Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Yesterday, gold failed to rally above the all-important $2,000 level, but miners finally showed strength. Is this a buy signal after all?

Things should be simplified as much as possible. But not more.

I’m usually emphasizing that gold miners’ weakness relative to gold is a bearish sign, and gold miners’ strength relative to gold is a bullish sign. That’s true in almost all cases. Yes, almost. There are times when it works differently, but I don’t want to overcomplicate things in each and every analysis.

Just like you could say that 2 + 2 = 4. Is it always the truth?

Yeah, well… kind of.

In physics, when you join particles that have some mass, the mass of them together is not exactly equal to the sum of those masses, because some energy had to be used. It’s much more complex than that, but my point is that 2 + 2 = 4 in the case of mathematics, but not necessarily in all cases in physics. Being in the realm of mathematics was probably the underlying assumption that everyone made when I wrote the above, but I actually never wrote that we were discussing the realms of math and not the ones of physics.

Just as nobody is making full disclosure while stating that 2 + 2 = 4, I haven’t been making full disclosure regarding the link between gold stocks and gold. In both cases, the simplification serves the same purpose: to provide information in a way that’s most useful.

Getting back to the point… So, are strong miners relative to gold a bullish sign?

Yeah, well… kind of.

That’s definitely the case most of the time.

The thing is, however, that it seems that right now we might be in one of those exceptional times.

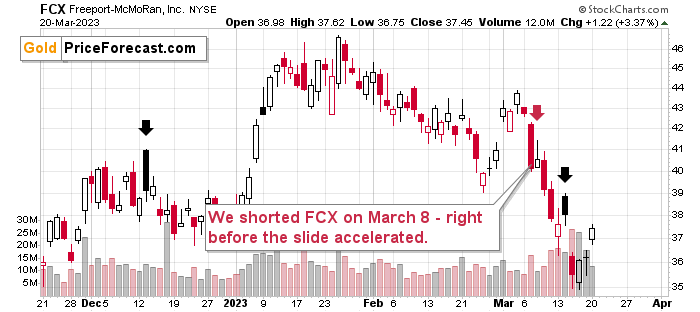

Before I jump into the main analytical course of today’s Gold Trading Alert, I’d like to briefly insert the FCX chart along with a quick comment.

The comment is that FCX rallied by over 3% shortly after we took profits from the short positions that we had entered on March 8. So, if you followed that trade, you not only entered very early in the fastest drop in months, but you also exited very close to the local bottom – congratulations once again! That was our sixth profitable trade in a row (taking unleveraged instruments into account).

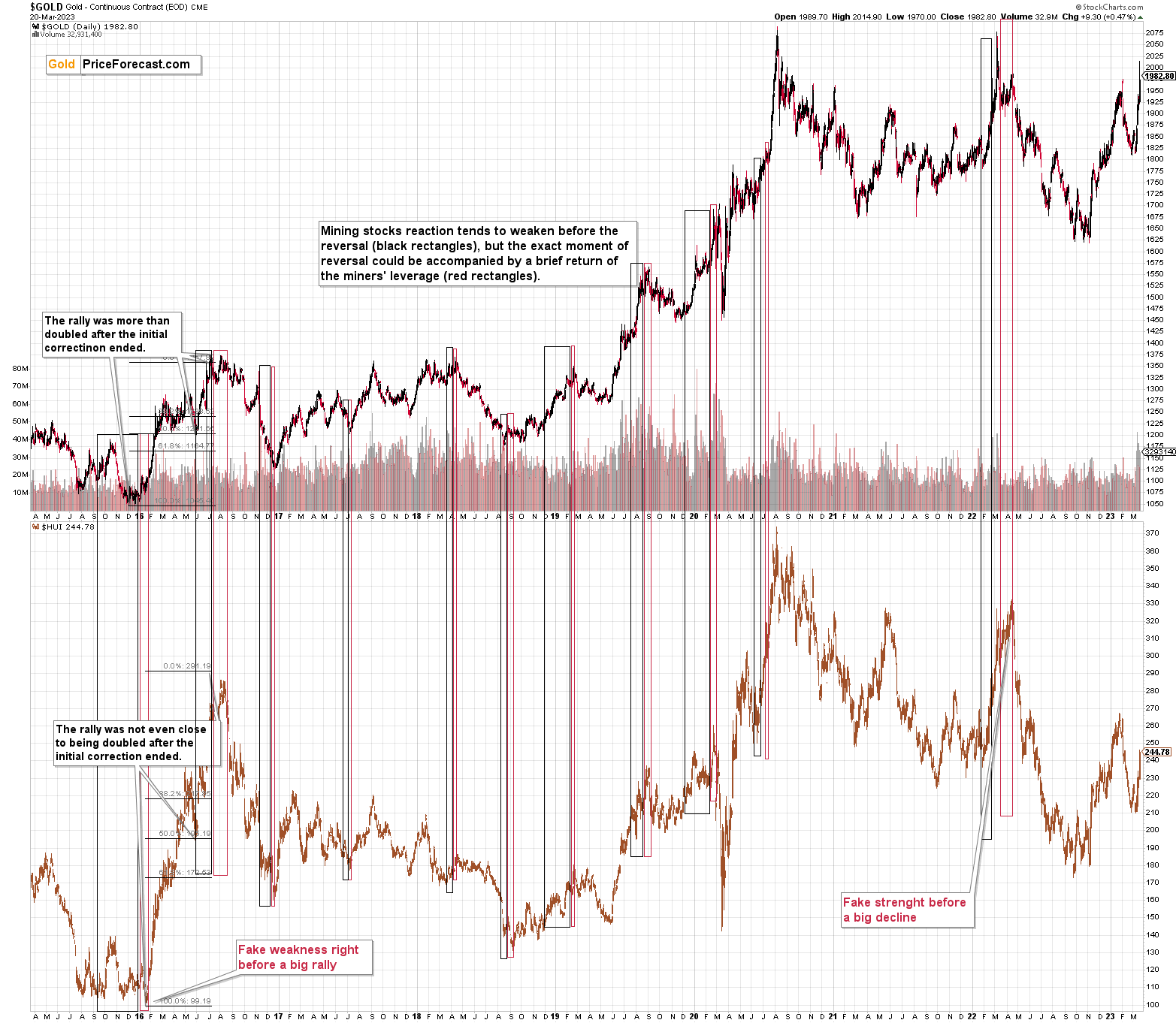

Having said that, let’s dig into the long-term chart featuring the HUI Index (proxy for gold stocks) and gold.

The black rectangles on the above chart show periods when gold stocks are weak relative to gold – they have low leverage to it. This suggests that the trend is about to change.

However – and this is the key exception that I want to emphasize today – this relationship can be turned upside down at the very end of a given move, especially bigger moves.

This is most likely (that’s very sector-specific; there’s no other research on that topic that I know of besides my own analysis) one of the ways in which the specific Wall-Street rule is seen in the precious metals sector.

The rule is that at the end of a given upswing, the worst performers (and, in general, companies with the poorest fundamentals) rally strongly. Why would this be the case? The tops are formed when the investment public enters the market. Those investors are rather uninformed and simply follow the herd. They but those cheap assets without stopping to reflect and ask if there’s a reason for them to be cheap in the first place.

Are the current times highly emotional? Of course!

Does this support herd-following mechanisms? You bet!

So, is there a good chance that the “buy the cheap, regardless of… whatever!” mechanism was triggered as well? Yes!

The above chart shows that this is quite often the case in the case of bigger rallies: after a period of weakness, the rally actually ends with a brief return of leverage. It’s a sector-specific bull trap.

It can also work the other way. In fact, this very mechanism started the 2016 rally – there was a fake decline and a fake breakdown, despite the fact that we hadn’t seen similar moves in gold at that time.

What followed then? A sharp rally.

What’s likely to follow now, given that everything is opposite?

A sharp decline.

All in all, while in most cases gold stocks’ strength relative to gold would be bullish, this time it seems that the implications are precisely opposite.

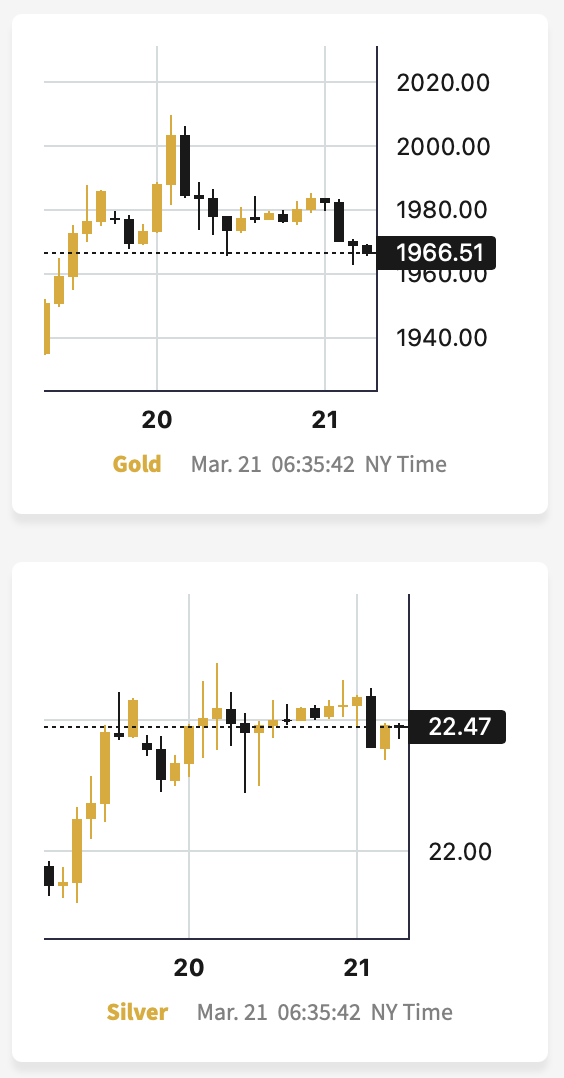

Also, speaking of relative performance, please take a look at the most recent immediate-term price moves in gold and silver.

Silver just outperformed gold on a very short-term basis. While gold didn’t move close to its recent intraday high (above $2,000), silver moved very close to those recent highs.

And – as you may recall – silver’s outperformance of gold is a sell signal.

Also, gold’s failed attempt to rally above $2,000 is an invalidation of a breakout by itself and a sell signal.

Interestingly, the most recent intraday highs formed a head-and-shoulders pattern, and the dashed line that marks the current (at the moment of writing these words) price is actually the neck level of the pattern. So, given just a little more weakness, gold would be likely to decline by another $40 or so.

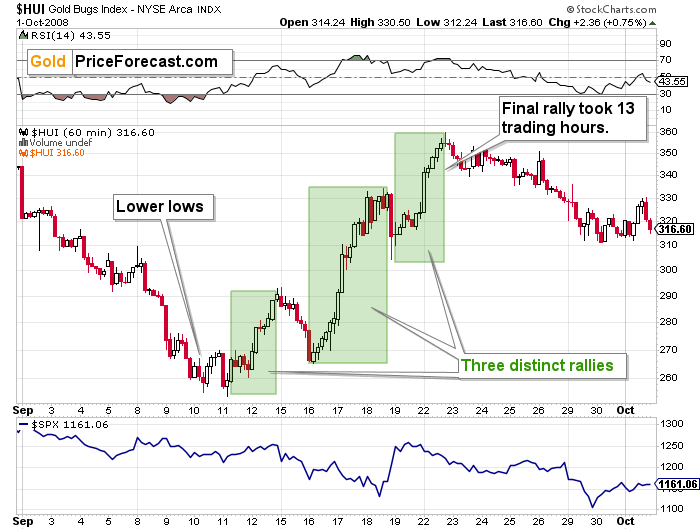

Finally, all the points that I made yesterday remain up-to-date. Even the ones about the HUI Index’s hourly chart and the specific analogy to 2008.

Still, do you know the saying that time is more important than price – when the time is up, the price will reverse?

The “weekly move” analogy was surprisingly accurate – gold’s final pre-slide rally took about a week. And that’s how much time the current rally took. This means that it’s likely to end today or shortly, anyway.

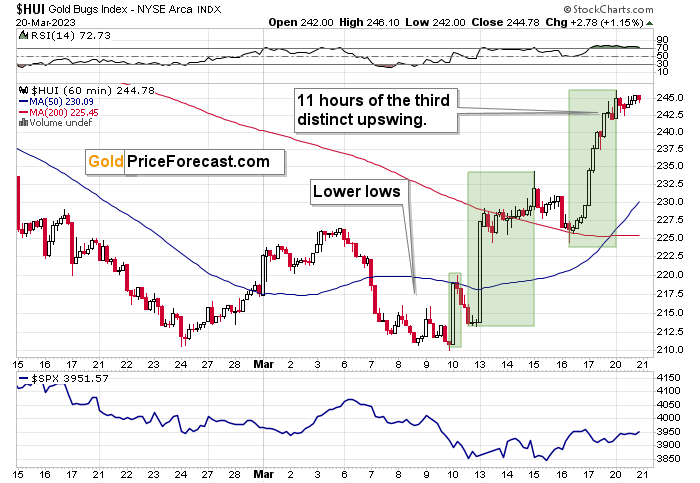

In fact, we see it even more clearly in the case of the HUI Index and its hourly chart.

Here’s what the HUI Index (a proxy for gold stocks) did back in 2008 before sliding.

The decline ended with lower lows, and there were three distinct rallies. The final one took about 13 trading hours.

Here’s the current situation.

The decline ended with lower lows, and there were three distinct rallies. The final one took about 11 trading hours SO FAR.

That’s definitely “close enough” for the top to be in at this very moment. However, let’s keep in mind that history might not repeat itself to the letter but rather rhyme, so it could be the case that gold stocks move higher for several more hours before topping. Of course, I can’t rule out a situation in which miners move even higher even for several additional days, but this seems rather unlikely at this point.

Based on the historical analogies to two major crises, it seems that we are very close to the top in mining stocks, or we have already seen it.

The really interesting thing about yesterday’s session is that the HUI Index didn’t move to new highs, which means that the analogy in terms of the length of the third upswings is very much intact.

Moreover, after the final top, the HUI Index moved lower in a measured way initially, and we see the same thing right now.

Also, if we count the length of the entire rally, it took 53 hours in 2008. Right now, we are 49 hours after the bottom. So, it still seems that the top is in or at hand – also from this perspective.

Finally, since the interest rate decision and the following conference are tomorrow, the markets might be:

- Volatile in intraday terms (so one might as well ignore those moves)

- Ready to move in a meaningful manner only after the announcement and after the dust settles (the initial reaction might not count).

Consequently, instead of trying to guess what Powell is going to do or say, I think it’s best to wait until the dust settles and then see how the trends resume – and the trend in junior mining stocks is clearly to the downside, and the downside potential in it remains enormous.

What’s going to happen to the rates, in my opinion? I think we’re going to see a 0.25% hike. At the moment of writing these words, about 86% of market participants agree with this expectation. Some assume that there will be no hike. So, if there is one, it will be a bearish surprise to the latter – and something bearish for stocks, gold, and – most importantly – junior mining stocks.

Again, the enormous potential for the current short position in junior mining stocks remains fully intact. I can’t make any guarantees, but I expect the profits from this trade to be some of the biggest that we have ever achieved.

Overview of the Upcoming Part of the Decline

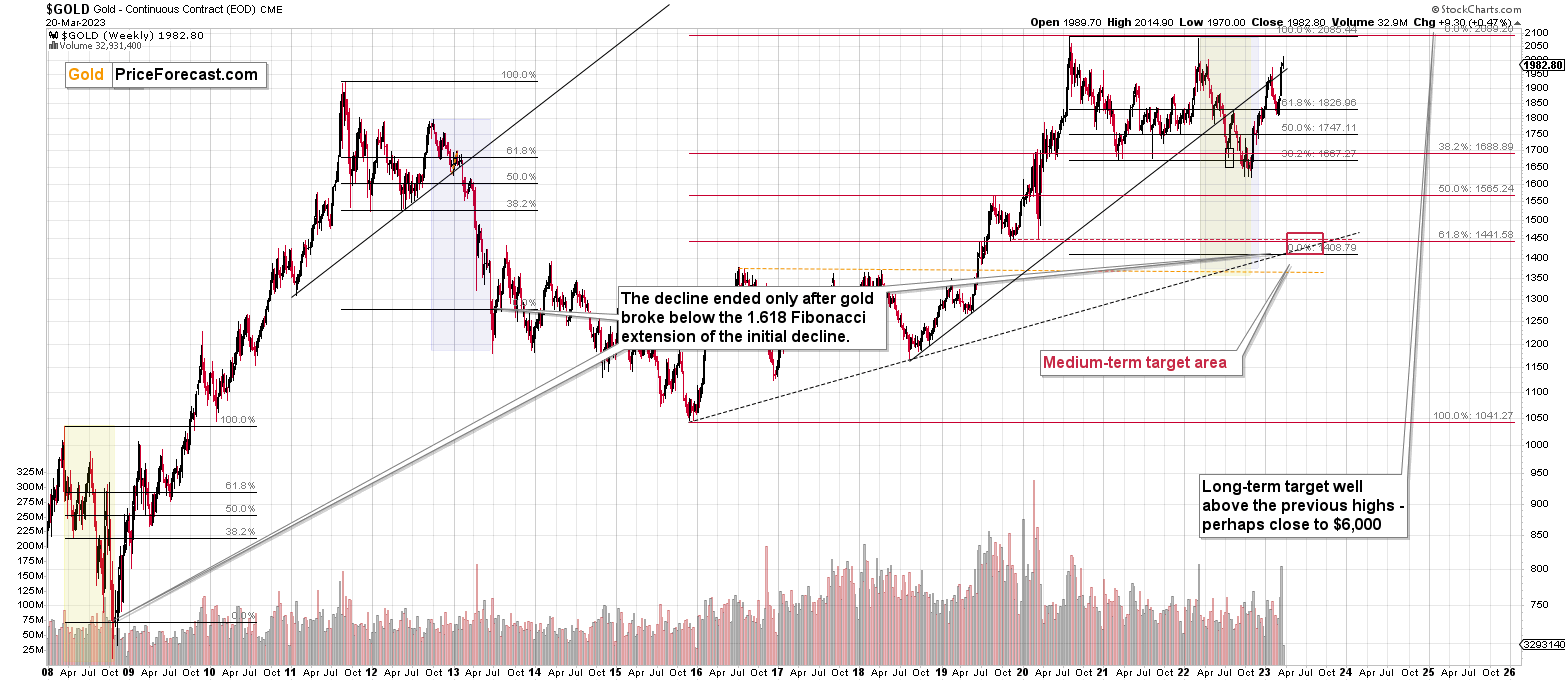

- It seems that we’re seeing another – and probably final – corrective upswing in gold, which is likely to be less visible in the case of silver and mining stocks.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,500 - $1,550.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

Please post your questions in the comments feed below the articles, if they are about issues raised within the article (or in the recent issues), and if they are about other, more universal matters, I encourage you to use the Ask the Community space (I’m also part of the community, after all), so that more people can contribute to the reply and then enjoy the answer. Of course, let’s keep the target-related discussions in the premium space (where you’re reading this).

Summary

To summarize, we recently took profits from the additional FCX trade (right before the trend reversed!) and the current short position in junior mining stocks is – in my view – poised to become very profitable in the following weeks, and perhaps days.

Things might appear chaotic in the precious metals market right now, but based on the analogy to the previous crises (2020 and 2008), it’s clear that gold, miners, and other markets are pretty much doing the same thing all over again.

The implications of this “all over” are extremely bearish for junior mining stocks. Back in 2008, at a similar juncture, GDXJ’s price was about to be cut in half in about a week! In my opinion, while the decline might not be as sharp this time, it’s likely to be enormous anyway and very, very, very profitable.

===

As a reminder, we still have a “promotion” that allows you to extend your subscription for up to three (!) years at the current prices… with a 20% discount! And it would apply to all those years, so the savings could be substantial. Given inflation this high, it’s practically certain that we will be raising our prices, and the above would not only protect you from it (at least on our end), but it would also be a perfect way to re-invest some of the profits that you just made.

The savings can be even bigger if you apply it to our All-inclusive Package (Stock- and Oil- Trading Alerts are also included). Actually, in this case, a 25% discount (even up to three years!) applies, so the savings are huge!

If you’d like to extend your subscription (and perhaps also upgrade your plan while doing so), please contact us – our support staff will be happy to help and make sure that your subscription is set up perfectly. If anything about the above is unclear, but you’d like to proceed – please contact us anyway :).

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $26.13; stop-loss: none.

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding profit-take level for the JDST: $13.87; stop-loss for the JDST: none.

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $17.83 (stop-loss: none)

SLV profit-take exit price: $16.73 (stop-loss: none)

ZSL profit-take exit price: $32.97 (stop-loss: none)

Gold futures downside profit-take exit price: $1,743 (stop-loss: none)

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the upside profit-take exit price: $10.97 (stop-loss: none due to vague link in the short term with the U.S.-traded GDXJ)

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the upside profit-take exit price: $25.47 (stop-loss: none)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief