Just a quick update as I get the feeling that you might be concerned with today’s move higher in gold.

Indeed, gold jumped up higher, and it’s testing $2,000 once again, and at the same time miners are testing their recent highs slightly above $35. What did it change?

To be honest, it didn’t change a single thing from what I wrote previously. We already saw the signal from silver as it outperformed gold on a very short-term basis, and we saw how severely mining stocks underperformed gold and the stock market.

Ok, there is one thing that did change.

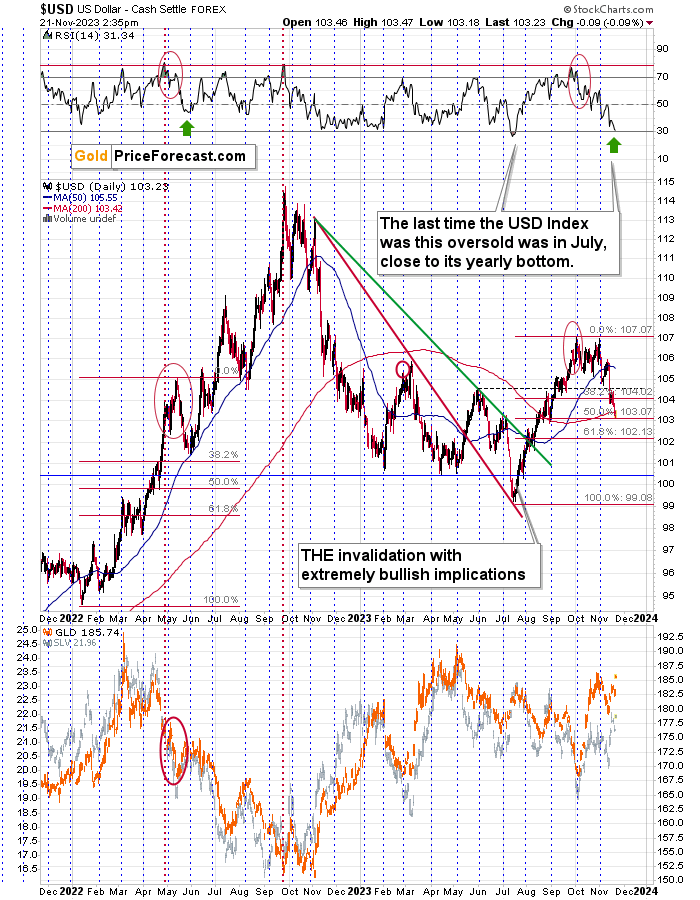

The USD Index moved to its 50% Fibonacci retracement level and the RSI based on it moved to 31 – very close to the classic buy signal (30). This means that the USDX is now extremely oversold from the short-term point of view, and this makes the situation more bullish for it, not more bearish.

This, in turn, has bearish implications for the precious metals sector, not bearish ones.

Also, let’s consider the current time of the year. We’re just ahead of the Thanksgiving weekend, and this will be the perfect opportunity for investors’ emotions to cool down, and to reassess the situation. How many of you heard about some problems in a companies, where your family members or friends work? How about your own company? I’ve seen and heard signs of economic problems all over the place. Literally, I heard more complaints about the business conditions from business owners, from employees and even from people working in “administration” who are preparing forecasts for the next year – it looks bad wherever I looked. Is it accidental? I don’t think so – there were too many different sources and from very different places (U.S., Europe, even Africa).

It doesn’t add up when you look at the stock market’s performance. And when people take their time to talk about it – when they meet for the Thanksgiving dinner (it’s about being grateful, but the weekend is long, and I’m pretty sure people will find a minute or two to also share their concerns), it might occur to them that maybe stock market is waaaay too high given what’s happening “in the trenches”?

And as stocks turn south in the near future, so will mining stocks (and FCX).

As people get more concerned, they are likely to turn to safe haven assets, such as… Yes, gold is one too, but I meant the U.S. dollar. After all, gold plunged in 2008 as the USDX soared. And mining stocks (and FCX) experienced an epic decline.

So, all in all, the bearish potential for the junior mining stocks remains enormous.

As always, we’ll keep you - our subscribers - informed.

Thank you.

Sincerely,

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief