Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective.

Once again almost nothing happened in the precious metals market yesterday and the outlook didn’t change at all. Consequently, we have little to comment on today except for one thing – silver’s breakdown. Let’s mover right to it (charts courtesy of http://stockcharts.com).

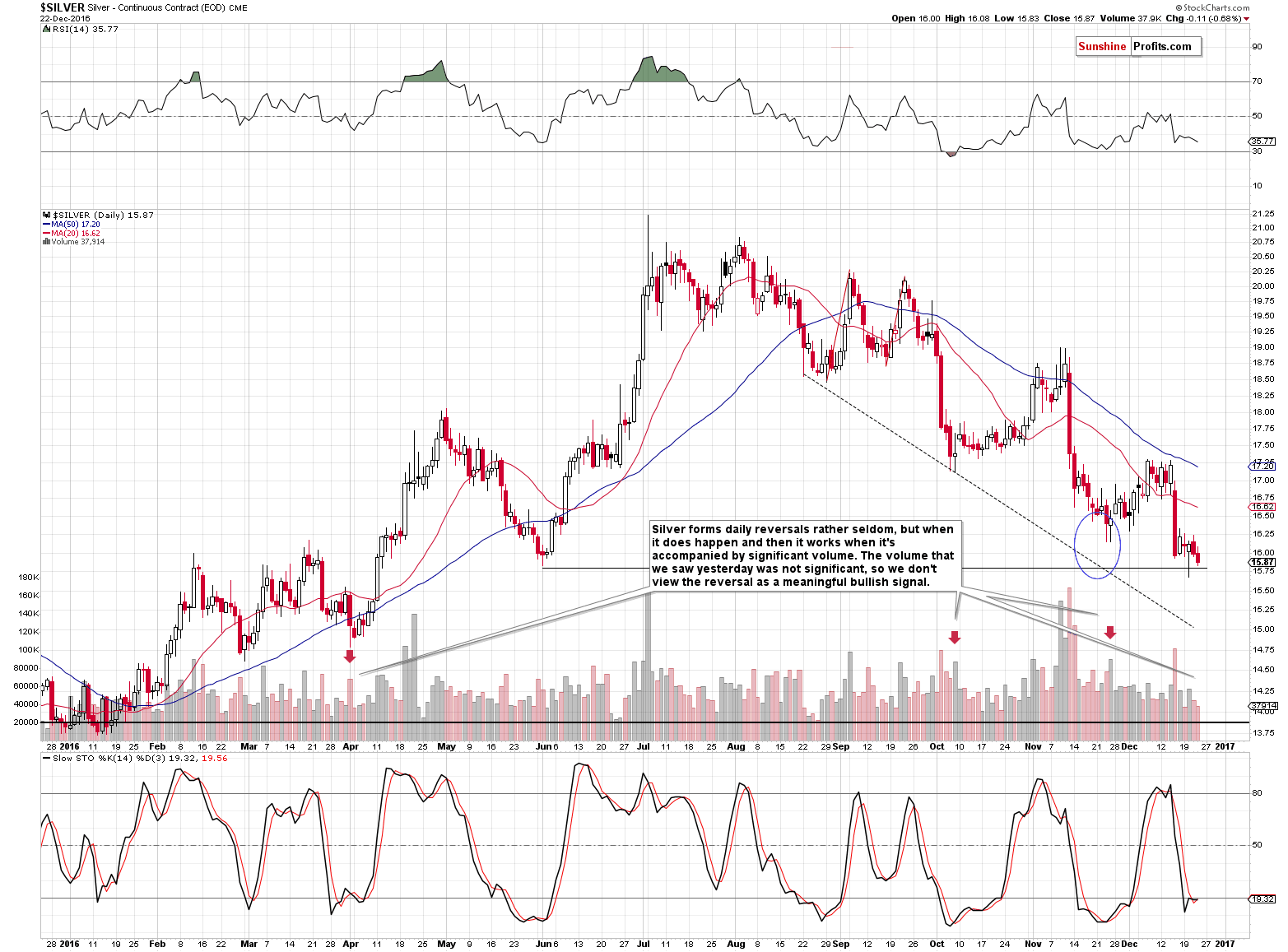

Silver didn’t move below this week’s intra-day low, but it formed a new low in terms of the closing prices. What’s even more important, yesterday’s close was also below the May / June bottom in terms of closing prices. Therefore, we saw a breakdown below 2 important levels. The breakdown was not confirmed as it is relatively small and it was accompanied by relatively low volume, but still – it happened, so the outlook deteriorated a bit.

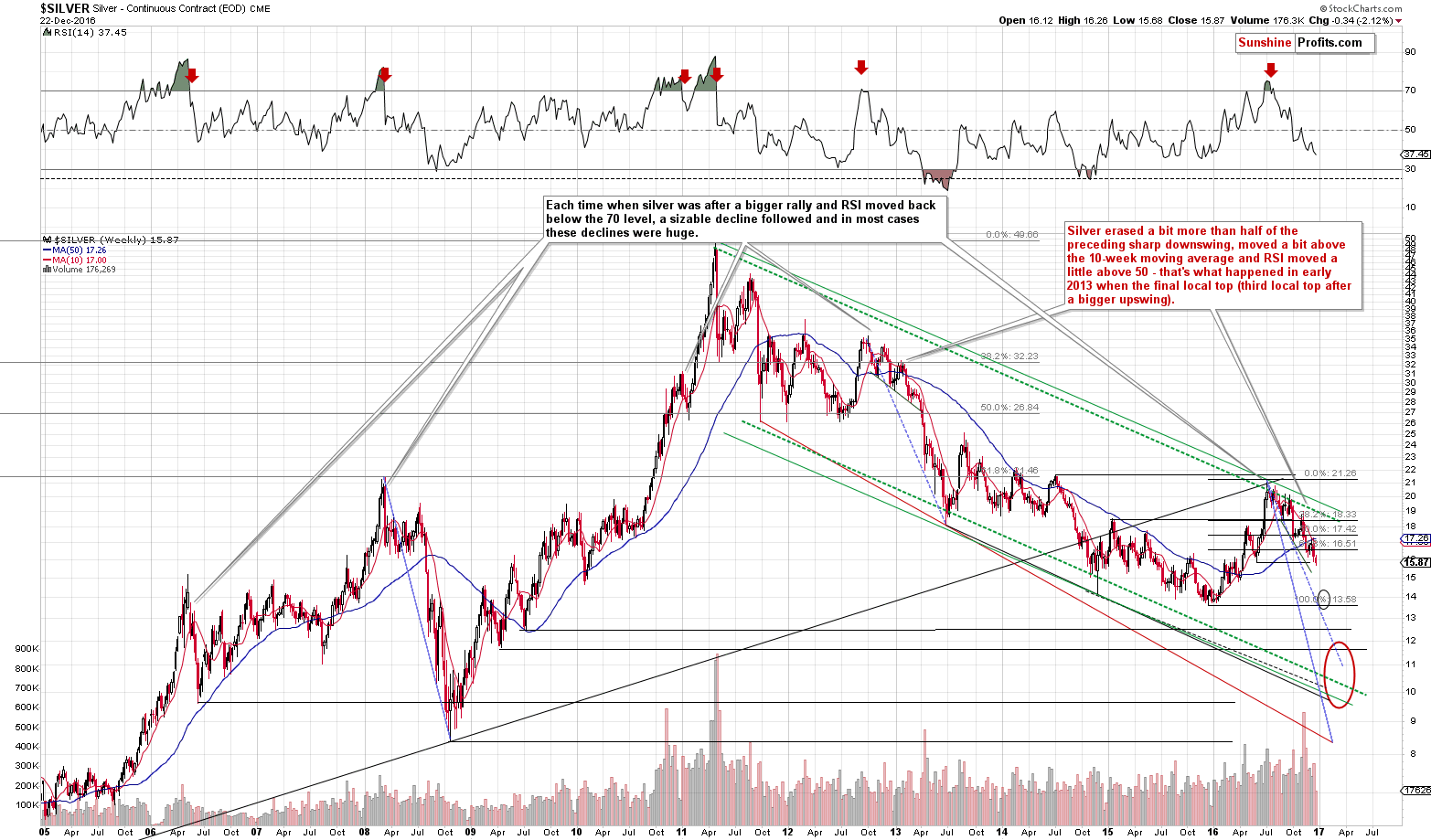

However, it’s more important than it seems because of what we can see on silver’s long-term chart.

The week is only one day from being over and unless silver rallies today, we will have a breakdown also in terms of weekly closing prices, which is much more significant. If that does indeed happen – and it is likely that it will – another big wave down is likely to begin. The next support level is at about $15, but we can’t rule out a situation in which silver moves right to its 2015 lows (in analogy to what is likely for gold).

Speaking of silver’s and gold’s downside targets for the short term, please note that only we feature a binding exit price only for gold – we do not provide it (instead we provide initial (!) target prices) for silver or mining stocks. The reason is that gold’s target is rather clear, whereas there are 2 targets for silver ($15 and $14) and targets for mining stocks are even less clear. Still, since the precious metals sector is likely to form a short-term bottom at the same time, we can assume that gold’s top will correspond to silver’s and mining stocks’ tops and thus we can base closing the entire short position based on gold’s price target.

Summing up, it seems that we will see another big move lower before a corrective upswing is seen (after which, we expect precious metals to move to new – and final – lows) and that we will see this decline shortly. Depending on the bullish confirmations that we may (!) see at that time, we may decide to temporarily open a long position once gold moves very close to its 2015 low, but it’s too early to say if it will really be the case at this time. Either way, it seems that the final bottom in the precious metals market will form below the 2015 low and we strongly suggest preparing for it.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels / profit-take orders:

- Gold: exit-profit-take level: $1,063; stop-loss: $1,183; initial target price for the DGLD ETN: $81.88; stop-loss for the DGLD ETN $58.77

- Silver: initial target price: $13.12; stop-loss: $17.53; initial target price for the DSLV ETN: $46.18; stop-loss for the DSLV ETN $24.86

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $22.62; initial target price for the DUST ETF: $143.56; stop-loss for the DUST ETF $41.88

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $38.12

- JDST ETF: initial target price: $104.26; stop-loss: $28.88

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Yesterday, there was a massive U.S. economic data dump. What does the release of several reports imply for the gold market?

Last Bunch of U.S. Economic Data in 2016 and Gold

Trump’s presidency may significantly affect the Fed’s functioning. For example, the president will fill two vacancies in the Board of Governors and will probably replace the Fed’s Chair and Vice Chair in 2018. We invite you to read our today’s article about Trump’s imprint on the Fed find out how they will affect the U.S. monetary policy, and, thus, the gold market.

=====

Hand-picked precious-metals-related links:

Gold heading for 7th weekly loss on 2017 rate hike views

Asia Gold-Price slump fails to revive demand in India; China premiums shrink

=====

In other news:

Mortgage rates soar to 2 1/2-year high, Freddie Mac says

Bitcoin Surges Above $900 on Geopolitical Risks, Fed Tightening

Deutsche Bank, Credit Suisse Settle U.S. Probes as Barclays Sued

UK economy grows faster than expected in the third-quarter, no sign of Brexit hit

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts