Briefly: In our opinion, short (full) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

We have previously described the precious metals’ downswing as a sector-wide phenomenon. It remains to be the case – gold, silver and mining stocks remain in oversold positions and we are waiting for a good buy or… sell signal.

Of course, once we see the signal’s confirmation the odds are that the price will be much lower and that’s why we think that having a short position at this time is justified from the risk / reward point of view.

Let’s see which of these signals will be seen sooner (charts courtesy of http://stockcharts.com).

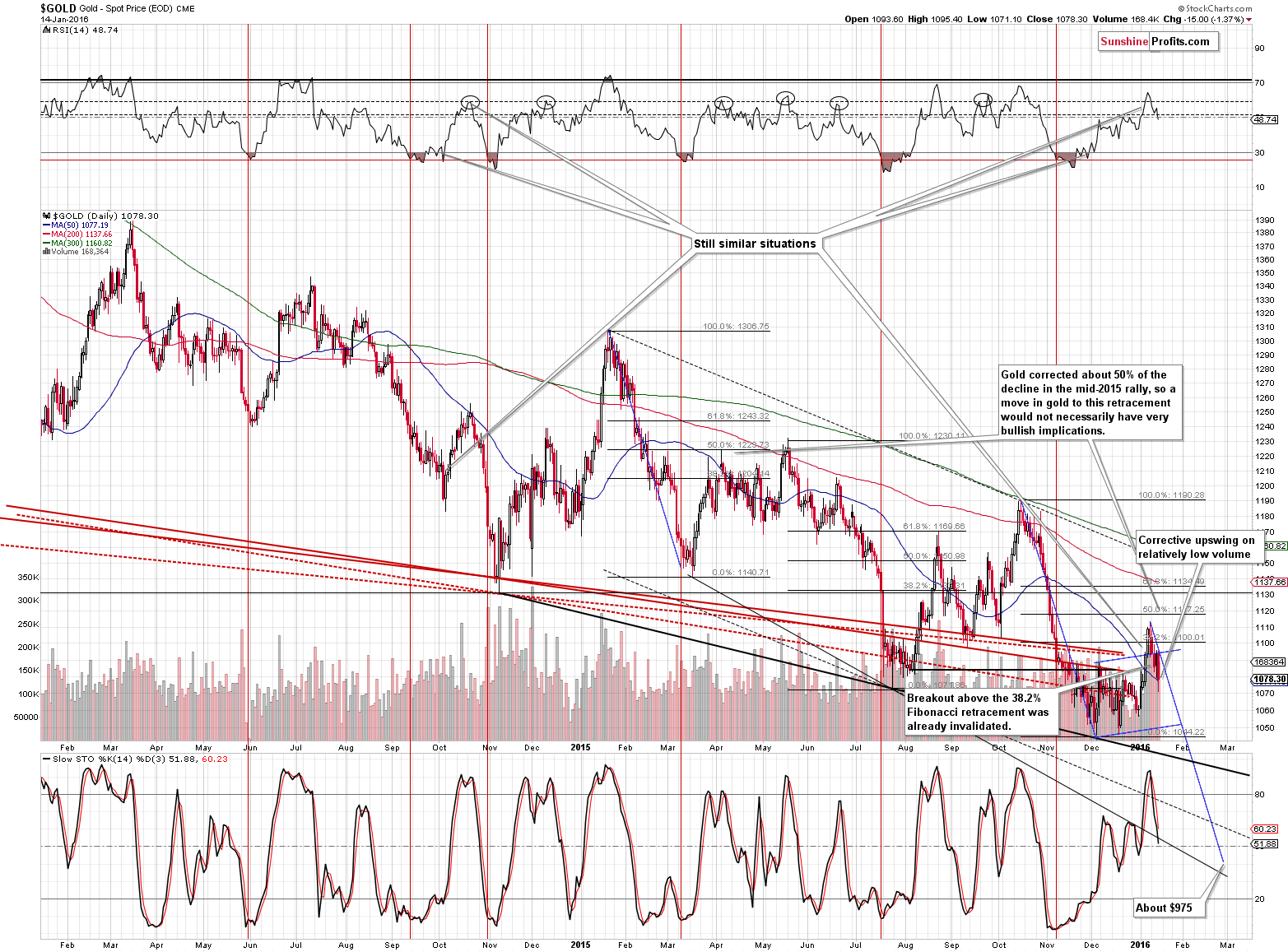

Gold indeed declined and the implications are bearish, but let’s examine the intra-day moves before making final calls.

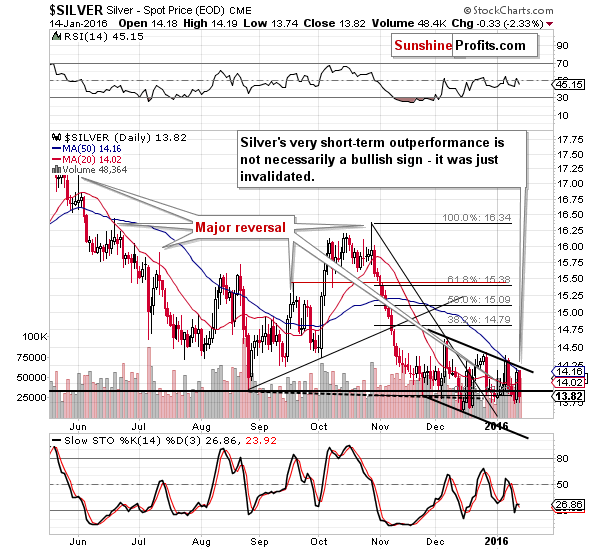

As mentioned earlier, silver moved visibly higher, but in yesterday’s alert we wrote that was something we had seen quite often right before big declines, for instance in late October 2015 or mid-August 2015. Silver is known (at least by those who have been following it for a longer time) for its fake moves, so it’s important to consider confirmations and other signals before making an investment or trading decision based on what happens in silver.

We summarized that silver’s recent performance may have seemed positive, but based on the way similar situations had developed previously, we actually viewed the white metal’s unconfirmed rally as something bearish – especially given the very weak performance of mining stocks.

We didn’t have to wait long for a confirmation of the above – silver canceled the previous day’s upswing and the rest of the precious metals sector followed on the very next day. The trend remains down.

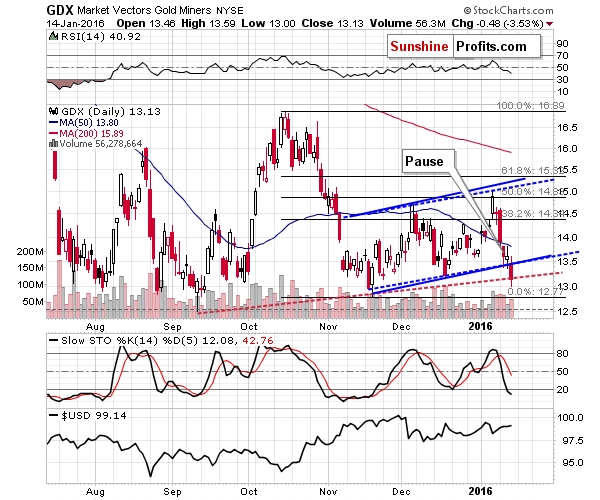

Mining stocks broke below the blue support line, which is a bearish phenomenon. The volume was relatively high (higher than what we had seen during the previous day’s pause), which serves as a confirmation.

The next strong support is at the September 2005 low and there is a minor support at the November 2015 low as well. Once these levels have been taken out, the slide will be likely to continue at an increased pace.

Summing up, the outlook remains bearish and the full short positions appear to be justified from the risk / reward point of view, even though we could still see a few days of strength before the decline resumes. After the invalidation of silver’s rally and continued weakness in mining stocks it might be the case that we will see a slide in prices without an additional corrective upswing. It seems likely that profits from this trade will at least match the current profits in oil and likely exceed the recent profits in stocks.

On a side note, we have just posted the Oil Trading Alerts’ performance and we invite you to review it (long story short, the oil trades resulted in gains of almost 90% in the past 12 months).

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $973; stop-loss: $1,143, initial target price for the DGLD ETN: $117.70; stop-loss for the DGLD ETN $74.28

- Silver: initial target price: $12.13; stop-loss: $14.83, initial target price for the DSLV ETN: $101.84; stop-loss for DSLV ETN $57.49

- Mining stocks (price levels for the GDX ETF): initial target price: $10.23; stop-loss: $15.47, initial target price for the DUST ETF: $31.90; stop-loss for the DUST ETF $10.61

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $15.23; stop-loss: $21.13

- JDST ETF: initial target price: $52.99; stop-loss: $21.59

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

In November, the Indian government launched three gold schemes. What do they mean for the gold market?

What India’s Gold Monetization Programs Mean for Gold?

Will 2016 be better than 2015 for the yellow metal? We invite you to read our today’s article, offering some qualitative predictions for the gold market for the upcoming months, and learn what factors will affect the price of gold in the new year.

=====

Hand-picked precious-metals-related links:

Gold is the bright spot in commodities rout but 2016 forecasts are divided

=====

In other news:

Chinese stocks enter bear market

ECB 'playing for time' after disappointing December

Populist Wilders Says EU Is Finished as He Leads Dutch Polls

Iran crude exports on track to hit nine-month high in December: source

Here's a sign that PayPal is embracing Bitcoin

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts