Junior mining stocks and FCX are both sliding today! The GDXJ is down by 2.4% at this moment, and FCX is down over 4%, greatly increasing the profits from our short positions in it!

If you happened to join recently, you are likely very happy with that decision.

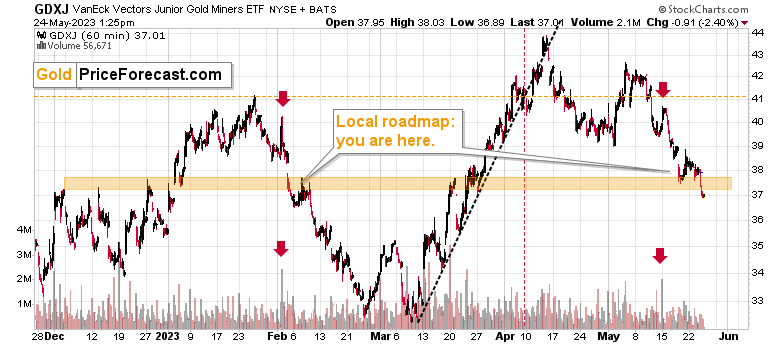

As of this minute, the GDXJ erased the entire rally that happened after mid-March. And, well, since it took less than 2 weeks for the GDXJ to rally from the early low to the current levels, the slide back to those lows could be quick as well.

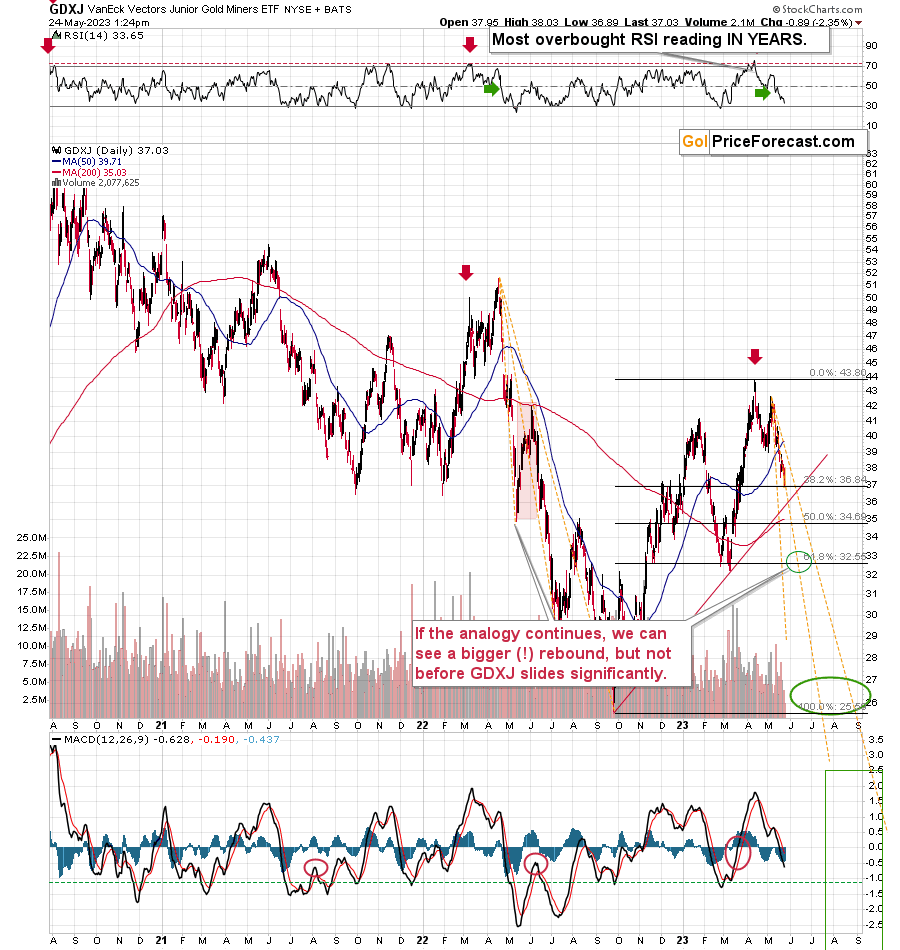

Now, the reason that I’m sending this message is to show you something that’s visible if we zoom out a bit.

The thing is that the GDXJ just moved to its 38.2% Fibonacci retracement level based on the entire 2022 – 2023 rally. This might trigger a pause or a small rebound, but it doesn’t have to do it.

The huge opportunity is in taking advantage of this decline, and not in timing every possible small rebound. So, while I continue to think that short positions in junior mining stocks remain justified from the risk to reward point of view, I would also like to give you a heads-up that if a small rebound happens here, it will be something normal, and not a game-changer.

All right, and I’m off to the webinar, which starts in 30 minutes.

Have an awesome afternoon, everyone!

As always, we’ll keep you - our subscribers - informed.

Thank you.

Sincerely,

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief