Earlier today, I wrote that many positive surprises have already happened for the precious metals market and that now it was time for them to move lower – as the normalcy and regular sentiment get back. And yet, we saw another surprise – this time from the initial jobless claims, which were higher than expected.

The precious metals sector moved higher, but… What we see so far today serves as yet another indication that a bigger move to the downside is about to follow. The two additional signs are:

- Very strong performance of silver – I already commented on it previously, but today we see another show of the same thing, which makes the bearish implications even clearer.

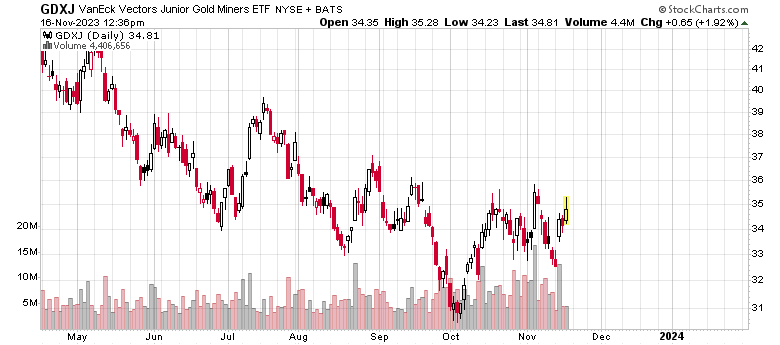

- The GDXJ is reversing, creating a shooting star reversal candlestick.

Silver moved clearly above its October highs, and while it already reversed, it’s still obvious that it outperformed on an immediate-term basis.

Junior miners are not above their October highs, and the reversal is quite clear. Of course, the session is not over yet, but so far, the reversal has slightly bearish implications. Silver’s outperformance has strongly bearish implications, so together they serve as a very strong bearish indication – which is in line with what I wrote in today’s regular analysis.

All in all, the outlook for the precious metals market remains bearish, and it’s likely that the profits on our short positions in junior miners will increase in the following weeks.

As always, we’ll keep you - our subscribers - informed.

Thank you.

Sincerely,

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief