Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

While it is usually the case that gold, silver and mining stocks move in the same direction, but the USD Index moves in the opposite one, yesterday’s session was far from this pattern. The only asset that moved against the others was gold, while silver and miners moved lower along with the USD Index. What can we infer from this?

First of all, this neither adds clarity to the price targets nor does it invalidate the ones that we discussed previously. However, it tells us two things:

- The precious metals sector is still likely to decline in the very short term just as the USD Index is likely to rally (there was no invalidation of breakouts in the case of the latter) due to the mining stocks’ underperformance of gold. Yesterday’s move lower in the general stock market could be partially responsible for it, but given the size of the USD’s daily decline miners should still have moved higher but they didn’t.

- The gold market was the only one that had a turning point in the first days of November and thus the fact that it’s moving relatively steadily higher can be viewed as a confirmation of this technique. The precious metals market didn’t (and the same goes for gold alone) manage to soar or plunge after gold’s turning point, but the reason is likely the fact that the needed trigger (a bigger move) from the USD Index has not been seen so far. Given this context, gold should have stayed flat, but instead it – insignificantly, but still – reversed and moved higher after the turning point. The rally was not something to call home about and it wasn’t strong enough to justify changes in the trading positions, but still, even this subtle move in gold is enough to confirm the usefulness of the turning point in gold as a technique for future trades.

Having said the above, let’s take a look at the charts (chart courtesy of http://stockcharts.com).

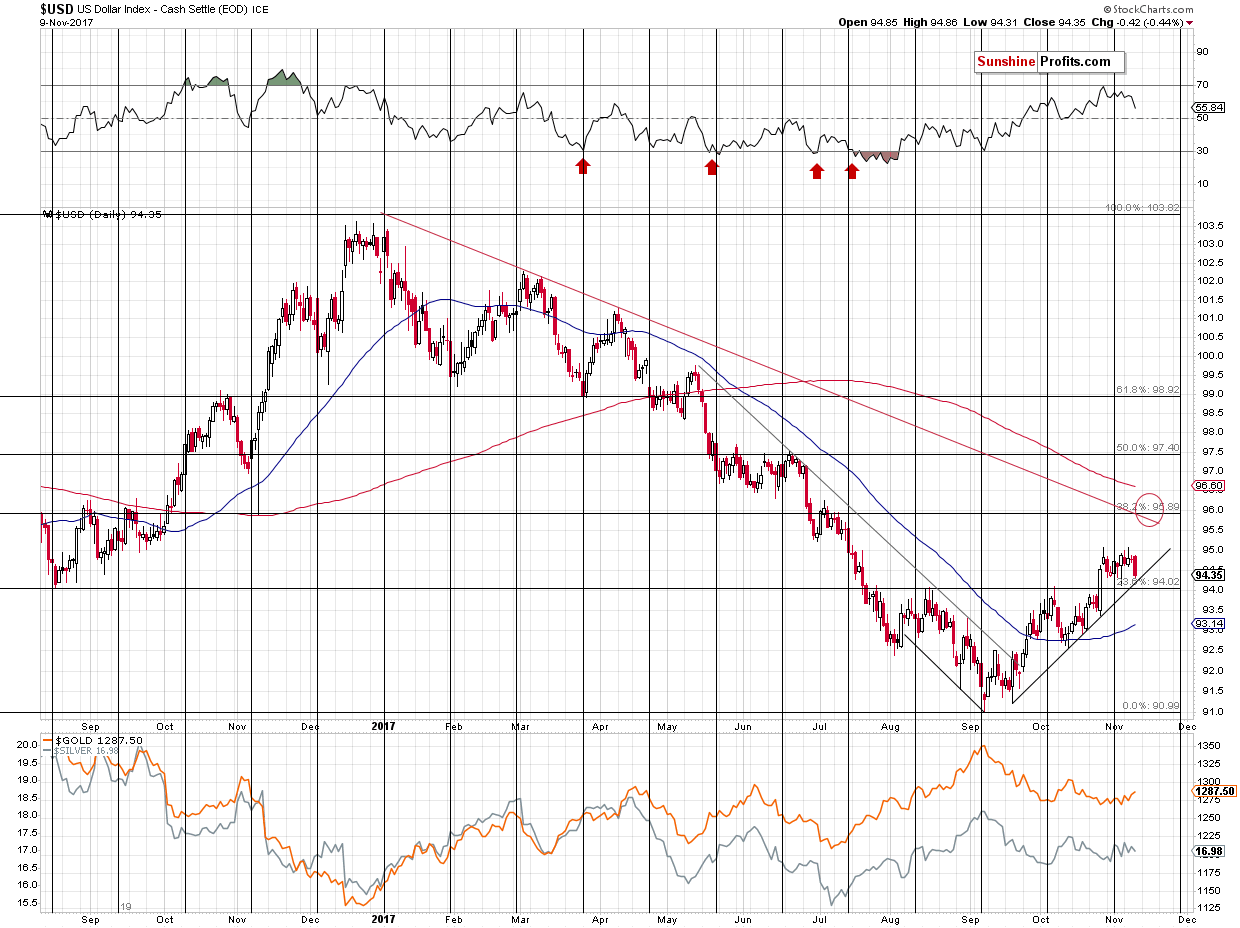

First of all, let’s say that nothing changed regarding the outlook for the USD Index:

The breakout above the neck level of the reverse head and shoulders pattern is more than confirmed, so another rally appears very likely to be seen this week. The target at about 96 level (precisely 95.89) is supported by the declining red resistance line and the 38.2% Fibonacci resistance level. Both are based on a clearly visible, medium-term move, so they are important.

With the USD Index still likely to rally in the following days (before temporarily declining), one should still expect the precious metals market to decline in the short run even if we are seeing some strength at this time.

Please note that yesterday’s daily downswing didn’t take the USD below the previously broken neck level of the reverse head and shoulders formation and it didn’t take the USD below the rising support line based on the September and October lows. Consequently, nothing really changed after yesterday’s session.

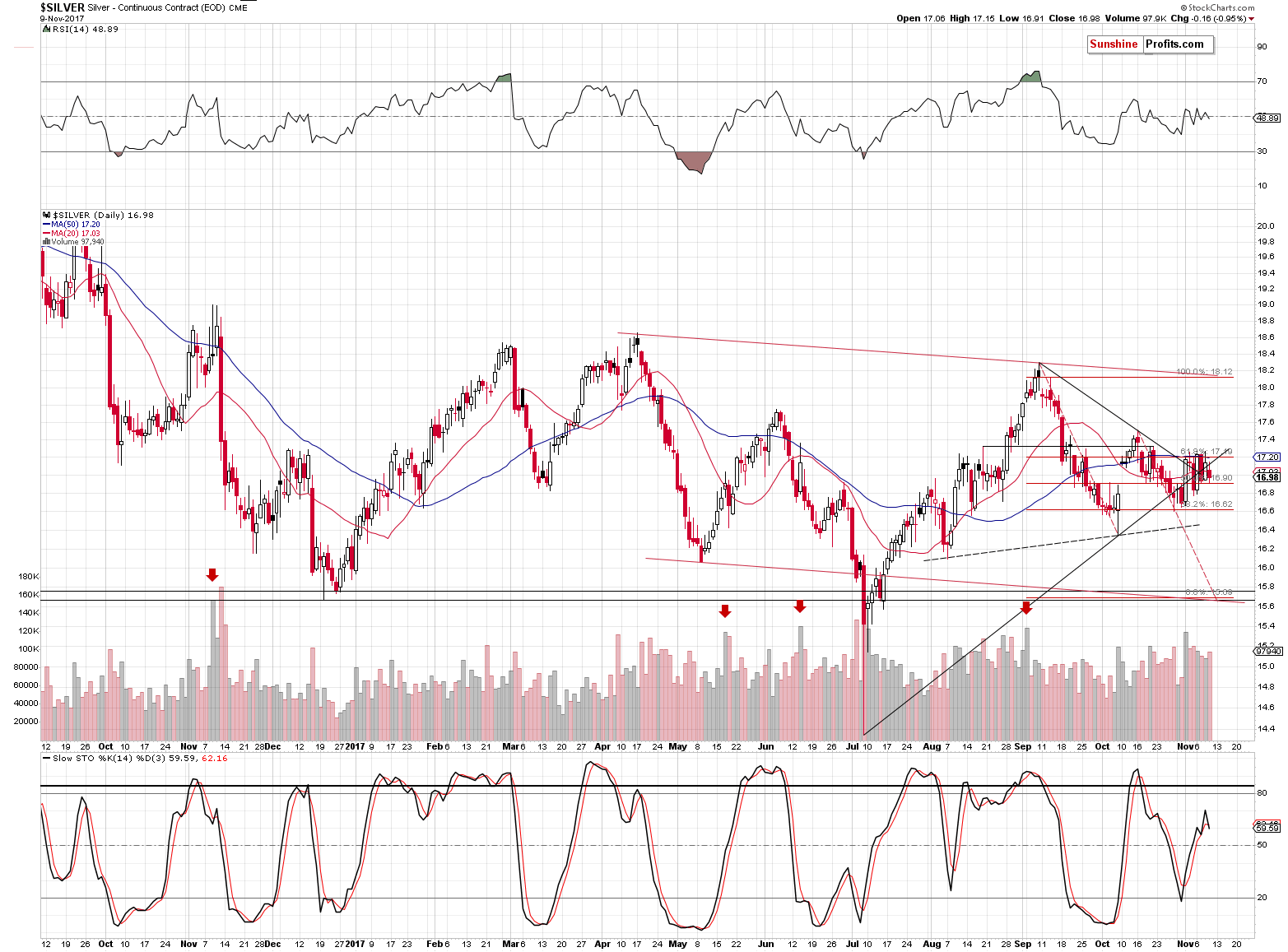

Silver and mining stocks declined. The Stochastic indicator based on the price of the white metal flashed a sell signal and while mining stocks didn’t fully invalidate the move above the rising support/resistance lines, their underperformance relative to gold is a strong bearish sign anyway.

Speaking of silver, please note that it seems to have reversed according to the apex technique that we described about a month ago:

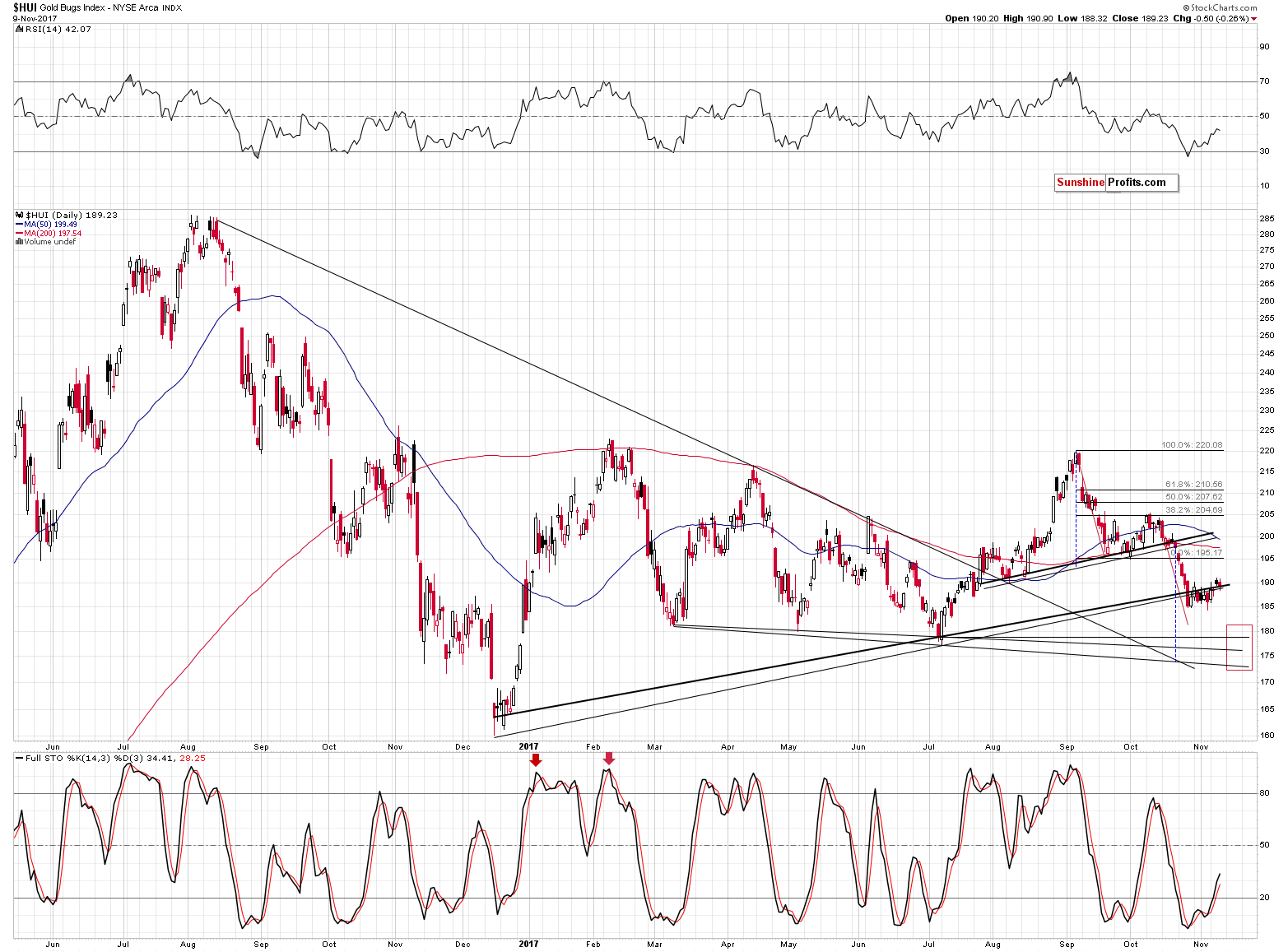

Let’s move back to the HUI Index chart once again as it features a new technique that we’ve been validating for the precious metals market and it finally seems that it’s justified to include it in our set of tools. The technique is the triangle apex reversal. The technique is quite straightforward and even though it may appear somewhat random (it mixes both price and time), it works surprisingly well.

Moving to the point, the triangles are usually drawn in order to create support and resistance levels, check whether a breakout or breakdown is more likely and estimate the likely size of the move that follows the breakout or breakdown. However, if one continues to draw the triangle borders until they cross, they will get a quite precise time target. You can see the above in action on the HUI Index chart. The triangle’s apex is a bit below 185, in early September. The former is irrelevant, but the time wasn’t. The HUI Index indeed topped in early September.

We noticed that the more visible the triangle is and the greater number of extremes confirm its existence, the more reliable the prediction for the turning point becomes.

In silver’s case, the technique pointed to a reversal on November 6th and that was indeed when we saw the high in terms of the daily closing prices.

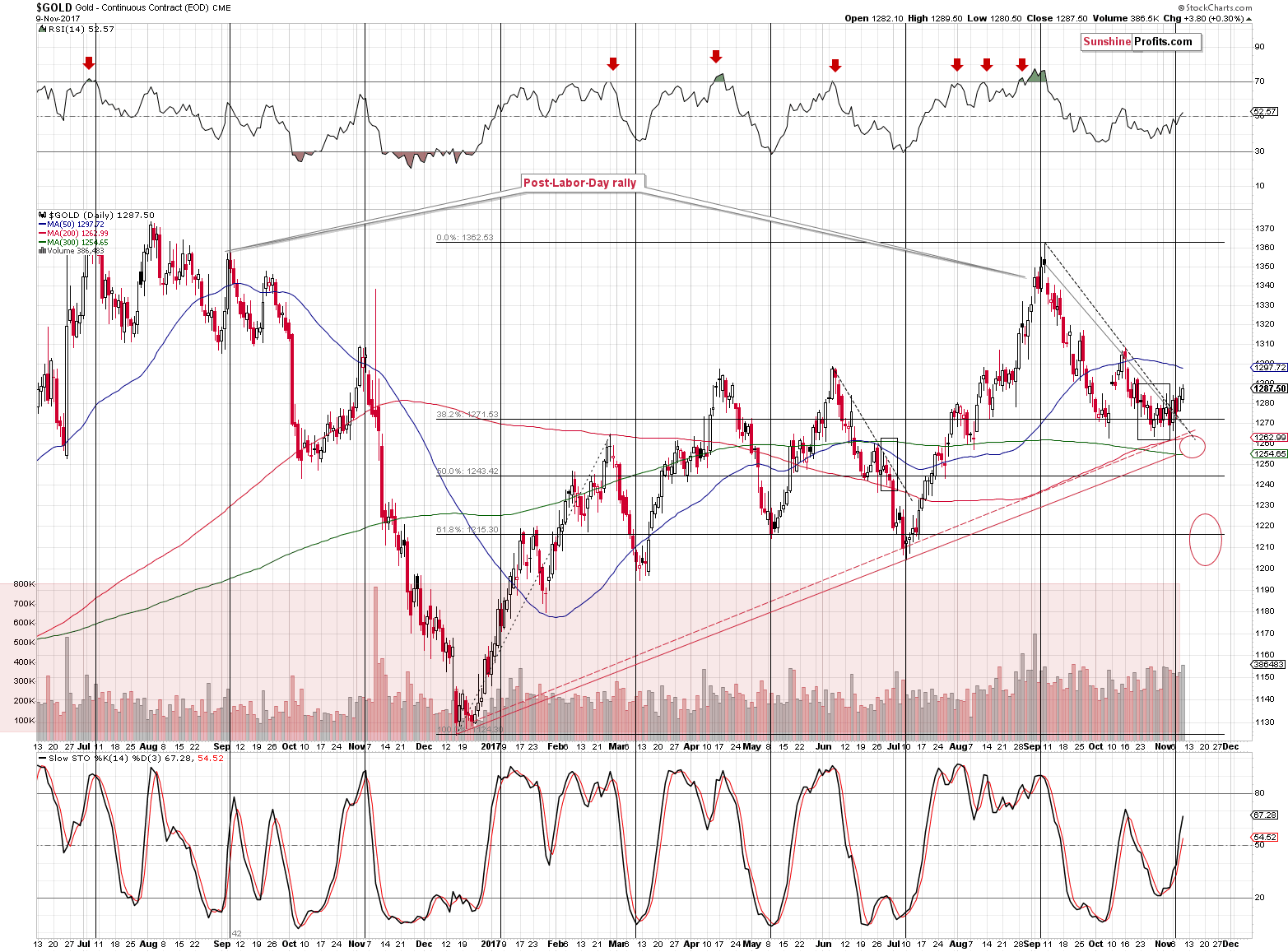

Gold moved a bit higher, but it’s trading more or less at Wednesday’s closing price at the moment writing these words, so overall very little changed recently.

Summing up, nothing really changed based on yesterday’s session. Based on what happened on Wednesday in gold, it became more probable that gold would form its next short-term bottom higher than in the $1,200 - $1,220 area, and at the same time it became more probable that we will have another interim trading opportunity before gold reaches its final bottom in the coming months.

To be clear, the medium-term outlook remains bearish, especially that the analogy to the 2012-2013 decline remains in place and the previously discussed long-term signals remain in place: gold’s huge monthly volume, the analogy in the HUI Index, the analogy between the two most recent series of interest rate hikes, and the RSI signal from gold priced in the Japanese yen. However, it seems to be a good idea to take advantage of the upcoming short-term correction, should we get bullish confirmations from metals or miners.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit price levels / profit-take orders:

- Gold: exit price: $1,218; stop-loss: $1,366; exit price for the DGLD ETN: $51.98; stop-loss for the DGLD ETN $38.74

- Silver: exit price: $15.82; stop-loss: $19.22; exit price for the DSLV ETN: $28.88; stop-loss for the DSLV ETN $17.93

- Mining stocks (price levels for the GDX ETF): exit price: $21.23; stop-loss: $26.34; exit price for the DUST ETF: $29.97; stop-loss for the DUST ETF $21.37

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and exit prices:

- GDXJ ETF: exit price: $30.28; stop-loss: $45.31

- JDST ETF: exit price: $66.27; stop-loss: $43.12

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Yesterday, the U.S. Senate tax cut plan was unveiled. What does it mean for the gold market?

In both 2015 and 2016, the price of gold bottomed in December. We invite you to read our today’s article about the current bullish and bearish factors driving the gold market and find out whether that pattern will repeat itself this year.

Will We See a Replay of 2015 and 2016 in the Gold Market?

=====

Hand-picked precious-metals-related links:

PRECIOUS-U.S. tax doubts push gold to first weekly rise in a month

Russian Fund Plans a $1 Billion Mining Venture With China Gold

Gold price: Global demand falls to 8-year low

New Tax To Hurt Gold Demand In Saudi Arabia And U.A.E.

=====

In other news:

Stocks Extend Drop, Bonds Fall; Dollar Fluctuates: Markets Wrap

Dueling Republican tax plans advance in Congress

Indonesia warns of tough response after Papuan rebels threaten Freeport

Bitcoin slides by over $1000 in less than 48 hours

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts