Briefly: In our opinion, short (full) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

Gold moved higher last week and we can say the same about mining stocks but to a much smaller degree. On the other hand, we can’t say the same about silver, which was almost flat. While gold is well above its December 2015 high, miners moved back below their corresponding high on Friday. Which part of the precious metals sector is leading the rest?

Let’s move right to the charts (charts courtesy of http://stockcharts.com).

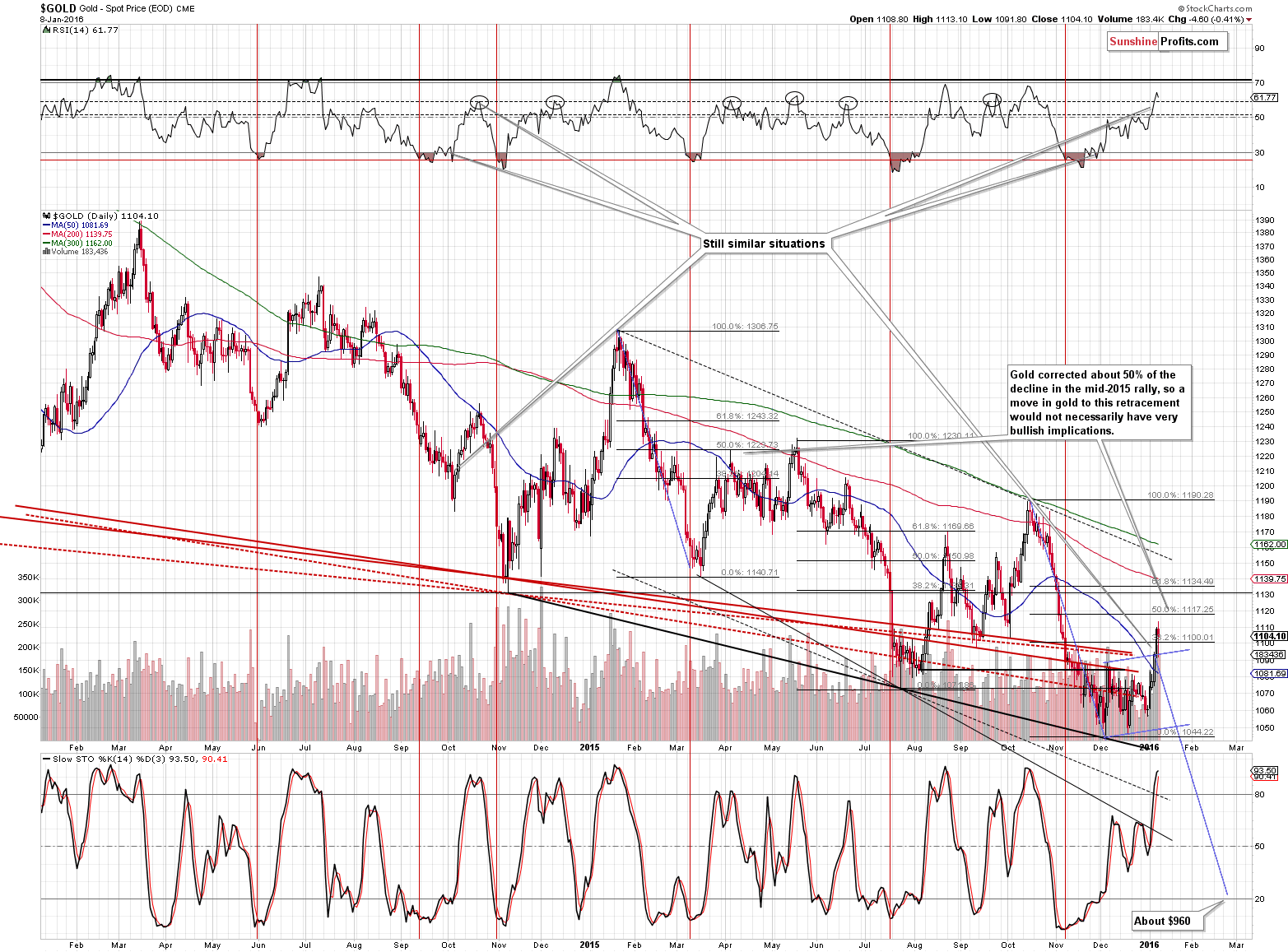

Gold closed the week above the $1,100 barrier, but only insignificantly so - $4 above it. The interesting thing about gold’s Friday session is that it was, to a great extent, a reflection of what happened in the USD Index (which moved much higher initially and gave away most of the gains before the session was over). This has bearish implications for the gold market, because the USD Index is right at the rising support line and thus likely to move higher.

Moving back to gold itself, the yellow metal corrected less than 50% of the previous decline, so technically the recent move higher continues to be nothing more than just a corrective upswing within a bigger decline. Our comments from the previous alert remain up-to-date:

Now, $1,100 is a round number and a 38.2% Fibonacci retracement level, so we still can’t rule out a move to this level, or even to the 50% retracement – on a temporary basis. Such a move would not change much from the medium-term perspective.

Let’s consider the similarities – for several weeks the above chart has been featuring the similarity between the December 2015 bottom and the October 2014 bottom. Continuing with this analogy, we see that gold moved close to its 50-day moving average and even a bit above it and the RSI indicator moved very close to the 60 level. Back in 2014 these circumstances meant that a local top was in. In fact, in many other cases (we marked these situations with ellipses on the RSI indicator) gold ended local rallies when the RSI approached the 60 level. The implications are bearish.

One more thing – technically, until gold moves above $1,135 or so – the 61.8% Fibonacci retracement level – the rally will likely be just a rebound after the October 2015 – December 2015 decline. Consequently, moving above $1,100 or even a bit higher, would not automatically make the picture bullish – many additional factors need to become bullish for this to be the case – and for now we simply see gold’s reaction to unforeseen geopolitical events, not a change in the trend.

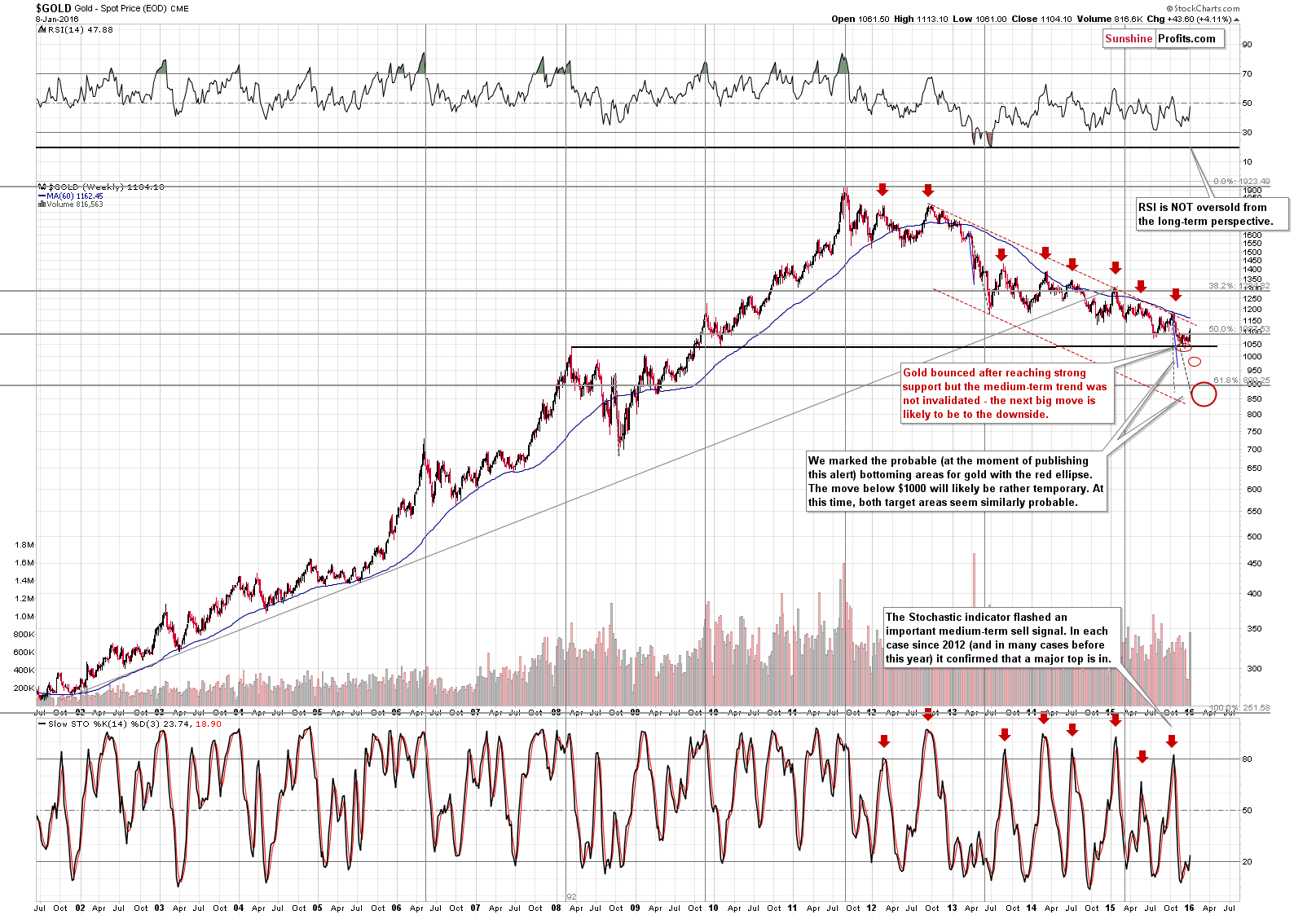

From the long-term perspective, the only two things that changed is that gold moved above the 50% Fibonacci retracement and that we saw a small buy signal from the Stochastic indicator, but that doesn’t change that much (the latter was also the case a few times in early 2013). It’s more important that the declining resistance line and the 60-week moving average remain unbroken and visibly above the current gold price.

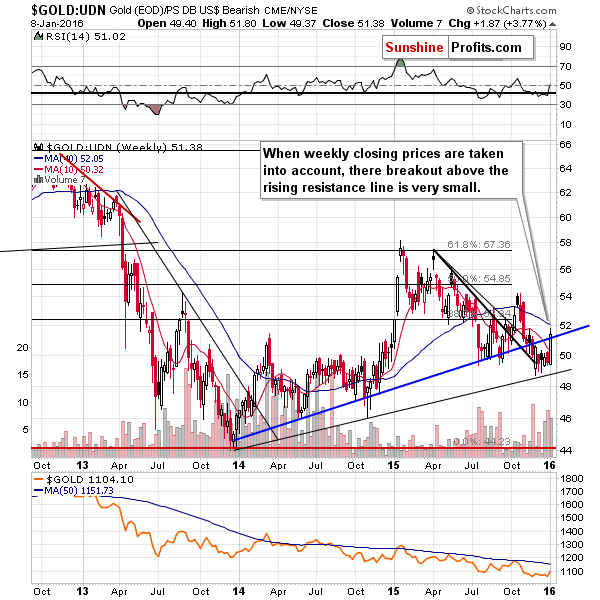

From the non-USD perspective, gold moved slightly above the rising support line based on the weekly closing prices. Consequently, we view the breakout as unconfirmed and without important bullish implications.

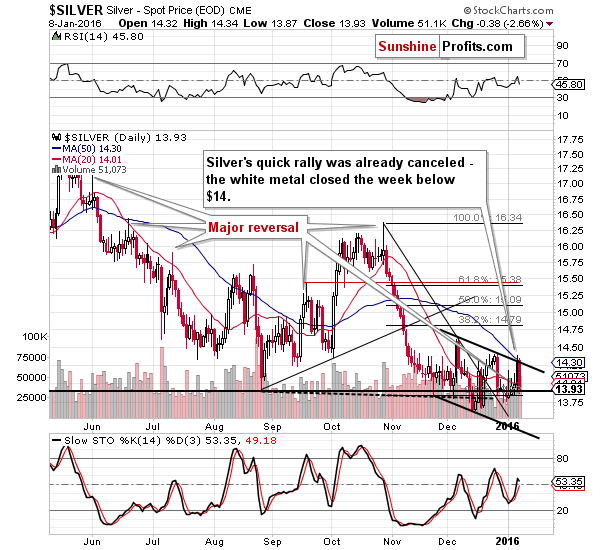

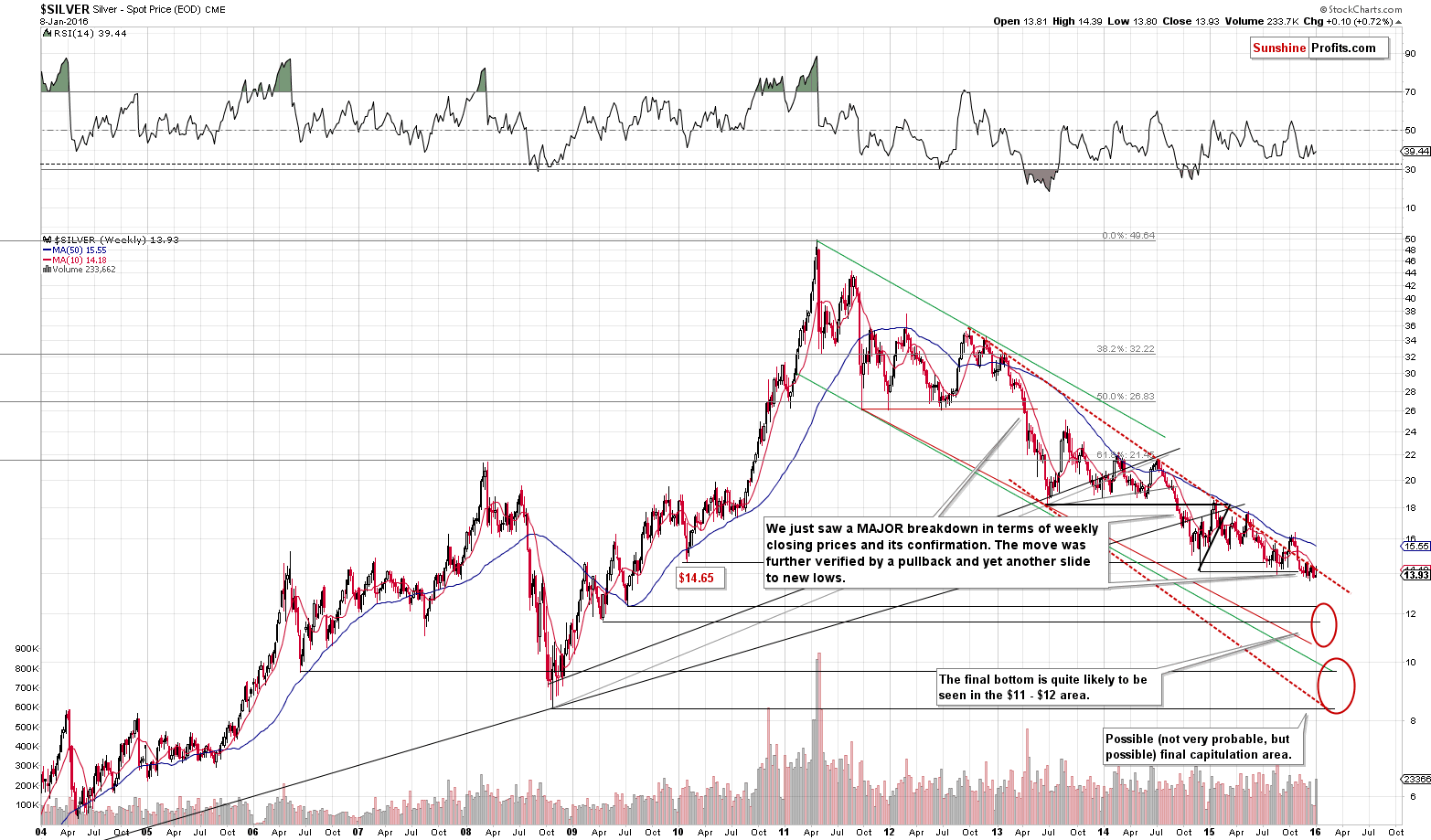

As far as silver is concerned, since we described the above chart when silver was already back below $14, and it closed below it, our previous comments on the above chart remain up-to-date:

Silver finally outperformed yesterday and… It’s back to the $14 level (at the moment of writing these words). There are implications of yesterday’s session, though, because in the recent months it was very often the case that declines were preceded by a short-term upswing in silver. Consequently, even though it might seem counter-intuitive, silver’s move higher yesterday was actually a bearish development.

On silver’s long-term chart we see that last week’s action, which initially appeared positive, actually turned negative before the end of the week. We saw a weekly reversal – something that we usually see before the market moves in the opposite direction to the one that it has attempted to move in. In this case, the implications are bearish.

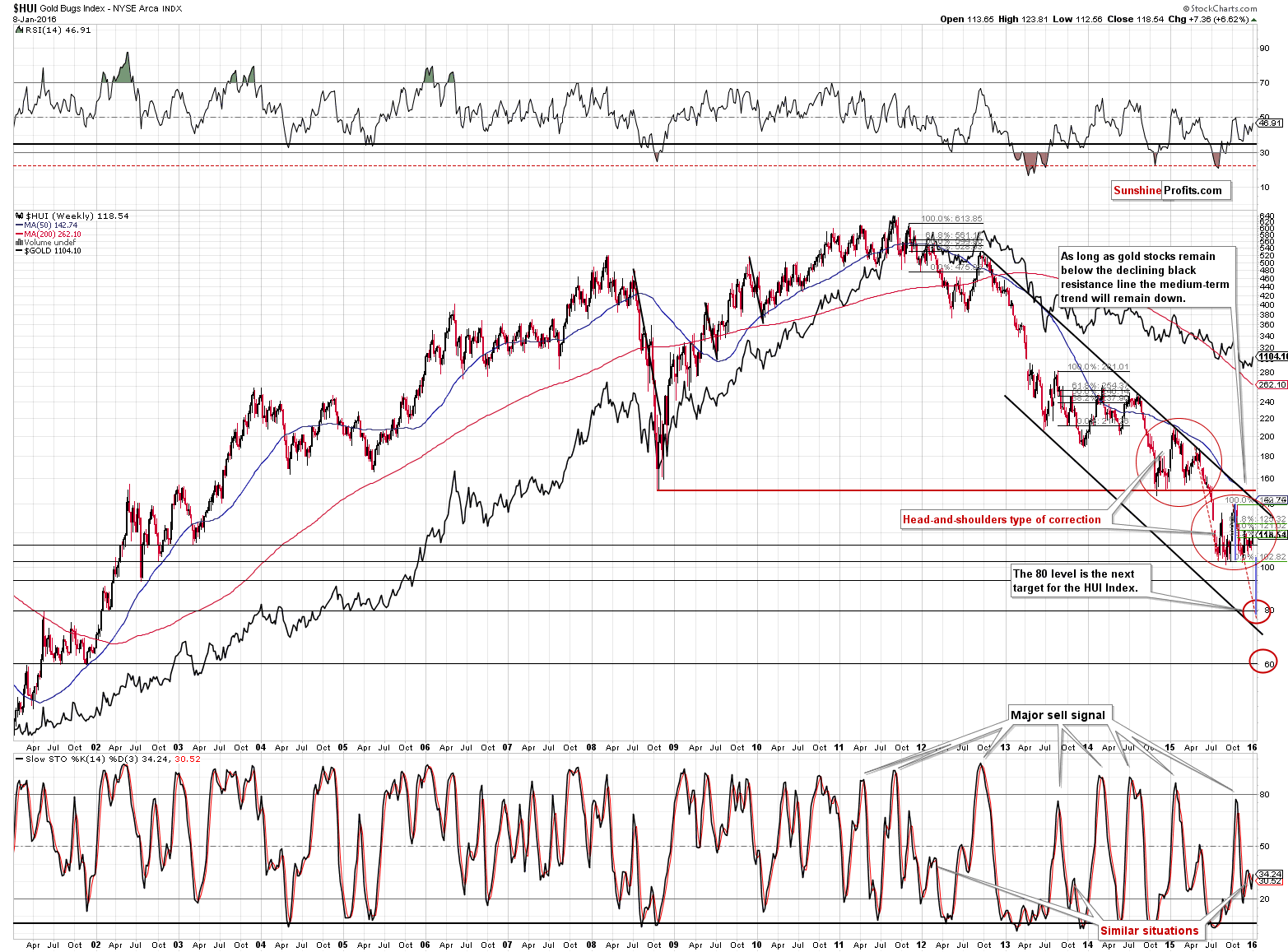

Moving on to gold stocks, we saw some positive action (the HUI moved higher by 7 index points), but as you can see on the above chart, it didn’t change anything. Gold miners remain in a consolidation after a sharp downswing. The trend remains down, so the major “surprises” will likely be to the downside.

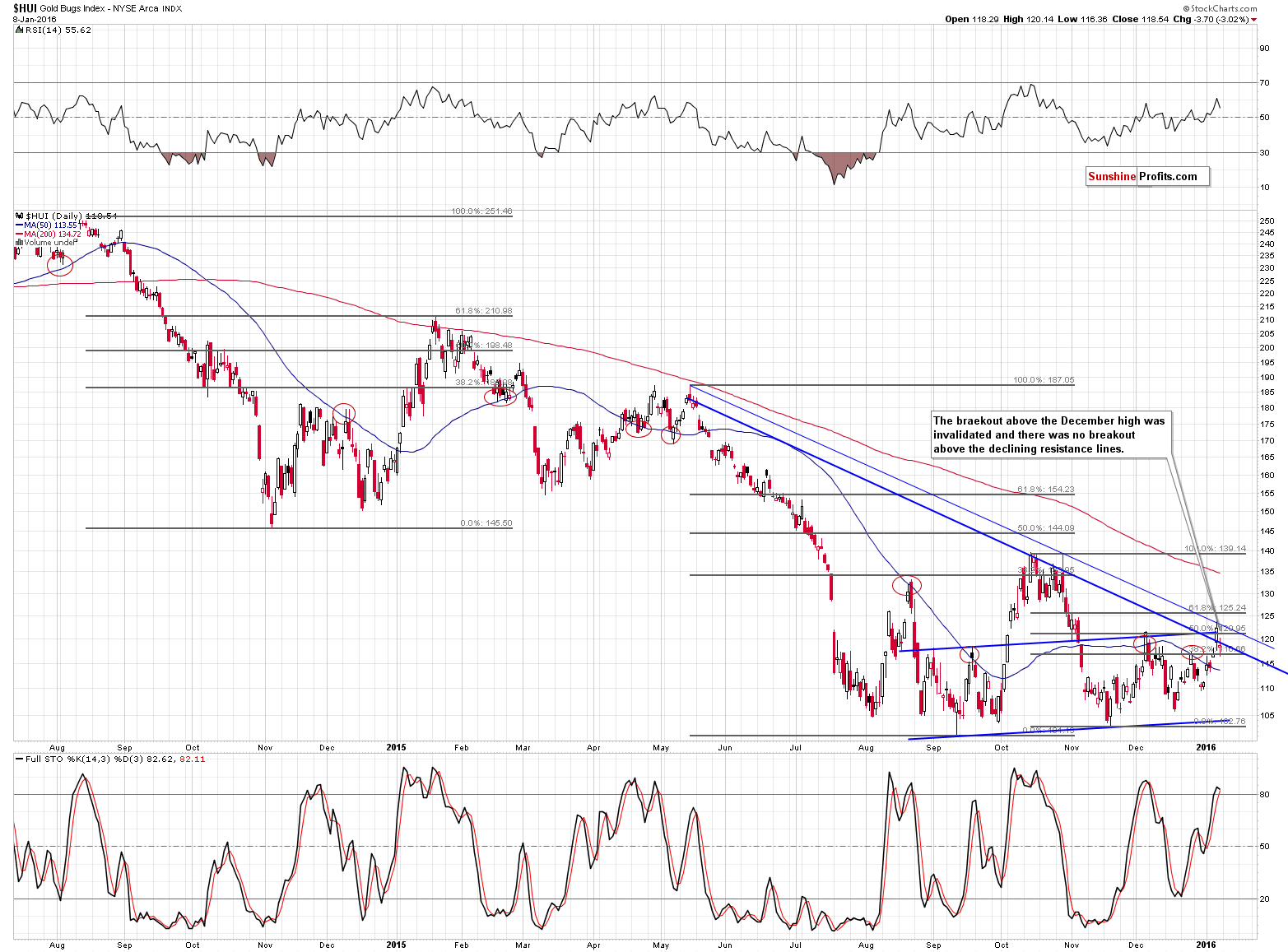

On the above short-term chart, we also see that not that much changed. Miners moved to the declining medium-term resistance line, above the December 2015 high and then declined back below the latter. Miners are above their 50-day moving average, but that doesn’t change that much either.

In the recent history, gold miners moved above their 50-day moving average 2 times: one time in early 2015 and the second time in April/May 2015. In the first case, gold miners rallied to the 61.8% Fibonacci retracement and reversed and in the second case gold miners declined shortly thereafter. So, if history repeats itself, like it tends to do (even though there are no identical days) we can see either a decline right away or after a small move above last week’s high (to 125 or so). Under such circumstances (looking at the above chart only), opening short positions or considering it seems justified from the risk/reward point of view, not closing them.

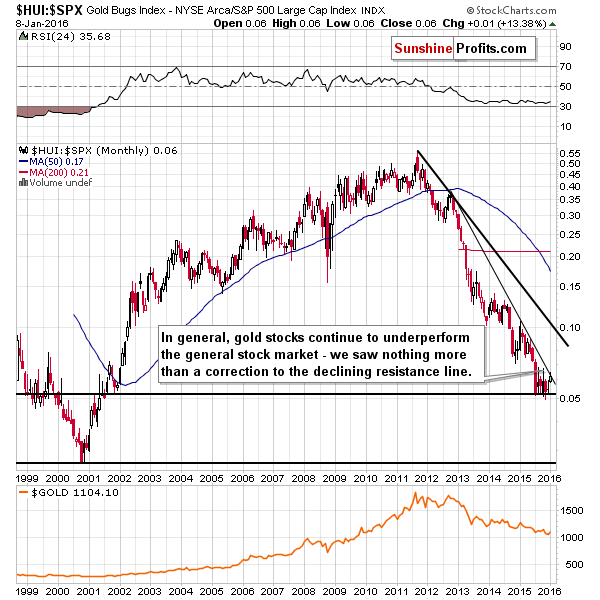

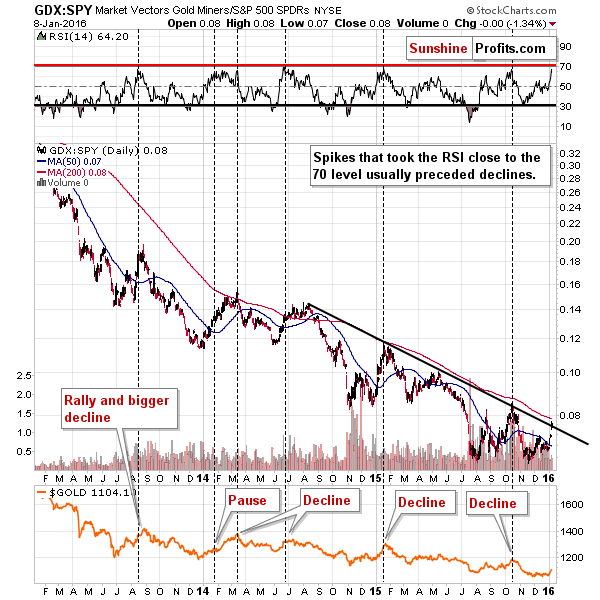

The gold stocks’ performance relative to other stocks suggests that we’ll likely see a move lower relatively soon.

Taking a look at the gold stocks’ performance relative to other stocks from the short-term point of view suggests that we are indeed likely to see a downswing relatively soon. The GDX to SPY ratio moved to its resistance line and the RSI is at a level we saw right at tops in gold or shortly before them (there was one case when a pause followed).

Interestingly, if this year begins like the previous one (which many say is the case), then based on the position of the RSI it seems that the rally is already over or about to be over.

Summing up, even though it seems that a lot happened last week, not that much changed. The action seen in silver is bearish, the action seen in mining stocks is rather inconsequential (we saw a rally, but it was not strong enough to keep miners back above the December high) and there were good explanations (other than the inherent strength of the gold market) for the move higher in gold – gold rallied most likely due to its safe-haven reputation after the stock market in China was frozen and after the tensions in the Middle East escalated. Despite being important events on a stand-alone basis, we don’t think their impact on the gold market will be anything more than temporary – there are no major confirmations of the bullish scenario in the charts (and gold’s sharp move higher is not a confirmation of a new bullish trend – it’s a reaction to an event).

Naturally, all trends can change, but there are simply not enough indications that this has just happened. Moreover, let’s keep in mind that we haven’t seen enough confirmations to say that the final bottom in the precious metals is already in, so – despite the major trends remaining down in gold, silver and mining stocks – there are also other reasons for which we think that the final bottom is still ahead of us. It seems that gold will follow in oil’s footsteps and decline significantly sooner rather than later.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $973; stop-loss: $1,143, initial target price for the DGLD ETN: $117.70; stop-loss for the DGLD ETN $74.28

- Silver: initial target price: $12.13; stop-loss: $14.83, initial target price for the DSLV ETN: $101.84; stop-loss for DSLV ETN $57.49

- Mining stocks (price levels for the GDX ETF): initial target price: $10.23; stop-loss: $15.47, initial target price for the DUST ETF: $31.90; stop-loss for the DUST ETF $10.61

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $15.23; stop-loss: $21.13

- JDST ETF: initial target price: $52.99; stop-loss: $21.59

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

On Friday, crude oil lost 1.14% as concerns over a global supply glut, the situation in China and the Middle East continued to weigh on investors sentiment. Thanks to these circumstances, light crude closed the week under the 2009 low. Does it mean that we’ll see a test of the barrier of $30 in the coming weeks?

Oil Trading Alert: Crude Oil Closed Week under 2009 Low!

S&P 500 index continued short-term downtrend on Friday, as it got closer to 1,900 mark. It may reach its last year's August - September lows. But will this downtrend extend even further before some potential upward correction?

Mixed Expectations Following Last Week's Sharp Decline - Reversal Or Just Pause?

=====

Hand-picked precious-metals-related links:

Gold down, but stocks turmoil keeps it close to nine-week highs

=====

In other news:

Intervention Loses Potency Just as Currency Wars Seen Escalating

Euro zone economic growth stable, China stabilising-OECD

Nearly half of U.S. stocks are in a bear market

China stocks start new week with 5.3% drop

This is what Goldman thinks about the Chinese yuan

China will find it tough to achieve over 6.5 percent growth over 2016-2020: state adviser

Oil Seen Heading to $20 by Morgan Stanley on Dollar Strength

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts