Briefly: In our opinion, speculative short positions (full) in gold, silver and mining stocks are justified from the risk/reward point of view.

Gold moved higher when stocks declined and it seems to be moving higher (on most days) when stocks are moving higher as well, which appears to suggest that gold can go higher no matter what the stock market does. Are the implications really bullish?

In our opinion, not really. Gold can also decline without the stock market’s help. We think that the corrective rally in gold was not really driven by the decline in the stock market, but to a large extent by the interpretation of what the Fed had said. It appears that the market viewed these comments as very bullish for gold, which is not necessarily the case. Consequently, the precious metals sector could decline regardless of what the stock market does in the near future.

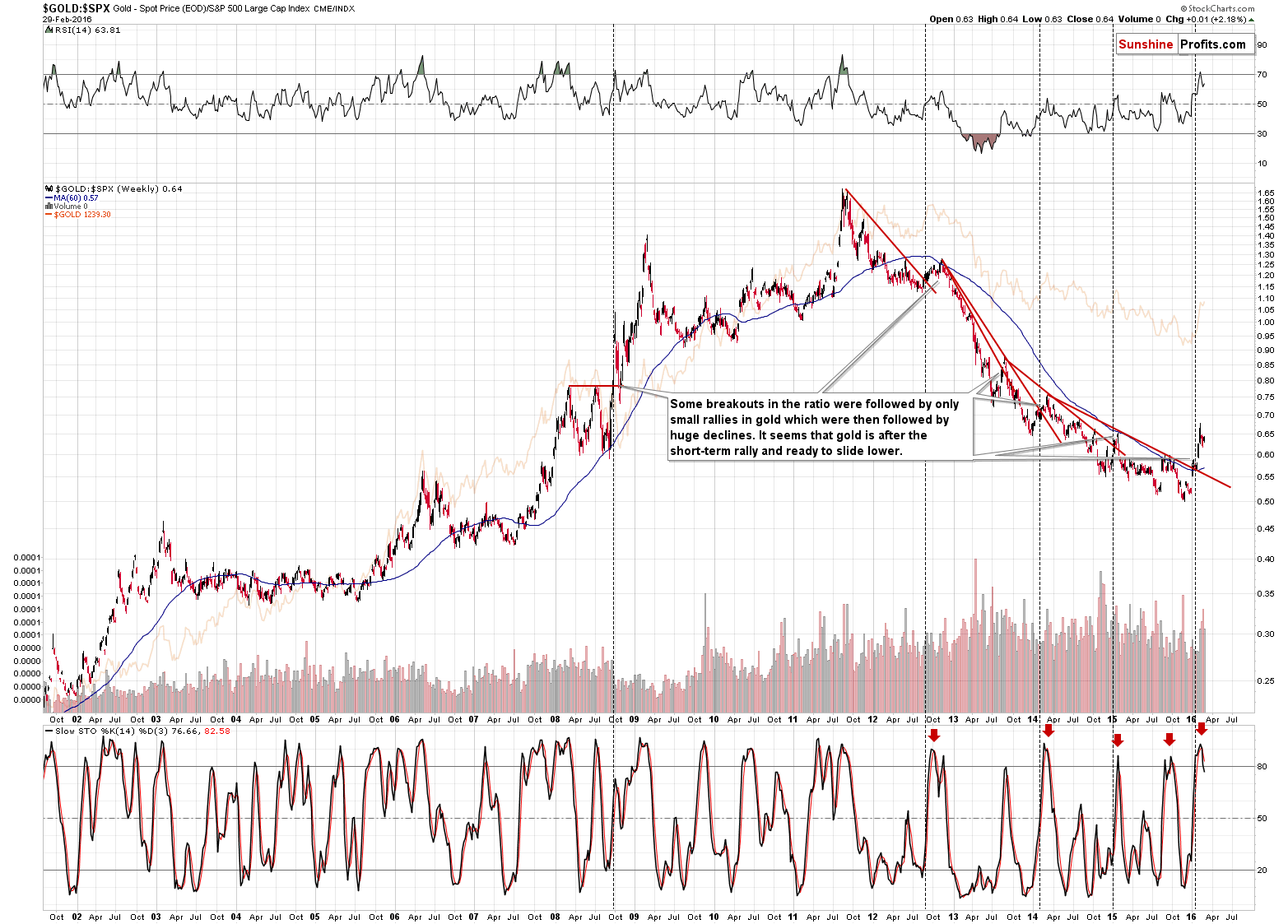

Some may say that the gold to S&P 500 ratio broke above its short-term resistance line and that this implies higher gold prices shortly. However, this too is a foregone conclusion. Let’s take a closer look (charts courtesy of http://stockcharts.com).

On the above chart we marked several other breakouts and dashed lines show what happened in gold right after them (note that the orange line in the background is the price of gold). Gold moved a bit higher in the short term and started a major decline shortly thereafter. We are already after this short-term upswing, so it could actually be the case that the implications of the mentioned breakout are currently bearish, especially given the sell signal from the Stochastic indicator.

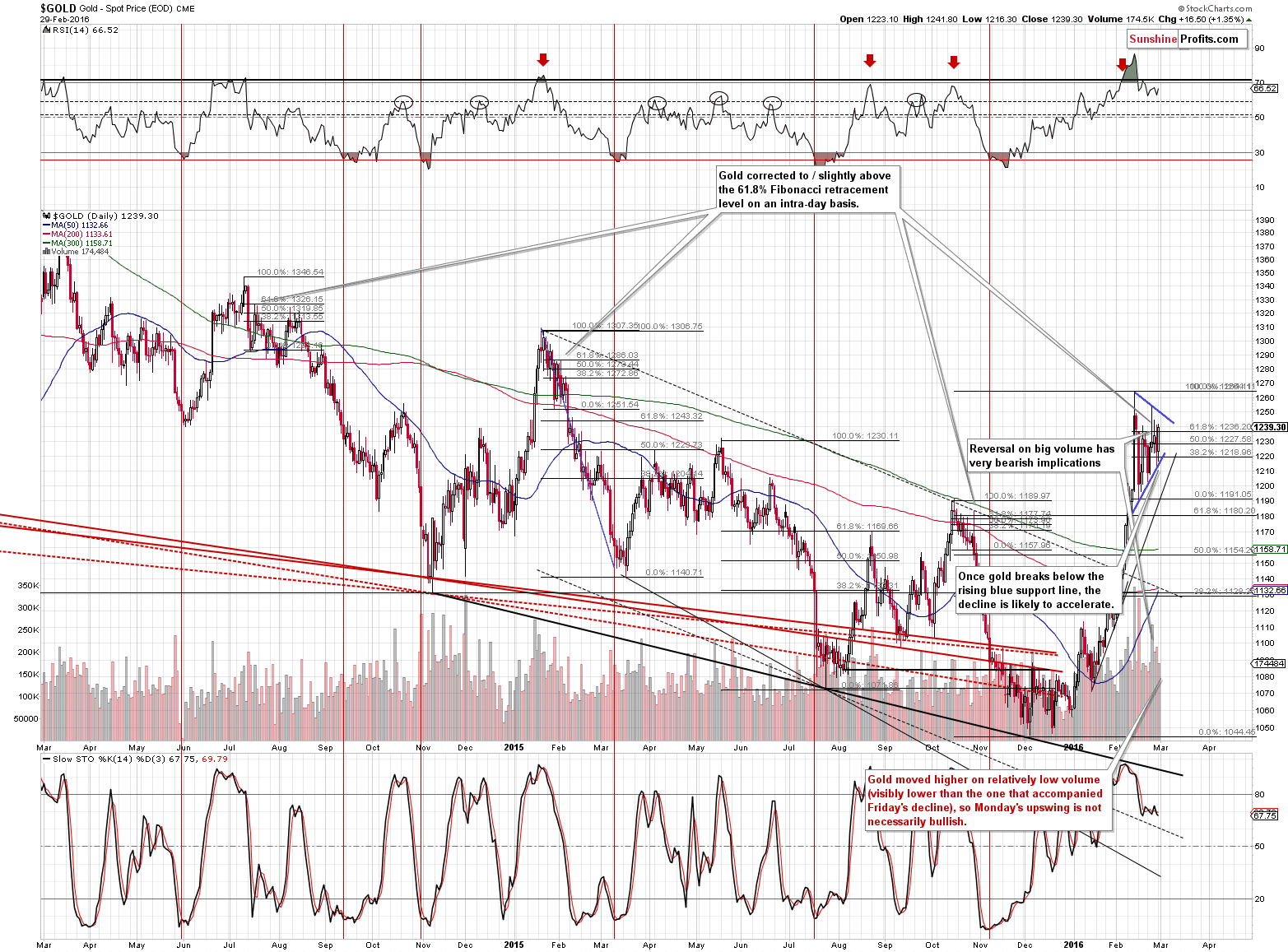

Moving to the yellow metal itself, we saw another daily rally, but it was accompanied by relatively low volume, so it’s nothing particularly bullish. If we see another daily rally on tiny volume, it would not make the outlook more bullish, but more bearish.

Why did gold likely rally? Gold is making the headlines. There are several articles on finance.yahoo.com and one of them (the most visible one) is a video featuring “a technician” (according to the title of the video) that based on very little details (at least almost none of them are included in the video) is saying that gold is quite likely to rally to $1,450 and that pullbacks should be viewed as buying opportunities. The important thing is that there was no strong justification of this view other than saying that the environment is positive because of some fundamental factors like low interest rates. This is something that is already publicly available and very likely factored in the current price.

The short-term resistance is a bit below $1,250, so a move to this level would not change anything from the short-term point of view.

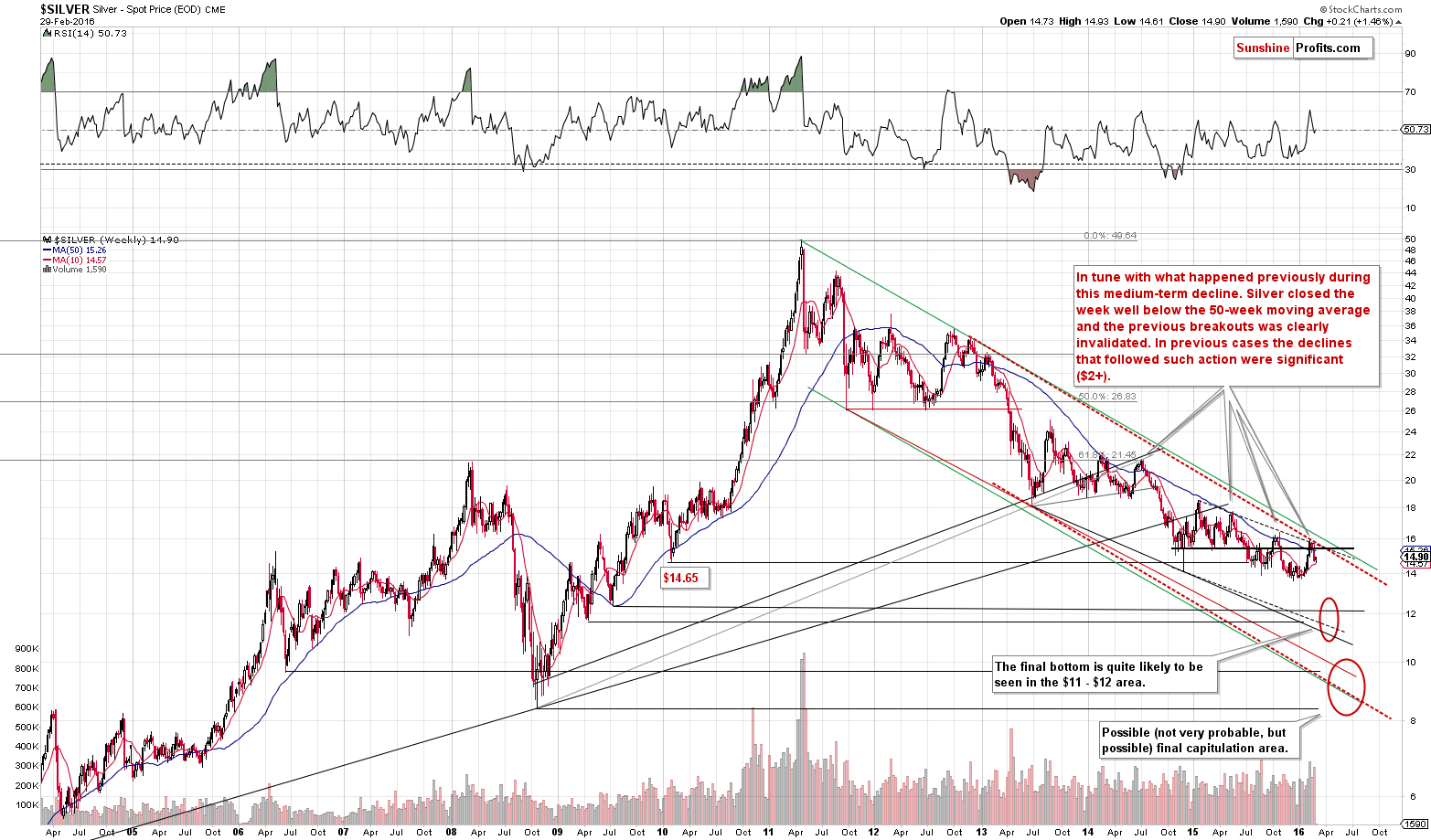

Silver moved a bit higher yesterday, but it remains visibly below the 50-week moving average – there was no breakout back above it. Consequently, our yesterday’s comments remain up-to-date:

Silver moved initially higher last week, but finally plunged on Friday and closed the week more than $0.60 lower. This move is significant by itself, but it’s more important that this decline invalidated the previous breakout above the 50-week moving average. There were a few cases when we saw this phenomenon and it more or less meant that the corrective rally was over and that we should prepare for much bigger declines, and new lows. The outlook remains bearish.

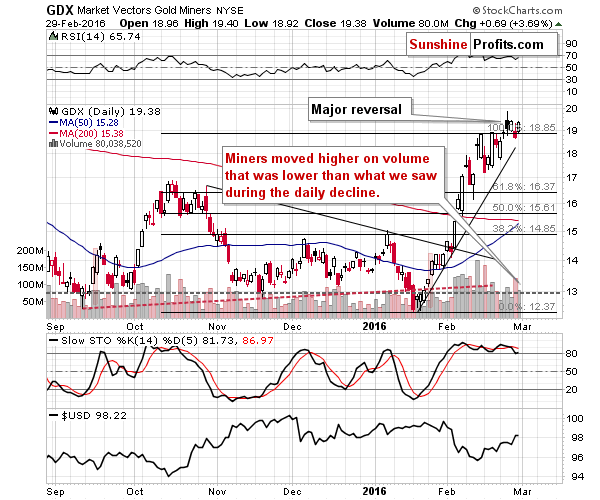

The long-term charts for HUI and XAU didn’t change based on yesterday’s move higher. Let’s take a closer look at the short-term GDX ETF chart.

Miners moved higher yesterday, but just like it was the case with gold, they moved higher on volume that was lower than what had accompanied Friday’s decline. This is more or less how mining stocks have been forming tops in the past. You can see one of these situations on the above chart - please note the low volume in the second half of October 2015 during the daily rallies.

Summing up, gold is making headlines and it’s moving higher on relatively low volume (and we have the same action in mining stocks and silver). This is something that we usually see close to or right at local tops.

Gold hasn’t broken below the short-term support line, but it appears that we will not have to wait much longer for the big slide in gold to really start (likely this week). Still, another move to or a bit above the 61.8% Fibonacci retracement in gold (like the one that we saw yesterday) can’t be ruled out – it doesn’t seem that it would change much, though. All in all, the outlook remains bearish and short positions in gold, silver and mining stocks appear to be justified from the risk/reward point of view.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $973; stop-loss: $1,274, initial target price for the DGLD ETN: $94.27; stop-loss for the DGLD ETN $52.44

- Silver: initial target price: $12.13; stop-loss: $16.14, initial target price for the DSLV ETN: $77.53; stop-loss for DSLV ETN $42.69

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $20.33, initial target price for the DUST ETF: $17.31; stop-loss for the DUST ETF $3.58

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $27.34

- JDST ETF: initial target price: $36.46; stop-loss: $6.88

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The price of gold has been rising recently despite some positive headlines on the U.S. economy. What does it mean for the gold market?

Gold Rising Despite Positive News on U.S. Economy

=====

Hand-picked precious-metals-related links:

Gold overvalued, time to sell: SocGen

Deutsche Bank: It’s time to buy gold

Citi Reiterates Positive View On Gold, Favors 'Quality Names'

Randgold's CEO Says Best Thing for Miners Would Be Lower Gold

Update: World's top 10 gold producers

Ugly duckling turns into a swan as Sibanye beats Gold Fields

How have gold producers fared after their long winter of discontent?

Jewellers in Mumbai go on strike to protest additional excise duty on gold

=====

In other news:

U.S. Treasury chief sees less risk of a global currency war after G20

Fed's Dudley sees risks to U.S. economic outlook tilting to downside

Euro zone January unemployment at lowest rate since August 2011

Global government debt to keep rising in 2016: S&P

Argentina Reaches Deal With Hedge Funds Over Debt

Make a Plan on How to Handle Risk, Then Stick to It

Norway Seeks to Piggyback on ‘Brexit’ Deal to Escape EU's Grip

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts