Briefly: in our opinion, full (150% of the regular size of the position) speculative short position in gold, silver, and mining stocks is justified from the risk/reward perspective at the moment of publishing this Alert. In other words, we are once again increasing the size of the speculative short position.

Gold has continued higher yesterday and reached its 50-day moving average this time. Gold stocks had an intraday reversal higher while silver reversed lower. Does this mean that the precious metals rally still has more room to go? After all, we haven’t seen any kind of silver outperformance that would hint at exhaustion of the upswing. Or do we necessarily have to see such an outperformance to suspect a top in the making? In short, the changes are big enough for us to once again change our trading position.

Let’s get into the rich details, starting with gold.

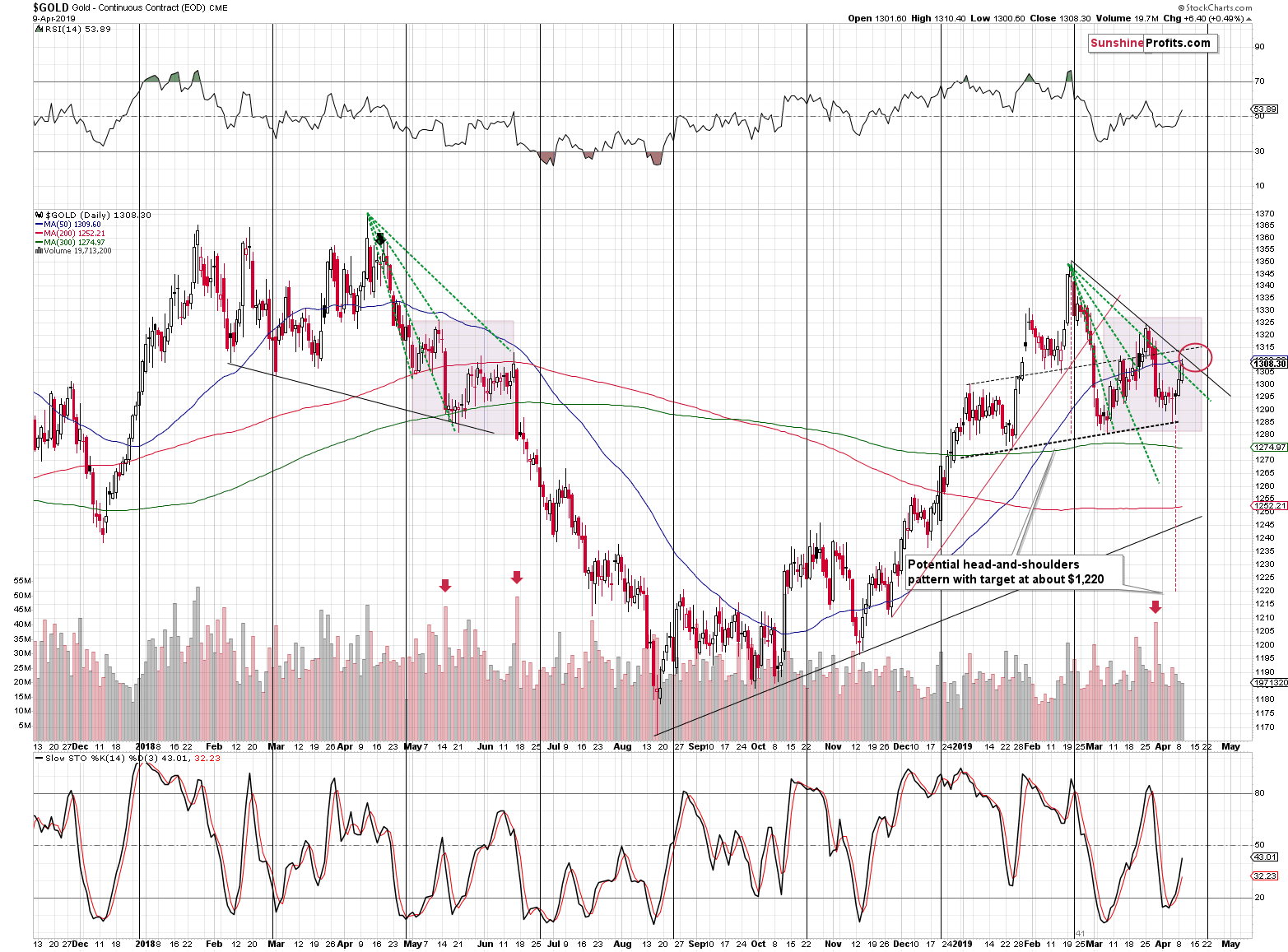

Gold’s Topping Out

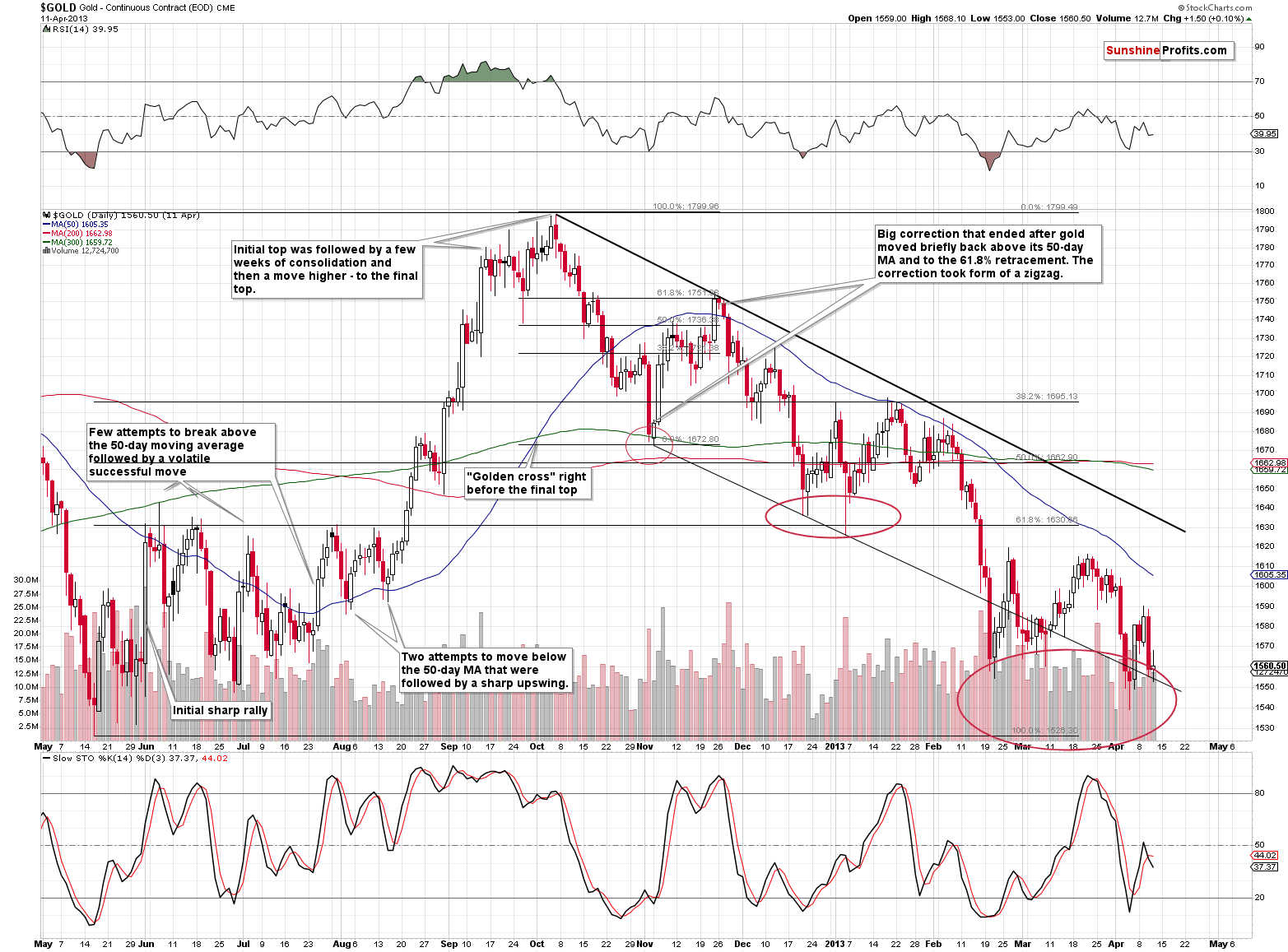

Gold is right in the middle of our trading range, which means that the odds for the top being in have risen. This is precisely why we decided to – once again – increase the size of our short position. The multiple bearish signs for the medium term that we discussed recently, including the powerful 2012-2013 – now analogy continue to support much lower prices in the coming weeks. The top in the metals and miners seems to be close enough to justify an increase in the size of the trade.

Gold touched its 50-day moving average and it almost reached its declining resistance line. The $1,310 level reached is also in perfect tune with the level reached in early December 2012, before declining in a profound manner.

If the history continues to repeat itself, gold is likely to slide shortly and move below the recent lows.

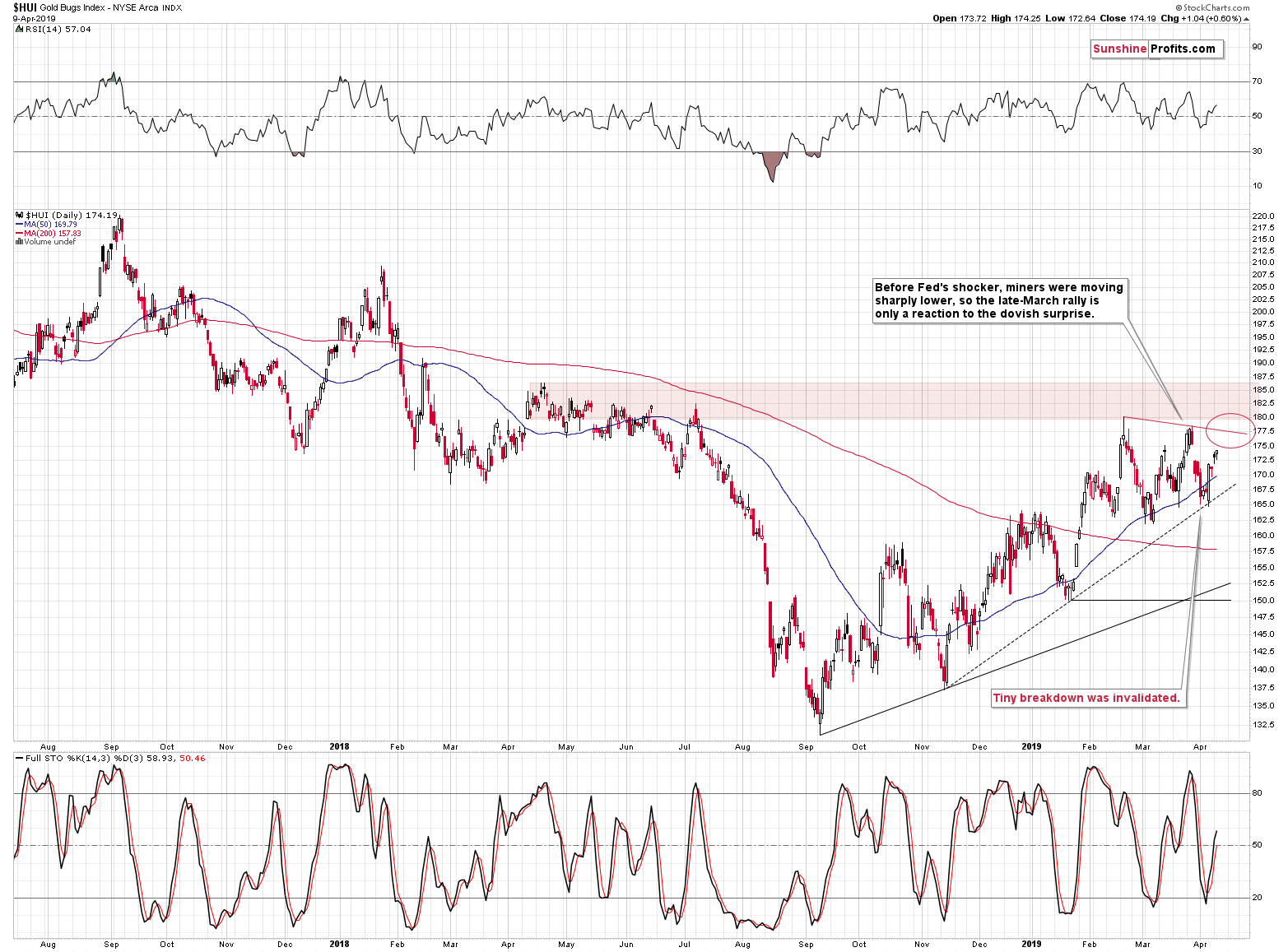

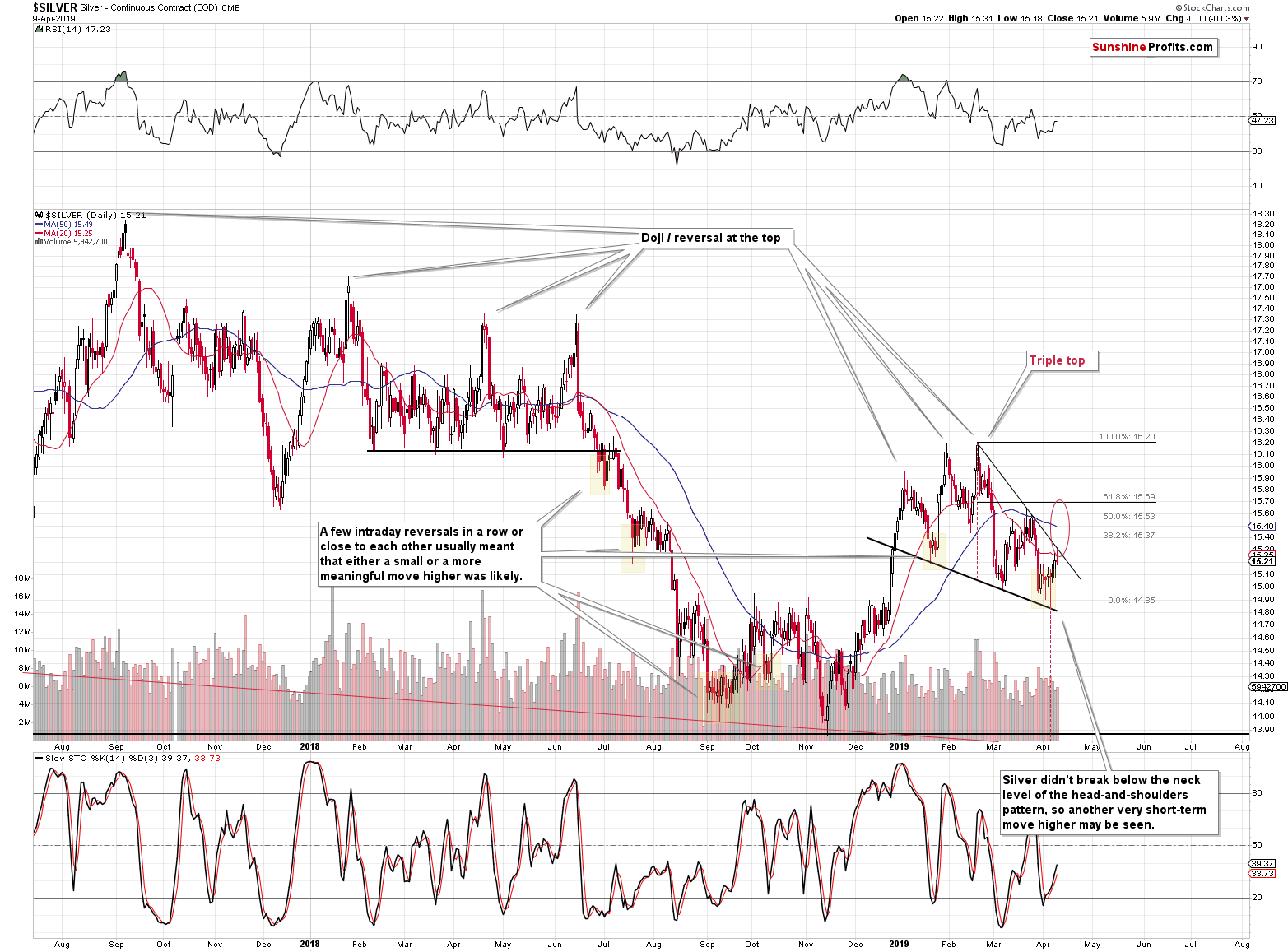

The Miners and Silver Examination

On April 5th, we wrote the following:

Yesterday’s invalidation and daily strength in the miners doesn’t change the medium-term picture at all. All that it indicates is that we are likely to see an additional short-term move higher before the decline truly picks up speed.

Let’s keep in mind that while miners tend to outperform in the early part of a given upswing, they tend to underperform in the final part thereof (while silver outperforms). Consequently, there is no 1:1 relationship between the size of yesterday’s rally in gold and gold stocks that would translate into the size of the upcoming rally. While gold is only halfway done rallying, miners’ rally might be almost over, and silver might be picking up steam to launch the final pop-up that deceives beginning traders only to take them by surprise later on.

Taking into account the move up that took gold higher from the intraday low, it was indeed half of the rally (at least so far), while the miners’ rally was indeed almost over. The only bearish confirmation that we’re missing, is silver’s outperformance.

Silver moved higher, reached its declining resistance line and reversed. That’s a classic topping sign. We didn’t see the quick outperformance so far, though. It does not have to happen, but if we did see it, it would be a cherry on the bearish cake – a great confirmation of the short-term reversal. Based on what we have, the outlook deteriorated, but not extremely so.

Whether the top in the PMs is in or not yet, might depend on the short-term performance of the US dollar.

The USD Index Update

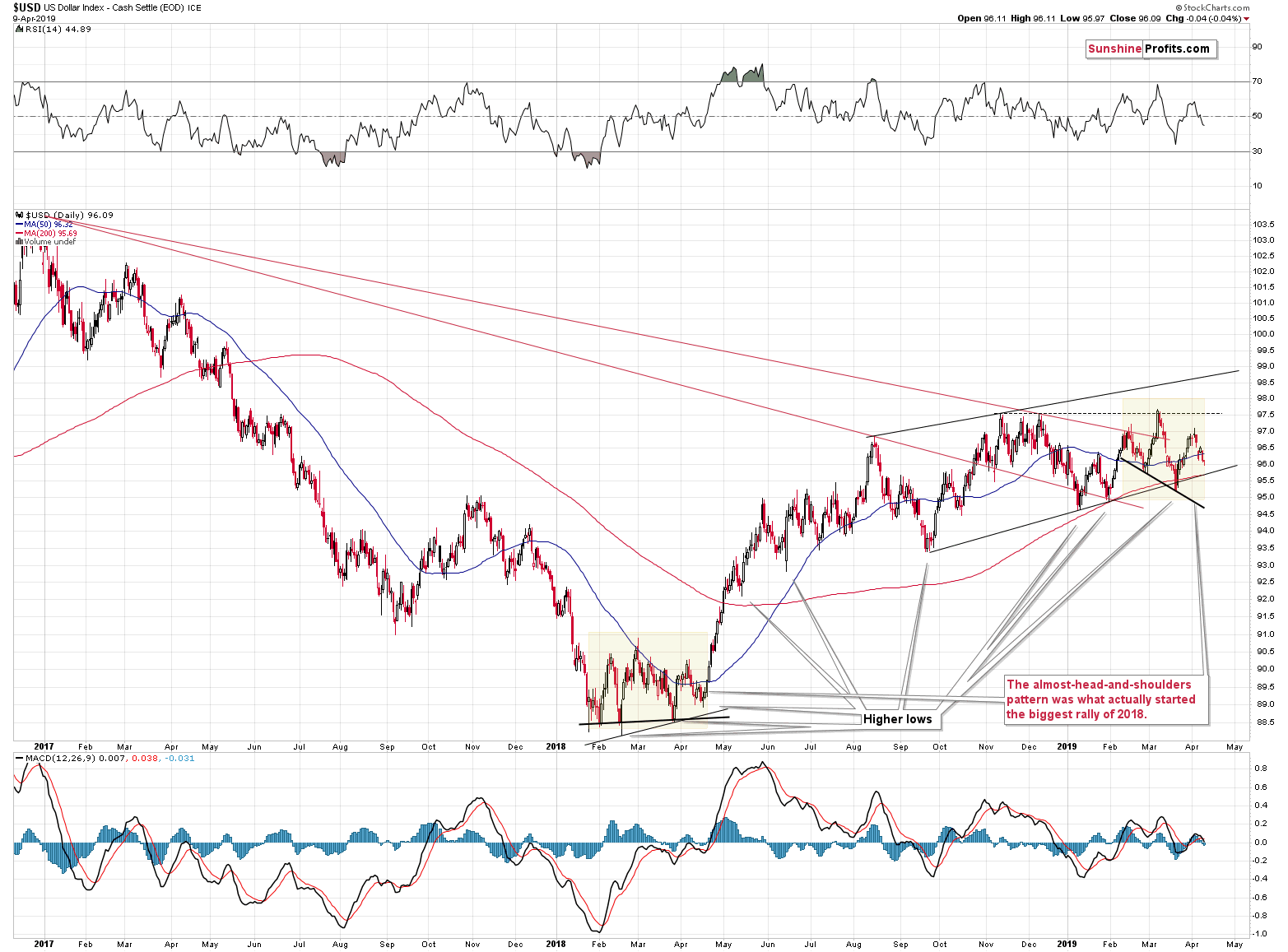

In yesterday’s Alert, we wrote that the most likely nearby support level is provided by the rising medium-term support line, at about 95.7 and that remains to be the case. Yesterday’s intraday low was just 0.27 above it. Can this mean that the bottom is in? Actually, yes.

It is usually the case that prices reverse after reaching a certain support level, but it’s important to keep in mind the way in which the USDX started the biggest of its recent upswings. Interestingly, the 2018 bottom formed in mid-April, so almost exactly one year ago. The way in which it started is what we would like you to focus on now.

Namely, the USD Index bottomed a bit above the rising support lines. It also bottomed in a double-bottom fashion, where the second bottom was lower than the first one. And it was a reversal. That’s exactly what we see right now. Yesterday’s move was the reversal that was the second – and lower – bottom and it took place a bit above the rising support line. The bottom for the USDX might already be in.

Day Trading Signals Announcement

On a different note, some time ago, we mentioned that we are working on and will be featuring a service dedicated to those of you, who want to profit on very quick - usually intraday - trades. We also wrote that it will not be provided as something that would substitute the current service, but rather as something in addition to all we provide right now.

After ongoing fine-tuning, verifications and tests, we are proud to announce that we have just added another level of service to our website - the Day Trading Signals.

Naturally, the current services, like Gold & Silver Trading Alerts, other Alerts, and our product Packages remain intact in all their aspects.

Just as their name suggests, they are Signals - not Alerts. They include the key parameters for a trade (entry level, profit-take level, and stop-loss level) and they don’t include the analytical reasoning, or any descriptions behind them. The Signals are thoroughly researched, however, spending time on describing a Signal would mean delaying the moment of its publication and could lower its usefulness to you. Timing is always critical in trading, but it’s particularly so in the case of day trading.

Even though they don’t include details behind market calls, explanations, or broader discussions, the Signals are likely to create a lot of value for those keen on participating in this kind of trades. How?

One word. Performance.

Without it, the Signals wouldn’t really be useful. With it, they certainly are. Our tests showed performance that was greater than we had originally expected. The words like “breathtaking”, or “astonishing” come to mind. In fact, if I (PR) hadn’t seen it with my own eyes, I wouldn’t believe that this kind of performance for a day-trading service was possible. Of course, we could tell you the exact numbers, but nobody would believe them. Ok, to be honest, we know that many of our subscribers would take our word for it, but we don’t think that it would be appropriate to ask you to rely solely on our word here. Instead of telling you, we will show you - in real time.

For the next month, our Day Trading Signals will be available for free for your review. They have their separate section, and you can access it whenever you want. In the future, there will be separate sections for different markets, but for now, we are putting all of them in one place, to make it easier for you to access them. In addition to the above, we will add a note regarding the recent Signals at the end of all our regular e-mails with links to main analyses. Such mailings (for instance mailings that will notify you about our Alerts), in addition to what they normally include, will also include a PS. with information regarding the Signals. In this way, you’ll be kept up-to-date and at the same time, it will not result in any more mailing that we share now. So, on your end, being informed about the Signals is hassle-free.

We know that many people will simply not be interested in this kind of service, so we wanted to be sure that we have a system that doesn’t bother people in this case. If you’re not interested, you can simply click on the links that will get you to the Alerts or articles, just like you used to do so far, while ignoring the PS. part.

However, if this kind of service is something that you’re interested in and you’d like to receive extra notifications about the Signals as soon as they are published, simply let us know. We will sign you up for a special day trading mailing list and you’ll receive the notifications sooner this way. Please note that there may be no Signals on a given day or there may be multiple Signals in it, so you might receive even several timely e-mails with Day Trading Signals per day. During our tests, there were on average 3-4 Signals per day (total for all markets that we took into account).

The special thing about our Signals is that in the vast majority of cases, we are not providing them for “now”, but rather for an entry price that needs to be reached first. Sometimes it takes minutes, and sometimes it takes hours before the entry price is reached. This means that it’s possible for you to get the same entry prices as we get. Not every Signal reaches its entry price level before being voided, but most of them do.

Also, generally we will not be sending follow-ups to a given Signal, because everything materially important has already been stated at the start. This simple approach worked extremely well during our tests. It’s also simple in terms of using it – set and forget, the trade is placed once and then it stays in the system until the next day. Some Signals will not be realized at all, and those that will, will likely be closed automatically, be it at a profit or at a loss. During our tests, the former was the case much more often. But, as we wrote above, we want you to experience the performance for yourself, instead of relying on our word.

Enough about the horse, tell me about the jockey.

Fair enough. The Signals are provided by Nadia Simmons, who you know as the author of Forex Trading Alerts and Oil Trading Alerts. In particular, the former included multiple profitable trades in the recent months…

Nadia has always been fond of the very short-term trades and most of her research over the previous years focused on this perspective. We haven’t previously created a service based on this research, because we didn’t think it was possible to deliver these intraday Signals to you in a manner that would be timely enough for you to act on them. Nadia made the breakthrough discovery several months ago, when she discovered a technique that combines the three key pillars: high-speed analysis & execution, performance, and simplicity. We knew that we might be able to deliver something unique to you, but we had to run thorough tests first. The results were… You already know. In the meantime, we also managed to greatly improve our internal publication process, so we will be able to get the Signals to you (as well as Alerts and other notifications) quicker and earlier than before.

What started as a quick notification, already became a small overview, so we won’t go into greater details here and now. If you are interested, we have four important links for you:

- Day Trading Signals section

- Day Trading Signals - Introduction

- Day Trading Signals - Frequently Asked Questions (the bottom of the page includes Day Trading Signals questions)

- Day Trading Signals – Performance (we included only the last few days, the first Signal that you can verify in real-time was posted today)

The names of the above links are quite self-explanatory. For now, the Frequently Asked Questions are actually what we expect the questions to be, based on our experience with other products. If you have a question that we didn’t cover in the FAQ, please let us know and we will be happy to help.

Also, you will find the very up-to-date first Day Trading Signal over here.

Summary

Summing up, after exiting almost the entire short position several days ago, we are re-entering it in a stable manner as the situation is becoming increasingly more bearish. And we are doing so at higher prices, thus increasing the overall profitability of the trade. The final confirmation from silver didn’t arrive yet, but gold and silver have both reached their targets and the USD Index might have already bottomed. If you entered a long position based on our analysis of short-term factors and you didn’t exit it yet, this might be the final call to take your profits off the table. The next big move in the PMs is likely to be to the downside.

Please keep in mind that the profit-take levels that we have for the current short position are placed as an “insurance” against a sharp drop in the PM prices. Given the myriads of very strong, medium-term bearish factors, the surprising moves are likely to be to the downside and we can’t rule out a situation in which gold drops to the December 2015 lows very soon. It’s not the most likely outcome, but it’s professional to be prepared for even the less likely – yet still possible – scenarios. We would like to emphasize that these targets absolutely do not mean that there will be no changes in the trading position in the meantime. In fact, you are currently witnessing the short-term adjustments. We may – and are quite likely to – adjust the current position, or even close it, and – perhaps – enter a long position once gold moves to the $1,215 - $1,240 area. The exact details of this trade are not yet known as they will depend on how gold moves to this area and what other signals we see at that time.

As always, we will keep you – our subscribes – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short position (150% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,357; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $39.87

- Silver: profit-take exit price: $12.32; stop-loss: $16.44; initial target price for the DSLV ETN: $47.67; stop-loss for the DSLV ETN $23.68

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $24.17; initial target price for the DUST ETF: $76.87; stop-loss for the DUST ETF $15.47

Note: the above is a specific preparation for a possible sudden price drop, it does not reflect the most likely outcome. You will find a more detailed explanation in our August 1st Alert. In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $35.67

- JDST ETF: initial target price: $143.87 stop-loss: $30.97

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager