Briefly: In our opinion, speculative short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward point of view.

Yesterday’s terrorist attacks in Brussels pushed gold higher early in the session – was this the “trigger” and will another rally follow?

In short, that’s very unlikely. In fact, we are already seeing a decline in today’s pre-market trading. Today’s alert is going to be short as we did not see many changes on the charts yesterday. Gold, silver and mining stocks moved higher early in the session, but erased almost all gains before the market closed. What are the implications?

Before moving to the gold chart, we would like to invite you to read today’s Gold News Monitor, as the following part of the alert will be the extension (focusing on trading and investment implications) of the discussion from today’s Monitor.

Quoting from it:

We have to repeat that the importance of the geopolitical concerns for the price of gold is often overstated. There is an old market saying: buy the rumor, sell the news. It means that gold is often boosted by negative geopolitical rumors, but when rumors turn into action the price of gold is often unaffected or even decreases, as this is when the profit-taking begins.

The demand for gold as a hedge against turmoil, threats etc. boosted gold higher, but the key thing is that despite that gold wasn’t able to hold these gains. When a given market is not moving in one direction despite a good reason to do so, it is a strong indication that the market is going to move in the opposite direction.

In the past few days (since March 17) gold has tried to move higher but ultimately closed either very close to the previous close or below it. Even with a good reason for gold to rally – it wasn’t able to do so. It moved higher by a mere $4.70 and the volume was relatively low.

This is a strong indication that the buying power is drying up or that it has almost dried up. Without new buyers willing to enter the market, the price can do only one thing – fall.

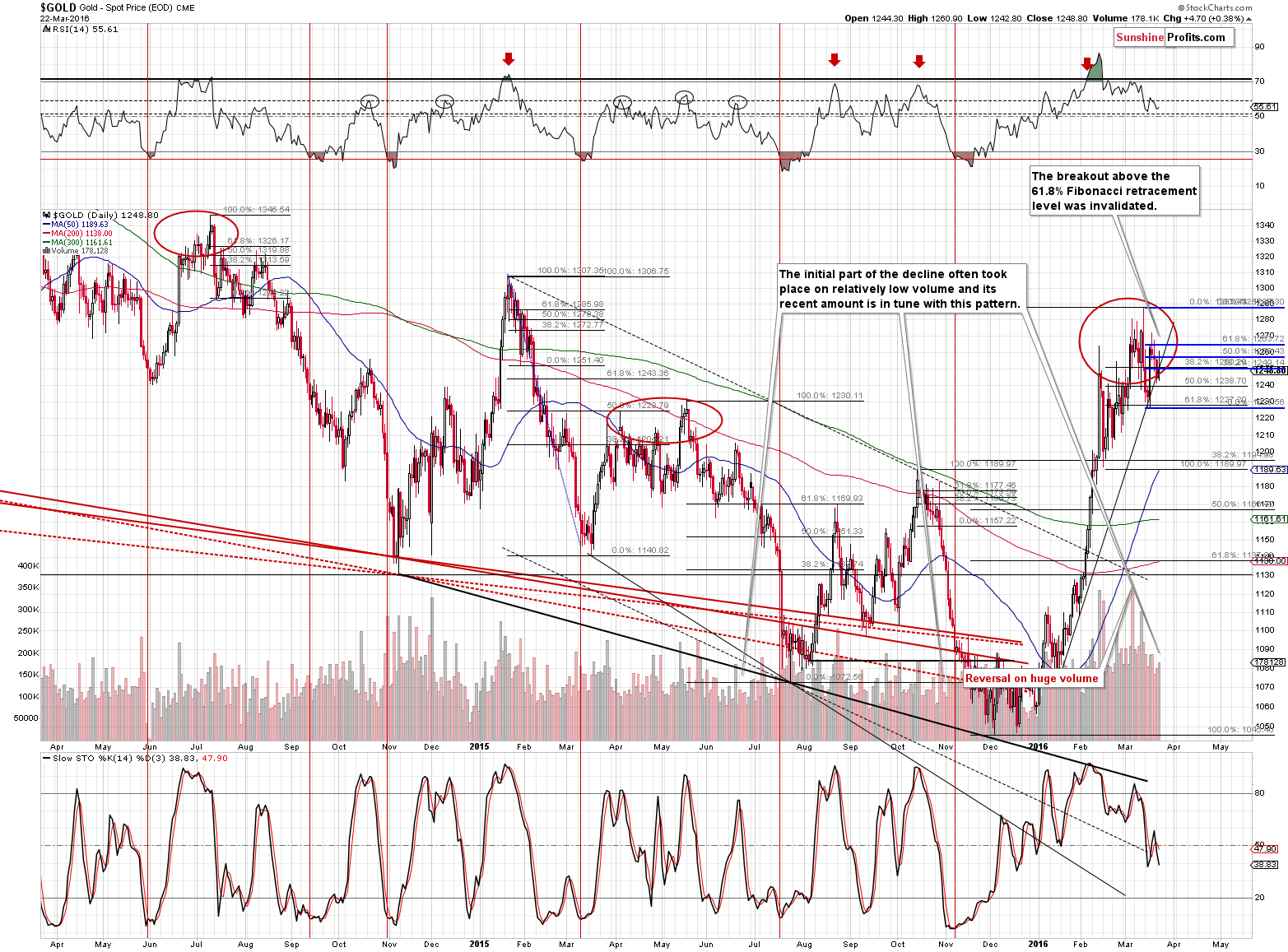

Let’s take a look at gold (charts courtesy of http://stockcharts.com).

You can see all of the mentioned things right on the chart, but there’s also one additional thing that we would like to point out.

At the moment of writing these words gold is trading at about $1,233 (about $15 below yesterday’s close), which means that we saw a breakdown below the rising support line. The breakdown is not confirmed yet as the session hasn’t even started, but this is a good indication that we may see a confirmed breakdown today. Once that happens, many traders are likely to exit their gold positions viewing this decline as something more than just a pause within a rally – and thus the decline is likely to accelerate.

All in all, since nothing changed based on yesterday’s price moves as far as the outlook is concerned, we’ll summarize today’s alert just as we summarized yesterday’s issue:

Summing up, the situation in the precious metals sector was very bearish based on Wednesday’s session and based on Thursday’s session it became even more bearish. Gold didn’t react to USD’s slide by rallying, silver outperformed on a short-term basis and miners formed a daily reversal on big volume after reaching an important resistance (May 2015 top). This is a very bearish combination and since there have been many medium-term bearish signals present, even before Thursday, we think that the outlook is now more bearish that it’s been in many months.

Friday’s and Monday’s sessions were rather inconsequential in our opinion and yesterday’s session actually provided us with bearish confirmations as gold failed to rally despite a good reason to do so – the signals from Thursday’s session remain in place.

While it’s usually the case that we can get at best a 75%-80% probability of a given move taking place (which means that about a fifth of the very probable moves will not happen), in our opinion it seems that the odds for the decline have now increased even higher – to 85% or so. Consequently, we think that a speculative short position is currently justified from the risk to reward point of view.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $973; stop-loss: $1,304, initial target price for the DGLD ETN: $90.29; stop-loss for the DGLD ETN $48.27

- Silver: initial target price: $12.13; stop-loss: $16.62, initial target price for the DSLV ETN: $71.92; stop-loss for DSLV ETN $36.89

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $22.57, initial target price for the DUST ETF: $7.60; stop-loss for the DUST ETF $2.16

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $31.23

- JDST ETF: initial target price: $14.14; stop-loss: $4.05

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Yesterday, terrorists launched coordinated attacks across Brussels in which at least 30 people were killed and hundreds more injured. Will the attacks on the Belgian capital affect the gold market?

How Will Terrorist Attacks in Brussels Impact the Gold Market?

Earlier today, official data showed that the U.K. rate of consumer price inflation increased by 0.3% in Feb, missing analysts’ forecasts. Additionally, although month-over-month consumer prices rose by 0.2% in the previous month, the data disappointed market participants, which pushed GBP/USD under 1.4300. How low could the pair go in the coming days?

Forex Trading Alert: GBP/USD – Currency Bears in Charge

We have a situation where Bitcoin hasn’t really moved very much in a couple of weeks. This doesn’t mean that the current situation is boring, in our opinion. The mere fact that Bitcoin hasn’t moved recently is by no means a guarantee that it won’t move in the future.

Bitcoin Trading Alert: $400 Level Becoming More Important

=====

Hand-picked precious-metals-related links:

CME, Reuters Announce Three Measures To Fix Broken Silver Fix

Citibank become full market maker for LBMA

=====

In other news:

Helicopter Money Takes Flight as Latest Drastic Monetary Idea

Half of World Stocks Embrace Bull Market on Fed-Fueled Rally

Fed Chair Yellen has a mini revolt on her hands

Europe recouping losses, Asia muted after Belgian attacks

=====

On an administrative note, due to the Easter weekend and travel schedule of your Editor, there will be no regular Gold & Silver Trading Alerts on Friday (there will be no trading in the US, anyway, so we don’t expect to see any visible price movement on that day) and on Monday. If there are important changes, we will send you a short intra-day alert anyway. Thank you for understanding.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts