Briefly: In our opinion, speculative short positions (full) in gold, silver and mining stocks are justified from the risk/reward point of view.

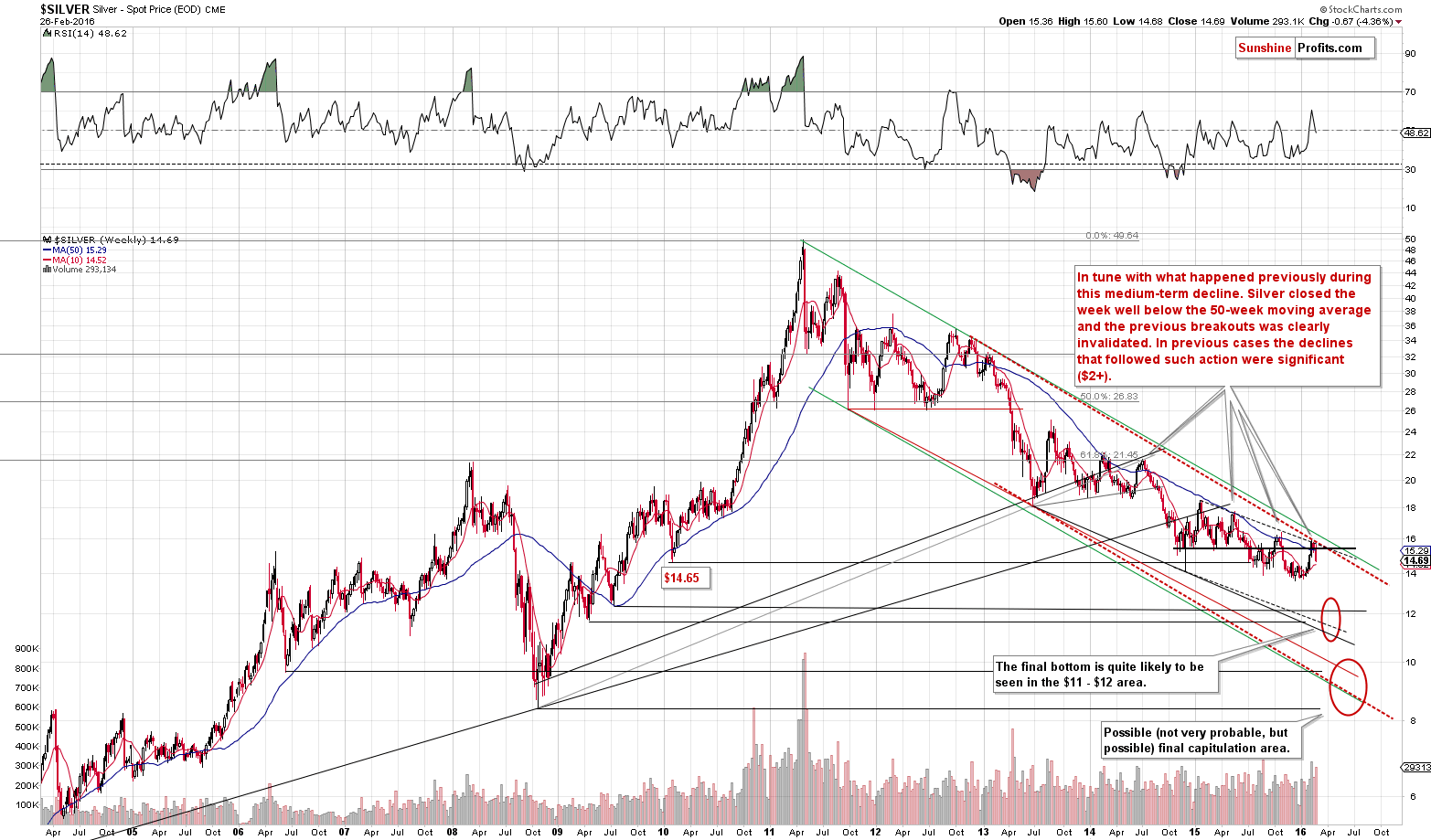

Gold and mining stocks didn’t do much last week (taking the closing prices into account), but silver declined more than 4%. Is silver leading the rest of the precious metals lower?

This appears to be the case, however, not simply because silver moved lower, but because it moved well below the 50-week moving average. Before we discuss it further, let’s take a look at gold (charts courtesy of http://stockcharts.com).

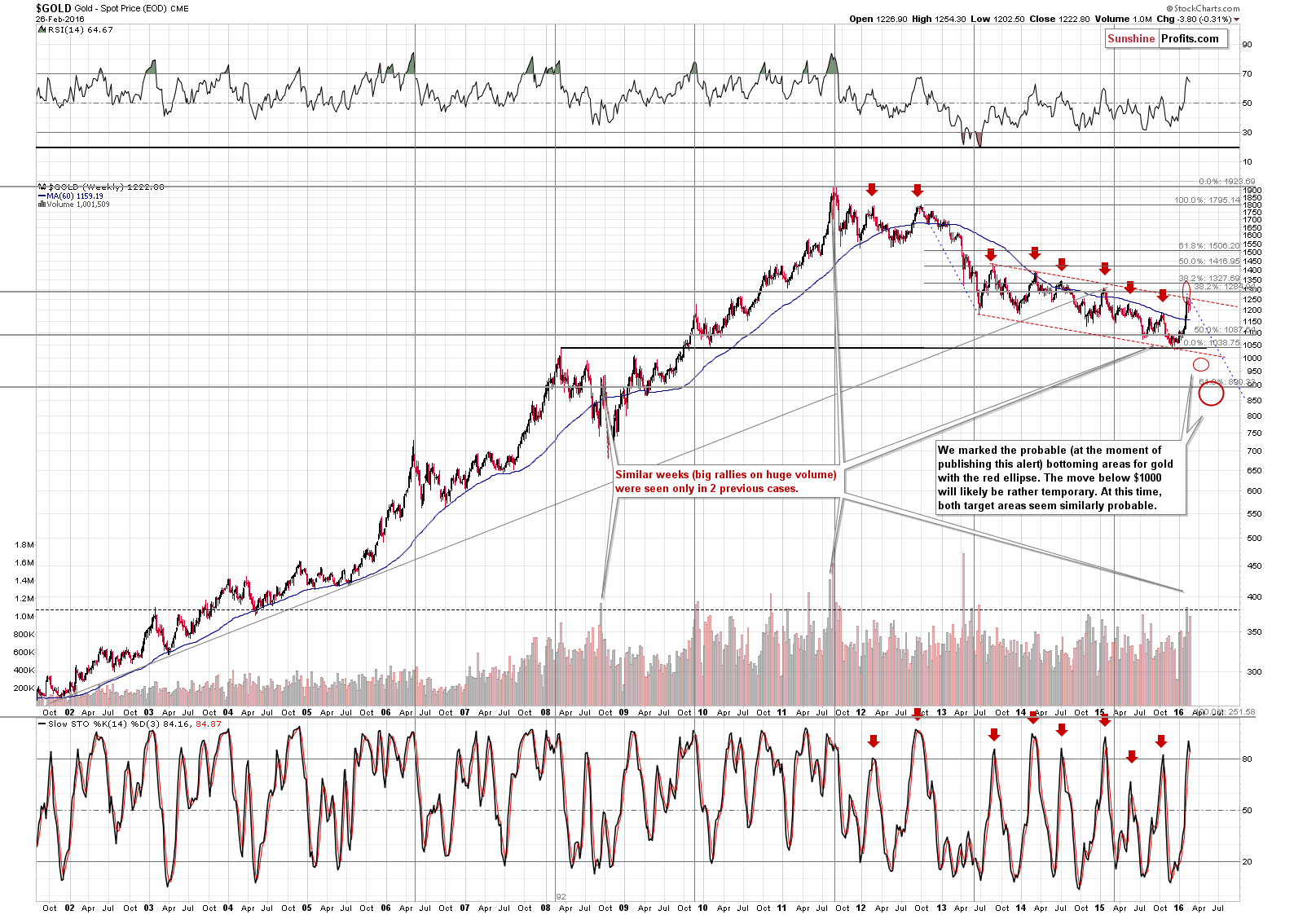

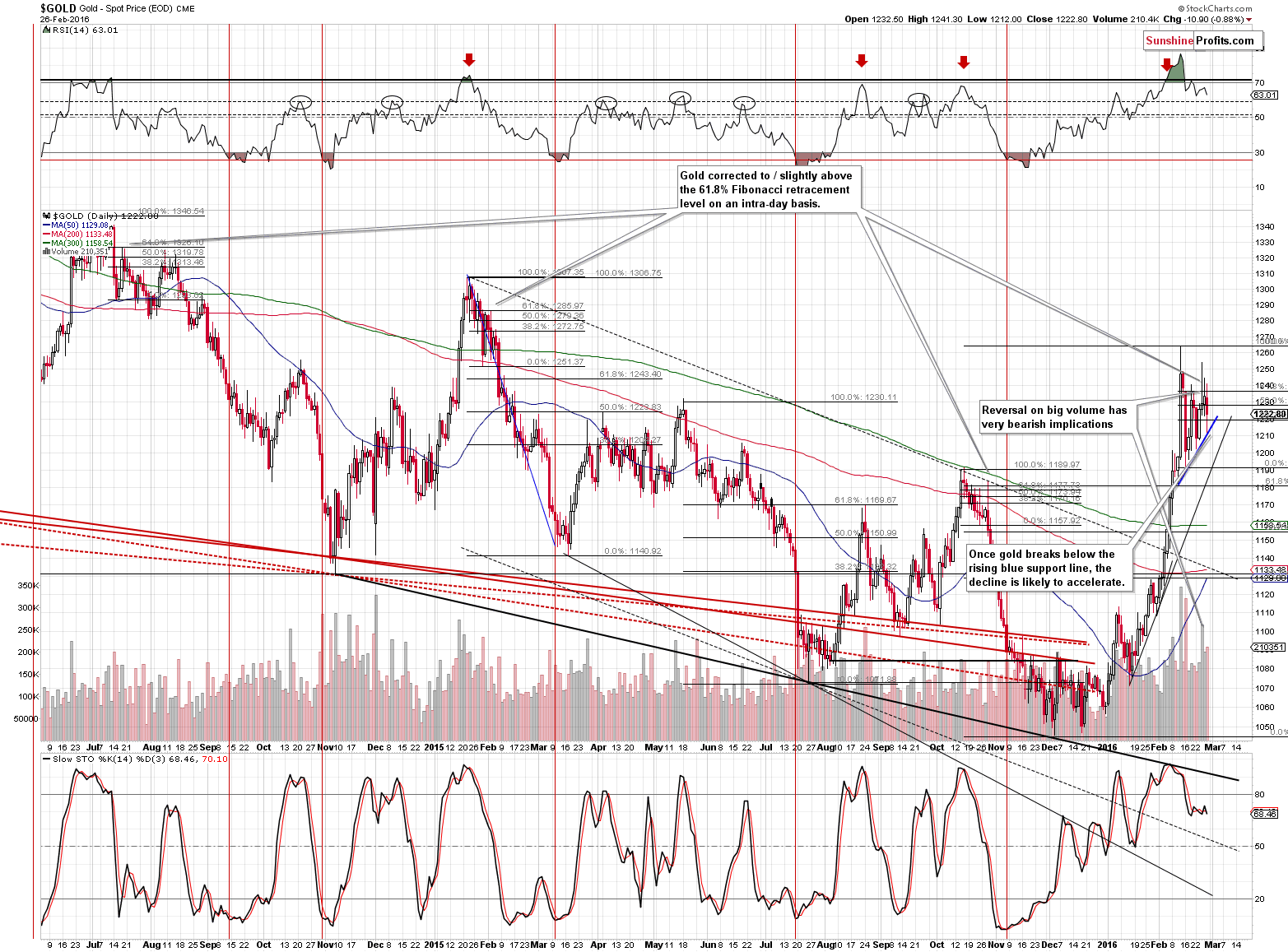

The yellow metal moved about $4 lower last week after attempting to break above the declining trend channel. The attempt was unsuccessful - gold declined right after touching the upper border of the trend channel.

The Stochastic indicator also flashed a small sell signal – it moved a below its moving average, which confirmed that the top was indeed in many times in the past – we marked these situations with red arrows. The signal is small because the indicator is just a little below its average, but still, in the past 4 years all similar cases were followed by major declines.

In our previous alert we wrote the following:

The pattern from October 2015 seems to be repeating – gold moved initially higher only to decline later during the session. Gold didn’t end the session much lower, but the invalidation of a daily $20+ rally is significant. This intra-day move created a reversal candlestick pattern called a shooting star. This is a very bearish development, especially that it was accompanied by huge volume.

Gold has declined since the mentioned reversal was formed, however, it the slide hasn’t been significant. The outlook remains bearish, but the acceleration of the decline is to be expected only after gold successfully breaks below the rising blue support line. Based on other factors discussed in this alert, it is likely to do so sooner rather than later (quite likely this week).

Silver moved initially higher last week, but finally plunged on Friday and closed the week more than $0.60 lower. This move is significant by itself, but it’s more important that this decline invalidated the previous breakout above the 50-week moving average. There were a few cases when we saw this phenomenon and it more or less meant that the corrective rally was over and that we should prepare for much bigger declines, and new lows. The outlook remains bearish.

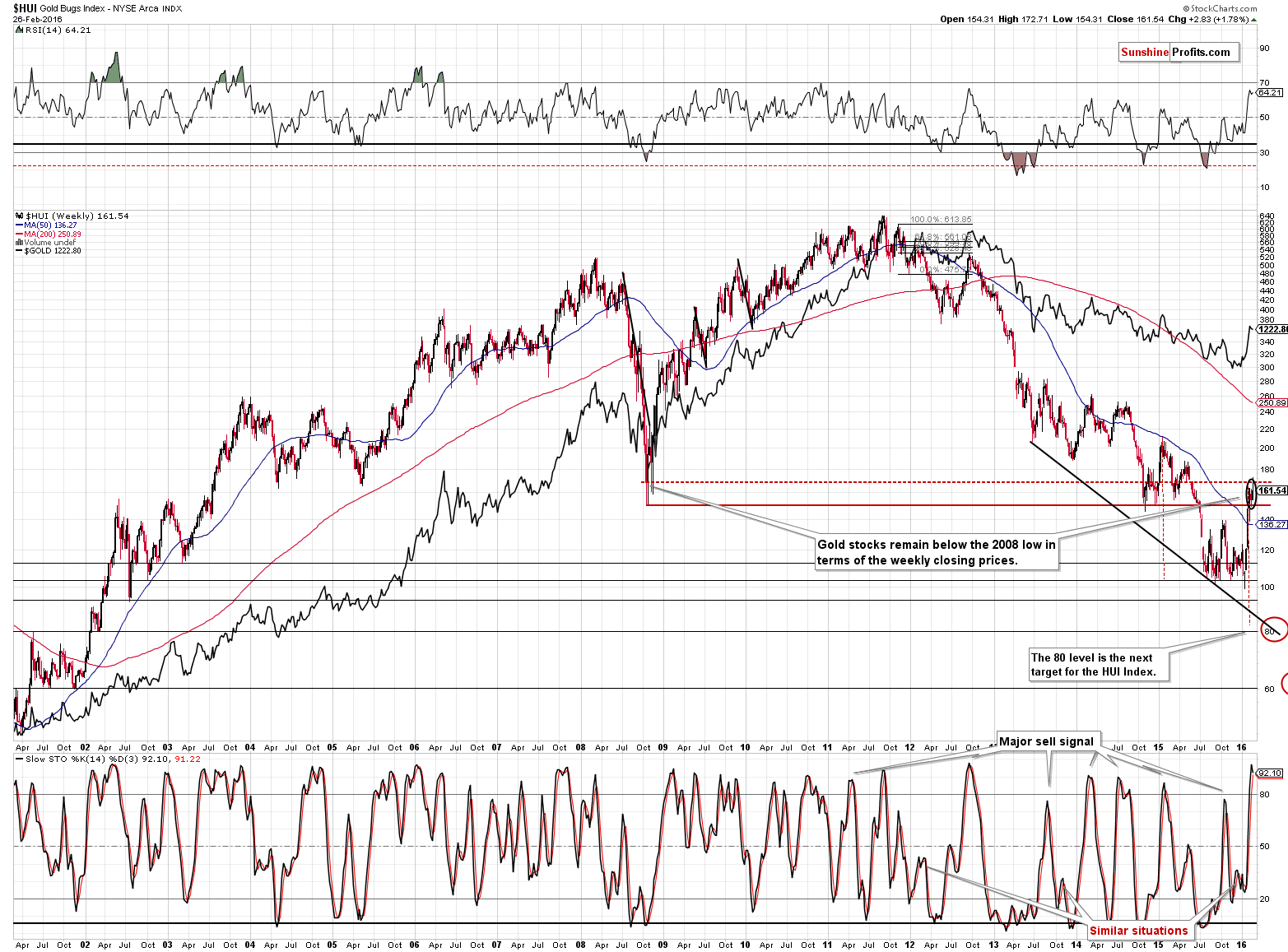

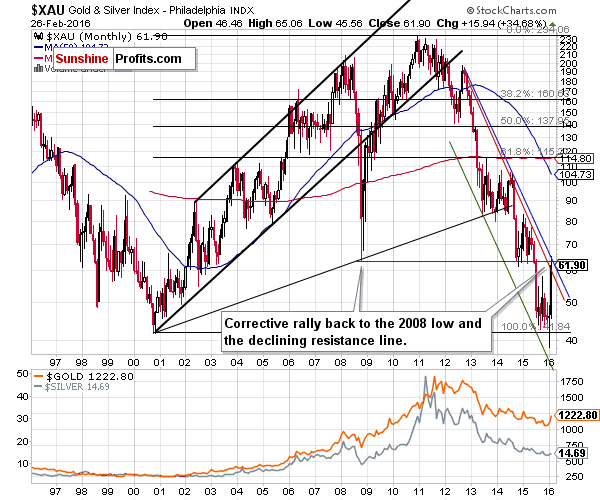

The HUI Index moved a bit higher initially last week – even a bit above the 170 level – but it gave away almost all gains and closed the week at 161.54. Gold stocks remain below their 2008 low in terms of weekly closing prices and this year’s move higher appears to be just a correction after the breakdown below this important low.

Looking at another proxy for the mining stocks (the XAU Index includes both gold stocks and silver stocks), we see that it indeed moved to the 2008 low (and the declining resistance line) and reversed. The outlook remains bearish.

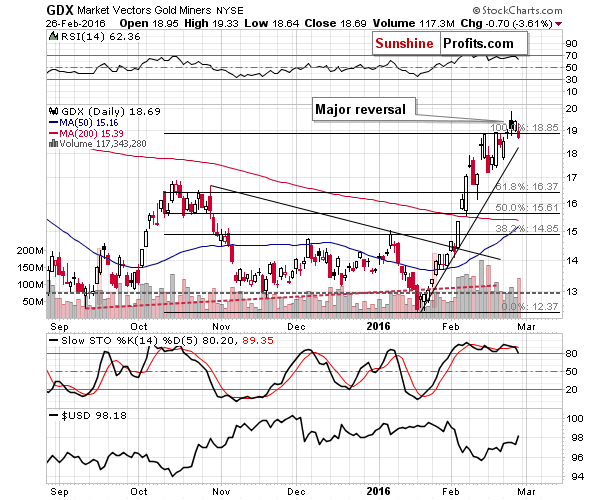

From the short-term point of view, the reversal that we saw on Wednesday is still clearly visible, just like the one in gold. We previously commented on it in the following way:

The volume that accompanied the reversal was not huge, but it was bigger than what we saw in the past few days, so the reversal appears to be meaningful. At the same time the volume wasn’t significant enough to confirm a small breakout above the previous highs. Consequently, the overall implications of yesterday’s session in mining stocks are bearish, but not as strongly bearish as the reversal in gold and silver, where the turnaround was much more visible.

What followed was another bearish session – miners moved a bit higher on very low volume. Friday’s session provided yet another bearish confirmation – we saw a decline on big volume (which was particularly big on a relative basis) and thanks to this decline miners invalidated the breakout above the previous February highs. The implications are bearish and it appears that the next big move in the sector is going to be to the downside.

Summing up, gold and mining stocks appear to be on the brink of starting another powerful slide, silver seems to have already started its big decline. Gold hasn’t broken below the short-term support line, but based on what we saw in silver and mining stocks (and also based on the previous failed attempts to move and close above the 61.8% Fibonacci retracement) it appears that we will not have to wait much longer for the big slide in gold to really start (likely this week). Still, another move to or a bit above the 61.8% Fibonacci retracement in gold can’t be ruled out – it doesn’t seem that it would change much, though. All in all, the outlook remains bearish and short positions in gold, silver and mining stocks appear to be justified from the risk/reward point of view.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $973; stop-loss: $1,274, initial target price for the DGLD ETN: $94.27; stop-loss for the DGLD ETN $52.44

- Silver: initial target price: $12.13; stop-loss: $16.14, initial target price for the DSLV ETN: $77.53; stop-loss for DSLV ETN $42.69

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $20.33, initial target price for the DUST ETF: $17.31; stop-loss for the DUST ETF $3.58

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $27.34

- JDST ETF: initial target price: $36.46; stop-loss: $6.88

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The annual meeting of the leaders of the world’s top economies has just ended. What does it imply for the gold market?

=====

Hand-picked precious-metals-related links:

U.S. Precious-Metals Trade Probe Shifts From Antitrust to Fraud

Gold funds post longest run of inflows since 2009: BAML

India imposes gold sales tax on top of record import duty

Gold wins in February as fund flows surge

Gold Speculators' Bullish Positions Continue Surge Higher

Australia's gold output climbs to 12-year high

Goldcorp cuts dividend, lowers production guidance for next three years

=====

In other news:

Global Shares Fall on G20 Disappointment, Fed Hike Prospect

China central bank resumes easing cycle to cushion reform pain

Why We Might Be Talking About 'Divergence' Again Soon

Fed Dots Don't Connect for Bond Traders Scorning Rate-Hike Path

Another financial crisis is imminent: Ex-BoE Gov

A Wealthier Warren Buffett Says Sour Politicos Are 'Dead Wrong' on Economy

It's Getting Harder for Currency Traders to Make Money, Market Veteran Says

Goldman Sachs: Why it’s wrong to be long the Japanese yen

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts