The precious metals sector moved higher today, and the USD Index moved lower, so you might be wondering if this changes the outlook.

It doesn’t. It’s the turn of the month, so seeing a turnaround in the USDX is normal, even if it’s just something temporary.

Precious metals reacted to this and rallied quite sharply. In particular, it might be surprising to see that junior miners rallied.

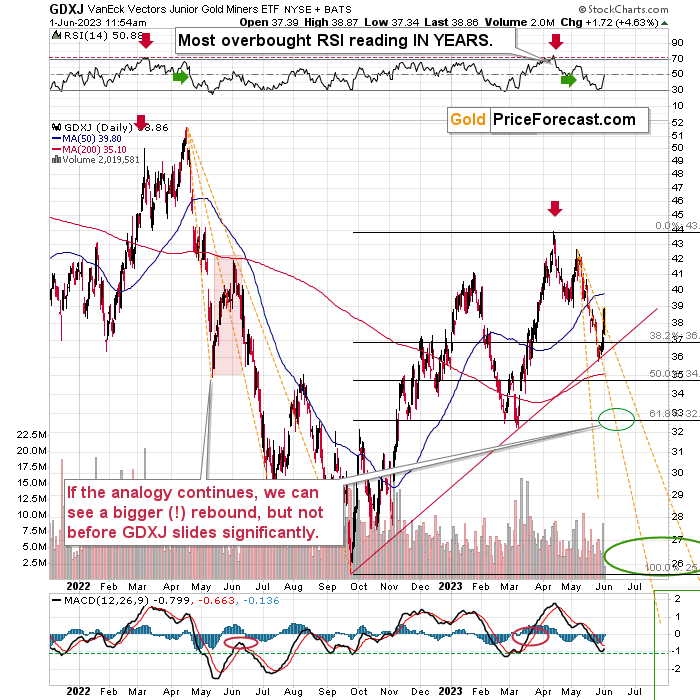

However, if you look at the orange, dashed lines, you’ll see that the size of the rally is very much in tune with what we saw in mid-2022, as a counter-trend rally to the big move lower.

The orange lines are copied from the previous decline to show what kind of price moves are normal. And, yes, while today’s rally seems to be a game-changer, it falls in the “normal-during-the-big-decline category”.

Interestingly, RSI jumped to 50 given the size of today’s rally, which is what (approximately) ended the mid-2022 correction.

So, can the correction be just a one-day event?

Yes.

It can last even a few days, but it’s unlikely to change anything as far as the medium term is concerned.

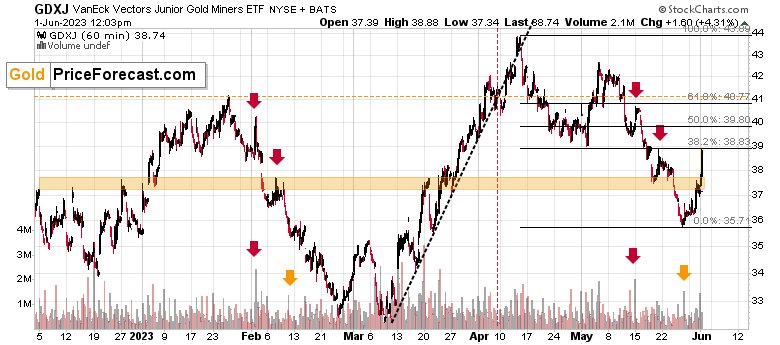

Also, please note that on a very short-term basis, the GDXJ moved to the 38.2% Fibonacci retracement level, which is a classic place for a market to correct. As such, a rally to this level, doesn’t change anything regarding the trend.

It remains down.

And the downside potential for mining stocks (and FCX) remains enormous.

As always, we’ll keep you - our subscribers - informed.

Thank you.

Sincerely,

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief