Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective. Since the position is already highly profitable, we are moving the stop-loss levels lower.

The precious metals sector took a dive this week and it seems that now it’s most important to estimate when a bigger upswing is likely to take place. After all, no market can move up or down in a straight line.

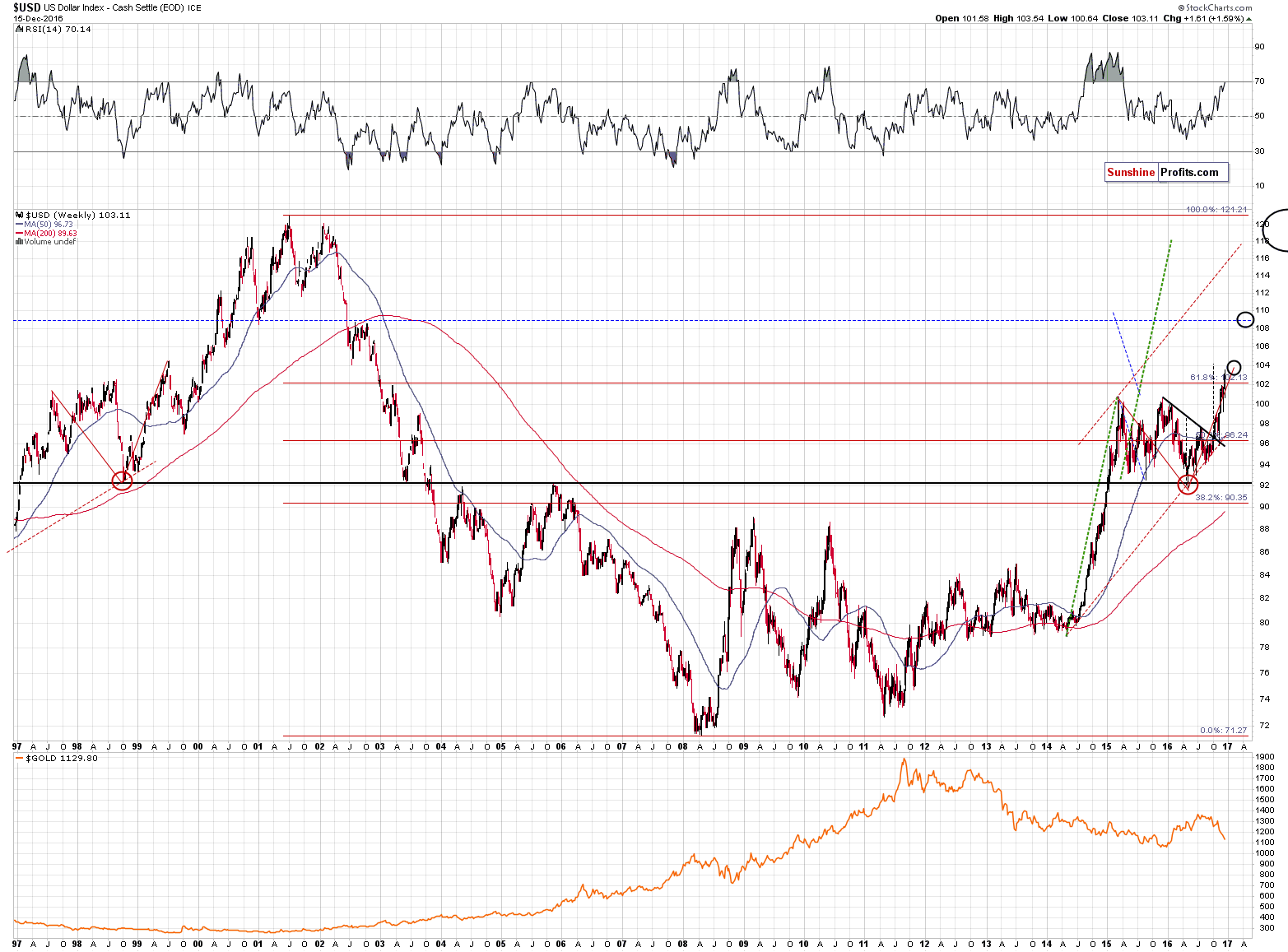

The key thing to monitor – in addition to gold’s, silver’s and miners’ prices – is the USD Index, so let’s start today’s alert with it (charts courtesy of http://stockcharts.com).

We previously wrote that the USD Index was likely to rally to the 104 level due to the similarity (the RSI indicator and the shape of the price movement were alike and the situations were almost identical in terms of time) to the 1999 rally and the way it ended. Since the USD Index moved above 103.5 this week, the target was almost reached – and gold is not close to reaching its downside target below $1,000. Since both markets move in tandem, it’s highly unlikely that the USD Index will top but gold doesn’t bottom at the same time. Consequently, it’s likely that either gold will bottom higher than expected, or the USD Index will move above 104 before the next visible (from the long-term perspective) decline takes place.

What’s more likely? In our opinion, the USD’s rally to higher levels is more likely. Is it possible for the USD Index to rally above 104 and still do something similar as in 1999?

Yes. Back in 1999, the USD Index most likely didn’t just top a bit above 104 per se. It most likely stopped the rally there (below 105) because 105 was the closest, very strong resistance (the 1989 top). So – it could be the case (and it’s actually quite likely) that back in 1999, the USD Index didn’t just rally above the 1998 high to 104 – it rallied almost to the next strong resistance level. So, we can expect the USD Index to rally to its next strong resistance level, not necessarily to 104.

The next strong resistance level is provided by the 108 – 110 area. The reasons are the 2002 tops and the 2000/2001 bottom. Moreover, it is also the target based on the size of the previous consolidation (blue, dashed lines show how much the USD should rally for the post-breakout move to be as big as the size of the consolidation).

Is there anything else that would support even higher USD values and a quite volatile rally from here? Yes, the symmetry between the 2001 – 2009 decline and the 2009 – now rally. The move from about 109 to 102 in late 2002 was not stopped by any meaningful correction, so we could see the same during the rally to 109 that is already underway.

The repeat of the Q4 2016 rally in the USD Index would (very approximately) take the USD to the 108 – 110 target area and if gold repeats its Q4 2016 decline, it will likely slide to about $900, which is very much in tune with our long-term bottom target for the yellow metal. At this time, the above seems to be the most likely outlook for the following months.

What about the short-term picture?

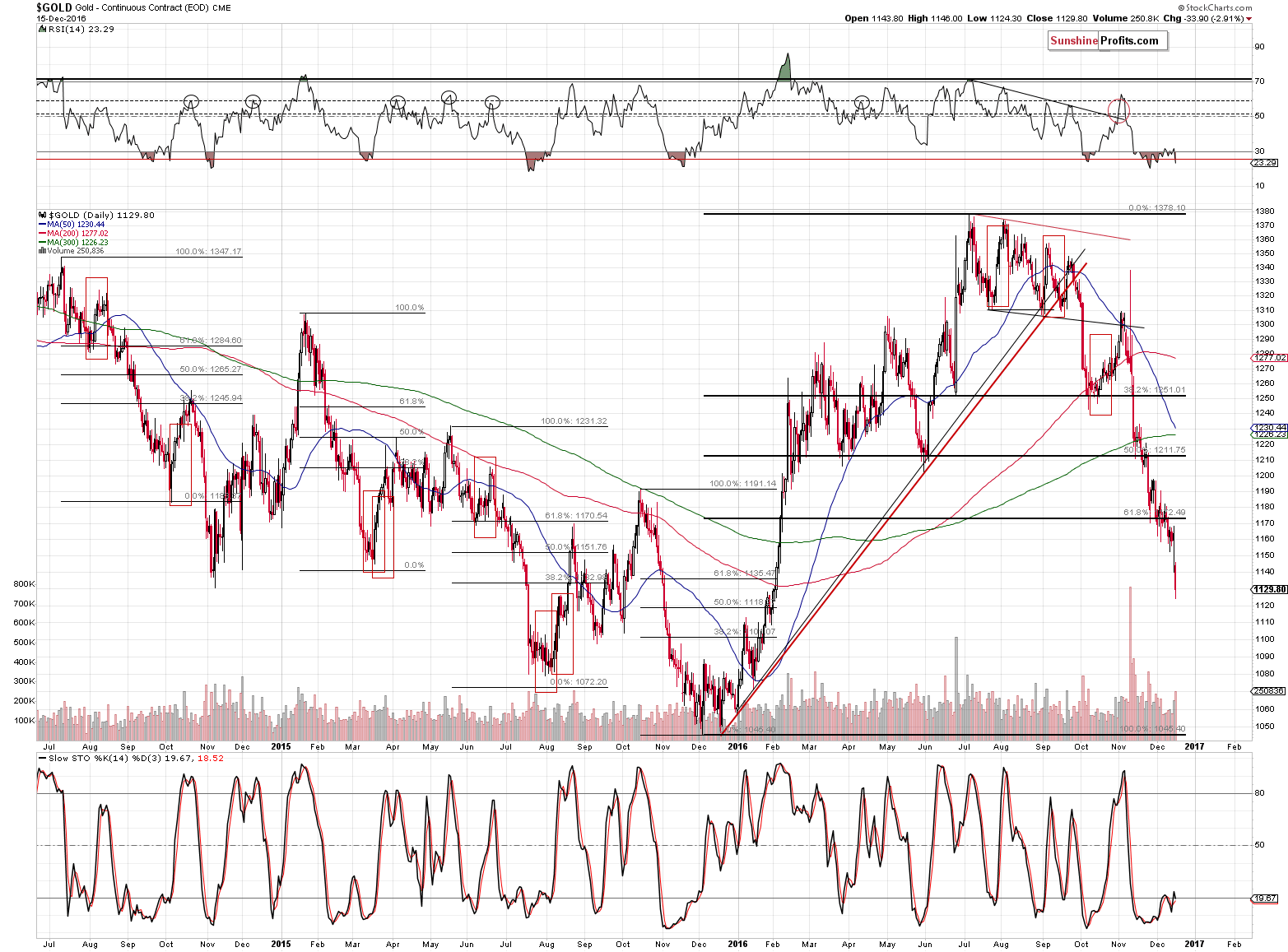

Gold broke below the 61.8% Fibonacci retracement level and there is no significant support level all the way to the 2015 lows. In early 2016, gold moved from $1,070 to over $1,200 without looking back and the opposite is quite likely to be the case this time – gold doesn’t have to pause before reaching $1,070 and it seems that a bigger pause could be seen only after gold moves to the previous lows or even below them (consolidating between $1,000 and $1,050).

There could be corrective upswings along the way, but at this time it doesn’t seem likely and there are no meaningful support levels until $1,070.

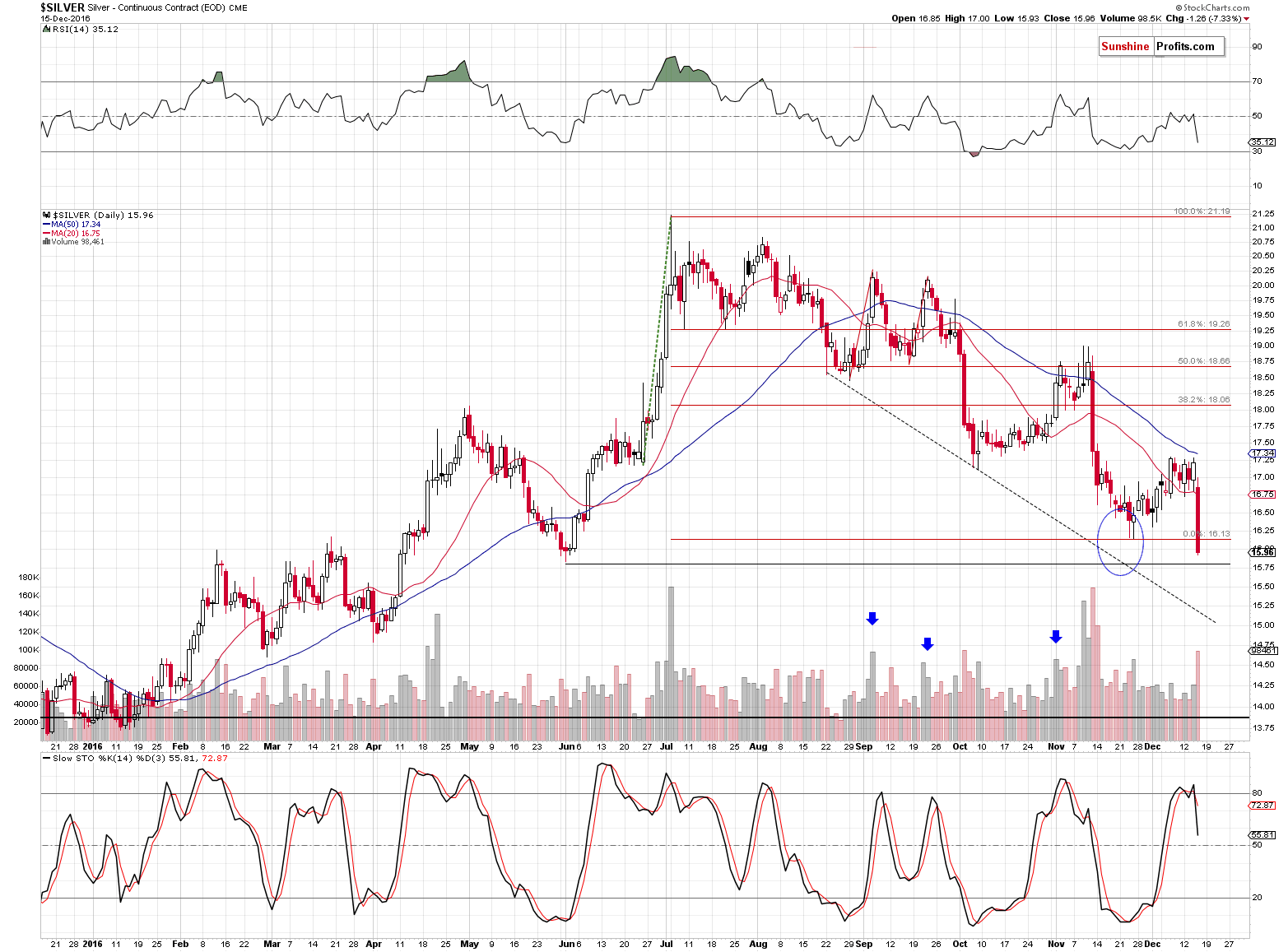

In the case of silver, the June low serves as support, but since it’s very close to the November bottom, it doesn’t seem likely that this level will really stop the decline this time. However, the combination of the April low and the declining dashed support line could, especially that it is currently close to the $15 level. That’s the price level that could generate a short-term rebound.

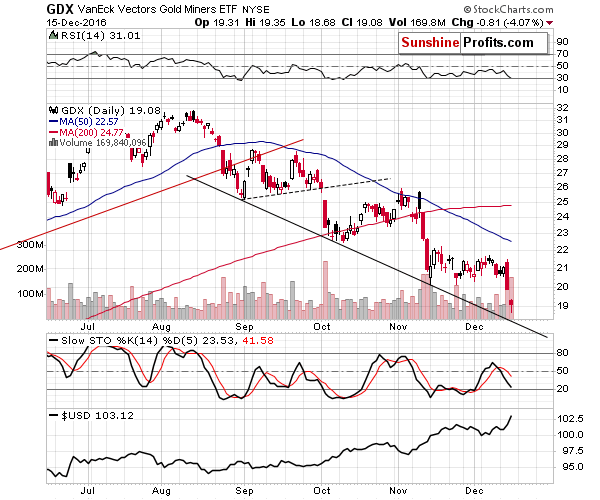

Mining stocks have support at about $18 due to the declining resistance line, but it seems that the long-term support levels are more important.

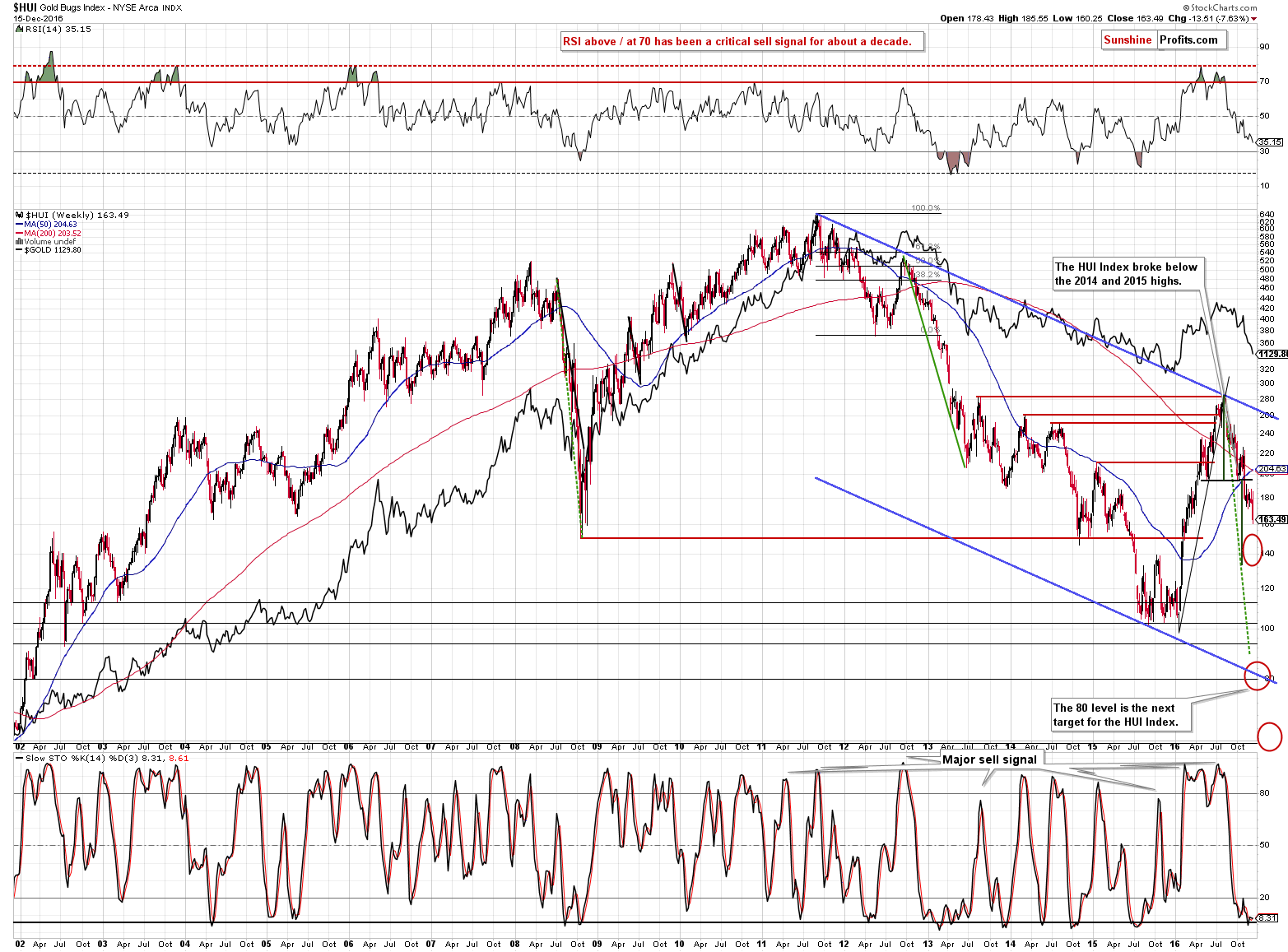

The 150 level in the HUI Index served as support for gold stocks in 2008 and twice in 2014. Based on this year’s head-and-shoulders formation we have a target slightly below 140, but this doesn’t really invalidate the importance of the 150 level. The 140 level could be reached on an intra-day basis whereas the 150 level could be the temporary bottom in terms of daily or weekly closing prices.

Still, just as gold stocks didn’t stop for long when they moved from 100 to 200, they don’t have to stop for long on their way down. Consequently, we are not placing exit orders at this time around the 150 level in the HUI Index. If we see bearish confirmations while miners move close to the mentioned levels, we could adjust or close the positions, but it’s too early to do so now.

Summing up, it seems that the USD Index could rally even higher without a bigger correction and that the precious metals market could rally much lower without a bigger correction. If we see meaningful bullish signs, we may temporarily close the current speculative short positions or adjust them, but at this time, this is not the case.

Since the speculative short position is already highly profitable, it seems that moving the stop-loss levels lower is a good idea. You will find details in the “trading capital” section below.

Also, let’s keep in mind that the upcoming big decline in the precious metals sector is likely to create a great buying opportunity in the case of the long-term investment capital - be sure to prepare yourself for it.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $1,006; stop-loss: $1,183; initial target price for the DGLD ETN: $88.88; stop-loss for the DGLD ETN $58.77

- Silver: initial target price: $13.12; stop-loss: $17.53; initial target price for the DSLV ETN: $46.18; stop-loss for the DSLV ETN $24.86

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $22.62; initial target price for the DUST ETF: $143.56; stop-loss for the DUST ETF $41.88

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $38.12

- JDST ETF: initial target price: $104.26; stop-loss: $28.88

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The latest FOMC meeting was accompanied by Yellen’s press conference. What are the implications of her remarks for the gold market?

December Yellen’s Press Conference Bad for Gold

Some analysts believe that Trump’s economic agenda implies the paradigm shift from sluggish growth and low inflation to reflation. Will the boosted infrastructure spending and tax cuts really spur economic growth and cause inflation or widen the fiscal deficit and weaken confidence in the U.S. dollar? We invite you to read our today’s article about Trump’s economic policy and find out how it will affect the gold market.

Making Deficits and Public Debt Great Again

=====

Hand-picked precious-metals-related links:

Gold Makes Pushback After Getting ‘Smoked’ by Fed’s Hike, Trump

Gold is at risk of doing something it hasn’t since the early 1990s

=====

In other news:

Post-Fed dollar rally steadies, stocks level near highs

Trumped-Up Dollar Seen Outshining All Else Into 2017

Draghi Said to Warn EU Rising Global Rates Pose Crisis Risk

Deutsche Bank Admits Misleading Clients in Dark Pool Trades

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts