Briefly: In our opinion, long (full) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

Silver declined significantly last week and closed it below $14, but we didn’t see this bearish signal in gold or mining stocks. The latter even managed not to break down despite a big slide in the general stock market, which is a bullish sign. What’s likely to happen before and after the Fed’s decision regarding interest rates this week?

Before we reply to this critical question, let’s analyze the charts and the results of the recent surveys regarding interest rates, starting with the former (charts courtesy of http://stockcharts.com).

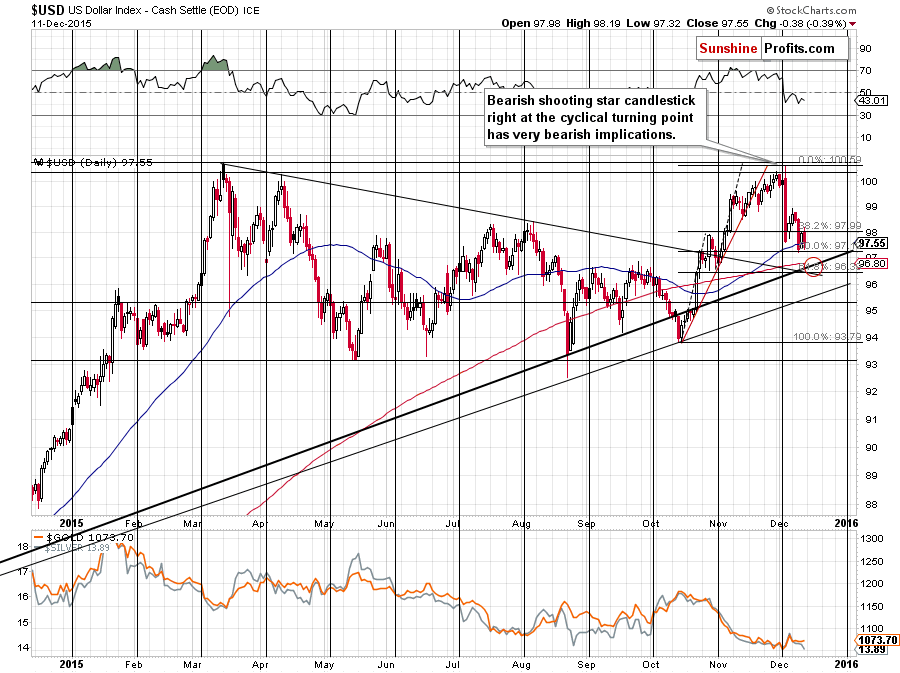

Let’s start with the USD Index. In the past few days, it’s been trading sideways around the 50-day moving average and the 50% Fibonacci retracement level. There was no breakdown on Friday, so our Friday’s comments remain up-to-date:

At this time, the USD is at its 50% Fibonacci retracement level, but it seems more likely to us that it will decline some more instead of stopping now. The reason is that the support at about 96.6 created by combination of factors is much stronger than just the 50% Fibonacci retracement that was just reached.

The interesting, and seemingly bearish factor at this time is that metals and miners didn’t respond to the decline in the USD by rallying. This would normally be bearish if it weren’t for the reason that a few days ago the precious metals market delayed its response to the USD’s slide by a day or so. Consequently, just because we haven’t seen an immediate reaction, the situation is not necessarily bearish - at least not yet. Still, if the USD slides visibly below 97 and metals and miners still refuse to rally, we might need to close the current long positions. Again, it’s too early to do so now, in our opinion, as the jury is still out regarding the metals’ reaction or lack thereof to the USD’s decline.

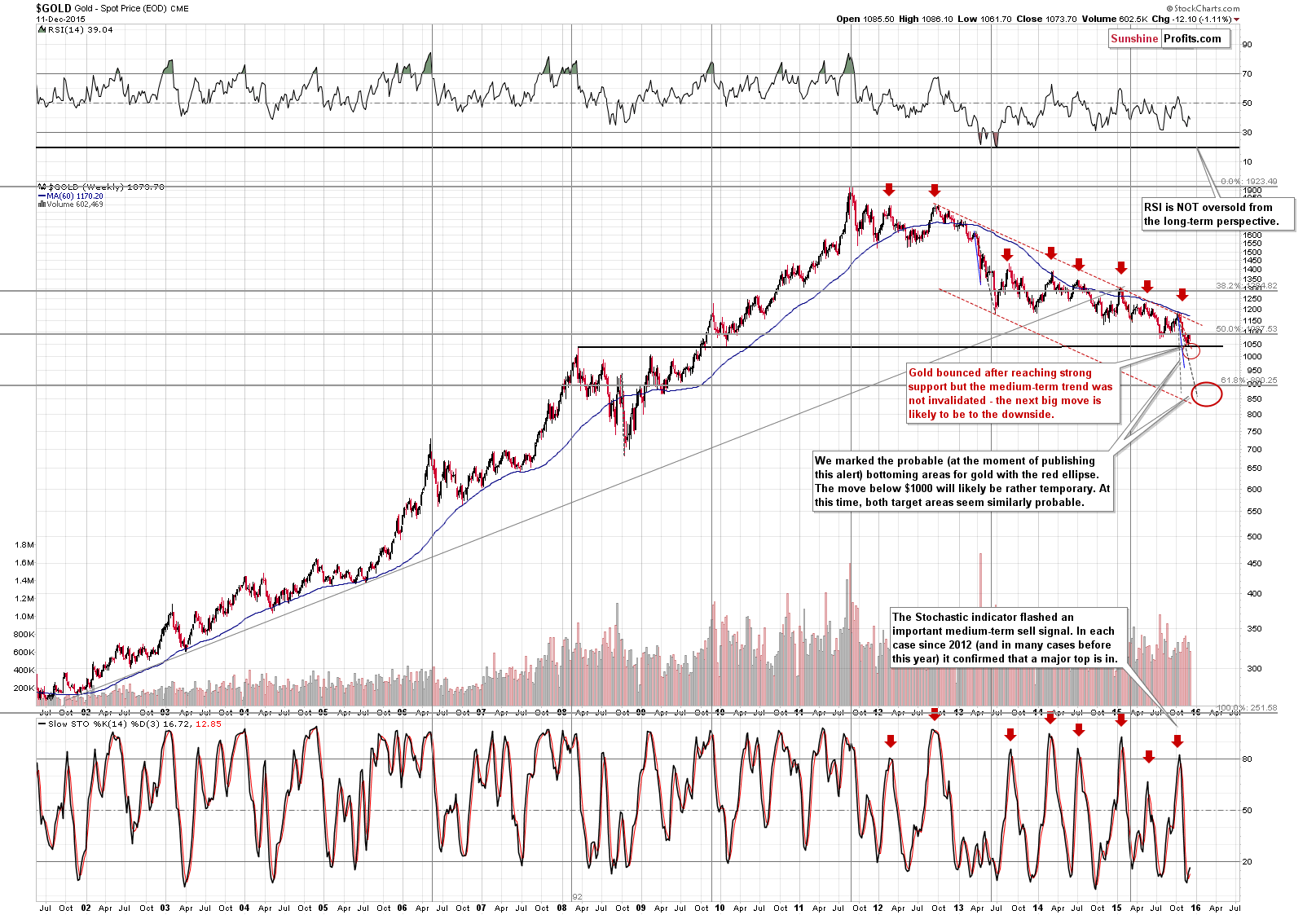

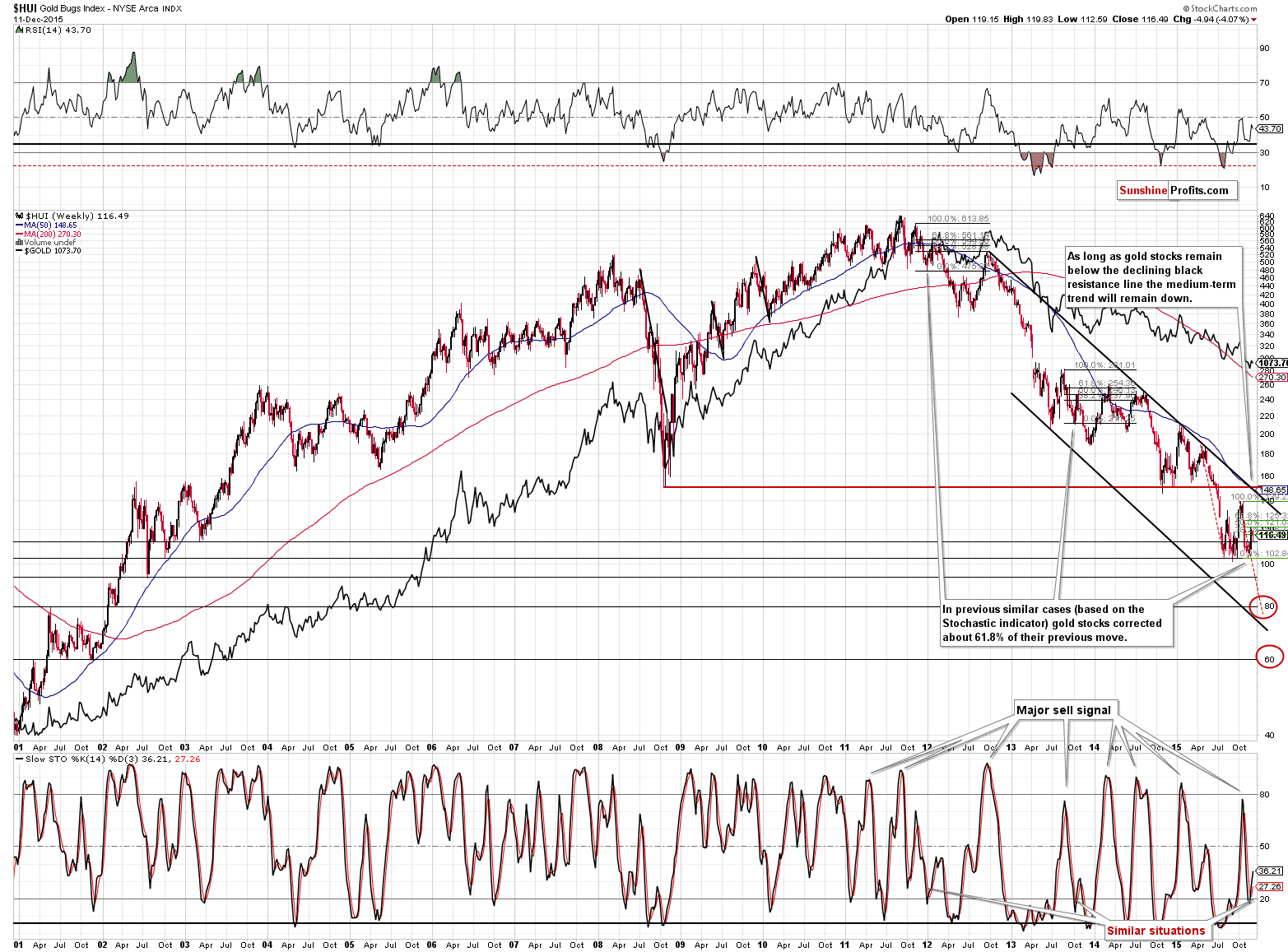

The long-term picture for gold didn’t change recently. The medium-term remains down even though we saw some short-term corrective upswing. We have yet to see the panic sell-off accompanied by overall hatred for gold in the mass media in order to view the final bottom as being in. For now, it seems that gold will need to decline even more for the above to materialize.

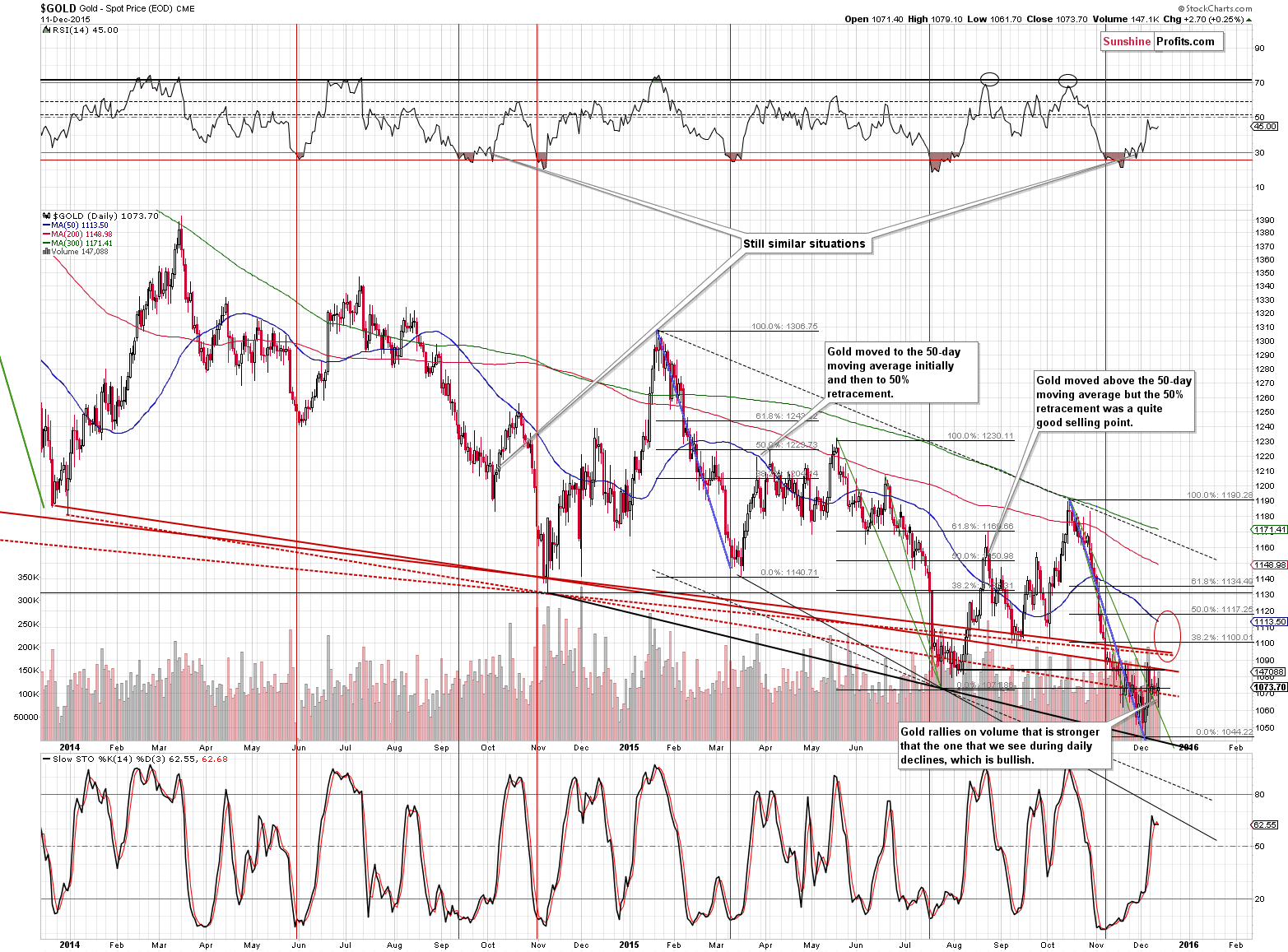

From the short-term point of view, we see that gold was trading sideways after a sharp rally, similarly to what we saw in the USD Index (in the opposite direction, of course). The price to volume link continues to have bullish implications as gold’s daily rallies are taking place on volume that is higher than what we see during daily declines. The implications are bullish.

We saw a very small sell signal from the Stochastic indicator, but it was too small to be considered meaningful.

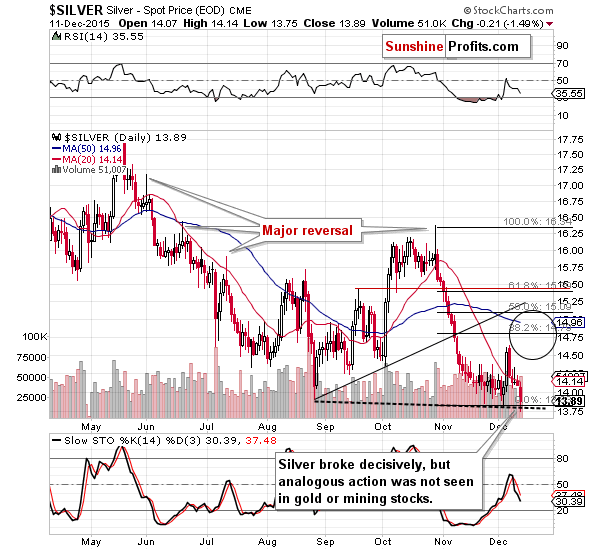

Silver moved 21 cents lower on Friday and silver broke below the previous lows (once again), however, this move was not confirmed by an analogous action in gold or mining stocks, so we don’t put great emphasis on it, even though the implications are bearish. Silver is currently (at the moment of writing these words) at about $13.70, but let’s keep in mind that silver is known for its sudden and sharp turnarounds. Moreover, let’s keep in mind what happened before the previous announcement from the Fed – silver soared right before the announcement (at the end of October) and it declined only after that.

It’s likely the case that silver was heavily influenced by the decline in the general stock market (just as the crude oil market was; by the way, in today’s Oil Trading Alert we are taking big profits from our recent short position off the table). Just as crude oil is quite likely to correct from here after reaching an important support level (and our target), the same thing could happen to silver.

Moving to the long-term picture featuring gold stocks, we see no changes, just like is the case with gold – the medium-term trend remains down despite a short-term move higher.

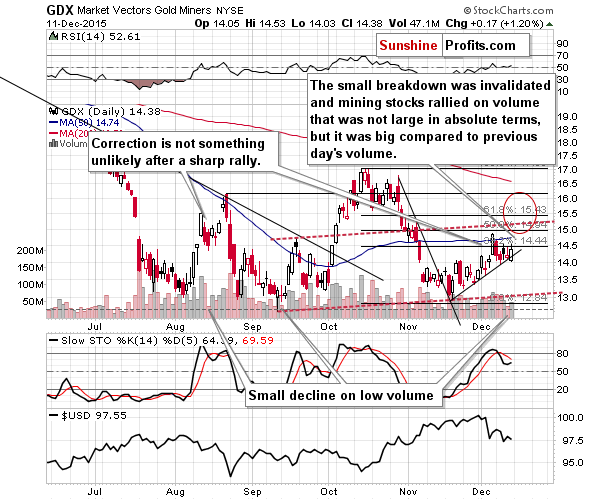

The situation in mining stocks continues to have bullish implications and there are 3 new reasons for it:

- Mining stocks managed to move higher despite a big daily decline in the general stock market.

- Mining stocks invalidated the intra-day breakdown below the short-term rising support line.

- The above took place on volume that was big on a relative basis (not in absolute terms, so the implications of this point are only somewhat bullish).

Consequently, while the medium-term outlook remains bearish, the short-term outlook remains bullish (and it just improved).

All in all, as far as charts are concerned, we have a bullish situation in gold and mining stocks and a rather neutral one in silver (speaking about the short-term only). Based on our 10+ years of experience with these markets, we can say that it’s more likely that it is the silver market that is providing false signals and that the overall outlook for the next few days remains bullish.

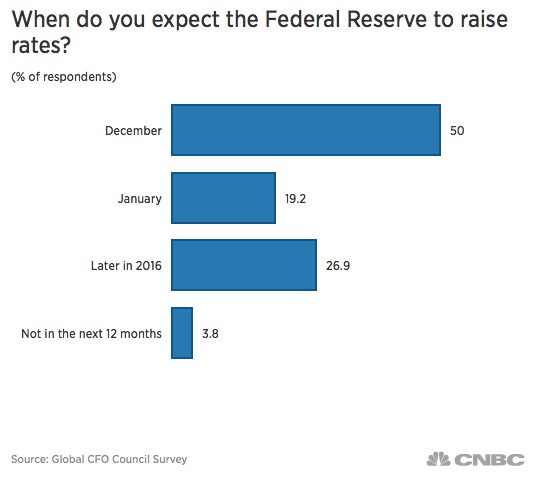

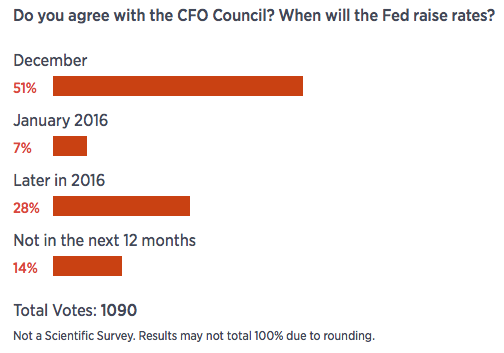

There is another important thing that needs to be taken into account – the upcoming decision of the Fed. On Wednesday, we will hear and read if the Fed has raised interest rates. The decision will have implications based on the investors’ expectations. Consequently, we took a look at surveys (source):

Only about half of the respondents (and we think we can assume that the same goes for investors) expect an interest rate hike this month. The other half expect no hike this month. Consequently, whatever happens, the market will likely react in a regular way (rising interest rates are likely to cause a decline in commodities, gold, and a move higher in the USD). If it was the case that over 90% of investors believed in an interest rate hike this month, such an increase could have no meaningful impact.

What’s our take? We think that the rates will be increased this month. Why? The data was good enough and the hike was “promised” often enough. Plus, perhaps most importantly, we didn’t get very inflationary comments from the ECB earlier this month. Assuming that the monetary authorities around the world are staying in touch and are coordinating their moves to “keep the system running” often leads us to correct projections of their actions. The lack of a major QE announcement (despite some expectations for it) led to a stronger EUR and lower values of USD Index. If the Fed were to increase rates with the USD at about 100 or above it, many could question such a move (strong USD hurting exports etc.), but with a weaker USD now, “we can surely afford” a stronger USD economically. The situation has been prepared and we don’t think that it has been prepared for nothing.

So, we have a situation that is bullish for the very short term, but it seems that whatever happens in the next 2 days, the precious metals market will move lower after Wednesday’s announcement. Consequently, we will exit the current long position before the announcement, but it seems that exiting it now is premature, as the technical picture did not deteriorate.

Summing up, the medium-term outlook for the precious metals market remains bearish, but the very short-term outlook remains bullish. We think that the Fed will hike interest rates this week, which will likely have bearish consequences for the precious metals market. However, since the technical picture remains bullish and the very short-term signs are positive, we are keeping the current long position intact, at the same time moving the exit orders in gold and silver lower, so that it’s easier to exit the position. If these levels are not reached, we will most likely close this position before the Fed announcement anyway.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Long positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit (profit take) order levels:

- Gold: exit (profit take) level: $1,087; stop-loss: $1,028, exit (profit take) level for the UGLD ETN: $8.05; stop-loss for the UGLD ETN $6.70

- Silver: exit (profit take) level: $14.47; stop-loss: $13.26, exit (profit take) level for the USLV ETN: $11.47; stop-loss for USLV ETN $8.54

- Mining stocks (price levels for the GDX ETF): exit (profit take) level: $15.37; stop-loss: $12.57, exit (profit take) level for the NUGT ETF: $34.59; stop-loss for the NUGT ETF $18.91

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and exit (profit take) levels:

- GDXJ ETF: exit (profit take) level: $20.68; stop-loss: $17.76

- JNUG ETF: exit (profit take) level: $38.97; stop-loss: $24.83

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Americans purchased more goods and services at retail stores in November. What does it imply for the Fed’s policy and the gold market?

Will November U.S. Retail Sales Affect Gold?

On Friday, crude oil lost 3.34% as a bearish report from the International Energy Agency added to worries over a supply glut and affected negatively investors’ sentiment. In this environment, light crude dropped to a fresh 2015 low, slipping to the lowest level since Feb 2009. What’s next?

Oil Trading Alert: Crude Oil Extends Losses

S&P 500 index got closer to 2,000 mark, as it broke below mid-November low. Will this downtrend continue?

Stock Trading Alert: New Downtrend or Just Another Pullback Within Two-Month Long Consolidation?

=====

Hand-picked precious-metals-related links:

Gold Speculators Raise Net Bullish Positions For 1st Time In 6 Weeks

Is platinum cheap or was it too expensive?

Austria Proudly Shows Off The 15 Tons Of Gold It Repatriated From London

=====

In other news:

It May Be Too Late Already for the Fed-ECB Divergence Trade

Investor nerves tested with yuan, oil, Fed in play

Wall Street veterans say rate-hike past is not prologue for markets

Crude Falls Below $35 per Barrel in New York for First Time Since 2009

OPEC is winning: Other oil producers are cutting back

Zuma Backtrack Shows Financial Market Vigilantes Alive and Well

The alleged Australian inventor of Bitcoin tried to spend $85m on gold

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts