Briefly: In our opinion, speculative short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward point of view.

Gold moved higher yesterday, but it doesn’t seem that it had a major impact on even the short-term outlook as even the short-term resistance line wasn’t broken. Consequently, the previous trends remain in place. Let’s take a look at the details, starting with the long-term gold chart (charts courtesy of http://stockcharts.com).

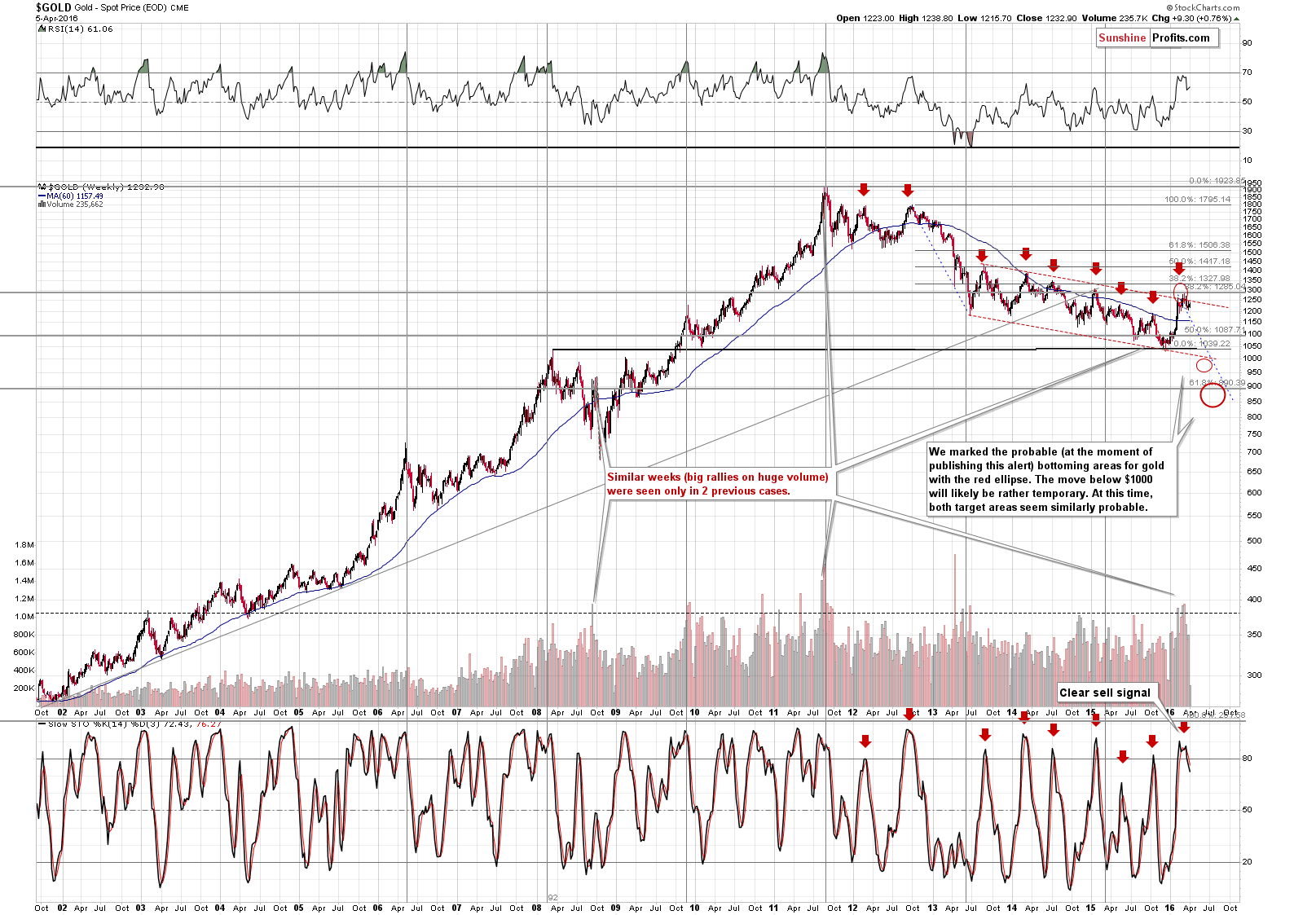

Once again nothing changed from this perspective and what we wrote previously about the above chart remains up-to-date:

(…) the outlook remains just as it was before this week began – it remains bearish.

The sell signal from the Stochastic indicator remains clearly visible and gold remains within the declining trend channel.

(…)

Although this year’s rally might seem big, gold actually didn’t even manage to move to the 38.2% Fibonacci retracement based on the 2012 – 2015 decline. Consequently, this year’s rally seems to be nothing more than just a correction within a bigger downtrend.

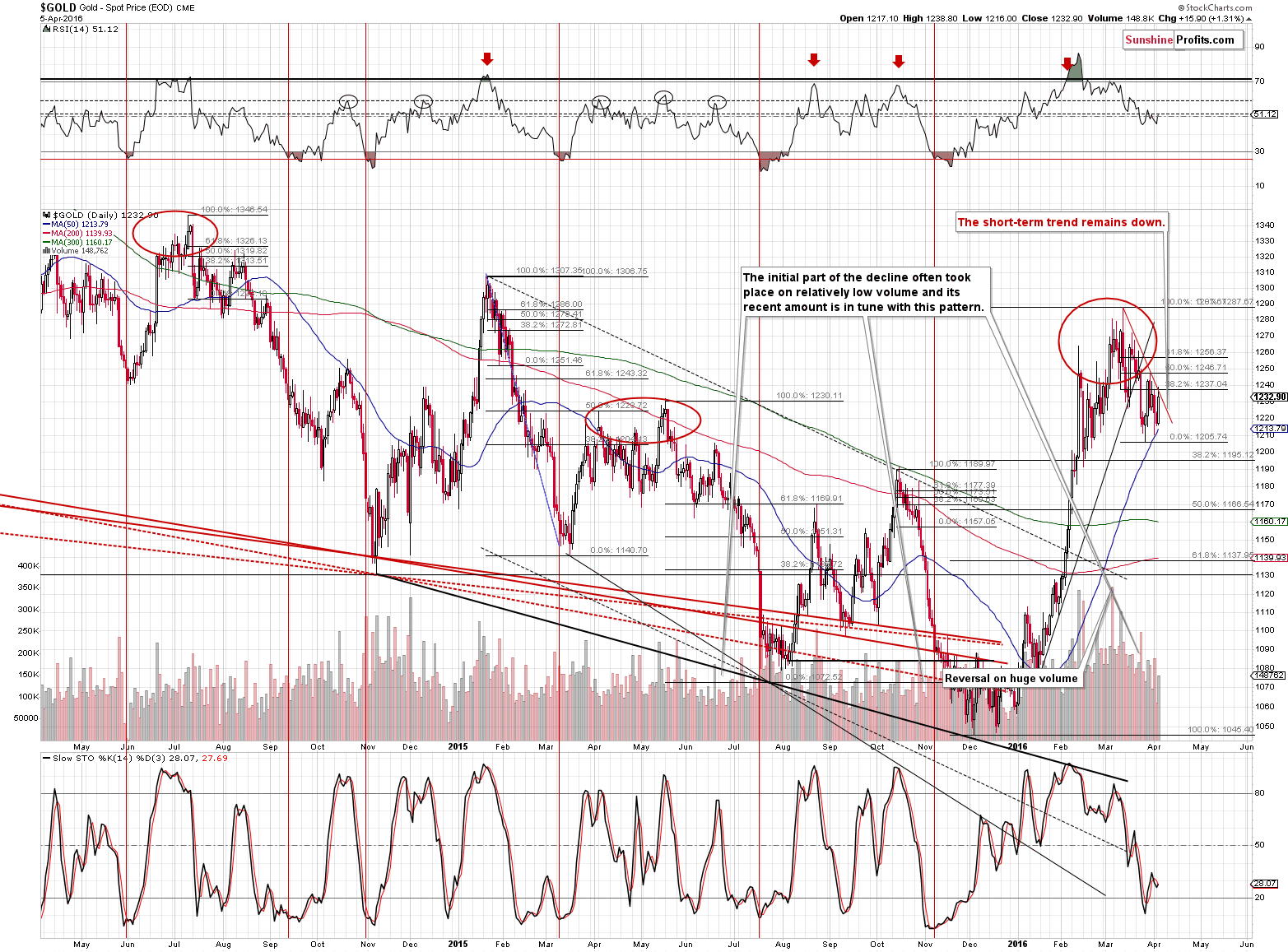

As far as the short term is concerned, we previously wrote the following:

(…), the trend remains down as well. Gold declined and practically erased Tuesday’s rally. The market participants seem to have realized that actually nothing changed based on Yellen’s recent comments and things are returning to normal after some very short-term volatility. (…), the previous downtrend remains in place.

Why a downtrend? Most importantly, because a downtrend is visible on the long-term gold chart, but also because the rising black short-term support line was clearly broken and this breakdown was more than verified.

Now, let’s move to what happened yesterday. Gold moved briefly to $1,238.80, but ended the session at $1,232.90 – below the $1,235 - $1,237 range. That’s important because that’s where we have the declining red resistance line and the 38.2% Fibonacci retracement level. Without a breakout above this level, nothing has changed from the technical perspective, so today’s rally still appears to be nothing more than a correction within a downtrend.

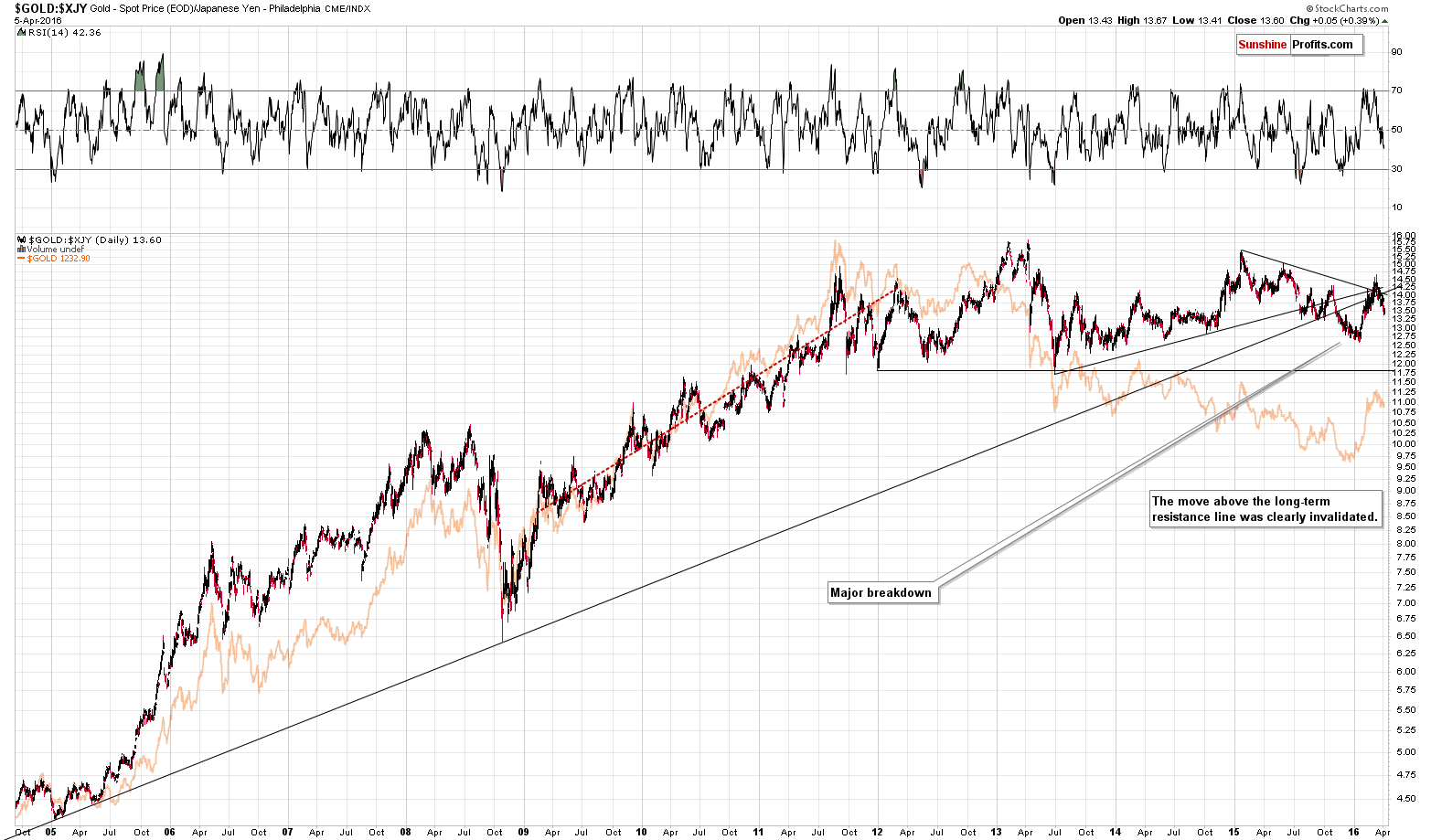

In yesterday’s Gold Trading Alert, we wrote about the gold price in terms of the Japanese yen and today’s we’d like to get back to this topic in order to show that yesterday’s session didn’t change anything.

The above chart continues to have clearly bearish implications for the medium term and the reason is that we see a very clear invalidation of a few small breakouts. Most importantly, gold invalidated the breakout above the rising long-term support / resistance line (the one based on the 2005 and 2008 bottoms). These are clear bearish signs with medium-term implications.

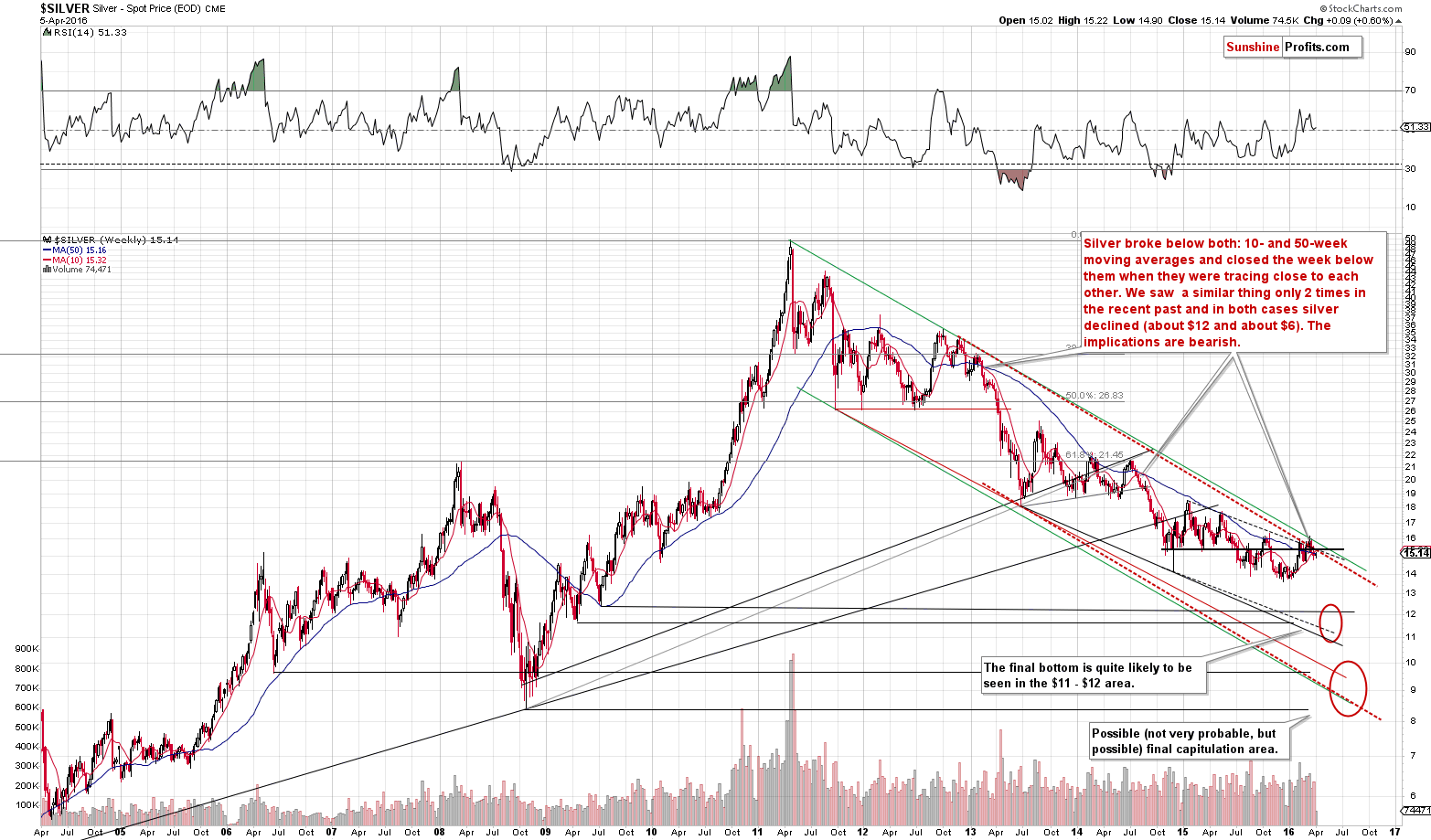

As far as silver is concerned, not much changed this week, and the most important signal is based on last week’s closing prices. We saw the decline’s continuation and, most importantly, we saw a breakdown below both the 10-week and 50-week moving averages (this week silver moved close, but not back above them). This is so important, because the last 2 times when we saw such breakdowns and both of them were close to each other, silver declined $12 and $6, respectively. Naturally, the implications are bearish - it appears that silver is about to move much lower in the coming weeks.

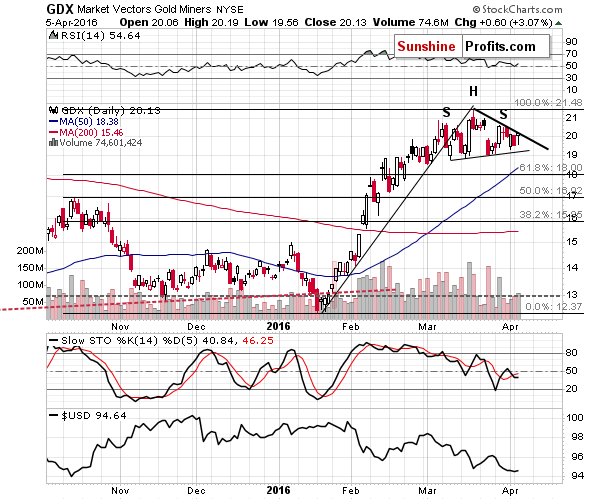

As far as mining stocks are concerned, well, once again nothing changed based on what happened yesterday. Miners are below the short-term resistance line, below the previous rising line and continue to form the head-and-shoulders top pattern. This pattern – if completed – would likely mark the start of the acceleration in the decline. Once we see a confirmed breakdown below the neck level (either a big move below the neck level on significant volume or 3 consecutive closes below this level), the bearish outlook for miners would become even more bearish.

Summing up, there are signs that the precious metals market is going to move lower in the coming weeks. The ones discussed above, plus those that we commented on in the previous days and weeks, make it very likely that the next big move in the precious metals sector will be to the downside. In other words, we expect that the best buying opportunity for long-term investments in the precious metals is still ahead. Moreover, it appears very likely that the profits on the current short trade will become much bigger before this trade is over.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $973; stop-loss: $1,251, initial target price for the DGLD ETN: $90.29; stop-loss for the DGLD ETN $54.19

- Silver: initial target price: $12.13; stop-loss: $15.42, initial target price for the DSLV ETN: $71.92; stop-loss for DSLV ETN $45.16

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $21.03, initial target price for the DUST ETF: $7.60; stop-loss for the DUST ETF $2.63

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $29.32

- JDST ETF: initial target price: $14.14; stop-loss: $4.70

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

At the end of March, Metals Focus released its Gold Focus 2016, looking at the developments in the global gold market and the future of gold prices. What are the main conclusions of the report?

On Tuesday, crude oil moved lower after the market’s open weakened by an unexpected decline in monthly U.S. gasoline demand. Despite this drop, the commodity reversed and rebounded in the following hours. As a result, light crude gained 3.10% and invalidated earlier breakdown. What does it mean for oil bulls?

Oil Trading Alert: Crude Oil – One-Day Rally or Something More

=====

Hand-picked precious-metals-related links:

Why Goldman’s commodity chief wants investors to bet against gold

NYU Graduates Seeking $11 Billion of Gold in Ransacked Mine

=====

In other news:

Wall Street bank says U.S. unemployment isn't 5%

The Coming Default Wave Is Shaping Up to Be Among Most Painful

'Brexit' No Barrier to U.K. Stock Valuations at Record Premium

Standard for responsible mining released

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts