Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective. This position was originally featured on Jan. 12, 2017 at 3:49PM.

In yesterday’s alert we discussed multiple factors affecting the precious metals market right now, but there is still more to the story than that. In today’s analysis, we will discuss the link between gold and the Japanese yen along with the outlook for the latter, and we will feature a moving average based on an important precious metals ratio. The latter may not seem important until one considers its implications in the past decade. Reviewing it changes the initial perception entirely. Let’s start with the former (charts courtesy of http://stockcharts.com).

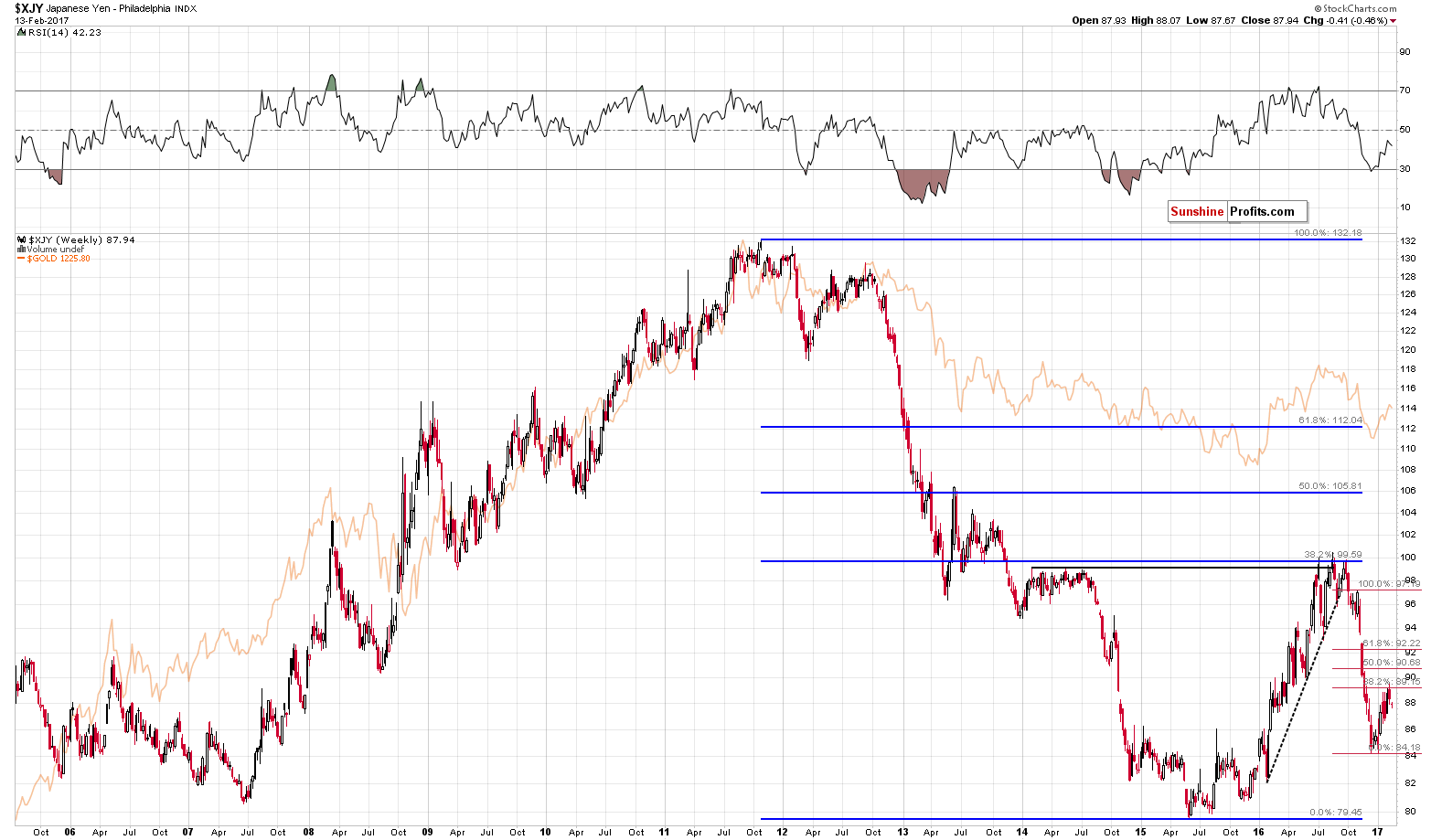

The Japanese currency and gold are closely related and it’s clearly visible that this link works not only in the medium term, but also in the short term. Therefore, monitoring the situation in the Japanese yen is a good idea (to say the least) for precious metals investors.

The Japanese yen declined from 2011 to 2015, rallied in the first half of 2016 and declined close to the end of the year. It’s been on a rebound for the past few weeks – just like gold. Now, the yen seems to have ended its rally. It moved to the 38.2% Fibonacci retracement, reversed and broke below the short-term rising support line. The latter is more clearly seen on the chart below (quoting yesterday’s Forex Trading Alert):

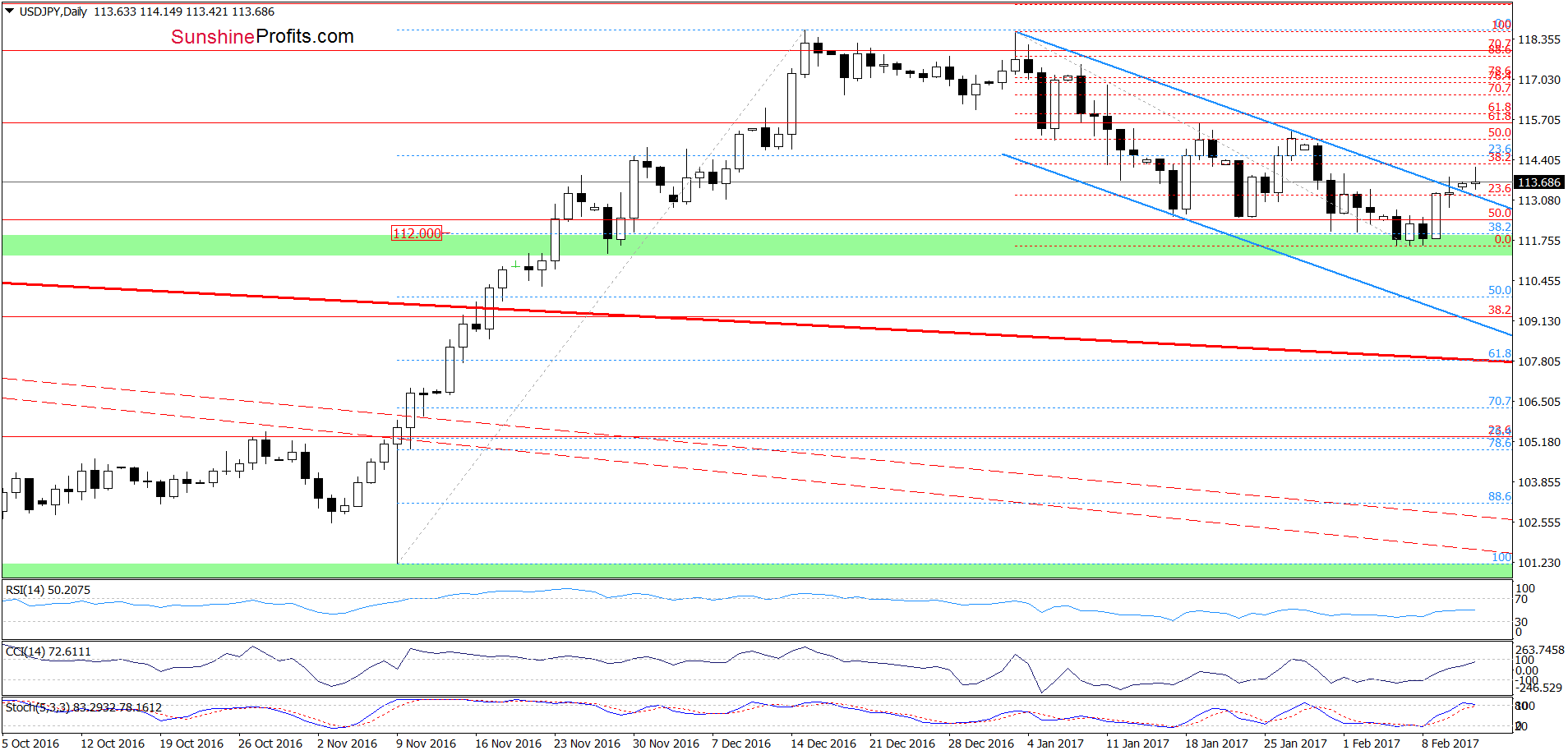

From today’s point of view, we see that USD/JPY extended gains and climbed above the upper border of the blue declining trend channel. Although this is a positive sign, which suggests further improvement, we think that it will be more reliable if the exchange rate closes today’s session above the blue line. In this case, we’ll see an increase to at least 115.36-115.60, where the January 19 and 27 highs are.

/ the above chart is the mirror image of the first chart, but the points regarding the breakout/breakdown remain up-to-date /

So, since the outlook for the Japanese yen is bearish and the link between it and gold remains intact, the above is bearish also for gold and the rest of the precious metals sector.

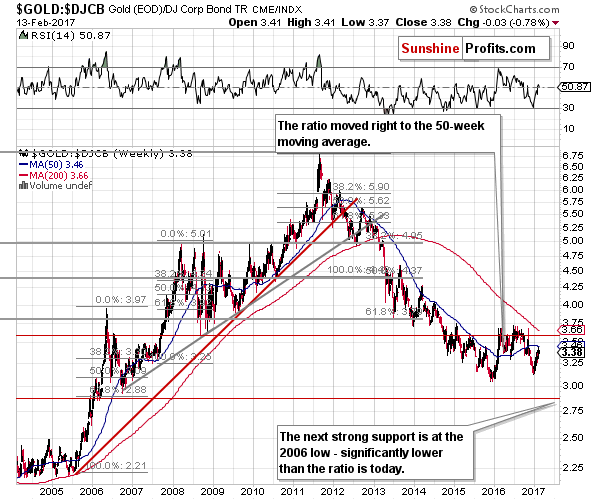

Having said that, let’s take a look at the 50-week moving average based on the gold to bonds ratio.

A brief look at the above chart is enough to understand why this moving average is so important – it has served as key support and resistance for years. In particular, it has been effective in detecting local tops since 2012 (it also served as support in mid-2016). The reason we are featuring the above chart and the moving average is that it was recently reached, but not broken. The implications are bearish as without a breakout the above suggests a turnaround – after all, that’s how strong resistance levels work. Naturally, what’s bearish for the gold to bonds ratio is bearish for gold as well.

Summing up, the bearish implications of the situation in the currency market for the precious metals market became even more bearish based on the euro’s weakness and the breakdown in the Japanese yen. There are also multiple signals in the precious metals sector suggesting that lower, not higher PM prices should be expected.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels / profit-take orders:

- Gold: exit-profit-take level: $1,063; stop-loss: $1,263; initial target price for the DGLD ETN: $81.88; stop-loss for the DGLD ETN $48.47

- Silver: initial target price: $13.12; stop-loss: $18.67; initial target price for the DSLV ETN: $46.18; stop-loss for the DSLV ETN $19.87

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $26.34; initial target price for the DUST ETF: $143.56; stop-loss for the DUST ETF $21.37

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $45.31

- JDST ETF: initial target price: $104.26; stop-loss: $10.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Hand-picked precious-metals-related links:

Germany has got its gold back — They must know something we don't

PRECIOUS-Gold gains ahead of testimony from Fed's Yellen

=====

In other news:

GLOBAL MARKETS-Trump rally gives way to caution as Yellen testimony looms

Ex-Goldman banker Mnuchin installed as Treasury secretary

Euro zone fourth quarter growth revised down to 0.4 percent, December industry output drops

German investor morale falls as political risks cloud outlook

UK inflation rate jumps to 1.8% as weak pound bites - business live

UK unlikely to trigger Article 50 at March 9 EU summit: Brexit minister

Pimco to Investors: Don't Underestimate the Chance of a Fed Mistake

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts