Briefly: in our opinion, full (300% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Gold plunged just as you knew it would. And so did silver and mining stocks. At the same time, the USD Index soared. You knew it was likely to happen as history tends to rhyme, and because you saw the charts featuring the key analogies in the previous Gold & Silver Trading Alerts. And you know also that it’s just the beginning.

If you have just joined this service, I encourage you to read yesterday’s analysis, as that’s where I’m describing the analogy between now, 2008, and 2011-2013. I will provide greater long-term context in the upcoming (weekly flagship) Gold & Silver Trading Alert that I post on Mondays. However, if you don’t want to wait, I encourage you to read this week’s flagship analysis – the markets generally moved as I had outlined there, except for the stock market which is still hesitating. I will say a few words about the latter later today.

In today’s analysis, I will not elaborate on why gold is likely to slide much lower because the above-linked analyses explain that, and you already saw the confirmation of the market moves this week. What I will focus on, instead, is whether we’re about to see a short-term rally and, if this is the case, what would be a good idea to do about it (in my view, that is).

In short, there are a few reasons suggesting that yesterday’s big-volume decline was the short-term bottom, a few reasons why gold, silver, and mining stocks might still decline a little more before forming a short-term bottom, and there’s also one reason to think that whatever happens in the near term doesn’t really matter because of a specific wildcard.

Let’s start with gold.

The Great Fall

Gold declined profoundly this week – by over $100. Yesterday’s and Wednesday’s (post-Fed) declines were particularly volatile and meaningful. The two bullish factors about yesterday’s decline are:

- It took place on huge volume.

- It caused the RSI indicator to go slightly below 30, which is a classic buy signal.

Also, gold moved relatively close to its late-April bottom, but not yet to it. Additionally, it’s near its rising medium-term support line, but not yet at it. Both levels are very close to the $1,750 level, which is also quite a round number, which sometimes makes a difference (it’s significant from the psychological point of view).

Circling back to the RSI – I marked (dotted, green lines) two times when the RSI moved to the 30 level after a decline. That happened in late November and late February. In one case, it marked the bottom and in the second case it was relatively close to the bottom but not yet at it.

What does the above chart tell us then? That gold might correct from here, but it seems more likely that it will decline a bit more before it does. Why? Because of the analogy to late February. That’s when we saw both: the RSI at 30 and a volume spike, which makes this situation more similar to the late-November one when the spike in volume was rather absent. So, based on the above chart, while we might see a bounce soon, it seems that it will be from around $1,750.

Before moving further, please note that there’s a triangle-vertex-based reversal point in late August. I’ll get back to it in the following part of the analysis.

Would this be in tune with the 2012-2013 roadmap? I’m not counting the 2008 analogy here because things were very volatile even beforehand, and they happened very quickly, so the exact analogy might not apply – only a general one.

Well, based on what happened in 2012, it seems that gold is likely to correct upwards right away. Once the RSI hit 30 back in November 2012, the first part of the huge decline was over. Please note that the chart ends where a really huge decline starts, so the real follow-up is much more bearish than it seems based on the above chart alone.

Moreover, please note that gold started correcting when it moved close to its previous short-term (August) high. Gold already moved slightly below its April 2021 highs yesterday, so both situations seem similar. From this point of view, gold is ready to rally right away.

How high did gold correct in 2012 before resuming its downtrend? It corrected 61.8% of its previous decline. So, at this time, it could rally up to ~$1,860 and still be in the medium-term downtrend. Now, that would be quite a substantial rally, so not something that those shorting gold might want to endure without closing the position temporarily. We’re not shorting gold, only mining stocks, but if you’re shorting gold, it might be a good idea to consider temporarily exiting or limiting the short position soon.

Speaking of mining stocks, let’s check how they reacted to gold’s Nov. 2012 correction.

The Mining Stocks

The GDX ETF corrected as well, but it didn’t correct 61.8% of its preceding decline. In fact, it didn’t even manage to correct 38.2% thereof. The correction was kind of “muted” when compared to the one in gold. If history rhymes, is it worth it to exit the short position temporarily? I’ll leave this question open for now.

The notable detail here is that the GDX started its Nov. 2012 correction with the RSI close to 30, but also when it moved slightly below its previous (August) lows, and the final short-term bottom took place after the second (!) day when it declined on big volume.

Interestingly, in the case of both: gold and GDX, we had one day where they both closed higher, but not significantly so – and this was the final call – it was the sign that the correction was starting.

Right now, the RSI indicator based on the GDX ETF is slightly above the 30 level, while the GDX ETF itself is still above its April lows.

Also, GDX is after one huge-volume session, and in 2012 it was after two of those when it formed its bottom.

And speaking of volume, please take a look at the dotted, vertical lines. I marked four situations where we saw a volume spike after a decline – in two cases it was a moment to go long, and in two cases it was a moment to stay short.

Therefore, based on the analogy to 2012, what we just saw might have been the final bottom, but it seems more likely that we’ll see the true short-term bottom soon – perhaps today. I’m still leaving the question regarding the corresponding action open.

Silver

Back in 2012, silver corrected more than 61.8% of its previous decline. However, since it’s been repeating its pattern from 2019-2020 (as marked above), it seems that focusing on the analogy to the first correction that we saw in March 2021 might be more appropriate. And that’s when silver corrected between 38.2% and 50% of the decline before sliding. Consequently, silver’s short-term upside target might be between $27 and $28. This is based on the assumption that it has already bottomed, though, which might not be the case, based on what we are seeing in the case of volume.

As previously, I marked the previous volume spikes (seen during declines) with dotted, vertical lines. I marked the first (!) of the volume spikes in case there were more of them. In 3 out of 5 cases, silver continued to decline in the near term, and in 2 out of 5 cases it was a short-term bottom. Consequently, just because we saw a move on huge volume, it doesn’t mean that the bottom is in.

Having said that, let’s take a look at the USD Index.

The USD Index

In short, it soared, and it moved to its 61.8% Fibonacci retracement based on the April – May decline. At the same time, the RSI indicator moved very close to the 70 level.

And in the lower part of the chart, you can see that while the USDX corrected 61.8% of its previous move, so did gold.

Theoretically, the above suggests that it’s high time for a breather in the case of both markets. And this might very well be the case, but…

But if history rhymes and the USD index is about to soar, just as it did in 2018, then we might not see any meaningful correction until the USDX is trading much higher.

I had previously written about the self-similarity between the 2017 and 2020 declines in terms of size, starting/ending points and their shape. The follow-up action also matched, but when the USD Index declined in April and May, the link seemed to be broken.

However, based on the shape of the price moves and the fact the second bottom was visibly above the first one, it seems that the area I marked with green – the broad bottoming pattern – was simply much broader this year than it was in 2018 and the self-similarity actually remains intact.

The question remains if the current rally is an analogy to the early rally that we saw in late-March and early-April 2018 (that was followed by a correction) or is it the late-April – May 2018 rally that took the USDX to about 95 before we saw a meaningful pause. Based on the size of the rally, it’s this huge upswing that’s already underway. Based on the shape of the move, it might still be that very early rally.

Either way, the next huge move is likely to be to the upside, and it’s relatively unclear if we will see a corrective downswing right now.

All in all, it seems that what I wrote so far today would favor getting out of the position in mining stocks (or planning to do so shortly) as a correction is likely to either take place right away or soon (before the downtrend resumes).

And this is where the wildcard comes into play – the stock market.

The Stock Market as a Wildcard

Back in 2008 and 2020, the mining stocks plunged profoundly when the general stock market declined. And since we’re right after the shift in the Fed’s rhetoric as well as after the invalidation of the breakout to new highs in the S&P 500, we could see stocks slide any day now.

Interestingly, the NASDAQ moved to new highs, and it didn’t invalidate this move so far, so we might need to wait for the final sell confirmation for a few hours or days. On the other hand, we might also need to wait for it for a few more weeks, but I don’t think that’s likely given the Fed’s recent comments.

If stocks slide, miners would likely decline too, even if gold is moving back and forth. And if miners fall along with stocks, it might be difficult to re-enter the previously exited short positions. You likely remember how fast miners can fall – we saw that in March 2020.

Circling back to the action that I think is a good idea to take right now, it seems to me that it would be best to keep the short positions intact unless we see a good confirmation that the short-term bottom is in. The indications we have right now are too vague for me to exit the positions. If we see another daily slide on big volume in miners while the GDX moves below its April lows of $34.31 (and gold moves close to $1,750), I will consider temporarily exiting the short positions in the miners and perhaps even opening a very quick long position in them.

Also, please note that when describing gold’s chart, I mentioned the triangle-vertex-based reversal point in gold close to the end of August. We can see the same thing in the NASDAQ. Since the really big moves tend to take place in many markets at the same time, it could be the case that we’ll see some kind of major reversal close to the turn of the month. The markets also quite often reverse close to the U.S. Labor Day, which is in early September (Sep. 6, 2021). This is the timeframe to remember.

Having said that, let’s discuss what the Fed did (and what it didn’t do) in greater detail.

Look What You Did

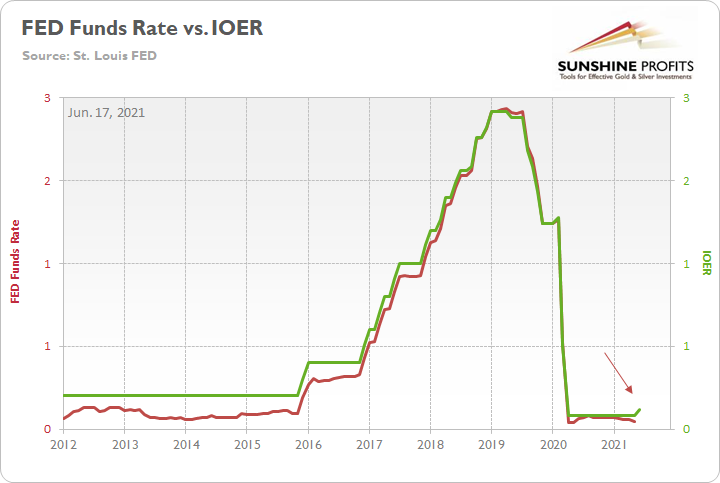

With the U.S. Federal Reserve’s (FED) reverse-repo nightmare frightening the liquidity out of the system, I highlighted on Jun. 17 that the FED raised the interest rate on excess reserves (IOER) from 0.10% to 0.15%.

I wrote:

The FED hopes that by offering a higher interest rate that it will deter counterparties from participating in the reverse repo transactions. However, whether it will or whether it won’t is not important. The headline is that the FED is draining liquidity from the system and increasing the IOER is another sign that the U.S. federal funds rate could soon seek higher ground.

Please see below:

To explain, the red line above tracks the U.S. federal funds rate, while the green line above tracks the IOER. If you analyze the behavior, you can see that the two have a rather close connection. And while we don’t expect the FED to raise interest rates anytime soon, officials’ words, actions and the macroeconomic data signal that the taper is likely coming in September.

And in an ironic twist, while the question of whether it will or whether it won’t seemed reasonable at the time, the tsunami of reverse repurchase agreements on Jun. 17 signal that 0.15% just isn’t going to cut it. Case in point: while the FED hoped that the five-basis-point olive branch would calm institutions’ nerves, a record $756 billion in excess liquidly was shipped to the FED on Jun. 17. For context, it was nearly $235 billion more than the daily amount recorded on Jun. 16.

Please see below:

To explain the significance, I wrote previously:

A reverse repurchase agreement (repo) occurs when an institution offloads cash to the FED in exchange for a Treasury security (on an overnight or short-term basis). And with U.S. financial institutions currently flooded with excess liquidity, they’re shipping cash to the FED at an alarming rate.

The green line above tracks the daily reverse repo transactions executed by the FED, while the red line above tracks the U.S. federal funds rate. Moreover, notice what happened the last time reverse repos moved above 400 billion? If you focus your attention on the red line, you can see that after the $400 billion level was breached in December 2015, the FED’s rate-hike cycle began. Thus, with current inflation dwarfing 2015 levels and U.S. banks practically throwing cash at the FED, is this time really different?

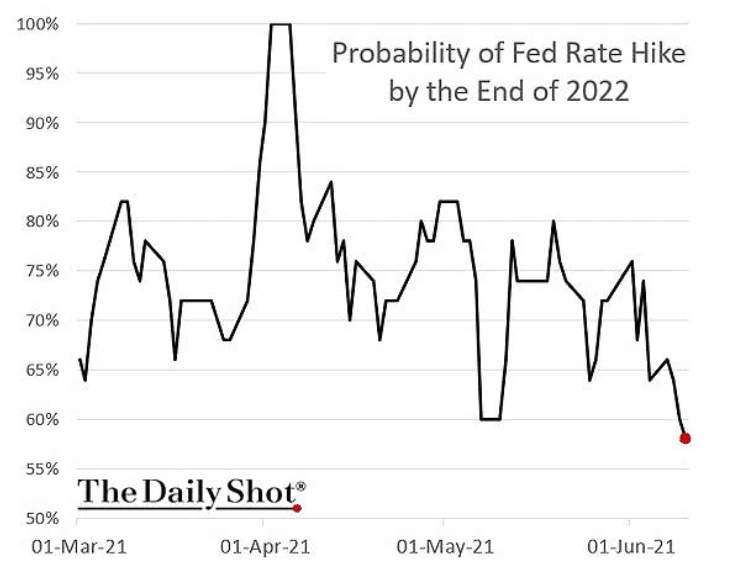

Furthermore, I noted on Jun. 17 that the FED’s latest ‘dot plot’ was a hawkish shift that market participants were not expecting.

I wrote:

The perceived probability of a rate hike by the end of 2022 sunk to a 2021 low on Jun. 12. However, after the FED’s material about-face on Jun. 16, I’m sure these positions have been recalibrated.

Please see below:

And as if the chart above had been inverted, the perceived probability of a rate hike by the end of 2022 has now surged to more than 90%.

The Death Toll of June 17th

In addition, while I’ve been warning for months that the bond market’s fury would eventually upend the PMs, not only has the FED’s inflationary misstep rattled the financial markets, but the U.S. 30-year fixed-rate mortgage (FRM) jumped to 3.25% on Jun. 17.

Please see below:

Furthermore, please read what Matthew Graham, COO of Mortgage News Daily, had to say:

“Markets were somewhat surprised by the Fed's rate hike outlook. Granted, the Fed Funds Rate (the thing the Fed would actually be hiking) doesn't control mortgage rates, but the outlook speaks to how quickly the Fed would need to dial back its bond buying programs (aka "tapering"). Those programs definitely help keep rates low. The sooner the Fed begins tapering, the sooner mortgage rates will see some upward pressure.”

To that point, with tapering prophecies officially morphing from the minority into the consensus, the PMs weren’t the only commodities sent to slaughter on Jun. 17. For example, the S&P Goldman Sachs Commodity Index (S&P GSCI) plunged by 2.37% as the inflationary unwind spread. For context, the S&P GSCI contains 24 commodities from all sectors: six energy products, five industrial metals, eight agricultural products, three livestock products and two precious metals.

Exacerbating the selling pressure, China’s National Food and Strategic Reserves Administration announced on Jun. 17 that it would release its copper, aluminum and zinc supplies “in the near future” in a bid to contain the inflationary surge that’s plaguing the region. As a result, if the psychological forces that led to the surge in cost-push inflation come undone, the USD Index could move from the outhouse to the penthouse.

To explain, I wrote on Apr. 27:

Why is the behavior of the S&P GSCI so important? Well, if you analyze the chart below, you can see that the S&P GSCI’s pain is often the USD Index’s gain.

To explain, the red line above tracks the USD Index, while the green line above tracks the inverted S&P GSCI. For context, inverted means that the S&P GSCI’s scale is flipped upside down and that a rising green line represents a falling S&P GSCI, while a falling green line represents a rising S&P GSCI. More importantly, though, since 2010, it’s been a near splitting image.

Inflation Is Still There

In the meantime, though, inflationary pressures are far from contained. And while the S&P GSCI’s plight would be a boon for the USD Index, the greenback still has plenty of other bullets in its chamber. Case in point: with the FED poised to taper in September and investors underpricing the relative outperformance of the U.S. economy, VANDA Research’s latest FX Outlook signals that over-optimism abroad could lead to a material re-rating over the summer.

Please see below:

To explain, the chart on the right depicts investors’ expectations of economic strength across various regions. If you analyze the second (CAD) and the third (GBP) bars from the right, you can see that positioning is more optimistic than the economic growth that’s likely to materialize. Conversely, if you analyze the first bar (USD) from the left, you can see that positioning is more pessimistic than the economic growth that’s likely to materialize. As a result, with U.S. GDP growth poised to outperform the U.K., Canada, and the Eurozone, an upward re-rating of the USD Index could intensify the PMs selling pressure over the medium term.

On top of that, while the inflation story is far from over (and will pressure the FED to taper in September), the Philadelphia FED released its Manufacturing Business Outlook Survey on Jun. 17. And while manufacturing activity dipped in June, “the diffusion index for future general activity increased 17 points from its May reading, reaching 69.2, its highest level in nearly 30 years.”

In addition, “the employment index increased 11 points, recovering its losses from last month,” and “the future employment index rose 2 points … [as] over 59 percent of the firms expect to increase employment in their manufacturing plants over the next six months, compared with only 5% that anticipates employment declines.” For context, employment is extremely important because a strengthening U.S. labor market will likely put the final nail in QE’s coffin.

But saving the best for last:

“The prices paid diffusion index rose for the second consecutive month, 4 points to 80.7, its highest reading since June 1979. The percentage of firms reporting increases in input prices (82 percent) was higher than the percentage reporting decreases (1 percent). The current prices received index rose for the fourth consecutive month, moving up 9 points to 49.7, its highest reading since October 1980.”

Please see below:

Investment Clock Is Ticking

Also, signaling that QE is living on borrowed time, Bank of America’s ‘Investment Clock’ is ticking toward a bear flattener in the second half of 2021. For context, the term implies that short-term interest rates will rise at a faster pace than long-term interest rates and result in a ‘flattening’ of the U.S. yield curve.

Please see below:

To explain, the circular reference above depicts the appropriate positioning during various stages of the economic cycle. If you focus your attention on the red box, you can see that BofA forecasts higher interest rates and lower earnings per share (EPS) for S&P 500 companies during the back half of the year.

As further evidence, not only is the FED’s faucet likely to creak in the coming months, but fiscal stimulus may be nearing the dry season as well.

Please see below:

To explain, the blue bars above track the U.S. budget deficit as a percentage of the GDP. If you analyze the red circle on the right side of the chart, you can see that coronavirus-induced spending was only superseded by World War Two. Moreover, with the law of gravity implying that ‘what goes up must come down,’ the forthcoming infrastructure package could be investors’ final fiscal withdrawal.

The Housing Market

Last but not least, while the S&P 500 has remained relatively upbeat in recent days, weakness in the U.S. housing market could shift the narrative over the medium term.

Please see below:

To explain, the red line above tracks the S&P 500, while the green line above tracks U.S. private building permits (released on Jun. 16). If you analyze the arrows, you can see that the former nearly always rolls over in advance of the latter. For context, the S&P 500 initially peaked before building permits in 2018 and alongside in 2015. However, in 2018, when the S&P 500 recovered and continued its ascent – while building permits did not – the U.S. equity benchmark suffered a roughly 20% drawdown. Thus, if you analyze the right side of the chart, you can see that building permits peaked in January and have declined significantly. And if history is any indication, the S&P 500 will eventually follow suit.

In conclusion, the PMs imploded on Jun. 17, as taper trepidation and the USD Index’s sharp re-rating dropped the guillotine on the metals. And with the FED’s latest ‘dot plot’ akin to bullet holes in the PMs, the walking wounded is still far from a recovery. With inflation surging and the FED likely to become even more hawkish in the coming months, the cycle has materially shifted from the goldilocks environment that the metals once enjoyed. And with the two-day price action likely the opening act of a much larger play, the PMs could be waiting months for another round of applause.

Overview of the Upcoming Part of the Decline

- The corrective upswing seems to be over, and gold seems to have started its big decline – one similar to what we saw in 2008 and 2012-2013.

- After miners slide in a meaningful and volatile way, but silver doesn’t (and it just declines moderately), I plan to switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this would take place – perhaps with gold close to $1,600. I plan to exit those short positions when gold shows substantial strength relative to the USD Index, while the latter is still rallying. This might take place with gold close to $1,350 - $1,500 and the entire decline (from above $1,900 to about $1,475) would be likely to take place within 6-20 weeks, and I would expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold – after gold has already declined substantially) is likely to be the best entry point for long-term investments, in my view. This might also happen with gold close to $1,475, but it’s too early to say with certainty at this time.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector would be likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Letters to the Editor

Q: Dear PR.

I have now thrown my Polish effigy away, completely covered with pins and burn marks, and I am busily erecting a shrine in your honor. :D Such is the capricious nature of the temperamental and often hysterical investor. It reminds me of the great opening to Gladiator...”hold the line”. https://youtu.be/ygsa6iO8X9o Without your daily missive, I would NOT have held the line. Gold just crashed clean through $1,800. I might wait for a dead cat to bounce and lock-n-load with more GDXJ shorts. As I said previously... if I had a wish, that would be NOT to check KITCO every morning and especially the DXY.

All the best

A: Thank you very much for your kind words. The shrine made me laugh, and I’m very happy that you’re enjoying my service. The reason I included this “question” even though it doesn’t really include one, is because I would like to point out that checking the price every minute might not be the best way to stay updated as it often makes one more vulnerable to “short-termism” – focusing on very small moves too much and losing focus of what’s more important while at the same time serving oneself a huge load of stress. We’re watching the markets for you, and we’ll keep you updated.

On a side note, I love that scene from the Gladiator, so I smiled when seeing it mentioned. I sometimes listen to the soundtrack from that movie while I’m preparing the analyses.

Q: Please relay to PR...WOW great consistent and disciplined calls on Gold and Silver!

A: Thank you! I’m very happy to see that you’re enjoying my analyses. A word of caution, though:

I would like to emphasize that even though the PMs move almost exactly as they did in 2008 and 2012, it doesn’t mean that one should increase the size of their positions beyond what they had previously (calmly) determined as appropriate. Having a “roadmap” might make one feel “invincible”, but let’s keep in mind that anything can happen in the markets, and the first rule of investing is making sure to be able to stay there for the long run – and exposing oneself to huge risk with a single trade is not a way to achieve the above. The 300% size of the regular position is already a huge position, and I would like to emphasize that it doesn’t mean getting 300% leverage on all of one’s capital! It only means that if one usually risks 2% of their capital, then perhaps risking as much as 6% might be a good idea here because of how aligned the multiple signals are. However, it’s not investment advice, and each investor needs to decide for themselves how much risk is too much for them. You can find some more details on that in this report in the “Position Sizes” section.

Q: Please provide your analysis of the Basel III event at the end of this month. (…)

A: I already did – you will find details in my June 2 analysis.

Q: Hi PR,

As always, I am glad to be on your side. I’m a fan of your daily reports and an admirer of your work. It’s interesting time and it’s fascinating to see how things are developing.

We just saw a major breakdown in gold, and I understand it’s hard to predict, but you've been predicting for quite some weeks now that gold would not go above $1940. Does the recent development change your outlook on how high it might go now? I am pretty confident you'll touch on this subject pretty soon, and I don't know if it is going to take you some time to re-forecast or not, but thanks in advance.

A: I think I explained it in today’s analysis, but to summarize once again: I think that gold made its final pre-slide top, and even if we see a counter-trend rally shortly, it won’t take gold above the $1,900 level. I think that we’ll see gold at $1,600 much sooner than we’ll see it at $1,900.

Summary

To summarize, it seems likely to me that the corrective upswing is over, given gold’s similarity to what happened in 2012 and 2018 and its turnaround at the double triangle-vertex-based reversal point, USD’s similarity to 2016, action in the silver, and gold miners, and the situation in the general stock market.

As far as the short term is concerned, in my opinion, it would be best to keep the short positions intact unless we see a good confirmation that the short-term bottom is in. The indications that we have right now are too vague for me to exit the positions right now. If we see another daily slide on big volume in miners while the GDX moves below its April lows of $34.31 (and gold moves close to $1,750), I will consider temporarily exiting the short positions in the miners and perhaps even opening a very quick long position in them.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

By the way, we’re currently providing you with a possibility to extend your subscription by a year, two years or even three years with a special 20% discount. This discount can be applied right away, without the need to wait for your next renewal – if you choose to secure your premium access and complete the payment upfront. The boring time in the PMs is definitely over and the time to pay close attention to the market is here. Naturally, it’s your capital, and the choice is up to you, but it seems that it might be a good idea to secure more premium access now, while saving 20% at the same time. Our support team will be happy to assist you in the above-described upgrade at preferential terms – if you’d like to proceed, please contact us.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $24.12; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $39.87; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $94.87; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures upside profit-take exit price: unclear at this time - initially, it might be a good idea to exit, when gold moves to $1,512.

Gold futures upside profit-take exit price: $1,512.

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief