I thought you might appreciate a quick update on today’s quick move higher in the precious metals sector.

In short, the initial jobless claims were higher than expected and more or less similar to what was reported on May 11.

This might indicate that the Fed won’t want to raise interest rates after all and maybe even lower them. However, the increase in the number was rather regular, nothing dramatic. It’s unlikely to change anything – especially that the same level was reported in mid-May.

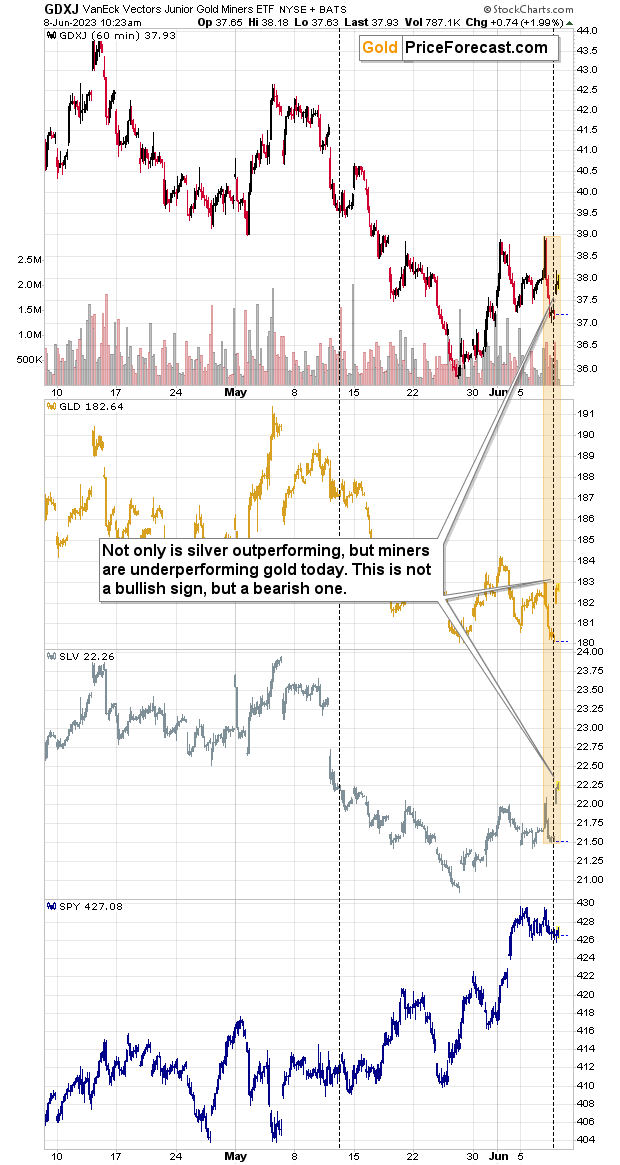

The vertical, dashed line shows what happened at that time.

There was a very short-term corrective upswing in junior miners after they continued their slide and declined much more than they did previously.

So, is today’s move up really bullish?

No.

Earlier today, I wrote about the likelihood of the previous decline being repeated, and, well, today’s upswing is just like what we saw at the very early part of the previous decline.

The difference is that this time the situation is even more bearish, because of the dramatic situation on the general stock market, and given the intraday sell signal from the relative valuations.

Mining stocks are relatively weak to gold (gold pretty much jumped to yesterday’s intraday high, while miners are only halfway there) and silver is relatively strong to gold – it even moved to new monthly high.

This is exactly what we tend to see before bigger declines, so it’s not a bullish sign. Conversely, it’s a confirmation of the bearish points that I’ve been making in the previous analyses.

As always, we’ll keep you - our subscribers - informed.

Thank you.

Sincerely,

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief