Briefly: In our opinion opening small (half) speculative short positions in gold, silver and mining stocks is now justified from the risk/reward perspective.

We summarized Friday’s alert in the following way:

Yesterday’s improvement in the outlook for the precious metals sector turned out to be very temporary. The situation in silver – especially its move to the resistance lines – has bearish implications. The reversal in mining stocks is even more profound and bearish. We are very close to re-opening the short position at this point. However, since the precious metals showed unexpected (and unlikely) strength recently, we remain a bit skeptical toward the bearish signs at this time. It seems best to take advantage of the fact that the trading week will end today. We’ll do it by waiting on the sidelines today and then and analyzing the situation once again before Monday’s open with the benefit of having the weekly closing prices, which should make things clearer.

The most important thing happened not on Friday, but in today’s pre-market trading. Gold declined visibly and so did silver. We don’t know how mining stocks will perform today, but it’s quite likely that they will decline as well. Have we just seen a local top? Let’s take a closer look (charts courtesy of http://stockcharts.com).

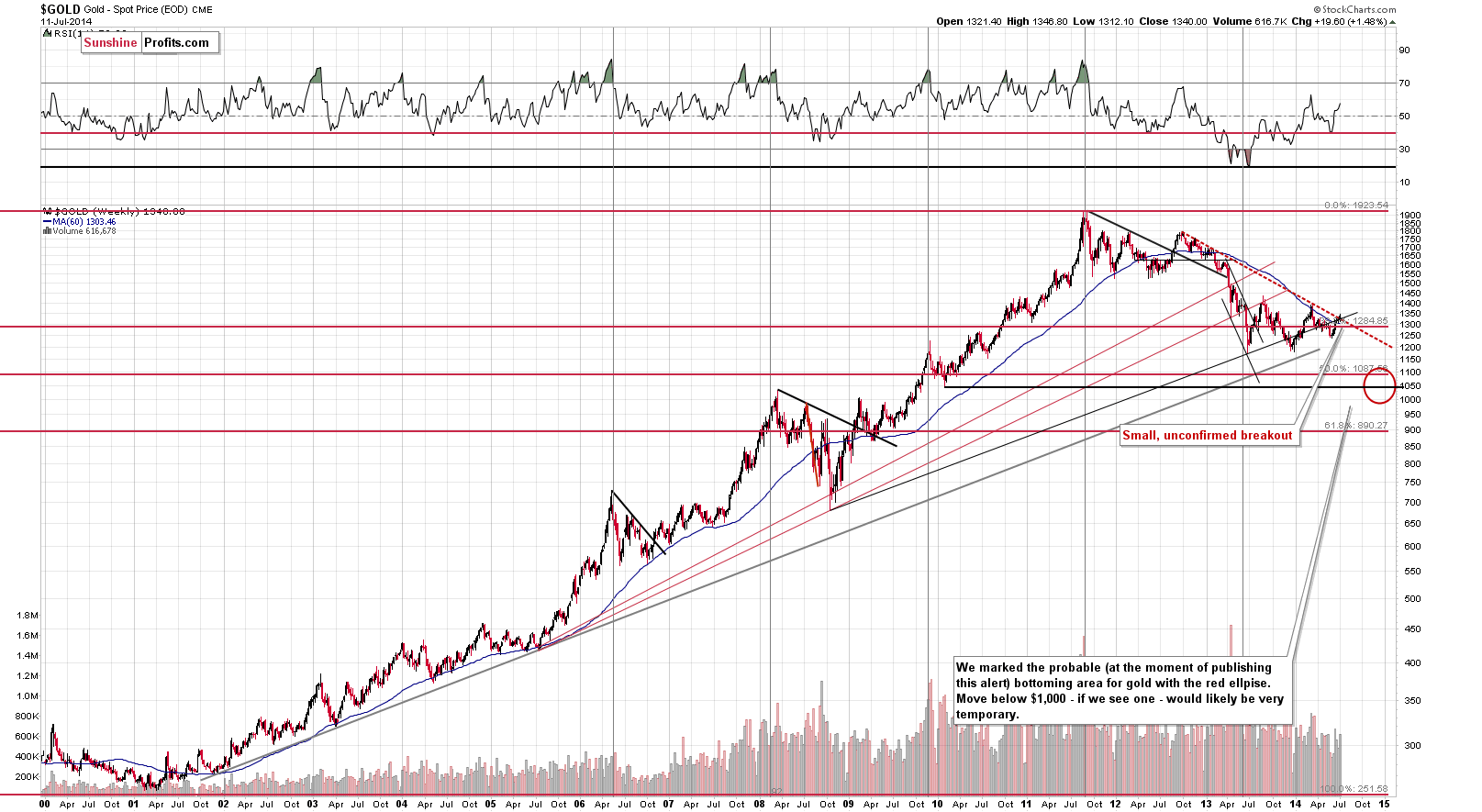

From the long-term perspective, last week’s breakout was insignificant, even taking into account what happened on Friday, and is by no means confirmed. Consequently, what we wrote previously remains mostly up-to-date:

On the long-term chart we see that even though gold moved higher – slightly above the rising resistance line – it remained below the declining red (dashed) resistance line. From this perspective, not much changed yesterday. We still think that the medium-term trend remains down.

It’s [staying on the sidelines] not “missing the boat” – it’s “waiting for the captain to set the final direction before you jump on the deck”.

What actually changed was that the small breakout was invalidated earlier today when gold moved back below the long-term resistance line. We didn’t believe the breakout would hold, and it didn’t.

On the short-term chart you can see that the breakout was indeed small and that today’s early downswing has already invalidated it.

Quoting Friday’s alert:

On the above short-term chart we see a breakout and an immediate invalidation thereof. To be more precise – it was almost invalidated. The price of gold moved visibly above the 61.8% Fibonacci retracement level, but reversed before the session was over. Yesterday, we wrote that the confirmation was the key word here, the breakout was definitely not confirmed. In fact, we expect it to be invalidated shortly.

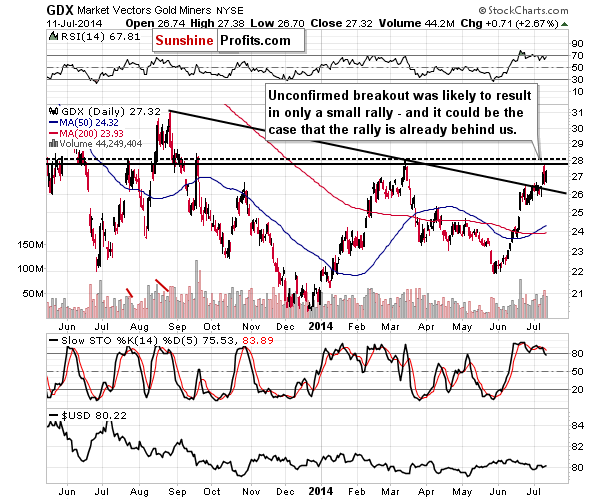

The situation in mining stocks hasn’t changed yet, but we will probably see a decline today, based on the move lower in gold.

On Friday, we wrote: the rally might already be over. The lower of the resistance level was just reached and we might have just seen a local top.

In light of Friday’s price/volume action, the above remains up-to-date. The volume that accompanied Friday’s move higher was smaller than the one on which miners had declined on Thursday, so the situation was more bearish than not. If miners manage to close back below the declining support/resistance line – more or less below $26 – we will have a strong bearish sign.

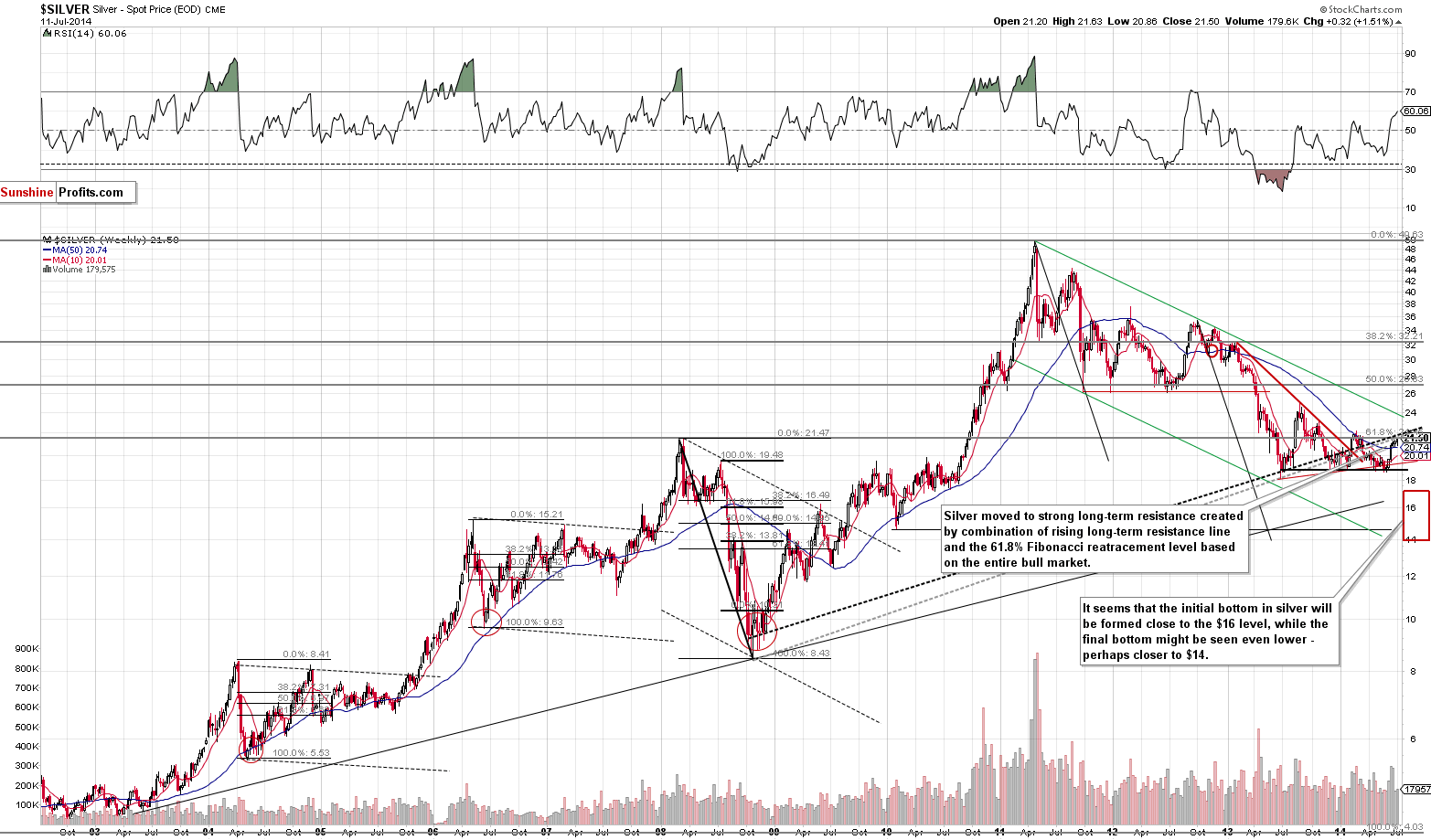

The situation in the USD Index and the juniors sector continues to support the bearish outlook for the precious metals sector (what we wrote on Thursday about it remains up-to-date). The same goes for silver.

The strong, long-term resistance levels were just reached. We saw a small breakout but it was invalidated earlier today. Since the medium-term trend remains down (lower highs), we can expect the next move lower to begin shortly. The short-term picture supports this outlook as well.

Our previous comments remain up-to-date:

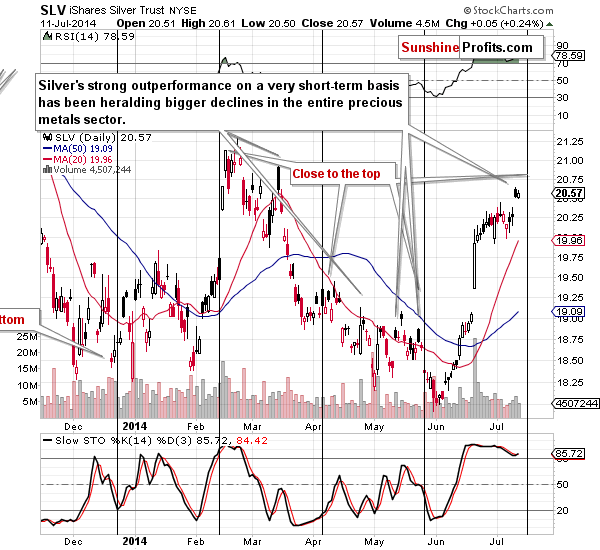

Not only has silver outperformed gold and miners on a very short-term basis, but it is now very close to the next turning point. The previous move was definitely up, so the turning point has bearish implications.

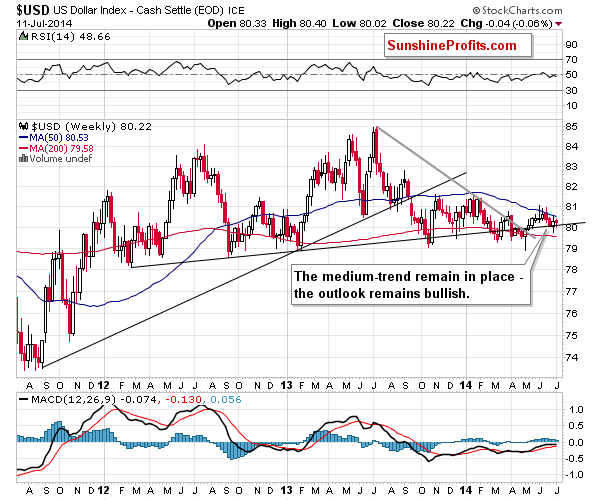

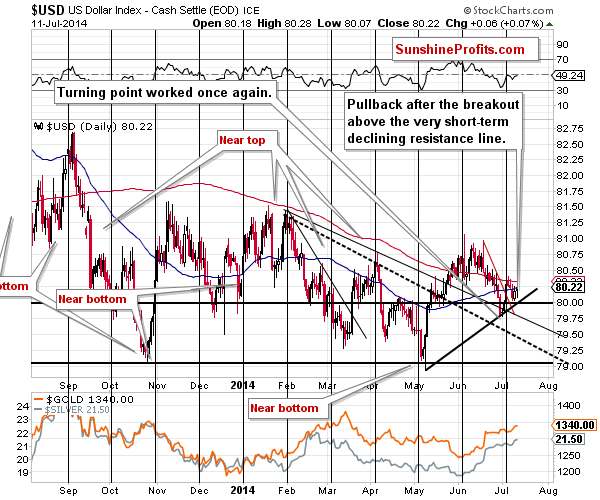

The medium-term outlook for the USD Index remains bullish – the index touched the rising support line last week, but reversed and moved back up before the weekend.

The short-term picture is also bullish.

The support lines and the psychologically important 80 level remain unbroken. The USD Index hasn’t rallied today (and hasn’t moved below the support lines either), which means that gold’s and silver’s decline materialized without the dollar’s help, which is a bearish sign, especially that they are likely to receive the dollar’s help (to decline more) sooner rather than later.

Summing up, on Friday we planned to wait for a bearish confirmation before entering short positions, and it seems that we got what we had waited for today. The situation is not clearly bearish in the short term, but, in our opinion, it’s bearish enough in order to justify a small short position in the sector.

To summarize:

Trading capital (our opinion): Short (half) position in gold, silver and mining stocks with the following stop-loss levels:

- Gold: $1,353

- Silver: $21.73

- GDX ETF: $28.30

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts