Briefly: in our opinion, small (50% of the regular size of the position) speculative short position in gold, silver, and mining stocks is justified from the risk/reward perspective at the moment of publishing this Alert.

The market has been declining in tune with its previous trend for a few hours but after gold and… Then it happened. Silver reached the neck levels of their respective head-and-shoulders patterns, and miners insignificantly broke below their rising support line and they all started to crawl back up. The crawl became a steady walk and then it turned into a run. Before the closing bell’s sound, gold and silver were more or less back to their opening prices and miners were after a big daily rally. A lot has happened. But what changed?

The very short-term outlook changed. It’s now rather bullish.

The more important thing is what didn’t change. The big, medium-term trend that has been confirmed by multiple factors and the analogy to the 2012-2013 decline. The downtrend remains in place and the strong bearish confirmations remain intact.

Based on both, we decided to change the size of the current short position, by closing most of it. In fact, we left only one fifth (50% out of 250%) of the position intact, so we almost closed it. Those subscribers, who are more short-term oriented and less risk-averse have probably closed their positions or even opened long ones. In our view, however, the medium-term factors are too strong to close the position entirely.

Let’s see how the short-term charts look like and how high can metals and miners move before turning south once again.

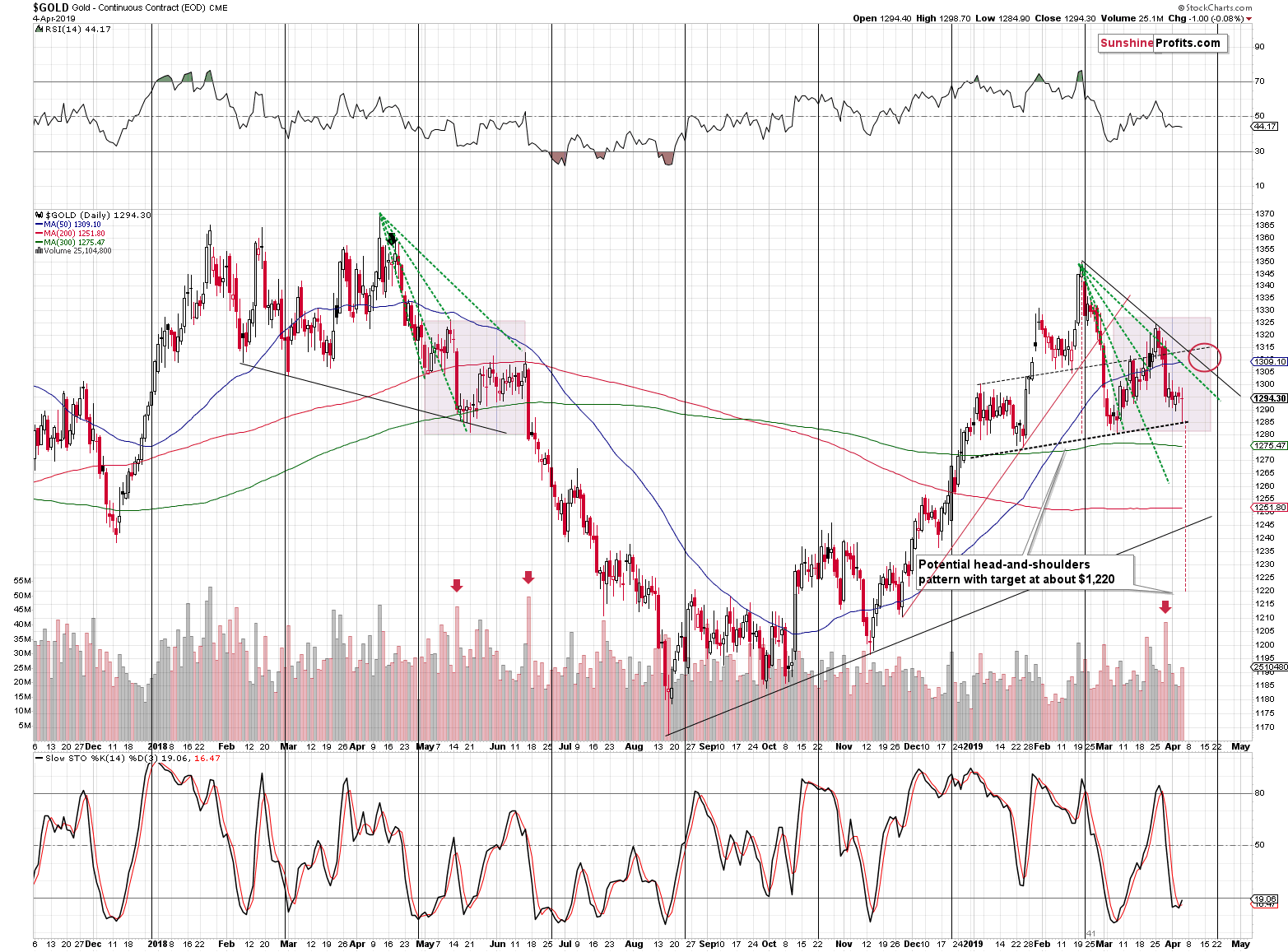

Short-term Examination of Gold

Gold’s reversal was quite clear and significant, so let’s check when we saw something similar during the recent analogous move. The analogous move here is the decline that started last April. The additional helpful detail is the fact that gold’s reversal was preceded by a few days of back-and-forth movement. During the mid-2018 decline, we saw two reversals close to the sizable downswings (just like the one that we saw last week). One in mid-May and the other in mid-June. Out of these two, only the former one was preceded by a few days of back-and-forth trading.

This shines more light on the entire analogy and the stage of the current decline. If yesterday’s reversal is just like the mid-May 2018 reversal, then the entire March rally is likely an analogy to the early-May 2018 upswing. The upswing was bigger this time, but it makes perfect sense because of the Fed’s dovish shocker. Last week’s downswing is therefore analogous to the mid-May 2018 one. This, in turn, means that another corrective upswing here would not be something surprising, but actually something normal and likely.

To make the analogy clearer, we used two techniques of marking it. We used red rectangles to show you how big the entire corrective period was and how long it took. The size is very similar, but as far as time is concerned, it seems that we have two more weeks before the decline accelerates.

The second technique is connecting the lows and highs with the initial high (green, dashed lines) and then copying this to the current situation. The very first local bottom was almost in perfect tune with the past pattern. And then… We got the Fed shocker. Gold moved relatively higher than in 2018, but it took only slightly more time. Then gold declined but since the decline started from higher levels, it bottomed higher. Still, as far as time is concerned, the situations are still similar. Gold reversed yesterday very close to the time when the green line ends.

Both techniques point to a local top close to April 19th. In June 2018, gold didn’t move above the previous local highs, so we don’t expect this kind of move this time either. The nearest likely resistance is in the $1,305 - $1,315 range. The lower border is created by the declining black resistance line – that’s the level it will approximately reach in 2 weeks. It’s currently close to $1,310, so that’s where gold could go, if it rallies sharply. There’s also a line that’s parallel to the neck level of the head-and-shoulders pattern (the thin dashed line) and it’s close to $1,315. Depending on what happens in the USD Index, gold could top out closer to the lower or higher border of the above-mentioned area. There’s even a possibility that gold would move even to the previous local high at about $1,325, but we don’t view it as likely.

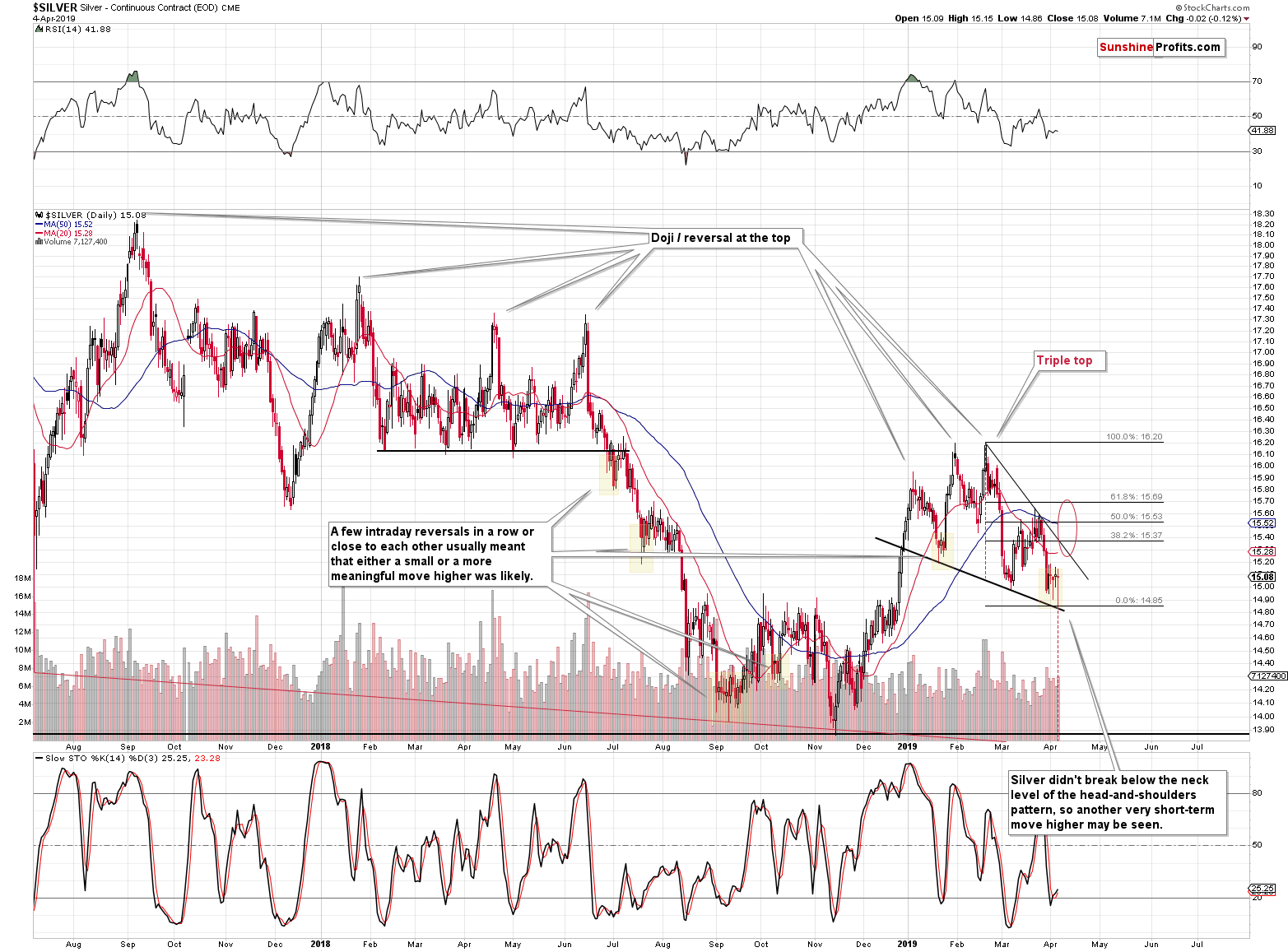

What about silver?

Silver in Tow

The analogous price target areas for the white metal (precisely, for silver futures as you can see on the above chart) is between $15.30 and $15.70. The lower border thereof is based on the declining resistance line and the upper border is based on the 61.8% Fibonacci retracement. The $15.40 level seems to be the most likely target as that’s where two resistance levels coincide – the declining resistance line (at least right now) and the 38.2% Fibonacci retracement.

As far as signal from silver is concerned, the thing that have based on yesterday’s reversal is a series thereof. In the recent past, when silver tried to move lower several times in a row, but failed, it meant that silver had to correct first. Sometimes the corrections were notable (late 2018, January 2019) and sometimes there were insignificant (two cases in July 2018), but they took place either way. Depending on which part of our target area stops the silver rally, the move can be described as either notable or not. And both fit the above-mentioned pattern.

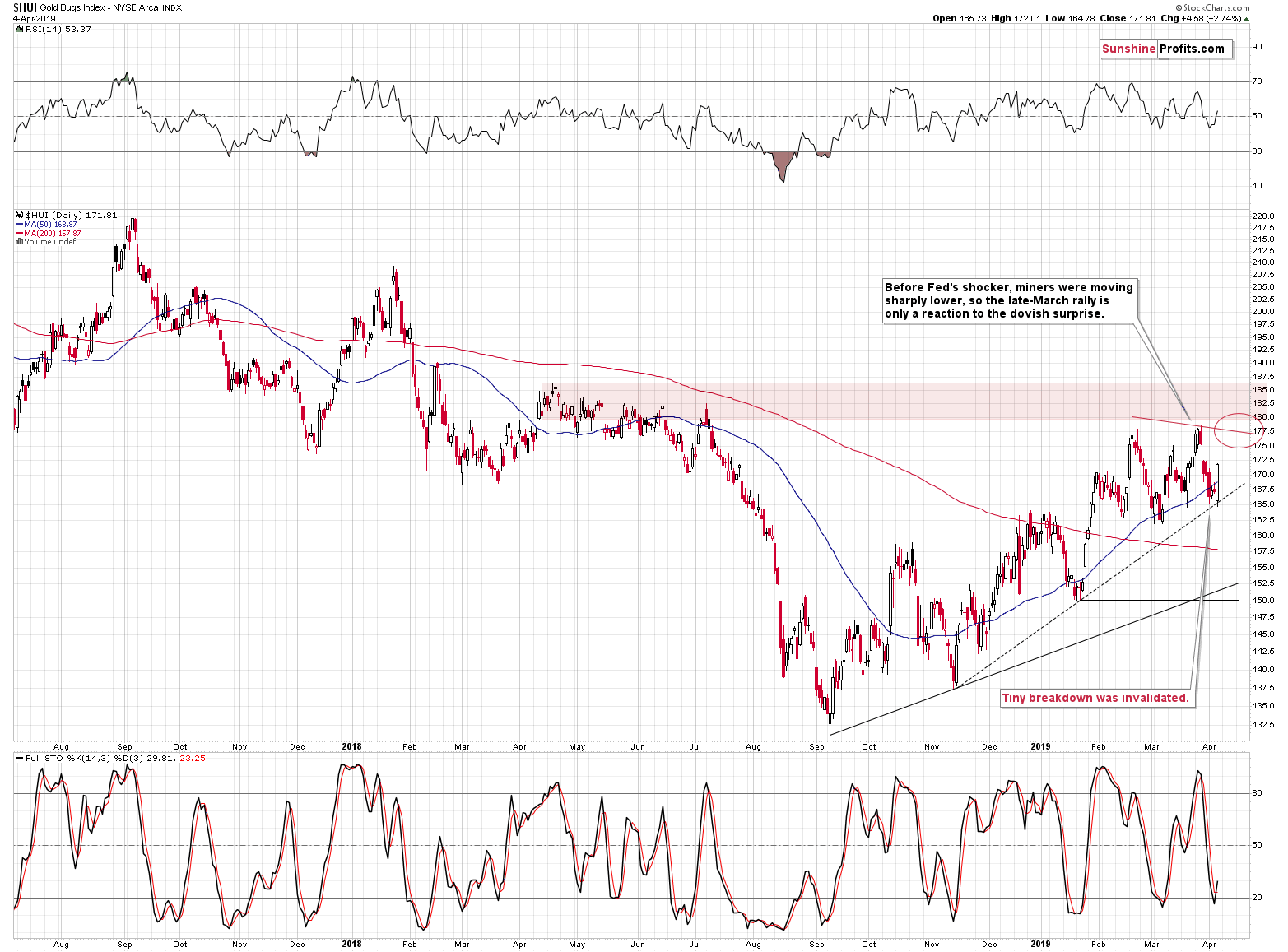

Now, It’s the Miners’ Turn

Gold stocks could move even to their 2019 highs before turning south. In yesterday’s intraday Alert, we wrote about lower target levels, but that was before the final part of yesterday’s rally. Given the current starting point, and the above-mentioned price projections for gold and silver, miners could easily test the previous high before declining once again.

The invalidation of miners’ small breakdown below the rising support line was the thing that made us start writing the intraday Alert and before we finished it, the price was already so high that the implications became even more bullish and we had to adjust the Alert before sending it. The implications of yesterday’s session conclusion are very bullish, but only for the short term.

Yesterday’s invalidation and daily strength in the miners doesn’t change the medium-term picture at all. All that it indicates is that we are likely to see an additional short-term move higher before the decline truly picks up speed.

Let’s keep in mind that while miners tend to outperform in the early part of a given upswing, they tend to underperform in the final part thereof (while silver outperforms). Consequently, there is no 1:1 relationship between the size of yesterday’s rally in gold and gold stocks that would translate into the size of the upcoming rally. While gold is only halfway done rallying, miners’ rally might be almost over, and silver might be picking up steam to launch the final pop-up that deceives beginning traders only to take them by surprise later on.

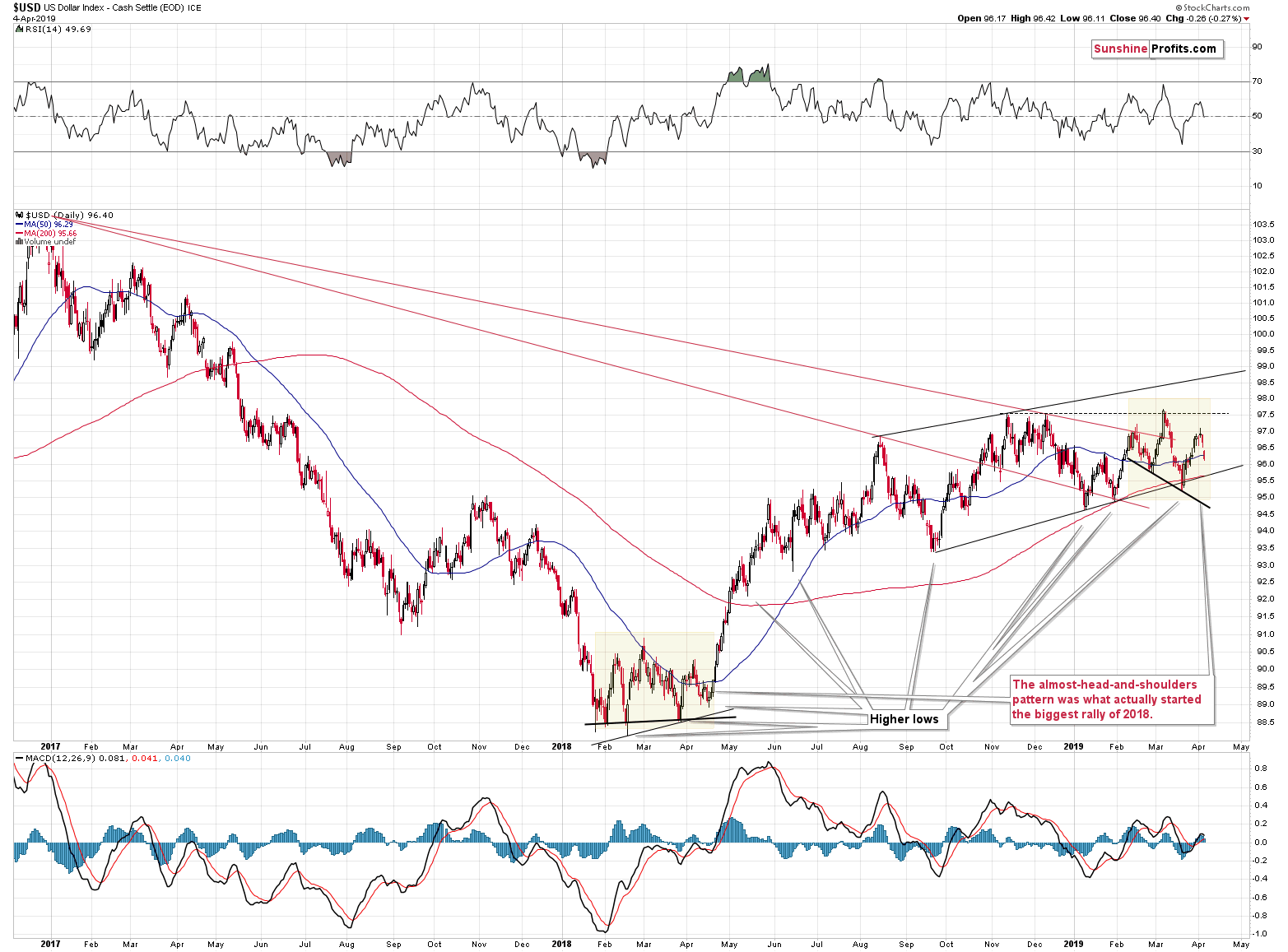

The Current Standing of the USD Index

The situation in the USD Index supports both: short-term strength in the precious metals sector and medium-term weakness. The latter is likely to be multiple times greater than the former.

The US dollar appears to be in a similar position to the one that we saw in April 2018. The index seems to be forming a bearish head-and-shoulders pattern and it has just moved below its 50-day moving average (blue line). The pattern is downward-shaped this time, but it still quite visible. Back in 2018, the pattern was never completed. In fact, the USD reversed even before moving to what might have been the pattern’s neckline. It moved below the 50-day moving average more or less by as much as it had previously been above it.

This, plus the current rising support line make it likely that the USD Index will bottom close to the 95.5 level. That’s about 1 index point below yesterday’s close. This is significant enough to trigger a quick upswing in the metals and miners, but it’s also small enough for one to wait it out, because of the action that followed. The rally that started in mid-April 2018 and ended in late May 2018 was huge and many times bigger than the initial downswing.

If you’re so sure that the USD will decline and the precious metals sector will rally, then why not simply go long?

Because we’re not “so sure”. There are short-term signs that point to higher metals prices in the next week or two, but there are myriads of signs that are much stronger than everything that we have covered today that point to much (hundreds of dollars ingold) lower prices in the PMs. The medium-term factors are stronger than the short-term ones, so the biggest surprises are likely to be to the downside. There’s a big risk connected with trading against the bigger trend (unless one wants to hold their position for just a few hours, that is) as opposed to being positioned correctly with regard to the bigger trend: if anything goes wrong then, one can just “wait the wrong out”. If one is not positioned in tune with the bigger trend, the above is not possible and waiting will only make things worse. That’s why we prefer not to go long in this case. Naturally, you may have other preferences and act accordingly.

Summary

Summing up, it’s almost certain that the next big move lower has already begun and that the 2013-like slide is in its early stage. The early stage is not as volatile as the final stage and periodic corrections may take place. It seems that one of them will take place in the next week or two. The medium-term downtrend remains confirmed by multiple strong signals, so the bullish implications of yesterday’s reversal are only for the short term.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Small short position (50% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,357; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $39.87

- Silver: profit-take exit price: $12.32; stop-loss: $16.44; initial target price for the DSLV ETN: $47.67; stop-loss for the DSLV ETN $23.68

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $24.17; initial target price for the DUST ETF: $76.87; stop-loss for the DUST ETF $15.47

Note: the above is a specific preparation for a possible sudden price drop, it does not reflect the most likely outcome. You will find a more detailed explanation in our August 1st Alert. In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $35.67

- JDST ETF: initial target price: $143.87 stop-loss: $30.97

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Mayday, mayday, we are sinking! The global economy is slowing down. How serious is the current slump? We invite you to read our today’s article about the true condition of the world’s economy and find out what are its likely implications for the precious metals market.

Will Global Slowdown Support Gold, or Is It Just Temporary?

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager