Briefly: In our opinion, regular (100% of the full position) speculative long positions in gold, silver and mining stocks are justified from the risk/reward perspective.

Gold declined yesterday on low volume and this seems insignificant only at the first sight. When one looks closer, it becomes visible that there are important implications for the following days. Let’s examine the gold chart for details (charts courtesy of http://stockcharts.com).

The key thing about the relatively tiny volume after a decline and then a small consolidation is that it is exactly what was seen right before upswings a few times earlier this year. 2 out of 3 of the above were sharp, so this could be viewed as a timely final call sign before the short-term upswing starts.

Gold closed below the 61.8% Fibonacci retracement yesterday, but only a little below it, so the breakdown is not yet meaningful as it is definitely not confirmed.

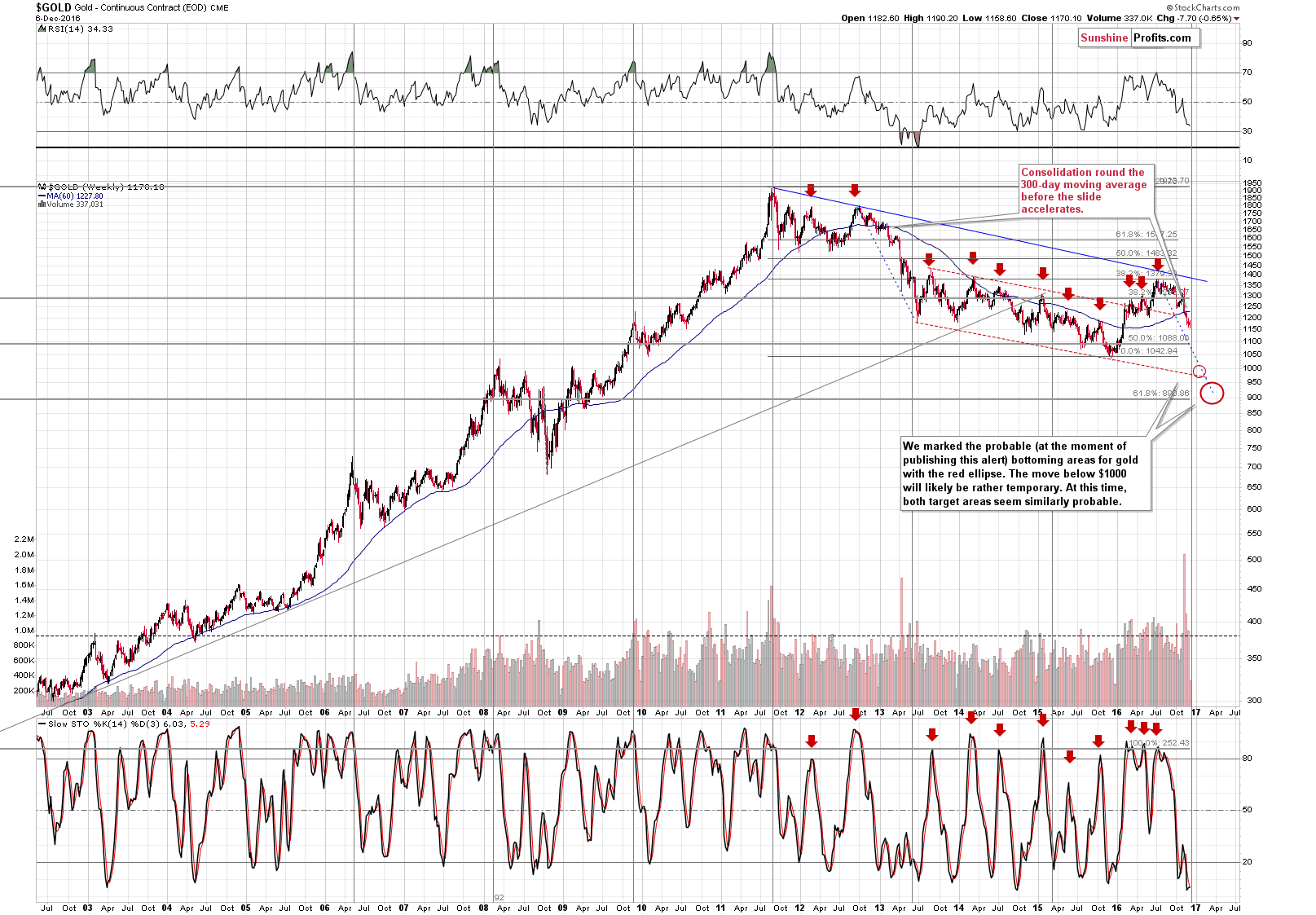

From the broader perspective, we continue to see that gold is almost right at the long-term turning point, which currently has bullish implications. Our previous comments on the this phenomenon remain up-to-date:

As we discussed above, not much happened in gold on a weekly basis, but we can see something significant on the above chart – the proximity of the long-term turning point in gold. Is it likely to market a major bottom for gold? That’s certainly possible, but let’s keep in mind that the turning points work on a near-to basis, and since it is the long-term chart that we discuss, the near-to could be a month or a few of them. This doesn’t help us with the short-term outlook by itself, but it does confirm that one should be preparing for the final bottom in the precious metals in the following months.

As far as short-term implications are concerned, we can say that a bounce here is quite possible based on the above chart especially that the current move continues to be similar to what we saw in early 2013 (which also was before the turning point). Back in 2013, the final short-term bounce before the big, volatile decline was seen shortly after gold broke below the 300-day moving average. This happened recently and thus it now seems that a corrective upswing – probably the final one before the big drop – will be seen shortly. The fact that the RSI is currently at more or less the same level as it was when the local bottom was formed back in 2013 makes the mentioned scenario more likely.

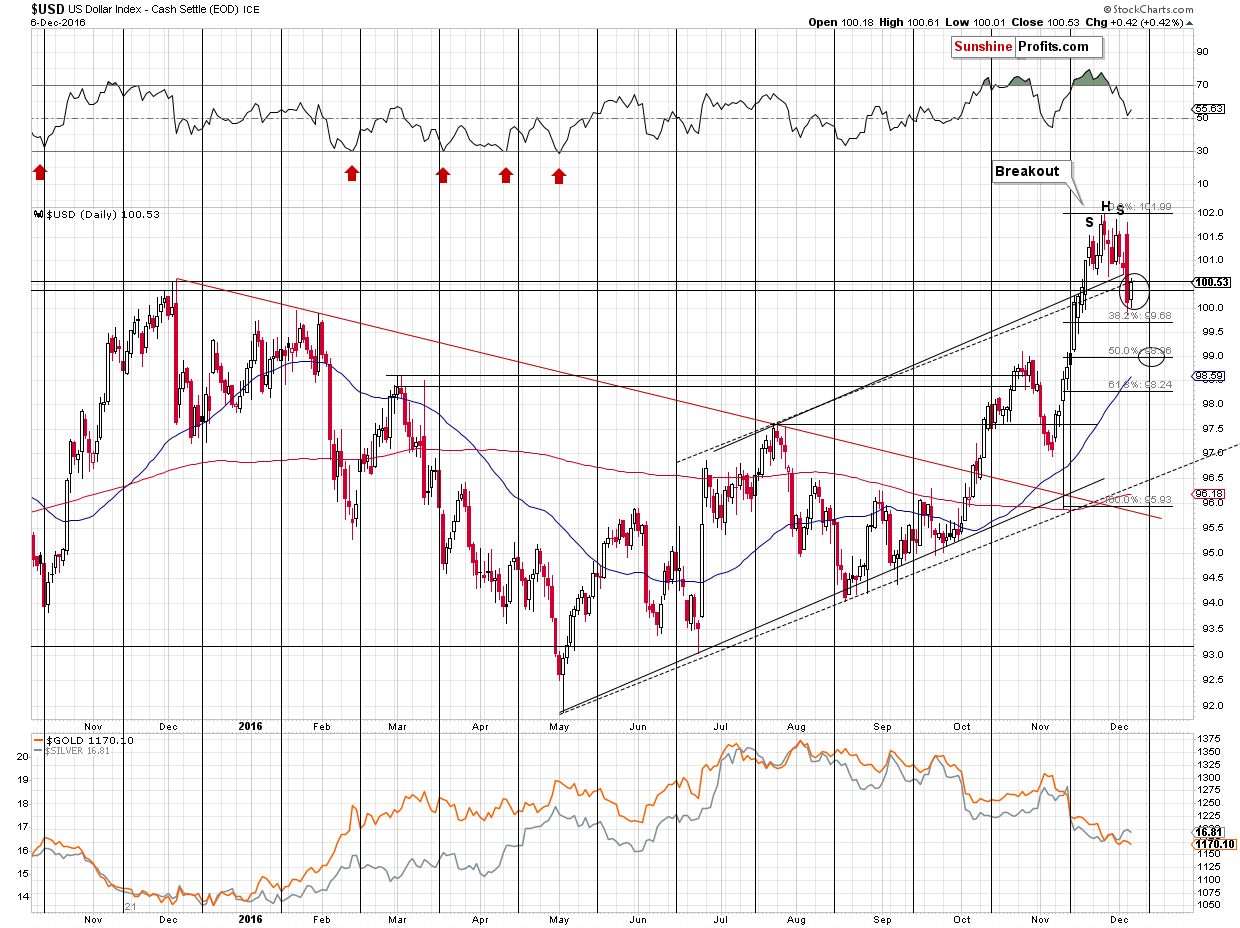

We discussed the situation in the USD Index yesterday and today we would like to add one thing about the relative performance of gold to the USD Index. Namely, the USD Index moved higher by over 0.40, while gold moved lower by only $6. This may not seem bullish at the first sight, but compared to what we’ve been seeing recently (lack of reaction to the USD’s decline), it’s a step in a bullish direction. If gold was really about to take a dive, then yesterday’s session would likely have served as a good trigger and we should have seen a much bigger decline than we did. Consequently, it does seem that gold could – and is likely to – move higher before the big decline continues.

Summing up, it still seems that a short-term (!) rally in gold is just around the corner even though the medium-term trend remains down. Gold showed at least some strength relative to the USD Index, the tiny volume that we saw yesterday suggests a quick move higher shortly and there are also other factors suggesting that a short-term rally in the precious metals market is at hand and that it is probably the final corrective upswing before the big plunge. Be sure to prepare yourself for the latter – we haven’t made a change in our long-term investment capital, but it is likely to change in the coming months. Again, it seems that we will have a short-term rally first.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Long positions (full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following entry prices, stop-loss orders and initial target price levels:

- Gold: initial target price: $1,237; stop-loss: $1,146, initial target price for the UGLD ETN: $10.48; stop-loss for the UGLD ETN $8.48

- Silver: initial target price: $17.27; stop-loss: $15.67, initial target price for the USLV ETN: $15.04; stop-loss for the USLV ETN $11.22

- Mining stocks (price levels for the GDX ETF): initial target price: $23.27; stop-loss: $18.87, initial target price for the NUGT ETF: $10.74; stop-loss for the NUGT ETF $5.78

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $38.17; stop-loss: $30.94

- JNUG ETF: initial target price: $8.88; stop-loss: $4.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

On Monday, the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) and the World Gold Council (WGC) approved the Shari’ah Gold Standard. What does it imply for the gold market?

Shari’ah Gold Standard Approved

=====

Hand-picked precious-metals-related links:

From Hot to Not, Investors Exit Gold Funds in Switch to Equities

=====

In other news:

Asian shares edge up as markets look to ECB after Italian jolt

Alarm Bells Over FTSE’s ‘Head and Shoulders’ Symptoms

Mobius Sees Weaker Dollar Next Year as Trump Boosts Industry

Bill Gross: Trump's Impact on Bonds, Stocks

BOJ Iwata keeps focus on money printing, exposes rift in board

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts