Briefly: in our opinion, full (300% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

When I wrote yesterday’s Gold & Silver Trading Alert, gold was trading at about $1,815. After that, it moved even lower, closing – and staying – below $1,800. That was the new 2021 low and the first yearly close below $1,800. This means that the bearish outlook clearly remains intact, and that practically all that I wrote yesterday remains intact as well.

Let’s start with gold.

Figure 1 – COMEX Gold Futures

On Wednesday (Feb. 3), I wrote (…) that the yellow metal’s breakdown below the rising red support line was not yet confirmed, but that the situation had already become more bearish. Gold closed below this line for the second day yesterday (Feb. 2) and given today’s decline, it seems that it’s going to close below it for the third consecutive day. This means that the breakdown is almost confirmed, and the implications are strongly bearish.

The breakdown is now fully confirmed. The consolidation is over and the next short-term trend is clearly down.

Now, given the proximity of the triangle-vertex-based reversal, I wouldn’t rule out a quick comeback and then another downturn within the next several days.

Theoretically, it’s possible that gold slides to $1,700 shortly and reverses there, but we wouldn’t bet the farm on this happening this or the next week. However, it is very likely to take place in February (more likely) or in March (less likely).

Well, given the close below $1,800 the scenario in which gold declines to ~$1,700 has just become more likely. It’s not a sure bet, but please note that in order for gold to decline to ~$1,700, it would just have to decline a little more than it had already declined in the past several days. Seems quite doable, especially if the USD Index keeps rallying.

Figure 2 – USD Index

And this is exactly what could happen, because the U.S. currency just confirmed two important breakouts:

- Breakout above the neck level of the inverse head-and-shoulders pattern

- Breakout above the declining medium-term resistance line based on the March 2020 and November 2020 highs.

The above is important also due to another – even more critical – reason.

Figure 3

Based on the remarkable similarity to early 2018 (also in bitcoin and dogecoin, and most likely also in stocks to some extent), the breakout above the declining resistance line (and the 50-day moving average) is likely to mark the start of a big, sharp upswing.

Back in 2018, the rally continued until the USD Index moved to its previous medium-term high. Afterwards, it started to move in a more moderate manner.

If the history rhymes once again (the similarity has been uncanny in the previous months), then the next temporary stop for the USD Index is a bit below 95, as that’s when the USDX topped in September 2020. Precisely, that was 94.80, so to be conservative, we can say that the next particularly significant resistance for the USD Index is at about 94.5.

Will this level correspond to gold at $1,700? This might be the case, but it could also be the case that gold declines to $1,700 even sooner. Given the current gold-USD dynamics, I don’t expect to see the USD Index at about 95 without seeing gold decline to at least $1,700.

Figure 4

Silver is not doing much today, so my comments from Wednesday’s analysis on this precious metal remain up-to-date:

Well, was silver’s rally just temporary?

This seems to have been the case. The white metal declined back below not only the 2020 highs, but also back below this year’s early high. Please remember that invalidations of breakouts have immediately bearish implications and we just saw more than one in case of silver.

So far today (Feb. 3), silver is quiet, but let’s keep in mind that back in September, it took only a few sessions for the white precious metal to move from approximately the current price levels to about $22.

Will silver slide as much shortly? This is quite likely, although the downswing doesn’t have to be as quick as it was in September.

Terms like the silver shortage, the size of the silver market and silver manipulation became incredibly popular in the last couple of days, which - together with huge SLV volume, and this ETF’s inflows - confirms the dramatic increase in interest in this particular market. This is exactly what happens close to market tops: silver steals the spotlight while mining stocks are weak. I’ve seen this countless times, and in most cases, it was accompanied by multiple voices of people “feeling” that the silver market is about to explode. For example, please consider what happened in early September 2020 on both (above and below) charts. Silver jumped and almost reached its August 2020 high, while the GDX was unable to rally even to (let alone above) its mid-August high.

Don’t get me wrong, I think that silver will soar in the following years and I’m not shorting silver (nor am I suggesting this) right now and in fact I haven’t been on the short side of the silver market for months. In fact, I expect silver to outperform gold in the final part of the next massive upswing, but… I don’t think this massive upswing has started yet.

Gold had it’s nice post-Covid panic run-up, but it didn’t manage to hold its breakout above the 2011 highs, despite multiple dovish pledges from the Fed, the open-ended QE, and ridiculously low interest rates. Plus, while gold moved above its 2011 highs, gold stocks have barely corrected half of their decline from their 2011 highs. Compare that to when the true bull market started about two decades ago – gold miners were soaring and multiplying gold’s gains in the medium run.

Let’s take a look at mining stocks, using the GDX ETF as a proxy for them.

Figure 5 – VanEck Vectors Gold Miners ETF (GDX)

Miners declined decisively yesterday (Feb. 4), and they once again closed below the neck level of the head-and-shoulders pattern. The final pause before the slide seems to be over.

My comments from yesterday on the above chart remain up-to-date:

Are miners weak right now? Of course, they are weak. It was not only silver that got attention recently, but also silver stocks. The GDX ETF is mostly based on gold stocks, but still, silver miners’ performance still affects it. And… GDX is still trading relatively close to the yearly lows. Silver moved a bit above its 2020 highs – did miners do that as well? Absolutely not, they were only able to trigger a tiny move higher.

And based on yesterday’s decline, most of the recent run-up was already erased.

Interestingly, the most recent move higher only made the similarity of this shoulder portion of the bearish head-and-shoulders pattern to the left shoulder (figure 2 - both marked with green) bigger. This means that when the GDX breaks below the neck level of the pattern in a decisive way, the implications are likely to be extremely bearish for the next several weeks or months.

Due to the uncanny similarity between the two green rectangles, I decided to check what happens if this mirror-similarity continues. I used purple, dashed lines for that. There were two important short-term price swings in April 2020 – one shows the size of the correction and one is a near-vertical move higher.

Copying these price moves (purple lines) to the current situation, we get a scenario in which GDX (mining stocks) moves to about $31 and then comes back up to about $34. This would be in perfect tune with what I wrote previously. After breaking below the head-and-shoulders pattern, gold miners would then be likely to verify this breakdown by moving back up to the neck level of the pattern. Then, we would likely see another powerful slide – perhaps to at least $24.

All in all, it seems that silver’s run-up was just a temporary phenomenon and the next big medium-term move in the precious metals and mining stocks is going to be to the downside.

There’s something more about those big head-and-shoulders patterns that you should know, and it’s not something minor.

Figure 6

The thing is – the three of the biggest declines in the mining stocks (I’m using the HUI Index as a proxy here), all started with broad, multi-month head-and-shoulders patterns.

And now we’re seeing this pattern all over again. The above picture should make it clear why I was putting “at least” in bold, when describing the targets based on the head-and-shoulders patterns.

In all three cases, the size of the decline exceeded the size of the head of the pattern. This means that the $24 target on the GDX ETF chart is likely conservative.

Can we see gold stocks as low as we saw them last year? Yes.

Can we see gold stocks even lower than at their 2020 lows? Again, yes.

Of course, it’s far from being a sure bet, but the above chart shows that it’s not irrational to expect these kind of price levels before the final bottom is reached.

The dashed lines starting at the 2020 top are copies of sizes of the declines that started from the right shoulder of the previous patterns. If things develop as they did in 2000 and 2012-2013, gold stocks are likely to bottom close to their 2020 high. However, if they develop like in 2008 (which might be the case, given the extremely high participation of the investment public in the stock market and other markets), gold stocks could re-test (or break slightly below) their 2016 low.

I know, I know, this seems too unreal to be true… But wasn’t the same said about silver moving below its 2015 bottom in 2020? And yet, it happened.

Having said that, let’s go to Europe and take a look at the markets from the fundamental point of view.

Down Where We Belong

For weeks, I’ve been warning that the Eurozone economy and the EUR/USD were on a collision course. And with Europe’s fundamental underperformance accelerating at a drastic pace, we may have just had impact.

On Feb. 4, the EUR/USD hit its lowest level since Nov. 30.

Please see below:

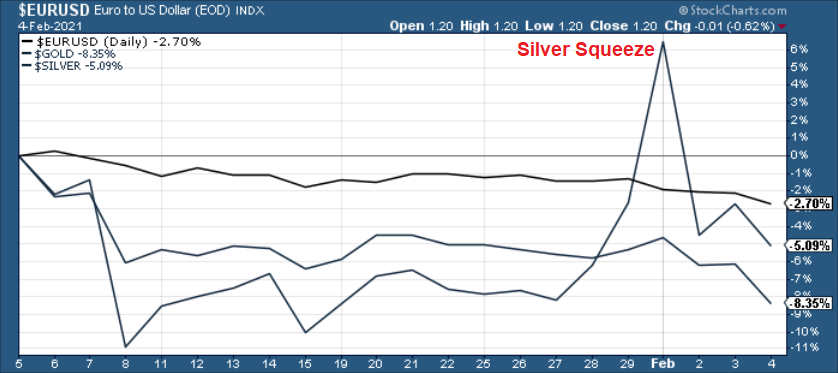

Figure 7

Along for the ride, the EUR/USD’s pain has not been the PMs gain. Because of their strong correlation, it’s no surprise that the euro’s downfall is making waves across the precious metals’ market.

Figure 8

Foretelling the decline, I warned that the EUR/GBP was about to crack. And given the EUR/USD’s strong correlation with the EUR/GBP, the latter’s collapse was an early warning sign.

On Monday (Jan. 25), I wrote that Janet Yellen’s pledge to “act big” on the next coronavirus relief package ushered the EUR/GBP back above critical support.

However, on Tuesday (Jan. 26), the key level broke again.

Please see below:

Figure 9

More importantly though, a break in the EUR/GBP could be an early warning sign of a forthcoming break in the EUR/USD.

Figure 10

If you analyze the chart above, ~20 years of history shows that the EUR/GBP and the EUR/USD tend to follow in each other’s footsteps. As a result, if the EUR/GBP retests its April low (the next support level), the EUR/USD is likely to tag along for the ride (which implies a move back to ~1.08).

And living up to its billing, the EUR/GBP is racing toward its April low.

Please see below:

Figure 11

And if the April low breaks, it could be lights out for the EUR/USD. Already, the currency pair has broken below its long-term declining resistance line. And if the technical damage continues and the EUR/USD breaks below the 1.16/1.17 level, its long-term support (roughly 1.05) is well within the range of its April low (roughly 1.08).

Figure 12

To make the fundamental case for a lower EUR/USD, the U.S. Treasury revealed on Feb. 1 that it plans to borrow $274 billion in the first quarter of 2021. In stark contrast to its November estimate of $1.127 trillion, the massive 76% reduction (the red box below) is the result of stimulus gridlock in Washington.

Figure 13 - Source: The U.S. Department of the Treasury

From a currency perspective, the about face is extremely bullish for the U.S. dollar. With the European Central Bank’s (ECB) printing press working 24/7, the FED/ECB ratio has already declined by 0.26% week-over-week. And now, with the U.S. Treasury reducing its Q1 borrowing, the ratio should continue to move lower.

To explain, the U.S. Treasury raises money by selling bonds to the general public. And to keep interest rates low, the FED purchases these bonds on the secondary market. The two claim that they don’t collaborate, however, the end result is always the same: the more bonds the Treasury issues, the more purchases that the FED has to make to keep interest rates low. Conversely, the less bonds the Treasury issues, the less purchases that the FED has to make to keep interest rates low.

As a result, the Treasury’s latest projection adds more wind to the greenback’s sails.

Also supportive of a weaker EUR/USD, the Eurozone economy remains on life support. On Feb. 4, IHS Markit revealed that its Eurozone Productivity PMI fell for a third-straight month (to 47.4 in January) and that the latest decline occurred at the quickest pace since June.

Please see below:

Figure 14

To explain the term, I wrote previously:

PMI (Purchasing Managers’ Index) data is compiled through a monthly survey of executives at more than 400 companies. A PMI above 50 indicates business conditions are expanding, while a PMI below 50 indicates that business conditions are contracting (the scale on the left side of the chart).

Even more insightful, service sectors in France and Italy (Europe’s second and third-largest economies) led the PMI decline, as both countries (figure 15 – the blue boxes below) underperformed the bloc average (figure 15 – the red box below).

Figure 15 - Source: IHS Markit

To make matters worse, Eurozone construction activity has fallen off a cliff. The IHS Markit Eurozone Construction PMI recorded its sharpest decline since May and an excerpt from the release read:

“The decline in construction output across the Eurozone was driven by falls in each of the three largest economies in the region. France posted the steepest rate of contraction, followed by Germany, with both countries seeing rates of contraction quicken since December. Italy meanwhile recorded a drop in construction activity for the third time in the past four months, albeit one that was only mild.”

But the one saving grace? 12-month confidence in Europe turned positive.

Please see below:

Figure 16

Indicating superficial strength, Eurozone inflation also rose by 0.90% in January (the red box below).

Figure 17 - Source: Eurostat

And while the positive January print ended a streak of seven-straight months of negative inflation, it’s not a cause for celebration. Previously, I wrote that higher inflation is a precursor to higher interest rates; and higher interest rates are a precursor to a stronger currency.

However, in the Eurozone, inflation is rising alongside deteriorating economic fundamentals. If you combine everything above with the fact that the youth unemployment rate (persons under 25) in Europe increased from 18.1% to 18.5% month-over-month in December, the region could be headed for stagflation.

Please see below:

Figure 18

To explain the term, stagflation occurs when a region has high inflation and high unemployment. In a nutshell: it’s the worst possible outcome for an economy, as monetary and/or fiscal easing becomes a double-edged sword.

Further supporting the possibility, the overall Eurozone unemployment rate has barely moved since September. Despite the best efforts of Europe’s governments and central bank, progress has become a slow process.

Figure 19 - Source: Eurostat

Conversely, the U.S. unemployment rate has fallen by 1.1 points since September – delivering yet another data point of relative outperformance.

Figure 20 - Source: U.S. Bureau of Labor Statistics (BLS)

In conclusion, the EUR/USD remains destined for devaluation. The Eurozone economy is drastically underperforming the U.S. and market participants are finally starting to accept this reality. As a result, the PMs are likely to remain under pressure. Given their strong correlation with the currency pair, a weaker EUR/USD is likely to drop the hammer on the metals. However, once the technical and fundamental damage is complete, the PMs will shine once again.

Letters to the Editor

Q: You have introduced a glittering array of charts and data to support your macro thesis, which is playing out, albeit in slow motion. I was in wealth management my entire career and I have never seen ANYTHING as comprehensive as what you produce. Not wanting to jump the gun, but I gather that the GDX tends to outperform in the early stages of a recovery and then the GDXJ tends to take over... then silver becomes a later runner. Do you see any reason why the forthcoming recovery will not follow this? To make it simpler... would it be fair to concentrate on gold mining stocks initially and to avoid SILJ in the early months? Finally have you heard of JGLD? It’s a new PROPER JUNIOR MINING EFT. GDXJ is mainly mid-tier stocks these days. I thought other readers would be interested.

A: It’s great to hear compliments from a professional – thank you!

As far as the relative performance is concerned, the above is indeed what’s often taking place, but I would like to emphasize (for those who might be reading my analysis for the first time today) that this outperformance doesn’t mean a situation where one market stops rallying and then only the other market is moving. No, it means that they all move in the same direction, but one of them is providing a bigger bang for the buck at a given time. Senior miners tend to do that at first (along with junior miners to some extent), then junior miners start to perform a bit better than seniors and silver is often strongest in the final parts of a given rally.

I wouldn’t use the word “avoid” with regard to SILJ in the early months of the next medium-term upswing, as it might imply that it’s bad ETF or one that would trigger losses even though the rest of the precious metals market moves higher. I’d use “prefer” or “use mostly for diversification purposes”. If you look at the SILJ to SIL ratio, you see that after the bottom silver juniors didn’t really lag the silver seniors, initially, but they did outperform about 2 months after the bottom.

Figure 21

Then again, if one followed the “seniors first, then juniors, and then silver” rule, they would still likely be happy with the results.

As far as JGLD is concerned – thank you for mentioning it. I haven’t previously commented on it. I agree that there are not as many juniors in the GDXJ junior ETF as there should be and that’s its more similar to the GDX than it should, and that the JGLD does solve this problem by having mostly low-cap juniors. However, it seems to me that it’s too early to use this ETF as it was launched only about two months ago and the liquidity in it is still very low. If it increases substantially before the time comes to focus on junior miners (as above), then this might be my unleveraged junior miner ETF of choice. Some people will likely still prefer the leveraged ones, though.

Q: Perhaps you can help me understand something about the GDX. I have searched everywhere to find out how the GDX is valuated. I currently have the March $36 put. Is there a way to find out how much the option will increase or decrease as the price goes up or down?

A: Well, we used to have a very easy way to do it on our website – we had a Flash app called Option Calculator, which I designed exactly for the purpose of making such quick simulations. But, since Flash is no longer supported, we can’t really use it. And since it was barely used, it makes no sense to develop it using a different technology. Anyway, there are option pricing models available online that you might want to use. No option model will tell you with certainty how much a given option will definitely be worth on any given day – that will depend on the buyers and sellers. But these calculators tend to provide a good ballpark figure. Here’s one option calculator that seems quite simple to use.

The only problem with it, might be the “volatility” – you might get that reading for a specific series of options on Yahoo!Finance, for instance over here: https://finance.yahoo.com/quote/GDX/options?p=GDX&date=1614902400

Overview of the Upcoming Part of the Decline

- I expect the initial bottom to form with gold falling to roughly $1,700, and I expect the GDX ETF to decline to about $31 - $32 at that time. I then plan to exit the short positions in the miners and I will consider long positions in the miners at that time – in order to benefit from the likely rebound.

I expect the above-mentioned decline to take another 1 – 6 weeks to materialize and I expect the rebound to take place during 1-3 weeks.

- After the rebound (perhaps to $33 - $34 in the GDX), I plan to get back in with the short position in the mining stocks.

- Then, after miners slide once again in a meaningful and volatile way, but silver doesn’t (and it just declines moderately), I plan to switch from short positions in miners to short positions in silver (this could take another 1-4 weeks to materialize). I plan to exit those positions when gold shows substantial strength relative to the USD Index, while the latter is still rallying. This might take place with gold close to $1,500 and the entire decline (from above $1,700 to about $1,500) would be likely to take place within 1-5 weeks and I would expect silver to fall hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold – after gold has already declined substantially) is likely to be the best entry point for long-term investments in my view. This might happen with gold close to $1,500, but it’s too early to say with certainty at this time.

Consequently, the entire decline could take between 3 and 14 weeks, while the initial part of the decline (to $1,700 in gold) is likely to take between 1 and 6 weeks.

The above is based on the information available today and it might change in the following days/weeks.

Summary

To summarize, it’s likely that the case that the next big short-term downswing has just begun as miners broke below the neck level of their almost-yearly head-and-shoulders formation.

The outlook for the precious metals sector remains bearish, especially when it seems that we are entering the “winter” part of the Kondratiev cycle. Silver’s strength seems bullish at first sight, but taking a closer look at this move, and comparing it with previous cases (when silver got so much attention) and with miners’ weakness, provides us with bearish implications for the medium term.

The confirmed breakout in the USD Index is yet another confirmation of the bearish outlook for the precious metals market.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in mining stocks is justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $32.02; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $28.73; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $42.72; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $21.22; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway. In our view, silver has greater potential than gold does):

Silver futures downside profit-take exit price: unclear at this time - initially, it might be a good idea to exit, when gold moves to $1,703.

Gold futures downside profit-take exit price: $1,703

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief