Briefly: In our opinion, no speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view. We will likely have another trading opportunity shortly.

Gold rallied yesterday after comments from the ECB triggered turmoil in the currency markets and it closed above the previous high (highest daily close of this year). Will this breakout result in higher prices in the near term?

In short, that’s quite possible – it’s too likely for us to open short positions right now despite indications that the next big move will be to the downside.

Let’s take a closer look at the charts (charts courtesy of http://stockcharts.com).

In yesterday’s first alert we wrote the following:

Gold moved lower once again yesterday and it closed $8 lower. That’s only a bit bearish, because we did not see a breakdown below the rising support line and the upper border of the previous triangle pattern. Consequently, the situation is still too unclear to enter a position at this time.

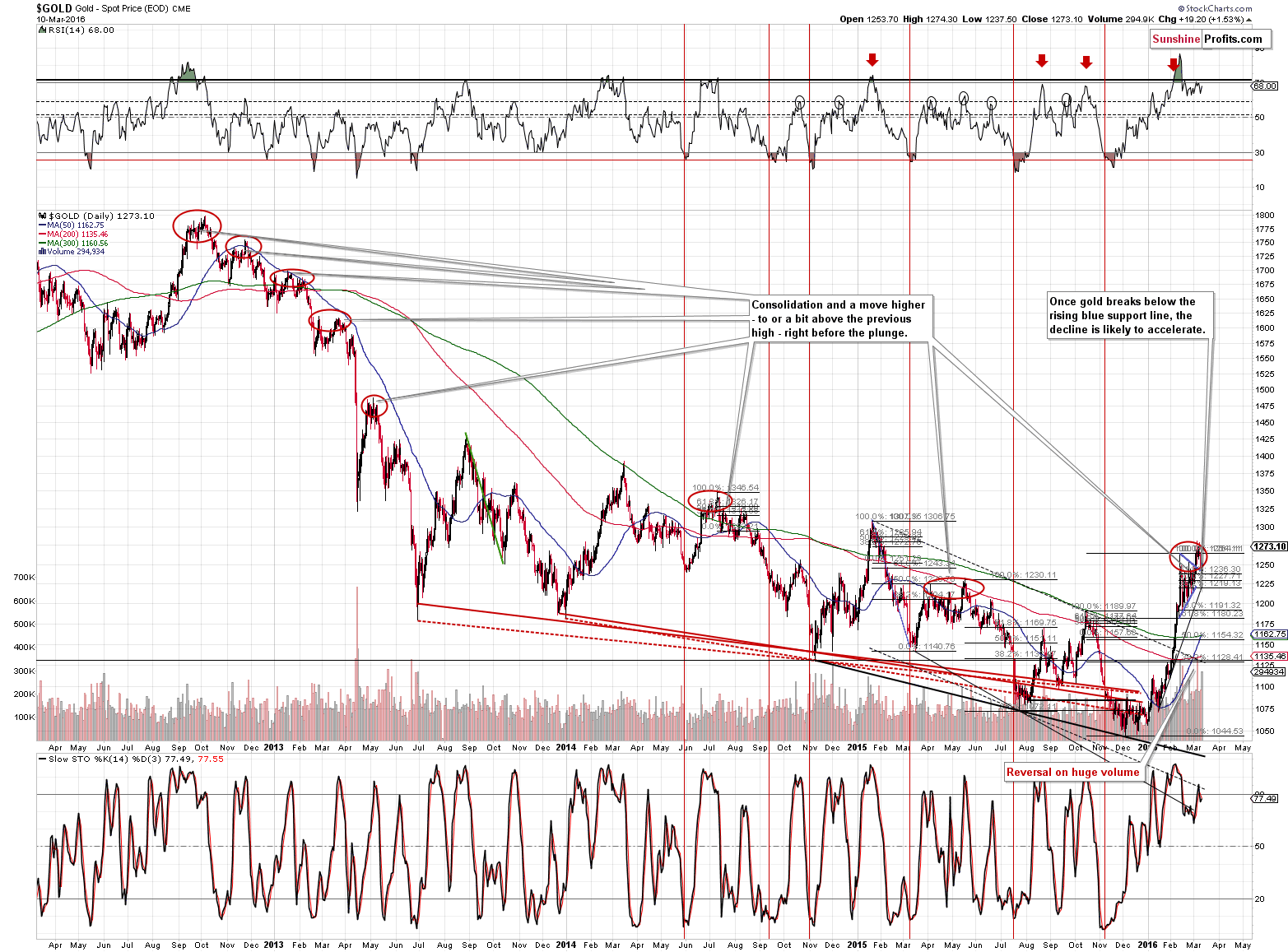

It turned out that the caution was more than justified. Gold moved almost $20 higher and closed above the highest (previously) close of the year. The breakout took place on significant volume, which suggests that it’s likely to be followed by further gains.

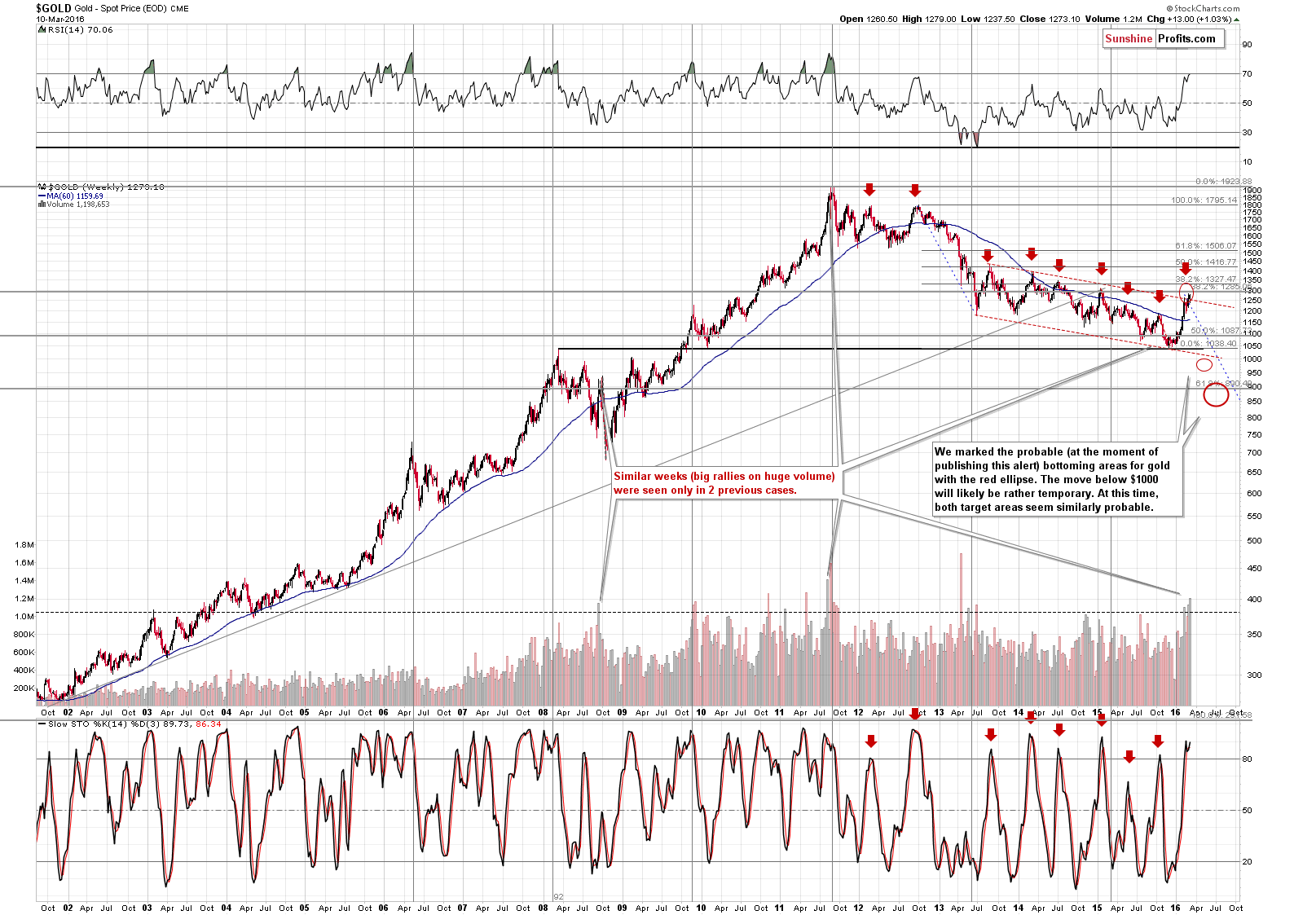

However, gold is not likely to rally far based on the long-term chart (and long-term charts have more important implications than the short- and medium-term ones).

We have already written about the possibility that gold could even move to $1,328 or so (thus correcting 38.2% of the decline that started in 2011) before declining once again and nothing has changed in that regard. The thing that we would like to focus on is the volume. On a daily basis, yesterday’s volume is a bullish thing, but if we consider the bigger picture, the implications are bearish for the medium term.

The only 2 times that we saw as big a volume as we’re seeing now was right before the 2011 top and right before the mid-2008 top. In both cases, sharp and huge declines followed in the following weeks. In the latter case, gold declined to new lows and in the former case, gold formed an all-time nominal high. While the implications are not for the very short term, they are important and bearish.

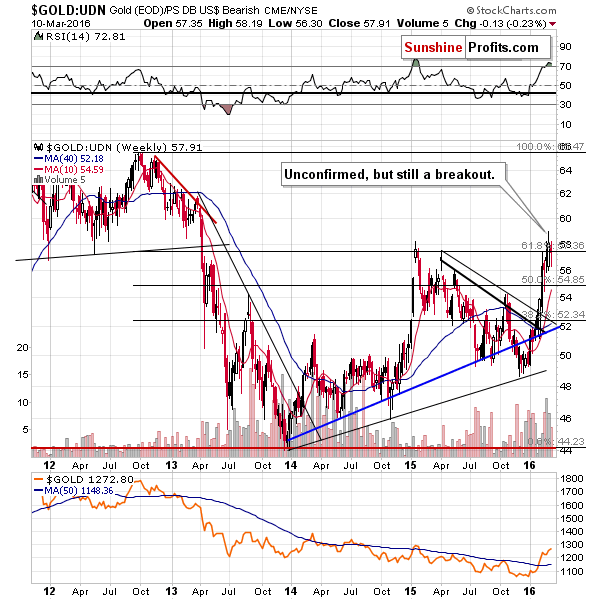

From the non-USD perspective, gold actually declined this week (after invalidating the breakout above the 2015 high). That’s a quite bearish piece of news, because we just saw major bullish news for gold from the ECB (additional stimulus). Gold in non-USD terms should have soared yesterday – and it didn’t, which is a bearish sign for the medium term.

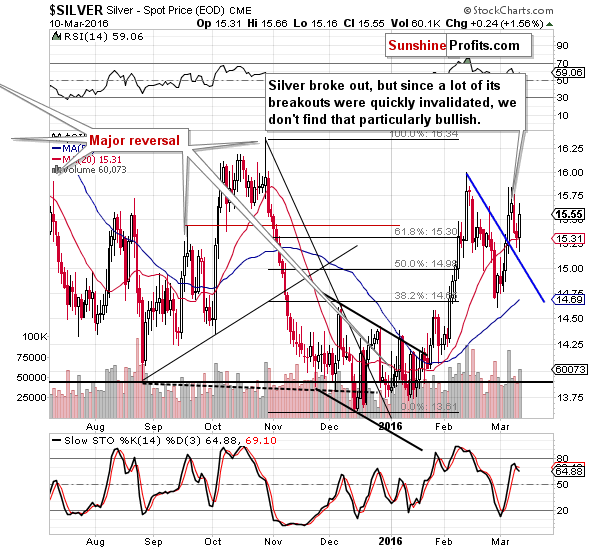

The situation in silver didn’t change much – silver moved higher after correcting the previous breakout, and it could be viewed as bullish… If it weren’t silver – silver tends to invalidate its breakouts, so we are not making much – if anything – of its recent move above the resistance line.

Silver didn’t outperform gold yesterday, so we saw no bearish confirmation from this market.

In yesterday’s first alert, we wrote the following:

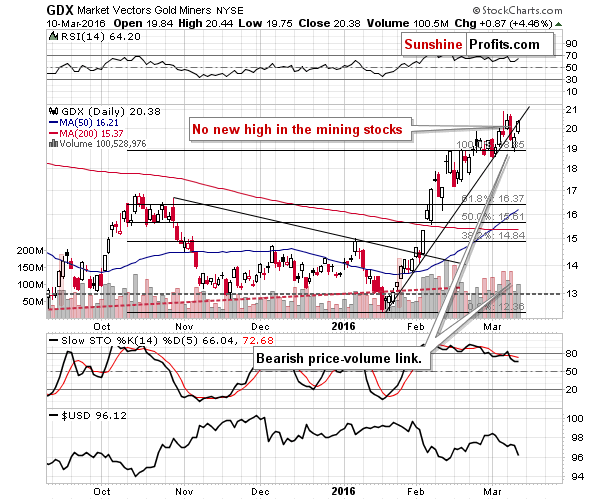

The miners broke below the rising support line on big volume on Tuesday (insignificantly, but still) and the bearish fact is that despite yesterday’s small move higher, the breakdown was not invalidated. The size of the volume that accompanied yesterday’s move higher (or a pause, depending on how one chooses to look at it, but this doesn’t change much) was low, which further confirms the bearish outlook.

The thing that we learned over many years of analyzing the precious metals market is that unlike many other markets, it takes 3 consecutive closes below a certain level for the breakdown to be confirmed. A “confirmed breakdown” is more likely to result in lower prices than an unconfirmed one. Consequently, if we see yet another daily close below the rising support line, the outlook will become much more bearish and we might re-open short positions at that time.

Instead of a clear close below the rising support/resistance line, we saw a move to the line and a close right at it. The implications are not particularly bullish (especially that the volume that accompanied yesterday’s session was not huge), but they are not particularly bearish either. If miners had closed lower, we could say that the breakdown was clearly confirmed, but with a close right at the support/resistance line, it as much confirmed as invalidated – overall, the situation did not clarify yesterday.

If gold continues to move higher in the following days, but miners underperform (or even decline), we’ll have strong bearish confirmations at hand. It could be the case that the underperformance is already in place as miners didn’t close at new highs, while gold did.

Summing up, the situation in the precious metals improved yesterday (for the short term only), remaining in rather unclear territory, but with an increased chance for a rally to $1,328 before a reversal. The main medium-term trend for the precious metals still seems to be down. Consequently, it seems that it’s justified to wait and re-enter the short position (or open a long one if we get much more bullish signs, but this doesn’t appear likely) in more favorable conditions (preferably at higher prices after seeing a major daily reversal).

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The London gold market is very opaque. We invite you to read our today’s article presenting the biggest market for precious metals in the world and find out how the London gold market really functions. We focus on the London Gold Fix, analyzing whether it is rigged or not.

London Gold Fix Rigging – Fact or Myth?

=====

Hand-picked precious-metals-related links:

LAWRIE WILLIAMS: PDAC in retrospect.Is the recent gold rally sustainable.

US dollar, inflation expectations matter more than ECB for gold

WGC: World Official Gold Holdings

Why poor man’s gold may be about to get more investor love

=====

In other news:

Europe Presses the Panic Button

Why Euro-Area Inflation Will Be Low for Years, According to Draghi

Stocks Turn With Bonds and Euro as Draghi Plan Gets Second Look

How to Stem the Feds’ Spending Addiction Before It Cripples Our Economy

Why giving politicians influence over monetary policy is a bad idea

For China Banks, Swapping Stock for Debt Is a Stopgap With Pitfalls

IEA Says Oil Prices Might Have Bottomed Out

Why the worst is not necessarily over for oil: IEA

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts