Briefly: In our opinion no speculative short positions in gold, silver and mining stocks are currently justified from the risk/reward perspective.

Gold moved sharply higher yesterday, which didn’t change much – the move was in tune with the previous performance of gold. The back and forth movement continues with no decisive action. It’s not that surprising given the time of the year, but things could get really hot at the beginning of 2015. The reason is the situation in the USD Index.

We explained why this is the case in yesterday’s alert, and since gold and the USD Index closed the session more or less at the prices which we had seen when we completed writing the alert, what we wrote in it is up-to-date also today. Consequently, today’s alert will be a in a large part a big quote of yesterday’s issue with small updates in parentheses. Additionally we will analyze the gold to USD Index ratio and the situation in mining stocks.

(…) Will the breakout in the USD be confirmed and will gold decline soon? At this time it seems likely, but not yet a sure bet. We realize this doesn’t sound too encouraging, and if we could “make” the market move decisively, we would surely strive to do it, but all we can do is to report to you the situation exactly as we see it and how we plan to take advantage of it. The only way that we can “take advantage” of an unclear situation is to stay out of the market as that means not putting the capital at an unnecessary risk. Taking a position without analyzing the situation thoroughly and without having a risk/reward situation that really justifies opening a position, doing so is just gambling. We don’t have a favorable risk/reward situation at this time. We featured the reasons for which we think so in yesterday's alert, and today we’ll focus on the one thing that changed – the breakout in the USD Index (charts courtesy of http://stockcharts.com).

In the previous alert we wrote the following:

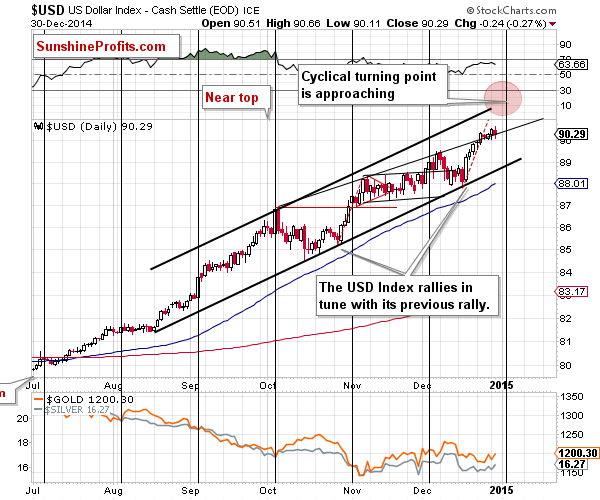

The USD Index closed the week above 90 and also above the rising short-term resistance line, so the short-term breakout is confirmed. The implications for the next several days are bullish.

The USD Index has indeed rallied and the implications continue to be bullish for the short run. There is a cyclical turning point in the first days of 2015, so we could see the next local top relatively soon, especially that the current move higher is about as big as the Oct. – Nov. rally.

The USD Index moved a bit lower on an intraday basis, but since it closed at the rising support line, there was no breakdown and yesterday’s small decline doesn’t have meaningful implications and the above comments remain up-to-date.

The long-term chart provides interesting and very important context for the above picture.

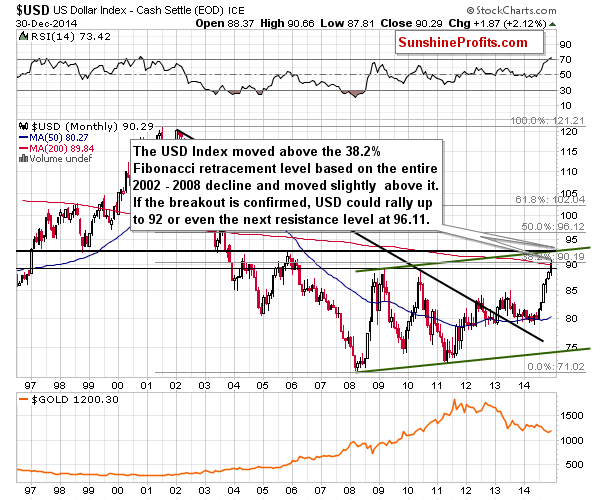

The USD Index has just encountered a major resistance line that it needs to surpass before a rally to 92 becomes very probable – the 38.2% Fibonacci retracement levels based on the entire 2002 – 2008 decline.

The Fibonacci retracements have worked for the USD Index many times in the past, so it could be the case that this level will keep the rally in check for some time. If not, and we see a confirmed breakout, then we’ll likely see another big rally – to the 92 level or perhaps even to the next retracement at 96.11.

However, we would first need to see the breakout and its confirmation. For now, we have just seen a move to this critical level. While the situation in the precious metals market remains bearish, without a breakout in the USD Index, the possibility of another slide in the USD and a rally in gold, silver and mining stocks will be too big for us to think that opening short positions in the precious metals sector is justified from the risk to reward perspective.

The USD Index closed above the critical resistance created by the 38.2% Fibonacci retracement for another day, so the odds for the breakout being confirmed have further increased. The context that we meant while describing the short-term chart is this particular resistance, which might turn into a strong support if the USD Index continues to rally.

If the USD rallies (based on the short-term chart) and forms a local top (based on the turning point), we could simply see a move back to the 38.2% Fibonacci retracement and a local bottom at this level – slightly above 90. After that, we could see a move to 92 and perhaps even to 96.11.

Moreover, if we see a move higher in the coming days, then a corrective downswing and a bottom at the 38.2% retracement, it could be just the bullish (for the USD) / bearish (for the precious metals sector) confirmation that we need to open a speculative (short) position (in the latter). We are not there yet, but we could be at this point in just a couple of days.

There’s not much more than we can say today – the charts below show virtually no changes based on yesterday’s price action.

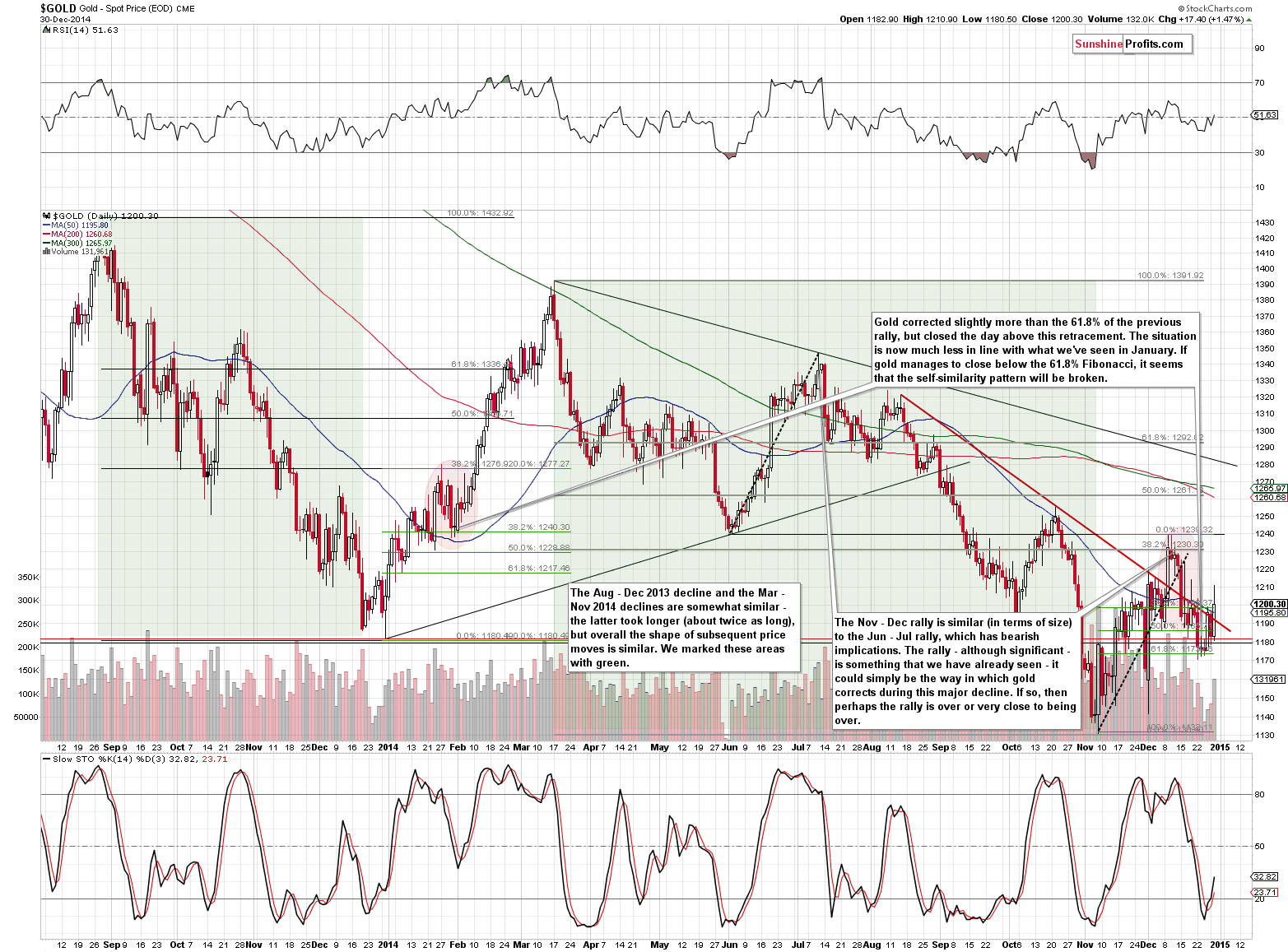

To be precise, there is no change in the implications in our view – the price of gold moved visibly higher yesterday, but it didn’t close much above last week’s closing price – only a few dollars higher. The breakout above the declining resistance line is small an unconfirmed, so it’s not necessarily bullish.

The volume was bigger than in the past few days, but it’s not that significant because the previous days’ volume was relatively low as traders took time off at this time of the year. All in all, we didn’t see a real change yesterday.

The previously-mentioned self-similar pattern could still be in place – the current situation is still somewhat similar to what we saw in January 2014. This means that based on the above chart alone we could see a rally in the coming days.

Moreover, there was a buy signal from the Stochastic indicator, which of course is a bullish sign, but on the other hand, there was no breakout above the declining red resistance line.

Overall, the above chart is more bullish than it was last week, but not bullish enough to justify opening long positions based just on it.

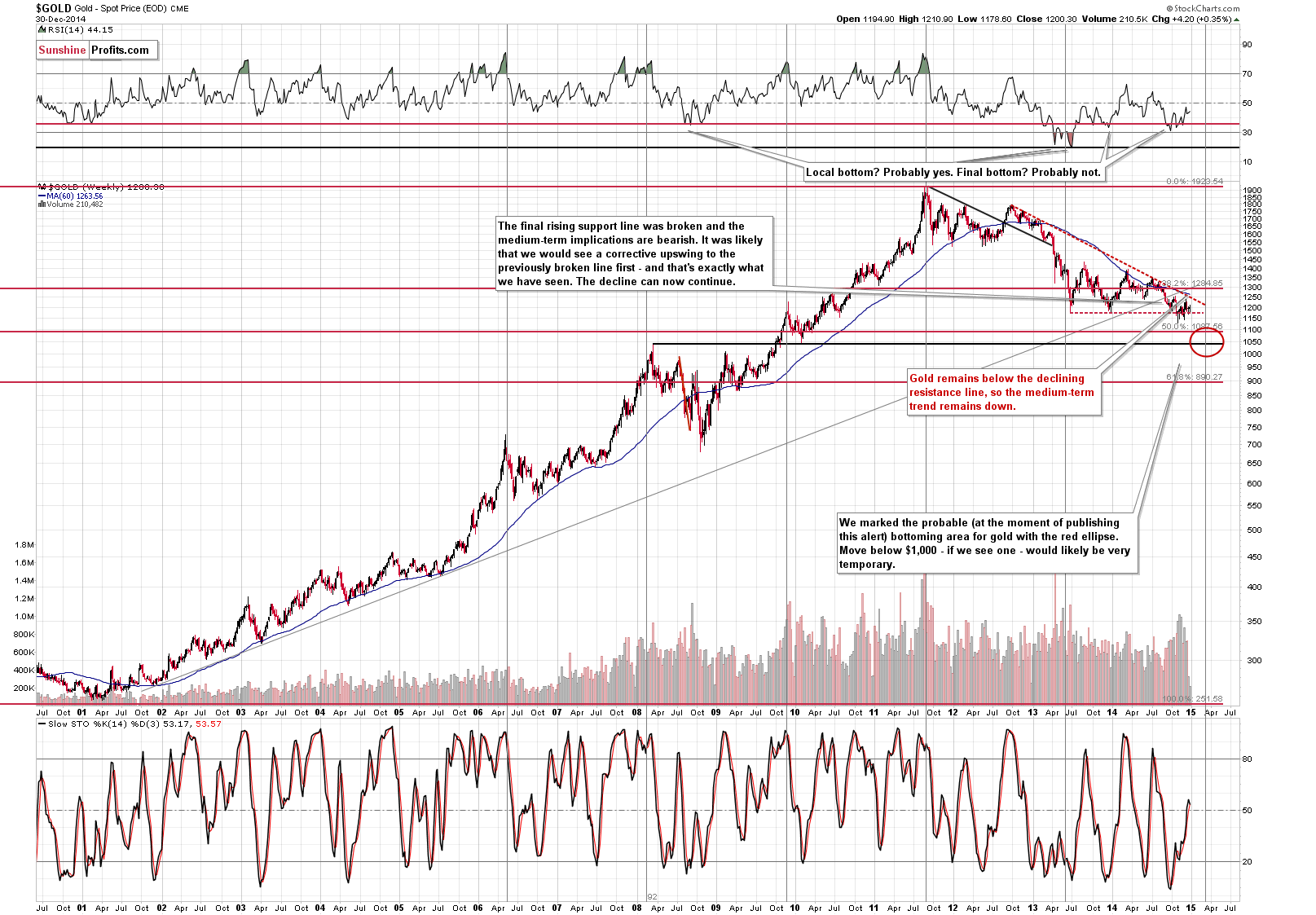

The long-term picture for gold remains unchanged. The events of the last two weeks didn’t change much as gold ended the previous week below $1,200 and – more importantly - well below the declining resistance line. The medium-term trend remains down.

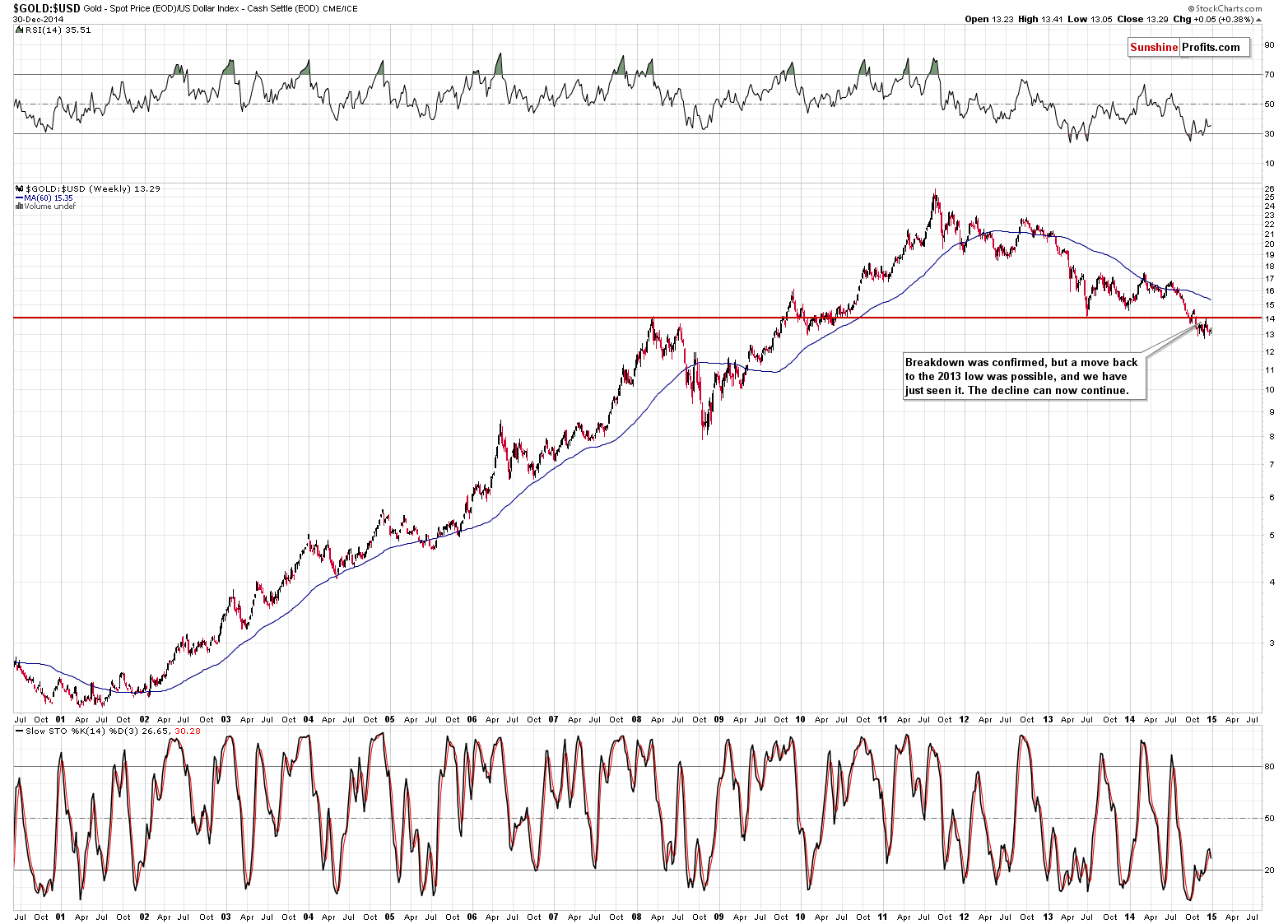

Before summarizing, we would like to draw your attention to the gold to USD Index ratio. This ratio clearly shows that yesterday’s rally was nothing important. The ratio is after an important breakdown and it was already confirmed. The implications remain bearish.

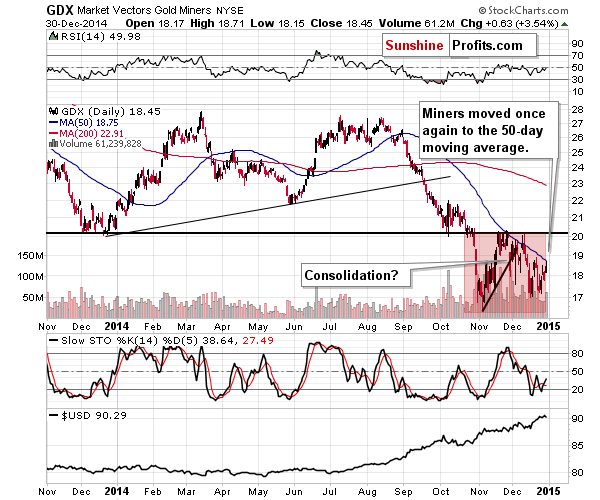

The final chart for today is the one featuring the mining stocks. The GDX ETF moved once again to its 50-day moving average. That’s the average that has been stopping local rallies since late November. We now see a 5th attempt to move above it. Since all the recent attempts failed and history tends to repeat itself, we are quite likely to see another local top relatively soon.

Please note that even if miners rallied from here – say to the $20 level or so – it would not really change the bearish outlook for the medium term. The late-Oct. – today performance still looks like a big consolidation within a very big decline.

Overall, the situation is still unclear as there are several factors that point to a looming decline in precious metals, but there are also some important signs suggesting higher values of PMs – like the critical resistance in the USD Index that could still generate a visible decline in the USD Index and a rally in the precious metals. The odds for a big decline in the coming days are now smaller based on the U.S. dollar’s ability to hold above the long-term 38.2% Fibonacci retracement. If the breakout is confirmed, we could have a favorable entry point for a trade in precious metals relatively soon. It really does seem that another trading opportunity is just around the corner. However, we are not at that point yet and other factors will need to be considered as well. We will be monitoring the market and we’ll keep you – our subscribers - informed.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Yesterday's Free Trading Alerts:

Bitcoin Trading Alert: Bitcoin Might Move Down

There was no conclusive action yesterday. Bitcoin went down on increased volume but neither the price action nor the volume was significant enough to suggest a possible change in the short-term outlook. Did we see any such change today?

Forex Trading Alert: Will EUR/USD Drop To 1.2100?

Yesterday, the combination of a stronger greenback and Greek Prime Minister’s commentary (Antonis Samaras said that he will recommend parliamentary elections are held on January 25) pushed EUR/USD lower. Because of these circumstances, the exchange rate broke below the support line and dropped to its lowest level since Jul 2012. Earlier today, the pair extended losses and hit a fresh 2014 low. Will we see a test of the barrier of 1.2100 in the coming days?

=====

Hand-picked precious-metals-related links:

Gold on Edge of Winning or Losing Year as Silver Declines

Gold rises 2 pct as year-end jitters knock stocks, dollar

=====

In other news:

Ukraine turns its back on its ‘worst year since World War II’

Official: Sonar detects wreckage from AirAsia Flight QZ8501 on sea floor

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts