Briefly: In our opinion, speculative short positions in gold, silver and mining stocks will be justified from the risk/reward perspective once the precious metals sector moves higher.

Gold reversed yesterday and it would have been profound, if it hadn’t been for the low volume that accompanied the move. Reversals are generally reliable only if they are accompanied by high volume, so what happened yesterday isn’t really bullish. Will the decline really continue right away?

That’s possible, but let’s keep in mind that mining stocks didn’t break below the previous lows and silver moved higher once again, so we have no meaningful bearish nor bullish confirmations at this time.

Let’s take a closer look at the charts (charts courtesy of http://stockcharts.com).

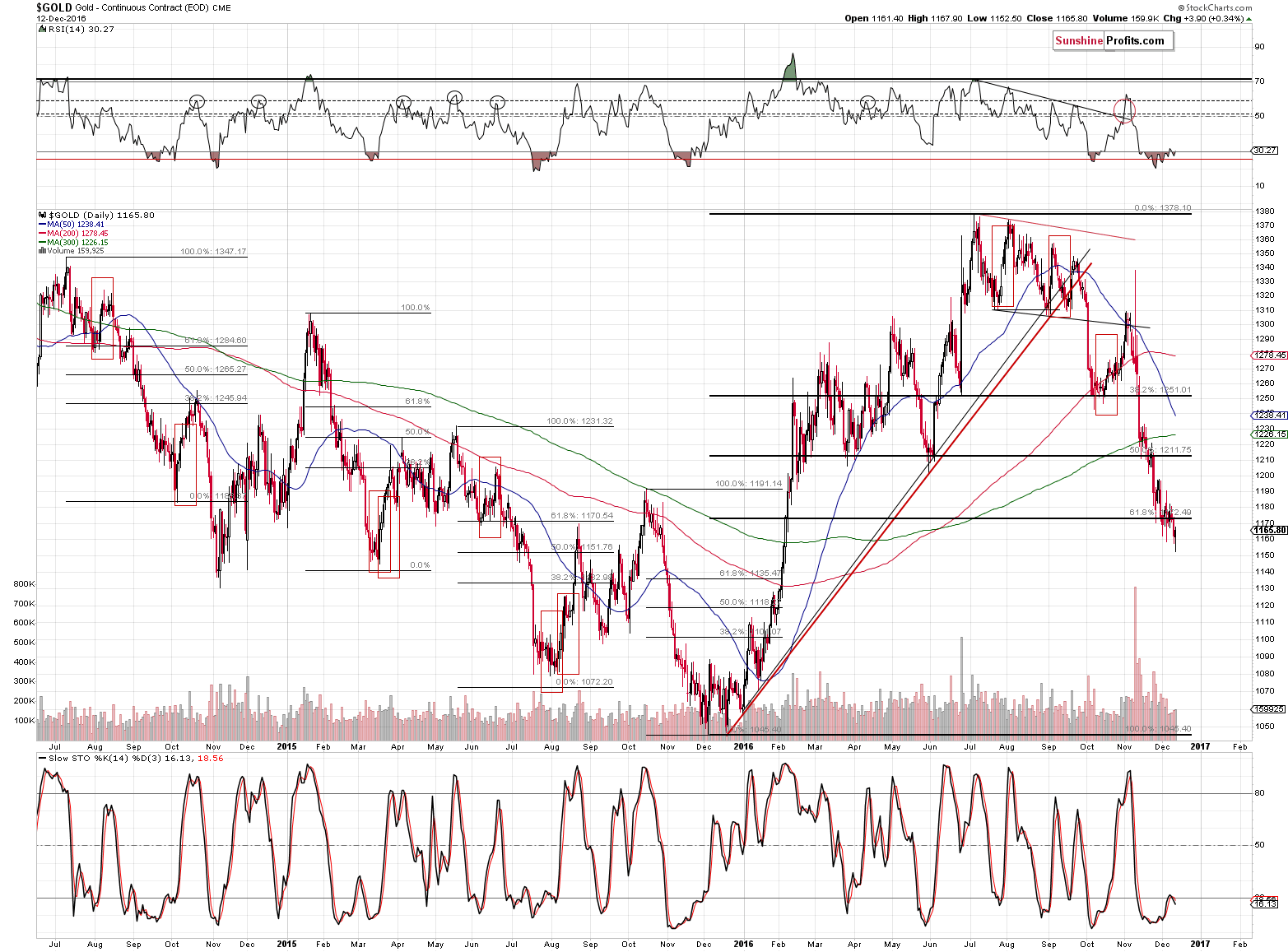

As discussed earlier, gold moved a bit higher yesterday, forming a daily reversal candlestick (precisely: a hammer candlestick), but the volume that accompanied the reversal was small, so it was not meaningful. The breakdown below the 61.8% Fibonacci retracement level appears to be almost confirmed, which has bearish implications.

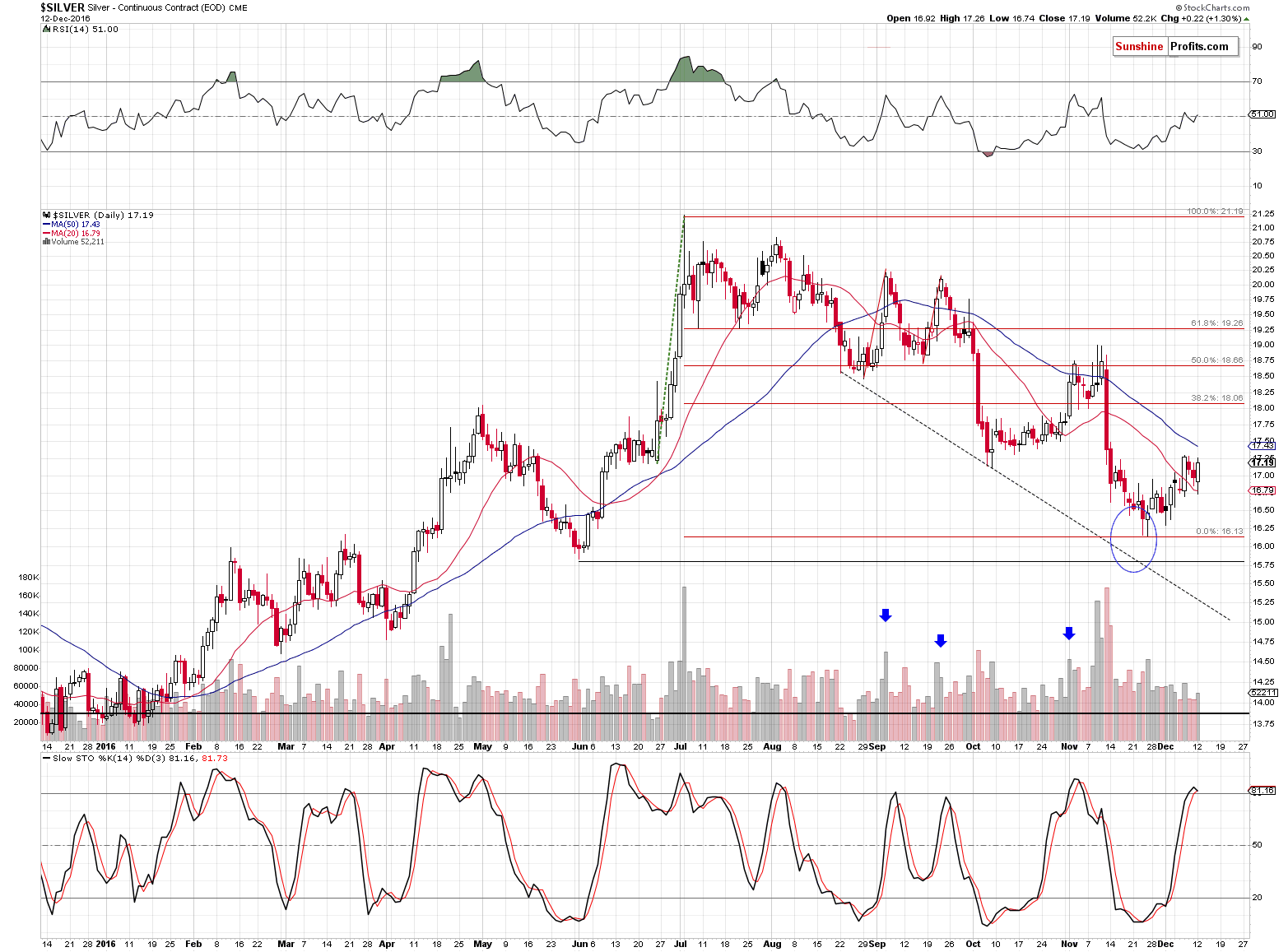

On the other hand, silver is not breaking below the previous lows. Conversely, it’s almost breaking to new monthly highs. Naturally, silver’s short-term strength can be a bearish confirmation, but that’s usually the case when both metals rally and silver greatly outperforms. Currently, the implications are not that clear – on one hand, the outperformance is bearish, but on the other hand, the lack of breakdown can be viewed as a sign of strength.

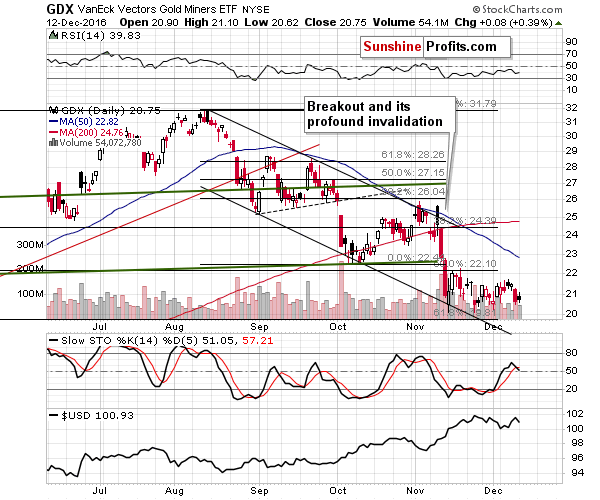

The analysis of mining stocks doesn’t add to the clarity – Friday’s decline took place on relatively high volume, and yesterday’s tiny move higher took place on lower volume and the implications are bearish. However, miners didn’t break below their previous lows, which – in light of gold’s declines – is a sign of strength and a bullish factor.

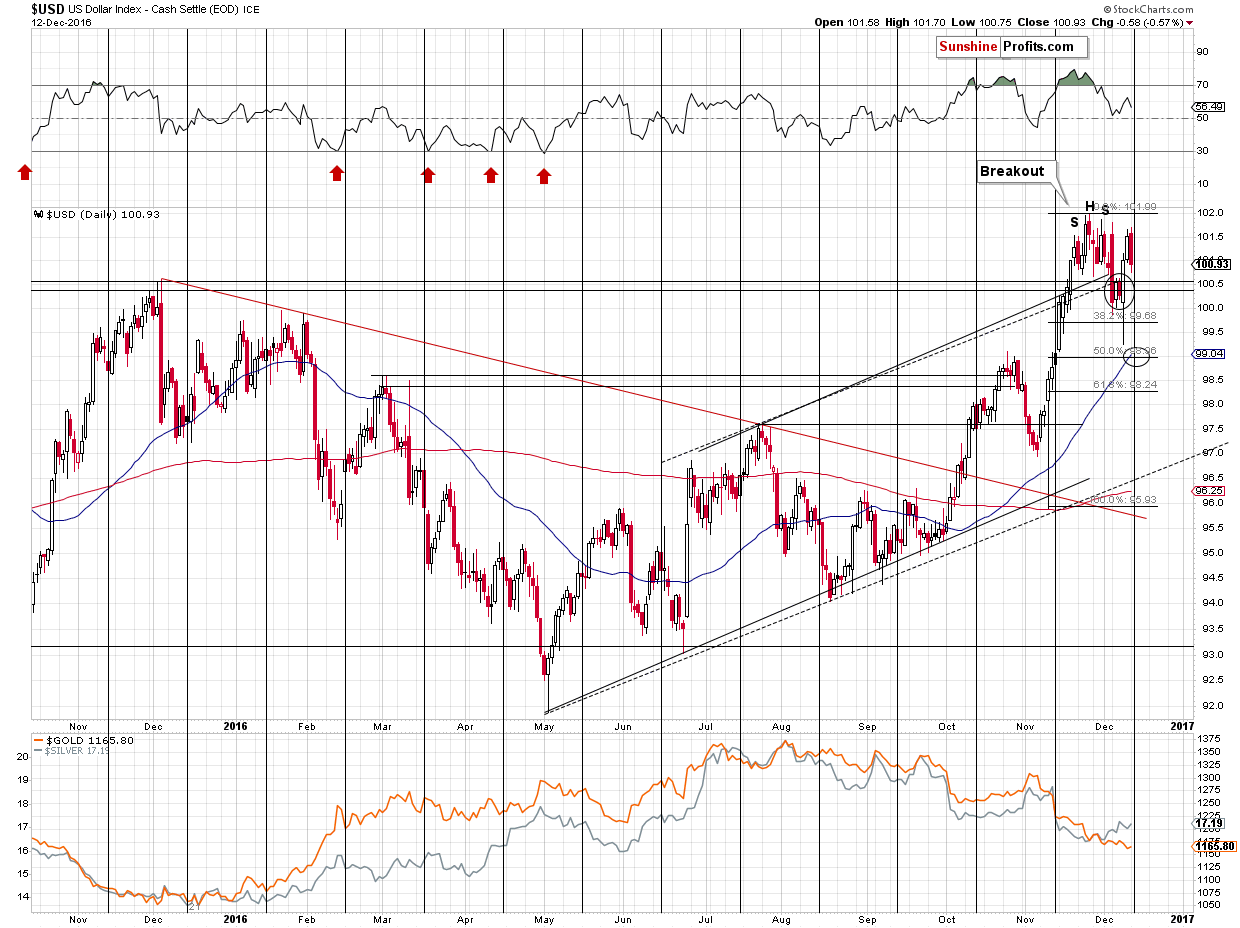

Finally, the USD Index is right at its cyclical turning point, which suggests a reversal. However, it would only add clarity to the current short-term outlook if there had been a clear trend in the previous several days – and it wasn’t the case. The USD Index moved sharply higher on Thursday and Friday, but declined on Monday, and it’s a tough call to say what is the very short-term trend right now.

Moreover, the USD Index already reversed in a profound way last week, and it could be the case that what was likely to happen based on the turning point has already happened (after all, the latter works on a near-to basis).

So, with a looming interest rate decision (which, in all likelihood, will be an interest rate increase), what’s the best (best meaning most justified from the risk to reward point of view) approach? We think it’s best to focus on the medium-term trend and on the good possibility that the market will initially overreact to the interest rate decision, just like it was the case with Donald Trump’s victory. Consequently, it seems that the plan that we described a few days ago remains up-to-date and it’s time to take action:

The same will be the case this time - the uncertainty will decrease and when that happens, the short-term tensions erode and bigger trends can resume. The medium-term trend for the precious metals sector is still down, so the above has bearish implications.

Still, the above doesn’t say how precisely the situation is likely to develop - but analogies to similar situations can. We saw a similar situation last month. Before Donald Trump was elected as the next U.S. President, his unlikely win was viewed as something that would drive gold much higher - some people called for a $150 - $300 rally if he won. What actually happened? Gold rallied initially, reversed and started a big slide. We expect something similar to happen after the rates are increased next week.

The question remains why would investors view a rate hike as something bullish for gold. Because last year - also in December - gold rallied after a rate hike.

Will gold rally first and then slide, just like when Donald Trump won the U.S. elections? It’s not certain, but it seems the most probable outcome at this time.

We will probably want to take advantage of such a move by placing entry orders for a short position above the current price. It is impossible to say if this will really be the case or what price levels we’ll choose as it will depend on what happens before the interest rate decision and what prices we see then.

You will find details of the positions in the “trading” section below the summary.

Summing up, the short-term outlook remains rather unclear and the medium-term outlook remains bearish. It still seems that we could indeed see higher prices right before the interest rate announcement. We haven’t seen significant bearish confirmations so far this week, so we are not entering speculative short positions at the current prices, but we do think that placing orders with entry prices above the current ones is justified from the risk to reward point of view. If these orders are not filled, we will probably re-enter the speculative short positions relatively soon anyway.

Also, let’s keep in mind that the upcoming big decline in the precious metals sector is likely to create a great buying opportunity in case of the long-term investment capital - be sure to prepare yourself for it.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (100% of the full position) in gold, silver and mining stocks will be justified from the risk/reward perspective (if gold, silver or mining stocks move to their entry price levels) with the following entry prices, stop-loss orders and initial target price levels:

- Gold: entry price level: $1208; initial target price: $1,006; stop-loss: $1,272, entry price level for the DGLD ETN: $56.14 ; initial target price for the DGLD ETN: $88.88; stop-loss for the DGLD ETN $45.77

- Silver: entry price level: $17.68; initial target price: $13.12; stop-loss: $19.13, entry price level for the DSLV ETN: $24.69 ; initial target price for the DSLV ETN: $46.18; stop-loss for the DSLV ETN $17.86

- Mining stocks (price levels for the GDX ETF): entry price level $21.88; initial target price: $9.34; stop-loss: $26.12; entry price level for the DUST ETF: $45.33 ; initial target price for the DUST ETF: $143.56; stop-loss for the DUST ETF $12.12

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: entry price level: $35.88; initial target price: $14.13; stop-loss: $44.12

- JDST ETF: entry price level: $32.26 ; initial target price: $104.26; stop-loss: $4.99

If gold’s entry levels are hit, also silver’s and mining stocks’ positions will automatically be justified at this time (regardless of their respective prices at that time).

If silver’s entry levels are hit, also gold’s and mining stocks’ positions will automatically be justified at this time (regardless of their respective prices at that time).

If GDX’s entry levels are hit only mining stocks will be affected and other positions (in gold and silver) will NOT automatically be affected. In this case, waiting for gold’s or silver’s entry price levels will seem appropriate before opening short positions in metals.

We will send a confirmation e-mail, but if the session is very volatile, we may not be able to deliver it to you before the prices reverse, so it seems that entering the orders at this time is justified from the risk to reward point of view.

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The second Fed hike in a decade is coming. What does it mean for the gold market?

=====

Hand-picked precious-metals-related links:

Indian Gold Imports Said to Jump to Year’s High in November

=====

In other news:

Raising Interest Rates in Uncharted Territory

Fear has clearly given way to greed

Look for the Fed to hike interest rates this week and to ignore the elephant in the room

OPEC Deal to Create Oil-Supply Deficit Next Half, IEA Says

New bank capital rules softened to ease European fears: sources

New Italy PM Gentiloni says ready to intervene to support banks

Exclusive: SWIFT confirms new cyber thefts, hacking tactics

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts