Briefly: in our opinion, full (250% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this Alert.

For many weeks the outlook for gold, silver, and mining stocks has been bearish and it’s been bullish for the USD Index. Yet, we only see back and forth trading in all the above, with a slight increase in the value of the USD Index. What gives? Why are the metals not declining as they “should”?

Today’s analysis is going to be a bit different than the usual ones, as the above questions is not visible on the charts. At least not entirely. When determining the short- and medium-term outlook it’s critical to apply technical, cyclical, fractal etc., analyses. However, this will only tell us what appears likely and will almost never reply to any “why” questions. To be clear, in case of trading, the “why” is often not necessary. The direct implications matter and that’s what the chart analysis can tell us.

However, knowing the “why” of a specific situation can be very useful when determining whether a given technique, signal (or analyst?) is still useful or did they become useless and should be replaced by something else. This is a very broad issue and can be discussed over many different areas. “Why” are some analysts bullish no matter what gold does or what happens in any other market? Because that sells their analyses much better than being objective and discovering the above can tell one not to follow the perma-bullish or perma-bearish analysts. “Why” are some traders losing money despite getting signals that are mostly correct? After close investigation, it turns out that in many cases it’s because of the poor money management and this “why” lets one focus on this area instead of changing the source of signals that was actually good.

In case of the reply to the reason behind the decline in the precious metals market, and more precisely, the lack thereof, the answer to the “why” question determines whether it makes sense to drop any remaining short positions, and perhaps if it’s a good idea to invest in gold with one’s long-term investment capital. After all, if the decline didn’t happen despite many factors pointing to it, it might be the case that gold, silver and mining stocks actually want to move higher and people are simply waiting for more positive news to invest and push price higher.

Did the above take place?

No.

The corrections are normal within declines. Consequently, it shouldn’t be surprising that after declining from above $1,350 in April to below $1,200 in August (approximately by $200 taking intraday extremes into account), gold didn’t decline more before taking a breather.

But shouldn’t a breather take a few weeks at most? It’s been 3 months and the decline still didn’t resume.

The above is a very good point. However, the market is not moving only by itself – it has multiple triggers and many short-term moves are results of news – often surprising ones. This doesn’t mean that news drive all the price moves and thus that chart analysis is pointless. The charts show what’s likely to happen in terms of how market is likely to react. But the market needs something to react to. There are many pieces of news each day and market will often move insignificantly based on all of them, but since all these reactions will be filtered by investors’ and traders’ sentiment, neutral news can cause rallies, declines, or no moves at all.

You see, if the market sentiment is very positive, and we get some bullish news, the price soars. If we have very positive sentiment and we get a piece of neutral news, the price moves higher anyway, and if we have very positive sentiment and get some bearish news, the price usually either declines very modestly or it doesn’t do anything at all.

Now, if the market sentiment is very negative, and we get some bearish news, the price plunges. If we have very negative sentiment and we get some neutral news, the price moves lower anyway, and if have very negative sentiment and get bullish news, the price usually either rallies very modestly or it doesn’t do anything.

If the medium-term downtrend in the precious metals market remains intact and the outlook remains very bearish, but the price is not doing much despite the fact that it’s been trading sideways for more than a few weeks, then the question is if we just saw bullish news. If yes, then market’s performance – prolonging the consolidation – is a confirmation of the bearish trend. If not, then it shows that the bearish trend is not as strong as it seemed at the first sight and that a different outlook should be strongly considered.

What did we see in case of gold? Very bullish news. Trump called Fed’s interest rate policy “crazy” and it was not a single-time event. He criticized the Fed multiple times and this appeared to be a threat to the Fed’s independence. And Powell finally said something that markets viewed as quite dovish (it really wasn’t, but it’s the market’s reaction that counts in the short run). Meanwhile, there were elections in the US (and the uncertainty regarding them should have triggered some safe-haven buying of gold) and the tensions between Ukraine and Russia increased once again after a few years of relative stability. These are all factors that should have caused gold, and the rest of the PMs to rally and to hold their gains.

And where is gold? Relatively close to $1,200, while silver is close to $14 and the HUI Index remains visibly below 150.

The price of gold had very good reasons (the “whys”) to rally and it didn’t – it just prolonged the previous consolidation. Consequently, the consolidation itself is not a sign invalidating the bearish picture. It’s a confirmation that it remains intact.

Let’s take a look at the charts, while keeping the above in mind.

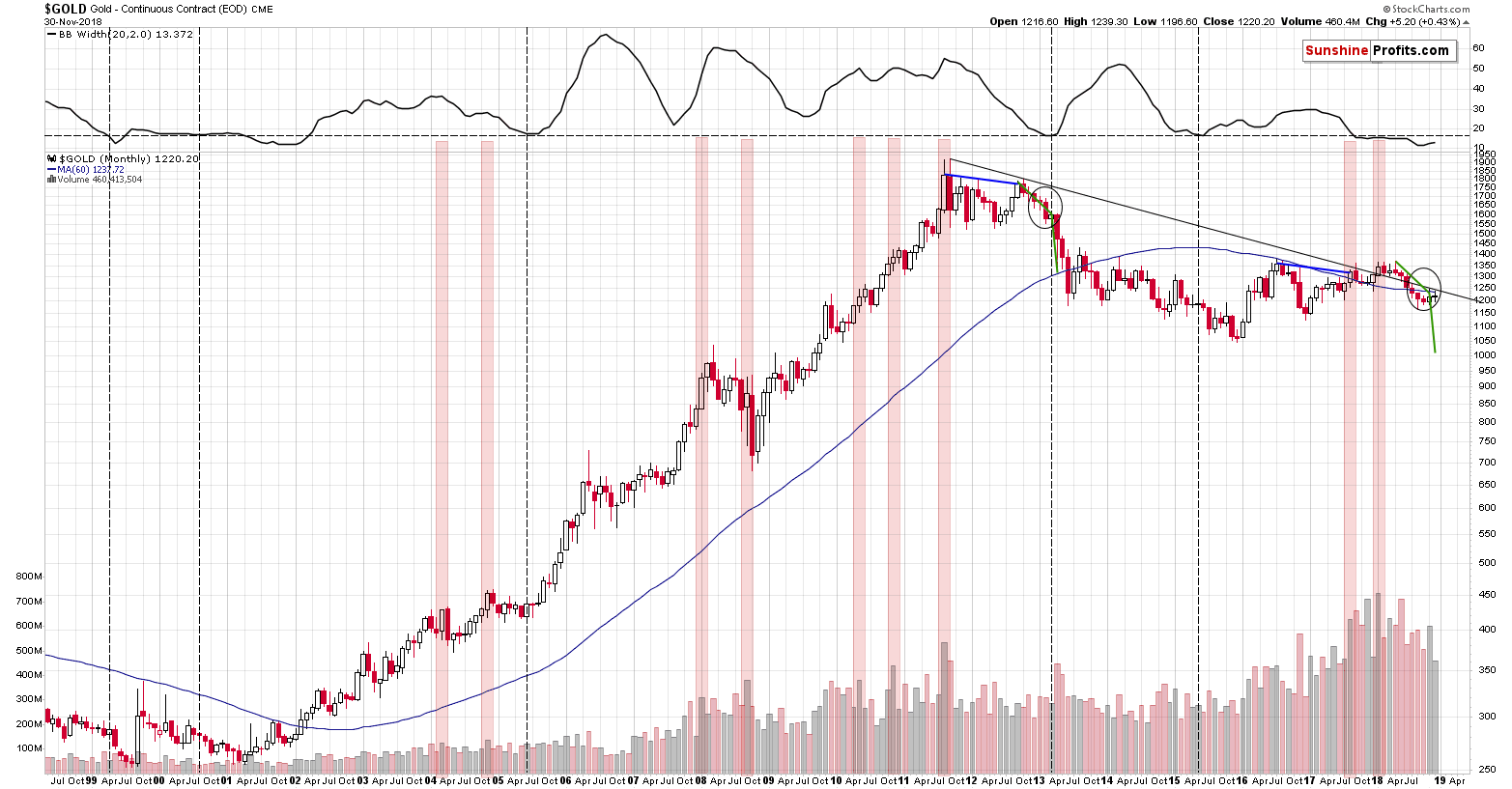

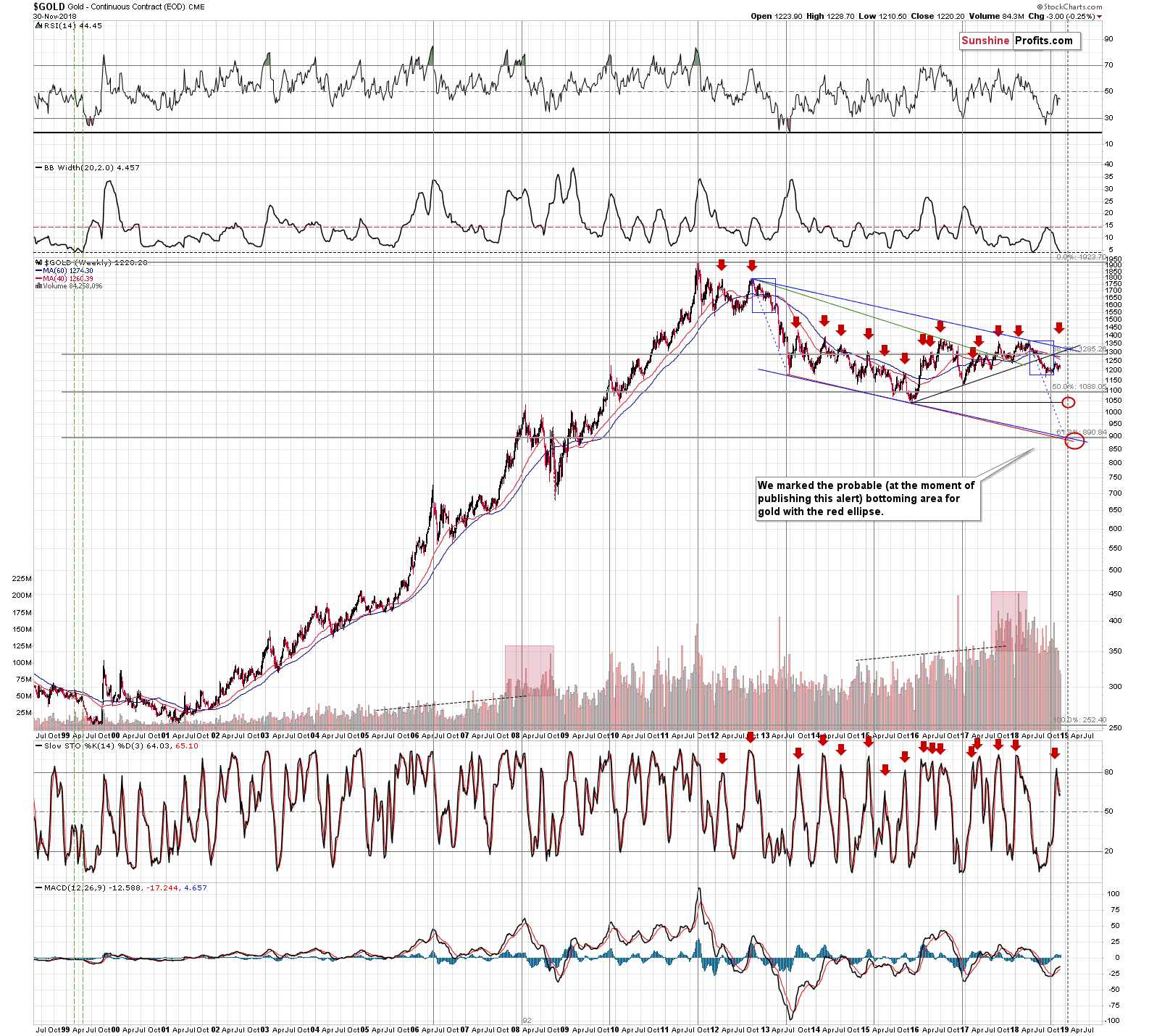

Gold’s 2013 – Now Analogy

As described above, gold didn’t do much in November, but it had good reasons to rally, so this boring price action is actually quite informative. The 2013 – now link is not 100% precise because of the above, but the deviation from the similarity is not big. The pattern that is most likely being repeated is still intact – it’s simply taking a bit longer this time. Is a monthly or even two-month-long delay a “bit”? Yes, because the entire pattern is multi -month long and thus a month is not that much time in comparison.

When we look at the above long-term weekly chart, we see that the 2013-now link remains intact. The blue rectangle that marked the initial decline in 2013 along with the corrective upswing fits the current situation very well. The difference is that this time gold didn’t plunge right after the corrective upswing, but it consolidated for a few more weeks. Still, it didn’t rally to new highs, so overall the corrective upswing seems to have ended in a way that’s very similar to what had happened in 2013. Based on the 2013-now link, a huge decline is likely to follow rather sooner than later.

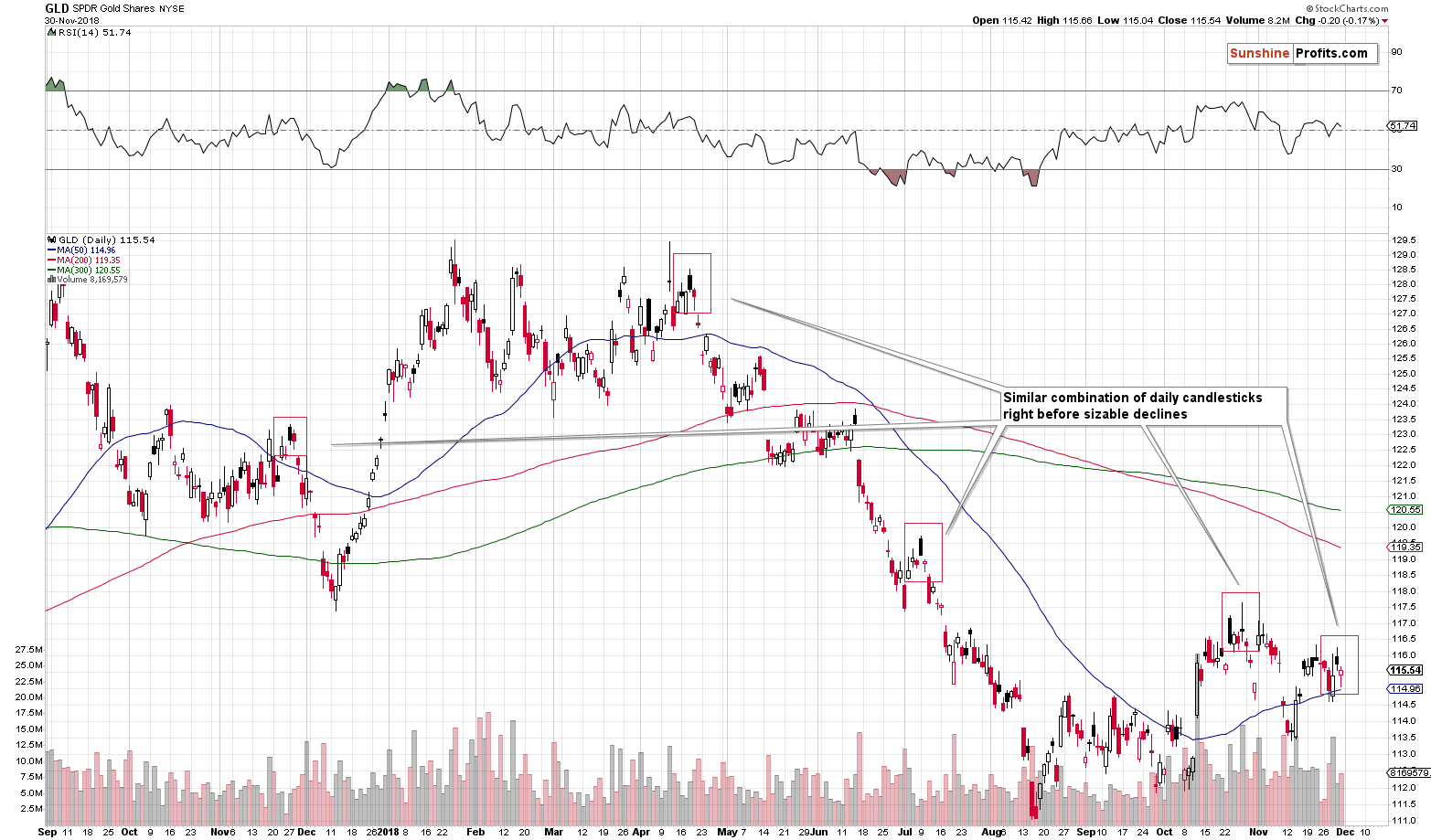

GLD’s Short-term Sell Signal

From the short-term point of view, we saw an indication that lower prices are indeed just around the corner. The GLD ETF formed black candlestick on Thursday and then a small reversal on Friday. That’s very similar to what happened in late November 2017, in mid-April 2018, in early July 2018 and in late October 2018. In other words, it happened right before sizable declines.

As a reminder, even if the above charts show the daily candlesticks in black if they are daily upswings in terms of the daily closing prices, but downswings when considering daily open and closing prices. In other words, it happens when the price opens much above the previous closing price and then declines during the session, but doesn’t erase all the upswing resulting from the higher open before the closing bell. These sessions were often seen right before declines and at times they were followed by small daily reversals, just like what we saw on Friday. This is important, because this reversal might appear bullish at the first sight – although it isn’t. In other words, it happens when the price opens much above the previous closing price and then declines during the session, but doesn’t erase all the upswing resulting from the higher open before the closing bell. These sessions were often seen right before declines and at times they were followed by small daily reversals, just like what we saw on Friday. This is important, because this reversal might appear bullish at the first sight – although it isn’t.

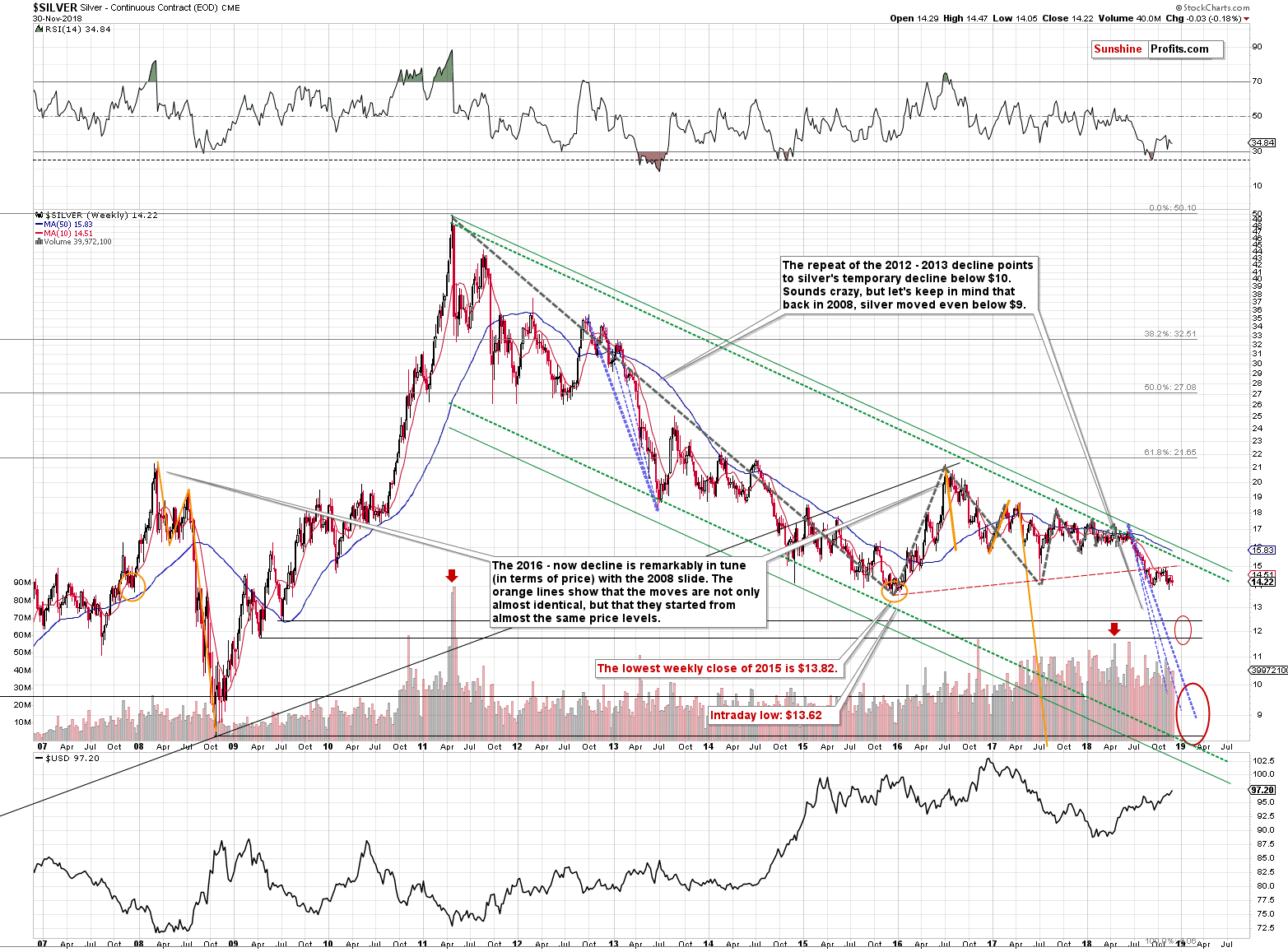

Silver’s Bearish Outlook

Silver didn’t flash any new signals, but it’s important to keep in mind that the white metal is after a major breakdown below the rising red line and its verification. Moreover, silver is very close to its 2015 bottom and was unable to rally from this strong support level despite bullish news. This is a strongly bearish combination of factors that has been in place for weeks.

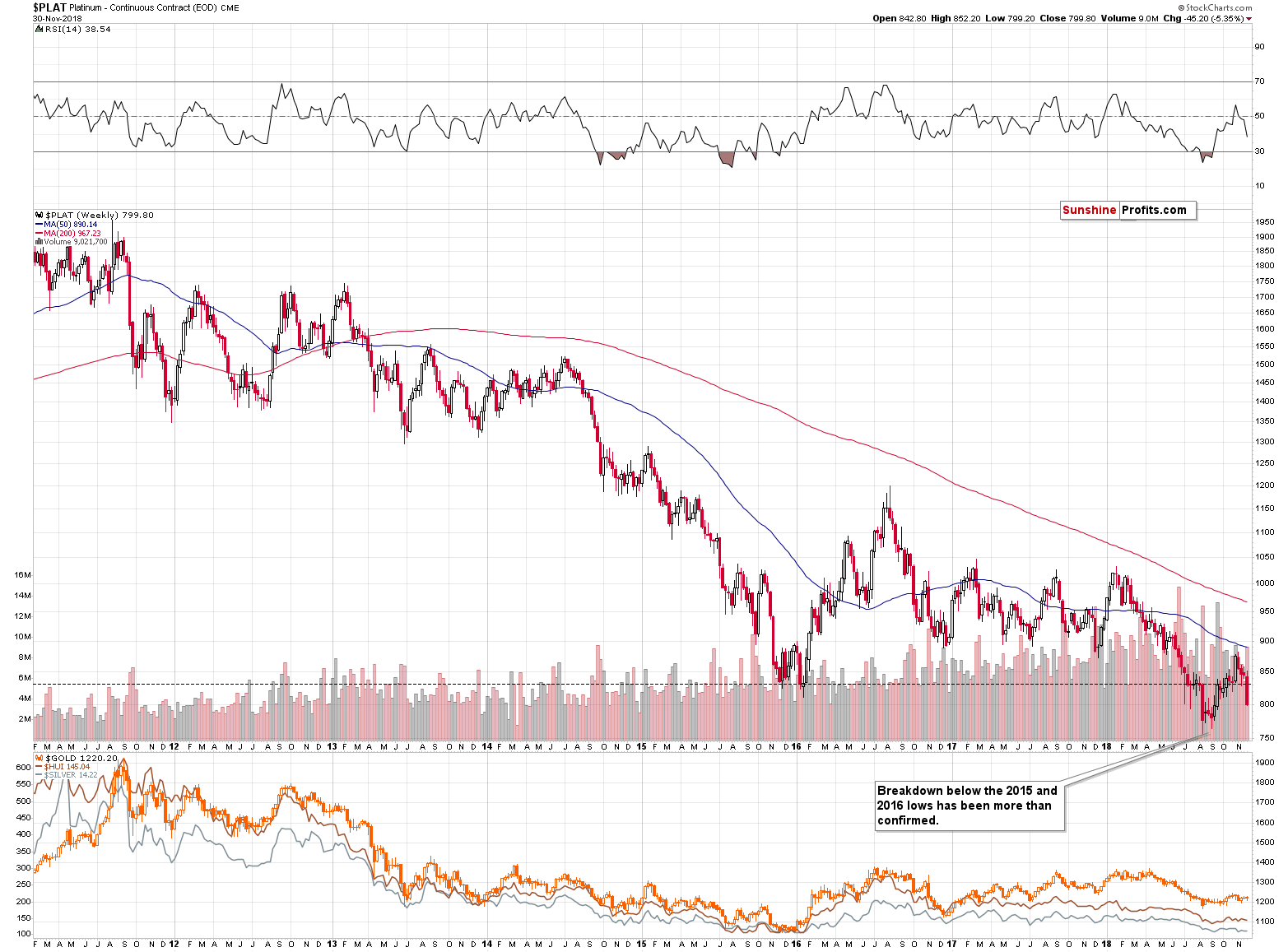

Platinum’s Breakdown

Another white metal, platinum, once again broke below its 2015 and 2016 lows. The previous breakdown was already confirmed, so we didn’t really trust the rally that followed. It seems that we were correctly skeptical. Earlier this year, platinum moved back and forth the previous lows without a meaningful weekly close below these key lows. This time, platinum plunged without looking back.

The volume was sizable, but not huge. It was big enough to confirm the move, but not big enough to suggest that the situation was extreme and as such prone to reversing its course. After all if the market becomes too oversold, it tends to correct. Last week’s volume suggests that the decline was not an extreme that needs to be corrected, but that it was more of a “business as usual” type of decline. The latter is much more likely to be followed by more declines, and since the entire precious metals sector tends to move together most of the time, this is also bearish for the other PMs and mining stocks.

Speaking of mining stocks, let’s take a look at what happened in them on Friday.

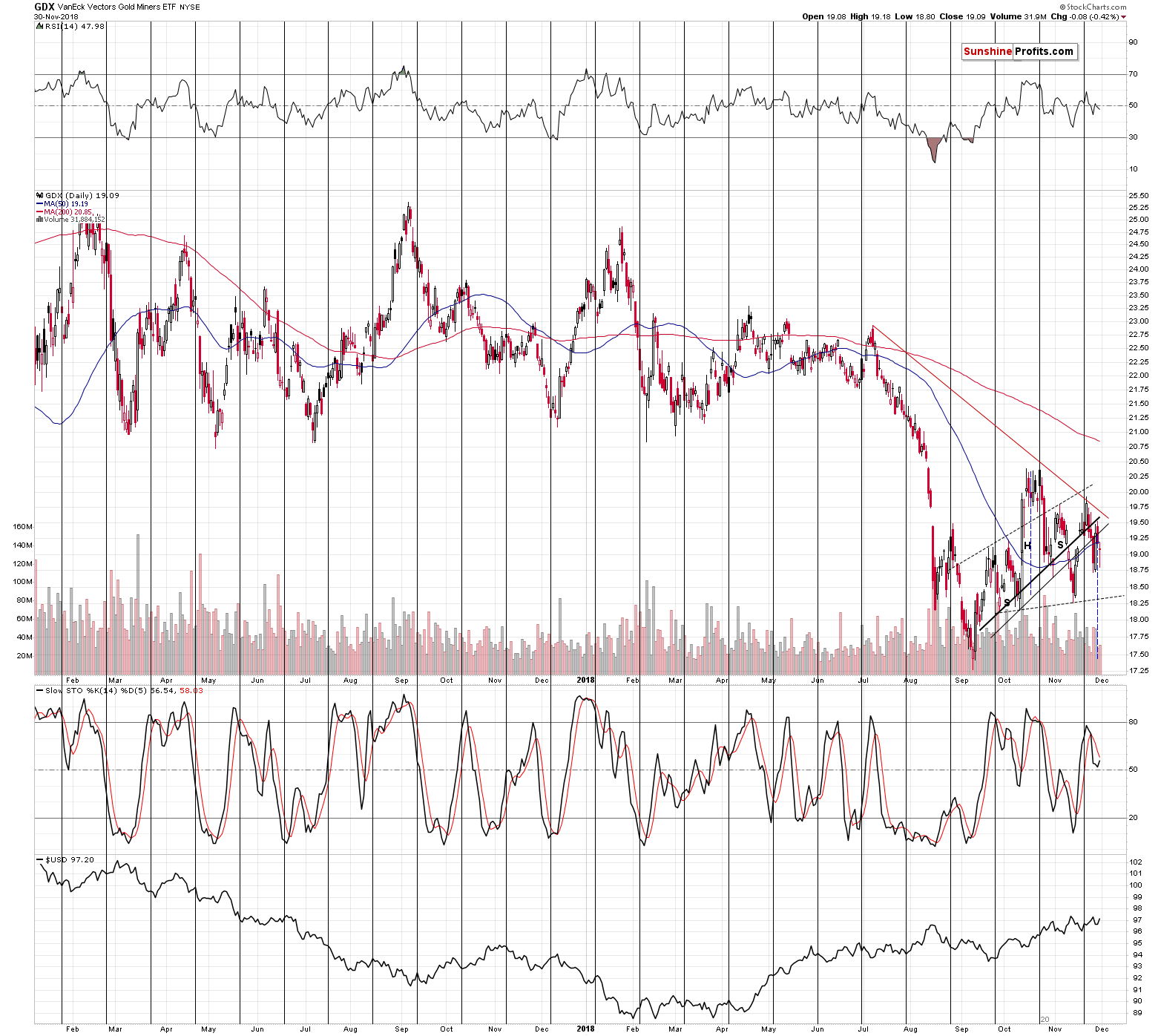

Mining Stocks’ H&S Pattern and Additional Bearish Signs

Mining stocks moved lower, but not significantly so. Consequently, the bearish head and shoulders pattern still seems to be forming, if we take the November low as the binding one, and it’s already completed if we take the previous low as the binding one.

All in all, in our Wednesday comments, we wrote the following about the above H&S formation:

The current pattern is a bit different than what we usually see as a head and shoulders pattern. It usually has one head and two shoulders. In this case, we have a pattern that had two left shoulders and two right shoulders. It seems odd, but it’s within the definition of what could be viewed as the H&S pattern. The implications are just as bearish as they would be if the pattern had a regular shape.

But, to be 100% objective, this pattern is not fully completed. The two neck lines that we have on the above chart are not the only way that such line can be created. Another way would be to create it based on the mid-October and mid-November bottoms. Such line would have not been reached, let alone broken. The decline is still likely based on multiple other reasons, but let’s keep in mind that the final bearish confirmation will be when the GDX ETF confirms the breakdown below approximately $18.30 – the above-mentioned hypothetical neck level.

This breakdown is likely to happen shortly and lead to a move to new 2018 lows. Confirmed breakdown below the September bottom will open the way to much lower mining stock prices and volatile declines.

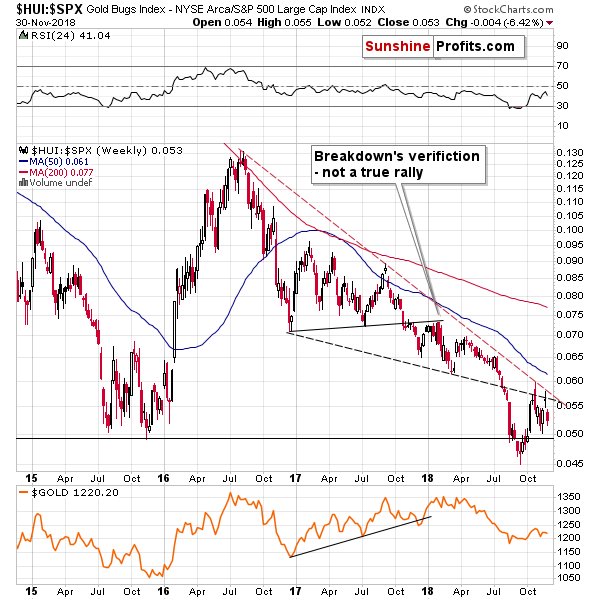

Compared to the price of gold, and to the movement in the general stock market, mining stock values also provide us with bearish indications. As far as the link with the latter is concerned, we see a continuation of a decline that followed a move back to the declining resistance line.

On October 29th, we wrote the following about the above chart:

Last week, the HUI to S&P 500 Index moved to declining red resistance and declined practically immediately. In this way, the small breakout above the declining black resistance line was quickly invalidated. The implications and outlook remain bearish.

And this remains to be the case. The key resistance line remains unbroken and last week’s decline confirms the current downtrend.

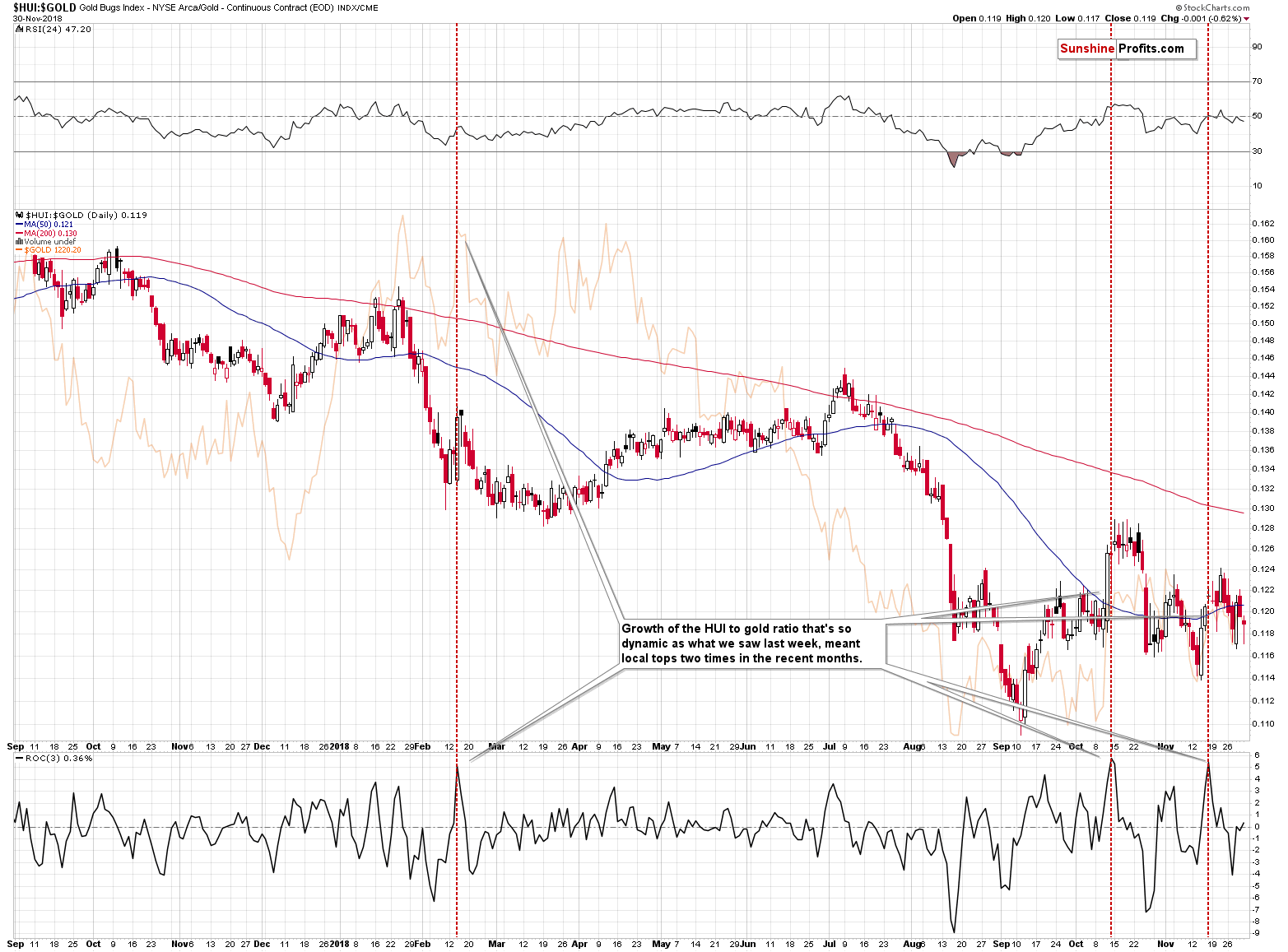

Compared to the price of gold, gold miners declined recently and what we wrote previously seems to have worked out just as we had expected. On November 19th, we wrote the following on the above chart:

The above chart features the gold stock to gold ratio. It rallied recently and the rally was sharp. Too sharp. The ROC (Rate of Change) indicator in the bottom part of the above chart shows the rapidness of the recent growth in the ratio. In other words, it gives a numerical and comparable value of how fast miners outperformed.

This value moved to its previous extreme and this was the case only two times in the recent past. Once about a month ago, and once in February. What happened next? The orange line in the background of the above chart shows what happened in gold. It moved back and forth for several days and then it declined. The most important thing is that the rally didn’t continue in any significant way. Whether it was the top or not wasn’t that critical. It was critical to close any remaining long positions at that time and at least consider opening short positions. In the absence of other bearish factors, one might have preferred to wait for more bearish confirmations, but at this time we have multiple sell signals in place, many of which are very strong.

In Metallica’s Mama Said song, one of the verses starts with the statement that “the brightest flame burns quickest” and it’s likely that we just saw an example thereof in case of the gold stocks to gold ratio. The rally was too sharp to be sustainable and thus it’s quite likely to end rather sooner than later.

The November 19th session was not the top, but the rally was indeed very close to being over. The top formed two days later – on November 21st. Gold closed just $3 higher on that day than on November 19th.

The bearish implications remain intact.

Summing up, the outlook for the precious metals market remains very bearish for the following weeks and months and short position remains justified from the risk to reward point of view, even if we see a few extra days of back and forth trading or even a small brief upswing. It is a very high probability of a huge downswing that makes the short position justified, not the outlook for the next few days. It seems that our big profits on this short position will become enormous in the future and that we will not have to wait much longer. Gold’s inability to rally on the increased geopolitical tensions regarding Ukraine confirm this scenario and since Powell’s speech didn’t change anything (despite causing some short-term price action), the downtrend will likely resume shortly. The bearish combination of candlesticks for the GLD ETF confirms the above as well.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (250% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,257; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $49.27

- Silver: profit-take exit price: $12.32; stop-loss: $15.11; initial target price for the DSLV ETN: $47.67; stop-loss for the DSLV ETN $28.37

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $20.83; initial target price for the DUST ETF: $80.97; stop-loss for the DUST ETF $27.67

Note: the above is a specific preparation for a possible sudden price drop, it does not reflect the most likely outcome. You will find a more detailed explanation in our August 1 Alert. In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $31.23

- JDST ETF: initial target price: $154.97 stop-loss: $51.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The S&P 500 index slightly extended its short-term uptrend on Friday and it will likely continue to retrace the November decline today. Will the broad stock market's gauge break above 2,800 mark?

Stocks Breaking Higher, New Uptrend or Still Just Consolidation?

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts