In short: In our opinion, small (half) short positions in gold, silver, and mining stocks are still justified (no changes since yesterday).

Gold moved sharply higher at the beginning of the session yesterday, only to pull back before its end. Let’s see how much it changed (charts courtesy of http://stockcharts.com.)

It changed nothing and, basically, what we wrote yesterday remains up to date. Gold closed without invalidating any of the previous important price moves. There was no move back above the rising short-term support lines, which have now turned into resistance and gold also closed below both declining resistance lines: the medium-term one (solid black) and the short-term one (dashed red one).

The same goes for the long-term perspective. The breakdown below the long-term rising support line is a fact, and a more-than-confirmed event. There was no invalidation.

Meanwhile, silver continues to decline and there are no changes in case of the signals coming from this market – they remain bearish.

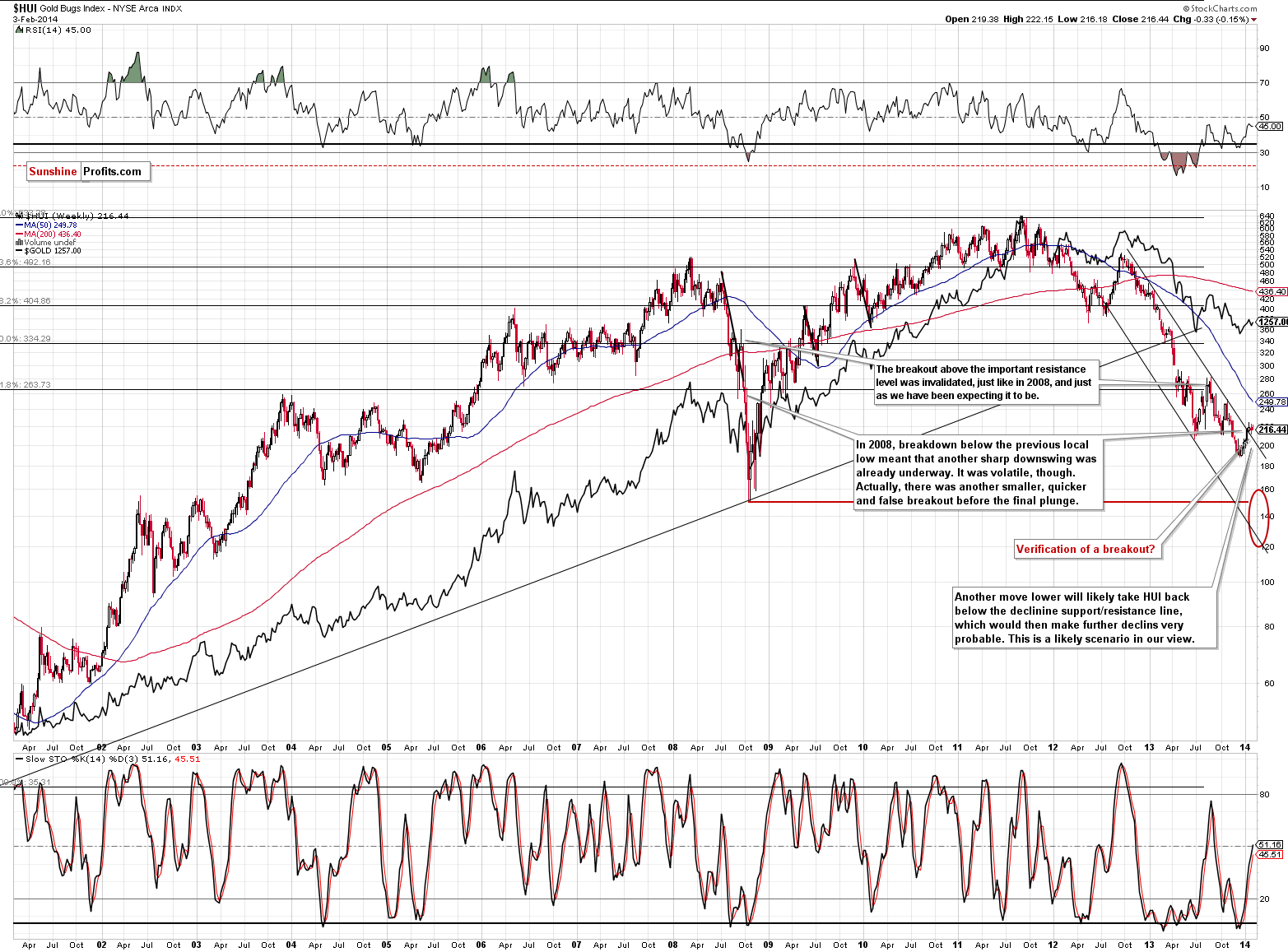

The most visible bullish sign present in the precious metals market is still the gold stocks’ breakout above the declining resistance line.

Yesterday, not much changed. In fact, gold stocks declined slightly despite gold’s move higher, which is a bearish sign. It’s not very bearish, though, as the general stock market declined substantially, so there was a good reason for gold stocks not to rally.

However, what we wrote yesterday remains up-to-date, and is still the key thing to keep in mind when discussing the miners’ performance:

The current breakout is small and it’s questionable whether it has been confirmed or not. It was confirmed by 3 daily closes above the declining resistance line, but in terms of price, there has been no significant upswing. This, plus silver’s underperformance and the lack of a breakout in gold makes us want to re-examine the breakout in the HUI Index.

As we wrote previously, the current move higher is similar to what we saw in 2008 right before the final plunge of the entire precious metals sector. There was one more significant correction (like what we saw in July – October 2013) and now we see a small, barely visible one. If they history repeats or at least rhymes, then not only is the current move higher not bullish, but bearish and was to be expected to some extent.

Naturally, one analogy doesn’t entirely invalidate the bullish implication of a breakout, but it does make it much weaker. Consequently, we don’t think that one should view the gold stocks' breakout as very important.

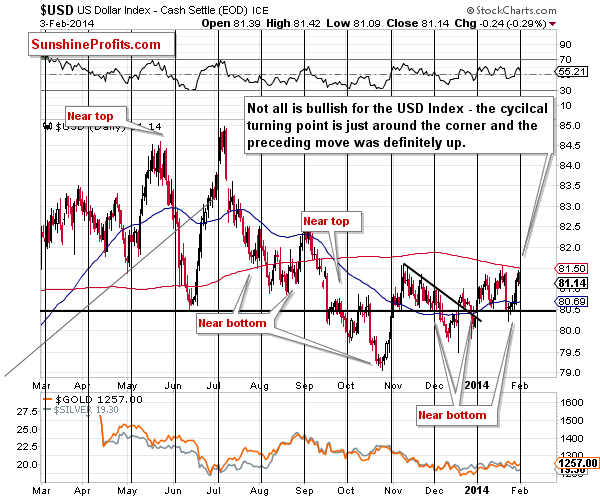

Yesterday, we wrote the following regarding the USD Index:

The cyclical turning point is here and the previous move was up, so we might see some sort of pullback or a decline shortly. We don’t expect it to be significant – we expect the next big move in the USD Index to be to the upside based on the long-term and medium-term breakouts.

We already saw a pullback yesterday, so perhaps what was likely to happen has already happened. Gold didn’t respond with a breakout and miners moved slightly lower. Overall this action was rather bearish for the precious metals market, because now the threat of a decline in the USD that could cause a breakout in gold is smaller. At this time it’s no longer very likely that another move lower will be seen based on the turning point – it might be already over.

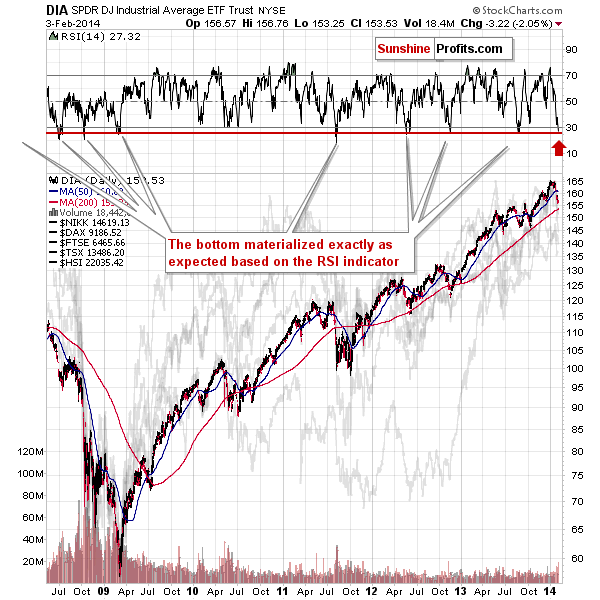

Finally, the recent rally in gold can be somewhat linked to the significant decline in the stock market that really started on Jan. 23. Gold soared on that day when stocks started to slide and it moved higher much less significantly yesterday when stocks declined even more rapidly. If gold’s recent strength can be attributed to the stock market’s weakness, then this signal has lost a lot of its strength in the past few days. In fact, gold didn’t move as high yesterday as it did on Jan. 23.

If gold was pushed higher by falling stock prices, then perhaps a rally in the stock market could make precious metals less attractive for investors. Based on the current RSI reading, a move higher in stocks seems very likely to be seen quite soon (if not immediately). Overall, the situation in the stock market and the rather unclear link between stocks and gold have mildly bearish implications for the yellow metal. This by itself is not significant enough to open any speculative position, but in conjunction with the fact that the downtrends in gold and silver remain in place and that the breakout in gold stocks is not really meaningful, it does paint a quite bearish picture for the precious metals market.

Summing up, taking all of the above into account, we arrive at the same conclusion at which we arrived previously – namely, in our opinion it’s a good idea to use a small part of the speculative capital to trade the (likely) coming decline in precious metals. If we see a meaningful confirmation of the bearish case (for instance, a decline on strong volume or a breakdown in the HUI Index), we will likely think that increasing the size of the short position might be a good idea. Naturally, in case of an invalidation of the bearish outlook, we will keep you informed as well.

On an administrative note, we have just published our first Corporate Social Responsibility report. It describes what we did in the CSR area in 2013 and what our plans are for this year. It’s not long (shorter than this alert) and reading it shouldn’t take much of your time. You can access it on our CSR Reports page.

To summarize:

Trading capital: In our opinion a short position (half) in: gold, silver and mining stocks is justified from the risk/reward point of view. We are planning to profit on a significant downswing, so the stop-loss orders that are appropriate in our opinion are not that close (however, if something invalidates the bearish outlook, we will let you know ASAP, even if stop-loss orders are not reached).

Stop-loss orders for the short position:

- Gold: $1,307

- Silver: $21.20

- GDX ETF: $27.20

Long-term capital: No positions.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA