Briefly: in our opinion, full speculative long positions (150% of the regular position size) in gold and silver are justified from the risk/reward point of view at the moment of publishing this Alert.

Gold, silver, and mining stocks corrected yesterday, but nothing changed as far as outlook is concerned. In case of gold and silver, the support lines remain clearly intact, and silver is relatively close to the middle of its recent trading range.

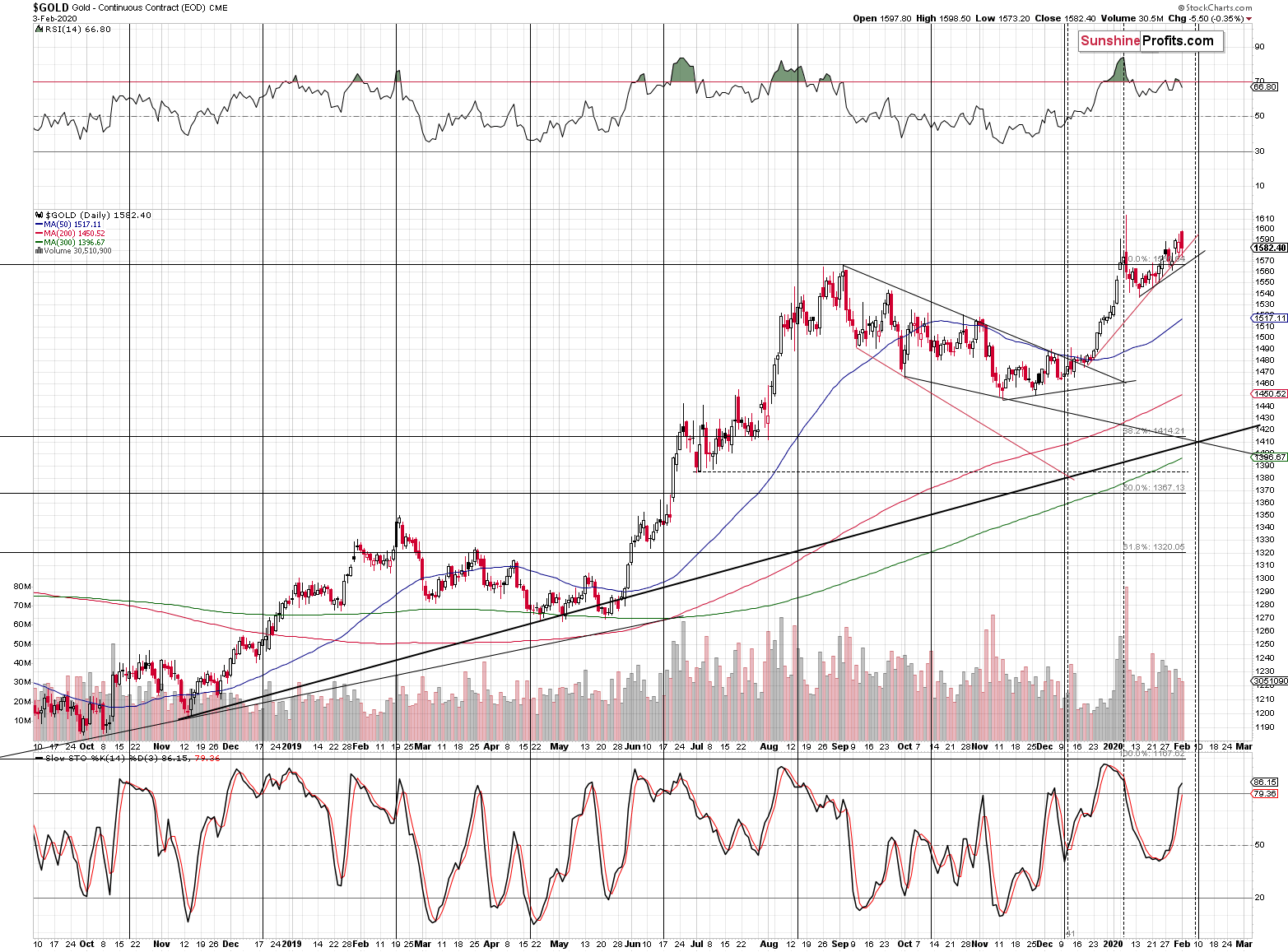

Despite the move lower, gold is above both nearby short-term support lines. The red support line that's based on the late-December low and one of the mid-January lows was touched and gold reversed shortly thereafter. The black support line based on two January lows was not touched. This means that nothing changed and gold is still likely to move higher and top close to its cyclical turning point and the triangle-vertex-based reversal. In other words, it's likely to top close to the end of this week or early next week.

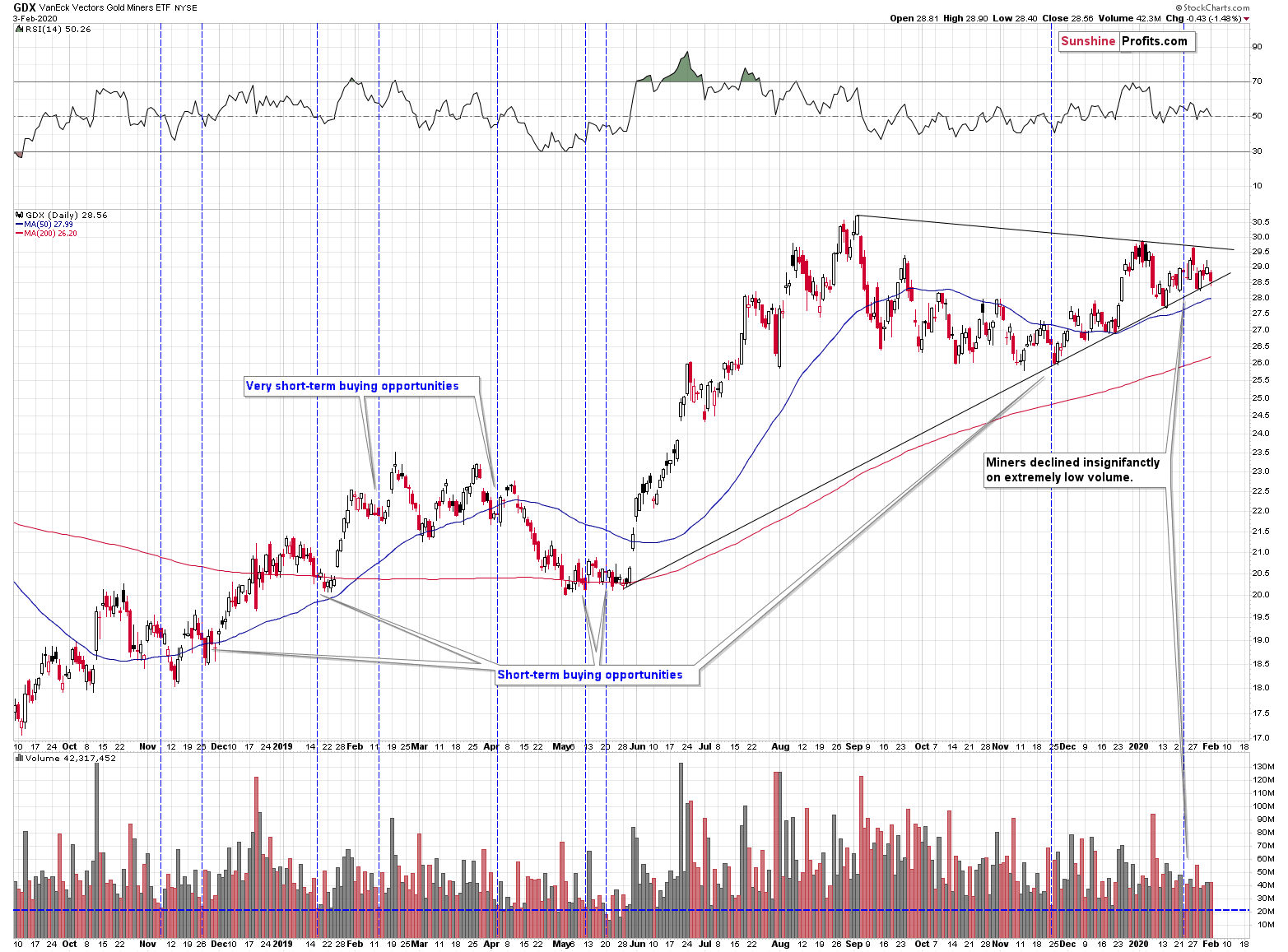

Mining stocks moved to their rising support line. Precisely, they moved very briefly below this line but this move was immediately invalidated. Because the support held, the outlook didn't change.

On one hand, the precious metals sector is likely to move higher, which means that GDX is likely to rally as well. On the other hand, it's likely the final part of the rally, which means that miners are likely to underperform gold. Consequently, while gold might move to or even slightly above its recent highs, mining stocks are likely to only move to their declining resistance line, without a breakout. Of course, we could see one, but it's not likely that we will.

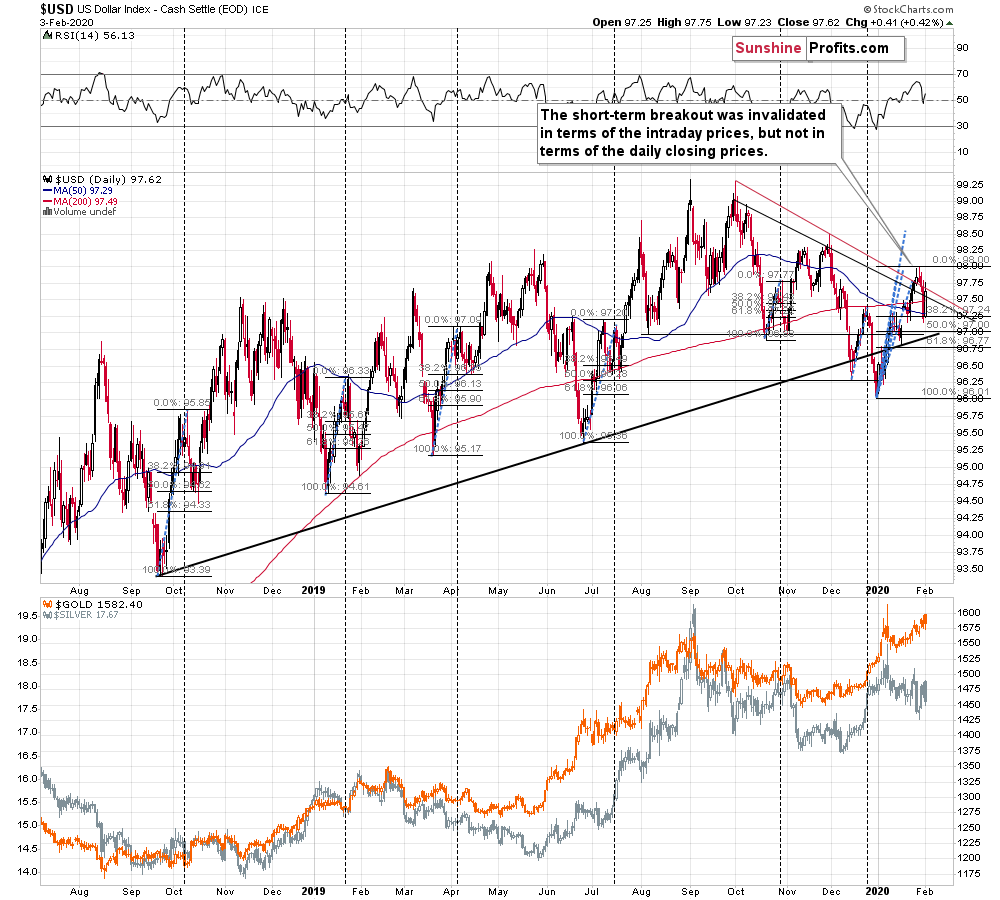

Yesterday in the USD Index...

The above chart shows that the USD Index has not only rallied, but that yesterday's session was volatile overall. It's not that surprising given the significant amount of news that hit the market yesterday. As we wrote in yesterday's Market News Report, most of the news were important from traders' point of view, but not necessarily so from investors' point of view. Indeed, the bigger trends didn't change at all, but the short-term turmoil was definitely present. This has implications going forward as well. Since the news was most likely to cause short-term movement, but not much more, then what was likely to happen, has probably already happened. In other words, one shouldn't expect additional significant market movement based on yesterday's news (like the ISM Manufacturing PMI).

Yesterday, the USD Index moved back above the declining resistance line that's based on the closing prices and in today's pre-market trading, it moved above the upper one, based on the intraday prices. This second attempt to break above the resistance lines may or may not be successful - it's far from being confirmed. In our view, another decline is still more likely.

That's what we saw in April and July 2019 - 2 of the previous 5 similar cases. The additional factor that supports this outcome is the similarity to the shape of the last two important tops - the October and November 2019 tops. In October, there was a small corrective upswing before the decline accelerated. In November, the USDX moved briefly above the previous high before the decline really picked up.

Let's keep in mind that USD's early February rally is likely to be short lived and that the USDX tends to give these gains away closer to the middle of the month, before rallying again. A decline in the next 5 days or so and then a rally would perfectly fit the scenario that we outlined as likely for PMs - a rally for another week or so and then a reversal followed by a decline.

...Means This for Silver

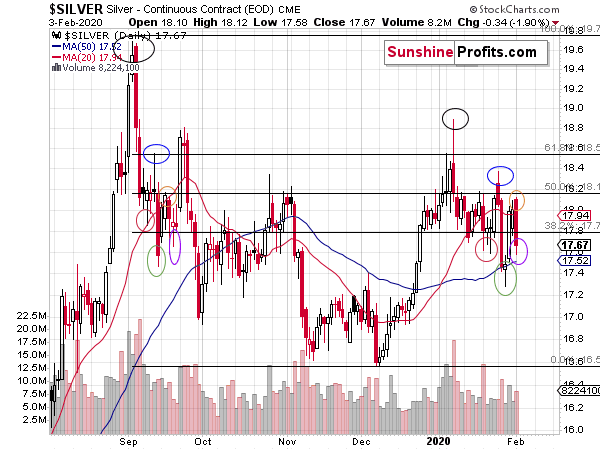

As far as silver is concerned, there is something interesting on its chart that we would like to share with you. Namely, silver's performance so far this year resembles the way silver behaved after the early-September 2019 top.

We marked the analogous price extremes with ellipses of the same color. The tops are in black, the initial lows are in red, the first corrective highs are in blue, then the lowest short-term lows are in green, then the next corrective highs are in orange, and then the final short-term lows are in purple.

If the similarity is to persist, silver is likely to rally particularly well this week.

Of course, just because a price pattern is similar to what we saw in the past (and it's just similar - not near-identical), it doesn't mean that it has to be repeated to the letter. However, as we outlined in yesterday's comprehensive analysis, silver tends to outperform gold in the final part of a given upswing, and it does seem that we are in the final part of the short-term rally. One of the reasons is that the fear regarding coronavirus is high, but it doesn't seem to have reached its peak just yet.

Summary

Summing up, this week or the first days of the next week are likely to include the top in the precious metals market and the end of the short-term rally. The medium-term outlook is very bearish and once the short-term correction is over, the declines are likely to resume.

Once silver hits $18.49, your profits from the long position will be automatically taken off the table, but we will let you know manually if we want to automatically open short positions at that time.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative long position (150% of the full position) in gold and silver is justified from the risk/reward perspective with the following stop-loss orders and binding exit profit-take price levels:

- Gold futures: profit-take exit price: $1,608; stop-loss: $1,558; initial price target for the UGLD ETN: $161.84 ; stop-loss for the UGLD ETN: $146.98

- Silver futures: profit-take exit price: $18.49; stop-loss: $17.24; initial target price for the USLV ETN: $99.97; stop-loss for the USLV ETN: $82.95

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager