Briefly: In our opinion, no speculative positions are justified from the risk/reward point of view.

Gold continued to move higher yesterday, but the biggest gains were seen in silver and mining stocks. What are the implications of these moves?

Let’s jump right into the charts (charts courtesy of http://stockcharts.com).

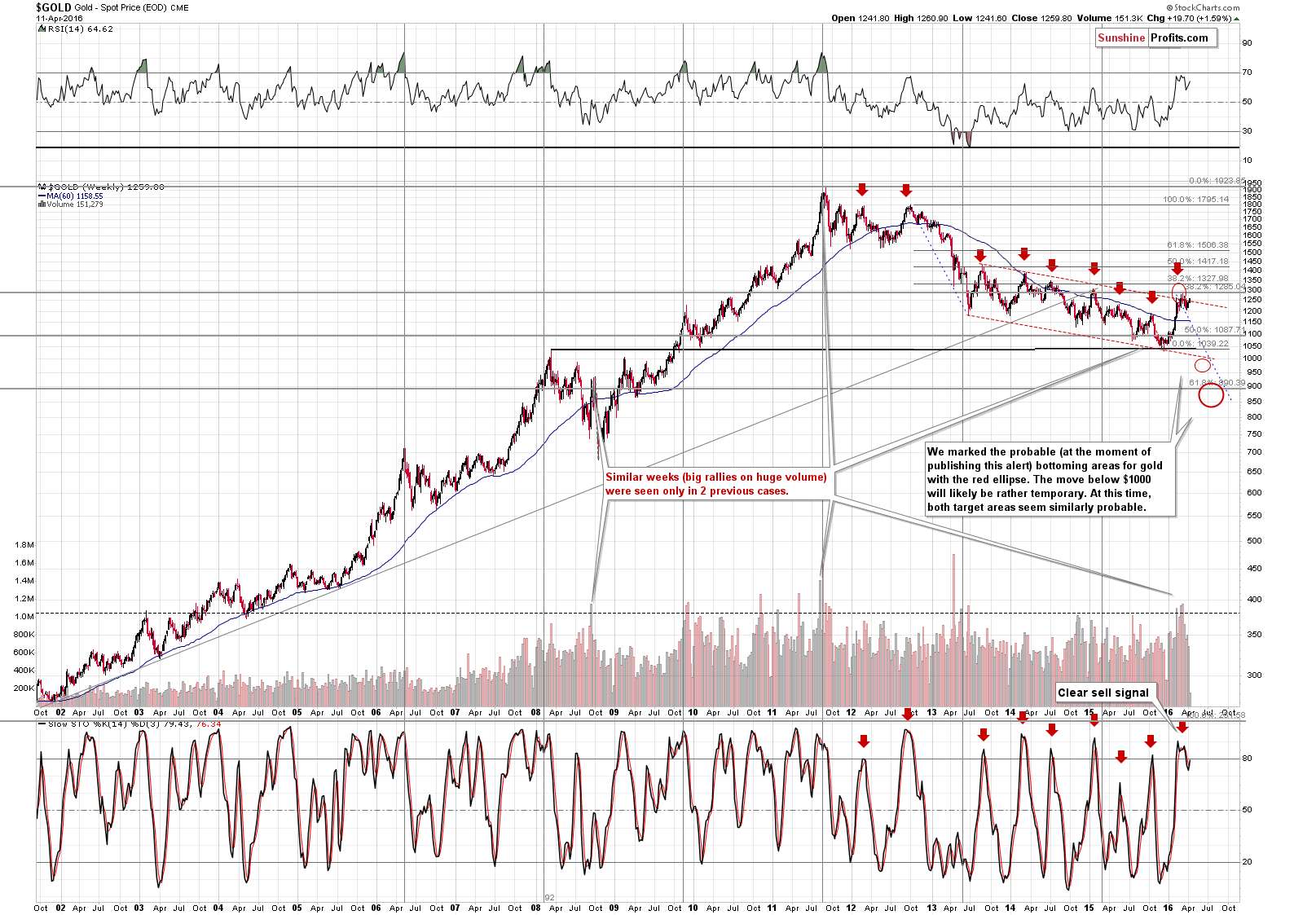

Most importantly, little changed from the long-term perspective. Gold is more or less at the upper border of the declining trend channel and there was no meaningful breakout above it.

One thing that may seem bullish is the value of the Stochastic indicator, which moved a bit above its moving average, thus invalidating the previous sell signal. In our view, it’s too early to view this as really bullish because the indicator is based on weekly closing prices and the week is far from being over.

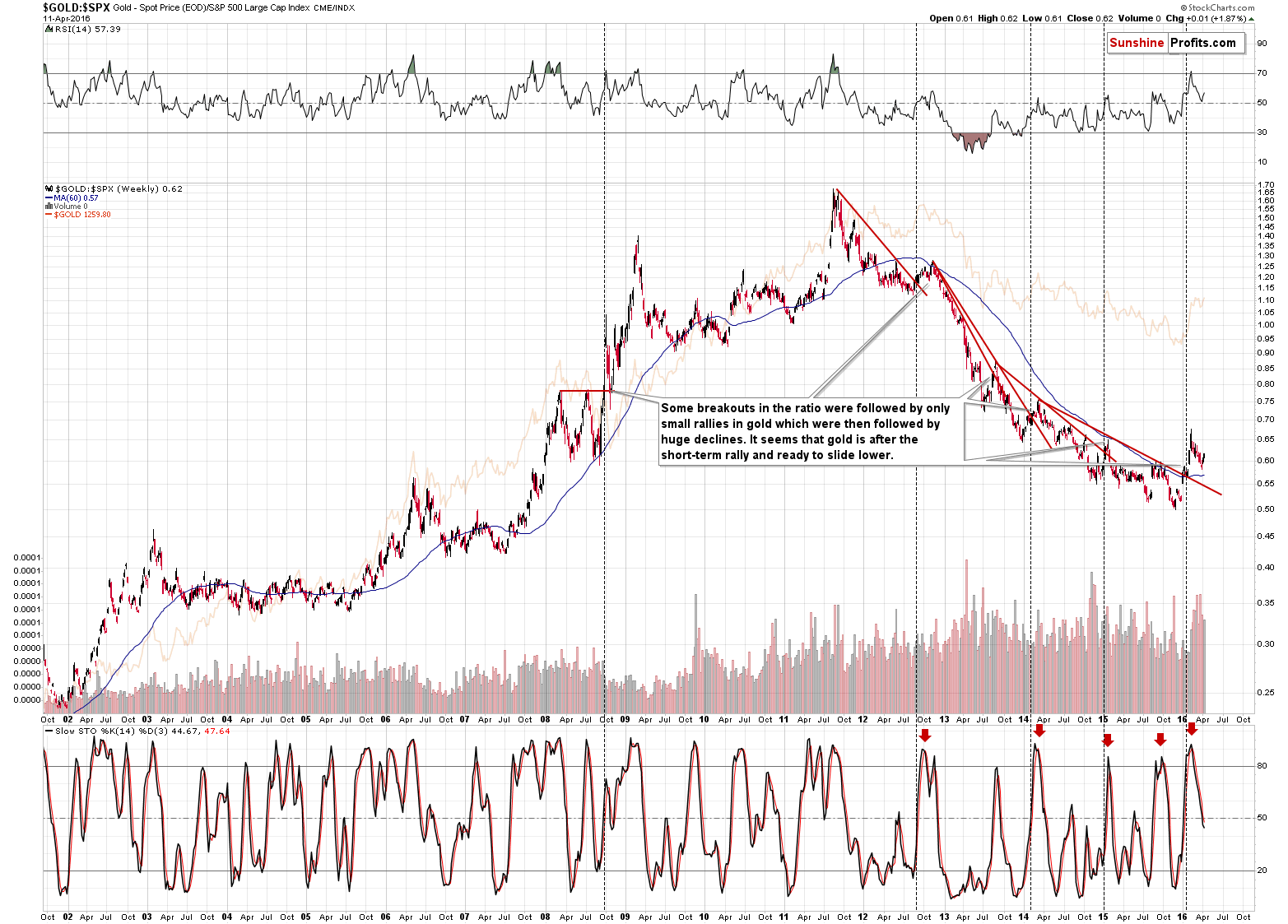

Besides, looking at the gold to general stock market ratio (which smoothens the medium-term moves) shows that the sell signal from the Stochastic indicator remains in place.

In yesterday’s alert we wrote the following:

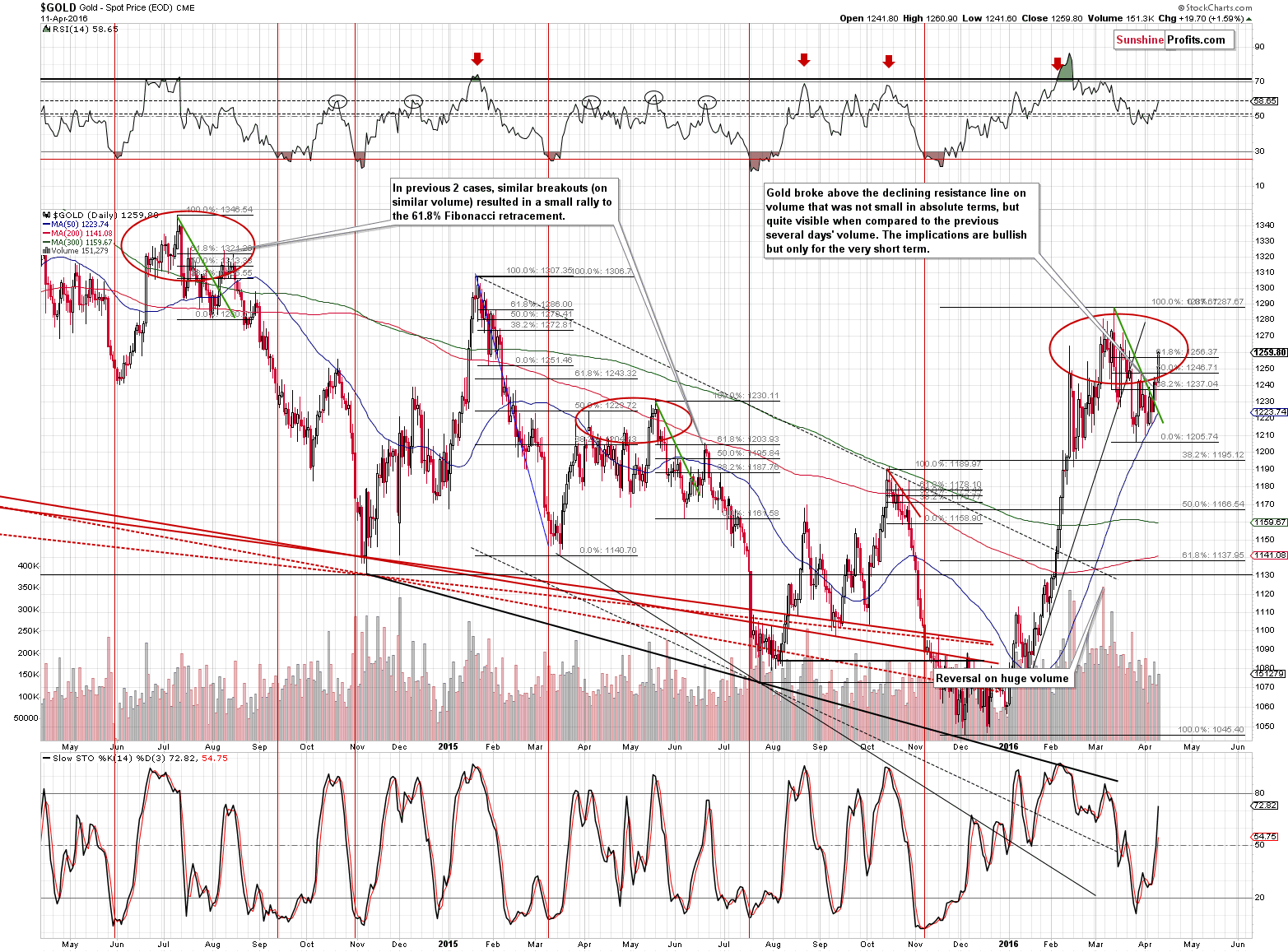

On the short-term chart, we see that gold didn’t invalidate the breakout above the declining short-term resistance line and the 38.2% Fibonacci retracement level. Is the breakout confirmed? We usually wait for 3 consecutive closes above a certain level before saying this is the case, but it seems that since gold closed the week above the previously broken levels, we can view the breakout as confirmed.

The question is if this is significant. As far as short-term is concerned, it seems that it is.

There are 3 similar situations visible on the above chart. We marked 2 of them with green lines and one of them (October 2015) with a red line. These 2 cases are more similar because gold broke out in terms of closing prices in both cases, and there was only an intra-day breakout in the third case.

So, what happened in these cases? In all cases gold moved higher and declined only after moving to the 61.8% Fibonacci retracement level. That was in fact the final chance to enter a short position, before the decline’s pace greatly increased.

What about the volume? It pretty much confirms the above. In cases when the breakouts caused small rallies, the volume on which the breakouts were seen were quite similar to what we saw yesterday – the volume was not huge, but decent.

The above remains up-to-date. Gold moved higher in today’s pre-market trading (to $1,255) so the rally could already be over.

At the moment of writing these words gold is at about $1,260, which is still very close to the 61.8% Fibonacci retracement. In both of the mentioned cases gold actually moved a bit above the 61.8% retracement before reversing, so the current situation is still in tune with what happened in previous cases.

Another interesting fact is the size of yesterday’s volume. Gold rallied almost $20, so one would expect the volume to big huge – but it wasn’t. It was relatively small, which has bearish implications.

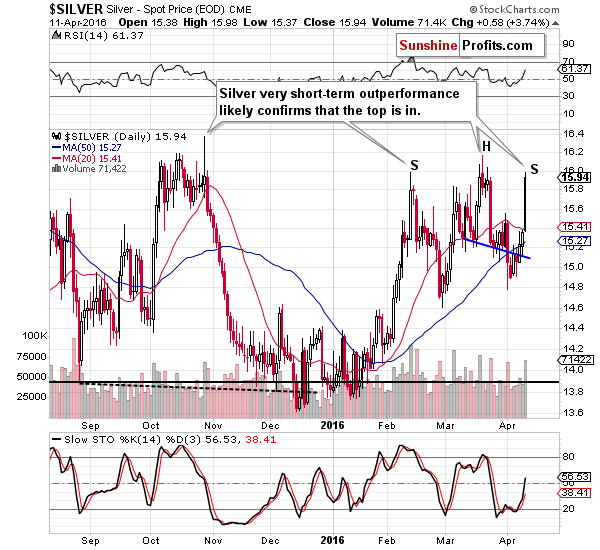

Let’s move to silver.

In yesterday’s alert we wrote the following:

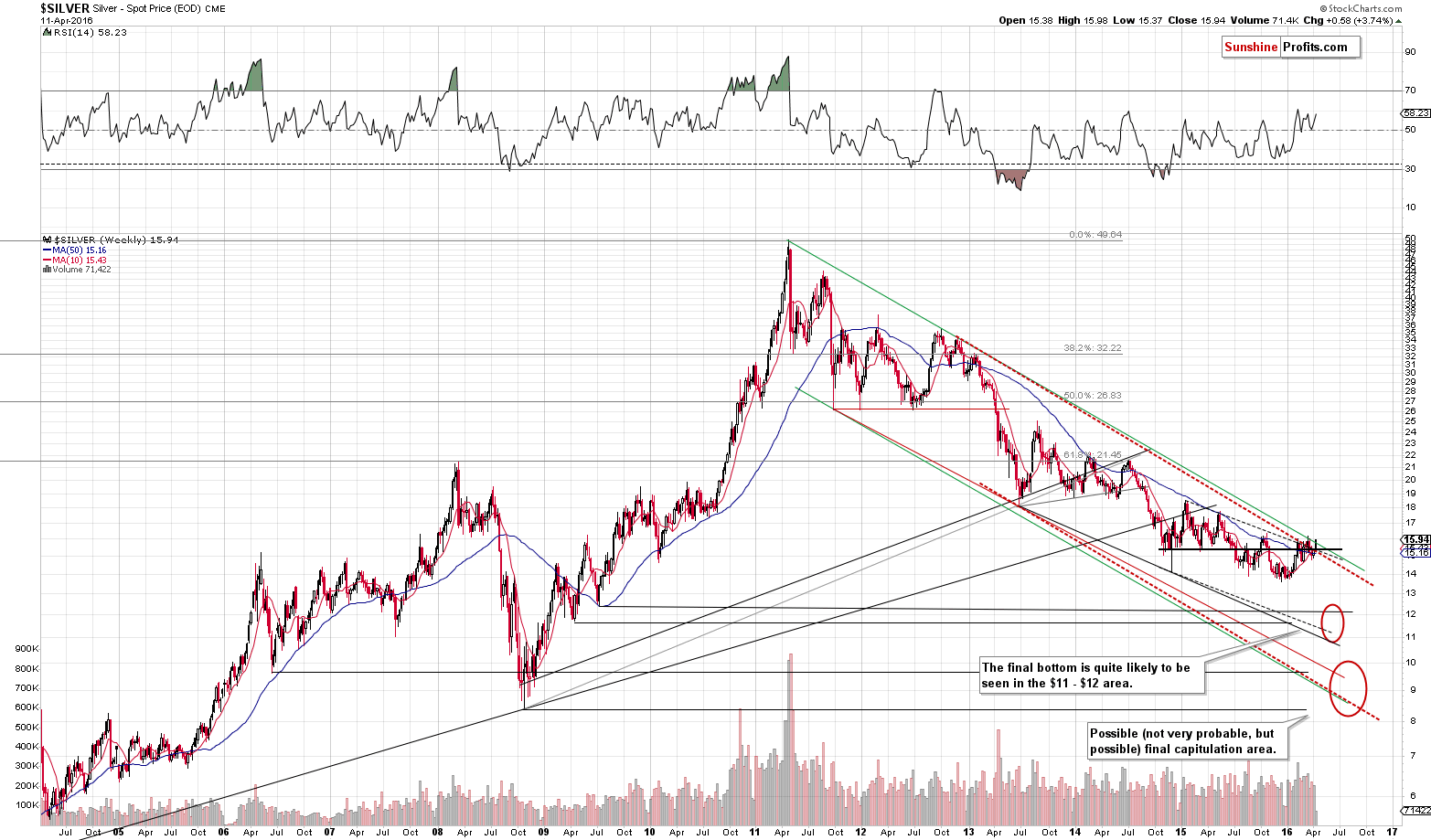

Just like it was the case with gold, there are no changes on the long-term silver chart. The trend remains down and the potential for any additional rally is very limited as there is very strong resistance (marked in green) relatively close to where silver is currently trading.

(…)

Silver has underperformed recently on a short-term basis, but let’s not forget that silver tends to outperform very temporarily right before local tops, so we could see a more visible move higher in silver shortly.

The above remains up-to-date. Silver could move higher on a very temporary basis and it could serve as a bearish confirmation.

Silver has just definitely outperformed on a very short-term basis and we have the bearish confirmation that we wanted to see. On the long-term chart, we can see that silver just moved a little above the long-term declining green resistance line. The previous attempt to break above it was quickly invalidated and it seems that this will be the case also this time.

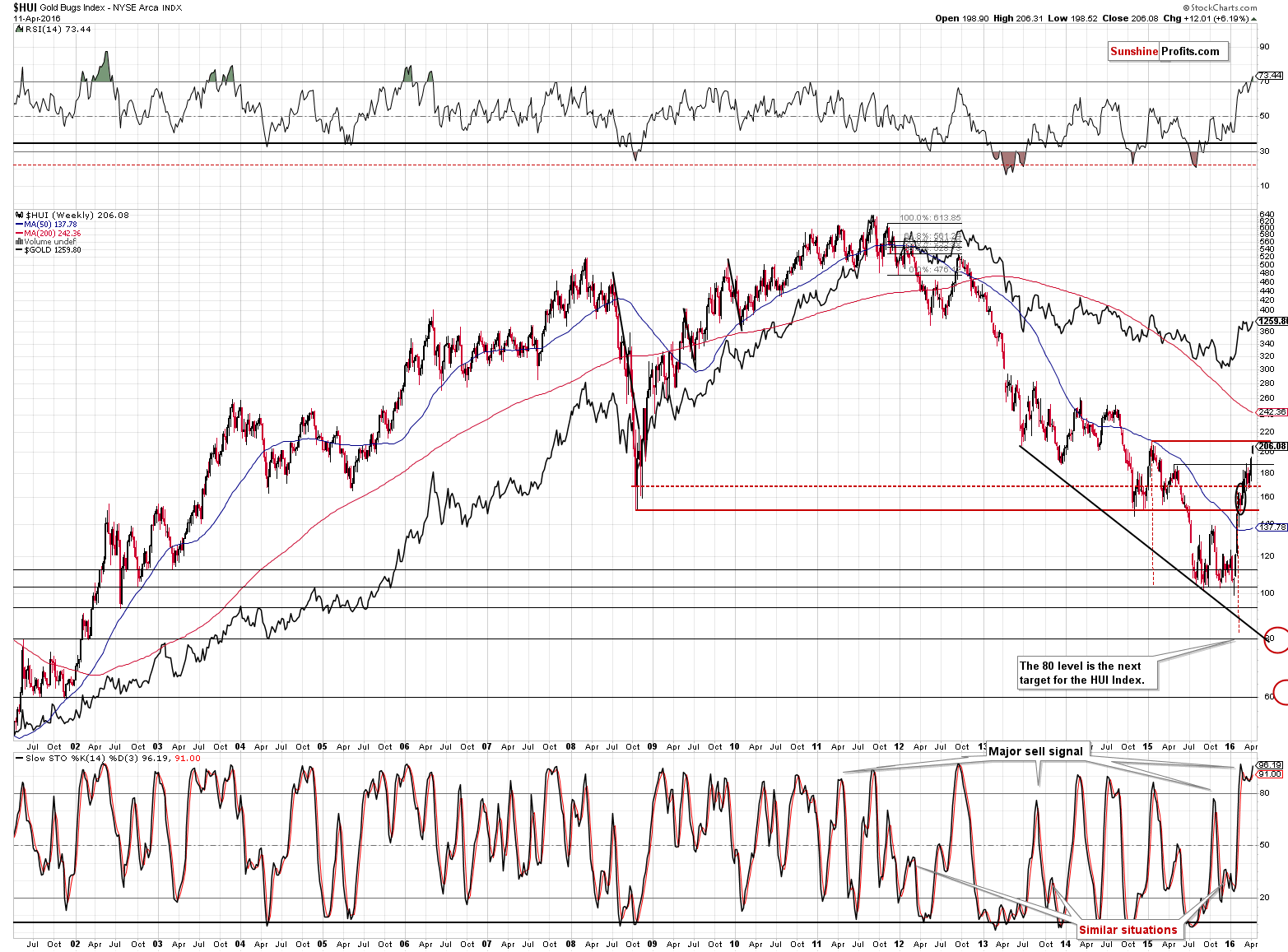

In yesterday’s alert we commented on gold stocks in the following way:

Gold stocks broke above the April 2015 high and this is a somewhat bullish event – somewhat, because this breakout was not confirmed. Still, based on this breakout, it could be the case that the HUI will move to the next resistance at about 211 before turning south again.

It is mainly due to this sign that we are not re-opening the short position at this time, despite gold moved almost to its 61.8% Fibonacci retracement in today’s pre-market trading. Given this bullish sign from the HUI Index, it seems best to wait for an additional sell signal before re-entering short positions.

The HUI Index indeed moved higher yesterday, but the 211 level wasn’t reached. This doesn’t mean that miners can’t decline before reaching this level. They can, for instance based on the 2015 high in terms of daily closing prices, which is at about 207 – very close to yesterday’s close.

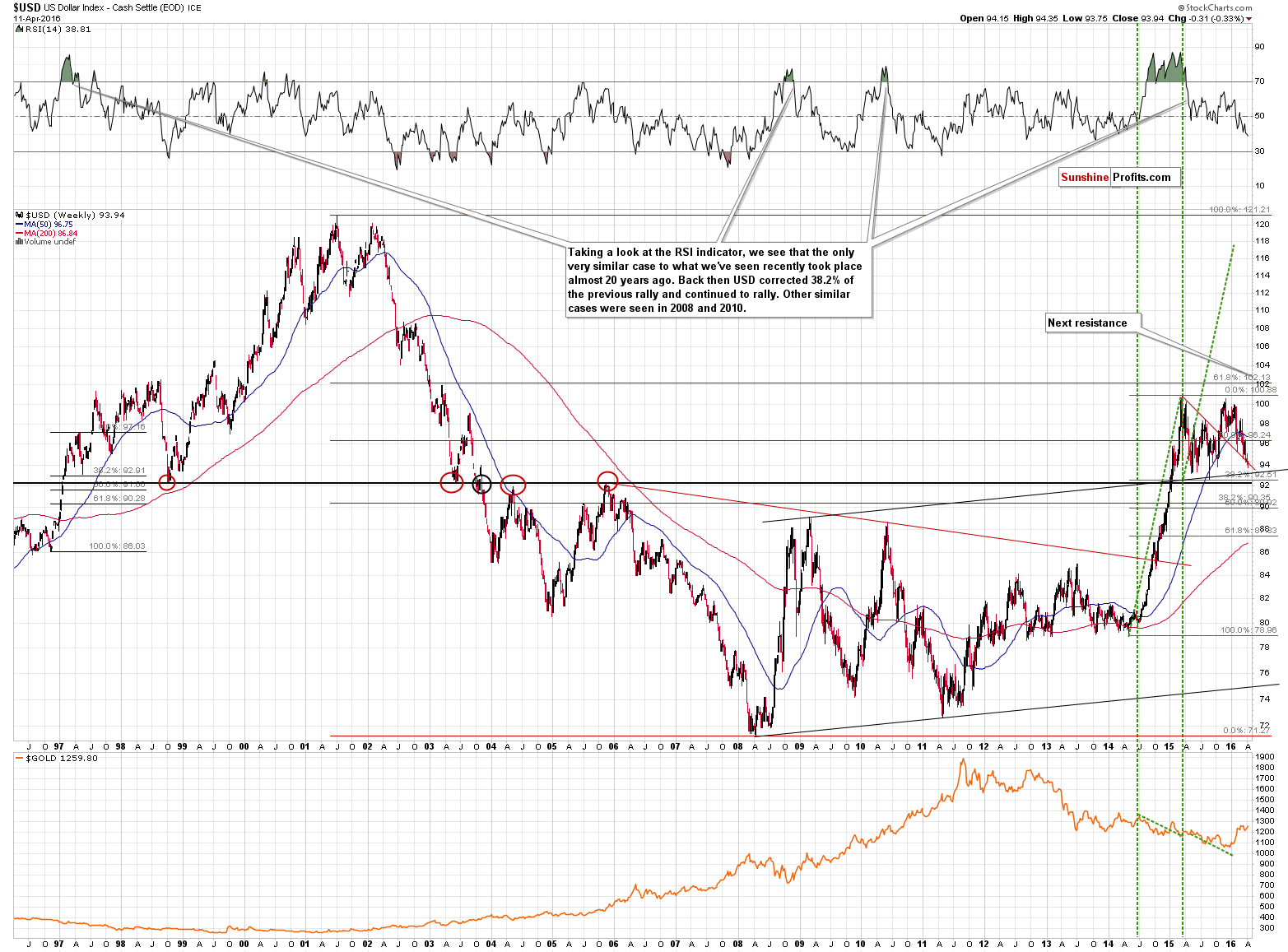

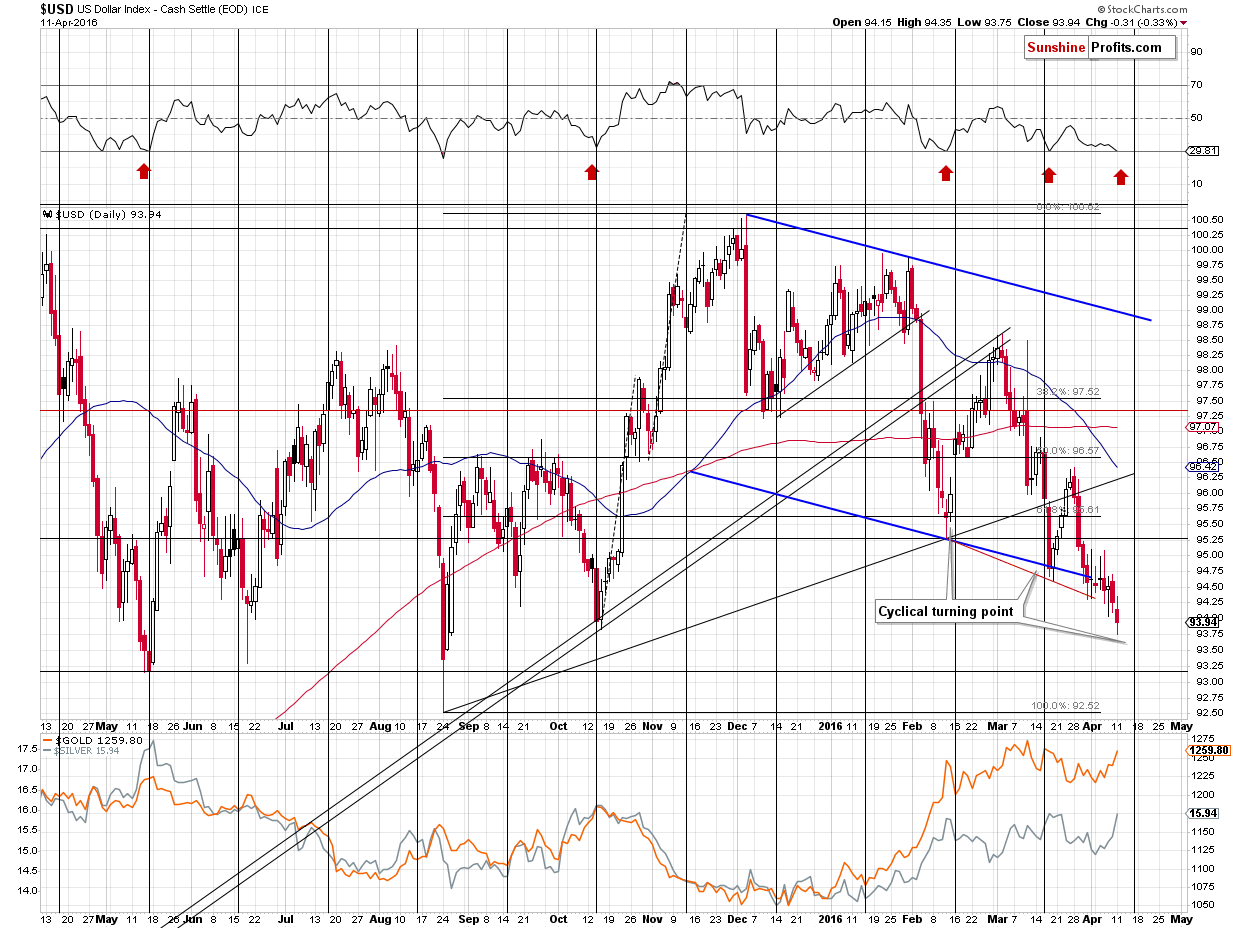

What about the USD Index? It declined and actually managed to close below the declining red support line. We don’t view the breakdown as confirmed at this time, and the most important thing is not the breakdown itself, but the proximity of other important support levels in case such a breakdown is confirmed.

The rising long-term support line (created as a parallel line to the line based on the key bottoms: the 2008 bottom and the 2011 bottom; the line provides support at about 93.2, and 92.2 is the support based on the 2005 high, the early 2003 low and the 1998 low.

Additional support levels are provided by the previous lows of 2015: 93.3, 93.2, and 92.5.

Consequently, even if the USD declines, thus breaking below the declining red support line from the long-term chart, it’s still not likely to decline far. Today’s low (so far) is a little below 93.7, which is very close to the highest of the mentioned levels. Therefore, a bit of a turnaround could be just around the corner.

Speaking of turnarounds, let’s not forget that the turning point for the USD Index is indeed just around the corner – only a few days away. This greatly increases the odds that we will see a turnaround shortly.

Summing up, it seems that the next shorting opportunity is just around the corner, but in light of the strength in the mining stocks, we are not opening a short position just yet. However, once we see this last piece of the puzzle and mining stocks underperform, we’ll likely short the precious metals sector once again. Based on the looming turning point is the USD Index, it seems that we won’t have to wait much longer.

As far as the long-term outlook is concerned, the strength seen in mining stocks may seem bullish, but without a breakout in silver, with gold below the 38.2% Fibonacci retracement based on the 2011 – 2015 decline, and with the USD Index close to a combination of multiple important, long-term support lines, it seems that viewing the miners’ rally as a game-changer would be inappropriate.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Last week, four Fed chairs gathered for a joint public appearance to talk about the global economy. What did they say about the Fed’s stance and what can we learn from that unusual meeting?

Bitcoin has remained flat for the last couple of weeks. Our take is that the next move might be pretty volatile.

Bitcoin Trading Alert: Bitcoin in Tight Range

=====

Hand-picked precious-metals-related links:

Gold price jumps, dollar sinks ahead of special Fed meeting

Gold Trades Near Three-Week High as Investors Look to U.S. Data

Fed "Policy Error" Sparks "Best Fundamentals In Years" For Gold

=====

In other news:

Obama, Fed's Yellen discussed economic risks in White House meeting

Hedge Funds Abandoning Dollar's Biggest Bull Run in a Generation

Deutsche Bank Says World “Past The Point Of No Return” In The Default Cycle

Economic Collapse Is Erupting All Over The Planet As Global Leaders Begin To Panic

Wall Street bull emerges, makes bold call on stocks

Demand for World Bank loans rises dramatically

Japan Aso: To take steps on yen rise as needed if speculative moves seen

Goldman Mortgage Settlement Is Much Less Than Meets the Eye

ECB Counts 500-Euro Cost Even as Cash Death Seen Exaggerated

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts