actually moving visibly higher despite daily price swings. In fact, looking at the above chart would not make anyone think that gold or silver moved to new lows, which was the case. Mining stocks are showing strength and it’s not a one-day event – the implications are bullish.

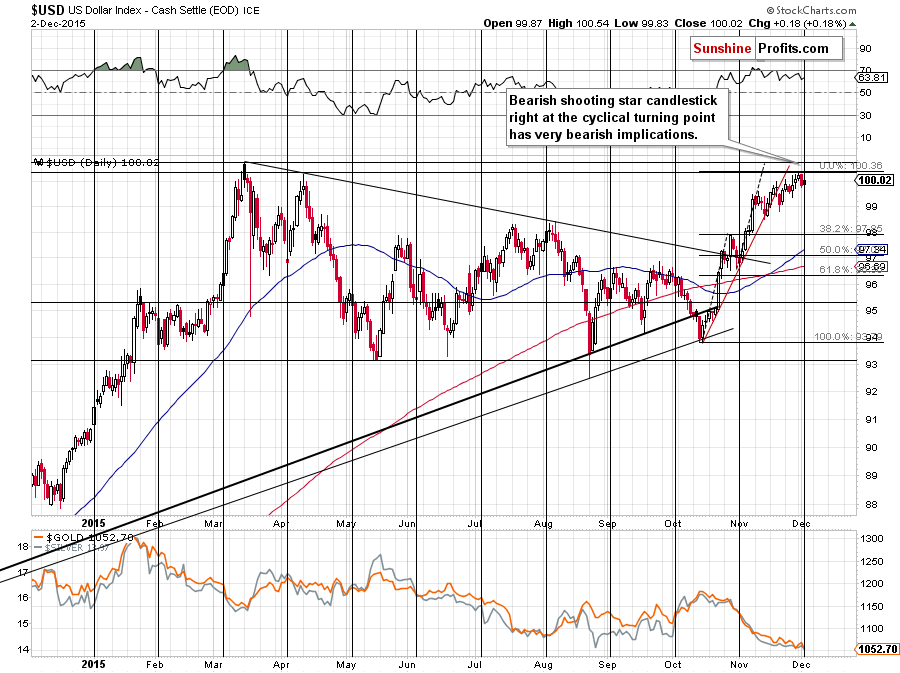

The final chart for today features the USD Index. In yesterday’s alert we wrote the following regarding the above:

Unfortunately, the short-term outlook is not as clear. The USD Index broke a little above the previous high (in terms of the daily closing prices), but the breakout is not confirmed. Will the USD confirm the breakout and rally further? Eventually or within the next several weeks – very likely, but it’s unclear whether this happens in the next several days. The USD’s cyclical turning point is here and given the current rally, the implications are bearish.

On the other hand, as we saw on the previous long-term chart, the USD is already after a sizable consolidation and it’s likely to move higher, so it could be the case that we will see a breakout shortly.

If we see a breakout, how high can the USD rally before correcting? It’s likely to rally to about 102 as that’s where we have the 61.8% Fibonacci retracement of the entire 2001 – 2008 slide.

How low can the USD Index go if it doesn’t manage to hold its recent gains? Probably to 98 or so (July and August highs).

The USD Index just moved below the 100 level and closed there, which means that its previous breakout above the previous 2015 high was invalidated. This has bearish implications for the USD Index and bullish implications for the precious metals sector. At the moment of writing these words, the USD Index is back at 100.04, but this move above 100 is both tiny and not confirmed by a daily close, so overall the situation is still more bearish than not.

We saw a particularly interesting price movement yesterday – they USD Index rallied and even moved to new highs and it declined shortly thereafter, closing at 100.02. This created a very visible reversal pattern – the shooting star candlestick. This pattern, seen after a big rally, signals declines. Another important fact is that this reversal took place right at the cyclical turning point and since the USD Index is after a big rally, it suggests at least a corrective downswing.

The implications for the USD Index are bearish for the short term and they are bullish for the precious metals sector.

Summing up, the outlook for the precious metals market improved significantly for the short term based on yesterday’s session. Mining stocks showed strength once again, which was significant in light of declines in both gold and stocks. The USD Index formed a bearish reversal, and the turning points in the USD and silver both provide additional bullish implications. Gold is very close to a combination of strong support levels, so it seems that the declines in the short term are likely to be limited.

Since there is quite a lot of short-term bullish factors in play (and the situation seems similar to what we saw on Jul. 27), it seems that opening a small speculative long position is justified from the risk to reward point of view. At the moment of writing these words gold is trading at about $1,049, so it’s practically at its support levels and it seems to be justified to enter the long positions at this time.

We will quite likely provide a follow-up to this alert shortly (either today or in the next few days) in which we will either close this small position or double it, depending on what kind of information the market provides us with.

To be clear – we think that this is an interim bottom and not the final bottom for this medium-term decline in the precious metals sector, and we think that after a corrective upswing another big (probably final) slide lower will take place.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Long position (half) position in gold, silver and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and initial (! – this means that reaching them doesn’t automatically close the position) target prices:

- Gold: initial target price: $1,097; stop-loss: $1,028, initial target price for the UGLD ETN: $8.17; stop-loss for the UGLD ETN $6.74

- Silver: initial target price: $14.47; stop-loss: $13.26, initial target price for the USLV ETN: $11.56; stop-loss for USLV ETN $8.85

- Mining stocks (price levels for the GDX ETF): initial target price: $15.37; stop-loss: $12.57, initial target price for the NUGT ETF: $34.59; stop-loss for the NUGT ETF $18.91

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $20.68; stop-loss: $17.76

- JNUG ETF: initial target price: $38.97; stop-loss: $24.83

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

We have already written that the International Monetary Fund has officially designated the Chinese yuan a global reserve currency. However, because there are still a lot of misunderstandings about the impact of this event on the global currency market and the price of gold, we will examine this issue in more detail.

S&P 500 index fell below the level of 2,100 again. Which direction is next? Is holding short position justified?

Stock Trading Alert: Positive Expectations Following Yesterday's Move Down, Will Uptrend Continue?

Although crude oil moved higher supported by a weaker U.S. dollar, the commodity reversed and declined as the uncertainty around weekly supply reports and OPEC Friday’s meeting weighed on the price. As a result, light crude closed another day under its key resistance area. Time for a drop to the barrier of $40?

Oil Trading Alert: Crude Oil Slips Lower Once Again

=====

Hand-picked precious-metals-related links:

AngloGold’s JSE Top 40 exit marks end of era for SA

After Monsoon Failure, Deluge Mars India Gold Demand Outlook

=====

In other news:

December rate hike is a done deal: Wells Fargo Investment Institute president

Janet Yellen: December rate hike likely, but Fed cautious for 2016

After Yellen's teaser, markets hope for Draghi the easer

Five reasons why job creation is so weak

CEOs aren't optimistic about U.S. economy in 2016

This is how low traders see oil going now

OPEC States Push for Output Cuts in Face of Saudi Opposition

ADB chief doesn't expect Fed hikes to trigger Asian financial crisis

INFOGRAPHIC: The race for Arctic domination

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Sunshine Profits - Founder, Editor-in-chief

Sunshine Capital Management, LLC

Sunshine Gold Investment Fund, LP

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts