Briefly: In our opinion, short (full) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

The precious metals sector is performing quite well this week, but gold, silver and mining stocks have not moved above their recent high – at least not yet. Are there bearish or bullish implications thereof?

The implications are bearish, because the above implies that gold, silver and mining stocks are in a consolidation and the odds are that the move that preceded it will be continued once the consolidation is over. This can change if we see an important breakout above the upper part of the consolidation, but we haven’t seen anything like that recently. Moreover, the medium-term trend remains down, so the big moves are likely to be to the downside.

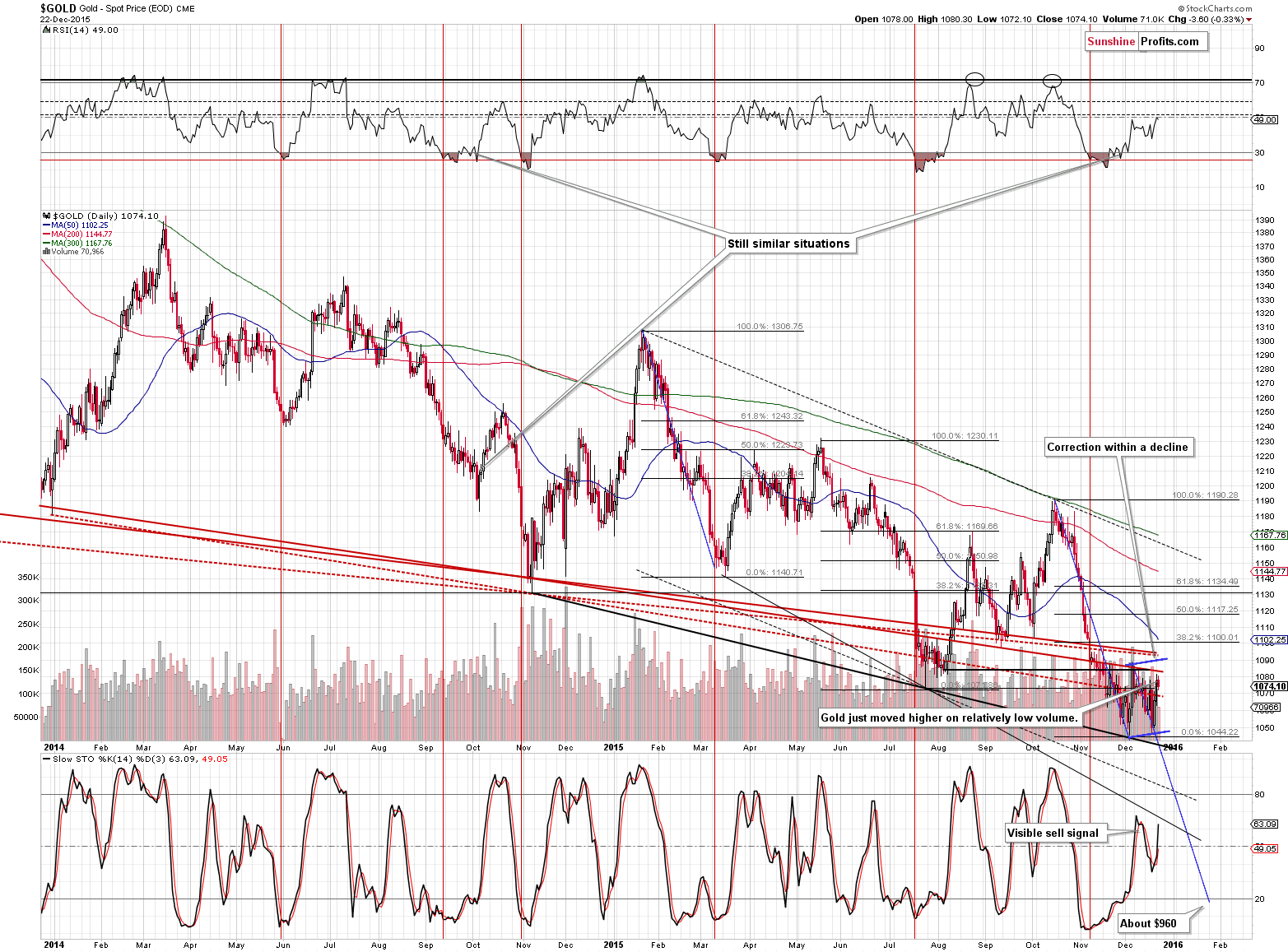

Let’s take a closer look starting with gold (charts courtesy of http://stockcharts.com).

In our yesterday’s alert we wrote the following:

The implications of the price-volume link remain bearish also today. Gold moved higher yesterday, but the move materialized on relatively low volume. Consequently, yesterday’s price action is most likely just another counter-trend move higher within a bigger decline.

Yesterday gold moved a bit lower on low volume, which is rather inconsequential (as a reminder, the implications of low volume are not symmetrical in case of rising and falling prices because of the way securities’ prices are set on exchanges). We saw something similar in late August 2014 (where prices declined a lot after a small move higher) and in December 2014 (where prices traded sideways for a few days and then moved higher). Overall, there are no certain implications of the yesterday’s price-volume situation.

Please note that even if the December 2014 situation repeats here, the price-volume link will likely show us that the tendency changed – note that in late December and early January 2015 gold rallied on significant volume and declined on small volume. We have not seen this kind of performance for several days in a row, so there are no bullish implications here.

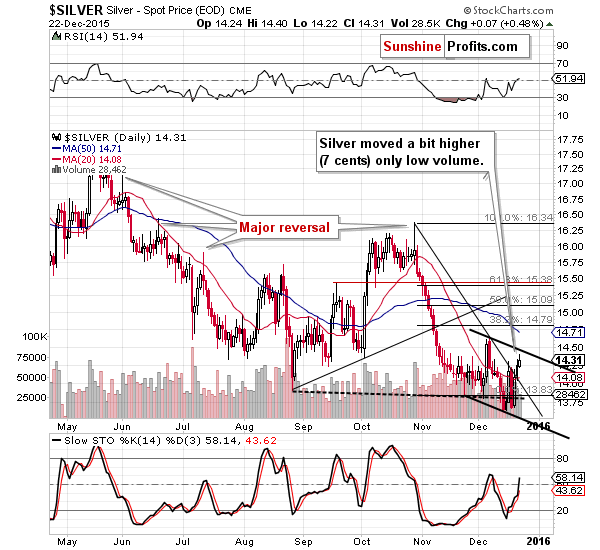

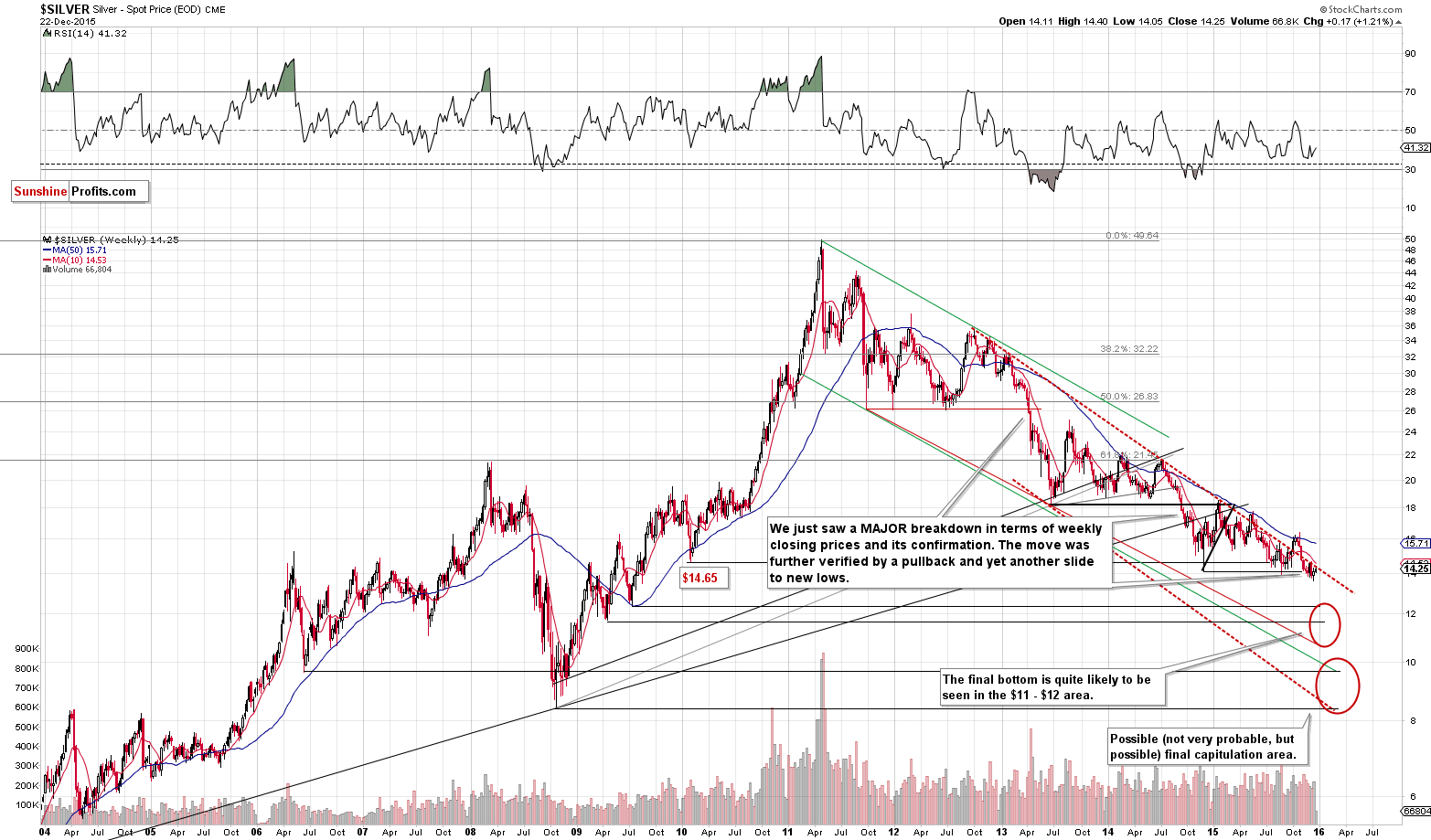

Silver moved 7 cents higher yesterday, but it remains well below the previous low and even the declining resistance created based on the line connecting previous 2 lows. Will silver move even higher before declining? That’s possible, but the upside is very limited based on the above-mentioned line and the previous high, not to mention the declining long-term resistance line.

Silver moved to the declining red resistance line many times and in the vast majority of cases this line stopped the price and prevented it from rising further. The odds are that this will be the case also this time.

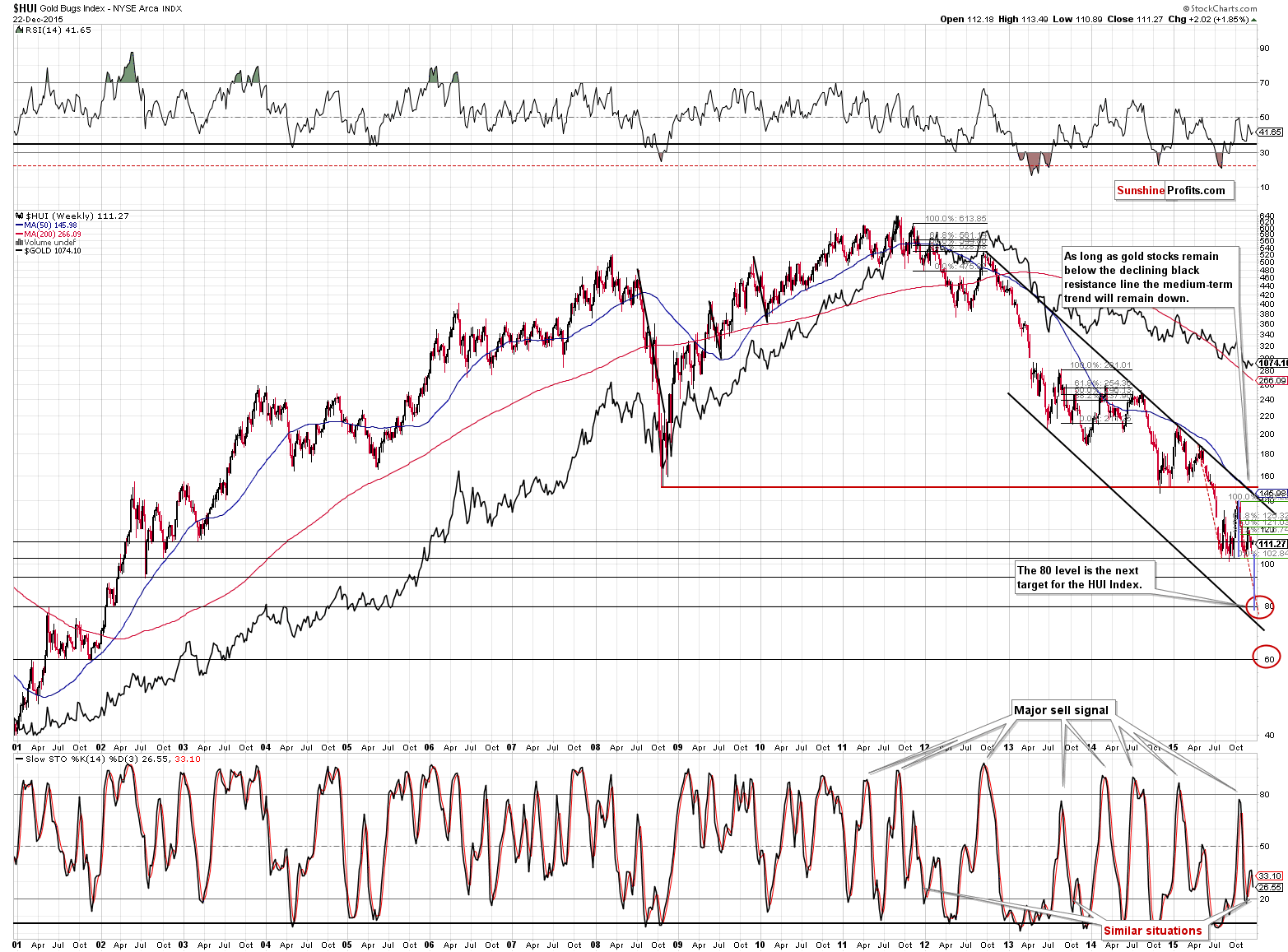

As far as the situation in the HUI Index is concerned, not much changed from the long-term perspective yesterday and our previous comments remain up-to-date:

The HUI Index moved visibly lower and it’s about to create a bearish head-and-shoulders pattern. The target based on this formation is the 80 level, which was our next interim target anyway based on the early 2002 low and other calculations (the gold price target and the gold stocks to gold ratio analysis). Consequently, this target is even more likely to really hold the decline (at least for some time). Please note that there is also another level to which gold stocks could decline – the 60 level.

It seems unrealistic – we know – but did 106 seem realistic when the HUI was trading above 600 just a few years ago? The fundamental outlook for the precious metals market remains bullish in our view, but that doesn’t change anything (!) regarding the short term or even the medium term, given a strong downtrend. Markets are logical only in the long run, and emotional in the short run. Consequently, it is possible for the HUI Index to become even more oversold than it is right now before the final bottom is in.

The one thing that we would like to add is that the Stochastic indicator has almost generated a sell signal. “Almost” because the above indicator on the above chart is based on weekly closing prices and the week is not over yet, but unless miners rally substantially, we will have another important bearish signal in place. Please note that the sell signals from the weekly version of the Stochastic indicator have very often resulted in declines and these moves were substantial.

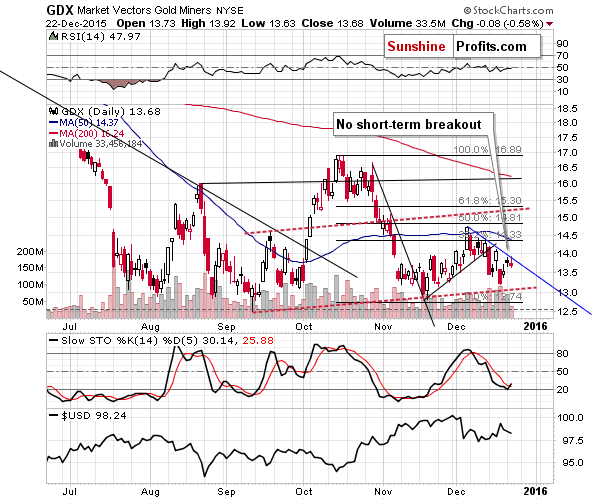

As far as the short-term picture is concerned, miners moved higher on an intra-day basis, but finally closed a bit lower. Consequently, the short-term resistance line remains in place and yesterday’s move changed rather little. The particularly interesting thing is that gold is almost at its previous December high while the GDX ETF corrected only about half of the December decline. The relative underperformance is a bearish sign.

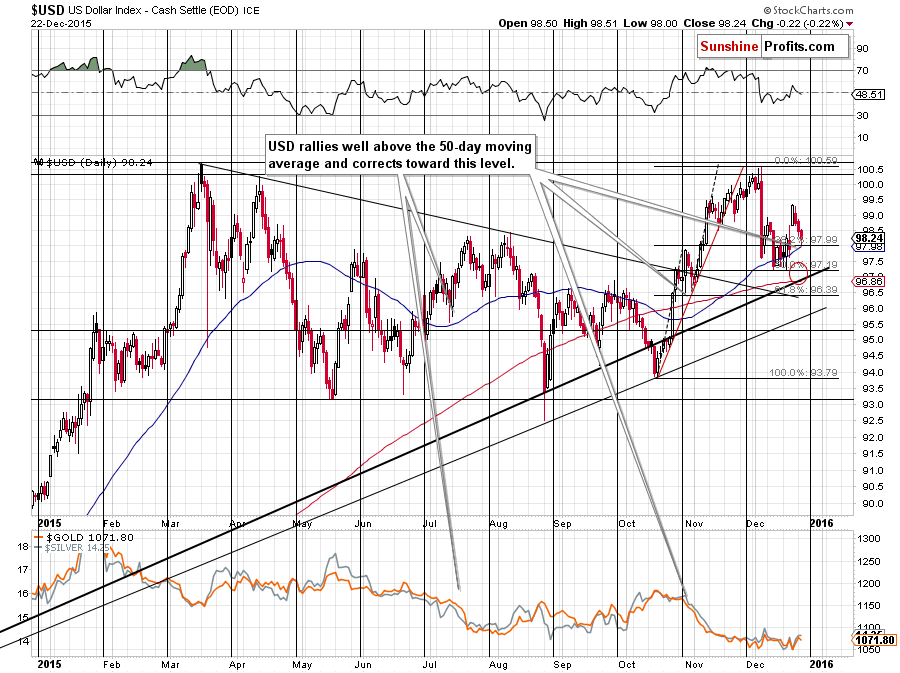

The USD Index is in a particularly interesting situation right now. It’s after the visible comeback above the 50-day moving average and it moved back to it. Breakouts above this average have been important events and confirmations of these moves were important s well. There were only 2 similar cases in the past year and in both cases a rally in USD Index followed.

More importantly, these were the times right before the start of a major plunge in the precious metals sector, so we have yet another bearish confirmation.

Summing up, it continues to appear that we are right before a major decline in the precious metals sector and whether metals and miners continue to consolidate for a few more days or not, doesn’t change much. It seems that the profits on the current speculative short position will become much bigger – after all our target of $960 in gold is well below the current market price and if the analogy to the 2013 slide is indeed in place, then we will likely not have to wait long before this level is reached.

The upcoming year will likely start with major events in the precious metals world and paying extra attention to this market for the first few months should prove well worth it.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $973; stop-loss: $1,107, initial target price for the DGLD ETN: $117.70; stop-loss for the DGLD ETN $81.84

- Silver: initial target price: $12.13; stop-loss: $14.83, initial target price for the DSLV ETN: $101.84; stop-loss for DSLV ETN $57.49

- Mining stocks (price levels for the GDX ETF): initial target price: $10.23; stop-loss: $15.47, initial target price for the DUST ETF: $31.90; stop-loss for the DUST ETF $10.61

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $15.23; stop-loss: $21.13

- JDST ETF: initial target price: $52.99; stop-loss: $21.59

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Last week, the Bank of Japan (BoJ) kept the pace of its money market operations unchanged, but it reorganized the stimulus program. What does it imply for the U.S. dollar and the gold?

Yesterday, the USD Index extended losses, which pushed USD/CHF to the lower border of the consolidation. Will it withstand the selling pressure in the coming days?

Forex Trading Alert: USD/CHF - Currency Bears vs. Support Zone

=====

Hand-picked precious-metals-related links:

Canadian lawsuit names Bank of Nova Scotia in gold price manipulation

HSBC: Platinum To Average $1,005, Palladium $655 In 2016

=====

In other news:

Consumer Spending in U.S. Increases by Most in Three Months

Default danger for US high yield in 2016

UK growth slowdown takes rate-hike pressure off BoE

Puerto Rico Payment Almost Impossible, Governor Reiterates

Don't bet on a happy new year for Greece

OPEC bashes prospects for electric cars

Record highs predicted for bitcoin in 2016 as new supply halves

INFOGRAPHIC: The world's strangest currencies

Exclusive: Seven big investment banks in UK paid just $30 million tax in 2014

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts