Briefly: In our opinion, short positions (full position) in gold, silver and mining stocks are justified from the risk/reward perspective.

Gold plunged yesterday, just as we expected it to and shortly thereafter we received multiple questions regarding the move. Most of them can be summarized by “is it too late to enter short positions” and “how low will gold go before turning up?”

As far as the first question is concerned, we can only give general answers as we can’t reply with each investors’ financial situation in mind, but we can say what we think about the market and this might be taken into account when making a decision to either open or close a trading position, while having in mind one’s particular circumstances. Having said that, let’s emphasize, that the reply is generally: “it’s not too late”.

As far as the market is concerned, the only thing that really determines whether a position should be held is the risk to reward ratio (the non-market factors are one’s individual risk preferences / financial goals etc.)

Both risk and reward stem from the outlook. The outlook depends on what’s going on in the market – what technical developments are seen, what cycles and turning points are present, how gold, silver and mining stocks are reacting to news, how they perform relative to each other, how they respond to currency moves and moves in other commodities and similar market-related phenomena. The outlook does not depend on one investor’s position (whether they are long or short and whether the position is profitable or at loss). The situation in the market and the outlook should determine each investors’ actions, but investor actions will not determine changes in the outlook (unless they are a central bank, huge investor like George Soros etc.)

Consequently, if the outlook changes and it deteriorates, it means at the same time that: new positions are not justified and the current positions are not justified. If there were any positions, they should be closed and if there were no positions, none should be opened. This is regardless of the status of the position (profitable / at a loss).

Since the outlook determines both decisions (opening / keeping positions) in the same way (the reasons that could make the situation different would be huge transaction costs, tax implications etc. – but that’s not what the market determines), one can say that if keeping a position is justified from the risk to reward point of view, then the same goes for opening the position, if there is none. This works also the other way around – if opening no position is justified at a given moment, then the existing ones should be closed. If the outlook didn’t justify one, then it doesn’t justify the other.

Consequently, as long as we write that positions are justified (please note that we don’t use a verb in this sentence – it can mean both: opening and keeping the position, since it’s existence is justified) it means both: opening and keeping a given position is justified.

As soon as that stops being the case, we’ll send out another alert (either a regular morning issue, or an intra-day one, if things change suddenly).

Now, knowing that the reply to the first question is that “most likely it is not too late to enter short positions – they remain justified from the risk to reward point of view’, we’ll move to the second question. On a side note, they are both different views on the same question as they both are essentially about the outlook.

On September 14, 2016, we published the Gold & Silver Trading Alert entitled Gold’s Bottom Targets and the following part of the alert will be the update of this alert as it remains almost entirely up-to-date.

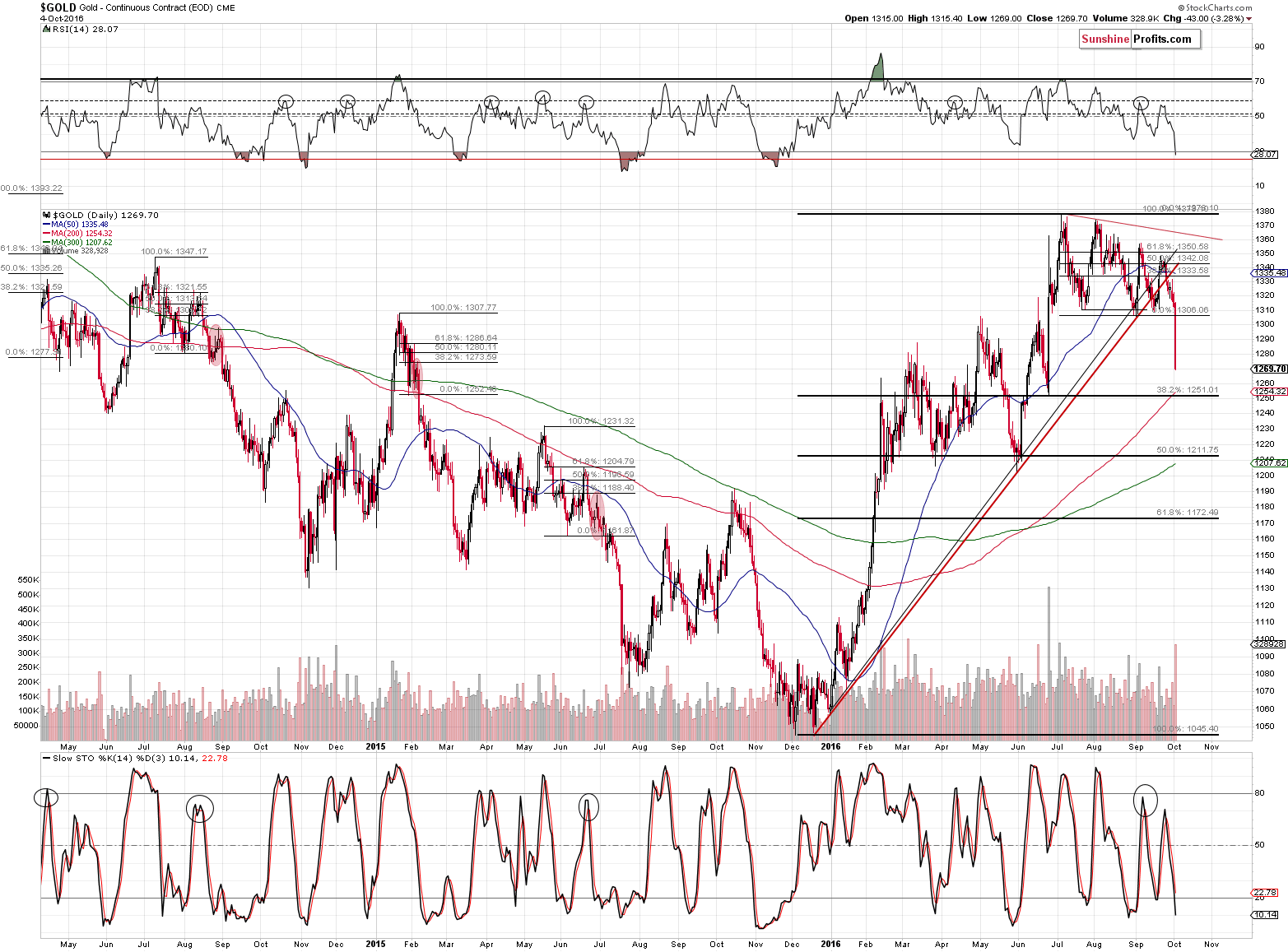

Let’s take a closer look at the gold charts (charts courtesy of http://stockcharts.com).

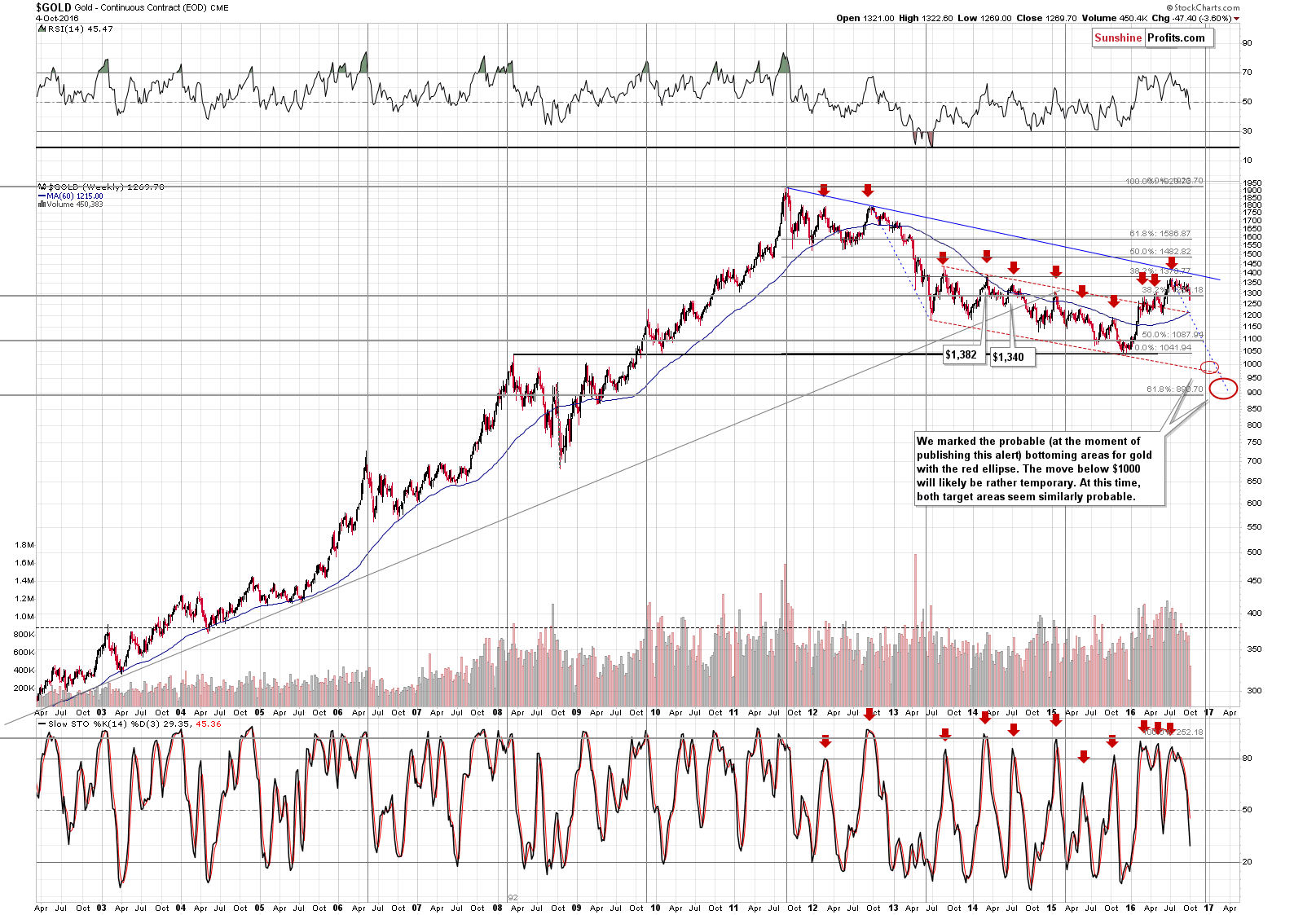

The reply to the question can’t be straightforward, as the question itself isn’t. No market moves in a straight line up or down and gold’s decline will almost certainly be paused by corrective upswings before it is completely over. Consequently, let’s first define, what we mean by “the bottom” here. It is the price level that will not be broken to the downside for the next decade or so (most likely never). We expect this kind of bottom to be formed below the 2015 low – at about $900 – as you can see on the long-term chart above.

The slide to this move is somewhat likely to be similar to the biggest decline that we saw in the previous years (in 2012 and 2013) – after all, history tends to repeat itself. If the pace of the decline is indeed similar, then we can expect the final bottom to be seen in the first part of 2017. That’s more or less in tune with the long-term turning points for gold (vertical lines) and it would correspond to the 61.8% Fibonacci retracement level based on the entire bull market.

Naturally, gold will likely not decline in a straight line (back in 2012 and 2013 this wasn’t the case as well) – there will likely be bigger and smaller corrections. Where are they likely to start and are they likely to be big or small?

Generally, the expected size of the bounce depends on the sharpness and size of the preceding decline, the strength of the support that would be reached and the time gold spent consolidating before the move.

There’s no doubt that yesterday’s decline in gold was sharp, but so far it hasn’t really reached a meaningful support and it spent quite a lot of time consolidating between $1,310 and $1,360.

Since gold broke below $1,300, the next support levels are provided by Fibonacci retracements based on the 2015 – 2016 rally. At $1,250 there is also the support in the form of the June bottom. The decline to this level is quite likely to be volatile, as there are no meaningful support levels between $1,300 and $1,250, so we could see a more visible corrective upswing after gold reaches $1,250, but that’s rather unclear at this time.

After moving below $1,250, gold is likely to slide to about $1,200 - the Fibonacci level there (it’s at $1,212) is close to the previous bottoms (March, May). Since there are 2 recent bottoms at this level (and they are also more prominent), this support is stronger and thus this level could generate a bigger bounce (perhaps even back to $1,250 or so), but it depends on many factors, including whether we will have a bigger bounce after gold reaches $1,250 first. If not, then the odds of a bigger bounce from $1,200 become much bigger.

Finally, the $1,172 level provides the weakest resistance as it is not accompanied by a confirmation from previous bottoms. Consequently, this level is least likely to generate a sizable rally, but we would like to emphasize that this is based on the data that we have today – the odds can change.

So, can we – right away – set up a detailed trading plan for the next several months? Not really – we only have indications what’s more likely to happen than something else, but without seeing confirmations of some sort once gold approaches the specific price levels, it’s too risky to say that opening or closing a trade will be justified at these levels. In other words, we know that it’s likely that something very interesting may happen at these price levels, but we’ll need to be closer to the mentioned price levels to say more. Volume levels, currencies, ratios, indicators etc. all need to be taken into account.

Still, if we see meaningful bullish signals when gold moves to $1,251 or so, we could temporarily close the short position in order to re-enter it at higher prices. If the bullish signals are weak or nonexistent, we’ll most likely not adjust the position. If gold moves sharply lower again and there is no big upswing from $1,250 or so, we’ll even more likely temporarily close the short position once gold moves close to $1,200. Again, that’s something likely, but not set in stone. It’s not likely enough to put in trading orders so far out.

Summing up, it’s likely that the profits from the current short trade will become much bigger before the trade is completely over and “the bottom” is in. There will likely be interim bottoms along the way, but the closest likely target is still $20 lower (in gold). If gold slides through this level and gets to $1,200, we may have a good opportunity to take profits off the table and re-enter the short position at higher prices. We will be monitoring the market for opportunities and report to you accordingly.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (100% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following entry prices, stop-loss orders and initial target price levels:

- Gold: initial target price: $1,006; stop-loss: $1,373, initial target price for the DGLD ETN: $73.19; stop-loss for the DGLD ETN $38.89

- Silver: initial target price: $13.12; stop-loss: $21.63, initial target price for the DSLV ETN: $39.78; stop-loss for the DSLV ETN $14.34

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $30.67, initial target price for the DUST ETF: $297; stop-loss for the DUST ETF $21.80

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $53.41

- JDST ETF: initial target price: $245; stop-loss: $16.59

Long-term capital (core part of the portfolio; our opinion): No positions

Insurance capital (core part of the portfolio; our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Yesterday, the price of gold plunged below $1,300. What does it mean for the gold market?

=====

Hand-picked precious-metals-related links:

As Investors See World Beset by Risk, Gold Rebounds From Tumble

Gold sees sharpest daily fall in three years

Gold Bugs Are Watching the Wrong Central Bank

Podcast: Gold and silver bullion brokers Sharps Pixley CEO on gold price impasse

Platinum price back in triple digits

=====

In other news:

ECB 'taper' talk hits stocks, sterling hits 31-year low

Chicago Fed's Evans 'fine' with December hike if data stays firm

Fed May Face Makeover Whether Trump or Clinton Wins White House

Oil hits highest since June on possible U.S. inventory drop

Could Tug-of-War Turn to War With China?

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts