Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks is justified from the risk/reward perspective at the moment of publishing this Alert.

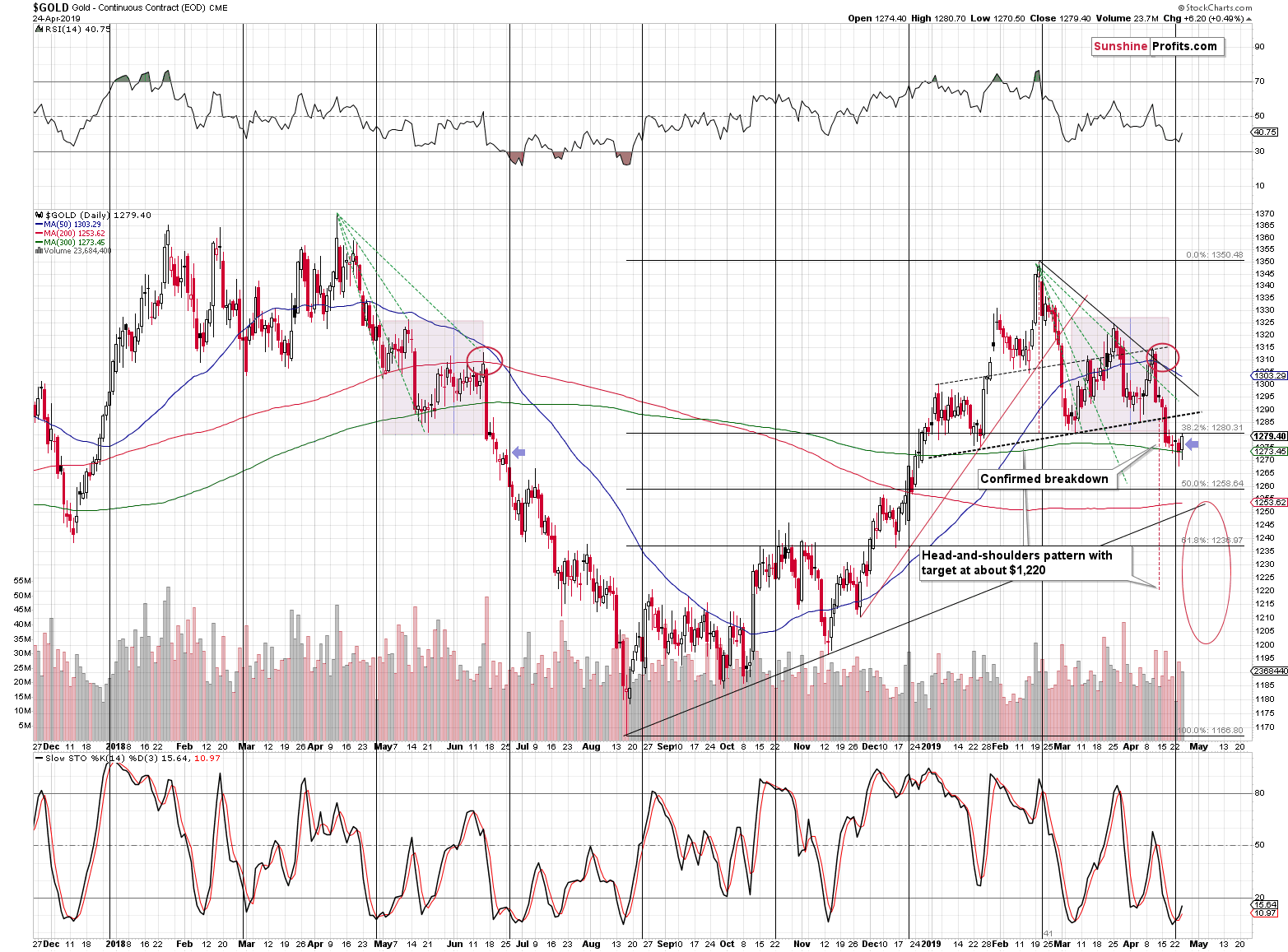

The USD Index soared yesterday, breaking to new yearly high. In fact, the last time we saw the USDX this high was two years ago, when the US currency was declining from the 104 top. However, the precious metals sector didn't decline based on this breakout. It moved a bit higher instead. It doesn't seem right, does it? Did this lack of bearish reaction just confirm that the PMs bottom is in?

No. The precious metals sector (especially mining stocks) was already after a meaningful decline and this means that taking a breather is rather normal. Gold is also just below the neck level of the head-and-shoulders formation, and comebacks to the previously broken neck level are a quite common form of verification. This is not bullish - it's normal at this part of the decline.

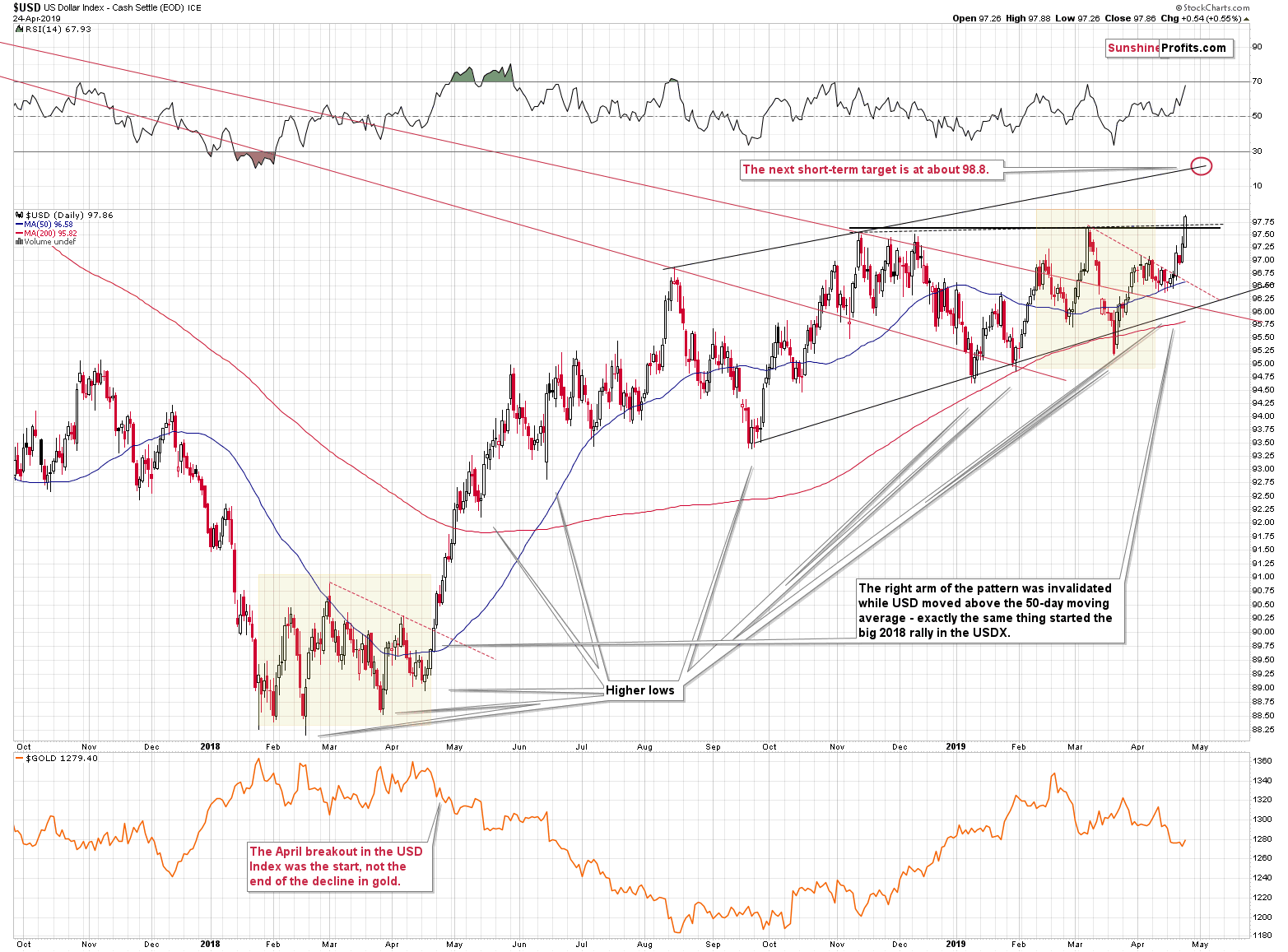

Let's start with the short-term USD Index chart.

The USD Index Is Breaking Out

In yesterday's Alert, we commented on it in the following way:

Meanwhile, the USD Index broke above the declining resistance line based on the previous highs. In the similar situation in April 2018, that was the final confirmation that the big rally in the USD has just begun.

Please note that when that happened, gold was still early in its decline. It fits perfectly the current gold picture.

We would like to add that gold was not really reacting to USD's rally immediately when it happened. It did decline, but the reaction was not as volatile as it theoretically should be given the size of USD's move. Yesterday, we saw an even weaker reaction in gold. Actually, it's quite normal, given that the USDX attempted to break above the 98 level several times in the previous months. All the previous attempts have failed, so why should this time be any different?

You know, this time actually is different. The general investment public doesn't know, however. This is the rally that followed the dovish surprise form the Fed, which means that USD is showing excessive strength against the bearish forces. This kind of strength in the face of adversity can easily take the USD well above the previous highs. In other words, even though it doesn't appear to be the case for most investors at the first sight, this time the USDX has a very good chance of successfully breaking higher.

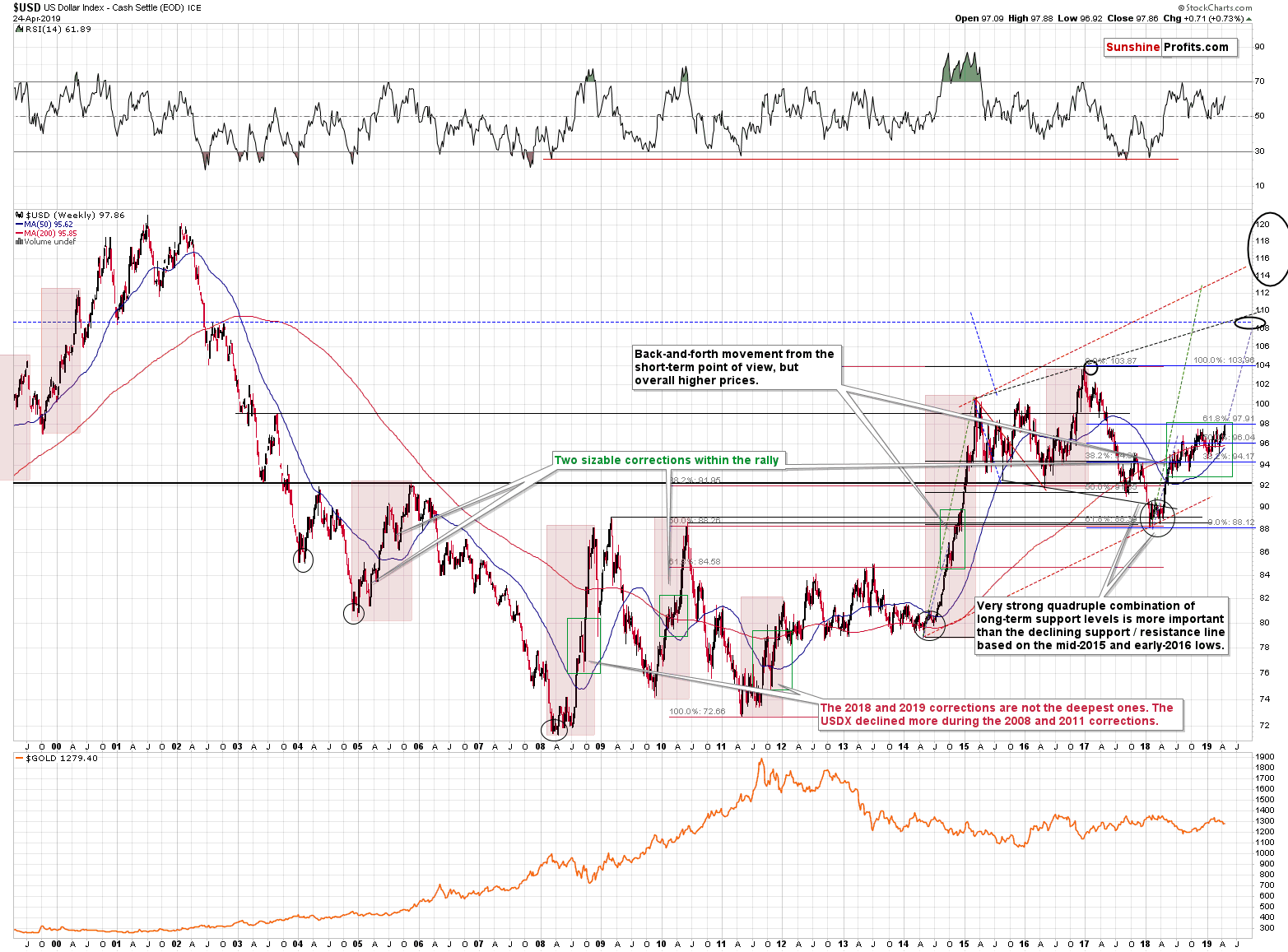

The short-term resistance is at about 98.8 (red ellipse on the above chart), but the much more important resistance is at the 2017 high. Please see the chart below.

Then, the next strong resistance will be at about 108, but we'll get back to the details regarding this target once USD takes out the 2017 high.

Yesterday's high is not important just because it's a breakout above the recent highs. It's important because it's the 61.8% Fibonacci retracement level based on the 2017 - 2018 decline, too. This might also be a reason as to why precious metals investors have been reluctant to take action yesterday. Once this level is taken out, the USDX is likely to rally sharply. Let's keep in mind that the back-and-forth action that we've been seeing for the past year is a "running correction" that is characteristic of the strongest bull markets. The important thing is that the moves that precede corrections tend to be similar to the ones that follow them. Applying this technique to the current situation provides us with 108 as the upside target.

We know - it seems unlikely to be reached, because it's distant. But, let's keep in mind that a rally to 108 would still be smaller than the price increase that we saw in 2014 and 2015. If USD doubles the latter rally, it will soar to approximately 113.

Can gold rally in this environment? It can, but it's not likely to rally initially. It's likely, however, to stop declining despite USD's gains and this will be a very important sign telling us to get back on the long side of the precious metals market. For now, it seems that gold is about to slide.

Let's take a closer look at what happened in the metals and miners.

Meanwhile in the Precious Metals Realm...

Gold moved a few dollars higher and it was a perfectly normal thing for it to do given the similarity to how it declined last year. The blue arrows illustrate where gold "is" in terms of the analogy. In June 2017, we saw a similar daily rally more or less in the middle of the short-term downswing.

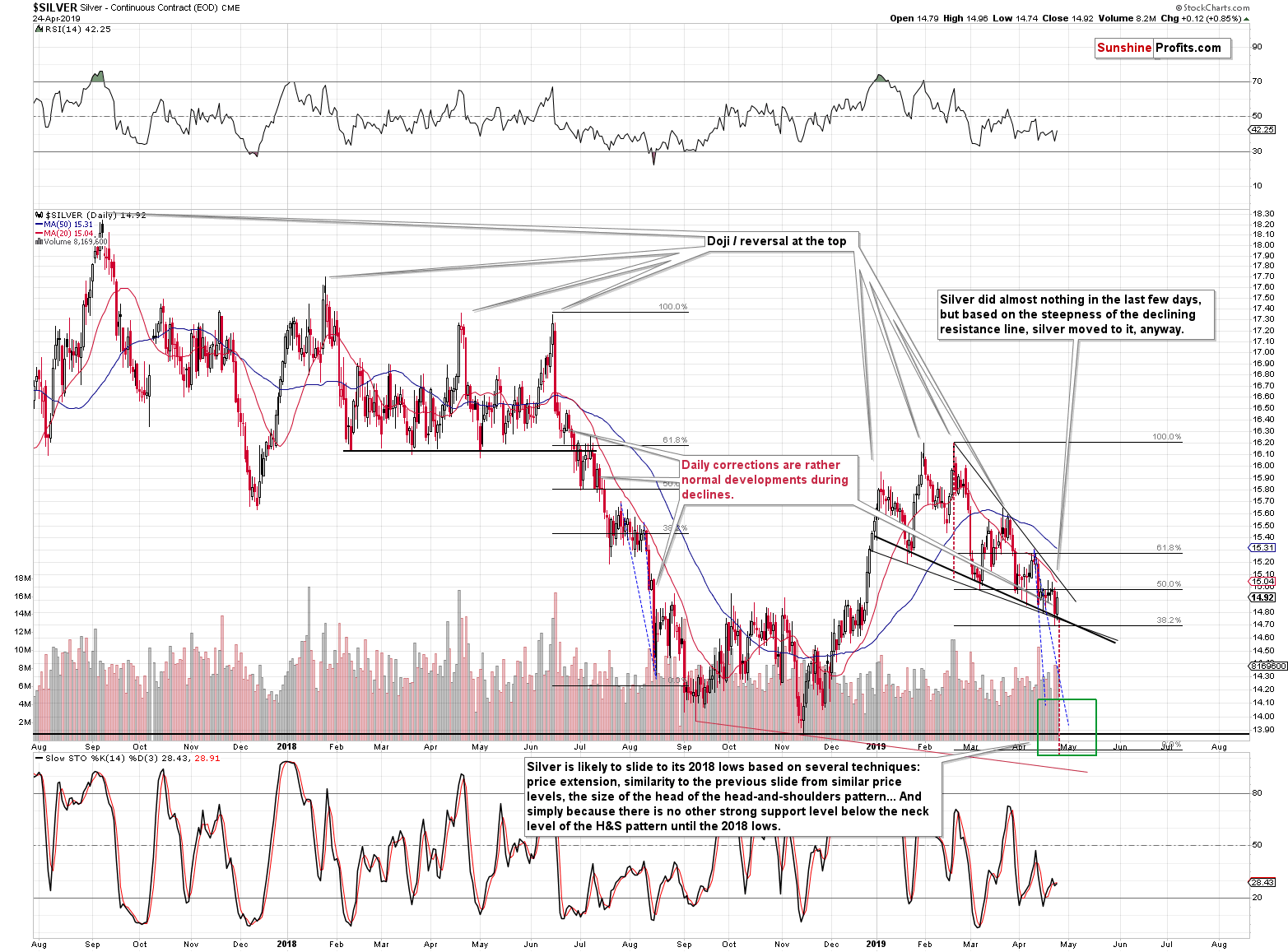

But silver rallied even more!

Silver bounced after moving to the declining support line and... It was a very normal thing to do for the white metal. Even if there was no support line, the size of the bounce was very much in tune with what silver did during other declines. We marked three similar cases from last year. None of them ended the decline and it doesn't seem that the white metal is close to the end of its decline also this time.

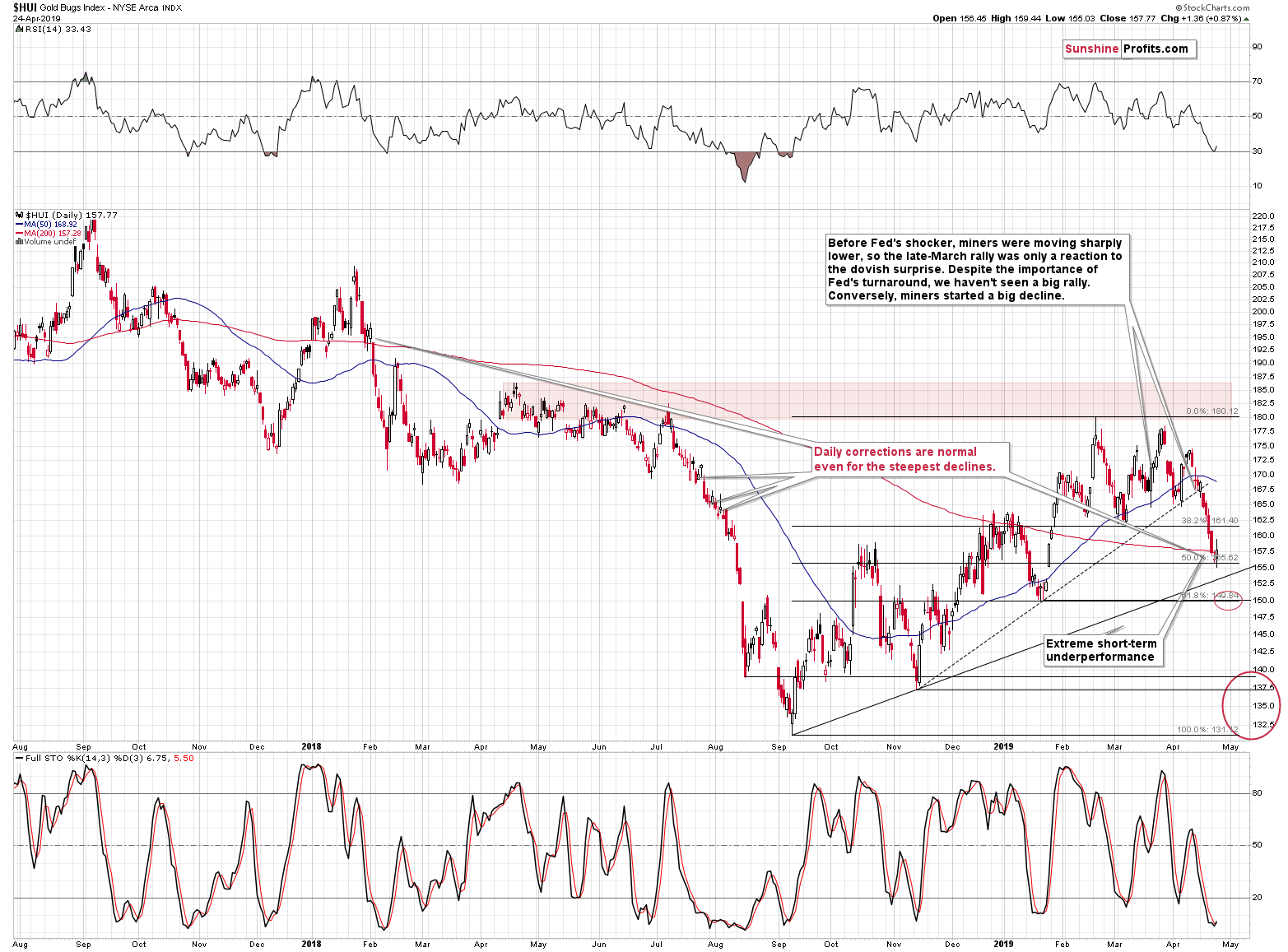

Gold miners seemed to be reversing, but they gave away part of their gains and the reversal candlestick really turned out to be a regular daily pause. We marked four similar cases to yesterday's session. Three of them took place during the biggest decline that we saw in the recent past. Consequently, yesterday's price action is hardly a bullish phenomenon.

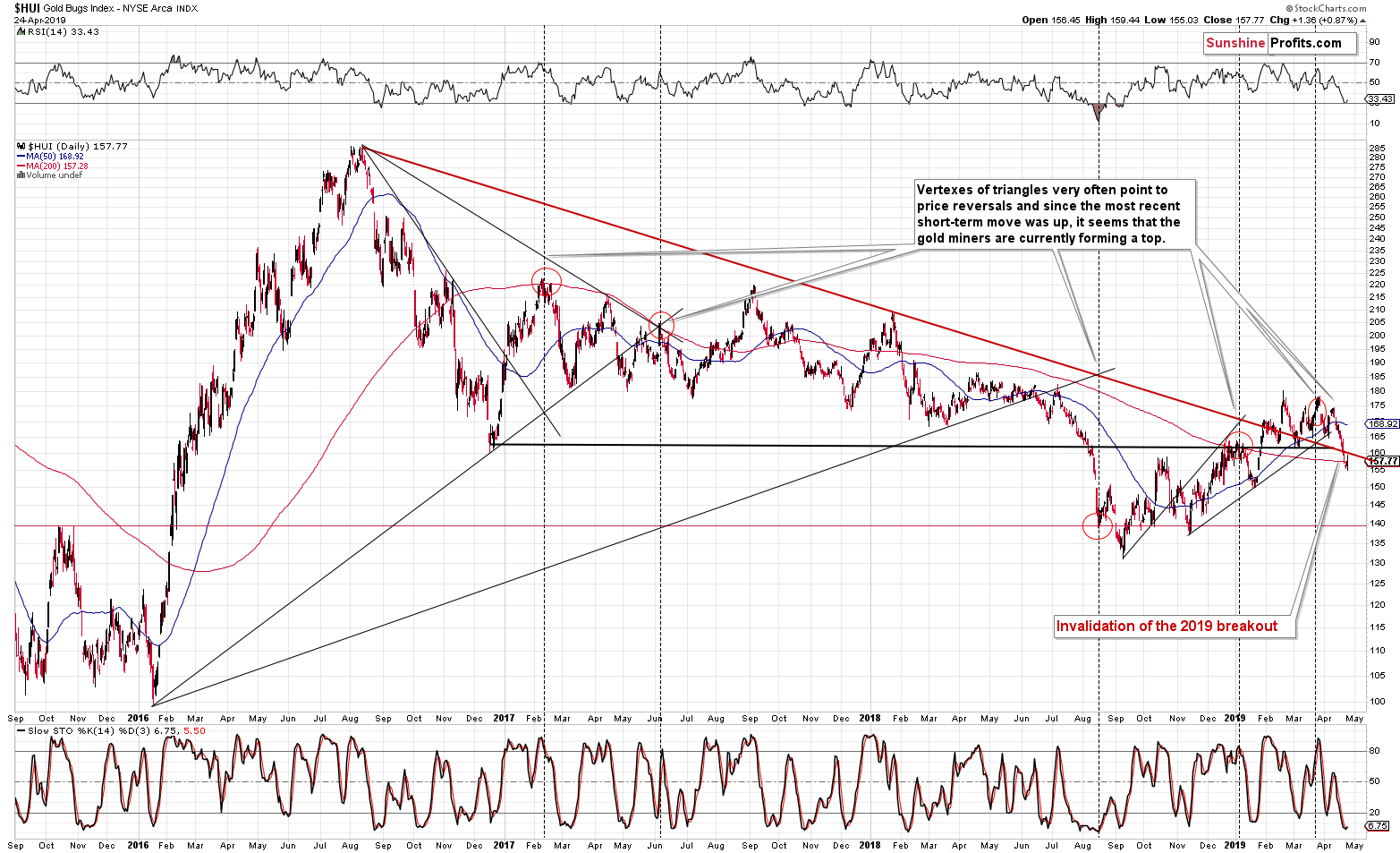

Actually, the above is not the most important development that took place in the gold miners. The key thing from the medium-term point of view was the recent invalidation of breakout above the declining medium-term resistance line.

The declining red line was broken earlier this year, and while the breakout was verified, gold miners never moved beyond the initial post-breakout high. Now, they invalidated the move above the declining red line and yesterday, they just temporarily moved back to it. This upswing didn't change anything and the main thing that one should focus on is the invalidation, not the pause that followed it.

This is a major bearish sign, because of the general rule that invalidations of breakouts are more bearish than the breakouts are bullish, and because of the importance of the line that we are discussing. The breakouts tend to be relatively small compared to the moves in the opposite direction that follow. Please take one more look at the long-term USD Index chart. The breakout above the previous highs in late 2016 was a breakout that was then invalidated. The decline that took place in 2017 was multiple times bigger than the late-2016 rally.

The post-breakout rally took the HUI about 15 index points higher, so the move lower that has just started is likely to be truly huge. The slide to the 2016 bottom is quite likely but based on other factors, we know that miners are not likely to stop there. Either way, the invalidation of the medium-term breakout is an apt way for a huge decline to start.

Summary

Summing up, the breakdown in gold is confirmed from multiple angles, miners underperform to an extreme extent, while silver appears ready to slide any hour now - it's difficult to imagine a more bearish combination for the short term. As if that wasn't enough, the USD Index seems to have bottomed. All the above creates an excellent shorting opportunity in the precious metals sector. There will likely come a time later this year when we will get in the back-up-the-truck territory with regard to precious metals, but we are not even close to these discounted price levels. However, it looks like the final slide towards them has already started. Based on the likelihood of seeing a temporary turnaround next week, we might have a good chance of exiting the current short position or even switching to a long one at that time.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short position (250% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,241; stop-loss: $1,357; initial target price for the DGLD ETN: $51.87; stop-loss for the DGLD ETN $39.87

- Silver: profit-take exit price: $14.03; stop-loss: $15.72; initial target price for the DSLV ETN: $37.47; stop-loss for the DSLV ETN $26.97

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $18.41; stop-loss: $24.17; initial target price for the DUST ETF: $34.28; stop-loss for the DUST ETF $15.47

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so - we think senior mining stocks are more predictable in the case of short-term trades - if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $26.42; stop-loss: $35.67

- JDST ETF: profit-take exit price: $78.21 stop-loss: $30.97

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Stocks retraced some of their Tuesday's run-up yesterday, as investors took short-term profits off the table. The S&P 500 got very close to the September 21st record high. Will it reach the new all-time high?

Stocks at Last Year's Record High

We've seen quite decent currency moves in recent days. And the market ain't exactly sleepy today, either. Let's put these moves into the picture. The implications lead us to make serious decisions. Is there a more pleasant sound than ringing a cashier's bell? Ringing YOUR cashier's bell, that is. Just see what we've exactly decided to do right now.

The Euro Is Down. But Is It Really Out?

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager